Compensation for delay according to the Labor Code of the Russian Federation

Labor standards establish that employees must receive earnings at least once every 2 weeks (that is, an advance and the remaining amount). The specific dates of the advance and the rest of the payment are set by the organization itself; this is stated in its internal documents:

- employment contract;

- collective agreement;

- internal regulations.

If the specified information is not fixed in the organization’s documents, this is a direct violation of labor legislation.

If the employer does not pay on time, he will have to compensate the employee for the damage caused - pay compensation. Accordingly, compensation according to the law is accrued for the period that begins from the expiration of 15 days from the accrual of wages (and the accrual date is set by the legal entity).

Compensation payments are included in the concept of a legal entity’s financial liability to an employee and are calculated in an amount not lower than 1/150 of the Central Bank refinancing rate. The amount of compensation is calculated as a percentage of the funds not paid on time.

Delay in payment of wages from the point of view of the law

In accordance with Article 136 of the Labor Code of Russia, wages to employees must be provided at least 2 times a month (every half month). The specific payment date is established by the organization’s local regulations: labor or collective agreement, internal regulations.

Important! If payday falls on a weekend or holiday, payments must be made the day before. The presence of other conditions in the contract does not comply with the law, which means they are invalid.

The grounds for holding an employer liable for non-payment of wages arise from the 1st day of delay. And starting from the 16th day, paragraph 3 of Article 142 of the Labor Code of the Russian Federation allows employees to suspend the performance of their official duties by notifying the employer in writing. This does not deprive the employee of the right to receive wages, including for the time during which he did not actually perform labor functions.

Employee rights

If an organization does not pay remuneration for labor (or other payments within the framework of labor relations, such as vacation pay) for more than 15 days, then the employee may suspend his work activity (Article 142 of the Labor Code of the Russian Federation).

You must notify your employer of this in writing.

Compensation paid to employees for late payment of wages

For each day of delay in transferring wages, the employer is obliged to pay compensation to the employee (Article 236 of the Labor Code of the Russian Federation). The amount of the penalty is calculated based on 1/150 of the current Central Bank key rate.

Liability for non-payment of compensation

If a citizen does not receive compensation, then he has the right to refuse to go to work until the organization pays off the debt to him (this also applies to delays in wages in general - after 15 days have passed from the moment the money should have arrived, the citizen may not work until the wages are paid). the fee will not be transferred to him).

Compensation payments are taken into account in the amount of the main debt, therefore, the head of the organization, individual entrepreneur or official bears responsibility for non-payment of compensation along with the penalty for non-payment (therefore, the penalties for non-payment of compensation are similar to those for delay or underpayment of amounts due to the employee).

Incomplete payment for the activities of employees or a long delay in payment may occur due to the fault of both officials responsible for accrual and payment (HR department employees, accountants), and due to the fault of the manager or organization. In addition, non-payment could have occurred due to the fault of third parties (for example, a bank that transferred money late).

In the latter case, the employer or other official of the organization, as well as the legal entity itself, is not at fault. In general, in order to apply certain sanctions to a person who has committed a violation (disciplinary, material, administrative, criminal), proof of his guilt is required.

Expert opinion

Mikhailov Vladislav Igorevich

Legal consultant with 8 years of experience. Specializes in criminal law. Member of the Bar Association.

Non-payment of remuneration for work is one of the most serious violations of labor legislation. One of the types of punishment provided for such a violation is a fine for non-payment of wages to company personnel.

The amounts of sanctions, as well as the procedure for their application, are different and depend on the circumstances of the violation in each specific case.

- What is considered a violation of payment deadlines?

- What financial losses does delayed wages entail?

- What administrative fines apply?

- What are the fines under criminal penalties?

- How can an employer avoid criminal penalties?

- What can an employee do if his salary is delayed?

What is considered a violation of payment deadlines?

The procedure for making payments for wages is enshrined in Art. 136 Labor Code of the Russian Federation. It establishes the following restrictions regarding the timing of salary transfers:

- Payment is made in two installments, 2 times a month;

- Payment must be made no later than 15 days after the end of the accrual period;

- If the payday coincides with a weekend or non-working holiday, then the transfer must be made on the next working day preceding the specified date;

- Vacation pay is paid no later than three days before the start of the vacation.

In addition, in Art. 140 of the Labor Code of the Russian Federation contains a special rule that requires a full settlement to be made upon termination of an employment contract on the day of dismissal.

Violation of any of these provisions will be considered as a fact of non-compliance with labor laws and may subject the employer to various types of liability.

