Why a briefcase?

Investments in a portfolio have a number of advantages over a separate account, the main one being the reduction of risks, which are known to be high in the Forex market. Of course, if you don’t diversify and invest all your funds in one trader, and he shows fantastic returns, then you can earn a lot of money from this. However, if a trader falls into a drawdown streak, your capital will melt at the same time as his account. And it’s not a fact that investors’ nerves will hold up. In this scenario, they usually begin withdrawing funds en masse, and the trader's trades are automatically closed by the broker if there is not enough capital to back them. As a result, if the manager does not take action, his account risks being lost.

Investing in different managers reduces risks. Even if one of the traders “merges” or enters a protracted drawdown, the profits of the others will compensate for the losses. Of course, it is necessary to choose managers with different strategies and trading on different currency pairs, otherwise profits and losses on all accounts will be mirrored, and there is no point in diversification.

On the other hand, using a portfolio implies a reduction in potential profit. If the portfolio is optimally balanced, then the average profit will be 10-15% per month, it is difficult to achieve more. While investments in only one PAMM account can bring unlimited profits, especially if the account is opened by an experienced manager and is at the “acceleration” stage.

So if you need stable and approximately equal profits throughout the entire investment stage, then it makes sense to assemble a portfolio of several PAMM accounts and invest in it. If you are interested in profit “here and now,” then you need to “catch” potentially profitable single accounts and invest in them to the maximum.

Translated into business language, investing in a Forex portfolio is like buying shares of several stable operating enterprises, and investing in one young PAMM account is like purchasing shares in a startup whose future is unknown. Of course, you can invest in one stable working PAMM account, but usually the profit from it is small, since its owner does not take unnecessary risks.

And here’s another interesting article: How the stock price is formed and where you can see it

Thus, a portfolio of several PAMM accounts will minimize risks by transferring the investor’s capital to different traders for management. Therefore, the most important question arises: how to choose suitable managers for investments in PAMM accounts that will generate stable income for a long time.

Mechanism of operation

The service offers two investment methods: PAMM account and PAMM portfolio. Let's look at the features of each.

PAMM account

How it works:

- The manager opens a PAMM account and deposits his own capital into it, which will participate in trading along with other investors. He will be able to return the originally invested money (or a smaller part of it in case of unsuccessful transactions) only upon liquidation of the account. Has the right to increase capital by adding funds.

- The manager develops an offer, where he prescribes the terms of cooperation: minimum entry threshold, percentage of remuneration. The latter often depends on the investment amount and can reach 50%, i.e. the investor will give half of the earnings to the trader.

For example, this is what the conditions look like for trader No. 1 in the Alpari rating:

- The account receives public status and is monitored on the brokerage site’s website. Any investor can monitor the manager’s transactions and communicate with him on the forum.

- The investor, based on certain criteria, which we will talk about later, selects a manager and a PAMM account, and invests money in it. After receiving the profit, part of it goes to remunerate the manager, the rest can be left on the account, or can be withdrawn.

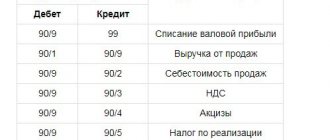

The profit distribution mechanism is presented in the diagram:

PAMM portfolio

The first rule of an investor is diversification. This is especially true for risky investments, such as PAMM accounts. To reduce risks, the manager creates a portfolio that includes several accounts. Determines everyone's share, contributes their capital and attracts investors with their trading. Can change the structure, delete and add new accounts if he sees that the strategy is not profitable.

The main advantage for an investor is risk diversification. A drawdown on one account is offset by a profit on another. It seems unlikely to lose all the capital invested in the portfolio.

The profit distribution mechanism is similar to that described above:

What is an optimal portfolio?

The name “optimal portfolio” is quite arbitrary, since each investor has his own goals and his own investment volume. All portfolios, like single PAMM accounts, can be divided into several categories depending on the profit/risk ratio.

Aggressive – includes the advantage of young PAMM accounts and accounts that implement risky strategies, for example, martingale. Such portfolios help to make large profits in a short time, but individual accounts are closed quite quickly.

