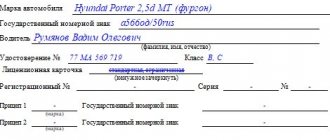

I was faced with the need to conduct these operations for individual entrepreneurs in 1C.

I found the following recommendation on one of the forums, and I follow it: Before answering this particular question, you must understand for yourself how you will generally conduct accounting for this individual entrepreneur. The main difference in accounting for individual entrepreneurs from accounting for, for example, an LLC is the free “flow” of funds between the business and everyday goals of the entrepreneur. After all, he also has other money and bills, and not all of his expenses relate to business activities. And it is not always possible to clearly distinguish which entrepreneur’s money is “personal” and which is “entrepreneurial”. With an LLC, everything that goes into the account or cash register must have two sides of the same transaction. If you receive money into your account, you have incurred a debt to someone or, conversely, someone’s debt has been paid off. Even when the founders contribute money, this is manipulation of their debt to form the authorized capital. The individual entrepreneur does not have this, but there are numerous settlements with the individual entrepreneur himself.The an account system that is used for organizations (and it is mandatory ONLY for organizations) does not provide for such calculations. Therefore, your very first action is to decide on which account you will account for settlements with the entrepreneur himself? We have already had relevant discussions on this topic several times - read it, it’s very useful. As a result, it is most optimal to use either score 76, or additionally enter your own, for example 72, 74 or 78. I personally recommend this path. Another feature of individual entrepreneur accounting is the absence of the concept of “accountability” for the individual entrepreneur himself. He doesn't have to answer to himself. Therefore, the fact that the director of an LLC is carried out through account 71 with a mandatory advance report is irrelevant for individual entrepreneurs. Now, if any other hired employee of an individual entrepreneur takes the money into account, he will have “accountability in full, just like in an LLC.

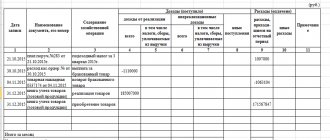

Here are the most typical transactions when accounting for individual entrepreneurs (for example, I will use the additionally introduced account 72 “Settlements with individual entrepreneurs”):

Dt 50 – Kt 72 – individual entrepreneur deposited personal money into the cash register; Dt 51 – Kt 72 – individual entrepreneur deposited personal money into an “entrepreneurial” bank account (your question relates specifically to this posting); Dt 60 – Kt 72 – the individual entrepreneur paid for goods, work or services from personal money; Dt 72 – Kt 50 – individual entrepreneur took money from the cash register (regardless of the purpose - personal, business, etc.); Dt 72 - Kt 51 - individual entrepreneur withdrew money from a bank account (also regardless of the purpose - personal, business, etc.); Dt 72 – Kt 62 – Individual entrepreneur personally received payment in cash at the buyer’s (customer’s) cash desk.

What I have drawn is not a dogma, but only an idea. Once you understand it, it will be easier to keep records. If you approach accounting for individual entrepreneurs with the same standards as accounting for an organization, you will constantly come across all sorts of questions and non-existent problems. ...

forum.klerk.ru

Personal money to the account, how to reflect it?

The patent taxation system (PTS) can only be used by a narrow circle of entrepreneurs whose activities fall into the list of activities of this system and whose number of employees does not exceed 15 people. With PSN, the individual entrepreneur only maintains KUDiR and pays a certain amount of tax in two stages.

Fixed payments to the Pension Fund are required under both systems. Basic accounting for individual entrepreneurs on UTII and Unified Agricultural Tax Individual entrepreneurs who have switched to taxation under the UTII system are not required to even keep a book of income and expenses.

Accounting for individual entrepreneurs

Also, a similar method of organizing records of expenses and income ensures orderliness and discipline of finances, own control over the movement of funds, the ability to plan and forecast, assess the effectiveness of activities and the dynamics of profits and losses by period, etc. No. 402-FZ states that individual entrepreneurs are not required to maintain this type of accounting.

However, the Tax Code in some cases requires business individuals to have financial statements in the form of recording income and expenses.

