Unified form TORG-12 (form)

When using unified forms of documentation, the consignment note is drawn up according to the TORG-12 form. The form and instructions for filling it out were approved by Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132. You can visit our website.

If necessary, you can enter additional fields, columns, and details into the form (see also Resolution of the State Statistics Committee of the Russian Federation dated March 24, 1999 No. 20) or use an independently developed and approved form of the consignment note (Part 4 of Article 9 of the Law “On Accounting” dated 06.12 .2011 No. 402-FZ).

Read more about this in the article “Primary document: requirements for the form and the consequences of its violation .

Details and rules for filling out TORG-12

Form TORG-12 contains all the required details specified in Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ.

You can start filling out TORG-12 by assigning a serial number and date.

The header of the document indicates the name and details of the seller and buyer. In the tabular part, the name of the supplied product, its quantity, price and total cost are noted.

In the “Bases” column, the seller most often indicates the number and date of the supply agreement.

The invoice will be invalid if it does not contain the signatures of the responsible persons.

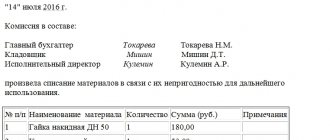

On the seller’s side, three persons must sign the invoice: the person responsible for the release of goods (for example, a storekeeper), the chief accountant and the manager. In practice, you can often see that one person signs for all three persons. This option is completely justified. The main thing is to issue an order or power of attorney for the right to sign the document.

Transfer TORG-12 electronic invoices to your counterparties for free - under the “Unlimited for 2 months” promotion from the Diadoc system

Try it

On the part of the recipient, two signatures are provided: “Cargo accepted” and “Cargo received.” The first signature is most often placed by a representative of the transport company delivering the goods to the buyer. The financially responsible person signs in the “Cargo received” column. The goods on the invoice can be received by an authorized person of the buyer by proxy.

The signature is certified by the seals of the parties. But since 2020, most companies can operate without a seal (Federal Law dated April 6, 2015 No. 82-FZ). If an organization has officially refused to use a seal, it does not need to be affixed to TORG-12.

The TORG-12 invoice is filled out in two copies: one remains with the supplier, the second with the buyer. If the cargo is transported by a transport company, then an additional waybill is issued.

You need to fill out all the required details of TORG-12. It is safer to indicate the terms of shipment and receipt of goods according to the invoice. In case of litigation, the terms in TORG-12 can play an important role.

When using the unified TORG-12 form, you cannot delete any details from it, but you can add your own.

TORG-12 can be stored on paper or electronically. If the invoice is electronic, it must be certified with electronic signatures.

Instead of a consignment note, the company has the right to use a universal transfer document (UDD). This document combines TORG-12 and an invoice. Using UPD, you can significantly reduce document flow.

When and why is the TORG-12 form used?

The unified form TORG-12 is used to register the sale (release) of inventory items to a third party. The main scope of the document is wholesale trade.

The seller issues a delivery note. For him, it is a document on the basis of which the write-off and sale of goods is reflected.

For the buyer, the TORG-12 invoice is one of the documents confirming the acquisition of inventory items and serves as the basis for their capitalization.

In what other cases TORG-12 is issued is described in the Ready-made solution from ConsultantPlus. Get trial access to the system for free and proceed to the material.

Signatures of the parties

The document in question has several columns that must be filled in by persons with a certain level of responsibility. This category includes people whose job responsibilities include authorizing the release of inventory items.

Also in these columns, there must be a signature of an employee of the accounting department, whose responsibilities include the preparation of documentation related to the performance of business transactions. Also, the delivery note must contain the signature of the employee who released the goods from the warehouse of the enterprise, acting as a seller.

What information does the delivery note contain?

The set of sections of the unified form TORG-12 is as follows:

- Information about the delivery participants (seller, consignor, consignee, payer), including their names, addresses, telephone numbers, bank details and OKPO and OKVED codes.

- Details of the contract on the basis of which the delivery takes place, and the waybill.

- Details of the consignment note itself - its number and date.

