In which legal acts can you find a sample of filling out waybills?

The main source of law, which records the procedure for filling out waybills, is Order of the Ministry of Transport of Russia dated September 18, 2008 No. 152 in its current version. Let us highlight its key provisions:

- waybills must be filled out for each individual type of vehicle (clause 9 of Order No. 152 of the Ministry of Transport); when using the car in shifts by different drivers, you need to create a separate sheet for each of them (clause 11);

Important to consider! Hint from ConsultantPlus: According to the explanations of the Ministry of Transport of Russia, one waybill can be issued for several drivers, if... (for more details, see K+).

- from 03/01/2019, the waybill is issued strictly for a shift or for a flight, whichever is longer. It is impossible to prepare waybills for a month (clause 10);

- the type of vehicle must be stated in the title of the document, and the number of the waybill in the title (in accordance with the numbering established by the company);

- in the document, in addition to the basic details of the sender: name, address and telephone number, the OGRN must be indicated;

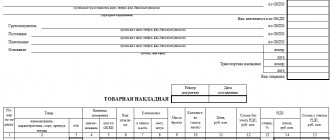

A sample form can be downloaded here.

- the waybill must indicate the odometer readings in correlation with the date and time of the car leaving for the task, as well as its return to the garage, signed by the responsible persons of the company or individual entrepreneur, and if the individual entrepreneur himself performs the work of the driver, then he personally (clause 13, p. . 14);

- if the waybill is issued when different drivers use the car in shifts, the odometer readings are noted on the sheet of the driver who first leaves the garage for the task, as well as the driver who drives back to the garage (clause 15);

- the waybill must record the date and time of medical examinations, which are carried out before departure on a flight and after returning from it - they are affixed by a medical employee directly involved in the examination, and are also certified by his signature with the obligatory indication of his full name ( paragraph 16);

- from 02/26/2017 (Order of the Ministry of Transport dated 01/18/2017 No. 17), a mandatory requisite of the waybill became a note on the inspection of the technical condition of the vehicle before departure on a trip (before a shift) - the controlling person conducting the inspection indicates the date and time of its conduct, certified signature with decoding to initials (clause 16.1);

- completed waybills must be registered in a special journal, which is started by the owner of the transport (clause 17).

Read about the procedure for filling out the travel logbook here.

Completed sheets must be stored in the organization using the vehicles for at least 5 years.

These are the provisions of the main legal acts governing the filling out of travel forms. The legislator has not determined how to fill out the relevant document - the necessary data can be entered into it either by hand or on a computer.

It is extremely important to fill out travel forms correctly. Let us consider what will happen if we neglect this using the example of several arbitration proceedings.

For more information about the features of waybills used by individual entrepreneurs, read the article “What are the features of a waybill for individual entrepreneurs (form)?” .

Filling rules

Vouchers are issued before the start of the flight, if its duration exceeds the work shift, or before the start of the first flight, if the driver manages to make several flights in one shift. If several vouchers are issued for one vehicle (if it is used by several employees), the date, time and odometer readings are entered into the documents as follows:

- on the ticket for the first departure - data when the vehicle leaves the parking lot;

- on the ticket for the second exit - data when the vehicle enters the parking lot.

Let's look at how to correctly fill out a truck's waybill. It records the truck’s departure date and the type of task:

- business trip;

- work according to schedule;

- working on weekends or holidays;

- Column;

- brigade;

- and so on.

A prerequisite is accurate information about the vehicle and its driver: you must enter the registration number, make and garage number of the vehicle, data on the trailer, if used, and full name. driver and information about his license. Let's take a closer look at an example of filling out a truck waybill.

The column “Tasks for the driver” contains the addresses and names of all customers. Then we indicate the distance to each destination and note the number of flights. At the end we enter the time of arrival and departure of the vehicle.

The section on the movement of fuel contains fields for filling in the brand of fuel, the code of this brand, the operating time of the vehicle engine and the special equipment that is installed on it. Be sure to enter the coefficient for changing the fuel consumption rate if the vehicle is operated in special conditions, for example, in cold weather. All completed fields are certified by the signatures of responsible persons.

Waybills are stored in the accounting department of the owner or lessee of the transport. Based on the waybills, records of the vehicle’s operation are kept, so it is advisable to store them together with shipping documents that make it possible to check them simultaneously. A mechanic or dispatcher accepts permits from drivers. If any breakdowns occur, then in the “Marks” column such an authorized person enters information about the repairs performed, its cost and the spare parts that were used. Based on these data, the accounting department, where the voucher must be submitted, must calculate the salary and costs of operating the vehicle.

Errors in the waybill and refusal to refund VAT

The legal consequences of errors made in a document such as a waybill can be very unpleasant for the taxpayer. Noteworthy is the case in which the Federal Tax Service refused to recognize the right of an individual entrepreneur to deduct VAT due to the fact that the waybills were filled out incorrectly.

