Causes

In some cases, the statutory documentation of a non-profit organization may provide for termination of activities on a number of grounds:

- Achieving the goal for which the association was created.

- The time allotted for the activities of a non-profit organization, prescribed in the statutory documentation, has expired.

- Making a decision to liquidate the organs of the organization if its composition differs from the founders.

A court decision on liquidation may be caused by the following reasons:

- The non-profit organization has repeatedly violated the legal provisions provided for by law, and their restoration is not possible.

- The scope of the activities carried out does not correspond to the tasks provided for by the charter.

- Failure of the organization to comply with court orders.

- Suspicion of the founders or the entity itself of extremism.

As for voluntary liquidation initiated by the founders or a body formed by the charter, the reasons for its introduction may be the following:

- material support is insufficient for further implementation of activities;

- the intended goals and objectives cannot be achieved;

- the area of activity, policies or strategies associated with the operation changes.

Moreover, the reason for liquidation may be bankruptcy.

In this case, not only the founders, but also other structures - the Federal Tax Service, the Pension Fund of the Russian Federation, etc. - become the initiators.

Liquidation of a non-profit organization

The liquidation of a non-profit organization, despite its activities and registration features, is practically no different from the termination of the activities of another legal entity.

Methods

There are several ways to terminate the activities of a non-profit organization:

- voluntary – if the decision on liquidation is made by the founders;

- forced - the application to initiate the procedure is accepted by the authorized body;

- bankruptcy - by filing an application by creditors.

The dismissal of employees during the liquidation of an organization is regulated by the Labor Code of the Russian Federation.

Voluntary termination of activity

Voluntary termination of the activities of an NPO occurs in the following order:

- The founders of the NPO decide to liquidate the structure.

- A liquidation commission is being formed .

- A notice about the liquidation of an NPO is published in the media.

- An interim liquidation balance sheet is drawn up.

- The balance is approved by the meeting of founders.

- Settlements with creditors are made according to the interim balance.

- The final liquidation balance sheet is drawn up.

- An application to register the liquidation of an NPO is submitted to the Federal Tax Service.

- The necessary changes are being made to the Unified State Register of Legal Entities.

The decision on liquidation must be drawn up in the form of a protocol, which lists all members of the liquidation commission by name, and determines the time frame for liquidation, as well as the time period for filing claims by creditors - this period must be at least 2 months. A sample protocol can be viewed here.

After the deadline for submitting claims, an interim balance sheet is drawn up - this is a document that reflects a list of all claims, the amount of previously considered and repaid creditor claims and information about the assets of the liquidated NPO. To form an interim balance sheet, members of the liquidation commission make an inventory of the property of the non-profit organization (real estate, bank accounts, office furniture and office equipment). If necessary, appraisal reports are drawn up. A notification about the formation of an interim balance sheet is drawn up in form P15001 and sent to the Federal Tax Service department.

If the NPO's cash is insufficient to pay all creditors, members of the commission organize an auction to sell the NPO's property, the estimated value of which exceeds 100,000 rubles; the remaining property is sold without bidding.

Payments to creditors are made in the following order:

- from the moment the interim balance is approved, compensation for damage caused , as well as arrears of wages and dismissal benefits are paid;

- a month after the balance is approved, payments for utilities, tax payments, fines are made, and debts to credit organizations are paid.

The remaining funds after payments are directed to charity, the statutory purposes of the liquidated NPO, or sent to the municipal budget. An application for registration of liquidation of an NPO is filled out using form P16001, which is submitted to the Federal Tax Service along with the final liquidation balance sheet, a receipt for payment of state duty and a certificate from the Pension Fund.

An entry on the liquidation of an NPO in the Unified State Register of Legal Entities is made within 10 working days.

Forced liquidation of NPOs

Forced liquidation of a legal entity can be carried out by authorized persons and only if there is a basis for these actions. The decision on the forced liquidation of an NPO is made by an arbitration court. Tax authorities, law enforcement agencies, as well as representatives of other organizations can file a claim there.