Employer's obligations to pay wages

The Labor Code establishes guarantees for workers at the legislative level; its goals are to establish state guarantees of labor rights and freedoms of citizens, create favorable working conditions, and protect the rights and interests of workers and employers.

In accordance with Article 129 of the Labor Code, wages (employee remuneration) are remuneration for work depending on:

- employee qualifications,

- complexity, quantity, quality and conditions of the work performed,

and:

- Compensation payments, additional payments and allowances of a compensatory nature, including:

- for working in conditions deviating from normal,

- for work in special climatic conditions and in areas exposed to radioactive contamination.

- Incentive payments (additional payments and bonuses of an incentive nature, bonuses and other incentive payments).

At the same time, in accordance with Article 136 of the Labor Code of the Russian Federation, when paying wages, the employer is obliged to notify each employee in writing:

- On the components of wages due to him for the relevant period.

- On the amounts of other amounts accrued to the employee, including monetary compensation for the employer’s violation of the established payment deadline:

- wages,

- vacation pay,

- payments upon dismissal,

- other payments due to the employee.

- About the amounts and reasons for the deductions made.

- About the total amount of money to be paid.

Wages are paid to the employee, as a rule, at the place where he performs the work or transferred to the bank account specified by the employee under the conditions determined by the collective agreement or employment contract.

Important

The place and timing of payment of wages in non-monetary form are determined by a collective agreement or employment contract.

Wages are paid directly to the employee, except in cases where another method of payment is provided for by federal law or an employment contract.

Note:

- Wages are paid at least every half month on the day established:

- internal labor regulations,

- collective agreement,

- employment contract.

- If the payment day coincides with a weekend or non-working holiday, wages are paid on the eve of this day.

- Payment for vacation is made no later than three days before it starts.

It should also be remembered that the possibility of receiving wages does not depend on:

- the organization makes a profit,

- product sales,

- sales of goods,

- performance of services.

Important

The monthly salary of an employee who has worked standard working hours during this period and fulfilled labor standards (job duties) cannot be lower than the minimum wage established by federal law* (Article 133 of the Labor Code of the Russian Federation).

*from 01/01/2013 The minimum wage is 5,205 rubles.

In accordance with the provisions of Article 133.1 of the Labor Code, in a constituent entity of the Russian Federation, a regional agreement on the minimum wage may establish the amount of the minimum wage in a constituent entity of the Russian Federation.

The minimum wage in a constituent entity of the Russian Federation may be established for employees working in the territory of the corresponding constituent entity of the Russian Federation, with the exception of employees of organizations financed from the federal budget.

The size of the minimum wage in a constituent entity of the Russian Federation is established taking into account socio-economic conditions and the cost of living of the working population in the corresponding constituent entity of the Russian Federation.

The minimum wage in a constituent entity of the Russian Federation cannot be lower than the minimum wage established by federal law.

At the same time, the amount of the minimum wage in a constituent entity of the Russian Federation is ensured:

- Organizations financed from budgets - at the expense of such budgets, extra-budgetary funds, as well as funds received from entrepreneurial and other income-generating activities.

- Other employers - at their own expense.

In accordance with Article 130 of the Labor Code of the Russian Federation,

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

The system of basic state guarantees for remuneration of workers includes:

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

- minimum wage in the Russian Federation;

- measures to ensure an increase in the level of real wages;

- limiting the list of grounds and amounts of deductions from wages by order of the employer, as well as the amount of taxation of income from wages;

- limitation of remuneration in kind;

- ensuring that the employee receives wages in the event of termination of the employer’s activities and its insolvency in accordance with federal laws;

- federal state supervision over compliance with labor legislation and other regulatory legal acts containing labor law norms, including inspections of the completeness and timeliness of payment of wages and the implementation of state guarantees for wages;

- liability of employers for violation of the requirements established by labor legislation and other regulatory legal acts containing labor law norms, collective agreements, and agreements;

- terms and order of payment of wages.

What financial losses does delayed wages entail?

Failure by an employee to receive the money due to him for work performed is sufficient grounds for supervisory authorities to apply various financial sanctions to the employer. These include:

- Financial liability in the form of a penalty accrued on the amount of debt for each day of delay;

- Administrative fines for violation of the Labor Code of the Russian Federation in accordance with the provisions of Art. 5.27 Code of Administrative Offences;

- Fines within the framework of criminal penalties, subject to certain conditions.

