Concept and legal regulation of employer's liability

Issues of financial liability of the parties to the Labor Code are given in Chapter 9 of this fundamental document. Chapter 38 of the Labor Code is devoted to the employer's responsibility to employees.

In addition to the mandatory conditions and guarantees for employees contained in the Labor Code, it is also possible to provide some additional ones. They are prescribed directly in an individual employment contract or in a special document that extends its legal force to all employees of the enterprise.

When holding an employer financially liable, you should be guided by the provisions of the Labor Code or individual conditions. But local regulations do not allow arbitrary changes in the ratio of the amounts of financial liability. Literally, this means that the employer’s responsibility to the employee cannot be less than that determined by labor legislation under Art. 232 of the Labor Code.

The peculiarity of financial liability is that after the dismissal of an employee, it remains in effect.

Financial liability can be understood as the employer’s obligation to compensate for damage to an employee resulting from the employer’s commission of certain actions or inaction. An example of such actions is the issuance of a dismissal order, or inaction - non-payment of wages or vacation pay.

As a result of the employer’s unlawful actions, employees experience certain unfavorable circumstances. The Labor Code classifies them as follows:

- impossibility of further work and the associated non-payment of remuneration to the employee under Art. 234 TK;

- causing actual damage to the property of a subordinate under Art. 235 TK;

- non-payment of wages or other payments provided for in the employment contract under Art. 236 TK.

Also according to Art. 237 of the Labor Code of the Russian Federation provides for compensation for moral damage caused to an employee.

Workers' compensation amount

The Labor Code initially builds its position on the fact that the employer is a materially and organizationally more stable and financially secure party to the legal relationship. Based on this logic, almost all cases of financial liability of the employer to the employee are not limited to a fixed amount and are charged in full. The law implies not only full compensation for harm, but also the payment of various additional compensations, as the best motivation to prevent violations of workers' rights.

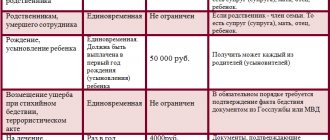

| Type of damage | Conditions for employer liability | Amount of employer's liability |

| Unlawful dismissal or suspension | Responsibility will arise when the labor inspectorate or court establishes that the employer has unlawfully applied the norms of Art. 81 and 76 Labor Code of the Russian Federation | Lost earnings calculated in accordance with Art. 139 Labor Code of the Russian Federation. Moreover, even the re-employment of a former employee or his refusal to continue working after being reinstated in his previous position will not free him from the obligation to compensate for lost wages. |

| Transfer to a lower paid position without reason or consent of the employee | Violation of Art. 72 of the Labor Code of the Russian Federation is also established by the competent authorities. The management of the enterprise can defend its innocence and challenge their decision. | The responsibility to prove the amount of compensation lies with the employee. In general, the difference in salary and the restoration of the salary in the future are subject to payment. As non-material requirements, the employee may insist on returning to his previous job if it was not laid off. |

| Inaction of the employer that resulted in loss of earnings or prevented new employment | The employer's financial liability to the employee will occur only if the inaction resulted in the actual impossibility of finding a job. Thus, failure to issue a certificate of social contributions will not be such a reason. | Payment of the average salary for the entire period until the root causes are eliminated, Art. 139 TK. Moreover, if the deadlines for reduction are not met, compensation of the average salary is carried out with a reduction in the amount of payment by the amount of severance pay already paid. |

| Damage or destruction of property due to the fault of the employer | If the employee can prove that his property was lawfully located on the territory of the enterprise and was damaged due to the fault of the employer. | Compensation is carried out at market value or by providing an identical thing. The choice of option occurs only with the consent of the injured party, Art. 235 |

| Postponement or non-provision of leave planned according to the priority schedule | A vacation schedule drawn up on the eve of the current calendar year gives the employee the basis to plan how to spend it: purchase a voucher and tickets, book entertainment or pay for a course of sanatorium treatment. If you have documents confirming payment, you can fight for their return. | You can try to reach a humane agreement with your superiors about the return of the amounts spent by sending him a letter. But, if this fails, the employee has a direct road to court. It is worth understanding that the judge will most likely approve only the amount of non-refundable expenses for reimbursement. Therefore, the employee should first contact those from whom he purchased the tourism product, and then go to court for the rest of the unreimbursed amount. |

| Non-payment of overexpenditure on accountable amounts | To prove that he is right, the employee must have in his hands the “stubs” of advance reports and evidence that the funds were spent on behalf of the organization, within the framework of the employment contract. | The outstanding amounts due will be paid in full. It is more difficult to prove that this was done late. Most likely, compensation for delayed payment can only be received in the event of dismissal, Article 235.236. |