The following information can be used as grounds that indicate that the liquidation of an NPO must be carried out:

- The NPO has either been found to have committed illegal actions at one time or several times, which are contrary to the current rules and regulations of the law.

- During the next audit of activities, serious violations were identified, the elimination of which is not possible without liquidating the NPO.

- When analyzing the activities, it was revealed that the current work has serious differences from those activities and goals that were previously specified in the organization’s charter, as well as in other important documents.

- Members of society were suspected of extremism, as well as other illegal actions, which must necessarily entail appropriate punishment.

How to close a public organization with a zero balance

> > Organizational and legal form Purpose of activity Public and religious organizations (associations) To satisfy spiritual or other non-material needs Communities of indigenous peoples Protecting the environment, preserving traditions when united by consanguinity or territoriality Cossack societies To preserve culture, perform state or other service .

For the revival of the Cossacks Funds For the implementation of social, charitable, cultural, educational, etc. projects State corporation For socially useful, managerial functions State company For the provision of public services Non-profit partnerships For all purposes provided for by law. If the company did not engage in farming, the balance will be at zero, but this does not apply to all parameters.

For example, the authorized capital cannot be less than 10,000 rubles.

Attention: It is important to submit a special notification to the tax authority.

Step 4 The liquidator or the chairman of the commission can act as an applicant for the liquidation of an LLC with a zero balance. To carry out the process, the following documents are required, which are submitted to the registration authority.

Liquidation Account Statement. An application drawn up according to a special form P16001.

It is important to have it certified by a notary.

Liquidation type balance sheet. Receipt for payment of state duty.

How to liquidate an NPO with a zero balance yourself.

Who can be the liquidator during the liquidation of an NPO? Procedure for using property

Liquidation of a non-profit organization is a common phenomenon.

Considering that this form of organization is a legal entity, the process must be carried out in accordance with the current legislation of the Russian Federation. In particular, the procedure is regulated by provisions from the Civil Code, as well as a number of laws and decrees. We will consider the main reasons why an NPO may be liquidated, as well as the procedure for action in this case.

So, first of all, it is necessary to establish who can act as an initiator in the event of liquidation of an NPO and for what reasons.

If the message comes from the founders, then the motivation is quite clear and transparent:

- The period allotted for the activities of the organization, prescribed in the charter, has expired.

- The NPO achieved the purpose for which it was opened.

- There is inappropriateness of further functioning (insufficient funding, inability to achieve set goals, etc.)

Also, the state and individual authorized bodies can act as initiators.

In this case, the reason for liquidation may be:

- Incorrect registration procedure for NPOs, etc.

- Reluctance to correct wrongdoings.

- Systematic violation of the law.

In addition, the reason may be bankruptcy, claims from the Pension Fund, creditors and other interested parties who have suffered damage. If we draw a parallel between the closure of a commercial legal entity and an NPO, we can notice many similarities.

Powers of the liquidation commission (liquidator)

The main responsibilities of the liquidator are summarized in the table.

| Authority | Implementation period | |

| Notification of the Ministry of Justice on the election of a liquidator | After its creation | Clause 3 Art. 20 of Law No. 129-FZ |

| Publication of an announcement about the start of the procedure | After sending notice of liquidation | Clause 1 Art. 63 Civil Code of the Russian Federation, clause 1, art. 19 of Law No. 7-FZ |

| Managing the affairs of an NPO, speaking on its behalf in court | During the period from appointment to completion of the procedure or initiation of bankruptcy proceedings | Clause 4 art. 62, paragraph 7, art. 63 Civil Code of the Russian Federation |

| Identification and notification of creditors individually | After 2 months after publication | |

| Receiving accounts receivable | Clause 2 Art. 63 Civil Code of the Russian Federation, paragraph 2 of Art. 19 of Law No. 7-FZ | |

