Can an employer reduce wages? And if so, in what specific cases is this possible? In practice, these issues are of interest not only to employees, but also to employers themselves, who for one reason or another have a need or desire to reduce the salaries of their employees. Let us note right away that, despite the fact that the Labor Code provides grounds for reducing employee wages, this is not so easy to do. It is very important to fully comply with the entire procedure for reducing wages, otherwise the employer may be held accountable by regulatory authorities.

In what case can an employer reduce wages without the employee’s consent?

An employment contract is a document whose entry into force requires the voluntary consent of two parties - the employer and the employee. Agreement must be reached on every condition of the document they sign. Based on this, changes to any of the terms of an already concluded agreement can also be made by agreement of both parties.

At the same time, the labor code in Art. 74 provided exceptions to this rule and gave employers the right to change the terms of the contract without the consent of employees, including the terms on the amount of their wages. As reasons, this article indicates reasons associated with changes in working conditions, both technological and organizational.

These include:

- Changes in the production process;

- Its structural reorganization;

- Other reasons.

Can an employer reduce wages on its own initiative?

Wages are an indicator of employer responsibility. Salaries must be paid constantly, on time and in the amount fixed by the labor agreement (Article 22 of the Labor Code of the Russian Federation).

Issuing wages is the direct and primary responsibility of the employer. Any deviations from legislative norms and the procedure for remuneration established by the collective agreement entail not only dissatisfaction of employees, but also penalties, the interest of the labor relations commission and, in special cases, legal proceedings.

It turns out that in matters of remuneration, the employer’s actions are strictly limited by the Labor Code of the Russian Federation. Does the head or personnel department of an institution have the right to independently reduce wages? Yes, management has the right to unilaterally reduce wages, but only under one condition - the employee must express his consent to this option.

But first things first. All labor relations in Russia are regulated by the Labor Code - this law determines what rights and obligations employers and employees have, what is the basis for mutual settlements, and how organizations (and individual entrepreneurs) pay their employees.

Based on the Labor Code of the Russian Federation, employers draw up their local regulations on wages: collective agreements and individual labor agreements, provisions on mutual settlements, bonuses, additional payments and allowances.

Further activities are carried out in full compliance with the rules and regulations of the internal labor regulations and the Labor Code of the Russian Federation. In all proceedings with the employer, the provisions of the Labor Code of the Russian Federation will have decisive weight.

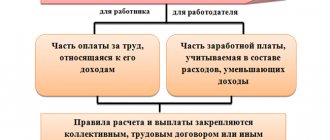

Official salaries are established in the staffing table. Each employee signs an employment contract, which lists his functions and determines his salary, additional payments, bonuses and the possibility/frequency of bonuses. All payments due to an employee are called wages, which consists of salary (fixed part), compensation, additional payments and bonuses (variable part).

The salary cannot be reduced - this is a permanent value that is determined not for a specific employee, but for the position as a whole. Therefore, employers reduce the variable part. This is where the key mistake lies.

Yes, bonuses, additional payments and allowances are paid solely at the discretion of management - managers, by their decision, determine the composition of recipients of compensation and incentive payments and their size. But employers forget that additional payments are also included in the salary and are fixed by the employment contract (or an additional agreement to it). And all payments that are legally established for an employee are not subject to reduction without the consent of such employee.

What are the options? There are only two of them - a reduction in wages at the initiative of management, followed by mandatory notification of employees and agreement of the parties.

We remind you once again that it will not be possible to reduce your salary individually - its reduction is carried out by order of the head of the entire institution and is accompanied by changes and approval of local regulations.

Now about the reasons. The employer has the right to reduce employee remuneration only in two cases: when organizational or technological labor aspects change. A salary reduction can only be made on these legal grounds - all other decisions regarding salary changes will be considered non-standard. Here's what can cause salary adjustments:

- changes in legal documents - collective agreement, remuneration provisions;

- improvement of technologies - commissioning of new equipment;

- changing the order of mutual settlements - time-based instead of piece-rate, shift-based, etc.;

- Conducting a special assessment of working conditions and identifying discrepancies between the functional scope of work for the position and actual standards;

- reorganization in any form.

All of the options listed are legal ways to reduce your salary and additional payments. Each organization has its own reasons for such a step, but in any case, it must be justified and carried out within the framework of Article 74 of the Labor Code of the Russian Federation.

Reducing remuneration for work as a disciplinary measure or to force dismissal is not allowed - such actions entail administrative and disciplinary liability for the employer.

