What is the volume of capital investment and what fixed assets are included in fixed capital? How are fixed capital statistics maintained? Where can I get help in attracting foreign direct investors?

The successful development of any enterprise - be it a large oil production complex or a coffee shop for 10 people - depends on smart financial investments in the company's fixed assets. To get maximum profit tomorrow, you need to take care of it today.

Achieving this goal is realized through investment in fixed capital. I, Denis Kuderin, an investment expert, will talk about what such investments are and how to make them wisely in a new publication.

At the end of the article you will find an overview of professional companies that will help you invest money profitably, plus tips on attracting investors.

Let's begin, dear friends!

How to earn passive income on websites

How to buy a website with income and receive from $10 to $3000, even despite the pandemic and its consequences. How much does a profitable website cost and how to start investing with 10,000 rubles or more in your pocket

More about the course

Kinds

The type of investment depends on the purpose of the fixed capital. This:

- investments in production assets (production lines, equipment, buildings, etc.);

- non-productive investments, when cash flows are directed to the creation and development of household and socio-cultural facilities, healthcare, and infrastructure.

- Composition and structure of the IEC

The composition is well shown by accounting, in the accounts of which fixed assets are taken into account. This:

- expenses related to land plots;

- buildings, structures and communications to them;

- technological lines, machines and equipment;

- motor transport;

- furniture, appliances, tools;

- objects of intellectual property, IT development, computer software;

- perennial plantings.

According to the technological structure, investments in fixed capital are related to:

- with the execution of construction and installation works;

- with the implementation of commissioning works;

- with the purchase of equipment, tools, inventory, protective clothing;

- with other capital works.

There is another division of investments by structure (volume):

- gross – the total volume of investments from all sources;

- net - gross, reduced by the amount of depreciation.

Structure

Another important parameter is the structure of investment activity. IVOC include:

- Accounting for types of financial assets.

- Type of economic activity.

- Taking into account funding sources.

- Accounting for economic activity.

By type of fixed assets

If we consider the percentage distribution of PF, statistical data on average from 2000 to 2020 fluctuates around the given figures:

- In housing – about 13% on average.

- In buildings and various structures with the exception of residential – 42%.

- In cars, vehicles, instruments and other equipment, about 37%.

- Intellectual property objects - 3.5%.

- Other types – 6%.

If we take into account this expression in rubles, then statistics provide the following parameters for 2020:

- The amount contributed to housing was RUB 2,321.9 billion.

- In non-residential structures and buildings - 7542.8 billion rubles.

- In machinery, equipment, instruments and various types of equipment - 6283.4 billion rubles.

- Investments in intellectual property objects amounted to 558.5 billion rubles.

- To other funds – RUB 1,075.4 billion.

By type of economic activity

The most successful, from the point of view of investing financial resources, are:

- Mining - there has been an increase since 2009 from 13.2% to 19.4%.

- Sufficient amounts are also invested in manufacturing industries, fluctuating around 14.5%.

- Agriculture shows lower figures – about 3.5%.

- Construction also has lows of around 0.7%.

By funding source

According to sources, the indicators are as follows:

- About 45% is invested from own funds. Moreover, about 20% comes from profit, 20% from depreciation and the remaining 5% from reserves.

- Of those attracted, 55% are spent. Of this amount, budget funds make up about 20%.

- Bank loans 9%.

- Bonded non-financial amounts are about 10%.

- Shares – 0.3%.

- Funds' funds - 0.5% and others - about 9%.

- Borrowed funds from other organizations are about 6%.

By type of ownership

From a property perspective, the amounts are distributed in percentage terms as follows:

- Russian ownership 85%. Of this, state property accounts for about 13%. Municipal – about 2%. Private – 61%. Mixed Russian without foreign participation about 7%.

- Foreign reaches just over 6%.

- Joint Russian and foreign over 8%.

Sources of financing

Investments in fixed capital are significant amounts, but without this the company simply cannot operate. There are 3 sources of funding.

Attracting investors

Third-party investors are not only interested in development, they are attracted by the opportunity to make decisions. Therefore, large third-party investments threaten the loss of independence.

