Forex exchange how to make money

To gain access to trading, you need to choose a reliable broker who will provide access to trading, as well as a convenient platform (software) for online trading. Also, to earn money you will need “leverage”, which can range from 100 to 2000 or more. As a result, by depositing only $1,000 into an account with a leverage of 1 to 100, you will be able to operate with a figure of $100,000 during a trade. By selling and buying different currencies, you can either earn or lose on exchange rate differences. At the same time, good platforms have a large number of automatic indicators for market analysis - both technical and graphical (up to fifty), with which it is easier to navigate the ongoing process.

What strategy should you choose so as not to lose all your money at once?

If you decide to trade Forex, it is better to adhere to the following rules.

Rule #1: Do not take on high leverage, especially if you are just learning to trade Forex.

In fact, the exchange rate usually does not fluctuate much. During the day, the difference most often amounts to hundredths of a percent. So, if you make transactions only for the amount of your deposit, you will not earn much.

This is why Forex is traded with leverage. This means that a forex dealer can provide you with a virtual equivalent of a loan. Real money will not come to your account, but leverage will allow you to increase the transaction amount several times. And you can not be limited only by the money that is on your deposit. By law, the maximum leverage that a Forex dealer can give you is 1:50.

Let's say your deposit is $100. The Forex dealer is ready to give you a leverage of 1:10. That is, you can open a deal for $1000. The forex program will reflect the “purchase” of $1000 worth of currency. If you want to open a trade for $5000, then you need to take a leverage of 1:50.

You can use not your entire deposit for a transaction, but only part of it. For example, from a $100 deposit, take only $20 and choose a leverage of 1:50. In this case, you will also be able to make a trade for $1000. And use the remaining $80 in the account for another operation.

If you guess the exchange rate change, you can increase your profits in this proportion. If you don’t guess correctly, you will incur losses in the same ratio.

For example, you open a deal to “buy” euros for $1000 with a leverage of 1:10. If the euro exchange rate increases by $0.2, then you will no longer earn $20, but $200. But if you don’t guess correctly and the euro falls by $0.1 against the dollar, you will lose $100 - the entire amount of your deposit.

In other words, your potential winnings, but at the same time the risk of losing money, increase in the same proportion as your leverage. Therefore, to begin with, choose a leverage in the range of 1:5–1:15.

Rule #2: Limit the deposit - the amount you deposit into your trading account with a forex dealer.

After all, you can lose this amount at any time. You won’t be able to trade profitably all the time; losses are inevitable. But the Forex dealer will not allow you to lose more than you have on deposit and go into negative territory. He will forcefully close the deal.

Let's imagine that your deposit is $100. As in the previous example, you decided to open a trade to “buy” euros for $5,000. To do this, you took a leverage of 1:50. But the euro went down against the dollar and fell in price by $0.1 during the day.

That is, your loss could be $500. But the Forex dealer will not let you lose more than what is in your real trading account, that is, more than $100. As soon as the euro/dollar exchange rate drops by $0.02 (and your loss will be $100), the forex dealer will immediately close the deal and reset the account to zero.

True, losing the entire amount in the account is also not pleasant.

Rule No. 3: use stop loss (stop loss) - automatic exit from the transaction.

Forex software usually allows you to limit losses on a trade. This option is called stop loss. This opportunity is worth using if you do not want to lose your entire deposit at once. Stop loss allows you to automatically close a trade when losses reach the limit you set.

Let's assume your deposit has grown to $1000. And you don't want to lose it all in one bad trade. Then set a stop loss - instruct the forex dealer to close the trade when losses reach, for example, $100. This way you can keep the remaining $900 of your deposit.

Unfortunately, not all Forex programs have a stop loss option. If it is not there, you will have to either risk the entire amount, or withdraw money from the Forex dealer’s trading account each time and leave there only a deposit that you are not afraid of losing.

Forex trading hours

The operating hours of the Forex exchange are strictly limited - any operations begin at 2 a.m. on Monday and end at 2 a.m. on Saturday. It seems that this is a completely reasonable restriction for particularly ardent players who could analyze the situation and sell or buy currency almost 24 hours a day. All this time, not only speculators and investors, but also banks make profits or suffer losses.

The work of the popular Forex brokers themselves - dealing centers - can also be limited. By the way, at the moment the activities of such organizations in the Russian Federation are not subject to regulation and control.

What is traded on Forex

3.1. Currencies

All currency pairs on Forex can be divided into three groups:

- Majors. The presence of an American dollar is required

- Minors or Crosses. Currencies of the world's leading countries, but without the American dollar.

- Exotics. Weakly volatile pairs

The first currency in the name pair is called “base”.

The main instruments for trading are currencies involving the American dollar USD. This is the so-called “major” sector. There are also many other pairs, but, as a rule, the most volatile pairs are those involving USD.

The most popular currency pairs are (majors):

- EURUSD (euro to US dollar)

- GPBUSD (British Pound to US Dollar)

- USDJPY (US Dollar to Japanese Yen)

- USDCHF (Swiss franc to US dollar)

- USDCAD (US dollar to Canadian dollar)

- AUDUSD (Australian dollar to US dollar)

- etc.

They account for more than 95% of the turnover of all trades (the first pair EURUSD - 60%).

There is a huge group of minors (or, in other words, cross-pairs). They do not contain the American dollar:

- AUDCAD (Australian dollar to Canadian dollar)

- AUDJPY (Australian Dollar to Japanese Yen)

- EURAUD (Euro to Australian Dollar)

- EURCHF (Euro to Swiss Franc)

- EURGBP (Euro to British Pound)

- EURJPY (Euro to Japanese Yen)

- etc.

3.2. Metals

There is also the opportunity to play on gold and silver futures on Forex:

- XAUUSD (gold)

- XAGUSD (silver)

Some brokers also have the ratio of gold and silver to other currencies:

- XAUEUR (gold to euro)

- XAUGPB (gold to British pound)

- XAUCHF (gold to Swiss franc)

- XAUAUD (gold to Australian dollar)

- etc.

3.3. World indices

Futures on world stock indices are also among the possible trading instruments. The most popular indices are:

- SPX500 (American Standard & Poors 500 Index)

- NQ100 (American NASDAQ 100 Index)

- FTSE100 (British index)

- DAX30 (German index)

- CAC40 (French index)

- NIKK225 (Japanese index)

Many brokers also have a stock futures section.

3.4. Cryptocurrencies

With the development of the cryptocurrency market, options with pairs for Bitcoin, Litecoin, and Ethereum began to appear:

- BTC/USD

- ETH/BTC

- LTC/BTC

- ETH/USD

- LTC/USD

Unlike traditional cryptocurrency trading on crypto exchanges, a commission is charged here for transferring a position (swap). Also this market is closed on weekends. As history shows, this can be very fraught, because... A young and turbulent cryptocurrency market can go far in some direction in 2 days.

