Author: Ivan Ivanov

Accounting account number 07 is used to collect generalized information on the presence and movement of any equipment, which can be technological, energy, or production.

The main feature of the account is that it contains units of tools that require installation work. Therefore, this tool is traditionally used by developers. Elements that require installation include parts that are assembled and subsequently attached to supports, load-bearing structures, and sets of spare parts for them.

What is taken into account

In accordance with the generalized instructions containing a detailed procedure for using the standard chart of accounts, confirmed by numerous government opinions, account 07 is intended to summarize information and materials about the presence and movement of equipment that requires installation and is used for installation at certain facilities.

This balance sheet line contains several more elements:

- 70-1 – sub-account characterizing tools for installation at warehouse facilities;

- 70-2 – here we are talking about elements for installation, which are transferred for installation;

- 70-3 – building materials.

Only those types are recorded on this account for which, before operation, it is necessary to carry out actions to assemble the elements, attaching them to the supporting structures.

The account in question is strictly active. Here, the inventory of sets of spare parts, as well as control and measuring instruments, takes place. No records are kept of objects that do not require assembly activities:

- transport;

- machine tools;

- mechanisms intended for construction purposes;

- agricultural units;

- tools for carrying out work;

- production equipment;

- devices that are not related to the components of the mounted elements.

Acceptance of these assets is carried out through account 08 in debit 01 without using 07.

Equipment as a fixed asset, document flow for equipment accounting

Home — Articles

Not all assets acquired by an organization for use in its activities can be directly accounted for as part of fixed assets. Many types of equipment require preliminary installation and adjustment, and testing. Inclusion of objects requiring installation into fixed assets is carried out after their acceptance from installation and commissioning. We will tell you about accounting for equipment that requires installation, about accounting for the costs of performing work on installing equipment, and about documenting operations for the acquisition and installation of equipment in the article we offer you. For equipment that requires installation and is intended for installation in facilities under construction (reconstruction) , in accordance with the Chart of Accounts for accounting the financial and economic activities of organizations and the Instructions for its use, approved by Order of the Ministry of Finance of Russia dated October 30, 2000 N 94n (hereinafter referred to as the Chart of Accounts of accounting accounting), includes technological, energy and production equipment, including equipment for workshops, pilot plants and laboratories . Equipment that requires installation also includes equipment that is put into operation only after assembling its parts and attaching them to the foundation or supports, to the floor, interfloor ceilings and other load-bearing structures of buildings and structures, as well as sets of spare parts for such equipment . This equipment includes control and measuring equipment or other devices intended for installation as part of the installed equipment. To account for equipment requiring installation, the Chart of Accounts uses account 07 “Equipment for installation”, and it is noted that this account is used by construction organizations.

Note! Account 07 “Equipment for installation” does not take into account equipment that does not require installation: - vehicles; — free-standing machines; — construction mechanisms; - Agreecultural machines. Agreecultural equipment; — production tools and equipment; — measuring instruments.