Another method is to reduce wages by agreement of the parties. This option is much simpler. The employer and employee discuss the conditions, and if the latter agrees to reduce payments, they sign an additional agreement to the employment contract.

The basis in this case is an order to reduce wages. If the employee does not agree with the new conditions, he has the right not to sign the agreement. If he is forced and threatened with dismissal, then there is only one option - to go to court.

How should a unilateral salary reduction be made?

It is extremely important that the employer follows the procedure for changing the terms of the contract concluded with an employee, including the terms on the amount of the established salary.

This procedure includes several stages:

- Justification of the need to reduce the established salary;

- Development of documentation and familiarization with it to employees 2 months before the entry into force of the new terms of the contract;

- Conclusion of an additional agreement on changes made to the contract.

Of course, every employee has the right to refuse to continue working under the new conditions offered to him.

And in this case, there are two possible ways for further development of the situation:

- Transfer of an employee with his consent to another vacant position;

- Termination of an employment contract.

It might be interesting!

Gray salary, what are the pros and cons

Reducing the amount of variable payments

Undoubtedly, the employer is obliged to pay employees their official salaries. Can he deprive his employee of all or part of his bonus? It all depends on what is written in the employment contract (see table).

| Conditions of the employment agreement | What's in practice |

| It is stated that when a plan or some other indicator is met, the employer undertakes to pay a bonus | Depriving an employee of a bonus will be illegal. This means that the manager violated the terms of the employment contract concluded with the employee. |

| It is noted that the procedure for paying bonuses is determined by the bonus regulations | When making a decision you will need to be guided by it. If monthly bonuses are not mandatory in accordance with this document, then a downward change in wages due to non-payment of bonuses will be legal. |

Is it possible to reduce the salary?

Natalia

Labor expert

The Labor Code does not contain a direct prohibition on reducing the salary. As a rule, to reduce it, employers make changes to the wage regulations in the organization completely. Also, the basis for changing the salary portion may be a reduction in the number of responsibilities of an employee without changing his job function. Currently, such situations are not uncommon, which in turn is associated with the development of technology, the automation of many processes and the shifting of a large part of the work to machines and robots.

Technological and organizational innovations

There is no clear list of changes of this kind in the Labor Code. Article 74 names only a number of situations when the employer has the right to unilaterally change the employment contract. The most common situations include the following:

- the technologies used in production have changed or new ones have been introduced;

- there was a change in technology;

- there was a change in the structure of the enterprise (including management);

- workplaces are improved through their special assessment;

- use of other forms of work organization;

- change in workload between departments.

Please note: only those changes that imply the impossibility of leaving the employee’s working conditions the same can be used as a basis for making amendments to the employment contract. If necessary, the employer will have to defend his point of view in court.

EXAMPLE 1 A drop in sales is not a compelling argument for reducing salaries, since it does not relate to technological or organizational changes.

What situations allow a salary reduction to be made at the initiative of the employer on legal grounds?

EXAMPLE 2 A manager relieves some of his responsibilities from his employees. This situation occurs when one of the areas of the enterprise is curtailed. As a result, some of the responsibilities will become irrelevant. Consequently, the terms of previously concluded employment contracts cannot be left unchanged. All this becomes the basis for making adjustments, which may result in a downward change in wages for a number of employees.

Keep in mind: if an employer, when making changes to an employment contract, refers to Article 74 of the Labor Code of the Russian Federation, then he does not have the right to change the labor function of his employees. This means that the head of the organization cannot unilaterally assign a different position!

Does an employer have the right to reduce wages during a probationary period?

Quite often, during interviews and when hiring, employers voice the condition that the salary paid during the probationary period will be lower than that which will be paid if it is completed. Such conditions are even included in the text of the employment contract. Formulations can be very different.

Some employers indicate that during the probationary period the employee will receive a salary at a certain percentage of the established amount (for example, 60 or 80%). Others indicate specific salary amounts for the probationary period and after its completion. Still others initially enter into an agreement with the condition of a low salary, and after passing the test they sign an additional agreement with the employee to increase it.

Please note that such actions by employers are unlawful and should not be used. Payment during the test period should be the same as after completion of the test. And the employee has the right to receive the rest of the amount if he submits a corresponding application to the regulatory authorities.

How to reduce the fixed part of your salary

An even more difficult situation, how to legally reduce an employee’s salary , arises when an organization wants to reduce the fixed component of the salary.

An important nuance: the employer cannot unilaterally change the terms of the employment contract. He needs to get the employee’s consent, and most of them will not do this.