Such portfolios are not suitable for the long term. Investors must be prepared to constantly monitor each account and react if there is the slightest suspicion of a future drain. The profitability of such a portfolio should be at least 50-100% per month, ideally higher, otherwise the game is not worth the candle.

Conservative – this portfolio includes stable working PAMM accounts. Each account has an impressive amount of funds under management, many investors with large sums. Traders simply will not enter into risky transactions, and a large amount of funds will help them wait out any drawdown and be guaranteed to make a profit. The average profit of such a portfolio is 5-10% per month; portfolios with lower profitability should not be considered.

Balanced – this type of portfolio includes conservative and aggressive PAMM accounts, located in a certain proportion (usually 70/30 or 80/20).

Conservative accounts act as a “safety cushion” and allow the investor to make a profit even if aggressive accounts break even or bring a loss. Such a portfolio is suitable for both the long and medium term, and is capable of generating 15-20% profit per month. The construction of this type of portfolio will be discussed further.

How to build a balanced portfolio

Collecting a portfolio for investing in PAMM accounts on Forex includes several stages:

- familiarization with PAMM accounts, subscribing to their news, monitoring trading (the optimal monitoring time is a month);

- formation of a portfolio with selected PAMM accounts in a certain proportion;

- monitoring profitability for two to three months, redistributing capital, adding new accounts to the portfolio;

- profit fixation – monthly with possible full or partial reinvestment.

Let's consider each stage separately.

Example

The broker company has a dozen successful traders who are ready to earn more by doing exactly what they did before.

The advertising broker tries to reach the entire potential audience:

- advertises in financial publications;

- hangs banners online, etc.;

- invites you to free training (or for a nominal fee).

The found investor enters into an agreement with the broker to open a PAMM account, where the manager and the amount of his remuneration are indicated. After investing a certain amount into the system, you can monitor the manager’s work in real time.

Let's say the manager's monthly profit rate is 4.5%. When an investor invests $5000 (all figures are taken as an example!), his profit is 5000/100*4.5 = $225, of which 40% is withheld - the trader’s remuneration. Therefore, $135 will be added to the investor’s PAMM account.

If the PAMM account is joint (it is owned by 2 people), for example $2000+3000, the profit will be distributed proportionally: $54 and $81. As a result, we have invested $2054 and $3081.

Selecting suitable PAMM accounts

Regardless of their portfolio goals, investors need consistently profitable PAMM accounts that are guaranteed to stay afloat in the short and medium term. Of course, it is impossible to accurately predict how long a particular trader will trade profitably, but you can make an estimate. To do this, you need to pay attention to the following factors:

- duration of trade – the longer the better;

- the size of the trader’s personal investments - again, the more personal funds a trader trades, the more careful he is;

- size of investment - if many investors have invested in a trader, this means that his trading is successful;

- maximum drawdown – if it is large, think about whether you are ready to potentially lose that amount of capital;

- average profit - it makes sense to consider the profit for the period that interests you - if, for example, you plan to open an account for a year, then you need to analyze the profit for the year;

- maximum deposit load - the smaller part of the deposit a trader risks, the less likely it is that he will “merge” the account (for example, if a manager uses no more than 2% of capital in one transaction, it is unlikely that the money in his account will run out before the transaction goes through plus; but if 40% of the capital was involved in the transaction, then the probability of a “drain” is high);

- currency pairs on which the trader trades - for the portfolio it is optimal to select accounts on which trading is carried out on various instruments; moreover, it is important to look at the diversification of risks within the account itself (for example, if a trader trades on the euro/dollar pair and on gold, then , most likely, he himself correlates the risks);

- aggressiveness - with most brokers it is indicated by asterisks: the more stars, the riskier the manager.

And here’s another interesting article: How much money do you need for investment?

After analyzing PAMM accounts and choosing the most attractive ones, you should add them to your bookmarks or favorites and monitor them. You may even have to do calculations on paper to know how much you could earn by investing in a given account.

