In what situations is this possible?

There are several most common reasons for closing an individual entrepreneur:

- independent decision of the entrepreneur;

- his death;

- the court's decision;

- expiration of the validity period of the document that is the basis for legal stay on the territory of Russia (for foreigners);

- bankruptcy.

You can close an individual entrepreneur through the MFC in the following situations:

- If the entrepreneur has made an independent decision to terminate his activities. In this case, you will need in advance:

- submit reports to the Federal Tax Service;

- pay debts on taxes, fines and penalties;

- fire employees;

- terminate contracts with partners;

- close bank accounts;

- deregister the cash register, if any.

- In the event of the death of the entrepreneur. Deregistration is carried out automatically after submitting documents confirming the fact of the individual entrepreneur’s death to the tax authorities through the MFC. The corresponding certificate can be obtained from the registry office.

If a foreigner’s visa expires, information about this is sent to the tax office. Registration automatically becomes invalid. This also applies to the court decision. The entrepreneur’s activities are terminated from the day the verdict is rendered.

Closing a business in Moscow

Step-by-step instructions on how to close an individual entrepreneur in 2020 that operated without employees in Moscow differ little from the rules in force in other regions.

- fill out an application on form No. P26001;

- print and pay the state fee on the tax office website;

- visit in person the Tax Inspectorate, which is located in Moscow, and provide the specified documents.

Interesting! Under any circumstances, the tax authority requires 5 days from the date of filing the application to terminate business activities to make a decision.

The applicant must personally appear at the tax authority to pick up the Unified State Register of Individual Entrepreneurs (USRIP) sheet. You can also liquidate a business on the official website of the Tax Service of the Russian Federation.

It is important to understand that after the termination of the activities of an individual entrepreneur, the certificate should be kept for another 4 years from the date of receipt. Also, tax books, contracts, information on expenses and income are subject to storage. These documents may be needed at any time, so you should be careful and keep them in a visible place for four years.

Advantages of liquidation through a multifunctional center

Closing an individual entrepreneur through the MFC has a number of advantages:

- convenient office hours (daily from 8 a.m. to 8 p.m.);

- access to information about the location of the center’s offices on the region’s website;

- the ability to submit documents at any branch of the MFC, regardless of the address of permanent registration;

- provision of consultations by center specialists;

- no need to visit many authorities, because service is available in a “single window” mode;

- the ability to receive several services at the same time.

The main advantage of customer service at the MFC is the absence of queues. The whole procedure takes about 15 minutes.

The period for obtaining results through the MFC is longer than when submitting an application independently. The delay occurs due to additional time spent on document flow between the organization’s branch and the tax service. At the same time, the center’s specialists are not able to predict the result in advance.

Termination of individual activities without staff - instructions

For those individual entrepreneurs who did not make insurance payments for their employees and operated without them, the procedure for closing a business is simple.

In 2020, the following step-by-step instructions will apply on how to close your own business:

- first of all, you need to close the current account that was used in doing business;

- submit the necessary documents to the body responsible for registration and liquidation of entrepreneurship;

- after which a corresponding note is made in the Unified State Register of Individual Entrepreneurs;

- It is important to pay all insurance premiums.

You can submit documents to the tax office at your place of residence in several ways:

- visit the organization in person or transfer documents through a proxy (there must be a power of attorney certified by a notary);

- submit documents to the MFC by visiting in person or through a representative;

- hand over to a notary, who will certify them and send them to the tax authority;

- send a letter by mail (it is important to choose a letter with a declared value and fully describe the attachments);

- on the government services website, if there is an electronic signature of documents.

For reference! You can also submit documents using the courier service Pony Express or DHL.

However, it is important to understand that a personal visit to a tax office will allow you to consider your application much faster.

Step-by-step instructions for closing an individual entrepreneur through the MFC

The key difference between the liquidation of an individual entrepreneur and the closure of a legal entity is the ability to terminate activities even if there are debts to counterparties, the budget, or the Pension Fund of the Russian Federation. The fact of debt will not be checked by the MFC, and if it is identified by the Federal Tax Service, there will be no refusal to close the individual entrepreneur. However, if after the closure of the individual entrepreneur there are still debts, they can be collected from the individual.

You can close an individual entrepreneur not only at the place of registration, but also through any division of the MFC. Before contacting the MFC, you need to fill out the application form P26001.