The application of financial liability does not depend on the will of the employer or employee; it occurs at the time of repayment of the resulting debt. The interest accrual period is determined from the date following the salary payment day established in local regulations and ends at the moment of full repayment of the debt.

The amount of charges is 1/150 of the key rate of the Central Bank of the Russian Federation for each day of delay. The formula for calculation is as follows: Amount of debt × 1/150 × % of the Central Bank × Number of days overdue.

- Delay period: from 04/16/19 to 04/22/19 – 7 calendar days;

A penalty of 1/150 of the key rate of the Central Bank of the Russian Federation is minimal; local regulations of the company may establish higher amounts of compensation for such cases.

What administrative fines apply?

Administrative fines are imposed by inspection bodies (GIT, Prosecutor's Office) if a complaint is submitted to them by an employee. In addition, it is possible to apply them following the filing of a claim in court.

List of material penalties in accordance with Art. 5.27 of the Code of Administrative Offenses of the Russian Federation for violation of the terms of payment of wages or their accrual in an amount below the minimum wage contains the table below.

If similar violations are repeatedly detected in the same subjects, the fines will be much larger.

An employee’s application to the labor inspectorate or prosecutor’s office serves as the basis for an unscheduled inspection. Based on its results, an order is issued with the collection of the specified fines.

Expert opinion

Mikhailov Vladislav Igorevich

Legal consultant with 8 years of experience. Specializes in criminal law. Member of the Bar Association.

If signs of a criminal offense are detected, the inspection materials may be submitted to the court. In addition, a court decision may temporarily restrict the head of a company from holding a leadership position or engaging in business.

What are the fines under criminal penalties?

The application of fines in a criminal case is possible only by court decision. To initiate criminal proceedings, the delay must last:

- For part of the amount – more than 3 months;

- For the full amount of salary – more than 2 months.

It is also necessary to have intent on the part of the employer, selfish motives. As a rule, this means that a company official had funds for a salary, but he deliberately did not pay it, or conditions were deliberately created for the lack of funds in the accounts to pay off wage arrears.

If an official is found guilty, he may face one of the following types of fines.

The period of delay in the interests of applying criminal penalties is calculated from the date following the approved day of payment of wages. In addition, if months of delayed wages alternated with months of payment, then the periods of non-transfer for these purposes are not cumulative.

A prerequisite for the application of punishment is the presence of guilt of the official and his selfish intent, personal interest. If such evidence is not provided or is considered insufficient by the court, the application of fines in criminal proceedings is impossible.

In addition to fines, other punishments may be applied in terms of being subjected to correctional labor or a prison sentence of varying lengths. Along with fines, it is possible to introduce restrictions for managers to occupy leadership positions.

What to do if your salary has not been paid

You can start defending your rights from the 1st day of delay. But first, it’s still worth asking the employer or the responsible accounting employee about the reasons for late payment of wages and the expected time frame for eliminating this violation. If a visit to the manager does not bring results, it is appropriate to take a number of measures (for more details, see “What to do if salaries are not paid (delayed)? Where to go in 2020?”).

Contacting the labor inspectorate

The application to the inspection is drawn up in free form, but it must contain the following details and data:

- full name of the organization, as well as last names, first names and patronymics of the first manager and chief accountant (if the latter is absent - an accountant or other employee responsible for calculating and issuing wages);

- the name of your position and length of service at the enterprise;

- information about the amount of wages, the established date and method of payment, the exact time of delay in days.

Labor inspectorates are required to conduct an inspection and make a conclusion about the presence or absence of a violation of workers’ rights to wages. There are several options below:

- sending an order to the employer to immediately repay wage arrears;

- notification to law enforcement agencies of identified violations (at the same time a notification may be sent to the tax office).

Suspension of work

After 15 days of delay, the employee has the right to suspend the performance of work duties until full payment of wages. The main thing is not to forget to inform the employer about this in writing in advance. Typically, notice of suspension of work is issued by a statement indicating the reasons for such a decision.

TIP: the application for suspension of work should be handed to the manager or secretary against signature. If for some reason this is impossible (for example, the boss refuses to sign), you need to use postal services by sending a registered letter with a mark of delivery to the addressee. Otherwise, it will be almost impossible to prove proper notice to the employer of the intention to suspend work.

Not all categories of workers have the right to suspend work due to non-payment of wages. In accordance with Article 142 of the Labor Code of the Russian Federation, this is prohibited:

- civil servants;

- employees whose job responsibilities ensure people’s livelihoods (gas, electricity, water, heat supply, ambulance and emergency medical care, etc.);

- employees employed in particularly hazardous industries.