As you know, when generating information about fixed assets, organizations must be guided by the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n (hereinafter referred to as PBU 6/01), and also Methodological guidelines for accounting for fixed assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 N 91n. However, the provisions of the above documents do not apply to items handed over for installation or to be installed. The provisions of PBU 6/01 and Methodological Instructions N 91n will be applicable to equipment only after completion of work on its installation and inclusion of the equipment in fixed assets, provided that the purchased and installed equipment satisfies the conditions, the list of which contains clause 4 of PBU 6/01, that is, when four conditions are simultaneously met : 1) the object is intended for use in the production of products, in the performance of work, in the provision of services, for the management needs of the organization, for rental; 2) the facility is intended to be used for a period of more than 12 months or the normal operating cycle if it exceeds 12 months; 3) the organization does not intend to subsequently resell the object; 4) the object is capable of bringing economic benefits (income) to the organization in the future. So, as we noted above, to summarize information about the availability and movement of equipment requiring installation, the Chart of Accounts uses account 07 “Equipment for installation”. The debit of account 07 “Equipment for installation” reflects the receipt of equipment from the supplier in correspondence with the credit of account 60 “Settlements with suppliers and contractors”. The amount of value added tax presented by the supplier is reflected in the debit of account 19 “Value added tax on purchased assets” and the credit of account 60 “Settlements with suppliers and contractors”. The VAT amount reflected in account 19 “Value added tax on acquired assets”, the VAT taxpayer organization has the right to deduct on the basis of Art. Art. 171, 172 ch. 21 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation). If the organization that purchased the equipment is not a VAT payer, then the cost of the purchased equipment will be recorded on account 07 “Equipment for installation”, taking into account the amount of VAT presented by the supplier. It should be noted that quite a lot of controversy arises as to at what point the amount of VAT on purchased equipment that requires installation can be deducted. As an example, consider a dispute that arose between the tax authority and an organization that was denied a refund of VAT on purchased equipment. The basis for the decision made by the tax authority was that the equipment was accepted for accounting under account 07 “Equipment for installation,” which is confirmed by the acceptance certificate and the balance sheet for the specified account. In the Resolution of the Federal Antimonopoly Service of the North Caucasus District dated January 16, 2008 N F08-8924/07-3340A, the court pointed out the inconsistency of the tax authority’s arguments, motivating its decision as follows. According to paragraph 1 of Art. 172 of the Tax Code of the Russian Federation, deductions of VAT amounts paid when importing fixed assets, including equipment for installation, into the customs territory of the Russian Federation are made in full after registration of these fixed assets, including equipment for installation. The above wording means that the deduction of VAT amounts presented by sellers to the taxpayer upon purchase or paid when importing equipment for installation into the customs territory of the Russian Federation is made in full after registration of this equipment. According to accounting rules, equipment that requires installation, in accordance with paragraphs 1, 3 of PBU 6/01, does not belong to fixed assets and is accepted for accounting on account 07 “Equipment for installation”. However, the procedure for registering fixed assets and equipment for installation (including the account into which equipment requiring installation is accepted) is not established by tax legislation; it is determined by the above accounting rules. Thus, accounting for equipment purchased by an organization on account 07 “Equipment for installation” indicates its correct recording (accounting). The actual payment for goods, acceptance of goods, and their entry into accounting are confirmed by case materials. In such circumstances, the court’s conclusion that there is a legal basis for the organization to claim VAT amounts for deduction corresponds to the norms of Chapter. 21 “Value added tax” of the Tax Code of the Russian Federation. A similar decision was made by the Federal Antimonopoly Service of the Moscow District in Resolution No. KA-A41/1916-09 of March 20, 2009 in case No. A41-7014/08. The transfer of equipment for installation is reflected in the debit of account 08 “Investments in non-current assets”, subaccount 08-3 “Construction of fixed assets”, and the credit of account 07 “Equipment for installation”. In subaccount 08-3 “Construction of fixed assets”, according to the Instructions for using the Chart of Accounts, the costs of construction of buildings and structures, installation of equipment, the cost of equipment transferred for installation and other expenses provided for in estimates are taken into account (regardless of whether this is carried out construction by contract or economic method). Installation of equipment can be carried out either by the organization itself or with the involvement of specialized contractors. Let's consider each of the methods. If the installation of equipment is carried out by the organization itself, the costs of its implementation are reflected in account 23 “Auxiliary production” (if there is such a division) or are taken into account directly in subaccount 08-3 “Construction of fixed assets”. Installation costs include the cost of materials, components, employee wages, insurance premiums accrued in accordance with the law, as well as other expenses directly related to the installation of equipment. Expenses previously recorded on account 23 “Auxiliary production” are then written off to the debit of subaccount 08-3 “Construction of fixed assets” and thereby form the initial cost of the fixed asset. In addition, the receipt of equipment for installation can be accounted for at accounting prices using accounts 15 “Procurement and acquisition of material assets” and 16 “Deviations in the cost of material assets.”