Unfortunately, cryptocurrencies are still not very liquid on Forex and therefore you will also have to pay a considerable spread for buying and selling digital money.

Play on the Forex market

To play in the Forex market, study the “input data” - account types, broker margin requirements, client documents. Accounts differ in the size of the minimum deposit (100 USD/EUR or more), available trading instruments (not only classic currency pairs, but also CFDs on metals, energies, indices and shares. Leverage varies depending on the broker (1 to 25 – 1 to 500) and many other parameters. By timely analyzing data and assessing trends, it is possible to both purchase a growing currency (or other instrument) and sell one that is decreasing in price relative to others in a timely manner.

Choose a simple strategy

If you trade Forex without any strategy, just for luck or intuition, then it is better to immediately take your money and throw it in the trash. Forex does not tolerate suckers, it requires a professional approach.

Forex beginners should choose one of the simplest strategies. This does not mean that it is easier to make money on them or that you can earn less. It’s just that such strategies contain less data, which means transactions are concluded more often. And the trader will be able to track his successes using a large array of data and determine where he is wrong.

There is no single strategy for how to trade Forex correctly. The manner of behavior in the market should be chosen depending on the currency pair, the volume of the deposit, the planned frequency of transactions, the duration of holding the order, etc. The strategy can even be changed depending on your mood. If you are calm today, do not choose an aggressive trading style, otherwise it will be uncomfortable. And if you are aggressive, first get your nerves in order, since you need to work in Forex with a clear head and sober thoughts.

Some of the simplest forex trading strategies include:

- Rainbow. Set up three moving averages with values of 5, 15 and 35. Open an order up or down depending on where the next candle closes after all three moving averages cross. The strategy is universal, but works best on major currency pairs on 5 and 15-minute timeframes.

- Three Indians. A trend strategy that works well on volatile pairs such as EUR/USD, USD/CAD and GPB/USD. Its essence is that you need to build a chart based on three peaks on a trend movement, and open a buy deal if the trend is up, and a sell deal if the trend is down.

- Trending (breakout). At the beginning of the trading day, the minimum and maximum lines of the previous day are drawn on the chart. Today they will be lines of resistance and support. As soon as one of the candles breaks the line and consolidates (i.e. the next candle opens above/below the line), you can open a trade in that direction. If the price returns to the previous corridor, you can open another deal. This strategy very often allows you to trade on Forex with profit, with correct and careful analysis of the chart, of course.

- Sniper . A scalper strategy that performs well on 5- and 15-minute timeframes. It is based on impulse levels and locking, i.e. opening transactions in different directions.

- At intersections. To do this, you will need two moving averages with periods of 15 (red) and 35 (blue), as well as MACD with default settings. A signal to buy will be the intersection of the moving average lines with confirmation from the oscillator. This is clearly visible on the graph.

Choose any one - and then expand it using your own observations and developments.

Forex trading

Trading on the Forex exchange in the United States is legally regulated by the government's Commodity Futures Trading Commission. The rules of bidding and conflict resolution are managed by a non-governmental association (National Futures Association). Traders outside the United States also try to comply with the requirements of the American NFA, since both private traders and funds avoid companies that do not meet the level set by the NFA.

However, participants in Russia, Ukraine and Belarus have to play on the Forex market at their own risk, since there is practically no government regulation in this area. In particular, the Federal Service for Financial Markets of Russia noted back in 2009 that the actions of participants in this market are not considered the activities of professional participants in the securities market. And therefore, it cannot be regulated by Federal Laws and legal acts.

And only in December 2014, a corresponding law was adopted, which clarified the essence of the concept (as trading on an unorganized market), and made it possible to protect individuals from fraudsters by requiring registration of a forex dealer with an SRO.

Forex concept. Terminology

Forex (from English - FOReign EXchange

- “foreign exchange”) is a market for international currency exchange based on freely formed (without restrictions) quotations (offered prices) based on demand for currency and, accordingly, supply.

Market participants are various types of banks (central banks, commercial), brokers and dealers, insurance and pension organizations and others (including private investors/traders).

This foreign exchange market was formed in the 1970-80s and until now its daily turnover has grown from 5 billion to 7 trillion. dollars and according to forecasts for the coming years, growth will only continue.

There is no single center (exchange in the usual sense) with many offices and large monitors, a single server that generates quotes or an official Forex website . This market is over-the-counter and represents a set of relations for the purchase/sale of currency between its participants, and liquidity (availability of a sufficient amount of currency) at current quotes is provided by the so-called liquidity providers (mainly large banks).

In the English-speaking segment, Forex refers to a broader concept - the foreign exchange market in general, but in Russia - more specifically, namely speculative trading.

Ordinary private traders trade through dealing centers (DCs). In common parlance they are called brokers, although there are some differences in these concepts.

The difference between a broker and a dealing center (dealer) . Without going into details, the broker always brings your funds to the real market and acts only as an intermediary, and the dealer is at his own discretion: he may or may not withdraw, paying from “his” funds (for example, up to some a certain amount, after reaching which it brings to the market the aggregate position of clients) based on quotes that it receives from suppliers. You can read more about the various broker work schemes here.

For trading large amounts, I recommend choosing only leading companies that have been operating for a long time (10 years or more). This broker is the undisputed leader in terms of funds turnover and the number of clients in Russia and the CIS countries (main advantages: the company has existed for more than 20 years, among the majority of Russian-speaking traders it has the best reputation compared to other brokers and is considered the most reliable, has good trading conditions. One of sets priorities - transparency of work with the client (as far as possible, of course). In addition, this company is significantly ahead of its competitors in the trust management segment - the PAMM account service, which undoubtedly brings the company additional turnover of client funds at the expense of the service’s investors, in addition to traders.

Forex Exchange for Beginners – Basics

The first thing that makes the Forex exchange attractive for beginners is that you can learn the basics of trading here. Before becoming a trader, it is important:

- choose a suitable broker to carry out operations (he will provide both software and leverage);

- understand the terms, study the basic methods of analysis (fundamental - for the country, technical - for specific operations);

- download software (terminal, most often Metatrader of a suitable version);

- try out the main types of operations in demo mode, and not with real money.

Advice from experienced people is:

- Trade not on a schedule, but when you have a balanced, thoughtful decision.

- Don’t read everything - choose the most important things from trusted sources.

- Study trends, but don't focus on them.

- Think through action scenarios, do not rely on “sudden inspiration.” Know exactly when you will stop operations.