- Information about the product: name, unit of measurement, quantity, price, as well as the cost and VAT charged to the buyer ( for information on filling out an invoice without VAT, read the material “How to fill out an invoice (TORG-12) when working without VAT (sample)” ).

- Information about attachments to the invoice (for example, certificates, passports, etc. for goods).

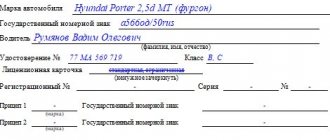

- The document ends with a section with numerous signatures. On the seller’s side, it is signed by the employee who authorized the release of the cargo, the chief accountant and the employee who directly released the cargo. On the other side, signatures are affixed by representatives of the buyer and consignee. Information about the power of attorney on the basis of which the buyer’s representative accepts the goods is also provided here, and the dates of signing the document by the parties are indicated.

The unified form TORG-12 also provides for the affixing of seals of the parties to the delivery. At the same time, the seal is not a mandatory requisite of the primary document (Article 9 of Law No. 402-FZ), therefore organizations that have officially abandoned the seal may not certify the invoice with it (see also letter of the Ministry of Finance of Russia dated 06.08.2015 No. 03-01 -10/45390).

An example of making corrections to a delivery note in form N TORG-12 from ConsultantPlus After the goods were shipped to the buyer, an error was found in the delivery note: the name of the product indicated “Refrigeration monoblock MM 115 R (code pl0102)”, whereas in fact the refrigeration unit was shipped in accordance with the contract monoblock MM 111 R (code pl0101) of the same price. Making corrections to each copy of the consignment note in form N TORG-12 on paper is made out as follows: You can see two ways to make corrections to TORG-12 in K+. Trial access to the system is free.

Features of filling out a paper invoice

The delivery note can be filled out both in paper and electronic form. If an organization draws up an invoice for goods in paper format, it is not required to use the TORG-12 form. You can use your own developed register. The form can include the required number of columns in accordance with the needs and industry specifics of the enterprise. The decision in what form the primary documentation reflecting the supply of goods will be generated is made by the manager. After developing and approving an independent form, it must be fixed in the accounting policies of the organization.

Include the required details in your own delivery note form:

- number and date of formation;

- name of the consignee and his details;

- name of the shipper and his details;

- a document on the basis of which goods are shipped - a contract, invoice, invoice, etc.;

- a table containing a list of supplied goods, unit of measurement and price characteristics;

- space for signatures of responsible persons indicating their positions;

- space for imprints of seals of the parties if they are used by organizations.

Electronic consignment note TORG-12

Primary documents can be prepared not only in paper, but also in electronic form (Part 5, Article 9 of Law No. 402-FZ).

Read about what signature you need to use for electronic documentation here.

For the electronic consignment note, a format has been approved for transmission via TCS ( from July 1, 2017 - Federal Tax Service order dated November 30, 2015 No. ММВ-7-10/ [email protected] ), which allows not only to establish an electronic exchange of invoices with counterparties, but also to submit invoices in electronic form at the request of tax authorities.

When is each of these documents needed?

An invoice for payment is issued when they want to notify the buyer that the organization that sells goods, products or provides all kinds of services hopes to receive funds from the buyer. This document is issued on the basis of contracts, acts of completed work or invoices. An invoice is an external document flow, because it contains information about the seller, but for the buyer.

An invoice is needed when the seller or contractor wants to inform the buyer about his details. This document is used for VAT accounting. It is issued by the counterparty only in the case when, according to the Russian Tax Code, he is obligated to pay VAT to the budget.

Important! If a contractor or supplier has issued an invoice, then he has certified not only the fact of completion of work or shipment of goods or products, but also the deduction of VAT itself. All details for this document are enshrined in the Tax Code of the Russian Federation N 117-FZ.

A consignment note is issued when the seller needs to transfer products or all kinds of goods to the buyer. The invoice must indicate the full and most accurate name of the product, as well as its own products, unit price, VAT, if any, and the total cost of the product.