| Delay in payment of wages or compensation | The uniqueness of this type of violation of labor rights is that when making a decision on the payment of material compensation, any arguments in favor of the employer’s innocence are not taken into account. | Based on the conclusions of the labor commission, not only the delayed amounts are subject to payment, but also 1/150 of the Central Bank key rate for each day, Art. 236 TK. If the dispute reaches the court, the employee may put forward a demand for additional compensation in the amount of the inflation index (indexation), Art. 134 TK |

| Moral damage | The court will require evidence from the employee of causing moral harm without suffering physical suffering. You can resort to universal concepts or testimony of witnesses. | Depending on the strength of the evidence presented, the court will approve or reduce the amount of compensation for moral damage, Art. 237 Labor Code, art. 1101 of the Civil Code of the Russian Federation. |

| Causing harm to physical health as a result of actions or inactions of superiors | To prove the harm caused, it is necessary not only to provide a doctor’s opinion, but also to link the causes of the disease directly to the behavior of the manager. | Not only documented expenses for medications and research and procedures are subject to reimbursement. The employee can also claim the amount of moral damages. If the employer categorically disagrees with the employee’s arguments, then they can only resolve the dispute in court. |

Due to the difference in the financial situation of the worker and his employer, legislation almost always regards cases of full financial liability of the employer as normal practice. At the same time, the employee himself is protected from compensation for inflated amounts by Article 138 of the Labor Code.

Conditions for liability

The conditions for the onset of financial liability for the employer include:

- Committing certain actions or inaction that caused material losses to the employee.

- Illegality or culpability of the employer's conduct.

- Real infliction of loss to the employee , which he, as the injured party, must justify and prove.

If the illegality of the employer’s actions or inaction is proven by an act of the competent authority that has entered into legal force, then the employer’s guilt is correlated with the specific individuals who represent it.

In the process of proving the employer's guilt in causing harm, it is necessary to prove the fact of causing damage, the negative consequences of it, justify the amount of damage and identify the cause-and-effect relationship between the employer's behavior and his guilt.

Legislative acts on the topic (Labor Code of the Russian Federation)

| Art. 231 Labor Code of the Russian Federation | On the investigation, registration and recording of industrial accidents |

| Art. 232 Labor Code of the Russian Federation | On compensation of damage by a party to an employment contract to the other party to the agreement |

| Art. 233 Labor Code of the Russian Federation | Conditions for the onset of material liability of a party to an employment contract |

| Art. 234 Labor Code of the Russian Federation | On compensation by the employer for damage caused to an employee as a result of illegal deprivation of his opportunity to work |

| Art. 235 Labor Code of the Russian Federation | On compensation by the employer for damage caused to the employee’s property |

| Art. 236 Labor Code of the Russian Federation | Financial liability of the employer for delays in wages and other payments |

| Art. 237 Labor Code of the Russian Federation | Financial liability of the employer for causing moral harm to an employee |

Damage from the inability to perform labor functions

If an employer dismisses an employee without proper grounds, the employee may receive compensation for the earnings that were not paid to him due to his inability to work.

The circumstances for an employee’s forced failure to perform labor functions and deprivation of his due earnings are given in Art. 234 TK. Restrictions on the implementation of labor functions by an employee according to the specified legal norm may be due to:

- Removal of a person from work , his dismissal or transfer to another job.

- Issuance of a work book to an employee with a delay.

- Registration of the dismissal of an employee with errors (for example, the grounds for dismissal or the date of termination of the employment contract were incorrectly indicated). As a result of committing such offenses, the employee loses the opportunity to find employment and receive income.

- Failure to comply with the decision of the competent authorities to reinstate the employee at work or delay in this procedure.

It is worth considering that these methods of depriving an employee of an objective opportunity to work are not exhaustive. An employee may apply for compensation from an employer in other situations.

The fact that the employer’s actions are illegal must be established by the competent authorities. In particular, the court must recognize the existence of damage to the employee associated with the inability to work when considering a claim from the employee.

Delay of salaries and other payments

The employer's liability for delays in wages and other payments due to the employee is provided for in Art. 236 TK. Financial liability in this case is of a compensatory nature, that is, the employer must compensate the employee in cash for each overdue day when paying wages.

Liability also arises in relation to the employer’s overdue obligations in terms of payment of vacation pay, sick leave, maternity benefits, child benefits, compensation for unused leave upon dismissal, and other incentive and compensatory payments that are provided for in the employment contract or local regulations.

The employer's financial liability implies that he is not only obliged to repay the debt to employees, but also to pay them compensation. Its size is calculated as 1/300 of the refinancing rate for each day of delay. This percentage is applied to the amount of debt the employer owes to employees.