What are the trading turnovers on Forex?

The turnover on Forex is simply colossal and continues to grow from year to year. Below are the average daily trading turnovers (data from Wikipedia):

- in 1977 - $5 billion

- in 1987 - $600 billion

- at the end of 1992 - $1 trillion

- in 1997 - $1.2 trillion

- in 2000 - $1.5 trillion

- in 2005-2006, the volume of daily turnover on the FOREX market fluctuated, according to various estimates, from $2 to $4.5 trillion

- in 2010 - $4 trillion

- in 2013 - $5.3 trillion

- in 2020 - $5.1 trillion

Difference between Forex Exchange and Stock Exchange

Since Forex is not an exchange, but an over-the-counter market, the difference between a Forex exchange and a stock exchange is colossal. The first and main difference is that Forex does not have a specific country, city or work address. In fact, this is a group of banks and other organizations united by a common system for conducting financial transactions. The second difference is that checking the volume of transactions is impossible, so traditional stock exchange indicators (indicators) do not apply here. The third difference is that individuals cannot conduct their own operations on the stock exchange, but through DCs (dealing centers), individual individuals can easily try themselves as a trader.

How transactions are made

Any monetary unit in Forex is expressed by a three-letter code. For example, the British pound / US dollar pair looks like this: GBPUSD. The currency on the left is called the base currency (in this case GBP), and the one on the right is called the quote currency (in this case USD).

Since any asset can be bought or sold, there are two prices:

- Bid (bid) - offer price. According to it, the seller is ready to sell the base currency (in this case GBP) and purchase the quote currency (USD).

- Ask (ask) - demand price. According to it, the buyer is ready to purchase the base currency (GBP) and sell the quoted currency (USD).

The spread is the difference between the bid and the ask. This is the brokerage company’s earnings, a commission, without which trading is impossible. The spread is paid once - at the time of opening a transaction.

The volume of any transaction is measured in lots. The standard is 100,000 units of the base currency. Previously, individuals did not have the opportunity to trade on Forex, since not everyone had such a sum of money. Now, thanks to leverage, any participant can engage in trading. It is this circumstance that made Forex so popular.

The broker provides leverage against the collateral amount (margin) on the trader’s deposit. Hence the name - margin trading. For example, a leverage of 1:100 means that a Forex transaction can be carried out with an amount that is 100 times less than the transaction amount. A special platform—a trading terminal—allows you to carry out trading operations. The broker provides it completely free of charge. On the website you can select and download the most suitable option for yourself.

Using the example of the GBPUSD asset, you can clearly examine the process of completing a transaction.

Having analyzed the situation, we see: there are all the prerequisites for the asset’s exchange rate to fall. At a certain moment, when the rate is 1.4200/1.4204, a decision was made to enter the market to sell. In other words, sell 0.1 lot of GBPUSD (10,000 GBP) at 1.4200.

It turns out that 10,000 GBP were sold and 10,000 × 1.4200 = 14,200 USD were purchased. In order to complete such a transaction, an amount equal to 14,200 USD is not required. It is enough to have 142 USD - a hundred times less. The missing funds are kindly provided by the broker.

After the price of the GBPUSD asset reached the value of 1.3655/1.3659, the order opened an opposite buy position, closing the previously opened sell position. Thus, 10,000 GBP is purchased, but at 1.3659. The difference, also known as profit, is

142.00 – 136.59 = 5.41 USD

Advantages of Forex

Despite the specificity of this over-the-counter currency market, the advantages of Forex are:

- The opportunity to start with small amounts (up to $100) and try working with a conditional demo account.

- Access to trading operations even for private individuals (through DC).

- High turnover (estimated at several trillion dollars per day).

- High volatility (currency pairs move hundreds of pips per day, giving you the opportunity to earn money faster).

In addition, the “law of supply and demand” directly applies here - there are no restrictions that real stock exchanges impose. There is no need to pay income tax - an advantage for starting with small amounts. In reality, the currency is not moving anywhere, which means there are no associated costs. The transaction volume can easily be increased (if it is successful) several times. You can work with Forex from anywhere in the world.

How to open a trading account

To practice, you can open a demo account with any virtual balance (this can be done from the terminal):

On a demo account, you can practice trading techniques and test strategies using virtual funds without risking real ones.

A real account (here is a comparison of trading conditions on different types of accounts) can be opened in your personal account. After that, you will receive the data you need to enter in the terminal in order to connect (“File – Connect to trading account”) by email to which you registered. When you connect to your account, you will see a zero balance. You can top it up in your personal account on the broker’s website by going to the “My Accounts - Trading Accounts - Real Accounts” tab and clicking the “Top Up” button. Next, you will find yourself on the replenishment page, where you can choose where to transfer funds from (bank cards, electronic money and others):

You can directly fund your trading account or deposit funds into your personal account account, and then, if necessary, make transfers to your trading account or to different accounts (if you have several).

Withdrawal of funds when closing a trading account or withdrawal of profits is made to your personal account account, and from it you can already withdraw to your card details or payment system wallets. Through payment systems, withdrawals are faster (for example, on WebMoney, according to the regulations - within business days; if you order a payment before 16:00 Moscow time, then usually the withdrawal occurs within a few minutes, if later, then it is usually postponed to the next day).

Forex exchange and understanding currency pair quotes

Any currencies are traded on the over-the-counter market. However, the purchase/sale of each is carried out through the other. If you are interested in the Forex exchange and understanding currency pair quotes, select which currency you are going to trade. Nuances:

- Currency pair – any 2 currencies, one of which rises or falls in relation to the other.

- The name encodes the direction of transactions: base currency/quote currency. Base – bought/sold, quote currency – measures the value of the “rate”.

- There are 4 main pairs: EUR/USD, USD/CHF (with Swiss franc), GBP/USD; USD/JPY (with Japanese yen). They are called Majors.

- Up to 90% of transactions are made with the US dollar, 37% with the euro, 20% with the yen, British pound sterling - no more than 17% of all transactions.

- Maximum activity (and changes in quotes) occur when the national banks of countries change rates. This time is called trading sessions.

How are trades concluded in the Forex market?

Before the transaction, you select two different currencies - a currency pair. One of them is basic, the second is quoted. Your task: try to predict how the rate of the quoted currency will change relative to the base one. If you are sure that the rate of the quoted currency will rise, you can open a deal to “buy” it. If you think it will fall, go “sell”.

Most often, the dollar is chosen as the base currency; you can choose any other currency as the quoted currency.

You have chosen a currency pair – euro and dollar. The dollar is the base currency, the euro is the quoted currency. For example, you expect the euro to rise against the dollar.