The further algorithm of actions for closing an individual entrepreneur through the MFC is as follows:

- you need to select an MFC to apply for a public service;

- Application P26001 and a set of required documents are submitted to the MFC specialist;

- upon receipt of documents, a receipt with an identification code is issued;

- On the appointed date, you need to go to the MFC and pick up the documents (you can choose the option of delivery by mail or express service for a fee).

Before contacting the MFC, you need to terminate employment contracts with staff and close accounts. Failure to do so may result in penalties for violating the law.

STEP 1. Prepare documents

You must submit to the MFC:

- Passport of a citizen of the Russian Federation.

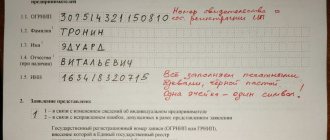

- Application for termination of activities as an individual entrepreneur in form No. P26001 (). The form can be filled out manually or using a computer. The procedure for completing the application is approved by Order of the Federal Tax Service of Russia dated January 25, 2012 No. ММВ-7-6/ [email protected] Please note : the form must be signed in the presence of an MFC employee. If documents are submitted through an authorized representative, then the individual entrepreneur’s signature on the application must be notarized.

- A receipt confirming payment of the state duty. At the initiative of the applicant (if the individual entrepreneur had hired employees), the following is additionally submitted:

- A certificate from the Pension Fund of the Russian Federation, indicating that the entrepreneur has submitted individual personalized information regarding his employees (form SZV-STAZH, accompanied by the inventory EDV-1).

Note: if this document is not submitted, the tax authority will receive information from the Pension Fund of Russia upon an interdepartmental request in electronic form.

Document submission options

There are several ways to submit documents.

- Personal visit to the MFC . The advantage of this method is that the applicant can be confident in submitting documents. He also has the right to receive any advisory support. The downside is that the method requires a certain amount of time.

- Personal appeal to the tax office . This method is considered the most preferable, since tax authorities will be able to check all debts and make a rational, informed decision on the liquidation of the individual entrepreneur or refusal.

- Contact the website of government services or the Federal Tax Service . These services allow you to solve many problems simultaneously and do it in the shortest possible time.

- Sending a letter by mail . The advantage of this method is that the procedure does not take long. The downside is the likelihood of delays during the document transportation process.

- Action through an attorney . The advantage is that there is no need for the applicant’s personal presence. The disadvantage is that you need to draw up a power of attorney and have it certified by a notary.

How a set of documents is submitted is up to each entrepreneur to decide for himself. The main thing is that this does not contradict the law and does not cause additional inconvenience.

What documents are needed to close an individual entrepreneur using the MFC?

In order to cancel a business activity in 2020, you need to provide the following documents:

- citizen's passport (original and copy);

- TIN (original and copy);

- application for termination of activities as an individual entrepreneur (form No. P26001), in which you must indicate your full name, OGRNIP, INN, contact phone number, email, a note about who will receive the documents after the process (or the document will be sent by mail ), as well as a signature. The form can be filled out manually or on a computer by signing the form in the presence of an MFC employee;

- a receipt confirming payment of the state duty;

- power of attorney for the department;

- power of attorney for the 3rd person, if the procedure will be handled by a representative of the individual entrepreneur.

If the individual entrepreneur had hired employees, then the entrepreneur, on his own initiative, can provide a certificate from the Pension Fund of Russia on the submission of individual personalized information in relation to these employees. If this certificate is not submitted, the tax service will receive data from the department in electronic form.

What is a certificate of no debt? Where can I get it?

This is a certificate of fulfillment by an individual entrepreneur (individual) of the obligation to pay taxes, fees, penalties, and fines. To obtain such a certificate, you must personally appear at the tax office at the place of registration with a written application for the provision of this certificate.

The certificate must be issued within 10 working days from the date of receipt of the written request by the inspectorate of the Federal Tax Service of Russia.

Example of a certificate of absence of tax arrears for an individual entrepreneur

STEP 2. Payment of state duty

According to paragraphs. 7 clause 1 art. 333.33 of the Tax Code of the Russian Federation, the state fee for termination by an individual of economic activity as an individual entrepreneur is 160 rubles.

You can pay the fee at the terminal located on the premises of the MFC.

Terms of service provision and its cost

If the liquidation of an individual entrepreneur is carried out through a multifunctional center, the duration of the process takes 5-8 working days from the date of submission of the full set of documents.

All services provided by MFC are absolutely free. In the case of registering the procedure for closing a business, you only need to pay a state fee in the amount of 160 rubles.