The payment day itself is not included in the calculations: compensation begins to be calculated from the day that follows the established salary payment day. The settlement day itself is not taken into account when determining the amount of compensation.

The timing of payment of salaries to employees must be specified in the employment or collective agreement or internal regulations. The absence of this information is equivalent to a violation of labor laws. Salaries must be paid strictly twice a month. For missing an advance payment, the employer must also pay compensation to the employee. The time interval between the advance payment and the final payment should not exceed 15 days. In this case, the final payment must occur on any date in the first half of the month, but no later than the 15th day of the month following the settlement month.

The employer must strictly adhere to the established deadlines for paying wages so that he does not have to pay penalties. He does not have the right to indicate a time frame in local documentation, for example, the advance payment is transferred before the 25th or in the period from the 21st to the 25th.

Payment of wages and compensation for unused vacation upon dismissal is made on the employee’s last working day.

Coverage of losses incurred by employees may be provided for in the provisions of a collective agreement, local regulation or employment contract. At the same time, the employer has the right to establish compensation exclusively in an increased amount in relation to the value contained in the Labor Code. That is, it should be more than 1/300 of the refinancing rate.

The employer's liability for late payment of wages occurs regardless of the presence or absence of his fault in this. Thus, he must compensate employees for expenses, even if they received their salaries late due to software failures.

The employer and his financial responsibility

“Human Resources Department of a Commercial Organization”, 2012, N 3

THE EMPLOYER AND ITS MATERIAL RESPONSIBILITY

The financial liability of the employee and the employer provided for by the Labor Code consists of the obligation to compensate for the damage caused to the other party and occurs in the presence of certain grounds. In this case, the employee is obliged to compensate only for direct actual damage caused to the employer, which is understood as a real decrease or deterioration in the condition of the employer’s available property. The employer compensates the employee for both direct property damage and damage associated with violation of the employee’s labor rights. We will discuss in this article in which cases an employer is financially liable to an employee.

First of all, let us clarify that the employer’s financial liability in cases established by the Labor Code does not always arise, but only under certain conditions. The first of these is the presence of the damage itself. The actions (inaction) of the employer must be illegal, that is, violate the current norms of labor legislation or local regulations of the organization. The employer must be to blame for causing the harm. In addition, there must be a cause-and-effect relationship between such an action (inaction) and the harm caused (Article 232 of the Labor Code of the Russian Federation). These conditions must be present simultaneously, unless otherwise provided by the Labor Code of the Russian Federation or other federal laws. For example, by virtue of Art. 236 of the Labor Code of the Russian Federation, financial liability for delay in payment of earnings and other payments occurs regardless of the employer’s fault.

Articles 234 - 237 of the Labor Code of the Russian Federation establish the following grounds for the employer’s financial liability to the employee:

- damage caused to the employee as a result of illegal deprivation of the opportunity to work;

— damage caused to the employee’s property;

— delay in payment of wages and other payments due to the employee;

- causing moral harm.

Note! An employment contract or written agreements attached to it may specify the financial liability of the parties. At the same time, the contractual liability of the employer to the employee cannot be lower, and the employee to the employer - higher, than provided for by the Labor Code of the Russian Federation or other federal laws (Article 232 of the Labor Code of the Russian Federation).

We also note that the financial liability of the parties arises regardless of whether the employee continues to work or the employment contract with him is terminated.

Now let’s look at the grounds for liability in more detail.

Illegal deprivation of an employee's opportunity to work

Among the main responsibilities of the employer established by Art. 22 of the Labor Code of the Russian Federation - providing employees with work stipulated by the employment contract, payment for this work within the time frame and in the amount established by local regulations in accordance with the Labor Code of the Russian Federation. If, as a result of the employer’s actions, an employee is deprived of the right to work and, accordingly, is deprived of wages for this period, and the employer’s actions are declared illegal, then the employer will have to compensate the employee for material damage - his lost earnings.

This obligation arises if earnings are not received as a result of:

— illegal removal of an employee from work, his dismissal or transfer to another job;

— the employer’s refusal to execute (or untimely execution by him) the decision of the labor dispute resolution body or the state legal labor inspector to reinstate the employee to his previous job;

— delay by the employer in issuing a work book to an employee, entering into the work book an incorrect or non-compliant formulation of the reason for the employee’s dismissal (Article 234 of the Labor Code of the Russian Federation).