The euro is currently worth $1,213. You open a deal to “buy” euros in the amount of $100. In reality, euros do not come to your bank account, but are reflected in the internal register of transactions of the Forex dealer and on your balance in the program.

Suppose that one day later the price of the euro actually rises to $1.223. You think it won't rise again and close the deal. Thus, you take profit: $(1.223 – 1.213) x 100 = $1. The forex dealer will credit this money to your real bank account - your deposit will be replenished. If the euro exchange rate falls to $1.113, your loss will be: $(1.213 – 1.113) x 100 = $10. And the forex dealer, on the contrary, will write this money off from your bank account.

However, you need to keep in mind that the Forex dealer takes a commission for his services. For example, for opening and maintaining an account, connecting to a trading program, conducting transactions, transferring money to a bank account and other services. All tariffs must be specified in the contract.

Psychology of working on the Forex exchange

Before you start taking any actions, it is important to understand what the psychology of working on the Forex exchange is. According to unofficial statistics, up to 95% of traders waste their money without achieving any profits. The funds go to the accounts of dealing centers. Detailed training, planning, work strategy, clear analysis and pre-thought-out action plans, performing operations only with a full understanding of the current process are the main components of the psychology of working on Forex. Punctuality and pedantry in carrying out your decisions are the only salvation for “hot heads” and those who are prone to greed and the thirst for quick profit.

Note. Before working with any new currency, it is important to conduct a fundamental analysis - study the state of the country, current processes and global trends, so as not to focus on short-term “differences” in quotes.

How to successfully trade on the stock exchange: options for making money

Inexperienced beginners are naively mistaken that trading on the stock exchange is the only option for generating income from the financial markets. But this is not true at all. You don't have to make deals yourself. You can make good money in other ways.

- Independent trading.

This is the most basic source of income. This is what I have been talking about for almost the entire current article. The trader performs market analysis and determines the future price direction based on his own trading strategy. And he makes a deal. If the forecast turns out to be correct, he makes a profit. Otherwise, it suffers losses.

But it is important to understand that losses are an important part of being a trader. They will always be there. The most important thing is that at the end of the reporting period (for example, a month) you end up with net profit.

On the Internet you can find many loud statements that here you can earn 300, or even 1000% profit every month. Don't believe it. For the most part, these are lures from deceivers and swindlers. If you click on such a link, you will be more likely to be pushed into some kind of product or “100% profitable strategy.”

A trader’s real earnings are 10-30% per month of the deposit amount. Well, how large the deposit is, so will be your monthly earnings. Therefore, it is better to calculate everything in advance.

- Trust management and PAMM accounts

If you do not know how to correctly predict the market, and generally understand that this is not your thing at all, then you can still receive passive income from trading on Forex thanks to trust management.

You give your capital to a successful trader for management. He makes deals, and then gives you part of his profit in the form of interest + your initial capital.

But not all traders are as successful as their statistics show. Many are aggressive traders. And your deposit can be lost in a short time. Therefore, you need to be very careful in choosing who you will transfer your own money to manage. There is absolutely no guarantee that you will receive your deposit back.

- infobusiness

This method of earning money can bring in hundreds of thousands of rubles a month. But it is only suitable for those who have extensive experience trading in the markets. It consists in the fact that you will conduct teaching activities, conduct webinars, paid lessons and much more.

The higher your work experience and experience, the higher the cost of your services will be.

Forex watch

In general, the over-the-counter Forex market operates 24 hours almost every day, with the exception of a regulated weekly break. However, many people download applications or install software that shows certain periods - the opening and closing of trading sessions on world exchanges. During such hours, Forex transactions are at their maximum in volume, and the spread – the gap between “demand” (ask) and “supply” (bid) – is significant. There are similar online services - they are less convenient because they do not offer alerts. At the same time, a good “watch” must indicate:

- current quotes;

- support levels;

- stock indices;

- Central Bank rate;

- USD index.

The clock allows you to determine the opening and closing times of trading sessions in a specific hour range.

CFD contracts

This stands for Contracts For Difference - contracts for difference in prices. This is a new type of trading that involves making money thanks to the difference between the prices of trading assets.

If earlier traders made money only on Forex, now, thanks to the development of new technologies, other financial instruments have begun to appear.

Mostly, such contacts are with binary options brokers who have decided to diversify their platforms and attract traders with extensive experience and experience in the financial markets. After all, CFDs are very similar in essence to classical Forex trading. This is a kind of golden mean between Forex and binary options.

CFDs (like binary options) are over-the-counter contracts. That is, with your transactions you will not in any way affect the trading volumes on the real foreign exchange market. All your investments remain exclusively within the broker. You are not entering the real market. This is where the name came from - over-the-counter trading.

Essentially, you are trading against the broker. And when concluding a CFD transaction, you kind of enter into a contract with the broker himself, according to which he undertakes to pay you an amount of profit that is equal to the difference between the opening and closing prices. If, of course, your prediction turned out to be correct.

As in Forex, the final profit here will depend on the number of points that the price has moved in the direction we need. There are also Ask and Bid prices, spreads, leverage, and so on.

Process of opening a CFD trade:

- First of all, a trader, based on his strategy and clear market analysis, decides whether the price will rise or fall. He opens a deal either immediately at the current price, or places a pending order (having reached the desired level, the deal will automatically open on its own).

- Next, you need to indicate the investment amount (lot size).

- As in Forex, it is recommended to place stop loss and take profit orders.

- Leverage.

After this, the transaction is considered open. As for trading strategies, they are approximately identical to those available for Forex.

CFD contracts are like a separate market with its own rules and features. This should not be confused with Forex, although their principles for concluding transactions are very similar. These are completely different tools for making money on financial markets. Trading on the stock exchange can be varied. And each trader chooses the instrument that will be comfortable for him personally.

Forex in Russia

The over-the-counter Forex market in Russia is represented by brokers - companies that organize work for traders. Many of them have been operating since 2008 and even longer. Due to the new law regulating the sale of currencies in 2020, it is not easy to officially provide access to the Forex market. The company will have to:

- join the SRO (self-regulatory organization), contribute 2 million rubles. to the compensation fund;

- increase equity capital to 100 million rubles;

- obtain a license from the Bank of Russia.

The conditions apply only to legal entities registered in the Russian Federation. Therefore, the vast majority of brokers are companies registered in other countries (Malta, Mauritius, Cyprus, South Africa, Great Britain, USA). As of January 1, 2020, Finam had an official license, and, according to TsRFIN, documents for its receipt were submitted by large “players” - Alpari, Teletrade, Forex Club, Profit Group.