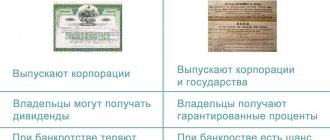

Money from fixed capital investors comes as:

- income from the sale of own securities;

- profit intended for payment of dividends, but by decision of the board aimed at the development of the company;

- finances of the budgets of the Russian Federation at various levels (technical and humanitarian assistance, often provided free of charge).

Your funds

Own money is often the main source of investment in fixed assets. This:

- capital contribution;

- retained earnings;

- depreciation;

- released finances as a result of the sale of assets;

- insurance compensation paid upon the occurrence of an insured event (accident, natural disaster).

Borrowed funds

Borrowing funds for investment in fixed assets is not a good idea, since you need to pay off the added value - interest. This:

- commercial bank loans;

- loans from organizations (mutual fund, investment fund, etc.);

- federal budget loans.

Where to get help with capital investments - review of the TOP 3 brokerage companies

Representatives of small and medium-sized businesses, as well as aspiring entrepreneurs, often use the services of professional intermediaries to achieve investment goals.

We present an overview of the three most reliable brokerage companies in the Russian Federation, which will help you manage your money profitably and invest it in the most promising financial instruments.

1) Opening Broker

The year the company was founded is 1995. The total number of clients at the time of writing is 95,000. Last year, the total volume of brokerage transactions on the Moscow Exchange exceeded 14 trillion rubles. Otkritie Broker is a confident leader in the growth of new clients among Russian companies. The company has a huge number of professional awards, prizes, medals and diplomas.

Clients have access to all the most effective modern investment tools - investing in their own business through the “Discovery” affiliate program, opening a brokerage account and buying and selling securities, assistance in managing the company’s fixed capital. Specialists will help you form an investment portfolio and teach beginners the basic skills of profitable investing.

2) BM Invest

The company was founded by private investors who have been multiplying their personal funds since 2006. As we can see, they did this very successfully, since they eventually managed to open their own investment company.

The priority area of activity of BM Invest is professional assistance in the development of small and medium-sized businesses. The company attracts investment from clients and also issues loans for the development of commercial projects. The organization operates under the supervision of the Central Bank. All company investments are insured.

3) RICOM-TRUST

The company was founded in 1994 and is one of the twenty largest investment companies by the number of active clients. Own capital of RICOM-TRUST is more than 1 billion rubles. The size of assets under management of the company is 3.5 billion. The company operates in the Moscow region and in 10 other regions of the Russian Federation.

Specialists will help enterprises and private traders increase their fixed capital by investing in the most reliable and profitable areas - securities (including shares of the largest American companies), currency, gold and other precious metals.

A useful link on the topic of profitable investments is “Investment Management”.

PKI directions

If we consider capital investments from the point of view of reproduction, then they can be divided into 2 areas:

- investments related to extensive development (expansion of existing facilities, construction of new ones);

- investments related to intensive development (modernization, reconstruction).

In Russia, over the last 5 years, construction has been in first place in terms of investment volume (57–65% of the total volume). The second is the purchase of new fixed assets (20–25%). And only then reconstruction and modernization (15–20%).

Investment calculation

The formula for calculating investments looks like the sum of depreciation funds, retained earnings and loans received. For its part, depreciation funds are the difference between the total amount of depreciation deductions, the amount of deductions used and the amount of free depreciation funds (including issued loans). The actual amount of retained earnings is the difference between the total amount of retained earnings and the amount of distributed net income.

The formula for calculating investments looks different if borrowed and equity funds were used simultaneously. In this case, the amount of the loan (with or without collateral) and funds borrowed from business partners are added to the result obtained by calculating using the first formula.

Accounting Features

Investments are accounted for excluding VAT. There are exceptions to this rule according to the Tax Code of the Russian Federation (Article 170, Part 2):

- if the fixed capital is exempt from taxation, it is accounted for at its declared value;

- if the purchased machines produce products for export.

Since all accounting is carried out in rubles, investments in fixed assets in foreign currency are recalculated at the Bank of Russia exchange rate upon completion of the transaction.

In addition, the valuation of investments is tied to the prices of the period for which the statements are prepared. Therefore, when accounting for investments in fixed assets, I recommend using the official methodology (Rosstat Order No. 746 dated November 25, 2016, with amendments and additions).