We are talking about arbitration case No. A65-20582/2013. The plaintiff, an individual entrepreneur, bought a car from an LLC and prepared a number of supporting documents - an invoice and an acceptance certificate. The seller issued an invoice to the buyer, which included VAT. It is also known that the individual entrepreneur paid for the car using credit funds.

The individual entrepreneur, having carried out the state registration of the car, submitted a VAT return to the Federal Tax Service, which indicated the amount to be deducted. However, the tax authorities denied the deduction to the individual entrepreneur, considering that the car was purchased not for business, but for personal purposes.

The buyer of the car filed a claim in arbitration, intending to have the Federal Tax Service's decision annulled in court. But his attempts were not crowned with success - the court in 3 instances confirmed the rightness of the tax authorities.

During the hearing, the individual entrepreneur presented to the court copies of travel documents as evidence of using the car for business purposes. However, the judges considered that these sources did not comply with the requirements of Order No. 152 of the Ministry of Transport, since they did not indicate some important, in the opinion of the court, details. In addition, during the hearings, it was established that in the vehicle acceptance certificate there was an error in indicating the name of the LLC that sold the vehicle to the individual entrepreneur.

Which form of a truck waybill should an individual entrepreneur use?

Before the cancellation of Order No. 68 of the Ministry of Transport dated June 30, 2000, all car owners-entrepreneurs used the PG-1 form approved by this normative act to issue a waybill. After its abolition, until 2013, it was necessary to use forms 4-P or 4-C, introduced into the document flow by Decree of the State Statistics Committee of Russia dated November 28, 1997 No. 78. And since 2013, with the adoption of the Law “On Accounting” dated December 6, 2011 No. 402 -FZ the need to use unified forms has disappeared.

Now entrepreneurs can independently develop their own travel form. It must be created in compliance with the requirements of Order No. 152 and Law No. 402-FZ.

We discuss issues of preparing a waybill, taking into account the latest changes, in on VK. Join us!

The choice of the form of the waybill must be fixed. Read about how to do this here.

If you need to draw up a waybill, then it can be based on either one of the previously used unified forms (PG-1, 4-S or 4-P), or your own development. Most often, individual entrepreneurs prefer the PG-1 form (the 2020 waybill form for a truck can be downloaded below from the link), since it contains all the details necessary to fill out and is quite familiar for use as a waybill.

A waybill in form 4-C is more suitable for cases when special vehicles are used. As for the 4-P form, it is convenient for entrepreneurs who use an hourly form of payment to pay drivers. In this case, the TTN is a mandatory addition to the 4-P form; its number is entered in the waybill. After completion of the voyage, 1 copy of the waybill must be attached to the issued waybill and stored with it.

All issued waybills are registered in a special journal. The entrepreneur himself is responsible for maintaining such a journal for the individual entrepreneur.

For an algorithm for registering and maintaining a log of waybills , see : Here.

It is quite important that the details confirming fuel consumption are taken into account and filled out in a self-developed form. A correctly completed waybill is a legal basis for the subsequent write-off of fuel and lubricants. This is also mentioned in the letter of the Ministry of Finance dated August 25, 2009 No. 02-03-06/2-161.

About the rules for accounting for expenses of an individual entrepreneur working on the simplified tax system, read the material “List of expenses under the simplified tax system “income minus expenses”” .

The destination is not specified - expenses for fuel and lubricants cannot be written off

Another very noteworthy situation occurred within the framework of arbitration case No. A55-23291/2012. The Supreme Arbitration Court refused to transfer it to the level of the presidium of this instance, thus leaving the cassation decision in force.

The taxpayer filed a lawsuit against the Federal Tax Service, intending to challenge the tax authorities’ decision to refuse to include fuel and lubricants costs in the company’s cost structure. Federal Tax Service inspectors considered these costs unconfirmed, since the travel sheets generated by the taxpayer to confirm the costs of fuel and lubricants did not indicate the destinations to which the drivers traveled.

The amount included in the lawsuit is quite significant - 700,000 rubles. But the taxpayer was unable to sue her. During the hearings at first instance, the judges confirmed that the tax authorities were right. The appeal gave the plaintiff a chance, establishing that the route of the car, as well as the destination of the cargo, should not be recorded in a document such as a waybill by organizations that are not transport companies in their main profile. In addition, as the appellate court considered, the waybill should not be considered as the only source capable of confirming the involvement of the car in the taxpayer’s business activities.

However, the cassation overturned the decision made by the appellate court. The judges considered that the waybill is a document that is created specifically for the purpose of confirming the validity of the company’s costs in the form of fuel and lubricant costs. Therefore, if the waybill does not contain information about the destination, then, according to the judges, it is impossible to reliably establish the fact that the company’s drivers used the car for official purposes. Therefore, this detail of the waybill, if we follow the position of cassation, should be considered as mandatory, reflecting the essence of the business transaction.