The document is drawn up based on the exact details of both the seller and the buyer. In practice, consignment notes are used in the legally established form TORG-12. Do accountants fill them out? signed, and also sealed and signed by the head.

Read more about what a delivery note and invoice are and why you need them here.

Sample of filling out the unified form TORG-12

A sample of filling out the unified form TORG-12 can also be seen and downloaded on our website.

All issues related to filling out the header and tabular parts of TORG-12 are covered in detail in the Ready-made solution from ConsultantPlus. You can view the explanations by getting free trial access to K+.

Packing list. Sample filling

The invoice can be filled out in an accounting program. There are also special services where you can fill out a bill of lading online.

To dispel all questions about filling out the document, we will give an example. ROS LLC shipped 6 bearings to Pam LLC. Each bearing costs 74 rubles excluding VAT. The total amount of the invoice is 523.92 rubles. From the seller, the responsible person by proxy is the manager T. P. Sinitsyn. It was he who signed TORG-12 in the designated columns. The goods were personally received from the supplier at the warehouse by R. O. Pechkin under power of attorney No. 4 dated 02/14/2017.

Results

The unified form TORG-12 is the primary document on the basis of which the seller sells the goods and the buyer arrives. The form is issued in 2 copies: 1 for each of the parties to the transaction, or sent electronically to the buyer, subject to its certification with an electronic digital signature.

Sources:

- Resolution of the State Statistics Committee of the Russian Federation dated December 25, 1998 N 132

- Resolution of the State Statistics Committee of the Russian Federation dated March 24, 1999 N 20

- Federal Law of December 6, 2011 N 402-FZ “On Accounting”

- Order of the Federal Tax Service of Russia dated November 30, 2015 N ММВ-7-10/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

How to fill it out? Step by step order

A consignment note is a unified document that regulates the sale of inventory items to third parties. Therefore, it must contain information about the name of the product, quantity, selling price, as well as the total cost and value added tax.

TORG-12 must certainly have the details of both the buyer and the seller. It provides space for a stamp, and all necessary signatures must be present. At the same moment when the invoice is drawn up and issued, the seller is obliged to issue another important document for the release of goods - an invoice.

Required details include:

- name of the organization that draws up the document;

- document's name;

- a number that corresponds to the date of compilation;

- name of the business transaction;

- in what units of measurement the implementation takes place;

- the names of the positions of the persons who perform the sales action;

- signatures of persons responsible for the implementation process.

This document is unified, which means there are special requirements for its completion. If it is filled out incorrectly, with errors, then the right to justify the write-off of inventory items is lost. Also, it cannot be used as a justification for expenses in tax accounting.

The very top section of the form contains information about the organization that ships the goods. The following must be filled in:

- Name;

- TIN;

- current account number;

- Bank BIC;

- index;

- legal and actual addresses;

- telephone and fax.

The columns “Payer” and “Supplier” indicate information identical to what is written in the sections “Consignee” and “Consignor”.

The “Base” field must contain the contract number and its date on the basis of which the shipment is carried out.

The summary table with the product must correspond in content to the invoice.

Why you need it and how to fill out the travel log book according to Form 8 - see here. Who draws up and signs the order for bonuses for employees - read in this article.

Purpose of form TORG-13

Why is TORG-13 needed? The document confirms the fact of transfer of inventory and materials from one division to another, or between financially responsible persons. It helps to maintain clear control and accounting of internal movement in all directions, and this is of great importance for the correct maintenance of accounting and reporting. Registration of an invoice is a guarantee that the property of the enterprise will not get lost when moving from one department to another.

Invoice TORG-13 - what is this document used for? It is necessary to register the movement of goods and containers, semi-finished products, products, but it cannot be used to move fixed assets. It is also used when returning goods by customers in retail trade and when transporting goods by company vehicles. It is unacceptable to issue goods and materials without an invoice.

The main difference between the waybill TORG-12 and TORG-13 is that the first document is used to formalize the release of goods to a third-party organization, and the second is used to formalize an internal movement operation within the framework of the activities of one legal entity. At their core, these are ordinary invoices.