What is meant by illegal removal of an employee from work? This will be removal on grounds not provided for by the Labor Code of the Russian Federation or other federal laws or regulations. Let us recall that Art. 76 of the Labor Code of the Russian Federation establishes the following cases of removal:

— the employee’s appearance at work in a state of alcohol, drug or other toxic intoxication;

— failure to undergo training and testing of knowledge and skills in the field of labor protection in the prescribed manner;

— failure to undergo a mandatory medical examination and psychiatric examination in accordance with the established procedure;

— identification, in accordance with the medical report, of contraindications for performing work;

— suspension for a period of up to two months of an employee’s special right (license, right to drive a vehicle, right to carry a weapon, other special right), if this makes it impossible for him to perform his job duties and if it is impossible to transfer the employee to another job available to the employer;

— requirements of authorized bodies or officials;

- in other cases provided for by federal laws and other regulatory legal acts of the Russian Federation. For example, the removal of a prosecutor for the period of investigation of a criminal case initiated against him <1>.

———————————

<1> Article 42 of the Federal Law of January 17, 1992 N 2202-1 “On the Prosecutor’s Office of the Russian Federation”.

Thus, the removal from work, for example, of an employee who has committed absenteeism or another disciplinary offense, will be illegal.

Despite the fact that labor legislation does not establish a specific procedure for removal, the employer is still obliged to take certain actions. For example, when suspending an employee from work who appeared intoxicated, it is first necessary to record this fact by drawing up a report, then request an explanation from the employee, and, if necessary, send him for a medical examination. If the employer dismisses the employee, but is unable to document the existence of grounds for this, such dismissal will be considered illegal.

Note! The employee is suspended (not allowed to work) from work for the entire period of time until the disappearance of the circumstances that were the basis for suspension from work or prohibition from work.

As for the translation, its procedure is established by Art. Art. 72, 73 Labor Code of the Russian Federation. In this case, illegality will consist in violating the transfer procedure or transferring the employee without his consent, if any.

In accordance with Art. 394 of the Labor Code of the Russian Federation, if dismissal or transfer to another job is recognized as illegal, the employee must be reinstated in his previous job by the body considering the individual labor dispute. Such a body makes a decision to pay the employee the average salary for the entire period of forced absence or the difference in earnings for the entire period of performing lower-paid work.

Note! The decision to reinstate an illegally dismissed employee or to reinstate an employee who was illegally transferred to another job to his previous job is subject to immediate execution. If the employer delays the execution of such a decision, the body that made the decision makes a determination to pay the employee the average salary or difference in earnings for the entire time of delay in execution of the decision (Article 396 of the Labor Code of the Russian Federation).

In addition, the employer will have to pay an enforcement fee, and may also be subject to administrative liability.

According to Art. 84.1 of the Labor Code of the Russian Federation, on the day of termination of the employment contract, the employer is obliged to issue the employee a work book and make payments to him. In this case, an entry in the work book about the basis and reason for termination of the employment contract must be made in strict accordance with the wording of the Labor Code of the Russian Federation or other federal law. If there is a delay in issuing a work book due to the fault of the employer, or if the reason for dismissal is stated incorrectly or does not comply with federal law, the employer is obliged to compensate the employee for the wages he did not receive during the entire delay. In this case, the day of dismissal (termination of the employment contract) is considered the day the work book is issued. If it is impossible to issue a work book on the day of dismissal due to the absence of the employee or his refusal to receive this document in hand, the employer sends the employee a notice of the need to appear for the work book or agree to send it by mail. Sending a work book by mail to the address specified by the employee is permitted only with his consent.

From the date of sending this notification, the employer is released from liability for the delay in issuing a work book to the employee <2>.

———————————

<2> Decree of the Government of the Russian Federation of April 16, 2003 N 225 “On work books” (together with the Rules for maintaining and storing work books, producing work book forms and providing them to employers).

If the incorrect formulation of the grounds and (or) reasons for dismissal in the work book prevented the employee from taking another job, then the court decides to pay the employee the average salary for the entire period of forced absence (Article 394 of the Labor Code of the Russian Federation).

As an example, let us cite the cassation ruling of the Supreme Court of the Urals dated April 11, 2011 in case No. 33-1234/11.

Citizen G. worked for individual entrepreneur Sh. as a sales agent from May 22, 2008. On April 13, 2009, G. wrote a letter of resignation of her own free will under clause 3, part 1, art. 77 Labor Code of the Russian Federation. Based on the order dated April 13, 2009, she was dismissed, but she was not familiarized with the dismissal order. On the day of her dismissal, G. worked, but she was not given a work book, but was sent by mail on 10/12/2009. The document was received on October 17, 2009. Before receiving the work book, on July 27, 2009, G. went to court with a demand for the recovery of average earnings during the delay in issuing the work book, compensation for the use of personal transport, compensation for unused vacation rights and compensation for moral damage.

The court of first instance satisfied the claims for the recovery of average earnings for the period of delay in the work book and compensation for moral damage. When making its decision, the court was guided by the following.