Thus, the legislation does not incriminate private individuals with obligations to do so, but the right of choice is retained - if the subject considers this form of document flow appropriate, he can apply it. The second element of choice is the degree of complexity of accounting - full or simplified. The procedure for generating documents in a simplified mode is regulated by the following acts:

Navigation

And the negative value of capital in the balance sheet will show the entrepreneur how deep he has got into the household’s “pocket”, and how much he will have to part with property not used in business activities, answering his debts to his creditors. The capital account balance shows whether the business is self-sufficient or is drawing funds from the household. If you started working with an individual entrepreneur from scratch, then everything is simple, but if you came to work for an existing individual entrepreneur, then many may have questions about what to do with the balances on accounts 70, 71, 75, 76, 66 and others, where the contractor is the entrepreneur himself, since the previous accountant did not read all of the above, and kept records as best he could? The answer is simple - since in relation to himself, an individual entrepreneur cannot be an employer-employee, a founder-enterprise, a debtor-creditor, a borrower-lender, you need to understand that his own funds appear here, and close all claims and obligations taken into account in these accounts according to the individual entrepreneur’s counterparty, in correspondence again with the capital account, in our case, as we agreed, with the 84th. This is the main thing that individual entrepreneurs need to remember when not only thinking through profitable transactions, but also organizing their accounting.

Subscribe to our channel in Yandex.Zen! Subscribe to the channel It would seem, what relation can full responsibility of this kind have to accounting? Yes, the most direct. strong> Incorrectly organized accounting can lead to the imposition of large fines and penalties for very likely (if not properly organized) accounting errors. And these sanctions can affect not only money and property related to the business, but the entire state of the individual entrepreneur. In addition, and this is worth paying special attention to, debts incurred while running a business are not canceled when the individual entrepreneur is closed. These debts will have to be paid, one way or another, because if this is not done, there may be talk of forced collection and even the initiation of a criminal case.

Accounting for individual entrepreneur account 720

What accounts can be used to reflect in accounting personal funds deposited and received by an individual entrepreneur from a current account, as well as funds associated with business activities (an individual entrepreneur keeps accounting records)? Is it possible to use count 75 in this situation? On this issue, we adhere to the following position: In our opinion, to reflect in accounting the funds deposited and received by an individual entrepreneur, you can use account 76 “Settlements with various debtors and creditors” by opening the appropriate sub-accounts for it. Rationale for the position: An individual entrepreneur (hereinafter referred to as an individual entrepreneur) is an individual, and the entrepreneur’s property (including funds) is not legally delimited. In accordance with Art.

Under the Civil Code of the Russian Federation, an entrepreneur is liable for his obligations with all his property. Individual entrepreneur. When returning invested funds to the personal account of the individual entrepreneur (withdrawal in cash), accordingly, the following entry is made: Debit 76, subaccount “Personal funds” Credit 51 (50) - return of funds to the personal account of the individual entrepreneur (withdrawal in cash). Income Individual entrepreneurs formed after paying taxes can be reflected in account 84 “Retained earnings (uncovered loss)”. In this case, the receipt of funds by individual entrepreneurs from income remaining after taxes can be reflected in the following entries: Debit 76, subaccount “Calculations on income Individual Entrepreneur" Credit 51 (50) - individual entrepreneurs were issued (transferred) funds for use for personal needs at the expense of income remaining after taxes; Debit 84 Credit 76, subaccount "Calculations for income of individual entrepreneurs" - reflects the amount of paid income of individual entrepreneurs. Accounting procedure accounting for personal funds deposited and received by individual entrepreneurs must be approved in the local individual entrepreneur document.

Accounting for individual entrepreneurs has many nuances and features that it does not hurt to get acquainted with for novice entrepreneurs. What tax regimes are applied by individual entrepreneurs, what are their advantages and disadvantages, what is the advantage of one or another method of accounting - all this can be found out in our article.