Going to court

Court proceedings are a fairly lengthy procedure, so it is better to combine filing a statement of claim with suspension of work. But first it’s worth finding out some nuances that are important for the outcome of the case:

- Has the salary been accrued? For cases where there are no disputes about the existence of a salary debt, as well as its amount, a simplified procedure for proceedings is provided. That is, writs of execution can be issued almost immediately.

- Is the non-payment of wages related to the withholding of part of it (especially relevant for partial delays). The maximum deduction cannot exceed 50% of the total salary. In addition, in accordance with Article 137 of the Labor Code of the Russian Federation, deductions are made exclusively in the following cases:

- return of overpaid advance for travel expenses;

- return of overpaid amounts due to calculation errors;

- upon dismissal - upon payment of wages for actually unworked days (except for dismissal due to staff reduction, change of owner or liquidation of the enterprise, conscription into the army, health status).

In addition, deductions can be made on the basis of a writ of execution received by the employer. Overpaid wages are not subject to return (except for cases where the employee’s guilt in committing unlawful actions is established in court).

How can an employer avoid criminal penalties?

Since 2020, employers have the opportunity to avoid criminal punishment , including in the form of fines. This is permitted in the following circumstances:

- This is the first offense in the employer's practice;

- The debt was repaid within 2 months from the date of initiation of criminal proceedings;

- All due penalties have been paid along with the debt;

- During the inspection, no signs of another crime were found.

Thus, the employer, showing good will, can obtain exemption from criminal punishment.

What can an employee do if his salary is delayed?

An angry employee can contribute to the employer being subject to fines for late pay. To do this he needs:

- Write a complaint to the State Tax Inspectorate;

- File a complaint with the prosecutor's office;

- If there are signs of a criminal offense, write a statement immediately to the investigative committee;

- Initiate a lawsuit.

As a result, the employer may experience negative financial consequences in the form of fines and more.

According to the latest statistics, every 5 working person has at least once encountered a violation of his labor rights. The most common violation on the part of the employer is late payment of wages.

A very small percentage of citizens are ready to go against their authorities and stand up for their rights. Fearing persecution from management or dismissal, in most cases the facts of delayed wages are known only within the company.

In fact, this behavior of workers only aggravates the situation - employers feel their impunity and use workers’ money for their own selfish purposes, although the law stipulates liability for such actions, even criminal liability. In this article we will tell you what the boss faces for delaying salary payments.

Where should an employee go to recover their hard-earned money? Is it possible to receive compensation for late transfer of funds? So, first things first.

What are the consequences for an employer if they delay an employee’s salary in 2020?

When delaying wages in 2020 for its employees, the employer must be prepared for the corresponding legal consequences. First of all, he will have to pay financial compensation for each overdue day. Also, he will have to pay a fine for violating labor laws .

Please note that similar penalties will be applied to the employer in case of delay in other mandatory payments, such as various disability benefits, as well as severance pay and vacation pay!

Penalties for late salary payments in 2020

So, as we already mentioned above in the article, every employer who has delayed wages to his employee/employees for more than 2 weeks will have to pay a fine established by the legislator, the amount of which currently amounts to:

- 120,000 Russian rubles (for partial payments) – or imprisonment for a period of up to 12 months;

- up to 500,000 Russian rubles or imprisonment for up to 3 years - with complete absence of salary payments.

Financial compensation

We remind employers that in the event of a delay in paying wages to an employee, he has the legal right to count on financial compensation, the amount of which is 1/150 of the key rate of the Central Bank of the Russian Federation. It is worth noting that these funds are accrued not from the 16th day of delay in the salary, as many mistakenly believe, but from the first day of delay.

If the employer refuses to pay the additional payment on a voluntary basis, the employee has the right to file a complaint against him with the relevant regulatory authorities.

Court and employer

Based on the rich experience of the lawyers of the Legal Ambulance website, we note that in most cases of asserting one’s rights in court in situations similar to those discussed above, the court takes the side of the employees (of course, if they have an evidence base).

Expert opinion

Lyudmila Kim

Invited expert: author of the “Child Support” blog, practicing family lawyer, 7 years of experience.

As a result, the employer not only pays wages and financial compensation, but also covers the costs of legal proceedings and pays fines to the state.

Naturally, in addition to the material side of the issue, the reputation of the company itself suffers. Therefore, we highly recommend that both parties resolve problems peacefully within the company.

Accrual rules according to the Labor Code of the Russian Federation

The employer determines the amount and procedure for calculating wages independently. The main condition is that this procedure does not contradict the norms of the Labor Code.