According to Art. 84.1 of the Labor Code of the Russian Federation, the employer is obliged to issue the employee a work book on the day of his dismissal. If an employee refuses to receive a work book at the time of dismissal, the employer becomes obligated to immediately send the employee a notice of the need to appear for a work book or agree to send it by mail. Failure to fulfill this obligation means a delay in issuing the work book, since the employer is released from liability for the delay only from the moment the notification is sent.

The individual entrepreneur did not provide any evidence that G. refused to receive a work book on the day of her dismissal, as well as evidence that she was sent a notice about the need to appear for a work book or agree to have it sent by mail.

According to paragraph 63 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 No. 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation” (hereinafter referred to as Resolution No. 2), the court by virtue of paragraph. 14 hours 1 tbsp. 21 and Art. 237 of the Labor Code of the Russian Federation has the right to satisfy the employee’s request for compensation for moral damage caused to him by any unlawful actions or inaction of the employer, including in case of violation of property rights. Thus, a sufficient basis for satisfying the claim for compensation for moral damage is the establishment of the fact of unlawful actions of the individual entrepreneur, and this fact has been proven by G.

Taking into account the fact that the violation of G.’s labor rights was a consequence of the employer’s guilty actions, and also taking into account the period of delay in issuing the work book, the court determined the amount of compensation for moral damage in accordance with the requirements of reasonableness and fairness, based on the specific circumstances of the case.

The deadline for filing a statement of claim in court G. was not missed, since by virtue of Part 1 of Art. 392 of the Labor Code of the Russian Federation, an employee has the right to go to court for resolution of an individual labor dispute within three months from the day when he learned or should have learned about a violation of his right.

The decision made by the court of first instance, the judicial panel of the Supreme Court of the Republic of Uzbekistan, was left unchanged.

Damage caused to employee property

Article 235 of the Labor Code of the Russian Federation provides for the employer's financial liability for damage caused to the employee's property. Damage can be either loss or damage to property. In this case, the obligation to compensate arises only if damage is caused to the employee’s property in the course of his work activity or in connection with the performance of his work function. Such damage is compensated in full, and its amount is calculated at market prices in force in the area on the day of compensation. If the employee agrees, damages can be compensated in kind.

The question arises: who should assess the amount of damage? Based on Part 2 of Art. 233 of the Labor Code of the Russian Federation, which states that each party to an employment contract is obliged to prove the amount of damage caused to it; the amount of damage is determined by the employee, and the employer can agree with it or not.

So, the employer is obliged to ensure the safety of the property belonging to the employee, but by virtue of Art. 233 of the Labor Code of the Russian Federation, for liability to arise, there must be a connection between the losses incurred by the employee and the unlawful actions of the employer. Since neither the Labor Code of the Russian Federation nor other regulations establish what specific property the employer is responsible for, difficulties arise in practice. For example, should an employer be held liable for a diamond ring that an employee kept in a safe at work? No, you shouldn't. The employer is responsible only for the property that, with his knowledge, is located at the workplace. Thus, if an employee uses a personal laptop at work by agreement with the employer due to a computer breakdown, the employer is clearly responsible for the safety of the laptop.

But it would be wrong for the employer to be responsible for all the personal belongings of the employee if the employee himself does not treat this with due caution: he leaves the office unattended, forgets valuables in a visible place, etc. Of course, now almost all organizations conclude contracts with security companies, whose responsibilities include ensuring the safety of employees’ property, but only to the extent stipulated by the contract. In any case, the employer can conduct an investigation into the theft, inviting police officers if necessary. The investigation is carried out on the basis of a statement or report from the employee. Within ten days from the date of receipt of the application, the employer is obliged to consider it and make a decision. If you disagree with the employer’s decision or do not receive a response within the prescribed period, the employee has the right to go to court.

Compensation for damage to the employee is carried out by order of the employer on the basis of an application, if the employer agrees, or on the basis of a court decision.

Delay in payment of wages

By virtue of Art. 21 of the Labor Code of the Russian Federation, an employee has the right to receive wages in full in a timely manner in accordance with his qualifications, complexity of work, quantity and quality of work performed. In turn, the employer is obliged to pay the full amount of wages due to employees within the time limits established in accordance with the Labor Code of the Russian Federation, the collective agreement, internal labor regulations, and employment contracts (Article 22 of the Labor Code of the Russian Federation).

Wages must be paid at least every half month, and for certain categories of workers, federal law may establish other terms for payment of earnings (Article 136 of the Labor Code of the Russian Federation). In this case, the collective agreement, internal labor regulations and the employment contract must indicate specific payment dates, for example, the 20th of the current month and the 5th of the next month.

Note! If an employer transfers wages to a bank card, he must take into account the time required to transfer funds to the bank account and then to the employees' cards. The date the employee receives his salary from the card should not be later than established by local regulations and the employment contract.