General features of accounting for individual entrepreneurs Features of accounting for individual entrepreneurs under OSNO Do I need an accountant for individual entrepreneurs using the simplified tax system and the patent system? Elementary accounting for individual entrepreneurs on UTII and Unified Agricultural Tax General features of individual entrepreneur accounting When deciding to register as an individual entrepreneur, not all businessmen understand that from the moment they are issued the appropriate certificate, they will have to answer for the results of entrepreneurial activity with all their property.

is not only a product for sale, not only store and office equipment, but also a personal car, your own apartment, a cozy cottage, etc.

Agree, what other account can show the lack of capital or the available capital after the reformation of the balance sheet without unnecessary movements of the accountant? But I still advise you to rename it, so that the words “Retained earnings” or “Uncovered loss” do not distract you from the essence. We will assume that I have convinced you and, based on this, we make the posting according to the above operation - Dt51-Kt84 50 thousand rubles. Thus, we answered the question “How to reflect the contribution of an entrepreneur’s own funds?” It is clear that instead of 51 accounts, any other fund account may appear, depending on what the entrepreneur “takes out” of the household and “brings” into the business. IP is not established by law. Therefore, we believe that an individual entrepreneur who has made a decision to maintain accounting records has the right to develop it independently. Instructions for the use of the Chart of Accounts for accounting financial and economic activities of organizations, approved by order of the Ministry of Finance.

It is inappropriate to write, since account 75 is intended to reflect information related to the contributions of the founders of organizations. From the income received, an individual entrepreneur can deduct expenses that are confirmed by documents; or expenses without such confirmation - in the amount of no more than 20% of the income received. Income is also reduced by the amount of taxes paid, contributions to the Pension Fund and state duties associated with doing business.

- Value added tax of 18%.

- Fixed contribution for yourself to the Pension Fund.

- Personal income tax and insurance contributions from wages of employees.

- Perhaps the region has some local taxes, which also need to be paid (property tax, transport tax, land tax, etc.).

Cash kept by the person assigned to handle cash is the till. But cash collected by the entrepreneur himself is no longer a cash register, since an individual entrepreneur cannot be a financially responsible person to himself and the cash in his pocket is not cash in business until he invests this cash in the business.

What can he do by handing over the collected cash to the person appointed for safekeeping. As we see, here too we can apply our “magic” “gateway”, carrying out all cash transactions by the individual entrepreneur himself through account 84.

lcbg.ru

Chart of accounts for 2020 with explanations and entries

The latest chart of accounts was introduced by Order of the Ministry of Finance in 2000 in order to reform the current accounting system and bring it closer to international accounting standards.

This document is intended for use by all enterprises and organizations, with the exception of public sector entities and credit institutions. For the latter, specialized Plans have been developed that reflect the specifics of their activities.

Accounts are a grouping of information about certain accounting objects, which occurs based on the use of the double entry principle (that is, data is simultaneously recorded as the debit of the first account and the credit of the other). If the account shows the property of the enterprise, then it is called active. These are accounts for reflecting fixed assets, materials, cash, goods, finished products, expenses, etc.

d. This type of account is characterized by the following:

Why does an entrepreneur contribute his own money?

In the process of economic activity, the need arises to pay in personal money to the cash desk. The reasons that prompted the individual entrepreneur to take this position are varied:

- providing financial assistance to your own business;

- replenishment of working capital for individual activities.

If there is not enough money, then the entrepreneur increases working capital at the expense of some amounts stored on a bank deposit. You should take into account such a nuance as registering the receipt of money for a subsequent competent report to the financial authorities.

The contribution of your own funds must be accompanied by an indication explaining the legality of their enrollment. Receipts are justified by the following formulations: “Replenishing the account with your own funds”, “Depositing personal savings”.

Registration of financial transactions is carried out taking into account the instructions of the Central Bank of Russia, in accordance with clauses 4.14, 4.5, dated 03/11/2014 N 3210-U.

Replenishment of the account for issuing salaries to employees

To settle payments with hired personnel, an individual entrepreneur has the right to deposit personal savings into the organization’s cash desk and subsequently spend them on production needs.

A simplified scheme for maintaining financial documents is mandatory for individual entrepreneurs, but it is allowed not to enter the receipt of money into the cash book and not to draw up receipt documentation.

It is mandatory to indicate your own funds deposited into the company’s account for the payment of salaries in a written document signed by the head of the organization. A statement for the disbursement of money is attached to the order.

If an individual entrepreneur deposits certain amounts, but does not draw up a receipt and debit order, he is obliged to record report data in a book that takes into account the simplified tax payment scheme and save cash and sales receipts. After the account is replenished, the payment of money for wages is carried out in accordance with the accrual order and several instructions indicating the legality of such actions. For reporting, the entrepreneur uses account 76.

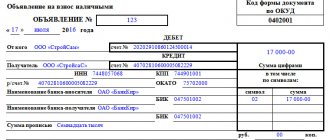

Accounting for personal amounts in the account

Depositing money by an individual entrepreneur into his personal account is not considered revenue. After the operation, a cash receipt order is filled out, which indicates the purpose of the funds as not related to business income. When filling out a debit order, you must indicate the number of the current account to be replenished and the address of the banking institution.

Of great importance is the correct execution of documents indicating the source of receipt of money when depositing it with the bank. An individual entrepreneur has the right to deposit cash through a bank cash desk only into his own account.

If this rule is violated, the bank refuses to accept money. After the transaction has been completed, the entrepreneur receives from the cashier a receipt signed and stamped by the financial institution that accepted the payment in cash. After posting the money, an account statement is issued indicating the entire amount. If funds were deposited as your own, you should post them through the cash register using account 84.

If money is deposited into the account of an individual entrepreneur and it is received from the sale of goods, it is necessary to indicate their purpose in the PKO, registering it as revenue. All accounting entries must be documented. If an entrepreneur deposited his own money into an individual entrepreneur’s account in order to pay off a debt, it is displayed in 1C with the obligatory issuance of a cash receipt order. The total amount accepted is not subject to recording in the income and expenses ledger.

An individual entrepreneur does not always keep accounting records, but if the appropriate documents are available, they use entries Dt 50.1 Kt 76.78.66 (at their own choice). Sometimes it is convenient to use account 72 - income, expenses of an individual entrepreneur, 72.1 - investing personal funds, 72.2 - replenishing an account.

It is considered possible to use account 84, since the funds of an individual entrepreneur are understood as the entire totality of his expenses, both profits and losses.

Taking into account all the positive and negative aspects of drawing up cash documents in the process of work, the individual entrepreneur formalizes the receipt of funds with order No. Ko-1. If money is deposited into the cash register, an account is used for accounting that records work with creditors and debtors, as well as postings (Debit 76, Credit 50) indicating the receipt of money through the cash register. If the entrepreneur refuses to maintain accounting documentation, it is necessary to comply with clause 2 of Art. 6 of Law No. 402-FZ, concerning tax accounting of profits and expenses.

Account 72 for individual entrepreneurs

Hello! In this article we will tell you how to correctly deposit personal money into the cash register for individual entrepreneurs. Today you will learn: Why deposit your money into the cash register During the period of operation of an individual entrepreneur, there may be different situations. At the initial stages, not every month can be profitable, and then the question arises about additional financing for your business.

After depositing funds into the current account, a transaction with the same credit will be generated, and account 51 will be reflected in the debit.

If in the future you plan to withdraw funds from your current account for personal needs, the program will also help with this. In this case, account 75 will appear, which will generate a check for cash withdrawal.

Are own funds in the cash register counted as income? Each transaction on a company account may attract the attention of the tax authority.

The main thing is to save all confirmation forms from banks and keep them for the entire period of the individual entrepreneur’s activity (preferably 4 years).

According to the document, the following posting will be created: “Dt 84.01 Kt 50.01.” In the case of depositing funds into the account of an individual entrepreneur with such type of transaction as “Personal funds of the entrepreneur”, a document is created called “Receipt to the current account”. The document must indicate the purpose of the payment and the amount.

According to this document, a posting should be generated: “Dt 51 Kt 84.01”.

