The main purpose of the defective act

A defective act (DA) is a primary accounting document that records all the shortcomings of material assets listed on the organization’s balance sheet, identified by a specially created commission. In essence, this is an expert opinion from specialists on the possibility of using equipment and inventory.

What is the document for? During operation, various equipment breakdowns occur, defects are identified, and physical wear occurs. A natural question arises: to repair or write off? It can be resolved only after a professional assessment of the condition of the equipment, for which an inspection is carried out by specialists (experts). It is in the DA that all identified shortcomings are noted and appropriate conclusions are drawn. Only on the basis of them can repair costs be incurred or material assets written off due to identified defects.

A defect report can be drawn up when accepting equipment and putting it into operation, during an inventory, during a routine inspection, or when malfunctions occur in the operation of the equipment. Based on this document, a defective list for equipment repair is drawn up or material assets are written off. If the DA is missing or drawn up incorrectly, the tax authority may not recognize the expenses incurred or write-offs in accounting. This leads to additional accrual of the tax base and penalties.

In what cases is it compiled?

A defective act for writing off various fixed assets (the form can be downloaded at the bottom of the article) is drawn up in cases where equipment and other assets are out of order and cannot be used for their intended purpose. The responsibility to draw up such an act (a sample is located a little lower) rests with the expert commission, whose members are appointed on the basis of an order from management.

A defective act for writing off fixed assets listed on the balance sheet (readers can download the form for free), including pieces of furniture, is also drawn up during a planned inventory.

Important! If, during the inspection of equipment and other fixed assets, the commission members decide that the furniture and appliances need to be repaired, they will draw up another act on the basis of which the repairs will be carried out. In the event that the equipment cannot be brought into working condition, the experts fill out the OS 4, 4a form (the sample is located above).

Rules for drawing up an act

Accounting in the Russian Federation is regulated by the Law of December 6, 2011 No. 402-FZ, incl. and regarding the preparation of YES. The document is drawn up based on the results of inspection of defective equipment. For this purpose, a commission is appointed, including specialists and representatives of interested parties. As a result of the necessary procedure, all defects and breakdowns entered into the table are identified. If necessary, additional expert opinions and technical documents are attached to the defect detection report. All commission members must sign the document. Objections are formalized in the form of a special opinion of a member of the commission attached to the DA. The document is agreed upon with the chief accountant of the organization and approved by its head.

Veronica Petrovskaya

Lawyer, specialization - civil law

All identified defects are examined according to the degree of impact on performance and the possibility of elimination. The commission draws conclusions about the need for repair and restoration work and its volume, and if further operation is impossible, write-off of material assets.

Compilation rules

When drawing up a defect report (a sample is below), on the basis of which the fixed asset will be written off, members of the commission must comply with all the norms of Russian legislation. This primary accounting document can be compiled either on paper or using computer technology. The form (the completed sample is located at the beginning of the text) must contain the following data:

- Name of the document (in this case, the act of writing off fixed assets is indicated).

- Date of inventory and technical inspection of equipment, machinery, furniture.

- Number (serial) of the document.

- The name of the organization on whose balance sheet fixed assets are listed.

- Company details.

- The exact name of the fixed asset, which matches the accounting data.

- Inventory number of the inspected object.

- A brief description of the identified defects and breakdowns that caused the failure of the fixed asset. In this case, defects that cannot be repaired are indicated. This category can also include obsolescence, which applies to high-tech equipment, for example, computer, climate control and digital equipment.

- All technical parameters of identified defects.

- List of all members of the expert commission. Positions held must be indicated.

- Signatures of authorized persons.

Requirements for the content of a defective act

There is no strict form of YES established at the legislative level. Each enterprise has the right to install it independently or compose it in a free style. It is important to comply with the general requirements for content established by paragraph 2 of Article 9 of Law No. 402-FZ. You should also take into account the recommendations of the Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7. As a rule, YES is drawn up on the organization’s letterhead, but can also be written on a blank A4 sheet. The document includes a list of defects (breakdowns) in the form of a list or table with their description and the possibility of eliminating them. In the final part, conclusions are drawn about the state of the inventory and ways of its further use (write-off).