Investments are useful

Currently, many ordinary people who have some income are thinking about how applicable the phenomenon of investment capital is to them, whether they can act as investors. Many people have heard about investment opportunities, but few can clearly formulate the purpose of such activity. For a person who has funds, the main task is to preserve and increase their wealth so that the amount currently available grows enough to be used to purchase an expensive item. If you create investment capital, you can thereby provide yourself with a financial cushion with which a person will feel safe at any time.

Our life is fraught with many risks. Investment capital formed in advance allows you to smooth out their unpleasant influence. Most of our fellow citizens try to keep money at home for a rainy day. Some people prefer to keep their funds in a bank. As experienced experts in this area say, the best option is to invest your resources in order to avoid depreciation. Money will work, and its owner will make a profit. The greater a person's investment capital, the better prospects for profit he will have.

What determines the effectiveness of investments?

When an investor determines an object for investment, he must take into account:

- investment climate of the country and a particular region;

- the pace of development of the entire industry;

- performance indicators of this enterprise over the last 3–5 years (the longer the reporting period, the better).

I recommend choosing undervalued enterprises in the top 5 industries.

- They have good financial and economic performance indicators.

- A competent management strategy made it possible to overcome the crisis years. There is an absolutely incompetent leadership, preoccupied with lining its own pockets. Then, even in the presence of a formal dictatorship, one cannot expect stable good indicators.

- There is a core of professionals (there is no staff turnover).

- Good material base. It will be of little use if investments in fixed capital are actually spent on purchasing a line, but there is no premises. Or the roof is leaking, the windows are full of holes, the plaster is falling on top. Expensive technology will be stolen for scrap metal.

Where do legs come from?

The enterprise receives investment capital from the owner’s own funds and attracted foreign resources. The first is retained earnings with deductions for depreciation. The second presupposes some free funds that are issued by an individual, a legal entity, or the state. Such funds are the main object of transactions using securities.

You may be interested in: How to get a loan without a credit history and certificates? Rules of registration, terms of the contract

Any savings become investments if they are spent on purchasing production elements. They are the only source of investment capital. Funds arise when income is received by individuals, corporations, when the government receives income, and the amount turns out to be greater than the expenses of this entity.

You may be interested in: Loan insurance at Home Credit: conditions, necessary documents, tips

Channel PROGRAMMER'S DIARY

The life of a programmer and interesting reviews of everything. Subscribe so you don't miss new videos.

Differences between investing in working capital and fixed capital

Working capital is intended for the purchase of goods, raw materials and supplies. The main one is for means of production. Therefore, in the short term it is more profitable to invest in the short term. Like in trading: they took money, bought goods, and sold them for a profit.

Investments in fixed assets imply stable output. The costs are higher (the cost of a beer bottling line and 100 cases of finished products are not comparable), but in a few years, after passing the break-even point, the income from investments will steadily “feed” the investor. Of course, if the market situation does not change for the worse.

Accounting

On the balance sheet of the enterprise, account 08 “Investments in non-current assets” is used to reflect investments. Here the accountant reflects the costs aimed at creating, modernizing the enterprise’s capacities, as well as their maintenance. This also includes expenses for the acquisition of fixed assets. If necessary, subaccounts are opened for account 08.

As an example, when purchasing an asset, subaccount 08.04 “Purchase of fixed assets” is used. As soon as the result of the OK funding is received, i.e. the fixed asset is manufactured or purchased, accounting begins on account 01 “fixed assets”.

The account is classified as active. The debit reflects the investments in working capital themselves, and the credit reflects the write-off of the organization’s expenses during the capitalization of assets.

Advantages and disadvantages

If earlier investors, whether ours or foreign ones, were actively buying shares, now the trend has changed. More and more financiers are considering the real sector and capital investments as a profitable investment.

Main advantages:

- the possibility of receiving regular income for a long time;

- the state provides benefits and preferences for investments in the real sector.

For the company, this also means consultations, support from the best specialists, exchange of experience, and training.

Of the minuses:

- This is an investment in the future, there will be no quick return;

- For small and medium-sized investors, it is difficult to choose an investment object.

A significant disadvantage for management is the need to:

- report on the money used;

- make decisions based on the interests of the investor.

