» Opening an individual entrepreneur » Closing

When closing an individual entrepreneur, a businessman submits a tax return to the inspection of the Federal Tax Service of the Russian Federation within 5 working days from the date of making an entry about the termination of business in the Unified State Register of Individual Entrepreneurs. In this document, the merchant indicates specific information about his company - tax period codes when closing an individual entrepreneur, etc.

The individual entrepreneur submits the declaration document to the regulatory authority after state registration of the termination of business activities.

Its completion and submission deadline are related to the tax system used by the individual entrepreneur (General or simplified taxation system, UTII, Unified Agricultural Tax).

In such a situation, the tax period code of the individual entrepreneur is indicated both in the declaration itself and in payment orders. In the first documents, a 2-digit code is used, and in the second, a 10-digit code.

Both encodings indicate the tax period for which the individual entrepreneur pays tax.

- 2 Application of the IP general taxation system (OSN)

- 3 Use of the simplified taxation system (STS) by individual entrepreneurs

- 4 Application of the IP Unified Tax on Imputed Income (UTII)

- 5 Use of the Unified Agricultural Tax (USAT) by an entrepreneur

- 6 Penalties for late filing of an individual entrepreneur declaration

Individual entrepreneur reporting when winding down a business

Upon completion of business activities, the individual entrepreneur submits the following business papers to the regulatory authority - the inspection of the Federal Tax Service of the Russian Federation:

- application for state registration of an individual’s completion of activities as an individual entrepreneur in form P26001. If a businessman submits an application not himself, but through a proxy, then such an application must first be certified by a notary;

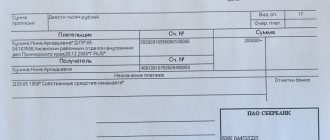

- receipt for payment of state duty (160 rubles).

Individual entrepreneurs must submit certain reports for their subordinates to the Pension Fund of the Russian Federation (PFR) and the Social Insurance Fund (SIF) before closing the company. In addition, the individual entrepreneur himself must deregister from the Social Insurance Fund. Only Pension Fund employees automatically deregister an individual upon receipt of information from the inspectorate about the completion of the merchant’s business activities.

In such a situation, a citizen of the Russian Federation pays fixed insurance premiums to the Pension Fund of the Russian Federation within 15 calendar days from the date of entering specific data into the Unified State Register of Individual Entrepreneurs about the suspension of the business activity of a citizen of the Russian Federation.

An individual entrepreneur can close his business at any time - the businessman submits a declaration document on the liquidation of the company, regardless of the reporting period in which he ceased his activities.

Application of the IP general taxation system (OSN)

When closing an individual entrepreneur, a businessman who uses the regular taxation system (OSN) submits a declaration to the Federal Tax Service of the Russian Federation in form 3-NDFL. In it, he indicates information about the income that he received in the period between the date of drawing up and submitting an application for state registration of the completion of business activities and the date of exclusion from the Unified State Register of Individual Entrepreneurs.

Then, within 15 calendar days from the date of filing 3-NDFL with the regulatory authority, the businessman pays the required amount of tax to the budget.

Also, when closing a business, an individual entrepreneur indicates a tax period code of 50 in the declaration document.

Individual entrepreneurs put down a similar code name when closing their office.

Code 50 means that the taxpayer provides information for the last calendar year.

What does it take to stop IP?

The termination of the functioning of an individual entrepreneur is regulated by legal acts and is carried out only in accordance with the established procedure. Otherwise, the activity will not be legally terminated. Therefore, you will need to submit reports in the future.

First, you must complete your activities and fulfill all your obligations. After this, an application with paid state duty is submitted to the tax office. Then you should submit reports when closing the individual entrepreneur. What period should I put in the declaration? We'll talk about this a little later. Now we note that the sample document depends on the taxation system on which the individual entrepreneur worked.

Using the simplified taxation system (STS) for individual entrepreneurs

According to the Tax Code of the Russian Federation, when liquidating a company, a businessman submits a declaration according to the simplified tax system (according to the simplified tax system) to the inspectorate of the Federal Tax Service of the Russian Federation before the 25th day of the month that follows the month of closure of the individual entrepreneur company.