To justify the incoming payment, you need to have a strict reporting form indicating:

- Deposit amounts;

- Current account numbers;

- Account number of the individual from which the transfer was made (that is, yours);

- Operation dates;

- Name of the banking institution;

- Transfer destinations.

IP transferred his money to the posting account

It is recommended to use the existing account to transfer funds received exclusively from various business transactions.

This profit relates to the individual and does not affect the activities of the company. And since there is no income as such, then you do not have to pay any tax.

It is important not to get confused in numerous incoming transactions and calculations. Correctly reflecting the profit of an individual entrepreneur in the final declaration, as well as in the internal documentation of the enterprise, will save you from unnecessary waste of your own funds.

You can deposit personal funds into your account as follows:

- cash at a bank representative office;

- using money transfers in electronic format;

- via an ATM;

- using a bank card.

Replenishing an account with personal funds does not require recording in the Book of Income and Expenses.

It is not advisable to use it to perform other types of cash flow movements. The easiest way to top up your account is to go to a bank office and deposit cash through the cash desk. However, it is not always possible to personally visit a banking institution to perform this operation.

- last name and first name of the entrepreneur receiving the funds;

- TIN number, personal and correspondent account;

- BIC of the recipient of the funds.

For this procedure, you must have a passport and information about the financial balance in the account of the sender of the money.

They will not be considered income and will not be used for subsequent accounting in the tax base.

If there is a commission for carrying out a funds transfer operation, the bank employee must inform the sender about this.

Upon completion of filling out the receipt, all columns are checked to ensure that the entered information is correct. After this, the bank specialist puts a mark on the form on the execution of the money transfer and the seal of the financial institution.

All financial transfers must be carried out in strict accordance with applicable regulations. All monetary transactions are subject to careful verification by the relevant cash flow control authorities.

To avoid problematic issues with paying taxes, it is necessary to pay special attention to the column for justifying financial transactions.

This will greatly simplify business activities.

Replenishment of the current account of an individual entrepreneur

The first thing that comes to an entrepreneur’s mind when the need arises to deposit money into an individual entrepreneur’s current account is to go to a bank branch. Topping up your account with cash through the cash desk of an individual entrepreneur service organization is one of the most common methods.

But what if, due to circumstances, you cannot get to your bank (for example, you are in another city), and at the same time you urgently need to deposit money into the individual entrepreneur’s current account?

In this situation it is necessary to distinguish:

- depositing your own funds into the individual entrepreneur’s account;

- depositing proceeds from business activities into the current account of an individual entrepreneur (carried out through a bank cash desk, less often through an ATM or through collection).

In the first case, you have the opportunity to send money to your account in any available way: Important! If you do not properly indicate the purpose of the payment, there is a risk that the tax service will consider the money received in the current account to be trade proceeds and charge tax. Important! If you use the specified posting, then you need to withdraw the individual entrepreneur’s money for personal needs from the current account using the same accounts, making a reverse posting: D84:K51.

In conclusion, some practical advice. Despite the fact that the legislation does not draw a clear line between the personal property of an individual entrepreneur and the property used in the business, the individual entrepreneur himself must clearly distinguish between these concepts for himself.

VAT is not assessed.” For this operation, the bank takes 1.5% of the payment amount.

When depositing money into your account, pay special attention to the basis of the payment so that no controversial situations arise when calculating taxes.

They not only differ in tariffs and commissions)) There is no mention that this is an individual entrepreneur on the card, only First Name Last Name, like on other Visas.

Because there is no such person as an individual entrepreneur, there is simply an individual. Then I come to the PKO and give wages to the RKO employees.

- with an individual entrepreneur's current account;

- with a plastic bank card of an individual entrepreneur as an individual;

- with corporate plastic card of an individual entrepreneur.

1. Write a check using a checkbook previously issued at the bank or issue a non-cash transfer to a plastic card of an individual entrepreneur (as an individual) using a payment order.

2. For the cash register, register PKO (receipt, receipt from the current account) and RKO (cash withdrawal). The option with a plastic card issued to an individual entrepreneur is simpler and more modern.