Receipt for state duty for liquidation of individual entrepreneur

Liquidation of an individual entrepreneur without an electronic digital signature of the applicant will cost 160 rubles. This is the amount of state duty for deregistration of an entrepreneur. 2020 is the first year in which there is no need to pay for the liquidation of an individual entrepreneur if documents are sent certified with an electronic signature. If the entrepreneur does not have an electronic signature, then a fee is required.

The receipt is paid to the details of the registering tax authority. If you have not changed your registration, most likely it will be the same tax office where the individual entrepreneur was registered. If in doubt, you can check the necessary contacts on the hotline of the Federal Tax Service or at the nearest Federal Tax Service.

Or you can prepare a receipt for paying the duty using the free service of the Federal Tax Service. In this case, the necessary details will be filled in automatically; you just need to indicate your registration address.

If you plan to liquidate an individual entrepreneur through the MFC, then select the appropriate description in the “Payment Type” field. But just check in advance which multifunctional center accepts documents.

STEP 3. Contact the MFC

Multifunctional centers accept applicants by appointment or in a “live” electronic queue.

You can make an appointment in advance:

- Through the “My Documents” website (if such a service is provided in the region of application). You must first register on the State Services portal.

- Call the MFC hotline or the contact number of the selected center branch.

It should be noted that MFC branches interact with the registering Federal Tax Service only within one subject of the Russian Federation.

Thus, if an entrepreneur who has a permanent residence permit in one subject of the Russian Federation (for example: Omsk region) decides to close an individual entrepreneur while temporarily staying in another city - outside his region (for example: Moscow), then submit an application for termination of activities to the local MFC will not work.

But you can close an individual entrepreneur in the Multifunctional Center of your region remotely - through an authorized representative, having issued a notarized power of attorney for him to perform the necessary actions.

In which MFCs can individual entrepreneurs be liquidated in 2020?

On the territory of the Russian Federation, an individual enterprise can be closed in any multifunctional center, regardless of the applicant’s place of residence. Thus, individual entrepreneurs use the principle of extraterritorial service, which allows them to submit a document to the MFC not in the region where the entrepreneur is registered, but at the place of residence (temporary or permanent).

STEP 4. Obtaining a completed USRIP record sheet

Upon submission of the application and the necessary documents, the MFC official will issue the citizen a notification receipt, which will indicate the approximate date of receipt of the completed Unified State Register of Entry (USRIP) entry sheet in form No. P60009.

In some regions, MFCs inform the applicant about the readiness of documents via SMS.

You can also track the status of the application through the local “My Documents” website using the receipt number, if such a service is implemented in the region of the application, or by calling the hotline (contact phone number of the department that accepted the documents).

The period for closing an individual entrepreneur through the MFC is about 8 working days. Of these, 5 days are allocated for the procedure for deregistering an individual entrepreneur at the registration inspection, and a few more days are spent transferring documents to the department of the Multifunctional Center.

If the finished sheet of the Unified State Register of Entrepreneurs will be received by an authorized representative of an individual, he must present a notarized power of attorney.

How to open (register) an individual entrepreneur

The registration of individuals as individual entrepreneurs is carried out by the Federal Tax Service (FTS), the result of the service will be the inclusion of the applicant in the Unified State Register of Individual Entrepreneurs (USRIP) and the issuance of a USRIP entry sheet to the applicant.

Please note: the issuance of individual entrepreneur registration certificates on special forms has been discontinued since January 1, 2020. Now (2018) only the Unified State Register of Entrepreneurs registration sheet is issued.

For the convenience of citizens, the state provides the opportunity to contact different authorities, so everyone can choose the method that is most convenient for them.

These are the methods:

- Personally contact the Federal Tax Service office directly. Pros: minimum costs. Cons: You may have to spend time filling out documents and standing in lines; you will have to come to the inspectorate a second time to get the USRIP record sheet.

- Submit an application for registration online through the Federal Tax Service website. Pros: You don’t have to go anywhere to apply. Disadvantages: you need to register on the Federal Tax Service website and open a personal account there. To obtain documents you will have to go to the tax office.

- Submit an electronic application for registration through the government services website. Pros: you can pay the state fee at a discount. Disadvantages: to do this, you will have to fill out an application and attach scans of documents to the application. To receive a service in this form, you need a so-called Enhanced Qualified Digital Signature. To obtain it, you need to contact special accredited centers and its maintenance costs money (3000-5000 per year).

- Submitting an application for registration by mail. This option will have to be used if you need to open an individual entrepreneur in another city.

- Registration of an individual entrepreneur through the MFC, which transfers your documents to the Federal Tax Service and takes the result from there. Pros: convenient operating hours, a huge number of MFCs throughout Russia, specialist help. Disadvantages: the period for providing the service is somewhat longer, since it takes an additional 2-4 days to transfer documents between the MFC and the Federal Tax Service.

Below we will describe in detail how to register an individual entrepreneur at the MFC, but before that we will provide the requirements for applicants and a list of documents required for registration.

After the closure of the IP

Please note that:

- an individual is not exempt from paying taxes, fines, insurance premiums and other debts incurred during his activities as an individual entrepreneur;

- if any of the actions described above to prepare for the closure of the IP have not been completed, then after closure they must be completed as quickly as possible;

- if there is an IP seal, its destruction is not necessary;

- if necessary, an individual entrepreneur can be opened again immediately after closure (for example, for a quick transition to another taxation system).

Closing an individual entrepreneur on the simplified tax system online

There are step-by-step instructions on how to close an individual entrepreneur on the simplified tax system without employees on the government services website in 2020, provided that the entrepreneur opened his business through this service and is its regular user. Such a businessman must have a digital signature and be registered on the portal. If there is no signature, you should not use this method, as it may take a long time, mainly for the acquisition of an electronic signature.

There are several steps you need to take:

- go to the government services portal;

- choose a business closure service;

- attach documents in electronic form that are needed to close the case. The necessary documentation is indicated on the website;

- view your personal email inbox, where you will receive a notification that the submitted application has been sent for consideration. After five days, the Federal Tax Service will give its answer.

What else needs to be done after the closure of the individual entrepreneur?

- Of course, you need to close the individual entrepreneur’s bank account;

- Terminate all individual entrepreneur contracts. For example, access to the Internet, with contractors, telephony, etc.;

- Calculate all employees, if any;

- And I would like to emphasize once again that it is necessary to pay off ALL debts on taxes, contributions and fines to the Pension Fund of Russia and the Federal Compulsory Medical Insurance Fund and the Social Insurance Fund;

- I will not list all the points, since each situation is unique. But you must understand that everything related to activities as an individual entrepreneur will have to be “cleaned up”.

Is it necessary to deregister with the Pension Fund of Russia and the Federal Compulsory Compulsory Medical Insurance Fund?

A controversial issue on which there is still no consensus. They say that now information about closed individual entrepreneurs is transmitted through interdepartmental channels and, they say, now there is no need to independently deregister after the closure of an individual entrepreneur.

It is recommended to contact the Pension Fund and the Federal Compulsory Medical Insurance Fund in order to resolve this issue. Especially if you are registered as an employer. This must be done in order to reconcile debts to these funds and submit ALL closing reports for yourself and your employees (if there were any).

And once again I would like to draw your attention to the fact that if you hired employees, you will have to be deregistered as an employer in the Social Insurance Fund and the Pension Fund of the Russian Federation and the Federal Compulsory Compulsory Medical Insurance Fund.

Bankruptcy of an individual entrepreneur with debts - the main nuances

Very often a situation may arise in which an individual entrepreneur wants to close his business because it does not generate a profit that would cover all expenses. In this case, he may find himself in serious debt, from which he will no longer be able to get out.

We wrote about the bankruptcy of individuals and individual entrepreneurs, which also provides step-by-step instructions and consequences, in a separate article.

If an entrepreneur owes certain amounts of money to individuals or legal entities with whom he has entered into an agreement for the provision of services or the sale of any goods and cannot return them, then he is declared bankrupt. We wrote in a separate article in more detail about what bankruptcy is, what stages and steps need to be completed.

In addition, if an entrepreneur borrowed money from someone (a private investor, etc.) to develop his business, but it eventually went bankrupt and there is no way to return it, then we will also be talking about recognizing the insolvency of the individual entrepreneur . For more details about declaring an individual entrepreneur bankrupt, read the article at the link.

In words, this situation is quite clear and transparent, but in reality we have to deal with imperfect legislation. The whole essence of the problem lies in the duality of the essence of an individual entrepreneur.

On the one hand, he is an individual, on the other hand, he is an economic entity who is liable in various situations, for example , to the court with all his property (subject to the restrictions discussed in the previous section).

Among other things, the bankruptcy of individual entrepreneurs was previously discussed only in one legal act, namely in Law 27-FZ , which was adopted in 2002 . This document, in Article 214, states that an individual entrepreneur must recognize himself as insolvent in a situation where he cannot fulfill the demands of his creditors. Based on this, it should be concluded that there must be good reasons for the bankruptcy of an individual entrepreneur.

Proving insolvency, namely the inability to fulfill both financial and other agreed obligations, will have to be done by providing financial statements with all the details to demonstrate the reality of one’s statements.

Since 2014, the situation has become somewhat different. According to Federal Law No. 476, from October 1, 2015, all individuals have the opportunity to declare themselves bankrupt.

Thanks to this, the question of individual entrepreneurs with their dual nature is removed by itself.

According to the described federal law, the UIP has a fairly obvious opportunity to declare oneself bankrupt if debts to the state are liquidated. structures (to the tax office, Pension Fund, etc.), but the total amount of debt to creditors is equal to 500 thousand rubles or more than this amount.

In this case, it is necessary to analyze the situation and contact the Arbitration Court, providing its employees with an application to declare the entrepreneur financially insolvent.

In the process of proceedings and declaring an individual entrepreneur bankrupt, the following measures are applied:

- Restructuring of all debt. In this case, this means an attempt to pay off the debt of a former entrepreneur with the help of a regular source of income, which would help to return everything in a maximum of 3 years.

- Sale of the debtor’s property that can be seized (the previously stated restrictions are taken into account). This procedure can only be carried out if the person does not have sources of profit that could cover the debt in the near future, that is, the first option is not suitable.

- Settlement agreement (implies joint agreement of the parties as some other way to resolve the conflict if the previous two cannot be used).

Declaring an individual entrepreneur bankrupt is similar to the bankruptcy procedure for legal entities.

Therefore, now we will consider such a concept as a bankruptcy estate (this stage is included in the bankruptcy procedure for legal entities). It means all the property that can be sold in the future to pay off the debt.

Also, to pay off a debt, a land plot cannot be sold if the only housing is located on it, as well as all kinds of personal belongings necessary for a person to live, for example, medications, etc.

Among other things, a former entrepreneur has the right to appeal the inclusion of some of his things that are included in the lists for sale, but they cannot particularly influence the repayment of the debt. The total cost of such things should not be more than 10 thousand rubles .

Attention! There is one more nuance that an individual entrepreneur should also take into account when declaring himself bankrupt.

If a person owns only part of any property, then the creditor can also count on this share. That is, he may demand the allocation of the bankrupt’s share in the property.

Let's look at a small example. The former entrepreneur borrowed money to develop his business. As a result, he ended up bankrupt. At the same time, the person owns an apartment in which he lives himself, as well as half of a private country house, which he shares with his sister as a summer house.

As a result , the creditor has the right to draw the court’s attention to this country house, since it is not the only home of the former entrepreneur. It turns out that the share of a person who, due to bankruptcy, ceased his activities as an individual entrepreneur, can be realized in court. Half of the house, belonging to the sister, will remain unharmed.

When the bankruptcy estate is formed, all the property included in it is sold.

In fact, the sale is carried out with the expectation of obtaining a sufficient amount to pay off the debt . After completing this procedure, if it was possible to eliminate the debts, the person is released from responsibilities to his creditors in full.

Step by step procedure

Step-by-step instructions will help you answer the question of how to close an individual entrepreneur in 2020 through the MFC. In this case, it is worth collecting and submitting a package of documents to the advisory bodies.

Where to begin

Before applying to close a business, you must do the following:

- Pay off the debt to the Social Insurance Fund. A certificate from such an organization will need to be provided with other documents to liquidate the business. However, in some situations it is possible to do without this document. In this case, the debts of the individual entrepreneur will be transferred to the individual.

- Pay off the debt to the Pension Fund. The specialist will accept the package of documents without this certificate. However, payments must be made according to specific deadlines. If money is not received into the Pension Fund account within several periods, the debt will be collected in court.

- Carry out mutual settlements with counterparties. It is recommended to do this before closing the IP. Otherwise, it will not be possible to provide primary accounting documents.

- Make payment to the Federal Tax Service. The difficulty lies in the fact that the application is submitted before taxes are assessed. Therefore, you should fill out a declaration and make a transfer to the profit received.

Important! The entrepreneur is given 5 days from the date of closure of the individual entrepreneur to pay debts. If he violates the deadlines, he will receive penalties.

Determining the amount of payment in the budget can be quite difficult. This is due to the fact that it is necessary to count from the beginning of the billing period until the exclusion of the individual entrepreneur from the Unified State Register of Individual Entrepreneurs. Therefore, it is better to use the services of an accountant or pay a little more.