In addition, at the same time, the merchant pays specific amounts of mandatory gratuitous payments to the treasury of the Russian Federation.

The taxpayer also submits a notice of termination of business activities to the regulatory authority no later than 15 days after the liquidation of his company.

At the same time, in accordance with Appendix No. 1 to the Procedure for entering specific data into the simplified declaration document, approved by order of the Federal Tax Service of the Russian Federation dated July 4, 2014, when closing his business, the businessman indicates the following codes:

- Code 50 - designation of the last tax period of the individual entrepreneur;

- Code name 34 - designation of the calendar year;

- Code 96 - the value of the last calendar year when liquidating the company of an individual entrepreneur who used the simplified procedure;

- Code name 0 - liquidation of the company.

Also, upon completion of the business, the merchant submits a zero simplified declaration (income) to the inspectorate.

In accordance with the tax legislation of the Russian Federation, businessmen submit such business paper to the inspectorate at their place of registration and before April 30 of the year following the previous calendar year.

At the same time, there are no other deadlines in the Tax Code of the Russian Federation for providing an individual entrepreneur with such business paper (including in the case of closing a business).

In such a situation, upon completion of business, the individual entrepreneur submits the declaration business paper before May 3 of the year following the previous calendar year.

Thus, an individual can submit a declaration document to the regulatory authority, no longer being an individual entrepreneur (after deregistration with the inspection of the Federal Tax Service of the Russian Federation in connection with the cessation of business as an individual entrepreneur).

However, according to the Ministry of Finance of the Russian Federation, upon completion of the activities of an individual as an individual entrepreneur, a citizen of the Russian Federation must provide a similar document to the regulatory authority and pay taxes to the treasury of the Russian Federation for the period in which he was engaged in business activities.

At the same time, in accordance with the Procedure for entering specific information into a simplified declaration document approved by the Federal Tax Service of the Russian Federation, the entrepreneur must indicate a tax period code equal to 50.

Sample filling

Filling out a liquidation declaration using the simplified tax system differs from the standard one only in that it has a different tax period code.

Otherwise, this document is formatted as a standard report. An incomplete tax period when closing an individual entrepreneur obliges you not to enter information during the period of “inactivity” and consider the last available value as the final value.

Entrepreneurs working under the “income” reporting scheme fill out sections 1.1, 2.1.1, 2.1.2; on expenses deducted from income - 1.2, 2.2.

When the difference between the semi-annual and quarterly AP is greater than zero, its value is entered in 040, less - in 050.

Filling 070 and 080 is similar.

“2” – no employees.

210 - business location.

Full name of the taxpayer or LLC name. The latter is entered in full (Limited Liability Company “Legal Company”) and duplicated in an abbreviated version (LLC “Legal Company”). Quotes are required.

Place a date and signature in the designated fields on each page.

Recommendations

You should worry about how to fill out the declaration correctly because mistakes in paperwork are punishable by a fine.

The necessary forms are downloaded from the Federal Tax Service website, where you can also find comments on entering information.

When submitting declarations, you should adhere to some rules:

- If there are errors in the declaration, they cannot be corrected - you must rewrite the document again. If inaccuracies are discovered after submission, additional paper is sent to the tax office, where in the “correction number” paragraph they put “1–,” “2–,” and so on.

- The values of the amounts are indicated in natural numbers. Pennies are rounded according to the rules of mathematics.

- The use of spaces or punctuation marks is prohibited. Dots (“.”) are placed only in the separation of day, month and year for the “date” field and to indicate the tax rate (6.0).

- Duplex printing is prohibited. The sheets are placed in a file separately from each other without being fastened. Only completed pages can be numbered.

- “Manual” filling out of the declaration according to the simplified tax system is carried out using a black, blue or purple colored pen, in large block letters. Dashes are placed in empty fields.

- When entering data on a computer, use the 16–18 font Courier New. Do not put dashes in empty acquaintances. Alignment of numbers is to the right.

Application of the Individual Individual Tax on Imputed Income (UTII)

When winding down a business, the merchant submits an application to the inspectorate using the UTII-4 form.