I decided to try anyway. How to proceed?

After studying the theory, you can move on to the next steps.

Select a forex dealer

The most important thing is that he must have a license from the Bank of Russia.

If there is no Russian license, the risk is not justified by anything. These are either outright scammers with whom you will definitely lose money, or foreign companies that operate illegally in our country. And in case of problems, you will have to sue them in the country where they are registered. Read more about unlicensed forex dealers in the article “Illegal forex: how to avoid falling for scammers.”

In addition to the license, it is worth clarifying a few more points:

- is it possible to undergo preliminary training before proceeding to bidding;

- Is it easy to install a trading terminal – a program or mobile application – on your computer or smartphone;

- is there a demo version to understand how the terminal works and test your strategies;

- Is technical support working well: is there a hotline, online chat, how quickly do consultants respond?

- what is the minimum deposit size (the probability of losing this amount is very high, so first choose options with a small minimum deposit).

Practice on a demo account

A demo account will allow you to understand how and from what you make money on Forex, and will give you the opportunity to try out different trading strategies.

Predicting exchange rates based solely on publicly available information about what is happening in different countries is very difficult. Therefore, to help players, there are programs that analyze technical indicators of currency movements and help build trading strategies. But the possibility of error is still high.

Open a real account

Have you practiced on a demo account? Have you worked on different strategies that you learned during training, and have you chosen a few that suit you? Now you can open a real account.

You determine the amount in the account yourself, but the Forex dealer may have its own restrictions on the size of the minimum deposit. It is better to start with a deposit that you are not afraid of losing.

It is not a fact that your strategy, tested on a demo account, will be just as successful on a real account. You will have to spend some more time and money to hone it and develop your own style. You can use several strategies at once, so you will slightly reduce your risks.

Glossary of Forex terms

We present to your attention a dictionary of the most common terms found in Forex trading:

Arbitrage - A risk-free type of trading when the same currency is simultaneously bought and sold against another to make a profit due to the difference in prices between the two counterparties.

Ask, ask – purchase price. In the currency quote it is indicated on the right. For example, in the quote GBP/USD 1.5771/1.5773, the purchase price is 1.5773. At this price, the trader can buy the base currency for the quote currency, in this case 1 British pound for 1.5773 US dollars.

Basis Point – One hundredth of a percent; used in relation to interest rates.

Base currency, base currency – the currency that comes first in the currency quote. For example, in the GBP/USD quote, the base currency is the British pound sterling. For many quotes, the base currency is the US dollar.

Buy, buy - purchase. A bar chart is a way of displaying price movement, in which each price segment is represented as a bar, which has a visual representation of opening, closing, minimum and maximum prices for the period.

Bid, bid – sale price. In the currency quote it is indicated on the left. For example, in the quote GBP/USD 1.5771/1.5773, the selling price is 1.5771. At this price, the trader can sell the base currency for the quote currency, in this case 1 British pound for 1.5771 US dollars.

Broker is an intermediary (organization or individual) who ensures the meeting of buyers and sellers on the market. To be able to make transactions on the Forex market, you need to choose a broker that meets the necessary criteria and open a trading account with him.

A bull market is a market situation in which sustainable growth is clearly visible.

Quote currency (counter currency), counter currency is the second currency in the currency quote. For example, in the GBP/USD quote, the quote currency is the US dollar.

Intraday trading, day trading, intraday – making transactions during a trading session without transferring open positions to the next trading day.

Volatility (variability), volatility is a market characteristic that denotes the measure of price movement over a certain period of time. Increased market volatility is often observed during the release of data on important economic indicators.

Graphic figures are various graphic analysis figures constructed using lines. Graphic figures make it easier to understand the market situation and help predict further price movements.

Chart, Chart – a stream of quotes, presented in graphical form and consisting of bars/candles.

Gap, gap – a gap in the price chart. A gap can occur during sharp fluctuations in the market, after the release of important economic data, or under force majeure circumstances. This phenomenon often occurs after the weekend, when closing and opening prices differ significantly.

Demo account is a training account with virtual money on which a novice trader can train, get acquainted with the trading platform and make transactions without the risk of losing capital. Trading on a demo account is practically no different from trading with real funds; quotes and charts are updated in real time.

Deposit, deposit – the amount of funds in the trading account.

Divergence, divergence, divergence is the discrepancy between the price chart directed upward and the oscillator directed downward. Indicates a weakening of the upward trend.

Diversification is a risk reduction strategy in which funds are distributed among different financial instruments. In relation to Forex, diversification is trading in different currencies that have minimal influence on each other.

A dealing center is a company that provides the public with access to trading on the Forex currency market. Typically, traders can make trades directly from the dealing room, equipped with all the necessary software.

Dealer - A market participant who carries out trading operations using the funds of the company (bank) in which he works.

Long position, long position – a transaction made with the expectation of making money on a rise in price. Take a long position - make a purchase.

A closed position is a transaction with a fixed result that is no longer affected by market fluctuations. Close a position – perform the opposite operation to the original one with the same transaction volume.

Indicator – market analysis tool; converted and specially processed data, which can greatly clarify the situation on the market and help predict further price movements. Superimposed on the price chart in the form of various lines and histograms. There are technical, economic (fundamental) and even psychological indicators.

Channel – a sequential decrease and increase in price within a price range limited by two parallel lines. Channels can be downstream and upstream as well.

Convergence, convergence, convergence - the convergence of a price chart directed downwards and an oscillator directed upwards. Indicates a weakening downward trend.

Consolidation, consolidation - market movement in a sideways direction within a certain price range. This is price stabilization that occurs after a pronounced directional market movement or occurs in the absence of major players.

Short position - a transaction made with the expectation of making money on a price decrease. Take a short position - make a sale.

Correction, rollback is a temporary price movement in the opposite direction from the existing trend. Occurs when the currency under study is overbought or oversold and is associated with a weakening trend.

Quote, currency quote, quote – market price; expressing a unit of one currency in units of another currency.

Leverage is the ratio between the amount of collateral and the borrowed funds allocated for it: 1:50, 1:100, 1:200 . Leverage 1:100 means that to complete a transaction you need to have an amount 100 times less than the transaction amount in your trading account with the broker. Example: you buy 1.0 lot USD/JPY. With a leverage of 1:200, the required margin will be $500, at 1:100 – $1000, and at 1:50 – $2000, but the cost of the point does not change.

Cross rate, cross-rate – quotes of world currencies that do not contain the US dollar. For example, GBP/JPY.

Liquidity is a market characteristic that denotes the efficiency and ease of execution of transactions, including large ones, which will not significantly affect price movements.