There is only one reason when it is not necessary to obtain consent from the employee. It is spelled out in Article 74 of the Labor Code of the Russian Federation. This basis is that working conditions have changed due to technological or organizational innovations. In order to figure out how to legally reduce an employee’s salary in this case, you must first understand when such grounds apply.

Salary reduction by agreement between employee and management

A reduction in salary is possible at any time if there is voluntary consent of both parties. In this case, it is not necessary to comply with any complex procedures on the part of the employer and it is sufficient to conclude one additional agreement between the parties. As a rule, employees agree to such changes in connection with a change at their request or at the suggestion of the employer in their work function, or a reduction in workload.

The additional agreement is concluded in writing in two identical copies, one for each of the parties and comes into force from the date specified in it or from the date of its signing.

Reduced salary for a pregnant woman

Quite often, employees who find out about their pregnancy ask employers to transfer them to another job that would suit them for health reasons. Such requests must be based on a medical opinion. By law, employers do not have the right to refuse them. According to Art. 254 of the Labor Code of the Russian Federation, such employees should have production standards and service standards reduced, or they should be transferred to another job without those unfavorable factors that could affect their health.

It is important to know! When transferring to another job, a pregnant employee must retain the average salary at her previous place of work, including for the period when she is released from work until she is given a new job.

Pregnant women also have the right to transfer to part-time work. But in this case, their earnings may be reduced in proportion to the time they work.

It might be interesting!

Compensation for delayed payment of wages in 2020

Employment contract and bonus clause

The employment contract must specify the terms of remuneration (salary, additional payments, allowances and incentive payments). This is required by Article 57 of the Labor Code of the Russian Federation. Therefore, it should be clear from each employment contract exactly what payments and within what remuneration system the employer is obliged (or has the right) to make to employees.

However, employers also have the right to adopt local regulations (Article 22 of the Labor Code of the Russian Federation), which can establish other payments. Thus, an organization may have a bonus regulation (see “Drawing up a bonus regulation”).

The possibility of reducing earnings largely depends on the total content of these documents (employment contract and local act establishing other payments in favor of employees).

Does an employer have the right to reduce wages for employees of retirement age?

An employee’s retirement in itself does not in any way affect the amount of wages paid to him if, after receiving his pension, he decided to continue working under the same conditions. Therefore, any attempts to reduce the salary of a working pensioner on the part of the employer will be unlawful and can be appealed.

The grounds for reducing salaries for such employees, as well as for other employees, are:

- Voluntary agreement of the parties;

- Transforming working conditions.

What should an employee do if his salary was reduced without warning?

Having received a smaller salary, an employee should not immediately despair. First you need to deal with the employer. Perhaps this was due to an error by an accounting employee or some kind of malfunction in the program.

However, if, after clarifying the situation, the employee learns that the employer has unlawfully reduced his salary, he should contact the labor inspectorate or the court to protect the violated right.

Natalia

Labor expert

It is important to know! In the event of an unjustified violation by the employer of wages to employees, he may be brought to administrative liability in accordance with the Code of Administrative Offenses of the Russian Federation.

By agreement of the parties

As can be seen from the previous section, an employer has only 2 ways to reduce an employee’s salary without his consent. For a situation of mutual agreement, there are also several options for legally reducing wages:

- In the event of certification and recognition of the employee’s competence as inappropriate to perform job duties (Article 81 of the Labor Code of the Russian Federation). In this case, there are options to transfer the worker to another (usually lower-level) position that he can perform. In this case, it is necessary to take into account his state of health. An important condition is the execution of the certification procedure and compliance with the regulations for its implementation.

- In case of transfer to another position with a reduction in wages (the basis is Article 72). Moreover, it can be either permanent or temporary. The employee's written consent is required (especially in the case of transfer to a position of lower qualifications).

- In a situation of staff or headcount reduction . This rule applies to both organizations and individual entrepreneurs. In this case, the scheme will be similar to the previous situation, since the employer will be able to reduce wages in connection with the offer of a new position. If an existing employee refuses the transfer, the manager is obliged to dismiss him and pay him severance pay, the amount of which corresponds to the average monthly salary. In addition, compensation is issued corresponding to the average salary, which will be paid for the period of employment (up to 60 days from the date of dismissal).

- of part-time work for any reason (Article 93 of the Labor Code of the Russian Federation). Here, either part-time work can be established (the employee is at work for fewer hours every day during the work week) or part-time work (he works part of the days of the work week, most often during a full work day). Payment in this situation can be made either based on time worked or on the basis of volume completed. The employer must be aware that he does not have the right to reduce the duration of annual leave, change the procedure for calculating length of service, etc.

Detailed instructions for registering the last case are in the following video: