- home

- Investments

Evgeny Smirnov

0

Article navigation

- Why are investment portfolios needed?

- The difference between portfolio investments and direct ones

- What is a portfolio investment?

- Formation of an investment portfolio, principles and models

- Principles of investment portfolio formation

- Investment Portfolio Models

- Classification of investment portfolios

- Risks of portfolio investment

- How to minimize portfolio investment risks

- What is the difference between foreign portfolio investments?

- How is an investment portfolio managed?

Portfolio investing is one of the most common types of profitable financial investments. The article will talk in detail about it, the risks associated with such activities, ways to overcome them and the expected benefits.

Content

What are direct investments What are portfolio investments The main differences between direct and portfolio investments Who can become a direct investor Who can become a portfolio investor Pros and cons of direct and portfolio investments How to become a portfolio investor Stage 1. Decide on investment goals Stage 2. Choose method of managing an investment portfolio Stage 3. Study the investment market Stage 4. Assess the effectiveness of your investment portfolio Stage 5. Periodically check and recheck your portfolio The main existing risks of portfolio investments 1. Wrong choice of investment instruments 2. Incorrect timing for investments 3. Inflation 4 .Interest rate fluctuations Instead of a conclusion

What is direct investment?

The concept of “direct investment” can be given two definitions:

- Direct investments are investments in production assets and other resources of the organization that have a direct impact on the production and financial results of the business.

- Direct investment is the acquisition of a share of the authorized capital of an organization, which gives the investor the right to participate in its activities and influence the adoption of important decisions.

Their essence lies in the fact that they are aimed at acquiring one specific object. For example, buying shares of one large company in order to obtain a controlling stake. At the same time, other investment instruments are not taken into account. That is, the investor has a specific investment strategy, which he strictly follows throughout the entire period of investment.

Advantages and disadvantages

Since portfolio investments represent investments in projects or securities, the main advantage is the possibility of receiving passive income. The disadvantages of the instrument are the likelihood of losing part or all of the invested capital. Since the investment base of business entities is formed by direct investments, by giving investors the opportunity to constantly make portfolio deposits, they are at risk. In the event of a crisis, investors will rush to exchange their securities for currency, which will result in financial problems for the company.

What are portfolio investments?

Portfolio investment is the investment of capital in economic assets with the aim of generating profit and diversifying risks. As a rule, these are investments in securities and other assets where the investor’s direct participation in their management is not required.

The main part, often even the only part, of the investment portfolio consists of securities.

Here you can read what the stock market is and how to trade on it.

Portfolio investments are made primarily through a stockbroker. And when forming an investment portfolio, both reliable assets with low returns and high-risk investments that, if successful, give decent profits, are taken into account.

In addition, portfolio investments are highly liquid. That is, the investor can sell the assets included in the investment portfolio at any time and leave the market.

In order for portfolio investments to bring their owner the greatest profit, it is better to form a portfolio of investments according to the following rules:

- investment assets must be of high quality and reliable;

- there must be diversification of investment assets;

- engaging a professional consultant.

For beginners, it’s best to start with a conservative portfolio approach. That is, the majority of such a portfolio should consist of low-risk assets, which will practically eliminate the loss of funds and will guarantee, although not large, but stable income.

What are the criteria for choosing stocks?

If you are interested in which stocks to buy in order to receive dividends, I advise you not to be lazy . Let's take a look at the most worthwhile investment options with me. Since there is no clear answer to the question “Whose shares should I buy?” It’s impossible to give, it makes sense to understand the differences between the most popular investment properties.

Should you choose a young or large company?

Perhaps the most risk-free and stable investment option can only be investments in industry and huge corporations. I don’t think any of you are seriously preparing for the imminent bankruptcy of Gazprom or Microsoft. But be prepared for the fact that the profitability of such assets will be several times lower than if you invest your capital in the development of a young and very promising company. Of course, in the case of the latter, the possibility of a sharp increase in the price of shares will be accompanied by huge risks associated with the possibility of bankruptcy of the company. But, as you know, those who don’t take risks don’t drink champagne.

On my own behalf, I can add that in the optimal investment portfolio there should be a place for both shares of large corporations and small enterprises that are just beginning to develop. Such diversification of the investment portfolio will allow you to play for growth and not end up among the bankrupts.

Should you choose portfolio foreign investments or prefer securities of domestic companies?

If any of you, dear friends, are already holders of securities, then you know that it is much easier to purchase shares of Russian companies than foreign ones. However, in the case of the latter, we can count on significantly greater stability. That is, during local crises, which, unfortunately, are no longer rare in our country, international companies suffer virtually no losses. So, if there is a downturn in the secondary market for securities of Russian companies, you, as a security holder, will suffer serious monetary losses.

Become the owner of a common or preferred share?

Don't these words mean anything to you? I talked about the types of shares here. Are you interested in receiving significantly larger dividends, spending less on purchasing securities, and do not want to take part in the management of the company? Your solution is to buy common shares. For those who are passionate about the idea of strategic investment, it makes sense to consider purchasing preferred shares. They will allow their owners to participate in the company's boards of directors.

Which industry should you invest in?

Today, your financial portfolio should be a collection of investments in industries that you understand. You should have at least a basic understanding of the activities of companies in this segment of the economy. So, if you are a specialist in the metallurgical industry, invest in the industry; if you are a financial expert, purchase shares of one of the largest banks.

Should you buy just one block of shares or several at once?

Many new investors think that a portfolio must contain shares of only one company. I hasten to disappoint you and inform you that such a policy is fundamentally wrong. It does not lead to anything other than the emergence of unnecessary risks. If you remember the cardinal rule of diversification, then you will never put all your eggs in one basket and give all your capital to one company.

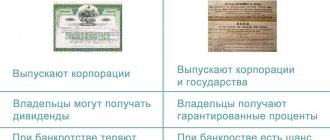

The main differences between direct and portfolio investments

To make the essence of direct and portfolio investments clearer to you, let’s look at their main and most important differences.

- Direct investments require a larger investment amount. When investing in a portfolio, you can get by with a small amount.

- The main part of portfolio investments are securities. Often, even the only one. With direct investing, there is a much wider choice of investment assets.

- The return on portfolio investments is lower than on direct investments. This is due to lower initial capital.

- Direct investments are made for the long term. Their payback is measured over years and requires constant monitoring by the investor. With portfolio investing, everything is exactly the opposite.

- Portfolio investments have much greater liquidity than direct investments, which can be very difficult to implement.

- The owner of a portfolio investment, unlike a direct investor, can leave the market at any time.

Types of investment portfolios

The types of investment portfolios depend on the purpose of forming the investment portfolio.

- If the investor's goal is rapid capital growth, he creates a growth portfolio.

- If the goal is a quick return on investment, then a liquidity portfolio is formed.

- The investor's goal is a guaranteed constant income; an income portfolio is formed consisting of shares of large oil companies, companies in the gas sector of the economy and large energy companies.

In addition, portfolios can be formed from regional securities or shares of companies in the same industry. Investment portfolios made up of foreign securities are also formed - portfolio foreign investments.

Who can become a direct investor

As already mentioned, direct investment requires the investor to have large initial capital and long-term global goals. When investing in direct investments, you should not expect profit in the next few years; it may simply not come. On the contrary, additional capital investments will be required in the future.

So it turns out that only people with huge savings, large companies and the state can afford this type of investment.

To give specific examples, direct investors become in the following cases:

- When a huge enterprise wants to absorb a smaller company.

- The investor's purchase of a controlling stake in order to directly participate in the fate of the company and direct its further development.

- An investor's investment of his funds in real estate at the design or construction stage with the goal of becoming the owner of this construction project and managing it in full.

- And all similar investments…..

Here it is imperative to take into account that these investments on a large scale can only be made by a person who has sufficient experience in such investments. And also, a person who knows what difficulties he will have to face, and what he risks losing as a result. And, of course, you must be psychologically prepared for any outcome of events.

Who can become a portfolio investor

Everything is simpler here. Anyone who cannot or does not want to become a direct investor can become a portfolio investor. In addition, portfolio investments do not require investing huge amounts of money, and they are much simpler than direct ones.

Both individuals and legal entities can engage in portfolio investment. An investor does not need to have any special knowledge or extensive investment experience behind him. He always seeks help from intermediaries, such as a brokerage company. And, if an investor has good special knowledge, he can invest on his own.

Pros and cons of direct and portfolio investments

To make it easier for you to choose between direct and portfolio investments, let's consider their main advantages and disadvantages.

The advantages of direct investment include:

- The opportunity to obtain the necessary funds for the implementation of the project, opening and developing a business.

- You can invest not only money in a company, but also intangible assets.

- Receiving huge profits and achieving a global goal.

The disadvantages of direct investment include:

- A huge amount of money is required to be invested.

- You have to wait quite a long time to make a profit.

- Additional investments are often required.

- High risks – there may be no profit.

- Not liquidity. It is practically impossible to sell and exit the market.

- Knowledge and experience required.

The advantages of portfolio investment include:

- No special knowledge required. You can involve a mediator in the process.

- There is no need to deal with the affairs of the owner of the securities.

- Portfolio diversification reduces the loss of invested capital.

- Ease of paying taxes.

- Highly liquid. You can always sell and exit the market.

The disadvantage here is that the profit will ultimately be lower than with direct investment.

Something like that. Now you, having weighed all the advantages and disadvantages of direct and portfolio investments, can make the right choice.

Principles of portfolio formation

When forming a portfolio for investment, it can include one type of asset or a whole set of them, the elements of which differ in terms of functioning and profitability. All assets must be liquid. They can be supplemented and completely replaced. When forming an investment, it is possible to combine several fundamental portfolio elements, however, due to the discrepancy between their parameters and operating principles, it will be difficult for the investor to synchronize them, so such a decision is undesirable.

Conservative

The desire to minimize risks is the reason for the formation of a conservative portfolio. His instruments are reliable, but have low returns. Such a portfolio is relevant among investors who do not have in-depth knowledge in the field of financial investments.

Diversified

When forming a portfolio based on the type of diversification, you should consider the possibility of filling it with several types of securities. Since the investor invests values in different companies, he has to constantly monitor the market trend. An imbalance in the distribution of funds can lead to the loss of all capital, therefore, to reduce risks, you should combine national and foreign deposits.

Principle of sufficient liquidity

When applying this principle in the formation of a portfolio, the investor always has the opportunity to exchange securities for banknotes. The portfolio's profitability is low, but the liquidity of its instruments reduces risks to the lowest possible level. If there is a danger of losing funds, the investor can immediately withdraw them from circulation in the form of instant profit.

How to become a portfolio investor

For those who have decided to engage in portfolio investing, below are step-by-step instructions on how to do it correctly.

Stage 1. Deciding on investment goals

Any investor, whether he is a beginner or not, must know specifically and precisely what he ultimately wants to get. The clearer the goal, the more effective his investment activities will be.

In addition, goals must be realistic. That is, it could actually be achieved. There is no need to try to achieve the unattainable. It’s also not worth reinventing the wheel.

Stage 2. Choosing a method for managing the investment portfolio

It is very important. The chosen strategy will tell you what, how and when to do.

There are two main strategies : active and passive.

An active investment management strategy implies that the investor must constantly monitor and analyze the market. An investor must constantly be active in the market: sell, buy, reinvest. That is, achieve your goal as quickly as possible. In addition, an active strategy requires the investor to invest a lot of money and time.

A passive investment strategy does not require constant participation from the investor. You just need to open an account and buy securities. After which you will only need to wait for them to rise in price.

Stage 3. Studying the investment market

At this stage, it is necessary to study and analyze the market in order to competently form an investment portfolio. The investment market is a huge platform, which can be so difficult to understand that it is better to turn to an intermediary.