Salaries consist of mandatory payments and accruals that management assigns at their discretion. Mandatory payments include maternity benefits, severance pay, and wages.

Optional items include bonuses, payment for difficult working conditions, and incentive payments.

According to the norms of the Labor Code, namely Art. 136 of this law, salary must be transferred at least 2 times a month .

The same article states that full payment to the employee for the previous month must be made no later than the 15th of the next month. As for vacation pay, it must be transferred 3 days before the employee leaves for vacation.

The employer is liable for late wages. Let's talk about it in more detail.

When an employer bears criminal liability

It is not always possible to get away with a fine for non-payment of wages. When management delays this for a long time, pursuing selfish interests (which has irrefutable evidence), the perpetrators are brought to justice. Their actions are qualified under Art. 145.1 of the Criminal Code of the Russian Federation. It all depends on the severity of the damage caused (see table).

| Crime | Punishment |

| Part of the salary is not paid for more than three months. We are talking about amounts not exceeding half of the employee’s full earnings. | According to the first part of Art. 145.1 of the Criminal Code of the Russian Federation, a private individual/director of an enterprise will be punished: • a fine of up to 120,000 rubles. or about a year's salary; • deprivation of the right to practice one’s profession – up to 12 months; • performing forced labor for up to two years; • restriction of freedom for up to 12 months. |

| Full salary is overdue for more than two months. | Responsibility arises under the second part of Art. 145.1 of the Criminal Code of the Russian Federation: • fine for non-payment of wages : 100 – 500 thousand rubles. or deduction of an amount equal to income for 3 years; • performing forced labor for up to 3 years + deprivation of the right to practice one’s profession for up to 3 years (the latter is not always the case); • imprisonment for up to three years + deprivation of the right to practice one’s profession for up to 3 years (the latter is not always the case). |

The most severe punishments are applied when illegal actions of management led to serious consequences: illness, suicide, etc. If guilt is fully proven in court, the consequences are as follows:

- payment of a fine for late payment of wages in the amount of 200 - 500 thousand rubles. or income for 1 – 3 years;

- imprisonment for a period of 2 to 5 years + deprivation of the right to profession for a period of up to 5 years (the latter is not always the case).

The Investigative Committee is involved in the investigation of criminal cases under this article. To hold the employer liable, it is necessary to submit a corresponding application to the Investigative Committee at the place of residence.

Deadlines for payment of wages

All employers are required to pay wages at least every half month. Salaries must be paid no later than the 15th day after the end of the period for which they were accrued. That is, the deadline for the advance payment is the 30th day of the current month, and for salaries - the 15th day of the next month (Part 6 of Article 136 of the Labor Code of the Russian Federation).

There is no concept of “half a month” in current legislation. The norm from Part 6 of Article 136 of the Labor Code of the Russian Federation means that salaries must be paid at least twice a month. Specific deadlines are determined in the Labor Regulations, collective or employment agreement.

The first half of the month is always the period from the 1st to the 15th of the current calendar month. The second half of the month is the period from the 16th to the last day of the calendar month. The main thing is to set specific deadlines for the payment of salaries. For example, according to the Labor Regulations, salaries are paid on the 5th and 20th. Then fulfill the requirement of Part 6 of Article 136 of the Labor Code of the Russian Federation (letters of the Ministry of Labor of Russia dated April 18, 2020 No. 11-4 / OOG-718, dated September 23, 2020 No. 14-1 / OOG-8532).

If the established payment day coincides with a weekend or non-working holiday, pay the salary the day before (Part 8 of Article 136 of the Labor Code of the Russian Federation

What punishment will the organization suffer?

The right to receive payment for work is stated not only in the Labor Code, but also in Article 37. Constitution. For violating this right, the employer may face:

- Disciplinary liability (under Article 192 of the Civil Code). According to this article, guilty persons may be temporarily suspended from official duties or even dismissed;

- Administrative punishment (fine);

- Criminal liability (under Article 145 of the Criminal Code).

Responsibility for delays in wages to employees is prescribed in Art. 142 Labor Code of the Russian Federation . According to this article, the degree of punishment will depend on the timing of non-payment of salary, the amount of debt, and the reasons for the delay.

Administrative measures

Article 5 of the Code of Administrative Offenses talks about administrative punishment for delayed wages. Liability under this article depends not only on the size of the debt and the timing of non-payment, but also on the form of business and the frequency of violations. If the law was violated for the first time, the fine will be :

- 50 thousand rubles. from the company;

- 20 thousand rubles. personally from the guilty person;

- Up to 5 thousand rubles. with IP.