Example. The contracting construction organization purchased equipment that required installation for its own needs. The cost of the equipment is 613,600 rubles. (including VAT - 93,600 rubles). The equipment installation work was carried out by an auxiliary division of the organization, the total cost of the work was 70,560 rubles. The following entries were made in the organization’s accounting records: Debit 07 “Equipment for installation” Credit 60 “Settlements with suppliers and contractors” - 520,000 - equipment requiring installation was received; Debit 19 “Value added tax on purchased assets” Credit 60 “Settlements with suppliers and contractors” - 93,600 - VAT presented by the equipment supplier is taken into account; Debit 68 “Calculations for taxes and fees”, subaccount “Calculations for VAT”, Credit 19 “Value added tax on purchased assets” - 93,600 - accepted for deduction of VAT presented by the supplier; Debit 60 “Settlements with suppliers and contractors” Credit 51 “Settlement accounts” - 613,600 - paid for equipment to the supplier; Debit 08-3 “Construction of fixed assets” Credit 07 “Equipment for installation” - 520,000 - equipment transferred for installation; Debit 23 “Auxiliary production” Credit 70 “Settlements with personnel for wages”, 69 “Settlements for social insurance and security” - 70,560 - expenses for installation of equipment are reflected; Debit 08-3 “Construction of fixed assets” Credit 23 “Auxiliary production” - 70,560 - installation costs included in the initial cost of equipment; Debit 01 “Fixed assets” Credit 08-3 “Construction of fixed assets” - 590,560 - installed equipment is included in fixed assets.

If the organization does not have the opportunity to install the purchased equipment on its own, then specialized installation organizations are hired for these purposes. Equipment installation work is carried out on the basis of a contract concluded between the customer and the contractor. Let us remind you that in accordance with Art. 702 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), under a contract, one party (contractor) undertakes to perform certain work on the instructions of the other party (customer) and deliver its result to the customer, and the customer undertakes to accept the result of the work and pay for it. The delivery of the result of work by the contractor and its acceptance by the customer are formalized by an act signed by both parties, which follows from clause 4 of Art. 753 of the Civil Code of the Russian Federation. A certificate of the cost of work performed and expenses, signed by both parties, is the basis for formalizing the results of the delivery of work and settlements between the customer and the contractor.

Example. The organization purchased equipment that requires installation, the cost of which is 1,982,400 rubles. (including VAT - 302,400 rubles). To carry out installation work, a contract was concluded with a specialized construction and installation organization; the cost of installation work according to the terms of the agreement amounted to 318,600 rubles. (including VAT - 48,600 rubles). Upon completion of the installation work, the parties to the contract signed an act of form N KS-2 and a certificate of form N KS-3, after which the installed equipment was accepted as part of the customer’s fixed assets and put into operation. In the accounting records of the customer organization, the transactions carried out are reflected in the following account correspondence: Debit 07 “Equipment for installation” Credit 60 “Settlements with suppliers and contractors” - 1,680,000 - equipment requiring installation has been received; Debit 19 “Value added tax on purchased assets” Credit 60 “Settlements with suppliers and contractors” - 302,400 - reflects the amount of VAT presented by the equipment supplier; Debit 68 “Calculations for taxes and fees”, subaccount “Calculations for VAT”, Credit 19 “Value added tax on acquired assets” - 302,400 - the amount of VAT on equipment was accepted for deduction; Debit 08-3 “Construction of fixed assets” Credit 07 “Equipment for installation” - 1,680,000 - reflects the transfer of equipment for installation; Debit 08-3 “Construction of fixed assets” Credit 60 “Settlements with suppliers and contractors” - 270,000 - the cost of installation work is included in the actual cost of the equipment; Debit 19 “Value added tax on purchased assets” Credit 60 “Settlements with suppliers and contractors” - 48,600 - reflects the amount of VAT presented by the contractor; Debit 68 “Calculations for taxes and fees”, subaccount “Calculations for VAT”, Credit 19 “Value added tax on acquired assets” - 48,600 - the amount of VAT presented by the contractor was accepted for deduction; Debit 60 “Settlements with suppliers and contractors” Credit 51 “Settlement accounts” - 1,982,400 - settlements were made with the equipment supplier and contractor; Debit 01 “Fixed assets” Credit 08-3 “Construction of fixed assets” - 2,252,400 - installed equipment is accepted for accounting as part of fixed assets.