| Preparation of an interim LB, its submission to the Ministry of Justice | Not earlier than the circumstances listed in paragraph 4 of Art. 20 of Law No. 129-FZ | Clause 3 Art. 19 of Law No. 7-FZ, paragraph 3 of Art. 20 of Law No. 129-FZ |

| Carrying out settlements with creditors | Clause 5 Art. 63, art. 64 Civil Code of the Russian Federation, paragraphs. 4, 5 tbsp. 19 of Law No. 7-FZ | |

| Fulfillment of tax obligations | Clause 1 Art. 49 Tax Code of the Russian Federation | |

| Filing for bankruptcy, notifying creditors of bankruptcy | If there is insufficient property | pp. 3, 4 tbsp. 63 Civil Code of the Russian Federation |

| Preparation of LB and its presentation with a statement according to f. 16001 to the Ministry of Justice | Clause 6 Art. 19 of Law No. 7-FZ, Art. 21 of Law No. 129-FZ, appendix. 9 to order No. ММВ-7-6/ |

In relations with third parties, the liquidator acts on the basis of the decision (protocol) on his election.

Participants (founders) are obliged to:

- Within 3 days, inform about the decision made (Clause 1, Article 20 of Law No. 129-FZ).

- Approve LB (clauses 3, 6, article 19 of law No. 7-FZ). If this is evaded, the liquidator has the right to go to court (see the decision of the Snezhinsky City Court of the Chelyabinsk Region dated September 21, 2017 in case No. 2a-482/2017).

Step-by-step instruction

Step-by-step instructions for terminating the activities of a non-profit organization is one of the issues related to the liquidation of an association.

It is important that the instructions consist of several stages that must be carried out step by step.

Stages

The procedure for terminating the activities of an NPO includes a number of stages.

These include:

- Holding a general meeting. It makes a decision to liquidate the association. The first stage may consist of a trial, the result of which is the adoption of a resolution to terminate the organization's activities.

- Selection of a liquidator - chairman of the liquidation commission. An individual or a group of individuals may be nominated. Subsequently, all issues based on the termination of functioning are considered by the chairman and the commission. The result of the meeting is recorded in the minutes, after which it is certified by the signatures of each participant.

Within three days after the meeting, an application (form RN0005), the compiled minutes of the meeting at which the decision on liquidation was made, and the minutes of the meeting approving the candidacy of the liquidator are sent to the department of the registration authority.

Additionally, the following documents are attached:

- registration certificate;

- certificate of registration with the tax authorities;

- TIN certificate;

- extract from the register;

- passports of all members of the liquidation commission.

Further actions:

- Publication of the relevant notice in the media. So that interested parties can obtain information about the termination of the activities of a non-profit organization, a message is submitted to the Bulletin. In the advertisement, it is important to indicate: the name of the non-profit organization, the time for submitting claims related to debts (at least 60 days), information for contacting representatives of the non-profit organization. Documents confirming publication must be kept in the archives of the liquidation commission until the completion of the procedure.

- Formation of an interim liquidation balance sheet.

- If there are debts, the next step is settlement with creditors.

- Formation of liquidation balance sheet. If there are no debts, then it will fully correspond to the interim balance.

- Payment of state duty, the amount of which is 800 rubles. It is not paid if the liquidation of a non-profit organization occurs through bankruptcy proceedings.

- Exclusion of an organization from the register. This stage is final.

Solution

The decision to terminate the activities of the enterprise is made at the general meeting of founders. The result is the formation of a protocol.

It will only be valid if there are signatures from each participant.

The decision can be made by the arbitration court if an insolvency procedure is introduced against the organization. At the same time, the observation stage begins.

A sample decision to liquidate an organization is here.

Notification

Notification of the termination of the activities of a non-profit organization is sent to all interested parties, as well as creditors who may make demands for repayment of debts.