The following points must be included in the YES text:

- The name of the organization that owns the material assets being surveyed, indicating the address of the location of the object and information about the manager approving the document. The organizational and legal form and the unit in which the procedure is carried out are specified.

- The full and exact name of the object being examined, indicating the inventory number. The date of release and commissioning (putting on the balance sheet) should be indicated.

- Composition of the commission indicating full names, positions and place of work. The details of the order for her appointment are indicated.

- The timing of the inspection and its features, incl. methods and instruments used.

- A list of identified defects and their description, the degree of their impact on the performance of the entire facility. Quantitative assessment is made in generally accepted units. The wording must be clear and technically correct.

- Conclusions about the operability of the object, the need for repair or write-off.

If the DA form has been approved at a given enterprise, then the “header” of the document contains the details of the order to establish it. The number of copies of the act must correspond to the number of interested parties.

The DA does not provide an estimate of the cost, does not provide estimates or calculations, or the cost of the equipment. All financial calculations are made later based on the technical conclusions outlined in the document.

Instructions for filling out the Material Write-off Certificate

- In the upper right corner of the document we enter the name of the enterprise, as well as the position, surname, first name, patronymic of the manager, who, after drawing up the act, will approve it.

- Then we fill in the title of the document, and also briefly convey its essence (in this case, “about the write-off of materials”), put the date: day, month (in words), year.

- Next, we move on to the composition of the write-off commission: the position of each employee, last name, first name, patronymic, as well as record the fact of writing off material assets and indicate the reasons for their write-off (unsuitability for use, identified defects, completed depreciation period, obsolescence, etc.) .

In the second part of the act, you need to include a table that lists in detail all the materials that have been written off, their name, quantity, price of one piece and the total cost of the written-off values as a whole.

If there are any notes on the materials being written off, they also need to be indicated in the table. Under the table you need to indicate the total cost of written-off materials (in numbers and in words), and after entering all the necessary information into the document, each member of the commission signs it, and the document is submitted to the head of the organization for signature. Defect report: sample defect report form, filling out - the topic of our review today. A defect report serves to document all defects, deficiencies, equipment breakdowns, etc. identified during an inspection or inspection of an asset. Such a report also serves as the basis for making a decision on writing off assets, carrying out repair work, drawing up estimates for future work, or even legal proceedings in the event unresolved serious contradictions between interested organizations. Equipment and other technical means, as well as various premises, are quite regularly subjected to technical inspection and examination; the defect report serves precisely to document the identified defects and malfunctions. The act is always drawn up by an authorized expert commission, which should include representatives of all interested organizations. Based on the results of the inspection, conclusions and an expert opinion are drawn, which are also entered into the report. Based on them, estimates for repair work or write-off acts are then drawn up. Therefore, it is very important to follow the procedure for drawing up a defect report and draw it up correctly. If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Today we will look in detail at how to draw up a defective act, what rules exist when filling out a standard form, what alternative forms are used and how the procedure for drawing up such an act occurs.

Requirements for the composition of the inspection commission

The expert commission for carrying out defect detection is appointed by the head of the organization (the owner of the asset) by order. The commission must include:

- Representatives of the organization that owns the asset: technical specialists, workers who directly use the inspected object and identified the defect, representatives of accounting and administration (the owner), quality control department employees and other employees if necessary.

- Representatives of interested parties: suppliers, buyers, contractors, transporters, manufacturers, specialists from repair organizations and other interested parties.

- Experts. It is advisable to involve third-party, independent specialists.

In the work of the commission, a material person is necessarily involved, in charge of the object being examined. The composition of the commission largely depends on the purpose of drawing up the DA and is individual in nature. If it is planned to file a claim in the future, then the participation of representatives of the defendants is mandatory. If the issue of a technical breakdown is being resolved, then often it is enough to involve specialists from your organization (without outside participation).

The absence of representatives of the interested party may lead to the recognition of the results of the commission's work as invalid.