Organizations performing equipment installation work on the basis of concluded contract agreements, equipment received from the customer is recorded according to the Chart of Accounts on off-balance sheet account 005 “Equipment accepted for installation” at the prices specified by the customer in the accompanying documents. After signing the certificate of completion of work, the installed equipment is removed from off-balance sheet account 005 “Equipment accepted for installation.” Note that equipment installation work usually includes the following : - assembly and installation of process, power, handling, pumping and compressor and other equipment at the site of its permanent operation, including checking and testing the quality of installation; — on the installation of connections to equipment (supply of water, air, steam, coolants, laying, pulling and installation of cables, electrical wires and communication wires); — for the installation and installation of technological metal structures, service platforms, stairs and other devices structurally connected with the equipment; — insulation and painting of installed equipment and process pipelines; — as well as other, not listed above, work and costs provided for in the price tags for equipment installation. Operations for the movement of fixed assets, in accordance with clause 7 of the Methodological Guidelines for the Accounting of Fixed Assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 N 91n, must be documented with primary accounting documents. Unified forms approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7 (hereinafter referred to as Resolution No. 7) can be used as primary accounting documents The following forms have been approved for equipment accounting : — Certificate of acceptance (receipt) of equipment (Form N OS-14) ; — Certificate of acceptance and transfer of equipment for installation (form N OS-15); — Report on identified equipment defects (Form N OS-16). The unified forms approved by Resolution No. 7 are intended for use by legal entities of all forms of ownership operating on the territory of the Russian Federation, as established by paragraph 2 of Resolution No. 7. An exception is made only for credit organizations and budgetary institutions. Registration and accounting of equipment received at the organization's warehouse for the purpose of its subsequent use as fixed assets is carried out using the Certificate of Acceptance (Receipt) of Equipment (Form N OS-14). The act is drawn up in two copies by the commission responsible for the acceptance of fixed assets, and approved by the head of the organization or a person authorized by him. The act of acceptance and transfer of equipment for installation (Form N OS-15) is used when transferring equipment for installation. Installation can be carried out either by the organization itself, if it has sufficient equipment and personnel resources for this, or with the involvement of third-party organizations. If the installation is carried out by the organization itself, then an act of form N OS-15 must be drawn up. When carrying out installation work by contract, a representative of the contract installation organization is included in the acceptance committee. In this case, a separate act of form N OS-15 for the transfer of equipment for installation is not drawn up. The authorized representative of the installation organization in receiving the equipment for safekeeping signs directly on the act, and a copy of such an act is given to him. A report on identified equipment defects (Form N OS-16) is drawn up for equipment defects identified during installation, adjustment and testing, as well as based on inspection results. Equipment that is installed and ready for operation is included in the fixed assets, for which an Act on the acceptance and transfer of fixed assets (except for buildings, structures) is drawn up (Form N OS-1), or an Act on the acceptance and transfer of groups of fixed assets (except buildings) , structures) (Form N OS-1b). These acts are also approved by Resolution No. 7. That is, the receipt of equipment, its installation and the subsequent commissioning of the equipment is formalized by sequentially drawing up acts of forms NN OS-14, OS-15, if necessary N OS-16 and an act of form N OS- 1 or N OS-1b. OKUD codes must be entered in all unified forms of documents. If an organization draws up documents using software, then these codes are entered automatically. If documents are compiled manually, then the form code should be entered into the form yourself. codes correspond to the forms of primary accounting documents listed above : form N OS-14 - 0306006; form N OS-15 - 0306007; form N OS-16 - 0306008; Form N OS-1 - 0306001; form N OS-1b - 0306031. Units of measurement, also contained in the forms, should be indicated in accordance with the All-Russian Classifier of Units of Measurement OK 015-94 (MK 002-97), approved by the above-mentioned department. As we noted at the beginning of the article, primary accounting documents record the fact of a business transaction. According to clause 2.2 of the Regulations on Documents and Document Flow in Accounting, approved by the USSR Ministry of Finance dated July 29, 1983 N 105, documents must contain reliable data and be created in a timely manner, as a rule, at the time of the transaction. If necessary, the primary accounting document may contain additional details determined by the nature of business transactions. Removing details already contained in them from unified document forms is not permitted. All lines in the documents must be completed. If there is no data to be reflected in the corresponding lines, free lines in the primary documents must be crossed out. Let's consider the issues of accounting for received equipment and its installation. The chart of accounts for accounting the financial and economic activities of organizations and the Instructions for its application, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, is intended to summarize information on the availability and movement of production equipment requiring installation, account 07 “Equipment for installation”. The debit of account 07 “Equipment for installation” reflects the receipt of equipment from the supplier in correspondence with the credit of account 60 “Settlements with suppliers and contractors” for the amount of cost excluding VAT. The amount of VAT presented by the supplier is reflected in the debit of account 19 “Value added tax on purchased assets” and the credit of account 60 “Settlements with suppliers and contractors”. The VAT amount reflected in account 19 “Value added tax on acquired assets”, the VAT taxpayer organization has the right to deduct on the basis of Art. Art. 171, 172 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation). If the organization is not a VAT payer, then the cost of the purchased equipment will be taken into account on account 07 “Equipment for installation”, including VAT. The cost of equipment transferred for installation is written off from the credit of account 07 “Equipment for installation” to the debit of account 08 “Investments in non-current assets”, subaccount 08-3 “Construction of fixed assets”. In the article, we noted that installation of equipment can be carried out either by the organization itself or with the involvement of installation organizations. When installation is carried out by the organization, the costs for its implementation are reflected in account 23 “Auxiliary production”. Installation costs include the cost of materials, components, employee wages, amounts of insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal and Territorial Compulsory Medical Insurance Funds, as well as the amount of insurance premiums for compulsory insurance against accidents at work and occupational diseases. Installation costs also include other costs directly related to the installation of equipment. Expenses recorded on account 23 “Auxiliary production” are then written off to the debit of account 08 “Investments in non-current assets” and are thereby included in the initial cost of the fixed asset. If the organization does not have the opportunity to install the equipment on its own, then installation organizations that specialize in performing this type of work are hired. A contract is concluded between organizations. The general provisions applied when concluding work contracts are contained in Chapter. 37 “Contract” of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation). We only note that according to clause 4 of Art. 753 of the Civil Code of the Russian Federation, the delivery of the result of work by the contractor, that is, in our case, the installation organization, and its acceptance by the customer, that is, the owner of the equipment, is formalized by an act that must be signed by both parties to the contract. Let's consider an example of reflecting in the accounting records of an organization the receipt of equipment requiring installation, and its installation performed by a third party.