Limit order, limit order – an order to complete a transaction with a limit on the maximum purchase price and minimum sale price. For example, with a quote of EUR/USD 1.3795, a buy order can be placed at a level below this value. And the sell order (sell limit) is at a level above this value.

Line chart, line chart – a graph of price movement, indicated by a curved line.

Trend line, trend line - a line constructed along the characteristic minimums or maximums of the price formed during the sequential movement of the market in one direction. The trend line is an important psychological level. It helps to find points of entry and exit from the market and track moments of trend change.

Locked positions are two orders opened in opposite directions for one trading instrument with the same lot on one trading account. As a rule, it is used to fix a floating loss.

Lot, lot – unit of measurement of the transaction. A standard lot is $100,000. In modern trading, micro-lots are also popular when trading on micro-Forex.

Money management, capital management, money management - competent management of a trading deposit, including the correct choice of lot when trading, the number of simultaneously open transactions, the number of currencies traded, etc.

Margin, collateral – securing a position with a certain amount of funds that the trader must deposit to complete a transaction. In modern trading terminals it is calculated automatically.

Margin call is a situation when trading with leverage when the funds remaining in the account are not enough to maintain open positions. If additional funds do not arrive to the account, the broker can independently close part of the client’s positions in accordance with the previously stated level.

A market maker is a significant market participant who, through transactions, can influence price behavior.

A bear market is a situation in the market when a steady decline in price is clearly visible.

MetaStock is a well-known program for technical analysis.

Meta Trader, MetaTrader is the most popular trading terminal.

A mechanical trading system (MTS) is a fully automated trading strategy designed specifically to allow trading without human intervention using modern software. MTS, which provides stable profits, is the dream of every trader.

Micro-forex, mini-forex, micro-forex – trading conditions under which it is possible to make transactions with a volume less than a standard lot (micro-lots). For example: 0.3 or 0.1 lot (30,000 or 10,000 units of base currency).

Non-market quote – a quote that is uncharacteristic of the current market trend and simultaneously fulfills the following conditions: has a significant price gap with the chart; returns to the previous level within a short time; there is no rapid market dynamics preceding it, and there is also no release of important economic indicators. As a rule, non-market quotes arise as a result of a technical failure on the side of the broker or its counterparties and are subsequently deleted from the quote history. In this case, orders processed at a non-market quote are cancelled.

Bond, Bond – (government security).

Volume – trading activity on a currency pair for a certain period of time. An increase in volume in the direction of the trend confirms its strength.

Warrant, order – an order to complete a transaction: buy or sell.

An oscillator is a type of technical indicator that works well during sideways market movements and shows overbought and oversold areas. As a rule, they are displayed in the form of histograms or a curved line and are located under the price chart.

A pending order is an order to execute a transaction when a certain price level is reached. By placing a pending order according to the desired conditions, the trader does not have to monitor the situation on the market - the transaction will be completed automatically.

An open position is a transaction with an unfixed result, which can potentially bring profit or loss, depending on the current state of the market.

Overbought is a market condition in which prices are too high and are likely to decline soon.

Oversold, oversold - a market condition in which prices are too low and are likely to rise soon.

Floating profit (floating loss), floating profit (floating loss) – unfixed profit or loss on open positions, changing in accordance with the dynamics of current quotes.

Breakout, breakout – price overcoming significant levels (support/resistance lines, trend lines, etc.)

Profit, profit – profit on the transaction.

Slippage is a situation in which an order is executed at a price worse than the stated one. This is possible after the release of important economic data or during sudden fluctuations in the market, when execution of an order at a given level is not possible.

Point, point, pip – the minimum possible price change. For example, if the quote changed from 1.3881 to 1.3882, it means that the price has moved 1 point.

Risk management (risk management), risk management – the use of methods of mathematical calculation and financial analysis in order to control and reduce risk when trading on the foreign exchange market.

Requote, Re-Quote - the broker offers a new price at the time of order execution. Often occurs during times of rapid market movement and can help generate greater profits when closing a trade. However, more often a trader in Russia has to deal with dishonest brokers who, using requotes, try to minimize the trader’s income and close the position at a less favorable price for him. More often the use of this term carries a negative connotation.

Market order - to buy or sell any specific currency at the current market price. Under normal market conditions, orders are executed automatically within 2-5 seconds.

Rollover - transfer of an open position to the next delivery (valuation) date.

Sell, sell – sale.

Swap - If a trader leaves an open position for the next day, then when it is transferred to the trading account, a certain amount of money, known in advance, is credited or subtracted from it (depending on the selected currency pair)

Currency swap, Currency Swap - The simultaneous conclusion of two opposite transactions in the direction of exchanging two currencies with different delivery times.

Scalper is a trader who makes profit from minor (minimal) price (rate) changes.

Advisor - a program for automatic trading, working independently according to a predetermined algorithm

Spike – A significant difference between the subsequent quote and the previous one.

Spread – the difference between the purchase price (ask) and the sale price (bid).

Stop-loss, stop-loss, S/L – an order fixing losses. Used to limit the trader's losses. The stop loss can be set in advance below the buy price or above the sell price and will be automatically executed when the desired level is reached.

Stop order, stop order – an order to complete a transaction with a limit on the minimum purchase price and maximum sale price. For example, with a quote of EUR/USD 1.3795, a buy stop order can be placed at a level above this value. And the sell order (sell stop) is at a level below this value.

Take profit, take profit, T/P – an order that fixes profit. Take profit can be set in advance above the buy price or below the sell price, and when the desired level is reached, it will be automatically executed.

Technical analysis, TA, technical analysis – analysis of market behavior and forecasting price movements based on visual perception of charts, taking into account historical data, using technical tools, constructing indicators and figures, identifying trends, etc. without taking into account economic trends and global events that may significantly affect market behavior. Technical analysis is often contrasted with fundamental analysis.

A trading system, trading strategy, trade system is a set of rules on the basis of which a trader performs operations on the market. Everyone can develop their own trading system that best suits their individual character traits and attitude to risk.

Trading session, trade session – operating hours of trading platforms located in different geographical areas. Main trading sessions: Asian, European and American.

Trading range, trade range - the distance between the lowest and highest price during a trading session, or the distance limited by two important price levels.

Trading terminal, trading platform, trade terminal – specialized software for making transactions on the market in real time. The most common trading terminal today is MetaTrader.

Trader, trader – a person who carries out transactions in the market.

Trading, trading – trading on the market.

Trailing stop is a type of stop loss, an order for sequential automatic fixation of growing profits on an open position with a favorable price movement. The desired level of restriction is set and the program automatically moves it. Trailing stop is set for an open position and works only when the terminal is turned on.