As you can imagine, this is very stressful for directors. In addition, there is a verification procedure before investments, additional reporting to control authorities. Therefore, if additional capital is needed, the manager turns to a commercial bank.

Risks

If the company is chosen correctly, the investment risks are low. Although you cannot count on high profits in the near future, investing in fixed capital is a reliable investment.

Investing personal capital. Part 1. Choosing an investment strategy.

Investing personal capital. Where to begin?

Most of us regularly ask ourselves the question: how to save money to achieve strategic life goals? For example, provide a decent pension . Or, when accumulating even a small amount of money (for example, comparable to six months’ monthly income), exciting thoughts immediately begin to come to mind about the profitable investment of these funds in some profitable “business”. However, more often than not, in the end everything is limited to keeping these savings on deposit investment experience for most people, at least in our country, is limited.

In our series of articles on investing personal capital, we would like to offer you a more thoughtful approach to how your money should work to achieve your goals. Let's start with the first component of any investment activity, namely the choice of investment strategy.

Stages of forming an investment strategy

Stage 1. First, you need to determine for yourself the parameters of all those strategic goals that you want to achieve, i.e. engage in investment profiling. At the same time, you need to try to specify your goals as much as possible in terms of time and quantitative characteristics, for example, by at least building a simple list like this:

- Create a reserve of 1,000,000 rubles. for higher education for a child (which will be required in 15 years).

- Change the car every 3-4 years (taking into account new investments of about 20% of the cost of the previous one).

- Move to a new, more spacious apartment. In this case, you will need, for example, a 20% mortgage contribution (3,000,000 rubles) for a housing cost of 15,000,000 rubles. In this case, the monthly mortgage payment will be, for example, about 100,000 rubles. (easy to calculate using any loan calculator, for example, here ).

- Retire by age 55 with a stable source of investment income equivalent to 70% of your current monthly income.

It is better to take into account the effect of taxes and inflation when calculating the required return on investment (we will consider a specific example below).

Obviously, such a list may be subject to adjustment over time, however, with proper financial planning, it will not be difficult for you (or your financial advisor) to review your investment portfolio, despite the fact that this must be done at least once a year, even if nothing strategically changes in your plans yet. The most important thing is to decide on the priority of each goal, as well as to what extent you are ready to diminish your desires. For example, delaying replacing a car or retiring for a few years if necessary.

Step-by-step instructions for investing in fixed assets

Simply deciding that additional funds are needed is not enough. Required:

- draw up a business plan. Competent calculations proving the return on investment;

- determine the fee for investments (% of income, share in the business);

- place information on the market (investment funds, broker banks, etc.);

- conduct negotiations with investors;

- sign contract.

The best brokerage companies providing investment assistance

I understand that the task of finding an investment property is difficult. If you have money, but no time or knowledge, contact the best brokerage companies.

Investment capital structure

Depending on the goals and objectives set, the structure of investment capital can vary significantly.

For example, if the goal is to preserve capital and protect against inflation, then a significant part of the portfolio will be bonds of reliable issuers, ETFs, blue chip stocks and American Treasuries.

If the goal is aggressive growth, then the portfolio structure will include stocks, ETFs for stock indices, corporate bonds, REITs, etc. Perhaps such an investor will include even more risky assets in his portfolio - PAMM accounts, bonds, penny stocks, cryptocurrency, etc.

The structure of the investment portfolio will depend on the following factors:

- duration of investment;

- desired income;

- method of generating income (the most common are dividends, coupons, resale of an asset);

- the ultimate goal of the investment;

- conditions for the withdrawal of capital from investments.

For example, if the goal is to assemble an investment portfolio for retirement, then you need to provide for a painless sale of assets so that their loss does not affect profitability or is somehow compensated - for example, by transferring funds to riskier assets. The duration of the formation of investment capital for retirement is calculated in years, and its size depends on profitability: the higher the income, the less money you need to ensure an acceptable standard of living.

Tips on how to attract investment

I always remind you of the importance of preparation and calculations. Any investor will want to review the financial statements, check the calculations and verify for themselves the profitability of the investment. So get your financial records in order, pay off large accounts receivable, and develop a credible business plan.

Do not refuse the help of companies specializing in finding investors. They are often asked the question: “Where to invest?”, so the one you need will be found faster.