PAMM account investment scheme

A PAMM account is created so that you can make a profit, but the investor himself does not trade. In the classic scenario, the scheme of investments and work is presented in 3 popular stages:

- The selected manager himself invests his funds, opens an offer and starts trading.

- The client studies the manager’s position on special resources, reads reviews of the work, studies the rating, which indicates the average drawdown, the maximum minus and plus for transactions, the period of work, and invests.

- Automatic distribution of profits according to the share of each investor.

I note that the manager of a PAMM account risks his money on an equal basis with his partners. This is the basic principle of operation of a financial instrument.

Portfolio proportions

The optimal proportion for a balanced portfolio when investing in PAMM accounts:

- 50% – conservative accounts (“airbag”);

- 35-40% – moderately aggressive accounts (bring the bulk of the profit);

- 10-15% – aggressive accounts (the expectation is that some of them will bring good profits that will cover possible losses).

How many accounts are needed? This is at the discretion of the investor. Typically, a portfolio contains from 10 to 15 PAMM accounts. It is optimal if you can invest at least $100 in each account - then this will provide a tangible option. If the investor does not have such capital, then he must distribute his funds between all accounts evenly, but so that the proportion is not violated.

At the same time, the investor is free to choose: if he is interested in greater profits, then he can increase either the number of aggressive accounts or increase the share of capital held on them.

Examples of investing in PAMM accounts

Today, Forex brokers offer different financial conditions for cooperation with them. The principle is identical: with a successful transaction, the investor received a profit, and so did the manager. When opening an offer, the manager indicates what his capital is, for example, $1000. The following describes the conditions - the minimum entry (for example, $1000), the moments of distribution of profits and losses, for example, 40 to 60.

The deal was open for a month and brought 20% profit. Thus, the total capital is 2400, of which (taking into account the starting investment of the PAMM account) $600 is the income of the manager, the rest is the partner. Of course, the amount of profit is divided by the number of all participants.

Please note when choosing a PAMM account that most impose a penalty for early withdrawal of funds.

Portfolio review

After the portfolio is formed, you need to give it time to work on Forex. Even if it gave unprofitable results within a month, there is no need to try to “shake it up” right away. The portfolio needs to last at least two to three months. Some traders trade at a loss for months, and then turn into a profit after a few large trades.

When reviewing your portfolio, you need to avoid a situation where you want to transfer all the funds to the most profitable account. We should not forget: the goal of a balanced portfolio is not to increase, but to preserve funds. Therefore, “distortions” should not be allowed. Moreover, if the manager made a profit this month, he may suffer a loss next month.

Profit taking

This is the most enjoyable part of the whole investing in PAMM accounts. When to withdraw money? It depends on the investor's strategy. If he intends to “grow” his capital, then he needs to reinvest all or most of the profits. Then his income will increase exponentially. However, if he plans to live on the funds received from investing, he can withdraw profits monthly or as needed.

And here’s another interesting article: Where to invest small money so that it makes money: full review

So, before withdrawing profits, you should decide what kind of income you, as an investor, need, and proceed from the average monthly earnings for the portfolio. If the required amount is not very large, it makes sense to increase it a little, and only then start systematically withdrawing funds.

What is a PAMM account?

The PAMM account became popular neither today nor yesterday. The peak of this type of investment was observed in 2011-2013, when many investors chose a similar area of money work. The point is that this is a platform that brings together traders and investors, and the latter do not trade themselves, but invest funds, choosing management on a trust basis.

PAMM accounts are often called an investment service that allows investors to earn money without opening transactions on the Forex market on their own.

Of course, as one of the main liquid tools for making a profit, the strategy opens up the opportunity to regularly increase capital for clients, and for traders to benefit from successfully completed transactions and increase their rating and create a reliable reputation. Translated from English, the strategy literally sounds like “percentage distribution control module.” Initially, several brokers provided services on the market, but due to the growing popularity of the area, their number rapidly increased.

A PAMM account is sometimes called PAMM - an abbreviation from the first letters of the words of the English term Percentage Allocation Management Module.