Salary 06.27.2012, 22:49 I am a pregnant accountant, I am an individual entrepreneur and I was advised to have this operation (the first part - from an account to a card) at my bank so that I don’t have to worry about the checkbook. I don't see any cash. This is an individual entrepreneur - he moved it from one pocket to another.

Personal funds reflected in 1C: Accounting

In the process of work, regardless of the type of activity of the organization, the entrepreneur uses the 1C program.

The total amount entered into the documents in connection with its posting is not reflected in reports to the tax authorities. A document confirming the receipt of money is generated at the time of depositing funds into the cash register. Be sure to fill out the columns “Base” and “Appendix”. Next, posting Dt 50.01 Kt 84.01 is generated. If an individual entrepreneur deposits his money into a current account, it is necessary to indicate the type of transaction and issue posting D151 Kt 84.01.

If a private entrepreneur spends money from his current account for personal needs, he can reflect the entire progress of the operation in the 1C system. For these purposes, account 75 is used, indicating the mechanism for working with founders. An entrepreneur just needs to issue a check, which can be used to withdraw money. Subsequently, documents are drawn up that take into account the inflow and outflow of funds in the individual entrepreneur’s account.

To withdraw money for personal expenses, an entrepreneur draws up a document that takes into account tax and accounting and records: debit (amount), credit (amount). After the pension tax has been withheld, debits and credits are noted again.

Depositing personal funds of individual entrepreneurs into the cash register

During the entire period of business, each individual entrepreneur may have several reasons why he will have to deposit his money into the cash register. The reason may be:

- debt repayment.

- financial support for your own business;

- replenishment of the current account;

If finances are not enough, then an individual entrepreneur can contribute money to his personal account from his own savings. In any case, you need to take into account the subtlety of the execution of this monetary transaction, because you need to draw up the correct ones for the tax office.

When depositing his own money into the cash register, an individual entrepreneur must accompany such payment with an indication that confirms the legality of this operation.

For example, a payment can be signed as:

- “Depositing your own finances into your account.”

- “Replenishing your account with personal savings.”

In this case, the execution of a monetary transaction is carried out taking into account the Central Bank of the Russian Federation. An individual entrepreneur has the right to deposit his own funds into the cash register and for.

At the same time, it is very important to correctly reflect the value of the receipt of this money in the book of income and expenses (KUDiR).

In this case, you must save all bank receipts.

As soon as the funds arrive in the appropriate account, the payment of salaries to employees will be carried out in accordance with the documents used, which confirm the legality of such financial transactions. The entrepreneur’s personal funds, which he decided to deposit in the cash register, can be considered as revenue.

Therefore, you need to immediately issue a receipt order. And it should be noted that these finances are not related to the activities of the individual entrepreneur, and also reflect the purpose of the payment. The entrepreneur’s personal funds, which he decided to deposit in the cash register, can be considered as revenue.

When filling out a debit order, it is also important to indicate the bank account number to which the transferred amount will be credited. It is also worth writing down the address of the bank where the transfer was made. When depositing money at the cash desk, it is very important to complete the documentation correctly. Namely, it is correct to indicate where this money came from.

Paying taxes on personal money of individual entrepreneurs

In the process of activity, an entrepreneur working on the simplified tax system deposits his personal funds into a bank account to pay for the rent of the premises. A pressing issue for him is the payment of tax on the amount transferred to the account.

An individual entrepreneur who deposited his funds into the account is not a person forming the tax base, and his personal money cannot be recognized as income, since it is not related to the sale of goods or services.

A private individual running a business has the right to spend his own money on any needs, unlike the managers of an LLC, who do not have such a right.

If a request is received from the tax service with a claim regarding payment, it is necessary to send a letter to the Federal Tax Service indicating the purpose of the funds received and the amount of the fee to be paid.

In documents created according to cash register data for individual entrepreneurs, it is necessary to reflect the cash flow mechanism, following the order of the Central Bank of the Russian Federation according to a simplified scheme. Maintaining a cash book is not the responsibility of an entrepreneur, but many managers prefer to document the movement of funds and maintain financial discipline. Maintaining account 50 “Cash” is necessary to reflect debits and credits.

Filling out a cash book helps an individual entrepreneur take into account the movement of money over a 12-month period. An alternative option is the accounting program “1C:Enterprise”. In the absence of a special book, it is impossible to determine the amount of cash remaining in the cash register.

The new provision on the preparation of cash documents applies to entrepreneurs working under the taxation system, and recommends that they issue the receipt receipt counterfoil to the person who paid the money. When working with legal entities or individuals, individual entrepreneurs should always have cash documents.

vseobip.ru

The procedure for depositing personal funds of individual entrepreneurs into the cash register

Hello! In this article we will tell you how to correctly deposit personal money into the cash register for individual entrepreneurs.

Today you will learn:

- Can the tax authorities recognize the deposit of personal funds of an individual entrepreneur into the cash register as income;

- Is it possible to deposit your own funds into the individual entrepreneur’s cash register;

- What operations need to be carried out in 1C when depositing amounts;

- Do I need to pay tax on my own funds at the cash desk?

- How to reflect in personal money;

During the period of operation there may be different situations. At the initial stages, not every month can be profitable, and then the question of additional financing arises.

In some cases, an entrepreneur wants to expand his boundaries, in which case personal savings can help. The law in no way prohibits an individual entrepreneur from disposing of his own. You have every right to deposit funds and withdraw funds at any time. This advantage sets the activity apart.

The only prohibition on withdrawing money from the account may come as a result or decision of a court hearing. If at the moment the enterprise needs an additional cash injection, the individual entrepreneur can deposit his own funds into the cash register.

There may be several reasons for this:

- Pay off some debts;

- You want to maintain the financial condition of the company;

- Give to hired workers from personal money (if the amount in the cash register is not enough for these purposes).

- Would you like to replenish your current account?

If the individual entrepreneur has debt and does not have sufficient funds on the balance sheet, depositing personal funds is a way out of this situation. This is especially true if the payment deadline is approaching, and the receipt of income to the individual entrepreneur’s account is not expected within a short time.

In any case, you need to register the deposit of your own funds correctly so that you do not have questions from the tax authority. Each transaction must be documented and correctly reflected in the company’s accounting. Depositing your own money into the individual entrepreneur’s cash register must be carried out in compliance with the requirements of the legislation on accounting and taxes.

Chart of accounts - basic concepts

The accounting chart of accounts is used in all individual entrepreneurs that keep records of financial and economic activities and make double entries.

When maintaining such a plan, the individual entrepreneur compares accounting indicators with the parameters of current reporting.

The chart of accounts is not used in banks and government agencies. This document is used in commercial companies and individual entrepreneurs.

When maintaining a chart of accounts - 2020, various non-state companies and individual entrepreneurs draw up a working chart of accounts. In such a document, individual entrepreneurs reflect 2 types of accounts - synthetic and analytical.

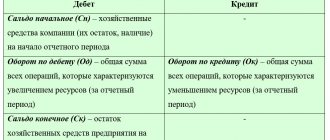

Depending on the type of business operation, accounting accounts are active (A), passive (P) and active-passive (AP).

Each account is a two-way table in which:

- on the left - debit (Dt);

- on the right is credit (Kt).

For some accounting accounts, Dt is an increase, Kt is a decrease, and for others, exactly the opposite.

Active accounts are accounts that record various funds of the company.

The balance for such an account is reflected according to Dt: an increase - according to Dt, a decrease - according to Kt.

Passive - accounting accounts that reflect the company's sources of funds. The balance is reflected by Kt: increase by Kt, decrease by Dt.

Active accounting accounts differ from passive ones in that:

- in all operations they have an opening balance for Dt, which reflects the availability of financial and other funds at the beginning of the calendar year;

- when using such accounting accounts, according to Dt, the funds of the individual entrepreneur increase, and according to Kt, they decrease;

- the final balance of such accounting accounts (A) is reflected only by Dt. Such a balance shows the amount of funds of the individual entrepreneur at the end of the calendar year.

Active-passive - accounting accounts that have a one-sided balance (by Dt or by Kt), a 2-sided balance (by both Dt and Kt).