Example (numbers are conditional). A VAT payer organization purchased production equipment that required installation. The cost of the equipment was 1,416,000 rubles. (including VAT RUB 216,000). To carry out the installation of equipment, an installation organization was hired, with which a contract was concluded. The cost of installation work is 159,300 rubles. (including VAT - 24,300 rubles). Upon completion of the installation work, the organizations signed a certificate of completion, after which the installed equipment was accepted as part of the fixed assets and put into operation. Accounting for settlements with the installation organization is carried out using account 76 “Settlements with various debtors and creditors”. Debit 07 “Equipment for installation” Credit 60 “Settlements with suppliers and contractors” - RUB 1,200,000. — the receipt of equipment requiring installation is reflected. Debit 19 “Value added tax on purchased assets” Credit 60 “Settlements with suppliers and contractors” - 216,000 rubles. — reflects the amount of VAT presented by the equipment supplier. Debit 68 “Calculations for taxes and fees”, subaccount “Calculations for VAT”, Credit 19 “Value added tax on purchased assets” - 216,000 rubles. — the amount of VAT is accepted for deduction. Debit 08-3 “Construction of fixed assets” Credit 07 “Equipment for installation” - RUB 1,200,000. — the equipment was handed over for installation. Debit 08-3 “Construction of fixed assets” Credit 76 “Settlements with various debtors and creditors” - 135,000 rubles. — the cost of equipment installation work is reflected. Debit 19 “Value added tax on acquired assets” Credit 76 “Settlements with various debtors and creditors” - 24,300 rubles. — reflects the amount of VAT presented by the installation organization. Debit 68 “Calculations for taxes and fees”, subaccount “Calculations for VAT”, Credit 19 “Value added tax on purchased assets” - 24,300 rubles. — the amount of VAT presented by the installation organization is accepted for deduction. Debit 60 “Settlements with suppliers and contractors” Credit 51 “Settlement accounts” - 1,416,000 rubles. — the equipment was paid to the supplier. Debit 76 “Settlements with various debtors and creditors” Credit 51 “Settlement accounts” - 159,300 rubles. — the cost of installation work has been paid. Debit 01 “Fixed assets” Credit 08-3 “Construction of fixed assets” - 1,335,000 rubles. — the object is accepted for accounting as part of fixed assets.

