Hello! In this article we will talk about salary supplements.

Today you will learn:

- What categories of citizens are entitled to salary bonuses and what types of them exist;

- How do allowances differ from surcharges?

- What are incentive payments and much more.

Everyone knows that even if a person is officially employed, this is not a guarantee that he will be given all the required additional payments. Therefore, today we will figure out what the employer is obliged to pay extra for and what additional payments and allowances employees have every right to.

Content

- Components of remuneration

- The legislator's word

- Allowances and surcharges: the difference between concepts

- Types of salary supplements

- Bonuses paid regardless of the will of the employer

- Additional payments to wages

- Who can count on bonuses and additional payments?

- An example of calculating allowances and surcharges

- Additional payments considered controversial

- Documentation that sets out the payment procedure

- Under what conditions are payments made?

- Employer's responsibility for payments

Compensation payments

These types of additional payments and wage supplements are required to be calculated; they have minimum values that are established and guaranteed at the legislative level. They are divided into two main groups.

This is important to know: What will be the pension supplements for rural workers in 2020?

The first involves the employee performing his activities in conditions that are not normal, ordinary, that is, his health may be damaged.

It can be:

- work in harmful and difficult conditions;

- too intensive work process, for example, activity on a conveyor production line;

- transportation of dangerous goods;

- activities at night.

This type of surcharge is the most common.

In addition, certain types of activities are carried out in places with harsh climatic conditions, which means that employees are entitled to an increased level of wages, achieved through compensation payments.

The second category includes compensation that is paid for the unusual nature of the activity:

- work on weekends (holidays or Sundays) when constructing a similar schedule;

- schedule with a large number of shifts;

- irregular work schedule;

- overtime work, that is, exceeding the norm;

- scheduled activities throughout the day, with breaks of two hours or more;

- activities in underground work.

The legislator's word

Remuneration is a kind of instrument, thanks to which the labor costs of all employees are compensated. The legislation provides for measures that are designed not only to protect the rights of workers, but also to establish a salary level that will correspond to real labor costs.

So, the law establishes:

- Based on Article 133 of the Labor Code, any employer does not have the right to set employees a salary that is lower than the minimum wage. Its size is determined by federal and regional legislation;

- Article 143 of the same Code says that the salary is set taking into account the tariff structure, or the tariff schedule, or categories;

- If the working conditions at an enterprise or organization deviate from the standard ones, then employees have the right to compensation for all additional labor costs, as specified in Articles 146 - 154 of the Labor Code of the Russian Federation;

- The employer has the right to set the amount of incentive payments;

- The Labor Code obliges the employer to calculate and pay wages.

Allowances and surcharges: the difference between concepts

In order to motivate employees, employers can pay not only the wages required by law, but also funds in the form of bonuses or other material incentives. And the state, in turn, obliges managers to pay additional payments when certain cases occur.

Now let's look at these points in more detail. What is a surcharge?

An additional payment is a type of payment that is in the nature of compensation, as it is assigned in the case when an employee worked on holidays, combined his work with the responsibilities of a colleague, that is, performed an increased amount of work.

An allowance is a type of payment that is intended to stimulate an employee so that he wants to further grow and develop in his profession. Examples include bonuses for long continuous work experience, length of service, academic degrees, and so on.

As for the general features, there is one: both payments increase the employee’s remuneration.

And their differences are as follows:

- Additional payments are mandatory, allowances are not;

- An additional payment is compensation, and an allowance is an incentive payment;

- The bonus emphasizes the importance of the employee, and the additional payment is designed to compensate for difficult working conditions.

Bonuses are paid at the initiative and desire of the manager!

Composition and varieties

In accordance with Art. 129 of the Labor Code of the Russian Federation, salary includes:

- remuneration for work;

- incentive payments;

- compensation.

In this case, the basic salary can be considered precisely the remuneration for the work performed. It can be of several types:

- salary - a certain fixed amount of payment for performing labor duties during a month during working hours;

- basic salary - this term is used along with the concept of “base rate”; it means a certain minimum wage for a state or municipal employee, without taking into account various compensations and allowances;

- tariff rate is a fixed payment for a certain completed standard of labor for a pre-agreed period of time.