If the delay in wages was repeated, the amount of the fine will increase to:

These measures are intended to encourage management to make payments on time and in full. Administrative fines can be issued by GIT employees and the court. That is, in order for management to be punished, the employee will need to write a statement to the judicial or supervisory authorities.

After considering the complaint, an inspection is carried out at the enterprise, based on the results of which a fine is issued . If the violation is serious and a fine alone is not enough, the case is sent to law enforcement agencies for further investigation, and possibly the initiation of a criminal case.

Criminal sanctions

The employer is criminally liable for delayed wages under Article 145 of the Criminal Code. The severity of the punishment will depend on the reasons and timing of the delay, the employer’s motives for committing the crime, and the amount of debt (whether partial payments were made or wages were not transferred in full).

The punishment may be more serious (up to 5 years in prison). The period will increase if it is proven that the delay in wages caused harm to the health, life of the employee or his loved ones.

Expert opinion

Mikhailov Vladislav Igorevich

Legal consultant with 8 years of experience. Specializes in criminal law. Member of the Bar Association.

For example, it was not possible to buy medicine on time, an employee committed suicide due to debts that there was no way to pay off, etc.

Employees of the Investigative Committee (should apply first) or the Ministry of Internal Affairs can accept a statement from an injured employee. A complaint to the labor inspectorate may also result in the initiation of a criminal case.

Although GIT employees do not have the authority to independently open cases under the Criminal Code, they can transfer information to law enforcement agencies for further investigation.

Suspension of work

Employees have the right not only to compensation, they can even suspend work if the delay is more than 15 days. This right is provided for in Article 142 of the Labor Code, but not for everyone.

Can't stop working:

- military personnel and emergency services personnel;

- workers in particularly hazardous industries;

- civil servants;

- workers involved in ensuring the life of the population (heat, gas, water, medical care, etc.).

Everyone else can write a notice to the employer and not go to work, except during periods of martial law or a state of emergency. Moreover, during downtime, the organization is obliged to pay employees an average salary.

To resume the work process, the employer needs to write to the employee a notice of readiness to repay the debt on the day he returns to work. The employee must report to work no later than the next working day after receiving such notice.

We are trying to get payment

Most regulatory and human rights organizations have a complaint procedure. That is, before writing a statement to the Ministry of Internal Affairs, the Investigative Committee or the court, you should try to resolve the problem directly with the employer.

is sent to the general director of the enterprise demanding payment of wages and compensation for the delay . Most often, a conflict situation is resolved at this stage, because not a single boss is interested in conducting inspections at his company.

The standard period for consideration of a claim is 10 days. If after this period no measures are taken to eliminate violations of the law, the employee should forward complaints to other authorities to protect his interests.

Where should I complain?

Where to file a wage arrears complaint first depends on the complainant's goals. Each authority has its own powers; with the help of one appeal you can punish the employer, with another – to achieve payment of the debt and compensation.

An application to the State Tax Inspectorate may result in management issuing a fine and an order to eliminate violations. Among these instructions, most likely, will be the payment of wage arrears. If the case takes a more serious turn (fraud or money fraud is discovered), the information will be sent to other departments.

Law enforcement agencies should be contacted in case of gross violation of the law. An application to the Investigative Committee or the Ministry of Internal Affairs will allow the unscrupulous employer to be punished according to the law, perhaps even depriving him of his position.

The court will help collect arrears of wages. In addition to the debt, the employee has the opportunity to demand payment of moral damages, lost profits and compensation for delays.

Salary compensation and its calculation

As mentioned above, financial liability is provided for violating the terms of salary payments. This means that from the first day of delay, the employer must charge, in addition to funds for wages, compensation, the amount of which is currently equal to 1/150 of the Central Bank rate .

For clarity, let’s look at an example of calculating the amount of compensation. Given:

- Salary delay period = 17 days.

- Central Bank rate = 7.25%.

That is, in addition to the main debt, management is obliged to transfer compensation to the employee in the amount of 246.5 rubles. In this case, the amount of compensation was insignificant, but, as a rule, wages are delayed for longer periods, and accordingly, the amount of the penalty will be greater.

Legislation on the timing of salary payments

The Labor Code of the Russian Federation (Article 136) establishes a number of rules for salary payments relating to:

- their frequency;

- deadline for making final payments for the period worked;

- set dates coinciding with weekends.