In accordance with the received requirements, a register of requirements is formed.

Interim balance

An interim liquidation balance sheet is required to match the assets and liabilities of the organization.

Once drawn up, it must be approved by the body that made the decision to terminate the activities of the non-profit organization.

Using the balance sheet, it will be possible to systematize profits and expenses and facilitate an audit by the tax authorities, if the relevant authority decides to carry it out.

A sample of filling out the interim liquidation balance sheet is here.

Calculation

The calculation will be carried out after compiling a register of creditors' claims within the specified time frame.

Initially, funds are paid to NPO staff, after which debts are repaid to non-governmental organizations, and then to other citizens and companies.

If there is disagreement with the creditor’s requirement, then the issue that has arisen can be resolved through the courts.

In a situation where capital funds are insufficient to repay debts, the liquidator’s property is sold.

Dismissal of employees

Employees must be notified of the upcoming layoff two months prior to liquidation.

For these purposes, notices are sent to them against signature, and at the same time the dismissal is reported to the social security authorities.

A sample notice of dismissal to employees due to liquidation of the organization is here.

Exclusion from the Unified State Register of Legal Entities

The completion of the procedure for terminating activities in 2020 is the exclusion of the non-profit organization from the register of legal entities.

Liquidation of NPOs through the Ministry of Justice: procedure, first steps

The procedure for abolishing an association is carried out in the following order:

- A general meeting of the founders of the NPO is held, following which a decision is made to terminate its activities. It must be documented; for this purpose, minutes of the meeting are drawn up. In addition, at the meeting it will be necessary to determine the list of members of the liquidation commission and also include it in the minutes (clause 3 of article 18 of the law “On Non-Profit Organizations” dated January 12, 1996 No. 7). From this moment on, all rights and responsibilities for managing the organization pass to this commission.

- Within 3 working days from the moment the decision on liquidation is made, an application drawn up in the form P15001 is submitted to the territorial branch of the Ministry of Justice of the Russian Federation (Clause 1, Article 20 of the Law “On State Registration...” dated 08.08.2001 No. 129-FZ). This is the key difference between the liquidation procedures for a commercial and non-profit organization: in the first case, the application is submitted to the Federal Tax Service, and not the Ministry of Justice.

- Information about the upcoming liquidation is published in an open source - the journal “Bulletin of State Registration”. The message also contains information on the timing and procedure for dissolving the association. This period, according to paragraph 1 of Art. 19 of Law No. 7, must be at least 2 months from the date of publication of the message.

- A register of the company's creditors is compiled, which includes information about all legal entities or individuals to whom the NPO has accumulated debt.

Close an NPO with a zero balance

Posted on by Organizational and legal form Purpose of activity Public and religious organizations (associations) To satisfy spiritual or other intangible needs Communities of indigenous peoples Protection of the environment, preservation of traditions when uniting on a consanguineous or territorial basis Cossack societies To preserve culture, serve state or other services.

For the revival of the Cossacks Funds For the implementation of social, charitable, cultural, educational, etc.

projects State corporation For socially useful, managerial functions State company For the provision of public services Non-profit partnerships For all purposes provided for by law. In the event that the company did not engage in farming, the balance will be at zero, but this does not apply to all parameters. For example, the authorized capital cannot be less than rubles.

- An application drawn up according to a special form P16001.

- Liquidation Account Statement.

It is important to have it certified by a notary.

- Liquidation type balance sheet.

- Receipt for payment of state duty.

It is 800 rubles.

To liquidate an LLC, you need to organize a tax audit. It is carried out in order to identify tax evasion. Federal Law “On State Registration...”) by sending a notification in the approved form;

- in the magazine "Vestnik"

- creditors are notified of the upcoming liquidation;

Liquidation of ANO is carried out in the following order:

- Firstly, a meeting of the highest management body is convened, at which a decision is made to begin the liquidation procedure of the autonomous non-profit organization and to elect a liquidation commission (liquidator). From the moment the liquidation commission (liquidator) is elected, all powers to manage the affairs of the ANO are transferred to her/him. Next, a notice of the beginning of the liquidation procedure in form P15001 is filled out and certified by a notary and submitted along with the protocol to the territorial body of the Ministry of Justice of the Russian Federation. In Moscow, documents must be submitted to the Main Directorate of the Ministry of Justice of the Russian Federation for Moscow.

- Secondly, after the deadline for entering information about the liquidation of an ANO into the Unified State Register of Legal Entities and receiving documents has expired, the ANO makes a publication about its liquidation, the procedure and deadline for filing claims by its creditors in the journal “Bulletin of State Registration”. This period cannot be less than 2 (two) months.

- Thirdly, after the expiration of the period allotted for submitting creditors’ claims, the liquidation commission/liquidator draws up an interim liquidation balance sheet, which is approved by the highest management body of the ANO. Next, a notification about the preparation of an interim liquidation balance sheet in form P15001 is filled out and certified by a notary and submitted together with a protocol on its approval to the territorial body of the Ministry of Justice of the Russian Federation.

- Fourth, after completing settlements with creditors, the liquidation commission/liquidator draws up a liquidation balance sheet, which is approved by the highest management body of the ANO. At this stage, all necessary reconciliations are carried out with the Federal Tax Service and extra-budgetary funds so that the ANO does not have any debt. If there is no debt to the budget, you can begin to close your current account with a bank or other credit institution. Next, a notice of liquidation in form P16001 is filled out and certified by a notary and submitted, along with a protocol on its approval and other necessary documents, to the territorial body of the Ministry of Justice of the Russian Federation.

Important! The liquidation of an autonomous non-profit organization is considered completed after information about its termination is entered into the unified state register of legal entities. Due to the fact that the territorial bodies of the Ministry of Justice have longer deadlines for making decisions, the period for liquidating an autonomous non-profit organization will be on average 6 (six) months.

In practice, if the ANO is zero, then you can combine stages 3 and 4 into one and submit all the necessary documents to the territorial body of the Ministry of Justice of the Russian Federation at the same time.

How to liquidate an NPO with a zero balance yourself. Liquidation of NPOs: how it happens

09/24/2020 Sometimes it becomes necessary to close an autonomous non-profit organization.

Amateurs may think that the liquidation process is simpler, which is completely wrong. In order for the liquidation of an autonomous non-profit organization to take place quickly and legally, you need to know many nuances. We will talk about them below. Autonomous is created not for the purpose of making money by the creator, but for socially significant work.

Such companies can operate in the fields of sports, science, medicine, and law. Liquidation of ANPO can be carried out either by government agencies. In the first case, the closure is considered voluntary, and in the second - forced.

First of all, a decision must be made to close.

It is adopted at a meeting of founders by a majority vote or by government agencies that are authorized to do so.

For liquidation to be legal, notices must be sent to all founders. And only after this can the procedure begin. At the first stage, the documents necessary for liquidation are collected.

This includes the preparation of the following papers:

- State registration certificate. Composition of the executive staff. Information about all founders. Extract from the Unified State Register of Legal Entities (photocopy of the document). Phone, mail and fax of the organization.

If the accounts for the last year before closing were nil, the accountant's contact details will be required. Then the following is carried out sequentially: A meeting of the liquidation commission, which will take over the procedure for closing the ANPO.

Liquidation of a non-profit organization by court decision

In accordance with paragraph 3 of Art. 61 of the Civil Code of the Russian Federation, state bodies with the appropriate powers can apply to the court with a claim for the forced liquidation of an NPO.

These bodies include:

- prosecutor's office (clause 1.1 of article 18 of law no. 7);

- departments of the Ministry of Justice of the Russian Federation (clause 1.1 of article 18 of law No. 7);

- tax authorities (Clause 11, Article 7 of the Law “On Taxes...” dated March 21, 1991 No. 943-I).

Only the Prosecutor General of the Russian Federation can apply for the liquidation of an all-Russian social movement or NGO of international level (Part 3 of Article 44 of the Law “On Social...” dated May 19, 1995 No. 82). The prosecutor of a constituent entity of the Federation may file a corresponding application in relation to regional and local NPOs (Clause 1.1, Article 18 of Law No. 7). Prosecutors of cities and districts do not have the right to take such an initiative. Branches of the Russian Ministry of Justice have similar rights.

The legal grounds for the forced liquidation of NPOs are established in paragraph 3 of Art. 61 Civil Code of the Russian Federation. An association may be abolished by court if:

- achieving the goals for which the organization was created becomes impossible;

- during the creation of the NPO, gross violations of the law were committed that were irreparable;

- The NPO carried out activities subject to mandatory licensing without obtaining permits;

- The NPO carried out activities that violated existing legislative norms (including constitutional ones);

- the activities of the NPO do not correspond to its statutory goals;

- There are other grounds provided for by current federal laws.

So, answering the question of how to close a non-profit organization, it is worth familiarizing yourself with the norms of civil legislation, as well as the provisions of Law No. 7, which determines the procedure for the functioning and abolition of non-profit associations. The grounds for liquidation of an NPO may be an independent decision of its founders or a court decision made on the basis of consideration of an application from an authorized government agency (prosecutor's office, tax authority or territorial branch of the Ministry of Justice). The procedure for liquidating a non-profit organization, step-by-step instructions for implementation of which are given above, is required to be followed by associations of all organizational and legal forms.

Grounds for liquidation of an NPO

NPOs can be liquidated voluntarily, forcibly (through the court), including through bankruptcy . The closure procedure largely depends on the basis on which it is carried out.

| Grounds for closing an NPO (under Article 61 of the Civil Code of the Russian Federation) | ||

| voluntarily | through the court | through bankruptcy |

| Decision of the participants (founders, body of the legal entity), including due to: expiration of the NPO's operational life; achieving the purpose for which it was created | Claim by a government agency (local government body) in situations where: state registration of a legal entity is considered invalid; there is no license to conduct activities; the norms of laws and the Constitution have been violated; prohibited activities were carried out, etc. | Legal entities are declared bankrupt by court order and liquidated on this basis in accordance with Federal Law of the Russian Federation No. 127 of October 26, 2002, i.e. when there are not enough own funds and the NPO is not able to pay off accumulated debts |

Important! The closure of a non-profit organization is carried out through the Ministry of Justice of the Russian Federation (and its territorial bodies).

You can contact the Ministry of Justice or its territorial bodies directly for all questions related to the state registration of NPOs. For example, in Moscow you can come for an appointment according to the approved schedule at the Department for Non-Profit Organizations (Krzhizhanovskogo St., 7, building 1).

Features of the liquidation of certain types of NPOs

Provisions of Art. 18 of Law No. 7 establishes special rules for the liquidation of the following types of NPOs:

- Funds. According to paragraph 2 of Art. 18 of Law No. 7, they can only be abolished by a court decision. The grounds for the foundation to terminate its activities are:

- lack of funds and/or property for the normal functioning of the fund and the lack of sources from which such funds could be obtained;

- the impossibility of realizing the goals for which the NPO was created, provided that they cannot be changed by making appropriate adjustments to the constituent documents;

- carrying out activities by the fund that contradict its statutory goals, etc.

- Branches of a foreign NPO that has non-governmental status. According to clause 2.1 of Art. 18 of Law No. 7, the grounds for their liquidation may be:

- liquidation of the parent non-governmental foreign NPO;

- failure to provide information required by law;

- inconsistency of the activities of the association with the goals of its creation, as well as with the information presented in accordance with the law.

How to close a public organization with a zero balance

Free legal advice: All Russia

Free legal advice: An NPO (non-profit organization) is an association created for specific purposes.