In the table we present the main components of the additional salary.

| Type of additional payments | Form of application | Grounds for provision |

| Stimulating | Allowances, bonuses, surcharges | A rule fixed in an employment or collective agreement, a one-time order of the employer. |

| Compensatory | Allowances, surcharges | Art. 129 Labor Code of the Russian Federation:

|

Types of salary supplements

For clarity, we present this information in the form of a table.

Table 1. Types and characteristics of allowances.

| No. | Type of allowance | a brief description of |

| 1 | For providing mentoring | They pay “old-timers” of enterprises for training young specialists |

| 2 | For high professional qualifications | Only highly qualified specialists are paid |

| 3 | Personal allowances | Paid in the event that a valuable employee needs to be kept at his place of work, but it is not possible to promote him in position or increase his salary |

| 4 | For having an academic degree or title | Employees who have defended their master's and doctoral dissertations, etc. |

| 5 | If you have access to state secrets | Employees of individual structures, diplomatic services |

| 6 | For knowledge of foreign languages | Often found in enterprises that produce products for export |

Such payments are established at any time, as a measure to encourage any achievements of employees (there are companies that make such payments for participation in corporate sports competitions, for those who do not go on sick leave for a long period of time, etc.).

Before canceling such payments, employees must be warned about this!

Next, we will consider the types of allowances that are mandatory.

Additional payments and allowances for government employees

For employees of municipal and state structures, additional funds are regulated at the legislative level. The procedure for providing similar amounts to employees of budgetary organizations is enshrined in Art. 144 Labor Code of the Russian Federation. The regulations of this article include employees working in structures at the federal, regional and local levels.

Specific types of allowances, their volume, as well as the procedure for their provision are fixed in internal regulations, based on legal requirements.

There are special profile standards for government employees and prosecutors. For example, Federal Law No. 2202/1 dated January 17, 1992. "About the prosecutor's office." The most common additional payments of this type include funds for :

- awarded title;

- length of service;

- knowledge of a foreign language;

- storage of secret government information.

There are also a number of special categories of government employees who are entitled to special additional payments:

- military personnel who took part in mine clearance. Their percentage increase in salary ranges from 1% to 2.5% of the established salary for the days when the relevant operations were directly carried out. This provision is fixed in Order of the Ministry of Defense No. 2700 dated December 30, 2011;

- employees of the Ministry of Internal Affairs who performed their official duties in circumstances of increased risk to life. Based on Art. 2 Federal Law No. 247 of July 19, 2011, additional payment is provided in an amount of up to 100% of the established salary (the specific amount of the bonus must be established by the employee’s immediate supervisor).

Bonuses paid regardless of the will of the employer

As Article 149 of the Labor Code says, the employer is obliged to pay for:

- For working conditions that are harmful, dangerous or difficult;

- For work in harsh climate conditions (if an employee spends the entire working day on the street, he has the right to receive this payment);

- For work at night (if the schedule is not shift);

- If the employee performs work that requires a high level of knowledge and skills;

- If an employee combines several positions at once.

The above list is the main one; there may be additional items, but they are already determined by the employment contract. But there is a nuance that needs to be paid attention to while the employment contract has not yet been signed, then it will be very difficult to appeal: the employer can indicate in the employment contract a list of works that the employee is obliged to perform. In this situation, the employee cannot demand additional payment.

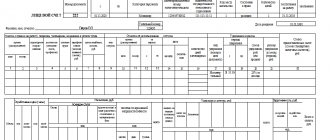

Design methods

If the payments are not permanent, that is, when they are one-time, management simply issues an order for a certain amount of additional payment. The employee becomes familiar with this order and then receives the amount due to him along with his salary. In some cases, the terms of additional payments are included in the employment contract, indicating the conditions under which they can be received. Then the employer can no longer change the amount of these payments in any way. Collective agreements describe the terms of additional payments in great detail. The employment contract also refers to them. The full terms of receipt are established in a local act. It, in turn, is adopted after agreement with the trade union organization representing the workers. Thus, the amount of compensation payments based on local acts may change upward, that is, in favor of the employee.

This is important to know: What will be the pension supplements for rural workers in 2020?

Additional payments to wages

Additional payments, as well as allowances, play an important role in the personnel remuneration system. We will also consider their types in table form.