If 1 balance is displayed from such accounting accounts, then it is considered final and summarizes the results of opposing business operations.

Thus, on line 99 “Losses and profits”, businessmen record both losses and profit indicators, however, at the end of a particular month they display the final financial result - profit (final balance - according to Kt) or loss (final balance - according to Dt).

In some cases, the final balance cannot be displayed in AP accounts. In such a situation, the closing balance differs from the accounting indicators.

In particular, accounting account 76 “Settlements with various creditors and debtors”, at first glance, can be replaced by 2 accounts: “Settlements with debtors” - active and “Settlements with creditors” - passive.

However, such calculations are reflected only in account 76, because daily changes occur in them - the debtor becomes a creditor and vice versa. As a result, splitting one 76 accounting account into 2 is considered an unnecessary action.

Video tips

Chart of Accounts 2020

The deferred tax liability upon disposal of an asset or type of liability for which it was accrued is written off from the debit of account 77 “Deferred tax liabilities” to the credit of account 99 “Profits and losses”.

Analytical accounting of deferred tax liabilities is carried out by type of assets or liabilities in the valuation of which a taxable temporary difference arose.

Account 77 “Deferred tax liabilities” corresponds with the accounts: By debit By credit 68 “Calculations for taxes and duties” 99 “Profits and losses” 68 “Calculations for taxes and duties” 78 Active-passive 79

- Calculations for allocated property

- Calculations for current transactions

- Settlements under a property trust management agreement

Account 79 “Intra-business settlements” Account 79 “Intra-business settlements” is intended to summarize information about all types

Accounting - 2020: a businessman drawing up a working plan for accounting accounts

Currently, all companies that use the simplified tax system are engaged in full accounting. In such a situation, an individual entrepreneur develops an accounting policy and a working accounting plan.

According to Federal Law No. 402 “On Accounting” dated December 6, 2012, individual entrepreneurs develop accounting policies using various federal and other standards.

In such a situation, individual entrepreneurs use the Accounting Regulations (PBU):

- 1/2008 - “Accounting policies of the company” (amendments were made in 2018),

- 5/01 - “Accounting for industrial equipment - inventories of various equipment”,

- 6/01 — “Accounting for OS”,

- 15/2008 — “Accounting for expenses on borrowed and credit funds”, etc.

In July 2020, amendments to the Law “On Accounting” dated December 6, 2011 No. 402-FZ came into force. The new PBU 1/2008 is valid in 2020. Thanks to these provisions, accounting can be maintained in accordance with international financial reporting standards. In particular, the new clause 7.3 provides for the right of an enterprise to deviate from the approved accounting rules if compliance with them leads to unreliable reflection of information about business activities.

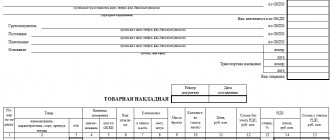

Businessmen in the company's accounting policies reflect specific forms of primary accounting.

Primary forms can be different, however, they must have the following details:

- name of the document (in particular, “Act of acquisition of valuables from the population”);

- date of document execution;

- IP company name;

- name of the business operation (in particular, “Purchase of commercial products”);

- various indicators of business operations (for example, “Quantity and cost of commercial products purchased by the individual entrepreneur”);

- job titles, signatures, surnames and initials of the individual entrepreneur employees who were involved in the preparation of a specific document.

In 2020, individual entrepreneurs may not use unified primary registration forms, however, businessmen can use them at will. Moreover, any unified form can be found in a special accounting program.

Businessmen draw up primary documents on paper and (or) on a computer - using an electronic digital signature (EDS).

In such a situation, businessmen draw up a document flow schedule that reflects the following information:

- which official, in what situation and within what time frame, draws up the primary document;

- which individual entrepreneur, when and at what time, transfers the primary data to the accountants;

- How long does it take for an individual entrepreneur’s accountant to process a document?

A similar schedule is a list of work on maintaining documents by various individual entrepreneurs. It is drawn up as an appendix to the Order on Accounting Policies.