In addition, an individual entrepreneur who has closed his business submits a declaration document to the regulatory authority and pays taxes to the treasury of the Russian Federation within the usual time limits, no longer being a merchant - until the 20th day of the month that follows the reporting month.

In such a situation, the merchant stops conducting business on UTII and ceases to be a UTII payer.

The businessman submits the UTII-4 application within 5 days after making an entry in the Unified State Register of Individual Entrepreneurs about the liquidation of the individual entrepreneur.

According to the recommendations of the heads of departments of the Federal Tax Service of the Russian Federation, when liquidating a company, it is better for a businessman to submit the necessary reports and pay taxes to the treasury of the Russian Federation before the state registration of the termination of business activity - before entering information about this fact in the Unified State Register of Entrepreneurs.

Also, according to information from Appendix No. 1 to the Procedure for entering information into the UTII declaration, established by order of the Federal Tax Service of the Russian Federation dated July 4, 2014, a businessman who pays UTII when closing a business in such a document indicates the following codes:

- Code 50 - designation of the last tax period of the individual entrepreneur;

- Code value 55 - designation of the third quarter during the liquidation of the company;

- Code 56 - designation of the fourth quarter during the liquidation of the company.

Closing an individual entrepreneur's business on UTII is not considered a cancellation of debts to the budget.

In such a situation, when liquidating an individual entrepreneur, the merchant submits a liquidation declaration to the inspection of the Federal Tax Service of the Russian Federation and pays UTII to the treasury for the last quarter in which he was engaged in business activities.

Such a document is submitted by individual entrepreneurs before drawing up an application or after the end of the tax period.

In such a situation, an individual entrepreneur cannot submit a “zero” UTII declaration.

If a citizen of the Russian Federation closes a company before the end of the quarter, a zero value for the physical indicator is set for those days and months in which the citizen of the Russian Federation was not engaged in business.

If in one of the months the individual entrepreneur worked partially, the calculation of the physical indicator includes the number of days starting from the day the individual is registered as an individual entrepreneur or until the day on which the tax authorities delete all data about the entrepreneur from the Unified State Register of Individual Entrepreneurs.

Declaration on the simplified tax system

Filing a declaration when closing an individual entrepreneur is mandatory in this case as well. In Art. 346.23 of the Tax Code of the Russian Federation talks about when this should be done. The deadline is considered to be the 25th day of the next month after the month in which the activity was completed, and a corresponding entry was made in the Unified State Register of Individual Entrepreneurs.

The declaration is submitted in paper or electronic form. The sample used for this is the same as when filling out the document in the usual case. The sections that are filled in in this case are:

When filling out the document, you should consider the following nuances:

Use of the Unified Agricultural Tax (USAT) by an entrepreneur

Businessmen - taxpayers of the Unified Agricultural Tax, upon completion of business activities as agricultural producers, submit a declaration by the 25th day of the month, which follows the month of closure of the individual entrepreneur company.

If the day of submission of the declaration to the regulatory authority falls on a Saturday, Sunday or holiday, then the merchant submits it during business hours.

According to Appendix No. 1 to the Procedure for entering data into the declaration document for Unified Agricultural Tax, approved by order of the Federal Tax Service of the Russian Federation dated July 28, 2014, a businessman who is a taxpayer of Unified Agricultural Tax when liquidating an agricultural enterprise indicates the following codes:

- Code value 50 - designation of the last tax period of the individual entrepreneur;

- Code 34 - designation of the calendar year;

- Code name 96 - designation of the last calendar year at the end of the business activities of the individual entrepreneur who applied the Unified Agricultural Tax.

Also, according to Appendix No. 2 to the Procedure for entering data into the declaration under the Unified Agricultural Tax, established by the Federal Tax Service of the Russian Federation, the entrepreneur indicates the following company liquidation codes:

- 1 - when transforming a company;

- 2 - when merging companies;

- 3 - when dividing an organization;

- 5 - when one company merges with another;

- 6 - upon division and simultaneous merger of one company with another;

- 0 - upon liquidation of the company.