Table 2. Types and characteristics of surcharges.

| No. | Type of surcharge | a brief description of |

| 1 | For an increased production rate | They are paid most often to workers who are paid on piecework. Mandatory condition: high quality of manufactured products |

| 2 | One-time additional payments | The so-called “lifting” for young professionals |

| 3 | For traveling or rotational work | Paid to those who work on a “shift” basis |

| 4 | For overtime work | If required by production needs (there is an order from the manager and written consent of the employee). If the employee carried out such activities on his own initiative, there will be no additional payment |

| 5 | For work at night | Night time is considered to be the period from 10 pm to 6 am. |

| 6 | For work of a harmful or dangerous nature | Paid to miners, emergency workers, nuclear power plant workers, etc. |

| 7 | For going to work on holidays and weekends | In this case, payment is made in double amount; exit is carried out on the basis of an order from the manager with the written consent of the employee. The additional payment will be calculated depending on the form of remuneration |

| 8 | For combining professions | Example: paid for performing the duties of a janitor and plumber in an institution or enterprise |

| 9 | For transportation of dangerous goods | It is usually paid in the railway transport, road transport, etc. industries. |

| 10 | Regional coefficient | Depends on the region of the country, as well as on natural and climatic working conditions |

Who can count on bonuses and additional payments?

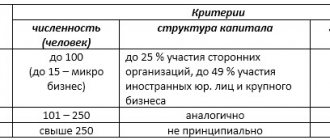

Not all categories of workers can count on the establishment of bonuses and additional payments.

These payments are not eligible:

- For those who work under a civil contract;

- Workers under a contract;

- Those with whom an agency agreement has been concluded.

This is explained by the fact that legal relations with such persons are regulated by the Civil Code, and not the Labor Code.

Those citizens who are hired on the basis of employment contracts, even those concluded for a certain period or who are part-time workers, have the right to receive all the specified monetary payments.

Supplements (additional payments) to wages paid monthly (concept, classification)

The legal basis for defining the concepts of “allowance” and “additional payment” is Part 2 of Art. 135 of the Labor Code of the Russian Federation, which determines that additional payments and salary supplements are designed to compensate the employee for difficult or deviating working conditions, as well as to stimulate him to professional and personal growth. Moreover, according to the mentioned norm, they are an integral part of the salary. The listed payments are established by the norms of the Labor Code of the Russian Federation, relevant laws and by-laws, as well as internal documents of organizations in relation to their employees.

It is worth adding that the legislation of the Russian Federation does not make a distinction between the terms “surcharge” and “surcharge”. Thus, when designating such a payment, it is logical to use one of the names that is found in legislative acts or is firmly rooted in practice.

The legislation does not offer a classification by type of existing allowances, however they can be divided into 3 groups, depending on the method of fixation:

- Established by law with the definition of a minimum or specific amount or accrual mechanism.

- Defined by law without establishing specific sizes and calculation mechanisms. In this case, their specific size has the right to be established by the organization’s administration.

- Not designated by law, but encountered in practice.

An example of calculating allowances and surcharges

In order for the understanding to become as complete as possible, let us consider the payment of allowances and additional payments using a specific example .

In a kindergarten, an employee is both a laborer and an electrician. It turns out that he combines 2 positions. As a general worker, his salary is 12,000 rubles. For the duties of an electrician, the management pays him an additional amount that does not depend on the salary - 10,000 rubles (as stated in his employment contract). Based on the results of his work, the amount of his bonus is 4,000 rubles.

The monthly payment calculation will look like this: 12000+10000+4000=26000 rubles. In our example, the allowance and bonus are accrued not as a percentage, but as a fixed amount. But these indicators can also be calculated depending on the salary, that is, as a percentage.

Allowances for length of service and high qualifications

Allowances for length of service and high qualifications are quite common in large enterprises. Let's look at how they are established, using the example of budgetary organizations.

The rules for setting incentive additional payments are specified in clause 2.3 of the Regulations on remuneration and with reference to Order of the Ministry of Health and Social Development of 2007 No. 818. Such payments include bonuses for intensity and high results, for quality work performed and for length of service (or length of service).

Based on these rules, no more than 30% of budget allocations can be allocated for such payments. But this restriction only applies to public sector employees: private companies have the right to set the amount of additional payments and bonuses for length of service and qualifications in an arbitrary amount.