They can be social, civil or charitable. A non-profit organization does not make profit or distribute it among its members. Income in a non-profit organization is possible, but it can only be spent on the purposes specified in the charter. In other words, NPO participants cannot use it in the form of net profit for personal purposes, with rare exceptions provided for in Article 116.

GK. For example, an educational institution can conduct business in the form of providing paid training services or renting out premises.

However, a non-profit organization is a legal entity, which means it must be registered and, if necessary, liquidated in accordance with the procedure established by law. Free legal advice: Organizational property can also be purchased with money received from membership dues.

If liquidated, it cannot be returned.

Membership contributions can be made not only in the form of finance, but also in any form permitted by the charter. Liquidation means a complete stop of activities and the cessation of the existence of a given association. The procedure can be carried out on the initiative of the founders of a non-profit organization (non-profit enterprise) or by a court decision.

How to liquidate an NPO with a zero balance yourself. How does the liquidation of an autonomous non-profit organization (autonomous non-profit organization) proceed?

The abolition of an autonomous non-profit organization is carried out for various reasons.

Most often, this is the achievement of the goals for which the institution was created. Liquidation of ANO is carried out in accordance with the norms of the Civil Code of the Russian Federation.

The procedure involves going through a number of mandatory steps. The decision to close is made by the owners of the non-profit organization.

The process requires notifying the public of the termination.

However, the law does not oblige managers to report the reasons for the decision.

may be done for the following reasons:

- Financial insolvency;

- Lack of desire to engage in previous activities.

- Failure to achieve the goals for which the institution was created;

The procedure can be carried out by court order. However, this requires reasons. For example, violation of the law.

The closure of a non-profit autonomous organization can be carried out using the following methods:

- Compulsory, in which the event is carried out on the basis of a court decision;

- Voluntary, in which the procedure is performed based on the decision of the founders;

- Bankruptcy if there are signs of insolvency.

These are the official closing methods. They are accompanied by a waste of a lot of time and money.

If you need to speed up the event, you can pay attention to alternative methods:

- A change in the composition of the founders, in which the rights to the organization are transferred to the legal successors on the basis of a transfer deed;

Solutions in case of insufficient funds of a liquidated NPO

The order of repayment of debts is determined by Art. 64 Civil Code of the Russian Federation. Also in the Civil Code of the Russian Federation there is an indication that if the NPO does not have funds, the costs of the procedure are borne jointly by the participants or founders (clause 2 of Article 62 of the Civil Code of the Russian Federation).

If a shortage of funds is determined, the liquidation commission is authorized to sell the property of the NPO, guided by the procedure established for the execution of court decisions (clause 4 of Article 19 of Law No. 7-FZ). However, the proceeds may also not be enough.

The question arises: what to do in this case?

There is a general rule that provides for separate property liability of a legal entity and its founders without the possibility of assigning it to each other (Clause 2 of Article 56 of the Civil Code of the Russian Federation). However, for some NPOs, exceptions have been made and additional responsibility for the founders has been established:

- for a consumer cooperative - in the amount of the unpaid part of the contribution (clause 2 of Article 123.3 of the Civil Code of the Russian Federation);

- association or union - in accordance with the charter (clause 4 of article 11 of law No. 7-FZ, clause 3 of article 123.8 of the Civil Code of the Russian Federation);

- a private, government institution - always (clause 4 of article 123.22, clause 2 of article 123.23 of the Civil Code of the Russian Federation), budgetary, autonomous - according to the demands of individuals arising from a tort (clauses 5, 6 of article 123.22 of the Civil Code of the Russian Federation).

Submitting claims in the procedure for applying subsidiary liability falls within the powers of creditors, but not the liquidator (see paragraph 7 of Article 63 of the Civil Code of the Russian Federation, article “What is subsidiary liability under the Civil Code of the Russian Federation?”). The liquidator has the right only to initiate bankruptcy.