Subsequently, the overpayment will be refunded. To do this, it is recommended to write an application to the Federal Tax Service. The money will go to the individual’s account.

Package of documents

Many people are interested in what documents need to be provided in 2019–2020 to close an individual entrepreneur. According to existing legislation, the following documents are required to be submitted to the MFC:

- application of the established form;

- passport with copies of all pages, including blank ones;

- TIN;

- passport for a cash register - when using this equipment;

- cash register registration card - if available;

- certificates from the Compulsory Medical Insurance Fund and the Social Insurance Fund - required if there are employees;

- receipt of payment of state duty.

Important! It is necessary to issue a power of attorney for an MFC employee who will be responsible for submitting documents to government agencies. A power of attorney for the entire center is also required.

You need to submit a whole package of documents to the MFC

Does any MFC offer such a service?

The availability of such a service at the MFC depends on the city or region. The list of services provided can be found on the organization’s website. In this case, it is worth looking for information at your place of residence.

It is worth considering that tax inspectors do not particularly approve of this method of closing a business activity. It will take 1 week to complete all the documents and publish information on the website about the termination of the individual entrepreneur’s work when contacting the MFC.

This organization does not check whether individual entrepreneurs have debts. She also does not request information about the payment of contributions to insurance funds. Such actions are not recorded in the provisions of existing regulations.

Time and cost of the process

If the individual entrepreneur stops working through the multifunctional center, this requires 5 working days. This period is counted from the moment the complete list of documents is provided. On the sixth day, you can contact the MFC or the tax office and receive a document confirming registration in the Unified State Register of Individual Entrepreneurs.

MFC services are completely free. In this case, when closing an individual entrepreneur, you must pay a state fee. Its size is 160 rubles.

You can pay the fee using a simple service available on the Federal Tax Service website. However, when submitting a package of documents through the tax office or MFC, the details will be different. When paying the state fee, the following information will be required:

- TIN of the applicant;

- FULL NAME;

- place of residence.

The service will automatically create a payment order. After that, you can print it and pay at any bank. It is also permissible to do this directly on the website through a credit institution. This method is considered the most convenient.

To close an individual entrepreneur you need to pay a state fee

Reasons for receiving a refusal to close through the MFC

The provision of public services for terminating the activities of individual entrepreneurs may be refused for several reasons. They are set out in Art. 23 of Federal Law No. 129-FZ of 08.08.2001:

- the package of documents for the provision of services is incomplete;

- the response to the request to the Pension Fund did not confirm the provision by the entrepreneur of data on employees;

- errors in the application;

- the application has been submitted to another territorial division;

- payment of the state duty has not been completed;

- The application contains the signature of a person who does not have the authority to do so.

To reduce the risk of refusal, it is recommended to carefully study the regulations on how to close an individual entrepreneur in 2020.

Can they refuse to close an individual entrepreneur at the MFC - the main reasons for refusals

A Russian may be denied liquidation of a company in several cases:

- All documents were not submitted. Pay attention to the documentation package.

- The procedure for registering an enterprise with extra-budgetary companies was not carried out.

- The information in the application was incorrect.

- The citizen did not pay the state fee.

- The representative did not provide a certified power of attorney.

Any refusal by the center’s employees can be challenged in court, or you can try to change the situation - for example, by paying a state fee, or providing additional documentation.

Now you know how you can register the liquidation of a company. Also read our other articles on how to register an individual entrepreneur and open an individual entrepreneur yourself in 5 simple steps. And if you haven’t decided yet whether you need entrepreneurship, read here which is better – an LLC or an individual entrepreneur.

Pros and cons of providing services through the MFC

Multifunctional centers were created to optimize the provision of public services to the population, reducing service time and waiting in queues.

The application acceptance procedure takes on average 15 minutes. The efficiency of the centers is confirmed by the following advantages:

- speed of resolution of problems arising during the registration process;

- the ability to solve several problems simultaneously;

- the quality of service is controlled and maintained at a high level;

- free consultations;

- convenient work schedule.

Possible disadvantages:

- Insufficient competence of personnel in some complex issues.

- The Federal Tax Service has a negative attitude towards registration through the MFC. Employees do not check debts on taxes and fees, so it is possible to close an individual entrepreneur with debts.

All wishes regarding the work of the centers can be left on feedback leaflets on the desks of MFC specialists or on the hotline.