If the payment day coincides with a weekend or non-working holiday, payment of earnings is made on the eve of this day (Part 8 of Article 136 of the Labor Code of the Russian Federation).

So, if the employer violates the established deadlines for payment of wages, vacation pay, dismissal payments and other payments due to the employee, the employer bears financial responsibility, which is expressed in the obligation to pay monetary compensation (interest) to the employee. Its size must be no lower than 1/300 of the refinancing rate of the Central Bank of the Russian Federation of amounts not paid on time for each day of delay. The amount of compensation paid to an employee can be increased by a collective or labor agreement (Article 236 of the Labor Code of the Russian Federation).

Please note that the employer is obliged to pay interest to employees at the same time as the delayed amounts, having formalized this by order. The employee does not have to write any statement. Otherwise, he has the right to appeal to the CCC, State Tax Inspectorate or court.

In addition, the accrual of interest in connection with late payment of earnings does not exclude the employee’s right to index the amounts of delayed wages due to their depreciation due to inflation processes, but only in court <3>.

———————————

<3> Resolution No. 2.

In this regard, let us remind you that payment for vacation is made no later than three days before its start (Article 136 of the Labor Code of the Russian Federation). In addition to the fact that in case of violation of the deadline for payment of vacation, the employer is obliged to pay interest to the employee, upon the written application of the latter, he is obliged to postpone the annual paid vacation to another period agreed with the employee (Article 124 of the Labor Code of the Russian Federation).

As for payments due to an employee upon dismissal, they are made on the day of dismissal, and if the employee is absent on this day, then the calculation is made no later than the next day after the employee submits the corresponding demand (Article 140 of the Labor Code of the Russian Federation).

Other payments for violation of the terms of which the employer is financially responsible include payment of sick leave. According to Part 1 of Art. 15 of the Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”, within ten days from the moment the employee presents sick leave at his place of work, he must be assigned a temporary disability benefit. Payment of benefits is carried out by the employer on the day closest to the appointment, established for the payment of wages.

If the delay in payment of earnings is more than 15 days, the employee has the right to suspend work for the entire period until the debt is paid. He must notify the employer about this decision in writing (Article 142 of the Labor Code of the Russian Federation).

Moral injury

Although moral damage Art. 151 of the Civil Code of the Russian Federation is characterized as physical or moral suffering of a citizen caused to him by actions that violate his personal non-property rights or encroach on other intangible benefits belonging to the citizen; the Labor Code classifies causing moral harm to an employee as the area of financial responsibility of the employer.

The Labor Code mentions moral damages in Art. Art. 3, 21 and 22. Thus, Art. 3 provides the right to apply to the court for restoration of violated rights and compensation for moral damage to persons who believe that they have been discriminated against in the world of work, Art. 21 establishes the employee’s right to compensation for moral damage; Art. Article 22 talks about the employer’s obligation to compensate for moral damage in the manner and under the conditions established by the Labor Code of the Russian Federation, federal laws and other regulatory legal acts.

And part 1 art. 237 of the Labor Code of the Russian Federation provides for compensation for moral damage caused to an employee by unlawful actions or inaction of the employer. Compensation for damage is carried out in cash in amounts determined by agreement of the parties to the employment contract. If the amount of compensation is not regulated by agreement between the employee and the employer, the damage is assessed by the employee himself and determined by the court. At the same time, the amount of compensation is determined by the court regardless of the property damage subject to compensation (Part 2 of Article 237).

The basis for compensation for moral damage may be moral and physical suffering resulting from:

— violation by the employer of the employee’s labor rights (illegal dismissal or transfer, application of disciplinary action, etc.);

- damage to health, injuries, mutilations, etc. As a rule, if an employee goes to court for restoration of violated labor rights, at the same time with this demand he also presents a demand for compensation for moral damage. And if the court finds the employer’s actions unlawful, the specified compensation is also recovered in favor of the employee.

If an employee is injured as a result of the employer’s failure to provide safe working conditions in accordance with labor laws, he can also go to court to claim moral damages. In this case, the employer bears the burden of proving his innocence in the accident.

Please note that the obligation to compensate the employee for moral damage occurs under the following conditions:

— causing physical and (or) moral suffering to the employee;

- the employer commits culpable unlawful acts or inactions;

— a cause-and-effect relationship between unlawful guilty actions (inaction) and physical and (or) moral suffering of the employee.

The obligation to compensate for moral damage may arise without the employer’s fault if the harm is caused to the life or health of an employee by a source of increased danger <4>.

———————————

<4> Resolution of the Plenum of the Armed Forces of the Russian Federation dated December 20, 1994 N 10 “Some issues of application of legislation on compensation for moral damage.”