An intermediary is, as a rule, a brokerage organization that has a special license to carry out investment activities. Plus, the brokerage company will tell you everything. It will sort things out and clearly show what, when and where it is better to invest. True, its services are not free, but you will save a decent amount of time and money.

The tasks of a brokerage organization, as a rule, include:

- keeping records of your finances; keeps strict records of your finances;

- Carrying out financial transactions on your behalf and informing you about their progress;

- providing a complete report on your cash flow;

- training and consulting, works as your tax agent.

True, you should not completely shift responsibility for financial transactions to a brokerage company. It will be better if you. at least partially, retain the right to make decisions for yourself.

Stage 4. Assess the effectiveness of your investment portfolio

Once you have created an investment portfolio, you will need to evaluate its performance. To do this you will need special knowledge and skills. In particular, it will be necessary to compare returns with risks and take into account market indices.

Here you need to know that preliminary calculations are always available for all participants on the exchange website.

Step 5: Periodically check and re-check your portfolio

You cannot create an investment portfolio and forget about it. It is necessary to periodically check and recheck it in order to eliminate illiquid and unprofitable assets and acquire more relevant, liquid and profitable ones.

True, you should not carry out checks too often; this can only cause harm by being led by emotions associated with market price fluctuations. As a result, the assets can be sold at a very reduced price.

It would be even better if you delegate the audit and assessment of the effectiveness of investment assets to specialists. They will do everything correctly and competently for you for a certain commission.

Investment portfolio and investors

Investors are also classified into:

- conservative investors;

- moderately aggressive;

- aggressive investors.

An investor's portfolio most often reflects his character and essence, if we are talking about an investor - an individual.

If we are talking about an investor - a legal entity, then the formation of an investment portfolio depends on the tasks facing the enterprise. Common to them are the principles of forming an investment portfolio - the ratio of profitability and risk: risk-free investments with a low level of profitability; moderately risky investments with guaranteed returns; investments with a high degree of risk and maximum profitability.

Main existing risks of portfolio investments

In conclusion, I would like to consider the main risks of portfolio investments. This will help you make fewer mistakes when forming your investment project.

1.Wrong choice of investment instruments

Often, in the case of independently forming an investment portfolio, it turns out to be ineffective and does not bring practically any profit to its owner. This is mainly due to the fact that investors, when forming an investment portfolio, are guided by the opinions of friends or simply trivial rumors.

It is best to entrust the formation and management of an investment portfolio to a brokerage organization. For a certain reward, they will do everything correctly and competently. And your investment portfolio will eventually bring you a decent income.

And, if you still decide to do everything yourself, do not be afraid to seek help and advice from brokers. This will help you avoid many mistakes and do everything correctly and competently.

2.Incorrect timing for investments

All professional investors know that entering the investment market must be done “on time”: buy when everyone is selling, and sell when everyone is buying. This is exactly the rule that all successful investors followed and still adhere to.

And, if you do not want to be an ordinary primate in the investment market, but are going to achieve enormous heights, go against the “tide”. Remember the importance of short-term investments, and don't forget about long-term prospects.

3.Inflation

Russian investments are usually subject to inflation. That is why many investors prefer to invest in foreign assets.

4. Fluctuations in interest rates

Unfortunately, interest rates tend to change. Which for an investor, especially a beginner, can end very badly. Sharp price hikes provoke newcomers to get rid of existing investment assets, which, as a rule, leads to the loss of a decent income.

Types of investment portfolios

Based on this approach, the types of investment portfolios are divided into:

- conservative;

- moderate;

- aggressive.

The conservative one consists of government securities, blue chip shares, gold and ensures high protection of the components and the portfolio as a whole, and the profitability of the investment portfolio is maintained at the level required by the investor.

Aggressive is stocked with high-yield securities, including their derivatives. These securities have a fairly high degree of risk. Therefore, the investor actively manages his portfolio or is in constant contact with the broker managing his portfolio.

Moderately balanced, optimization of the investment portfolio in terms of profitability and degree of risk is its characteristic feature. Such a portfolio contains both high-yield securities with a high degree of risk and low-yield reliable securities, such as government bonds.

Read more about investment management.