How to liquidate an NPO with a zero balance yourself

Employees are paid wages and other payments provided by law.

The dissolution of NPOs is subject to the general rules for terminating the activities of legal entities established by civil law. Step-by-step instructions for liquidating a non-profit organization in 2020 may vary depending on the grounds for which the organization is being liquidated.

Personnel working in a non-profit organization are dismissed according to the relevant article of the Labor Code, about which the necessary entries are made in the work books.

Based on the record, former employees can register with employment centers and, if work is not provided, receive unemployment benefits in the manner prescribed by law. Exclusion from the Unified State Register of Legal Entities Liquidation is not legally equivalent to exclusion from the Unified State Register of Legal Entities.

The organization completely ceases to exist upon liquidation from the moment it receives an extract from the Unified State Register of Legal Entities.

This extract indicates the registration of the liquidation of the NPO.

An exclusion from the Unified State Register of Legal Entities can be made if the legal entity did not provide reports during the year or did not carry out transactions on the bank account for the same period. The document is accompanied by the final liquidation balance sheet and a receipt for payment of the state duty (its amount is 800 rubles).

Based on the documents received, the Ministry of Justice makes an entry in the Unified State Register of Legal Entities about the termination of the activities of the NPO. From this moment on, the non-profit association is considered abolished.

Material obligations of NPO participants In the event that the association’s own funds are not enough to pay off existing debts, bankruptcy proceedings are carried out in relation to it.

In accordance with paragraph 2 of Art. 62 of the Civil Code of the Russian Federation, if the money available to an NPO is not even enough to carry out the liquidation procedure, the founders of the association must finance it themselves; material obligations are distributed jointly.

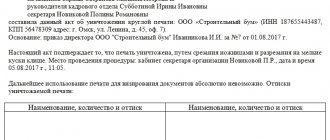

Sample protocol on liquidation of a non-profit organization

The minutes of the general meeting of participants of an NPO, containing a decision on its liquidation, may look like this:

PROTOCOL

general meeting of participants

NPO "Center for Personal Development"

01/10/2020 Yaroslavl

Agenda:

- On the election of the chairman and secretary of the meeting.

- On the liquidation of the company.

- On the creation of a liquidation commission.

- On the appointment of the chairman of the liquidation commission.

- On setting a period for liquidation.

Listened:

- On the first issue - about the election of A. I. Gutov as chairman of the meeting, and A. P. Ermolina as secretary.

- On the second question - about the inexpediency of further activities of the NPO and making a decision on liquidation.

- On the third issue - about the creation of a liquidation commission consisting of three people:

- Gutov Anton Ivanovich - director.

- Ermolin Alexey Petrovich - chief engineer.

- Odushkina Valentina Borisovna - chief accountant.

- On the fourth issue - about the appointment of Anton Ivanovich Gutov as chairman of the liquidation commission.

- On the fifth question - about setting the liquidation deadline until July 10, 2020.

Decided:

- Elect A. N. Gutov as chairman of the meeting, A. P. Ermolina as secretary. Voting results: for - 3; against - 0; abstained - 0.

- Liquidate NPOs. Voting results: for - 3; against - 0; abstained - 0.

- Create a liquidation commission consisting of three people:

- Gutov Anton Ivanovich - director.

Ermolin Alexey Petrovich - chief engineer.

- Odushkina Valentina Borisovna - chief accountant.

- Appoint Anton Ivanovich Gutov as chairman of the liquidation commission. Voting results: for - 3; against - 0; abstained - 0.

- Set the liquidation deadline to December 10, 2018. Voting results: for - 3; against - 0; abstained - 0.

Voting results: for - 3; against - 0; abstained - 0.

All issues on the agenda have been considered.

Chairman of the meeting /Gutov/ A. I. Gutov

Secretary of the meeting / Ermolin / A. P. Ermolin