At the same time, by virtue of Art. 1079 of the Civil Code of the Russian Federation, moral damage will be recovered if the employer does not prove that the damage arose as a result of force majeure or the intent of the victim. The amount of compensation for harm may be reduced if the harm was caused by the gross negligence of the victim himself (Article 1083 of the Civil Code of the Russian Federation).

Thus, the Khabarovsk Regional Court issued a cassation ruling dated November 2, 2011 in case No. 33-7969 against the decision of the Kirovsky District Court of Khabarovsk. The essence of the matter was as follows. E. filed a lawsuit against Russian Railways OJSC for moral damages caused by the death of his father while performing his job duties as a result of an industrial accident. E.'s father (A.) worked as an excavator operator and died from injuries received as a result of an industrial accident that occurred on November 11, 2009. The injury occurred as a result of the explosion of a hot water boiler used to heat the premises intended for the accommodation of construction crew workers. The court found that the explosion occurred due to a combination of design deficiencies and unprofessional actions of maintenance personnel (namely employee Ch.), who had not been trained in the prescribed manner and did not carry out the sequence of operations during an emergency shutdown of the boiler, as provided for in the instructions. Gross negligence on the part of A. is not confirmed by the case materials.

Guided by Art. Art. 151, 1079, 1083 of the Civil Code of the Russian Federation, taking into account the nature and degree of moral suffering caused to E. by the death of his father, based on the principle of reasonableness and fairness, the court recovered from Russian Railways in favor of E. monetary compensation for moral damage. The judicial panel of the Khabarovsk Regional Court upheld this decision.

Compensation for moral damage to an employee is also formalized by order of the employer. Its basis is indicated either by the court decision or the details of the agreement, if it was concluded.

L. V. Kurevina

Journal expert

"Human Resources Department

commercial organization"

Signed for seal

29.02.2012

Damage caused to employee property

If the property of an organization employee was damaged by a full-time employee of the organization or an employee performing his duties under an employment contract on behalf of the organization, then the employer must compensate the employee for the damage.

An employee's property includes all things owned by him . This could be vehicles, tools, personal belongings of an employee, etc.

The Labor Code does not provide a specific list of employee property for which financial liability arises. It can be assumed that the employer compensates for damages for property that is in the organization with the knowledge or consent of the employer. For example, an employer is obliged to compensate the cost of an employee’s outerwear if the employer assumes the responsibility to ensure its safety (for example, the organization operates a wardrobe).

Understanding the damage caused to the employee must take into account Art. 15 Civil Code. It says here that it includes real damage caused to the employee, and it is subject to compensation in full without restrictions.

When determining the amount of damage, the employee must take into account current market prices or the in-kind form of compensation for damage caused. The latter must be determined by agreement of the parties, that is, the employee’s consent to receive compensation in this form is required, and it must be documented. The determination of the possibility of compensation for damage in kind is contained in Part 2 of Art. 235 TK.

Damage is calculated based on the prices of the employee’s location. The Labor Code does not contain provisions on determining the market value of property for compensation for material damage, therefore, when determining it, you can use special regulations. For example, the provisions of the Federal Law “On Valuation Activities in the Russian Federation” of 1998 No. 135-FZ.

It is also worth considering that damage is determined precisely on the basis of market prices on the day of compensation, and not on the date of infliction. This may be beneficial to the employer, since at the time of compensation the market value of the property may decrease.

Compensation for moral damage caused to an employee

Moral damage can be understood as physical or moral suffering caused by the employer through his illegal actions (inaction) to the employee. Such actions include late payment of labor, incorrect calculation of wages for overtime work, refusal to conclude an employment contract without proper grounds, etc.

Labor legislation does not limit the rights of an employee to possibly receive compensation for damage caused. Issues of determining the amount of damage and the procedure for claiming compensation for moral damage are given in the Civil Code.

Moral damage is compensated to the employee in the amount determined by agreement of the parties or in court. When considering a claim, the judge, at his own discretion, will determine the validity of the amount of moral damage that the employee has submitted for payment. The court may reduce it or order payment in full.

According to Art. 151 of the Civil Code, when establishing the amount of moral damage, the guilt of the offender, as well as other facts that deserve attention, are taken into account. The court also takes into account the level of moral and moral torment of the victim, taking into account the uniqueness of his personality.

The employee must prove the fact of causing such suffering independently. As confirmation of the facts stated by him, an illness that arose due to the loss of a job, anxiety due to the impossibility of employment, a difficult financial situation, etc.

The procedure for holding an employer liable

The employer is held liable in the following order:

- The fact of damage to the employee's property is determined . Typically, the initiative to record damage comes from the employee as an interested party. This fact can be documented in the form of a memo from the employee addressed to the employer. It is drawn up in free form and contains an indication of the employee’s full name, the circumstances of the damage, the date and time of the event and a list of property that was damaged.