The main thing in this list is the rule that salaries should be paid at least every half month. The employer must set the specific dates of these events (spaced from each other by the required number of days) independently, fixing them in one of the internal regulations:

- labor regulations;

- collective agreement;

- employment agreement.

Since the rules for calculating wages in most cases require the calculation of its amount after the end of the month worked, that half of it that is paid before the end of this month is regarded as an advance that does not require detailed calculation operations.

Expert opinion

Mikhailov Vladislav Igorevich

Legal consultant with 8 years of experience. Specializes in criminal law. Member of the Bar Association.

The second half represents the final payment for the month, and the due date for its payment cannot be later than the 15th day of the month following the month in respect of which the salary was accrued.

If any of the selected dates coincides with a weekend, the payment must be made before that day.

Important nuances and features of filing a complaint about the lack of salary in 2020

When filing a complaint with one or another authority, legal experts at the Legal Ambulance website recommend taking into account the following nuances:

- according to the current legislation of the Russian Federation, as of 2020, each application must be registered in the manner prescribed by the legislator, and therefore must be drawn up exclusively in simple written form;

- Based on our practice, we note that collective complaints today are considered much faster;

- When filing a complaint with one of the above bodies, be sure to prepare the so-called evidence base (certificates, acts, photos, eyewitness accounts, etc.)!

EVERYONE NEEDS TO KNOW THIS:

Part-time employment contract: sample 2020

Rights of an employee who has not received his salary on time

An employee who has not received his salary within the prescribed period has the opportunity to file a complaint with the State Labor Inspectorate (Rostrud) or file an application in court. Both authorities are contacted at the location of the employer.

The employee may not show up for work during the period of suspension. Moreover, the employer is obliged to pay him for this entire period, based on the employee’s average earnings.

However, not every situation, place of work or position allows an employee to take advantage of such a measure.

Employer's liability in case of delayed wages

The liability arising from the employer in connection with delays in salary payments may turn out to be:

- material - it is provided for by the Labor Code of the Russian Federation;

- administrative - in accordance with both the Code of Administrative Offenses of the Russian Federation and the Labor Code of the Russian Federation;

- criminal - according to the Criminal Code of the Russian Federation.

The first type of liability obliges the employer to pay compensation to the employee for late payment and compensate for moral damages, if such compensation is provided for in the employment agreement.

The decision to impose liability of the second type is made by the inspector of Rostrud. Moreover, such responsibility can be expressed not only in the requirement that the employer and its officials pay an administrative fine.

Since December 13, 2019, Rostrud has the right to make a decision on collecting wage debts out of court through the FSSP if the employer does not comply with its instructions to repay such debt.

Criminal liability concerns only managers and is associated with their personal interest in non-payment. If such a crime is committed for the first time, they can be released from criminal liability if they pay back wages and compensation for delayed payments within 2 months from the date of initiation of the criminal case.

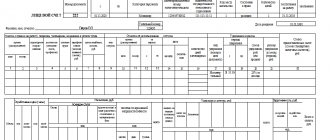

The amounts of sanctions arising from each type of liability are given in the table.

Let's sum it up

- Regarding the timing of salary payments, the rules enshrined in the Labor Code of the Russian Federation apply, obliging the employer to make such payments twice a month and adhere to the dates established for this.

- A delay in payment allows an employee not only to appeal to Rostrud or the courts, but also to suspend work if wages are not paid within 15 days. The employer is obliged to pay for the period of suspension if all the conditions accompanying this procedure are met.

- For an employer, untimely payment of wages results in liability, which has 3 types - material, administrative, criminal. The first boils down to the need to pay compensation for the delay, but may also require compensation for moral damage. Involvement in the second is carried out by an inspector of Rostrud, and it may concern both the employer and its officials. The third arises only for managers and only if they have a personal financial interest in delaying payments.

Any working person must receive a salary on time and in full. This right is guaranteed by the Labor Code and Russian legislation (Article 21 of the Labor Code of the Russian Federation, Article 37 of the Constitution of the Russian Federation). This article provides a complete overview of what punishment is provided for management if there is a permanent delay in payment.

The employer's liability for delayed payment of wages in 2020 is manifested in the following types:

It should be

Article 136 of the Labor Code requires that salaries be paid at least every half month, but each organization must set the terms of these payments itself. The main thing is that you pay for each part of the month no later than 15 calendar days from the end of the period for which it was accrued.

The terms of payments must be specified in the employment contract, the Regulations on the payment of labor or other local document. Responsibility for violating deadlines also needs to be spelled out there.