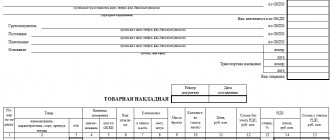

Application of the unified form OS-16

Any enterprise has the right to independently establish the form of YES. To facilitate this task, the State Statistics Committee of the Russian Federation, by its Resolution No. 7 dated January 21, 2003, proposed a unified form (Act on Identified Equipment Defects - Form No. OS-16). It is suitable for troubleshooting during the acceptance, installation, commissioning and testing of new equipment, but can also be used in other cases of object inspection.

Form OS-16 is a double-sided form. The following items must be filled out on the front side:

- Information about the owner of the object being surveyed (OKPO code) indicating the structural unit.

- Location of the object (address of the organization, division).

- The number and date of this act and documents related to the surveyed object.

- Names of the parties involved in the delivery of the object: manufacturer (manufacturing country), supplier (seller), shipper and transport organization (carrier), installation organization (installer), indicating OKPO codes.

- The stage at which the inspection is carried out (acceptance, adjustment, testing, installation, etc.).

- A list of identified defects in the form of a table indicating information about the equipment and technical documentation for it (including date of manufacture, passport data, brand, etc.).

On the reverse side of the act are the commission’s conclusions and recommendations on measures that need to be taken to eliminate defects. The conclusion must be signed by all members of the commission.

Sample of filling out a defect report

Depending on the purpose of the DA and the stage of operation of the facility, various forms of the document can be used. There are 2 characteristic varieties:

- Defective act for write-off. The rules for its design do not differ from the standard ones. The head appoints the commission. It should include a technical specialist (QC employee), a financial entity under whose accountability the facility is located, and a chief accountant. If necessary, a representative of the supplier or adjuster is involved. The chairman of the commission is appointed by order. This may be the head of the organization or another person. The text of the act must contain complete information about the object being inspected, incl. date of manufacture and commissioning. The final part must indicate the reasons for the impossibility of restoration and draw a conclusion about the need to write off the object. The write-off act is drawn up for each object separately. A sample of this DA can be downloaded here.

- Defective report for current repairs. Its structure does not differ from other similar documents. It is important to describe in detail the identified defects and possible elimination methods in the list (repairing the part itself, replacing a new one, etc.). In conclusion, recommendations are given for carrying out repair and restoration work. The work of the commission should involve representatives of repair and adjustment organizations with which it is planned to conclude an agreement. They will confirm the possibility of repairs.

The organization itself determines the form of the YES. It is important to take into account that an insufficiently justified defect of an object can cause disputes that can cause financial consequences. When drawing up a document, it is necessary to use clear language that does not allow for ambiguous interpretation. Corrections are not allowed. The lack of a common opinion among the commission members about the condition of the object requires the involvement of independent experts, whose opinions will help establish the truth.

A defect report is an important and necessary document, without which material assets or repair costs cannot be written off. It can be drawn up in any form, and the composition of the expert commission is determined by the head of the organization that owns the object being surveyed, but it should be remembered that inaccuracies and insufficient justification of the conclusions can lead to the invalidation of the survey results. For a legal write-off, proper document execution is required.

What document is drawn up when a defect is discovered?

It is the defective act that can be the basis for writing off the operating system or product, since it contains data regarding identified defects in the equipment, and the act also indicates the option for correcting them if the commission has determined that the equipment is subject to restoration.

Important: a defective act must be drawn up in accordance with all requirements, since its inaccurate formation often serves as a refusal by the tax service to recognize repair expenses, which will entail the accrual of additional taxes and fines.

The act does not contain the price of repair work or damage received; it is the basis for drawing up:

- Estimates for repairs;

- Report on the feasibility of repairs;

- An order to carry out repair work;

- Write-offs of worn-out objects. Here you will learn how to correctly draw up an order to write off fixed assets.

Important: the document must be generated if the equipment is under warranty or service.

You will learn how to correctly compose and edit a defective statement in this video:

Who draws up the act and when?

The document must be signed by all participants in the equipment inspection.