And in conclusion, let us draw the readers’ attention to one more important point. A lot of controversy arises over at what point the amount of value added tax on purchased equipment that requires installation can be deducted. A similar dispute arose between the tax authority and an organization that was denied a refund of VAT on purchased equipment. The basis for this decision of the tax authority was that the equipment was accepted for accounting under account 07 “Equipment for installation”, which is confirmed by the acceptance certificate and the balance sheet for the specified account, as well as the fact that the organization did not have an act of form N OS-14. In the Resolution of the Federal Antimonopoly Service of the North Caucasus District dated January 16, 2008 N F08-8924/07-3340A, the court pointed out the inconsistency of the tax authority’s arguments, motivating its decision as follows. According to paragraph 1 of Art. 172 of the Tax Code of the Russian Federation, deductions of VAT amounts paid when importing fixed assets, including equipment for installation, into the customs territory of the Russian Federation are made in full after registration of these fixed assets, including equipment for installation. This wording means that the deduction of VAT amounts presented by sellers to the taxpayer upon purchase or paid when importing equipment for installation into the customs territory of the Russian Federation is made in full after registration of this equipment. According to the accounting rules, equipment that requires installation, in accordance with clauses 1, 3 of PBU 6/01, does not belong to fixed assets and is accepted for accounting on account 07 “Equipment for installation”. However, the procedure for registering fixed assets of equipment for installation (including the account into which equipment requiring installation is accepted) is not established by tax legislation; it is determined by the above accounting rules. Thus, accounting for equipment purchased by an organization on account 07 “Equipment for installation” indicates its correct recording (accounting). The actual payment for goods, acceptance of goods, and their entry into accounting are confirmed by case materials. Under such circumstances, the court’s conclusion that the company has a legal basis for claiming VAT amounts for deduction corresponds to the norms of Chapter. 21 Tax Code of the Russian Federation. It should be noted that the equipment purchased by organizations does not always cost a lot of money. The cost of some types of equipment may not exceed 20,000 rubles, and such objects, as you know, are not recognized as depreciable property for the purpose of calculating income tax. In Letter of the Ministry of Finance of Russia dated May 12, 2010 N 03-03-06/2/89 it is noted that the costs of purchasing equipment costing less than 20,000 rubles. taken into account for tax purposes in accordance with paragraphs. 3 p. 1 art. 254 Tax Code of the Russian Federation. The cost of such property is included in material costs in full as it is put into operation.

We make corrections to primary documents

How to correct a primary accounting document

Application of a universal transfer document

How to check the authenticity of a sick leave certificate

Document retention periods

Basic postings

- The cost criterion for materials purchased from suppliers is reflected in Dt 07 Kt 60.

- If we are talking about acceptance for installation, then such an operation will be reflected according to Dt 07 Kt 75.

- When considering the cost of assembled pieces of equipment for installation, which are used during special installation activities, you should take into account the wiring Dt 08 Kt 07.

- In case of disposal of parts for installation and building materials, the cost is reflected within the framework of posting Dt 91 Kt 07.

Maintaining analytical accounting activities on the account is carried out in accordance with the storage locations of equipment and building materials.

Organization of accounting

Units requiring installation are accepted on a debit basis. At the same time, their actual acquisition cost is recorded. It consists of purchase prices and costs of transporting objects to the enterprise’s warehouses. When purchasing units from individuals and enterprises for a fee, account 07 is debited in correspondence with the account. 60 and other similar ones. The receipt of objects can be reflected using an account. 15, registering operations for the procurement and receipt of material assets. If it is not applied, then the acquisition is reflected in a manner similar to that established for operations with materials. When accepting aggregates contributed by the founders on account of their contributions to the share (authorized) capital, account 07 is debited in correspondence with the account. 75.

Receipt of equipment for installation

Equipment suitable for installation and intended for it is accepted for accounting under debit 07 according to the actual cost indicator and consists of amounts at purchase prices, including expense areas.

Traditionally, the receipt of equipment for installation activities can be reflected using account 15, which characterizes the manufacture and acquisition of material assets, or without its use.

The contractor accepts the equipment that is transported to the construction site in account 005, and its cost is written off from the same account. In case of sale, write-off, or transfer of equipment, its price is written off to account 91.

Equipment may arrive at the following times:

- actual acquisition;

- receiving a gift;

- making a capital contribution.

All cost areas are reflected according to Dt 07; the cost includes the following cost elements:

- the cost of the components noted in the accompanying documents;

- costs for delivery of valuables;

- costs of lining, storage measures;

- interest on loans received to pay the cost of components of equipment;

- expenses of accountable persons who buy tools themselves.