- The employer draws up an act of damage to the employee's property based on the received report . The preparation of such an act in this case is the responsibility of the employer, since the act allows not only to record the date and circumstances of the damage, but can also serve as the basis for subsequently bringing the employee, through whose fault the damage to the property of another employee was caused, to financial liability. For example, a cloakroom attendant who did not ensure the safety of an employee’s property, although this was her direct job responsibility. The employer also has the right to conduct its own investigation to establish the causes of the incident and determine the list of those responsible for the incident. For this purpose, a special commission can be created on the basis of the enterprise.

- The employee submits an application to the employer demanding compensation for damage . It is drawn up in two copies: one of them is given to the employer, and the second remains with the employee.

- The employer determines the amount of damage caused to the employee’s property and records it in a regulatory legal act.

- An official order is issued by the employer to compensate the employee for damages . It is drawn up in free form and contains an indication of the list of property of the employee who suffered damage, as well as the amount of payment. The order is also issued if compensation is made by court decision.

The specified algorithm for repayment of damage is conditional and may vary depending on the specifics of the situation.

Forms of financial liability

The employer's liability is divided into types depending on the grounds on which it is imposed:

- Damage due to which an employee can no longer perform his or her job functions. Regulated by Article 234 of the Labor Code of the Russian Federation.

- Damage to employee property. For example, a manager uses an employee’s car for business purposes. There was an accident. In this case, the employer must pay all costs associated with the repair work. Payment of compensation is regulated by Article 235 of the Labor Code of the Russian Federation.

- Damage associated with delayed wages. Delay in mandatory payments also harms the employee. Payment of compensation is carried out on the basis of Article 236 of the Labor Code of the Russian Federation.

The manager is also obliged to pay compensation in the event of moral damage to an employee.

NOTE! The above list is exhaustive, that is, the employer cannot have any other grounds for financial liability to the employee. Most often, an entrepreneur is held accountable for illegal dismissal, suspension from work, or transfer to another position.

Let's consider all cases when the employer's financial liability arises in more detail.

Inability to perform one's job functions

The employer is obliged to pay compensation if, through his fault, the employee is unable to perform his job functions. For example, these situations could be:

- Wrongful dismissal or illegal transfer to another position.

- The employer does not want to reinstate the employee to his previous place of work.

- The manager does not give the employee a work book or other documents, and for this reason the person cannot get a new job.

The employer must pay compensation in full. However, it is not always easy to determine the extent of damage. For example, if a person was unable to get a job in a company due to the lack of a work book, the amount of compensation is established based on the following calculation: salary for each day without work.

Damage to employee property

An employee's property refers to his belongings, either owned or leased. Harm means damage, loss, damage, etc. To receive compensation, the employee must submit a corresponding application. The employer is obliged to respond to it within 10 days.

Delay of salary

Salary can mean various payments: salary, vacation pay, sick leave, bonuses. If an employee does not receive wages within the established time frame, he can contact the labor inspectorate. If a person leaves work, he must send an application to the inspectorate within 3 months from the date of delay. If the employee continues to work for the company, there is no time limit for filing an application.

Compensation for damage of this kind includes not only delayed wages, but also charges for each day of delay. The size of these charges is determined based on the Central Bank refinancing rate.

An employee who has not received a salary has the right not to go to work until the delay is eliminated. When the employer is ready to pay the funds, it must give the employee notice in writing. The employee must go to work after receiving the paper.

Moral damage

Moral damage involves causing mental and moral harm to an employee. For example, an employer insulted a person and affected his religious feelings. The amount of compensation and the possibility of its payment are established by agreement of the parties. If this agreement is not reached, the employee may file a lawsuit. You must include evidence of the employee’s suffering and the manager’s guilt in your claim. For example, this could be a certificate confirming the diagnosis of a nervous disease. When establishing the amount of compensation, the degree of moral damage suffered by the person is taken into account. The court takes into account the nuances of a particular case: an agreement between the parties on an acceptable amount can be reached or it can be forced by the court. The court considers the degree of guilt of the employer towards the employee, the amount of moral suffering of the victim, and other circumstances, adhering to the principles of fairness and reasonableness.

Where can an employee apply for compensation?

Initially, an employee to whom the employer must pay compensation for damage caused must submit this claim to the employer. The procedure for contacting may be contained in internal documentation. In particular, the procedure for compensation of losses, the amount and timing of payments may be prescribed here.

If the employer refuses to voluntarily pay compensation, the employee may seek protection of his interests:

- to the labor inspectorate;

- to the prosecutor's office;

- to court.