Trend, tendency, trend, tendency - a stable and obvious direction of price movement that persists for a certain time. The trend can be upward (upward, up-trend) and downward (downward, down-trend).

Support level is a psychologically significant level at which mass purchases usually begin. The support level is an important part of technical analysis; it is built using two or more price lows in the form of a straight line.

Resistance level is a psychologically significant level at which mass sales usually begin. The resistance level is an important part of technical analysis; it is built using two or more price highs in the form of a straight line.

Fibonacci - in the Forex market it is used in the meaning of the market analysis tools of the same name, named after the great mathematician Leonardo Fibonacci, who studied the sequence of numbers and deduced interesting patterns. The following tools are traditionally used for market analysis: F Levels, F Time Zones, Extension, Channel, Fan, Fibonacci Arcs.

Hedging is the opening of a position in the opposite direction on the same currency pair. Typically, opposing positions close each other. In many trading platforms, both positions remain active.

Flat, flat – lateral price movement within a certain price range; uncertainty in the market when there is no obvious downward or upward trend in price.

Forex, forex is an over-the-counter transaction market where trading operations with currencies are carried out.

Fundamental analysis, FA, fundamental analysis - analysis of the economic and political situation in the world and in individual countries, as well as events that may affect the further behavior of the foreign exchange market in order to determine price movements. Fundamental analysis is often contrasted with technical analysis.

Japanese candlesticks, candlestick chart, candlestick chart is a special way of displaying a price chart, in which the opening (open) and closing (close) prices of the period, as well as its maximum (high) and minimum (low) prices are clearly visible. For ease of visual perception and quick determination of trends, candles are usually painted in different colors depending on the direction of price movement.

Appreciation is an increase in the value of a unit of one currency expressed in units of another currency.

Bar Chart - image of a price chart in the form of a bar chart.

Bear is a person who plays to reduce the exchange rate of a currency.

Bull is a person who plays to increase the exchange rate of a currency.

Equity – the balance of funds on the trading account, calculated in the currency of the insurance deposit.

Day Order - an order to complete a transaction, valid during the day.

Day Trading - trading operations performed within one day.

Go to choosing the best Forex broker

How much can you earn

Several factors influence the amount of future earnings. The desire to make big profits is not a priority, and working in Forex has nothing in common with working for a manager. It is unlikely that anyone will be able to name specific figures for a trader’s earnings.

- The presence of a certain set of personal qualities, as well as a psychological state. If a person does not know how to control his emotions, he will not see big earnings. He will earn money for a short time, and then he will still incur losses. If he knows how to control himself and calculate every step, success will come, and with it good earnings.

- Deposit amount. Traders usually measure their income as a percentage of their deposit. A good figure is about 15% per month. Disappointed? But this is an objective figure. If trading is done carefully and deliberately, the percentage can increase.

- Following a specific strategy. The more thoughtful the strategy, the more clearly it is followed, the better the result.

- Following money management rules. If the trader is experienced, he understands that they must be followed. There are two sides to this: if you enter the market with the entire amount of your deposit, as many beginners do, you can earn a lot, or you can suffer a complete collapse. In this situation, it’s not work, but a game of roulette. And if you follow the rules, the profit will not be huge, but the risks will be less.

- State of the market. The market can be sleepy, almost dead. This usually happens before serious news or after it has come out. On such days it is better not to open trades; you won’t be able to earn much. Profit does not always depend only on the trader.

So, let's summarize. If a trader carefully analyzes the market, keeps his emotions under control, and also follows a number of the rules already mentioned, the profit will be up to 30%. Over time it will increase. A jump to 100 percent or more is more luck than a pattern.

FAQ: answers to frequently asked questions

6.1. Forex kitchen - what is it?

There is such a thing as “Forex kitchen”. This means that all traders’ transactions do not go out to the interbank market, but are carried out within the broker. Is this a scam? In general, yes, but for a market trader this should not affect trading results. Essentially, we are playing with a broker, but using the same quotes as real ones. If we win money, then it is a loss for the broker; if we lose money, then it is his profit.

A large broker will honestly pay you your profit in any case, so whether this transaction was inside the broker or not, we will never know.

Which Forex broker to choose

Most likely, you have already heard about Forex and have an idea about it. Although sometimes the information is greatly distorted and appears either in too rosy a light or in a negative one. But if you look at the situation soberly, everything depends on you.

In Forex, you can lose all your money or multiply it a hundredfold, depending on how you act. But in any case, you should not go there without special preparation - read at least 3-4 books on this topic, read information on specialized sites and forums.

A forex broker is an intermediary that helps traders participate in the international foreign exchange market. He must have a trading account and a trading platform in order to trade.

When choosing, you should take into account several criteria:

- Quality of work and reputation - for this you need to study reviews on different sites and forums.

- Trading conditions – broker commission, spread, swap. Study this information immediately so as not to lose 50% of your income trying to withdraw money to your account.

- Support is especially important for beginners to clarify unclear points. So pay attention to the quality of support.

- Software, for example, mobile applications help you stay up to date, but not be tied to the monitor.

If you do not understand these issues, I recommend working with trusted companies whose names are known and promoted:

- RoboForex is a stable company that offers favorable conditions and fast payouts.

- Forex4You provides good account service conditions for its clients

- AForex is an old exchange with a good reputation.

In principle, you can start working on any of them, because they last long enough and have a good reputation. Negative reviews are most often written by people who lost money due to their mistakes and blame the site. But from this point of view they are all equal.

Video: Forex for Beginners

How to pay taxes on Forex

To avoid becoming a victim of red tape, you can do the following:

- You can open a bank account for trading;

- Towards the end of the year, contact your broker and request a report on all transactions that were completed. This stamped report is sent by registered mail and then presented to the tax office;

- Calculate the amount and pay 13% of it;

- At the place of registration, fill out and submit a declaration.

Any income that a citizen receives in addition to his main place of work must be declared.

Forex Brokers

Why do you need a Forex broker? They provide a large number of services useful to the trader: they can provide a cash loan, provide clients with information materials, and so on.

Many companies provide training to their clients, help withdraw funds, and provide consulting services.

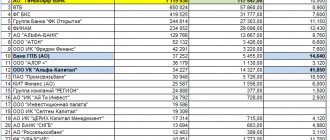

Our table provides information about several such companies.

| No. | Name | Characteristic |

| 1 | Forex Club | He has been working with both beginners and professionals for a long time. Provides full customer support |

| 2 | Alfa-Forex | Mainly works with professional traders |

| 3 | InstaForex | A great start for beginners: you can get big bonuses |

| 4 | Alpari | A very large company, one might say, the largest. Conducts webinars and master classes |

3What do Forex participants risk?