Incentive payments are set by the heads of budgetary organizations as a percentage of salary or in a fixed amount.

The length of service for calculating the bonus is calculated on the basis of Government Decree No. 1012 of 1993 . This includes the entire period of labor activity in the relevant area, regardless of any interruptions that occur (except for cases of dismissal of an employee due to his fault). Also, periods of entrepreneurial activity and work under civil contracts are excluded from the length of service.

Additional payments considered controversial

In this part of the conversation we will pay attention to budgetary enterprises and institutions. It is no secret that their employees receive their salaries from budget funds.

In this regard, the Federal Service for Financial and Budgetary Supervision has questions regarding several types of additional payments, namely:

- Additional payment for working with computer and office equipment;

- Additional payment for combining positions.

When certain control measures were carried out, Rosfinnadzor employees considered that before assigning these types of additional payments, it was necessary to conduct a full certification of workplaces, otherwise their payment would be unlawful.

Let us note that often enterprises and institutions do not agree with this position, and when going to court, judges take their side.

Documentation that sets out the payment procedure

- Collective agreement;

- Regulations on remuneration;

- Regulations on bonus payments to employees;

- Employment contract (may contain a reference to a collective agreement);

- Staffing table;

- Order from the manager (if the payment is a one-time payment and not permanent).

Personal salary supplement

Labor legislation does not contain a definition of personal allowance. Such forms of additional payment are established for the employee for special distinctive qualities that contribute to more efficient performance of labor functions.

Personal bonuses can be established for knowledge of foreign languages or having a second higher education, professional skills, the need to work on a computer for more than 4 hours daily, etc.

Such bonuses are aimed at stimulating employees to improve their professional level and developing their responsibility for completed tasks.

The personal allowance is introduced according to the norms of Art. 129 of the Labor Code on the basis of the current regulations on remuneration and by order of the manager.

There is no standard model for such an order provided by law. The employer may approve it at his own discretion. An order form for a salary increase can be downloaded here.

The order specifies information about the employee who is entitled to the bonus, its size, and the legal basis on which it is established.

Under what conditions are payments made?

Any allowances and additional payments must first of all be contained in the pay slip of each employee.

There are a number of rules that the head of an enterprise or institution must adhere to:

- Each employee must have a task, for the successful solution of which he receives encouragement. But the task must first of all be solvable, and not a dead end. Simply put, any employee should have the opportunity to achieve good results;

- If we are talking about a bonus, then the amount should arouse interest, that is, be significant. It is unlikely that an employee will refuse smoking breaks for a bonus of 200 rubles;

- Employees should be aware that it is possible to receive certain incentives and additional payments. It is best to notify about this by drawing up an annex to the employment contract. Each newly arrived employee will be immediately familiar with this.

If the manager is ready to encourage his employees and pay them extra for something, then these recommendations will be quite feasible.

Additional information about payment terms

There are a number of rules for managers of enterprises and institutions:

- Employees receive incentives only for a specific task that was successfully completed. The main thing is that the task itself does not baffle, but is solvable. That is, a citizen must be given the opportunity to achieve a good result.

- As for bonuses, their amounts should be quite significant to arouse interest.

- Employees must know for sure that they are entitled to additional compensation. The best option for notification is the use of additional annexes to the contract. Every employee who joins the company is introduced to this application.

The manager’s responsibility is to issue an order to change the allowances. Changes are made either according to the text of the main agreement, or an additional agreement is concluded. A similar procedure applies to bonuses of all types, mandatory and voluntary.

The manager should not report to subordinates if the payments are strictly incentive in nature. When canceling the bonus part, it is enough to notify employees in writing. A violation is considered to be a situation where an employer completely ignores warnings.

Employer's responsibility for payments

The employer is not required to report to employees for the amount of incentive payments. If, due to a difficult economic situation, crisis, or other circumstances, the bonus portion of wages is cancelled, a written warning to employees is sufficient.

The only violation here will be that the employer ignored the procedure for warning employees, nothing more.

In general, if you properly motivate employees, you can achieve truly high results and performance. For this purpose, the employer should use incentive measures that stimulate payments. This will not only increase labor productivity, but will also have the best impact on product quality.