General characteristics of an off-balance sheet account

As a result of its activities, the organization acquires assets that do not belong to it, but are listed for a period of temporary use or storage. Off-balance sheet accounts are designed to account for this type of asset. Their accounting is determined by the Chart of Accounts and instructions thereto, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n. The peculiarity of off-balance sheet accounts is that the amounts for business transactions are not cross-registered in the debit of one and the credit of another account, but are recorded only in the debit or credit of such an account.

You can find out about which accounts are called off-balance sheet and what regulatory documents establish the accounting procedure for them in the article “Rules for maintaining accounting on off-balance sheet accounts.”

Installation work

Installation work is a whole group of activities that includes the following areas:

- assembly and installation of equipment elements at the site of permanent use;

- measures for the technological supply of various communications (this may include the supply of water, air, installation work on cables and electrical wires);

- checking equipment for serviceability;

- insulation works and painting activities.

The equipment can be of any nature and purpose; its main feature is the impossibility of commissioning without the assembly process (i.e. without preliminary configuration, connection). Accounting for all costs of delivery, storage, and transportation also occurs on account 07 in order to determine the actual parameter of the cost of production.

Retirement of equipment

The disposal of equipment that was purchased but was not subject to installation activities is carried out on account 07. There may be several reasons for this phenomenon:

- write-off due to correction;

- sale to another person;

- free transfer.

If the equipment is unsuitable, and at the same time it did not have time to be transferred for installation, it is written off in Kt 07 and goes to Dt 94. If there is no fault of a specific person in the formation of the causal factor of unsuitability, then the losses go to other expenses, and in other situations they are recorded on accounts guilty employees.

If an object that was not previously subject to installation is decided to be sold or given as a gift, this procedure is completed through 91 invoices. If there is a debt obligation to pay VAT, it must be calculated on the cost of sales.

Taking into account equipment requiring installation

Some of the equipment that goes into production usually requires installation. This can be production or technical equipment that functions only after its assembly, as well as measuring instruments that are mounted to the main equipment.

Let's look at an example:

in October 2020, JSC Bogatyr purchased equipment at a price of 6,745,000 rubles, VAT 1,030,271 rubles. The equipment was purchased for the purpose of assembling a conveyor line. Delivery services - 41,000 rubles, VAT 6,254 rubles. For installation, the contracting organization Montazh Plus LLC was hired (cost of services 234,000 rubles, VAT 35,695 rubles).

The accountant of Bogatyr JSC made the following entries in the accounting:

| Dt | CT | Description | Sum | Document |

| 60 | Reflection of the cost of equipment requiring installation | RUB 5,714,729 | Sales Invoice | |

| 60 | Reflection of the cost of transport company services | RUB 34,746 | Certificate of completion | |

| 19 | 60 | Reflection of input VAT on the cost of equipment | RUB 1,030,271 | Sales Invoice |

| 19 | 60 | Reflection of input VAT on the cost of transport company services | RUR 6,254 | Certificate of completion |

| 08_3 | Reflection of the cost of equipment transferred for installation of the conveyor line (5,714,729 + 34,746) | RUB 5,749,475 | Equipment acceptance certificate | |

| 68 VAT | 19 | Acceptance for deduction of input VAT on costs of purchasing equipment (1,030,271 + 6,254) | RUB 1,036,525 | Invoice |

| 08_3 | 60 | Reflection of value | RUB 198,305 | Certificate of completion |

| 19 | 60 | Reflection of input VAT on cost | RUB 35,695 | Certificate of completion |

| 01 OS in operation | 08_3 | Acceptance of registration and commissioning of the conveyor line (5,749,475 + 198,305) | RUB 5,947,780 | OS commissioning certificate |

| 68 VAT | 19 | Acceptance of input VAT deduction from the cost | RUB 35,695 | Invoice |

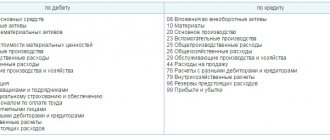

Which accounts does it correspond with?

Account 07 “Equipment for installation” is used for various pieces of equipment that require installation work. Installation is the work of assembling forming components - spare parts attached to the main structures. During operation, this line corresponds with other accounts.

By debit: 15, 23, 60, 67, 71, 75, 76, 79, 80, 86, 91.

On loan: 08, 23, 76, 79, 80, 91, 94, 99.