Before offering you to make money on Forex, every self-respecting intermediary - broker - will definitely give you a warning about the risks, or, in any case, will place a link to it somewhere in the footer of the site in small print. There are probably brokers who don’t warn about risks, but we haven’t come across any of them at all.

What does “risk” mean? In general, it is the likelihood that some kind of trouble will happen that will have certain consequences. A trouble that has consequences in the context of participation in Forex is the loss for some reason of either part of your capital or all of your funds. Let's talk about what can cost us money and nerves.

First of all, you need to understand the following: there are trading and non-trading risks in Forex.

Trading risks on the Forex market

Similar article: Forex brokers' work scheme - A-book and B-book So, what are “trading risks” on Forex? The definition is self-explanatory: it is the probability that your funds may be partially or completely lost during trading operations.

Using leverage on the one hand increases your potential income, but if the market goes against you, leverage will play a cruel joke on you - a strong enough price movement will take you out of the market, while part of your funds will be burned on stops (if the movement is very strong, you won’t have stops will help, and your balance will drop to the margin call level, that is, almost to zero).

How to reduce trading risks? Analyze the market, follow money management, use diversification. There are always trading risks, but they can be managed.

Non-trading risks in the Forex market

All other troubles in Forex that are not directly related to the competence and discipline of a particular trader are called “non-trading risks.” The latter, unlike trade ones, are known for their diversity and diversity.

Technical risks

Technical risks are the risks of financial losses due to malfunctions of power, electronic, mechanical and other service systems.

Example: one of our friends, also a learned PAMM account manager, concluded a number of transactions in a brokerage company, which brought him and us some income. It was at night. In the morning, our friend discovered that all transactions made between evening and morning were declared invalid due to a technical failure in the equipment on the broker’s side. Simply put, their computer crashed and they took all the profits.

Any failure in a trader's or broker's computer, any disruption in communication, incorrect settings or updates to the trading platform, and even a commonplace mouse in a switchboard company can lead to disaster.

Try not to use technically faulty hardware and “left-handed” software. And connect to normal Internet. Be vigilant with updates to trading platforms: sometimes updates lead to failures. If a technical failure occurs on the company’s side, it will solve your problem as it sees fit. Hence the conclusion - choose the right intermediary who values your name and reputation.

Risks associated with data security

Anything related to money is of interest to criminals. First of all, this concerns your personal data: logins, passwords, PIN codes, etc.

Your task is to protect all this from third parties. You're taking a serious risk if you don't think about safety.

Remember: you are solely responsible for maintaining the confidentiality of the information you receive from the company and assume the risk of financial losses caused by unauthorized third party access to your account, electronic payment system wallets or bank accounts.

At a minimum, you must:

- use antivirus software;

- use only complex passwords and logins for your accounts;

- block access to your phone and computers (codes, passwords...);

- Avoid any public discussion of your financial affairs (this is important).

Hackers can attack not only you, but also the broker. And this case will most likely fall under the category of risks beyond your control - force majeure.

Possible risks in the Forex market

Force majeure, legislative, political and other risks

Nobody knows what will happen tomorrow on the market/at the broker, what law our “servants” will pass the day after tomorrow, with whom the authorities will quarrel, and who else will impose sanctions on us. As for legal risks, Russian Forex participants have every chance to reduce them to a minimum - in 2015-2016, a new Forex law came into force with the Central Bank as the main regulator and SROs, the founders and participants of which are industry leaders.

Scam as the highest form of non-trading risks

Scam is an ordinary scam. In the context of Forex, scam is a deliberate deception, misleading the brokerage company of its clients. Scams vary in scale, from banal technical obstacles (non-market quotes, artificial slippage) and delays in withdrawing funds, to serious violations of the rules on the part of the company (unreasonable cancellation of transactions, “freezing” of funds).

The topic of scam on Forex is covered in sufficient detail in this material.

Do you need a robot?

Quite often, novice traders try to make their work easier by entrusting operations and execution of transactions to automated systems and trading robots offered by large brokers. It seems to them that such behavior will secure the account and reduce risks - after all, the machine will better calculate opportunities and profits, instantly “see” a change in the trend and react to it with lightning speed.

In reality this is not the case at all. Automated systems have many disadvantages:

- They do not take into account indicators of fundamental analysis, which means that if extraordinary events occur (for example, disasters, terrorist attacks, coups, unstable political or social position), they will not react to them until the market forms a new line of behavior. Such a delay can have a very negative impact on the account balance;

- Hundreds of such systems (advisors, as they are often called) compete with each other on the Forex market, and under these conditions there is no need to talk about large incomes - after all, such systems “think” approximately the same way. The exception is robots created by programmers in collaboration with the best traders “for themselves” - but, of course, it is impossible to gain access to them;

- System settings for operation, as a rule, only include setting critical values - profit, loss, transaction size, etc. Otherwise, the robot follows a standardized script. As a result, for every 1 profitable trade there may be 2-3 unprofitable ones, and in the best case, your deposit will remain in its original state.

As we can see, you should not completely trust a robot - this is fraught with losses. However, it is worth recognizing that such systems conduct a systematic and extensive analysis of quotes, indices, calculation of trends and indicators, which can be used when making decisions. Thus, you will spend much less effort on a full-fledged technical analysis, using the robot as an advisor, and reserve the right to make decisions based on your own knowledge and factors not taken into account by the machine.

Positive and negative aspects of making money on Forex

Pros:

- There is no limit to the amount you can earn;

- Before starting work, no one will be interested in whether you have a diploma or whether you speak three foreign languages;

- Ability to work from anywhere in the world where there is Internet;

- The schedule allows you to deal with personal matters, successfully combining them with work;

- The bosses are absent, and colleagues do not ask stupid questions.

Minuses:

- There is always the possibility of losing money;

- There is no opportunity to abandon everything and leave: there will be no income;

- It's difficult to explain to others what you do. Many people believe that Forex is just another scam.

In general, everyone formulates their own advantages and disadvantages, we only talked about the general ones.

Demo account

This is a “sample” of a real account. It is given so that a novice trader does not risk his money, but at the same time becomes a full-fledged market participant.

By opening a demo account, you can decide on a strategy and analyze all the instruments available for trading.

The disadvantages of working with demo accounts are that sooner or later the trader’s sense of risk will begin to dull. And earnings received from virtual money have very little practical significance.

There are also many myths associated with a demo account. For example, using it you can easily learn how to earn money. This is far from reality. This account is designed to allow a beginner to see and understand the technical side of trading.

You can trade on a demo account until you achieve real and constant profits (over a period of 1 to 3 months).