Information about the destination recorded in a document such as a waybill, if we follow the logic of the provisions of the ruling of the Supreme Court in this case, must be sufficiently detailed. As VAS believed, the waybill should include the name of the organization where the car is going, as well as the address of the corresponding facility.

Results

Individual entrepreneurs can use a unified form of a truck waybill or develop it independently, taking into account the requirements of the Ministry of Transport of the Russian Federation established by Order No. 152 dated September 18, 2008.

Sources:

- Federal Law of December 6, 2011 No. 402-FZ “On Accounting”

- Order of the Ministry of Transport of Russia dated September 18, 2008 No. 152

- Resolution of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Rules for issuing waybills for accounting in 2020

In practice, a fairly wide range of waybills can be used - it all depends on the type of vehicle, the method of its use, as well as the specifics of the organization’s activities. The main source of law that approves waybill forms for various types of automotive equipment, as well as types of enterprises, is State Statistics Committee Resolution No. 78 dated November 28, 1997. However, the use of this document is not mandatory, and the owner of the transport has the right to develop his own waybill form or, Taking a suitable unified form as a basis, supplement it with the necessary details.

But whatever the form used by the owner of the vehicle, it must contain the required details for him, it must be approved as used and filled out, following the recommendations of Order No. 152 of the Ministry of Transport.

For information about the latest changes made to this order, read the material “The list of mandatory details of the waybill has been expanded .

Based on standardized forms, our specialists have prepared for you samples of filling out travel forms in Word format.

the most commonly used travel forms and examples of how to fill them out in articles such as:

- “Waybill for a truck of an individual entrepreneur”;

- “Truck waybill in accounting (form)”;;

- “A waybill for a passenger car according to Form 3 in accounting”.

How to issue a waybill for a passenger car

The rules for issuing a passenger vehicle voucher (form No. 3) were adopted by order of the Ministry of Transport of the Russian Federation dated No. 152 on September 18, 2008.

Registration is carried out, for the most part, by dispatchers. At enterprises where there is no such service on staff, and the passenger vehicle is the boss’s personal car, the permit can be filled out by the boss himself or an employee appointed by order. If filling out vouchers is entrusted to the driver (this is not prohibited), he is obliged to fill out the vehicle mileage based on instrument readings. Form No. 3 can be issued for passenger vehicles, both in motor transport enterprises and in ordinary institutions. The design features of this form are reflected in Rosstat letter No. IU-09-22/257 dated 02/03/2005, where it is noted that each travel form is stamped with an enterprise stamp (not a seal). You are also required to comply with other standards for filling out vouchers.

( Video : “How to fill out travel forms correctly”)

It is required to record instrument readings both on the eve of leaving and when returning to the garage. The fuel sensor, speedometer and other devices are subject to accounting.

Provisions for filling out vouchers:

- An auto mechanic is required to inspect the vehicle's maintenance, having entered his/her report on the form on the eve of departure.

- A medical professional is required to check the driver’s health, displaying the date and time, a personal signature, and also writing down the phrase that the driver “had a medical examination on the eve of departure with permission to work.”

The issued form is completed as follows:

- In the upper left section of the form fill out:

- Movement start date.

- Name of the company that owns the vehicle.

- Information about the driver.

- Vehicle details.

- Time to leave the garage.

- Time to return to the garage.

- Medical examination information.

- Medical details employee who carried out the inspection.

- In the right section of the form enter:

- Codes from the company's constituent materials.

- Ticket number.

- Mileage.

- Information about the auto mechanic performing vehicle maintenance.

- Type of fuel.

- Volume of fuel and lubricants filling.

- In the lower section of the form the following is indicated:

- Signature of a mechanic confirming the serviceability of the vehicle.

- Driver's signature.

Why do you need a waybill?

This is a primary document; it is necessary for accounting and writing off the costs of maintaining a car.

Also, on the basis of “vouchers” (as this paper is often called), many institutions calculate the driver’s wages. All institutions, organizations and private entrepreneurs that operate cars are required to draw up waybills. The form of the document can be developed and approved independently, or you can use the form approved by Goskomstat Resolution No. 78 dated November 28, 1997. An exception is enterprises providing services for the transportation of goods or passengers; they are required to keep records of vehicle movement in unified forms.

A permit is required when using a car for work purposes. The form of ownership of the vehicle does not matter. That is, if the car is on the organization’s balance sheet, rented from a third-party company, or an employee’s personal car is used for the needs of the institution, there must be a voucher.

The forms should be recorded in a special registration journal. It must be maintained by all legal entities and private owners who operate cars.