Responsibility begins from the first day of delayed payment of wages. This includes material, administrative, and in particularly serious cases, criminal liability.

Disciplinary responsibility

Delayed wages due to the fault of the manager or official representatives is an improper performance of their direct duties. This may entail receiving one of the disciplinary sanctions in the form of a reprimand, reprimand or dismissal (Article 192 of the Labor Code of the Russian Federation).

If the facts of violation are proven, the employer applies appropriate enforcement measures to the management of the institution (Article 195 of the Labor Code of the Russian Federation).

To carry out an inspection, a representative of the interests of employees (this may be a trade union) submits a corresponding application to the employer, which indicates violations on the part of management. The employer is given 1 week to review this document (Article 370 of the Labor Code of the Russian Federation).

Next, he takes measures to eliminate violations, selects the form of disciplinary punishment and notifies the applicant about this (Article 22 of the Labor Code of the Russian Federation).

The period of validity of this punishment is 1 year from the date of its imposition.

Table of fines for late wages in 2020

| First violation | |

| Director, chief accountant | 10,000 – 20,000 rub. or warning |

| Entrepreneur | 1000 – 5000 rub. |

| Company | 30,000 – 50,000 rub. |

| Repeated violation | |

| Director, chief accountant | 20,000 – 30,000 rub. or disqualification for 1-3 years |

| Entrepreneur | 10,000 – 30,000 rub. |

| Company | 50,000 – 100,000 rub. |

Material liability

This responsibility is imposed on the manager for the delay in paying wages to employees. Employees have every right to demand payment from the employer, as well as receive interest for late payment and compensation for moral damage incurred.

In this case, the fact for what reason there was a failure in the issuance of pay does not play any role. Find out more about workers' rights when wages are delayed here.

The employer has 15 calendar days left to pay wages from the end of the accrual period (Article 136 of the Labor Code of the Russian Federation). The exact date of payment is determined by the internal regulations of the institution and is supported by the relevant agreement.

Compensation

Previously, this rate was 1/300. Thus, the minimum amount for compensation has been doubled by the Law. At the request of the employer, the amount of compensation can be increased and must be specified in the employment agreement or local regulations (Article 236 of the Labor Code of the Russian Federation).

Payment for late wages is the direct responsibility of the employer: the employee does not need to submit any documents or complain to higher management. Compensation is paid at the same time as the delayed salary amount.

Suspension of official duties

An employee may not come to the workplace until the day wages are paid if the delay in payment exceeds 15 days (Article 142 of the Labor Code of the Russian Federation). You should inform management of your desire in writing.

When management begins making payments, that employee is notified by notice in writing. After receiving it, he must go to his workplace. If he did not do this, this act is regarded as truancy.

Some categories of employees cannot stop performing their job duties (Part 2 of Article 142 of the Labor Code of the Russian Federation):

- military and civil servants;

- people who support people’s livelihoods (electricians, doctors, etc.) or who work in particularly hazardous industries and equipment;

- when a state of emergency is declared.

Administrative responsibility

Punishment can only occur if the manager is guilty of delaying payment deadlines.

The employer is responsible for delayed wages with the following consequences (Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

- manager and individual entrepreneur: warning or fine of 1000-5000 rubles. Repeatedly ─ up to 20,000 rubles (Part 4 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation), ban on holding a position for no more than 3 years.

- fine for the institution: 30,000-50,000 rubles. In case of a repeated incident, a penalty of up to 70,000 rubles is imposed (Part 4 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Day off

If the salary payment deadline falls on a weekend or non-working holiday, it is issued before this day (Article 136 of the Labor Code of the Russian Federation). For example, wages must be paid on the 8th of each month. Then cash for February 2020 is paid to employees on Tuesday, 03/07/2017, since 03/08/2017 is a non-working holiday (International Women's Day). Information on payment for work on a day off according to the Labor Code can be found in the article https://otdelkadrov.online/5966-poryadok-raschet-oplaty-raboty-v-vyhodnoi-den-po-trudovomu-kodeksu-rf. If these requirements are not met, the employer may be subject to an administrative fine.

Bringing to administrative liability for violation of labor laws is possible only through the court. Administrative proceedings are initiated and a corresponding protocol is drawn up. If a delay in the payment of wages is detected, the state labor inspectorate issues an order to repay it within a month. Not only working, but also dismissed employees should receive wages.

Inspectors monitor the remuneration process and enter employers who have violated the Labor Code into a special register. This data is submitted to the prosecutor's office.

Watch the video about criminal liability for non-payment of wages