Definition and types

A bill in simple words is a type of debt security that gives the right to one party to a transaction to receive money from the other party in full and within a specified time frame or upon presentation.

To put it simply, this is a promise to pay. The subject of a bill of exchange is only money.

The concept has been known since the beginning of our era (VII century). The bill system was developed to speed up the trading process and ensure the security of trade transactions. The merchants of Italy, for example, brought their ships loaded with goods into the harbor. They sold it. And instead of cash, which was unsafe, they received bills of exchange, which they presented for payment upon return.

The legislation regulating the circulation of the document is, of course, not that old, but its age is also impressive. In 1930, a special law was adopted at the Geneva Conference. In Russia, they use the federal law of 1997, which refers to the 1937 Decree.

But both documents say that they are being introduced due to our country’s accession to the International Convention, therefore they practically repeat the law of 1930. It turns out that the circulation of this security is regulated not by civil, but by international law, which increases its reliability.

There are two main types of bills:

- Simple. Its hallmark is the participation of two parties. The payer or debtor is the person who issued the document. He is called the drawer of the bill. Example: Alexey wants to open his own business, he needs 500 thousand rubles for this. He turns to Nikolai with a request to borrow money. Nikolai agrees and receives the status of bill holder. Alexey writes out a bill. Depending on the stated conditions, Nikolai presents the bill for payment on a certain date. Alexey returns the money.

- Transfer or draft. There are 3 parties involved. Sergey is added to the described example. It was he who was indicated by Alexey as the debt payer in the issued bill. Nikolai demands money from Sergei. Naturally, Sergey must give consent (acceptance) at the time of registration of the security for the payment of money.

There are other classifications. By method of income received:

- Discount. Has a nominal value. For example, the debtor Alexey issues a document to Nikolay (the holder of the bill) in the amount of 500 thousand rubles. But Nikolai transfers only 450 thousand rubles to Alexey. The amount to be repaid later will still be 500 thousand rubles. The difference is Nikolai’s income.

- The interest note also has a face value, but the income to the holder of the note is paid as a percentage.

By debt repayment period:

- indicating a specific date;

- with redemption immediately upon presentation of the security or after a specific time.

Payment guarantee:

- avalized, i.e. when a third party (for example, a bank) guarantees for the debtor that he will pay the debt on time and in full, in this case they are jointly and severally liable;

- not avalized - without guarantee.

Aval is a bill of exchange guarantee under which a third party assumes responsibility for the obligations of the drawer.

By right of transfer:

- by endorsement - the first holder of the bill can transfer the bill of exchange right to another person;

- personal – no right of transfer to another person;

- bearer - a document can change hands an unlimited number of times.

Sberbank's website clearly states that it does not honor bills issued by third-party issuers with which it has partnerships.

Bills of exchange can be issued by legally capable individuals or legal companies, except for state executive authorities. Banks often issue these securities, mainly to raise capital.

The bank bill does not participate in the deposit insurance program, therefore, in the event of license revocation or bankruptcy, the bill holder will be able to return his money only after the sale of the bank’s assets. In addition, he acts not only as an issuer of securities, but also as a bill holder, buying them from other persons.

Commodity bills

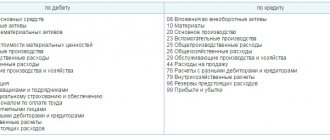

Accounting with the drawer

For the drawer, the issued commodity bill will be a debt obligation. To account for trade bills issued, a separate subaccount 60 of the “Settlements with suppliers and contractors” account is used; let’s conditionally define its code 60.3 “Bills issued”.

Orion LLC, to pay the debt to the supplier, issued a promissory note worth 118,000 rubles, incl. VAT 18,000 rubles, with a certain payment period.

Accounting at Orion LLC for bills of exchange issued for settlements with transaction suppliers:

| Dt | CT | Operation description | Amount, rub. | Document |

| 41 | 60.1 | The debt to the supplier is reflected | 100 000 | Invoice |

| 19 | 60.1 | VAT charged | 18 000 | Invoice |

| 60.1 | 60.3 | A bill of exchange was issued for the amount owed | 118 000 | Accounting information |

| 60.3 | 51 | The bill was repaid on time | 118 000 | Payment order |

Accounting with the bill holder

For settlement of received trade bills, subaccount 62.3 “Bills received” is opened.

The Sirius accountant generates transactions and reflects the received bill in his accounting as follows:

| Dt | CT | Operation description | Amount, rub. | Document |

| 62.1 | 90.1 | Revenue reflected | 118 000 | Invoice |

| 90(VAT) | 68 | VAT charged | 18 000 | Invoice |

| 90.2 | 41 | The write-off of the cost of goods is reflected | 55 000 | Invoice |

| 62.3 | 62.1 | Receipt of a bill of exchange from the buyer is reflected | 118 000 | Accounting information |

| 51 | 62.3 | Repayment of the bill is reflected | 118 000 | Bank statement |

Difference from other debt documents

The main distinguishing feature of a promissory note compared to other debt securities is that it does not state the reason why one party is obligated to transfer money to the other party. If the paper is filled out correctly, then the terms of the transaction are not discussed or contested in court. They just have to be done. In essence, a bill of exchange is a confirmation of the existence of the debt itself, no matter what.

Distinctive characteristics:

- It is issued only on paper. Mainly on a special form with security elements containing the necessary details.

- There is joint liability for all persons who signed the document.

- Regulated by international law (Geneva Convention).

- The holder of the bill may change.

- Used in various fields of activity.

- Simplified collection procedure in case of refusal of the drawer to pay the debt. A protest is filed with the notary. The court then issues a foreclosure order without a hearing. Enforcement proceedings begin.

- Does not require state registration.

Tax accounting

When using bills of exchange in payments for purchased products, the taxpayer must keep records separately for VAT amounts that are and are not deductible. In this case, we are talking about bills of exchange for third parties, due to the fact that when transferring one’s own debt securities, the sale does not occur.

You can find out whether you need to pay VAT by studying paragraph 2 of Article 146 of the Tax Code of the Russian Federation.

In the case where the operation is subject to VAT, the procedure for calculating and paying the tax will be the same as for an ordinary sale: the VAT tax base will be determined as the price of products sold by their volume, which determines the cost of sale.

The date of calculation of VAT is also determined in the general manner - at the time of shipment or receipt of advance payment, also in the form of a third party bill of exchange purchased in the tax period that precedes the purchase.

After calculating the “added” burden, an invoice is issued. In the VAT return, the sale of products for which a bill of exchange was received as payment will be reflected in the same way as an ordinary sale.

Separate accounting may not be carried out in this case when the organization’s expenses, which are associated with VAT-free work, do not exceed the materiality threshold of five percent of the total amount of its expenses.

If bills of exchange are used in settlements occasionally, then you will not have to keep records separately on this basis in accordance with paragraph 4 of Article 170 of the Tax Code of the Russian Federation.

If accounting for bills of exchange in accounting still needs to be carried out separately, then it is possible to highlight the expenses that are associated with their circulation and justify the calculation procedure in the accounting policy for tax purposes.

With all this, a bill of exchange can only pay the price of purchased products or services excluding VAT.

Regarding income tax, we note that the base for transactions with bills of exchange must also be calculated separately.

Often, using debt securities as a means of payment, companies carry out transactions at their face value.

This means that all additional expenses for their acquisition and sale are losses of the company, which are not taken into account when taxing income of the reporting period, but can be transferred to future indicators of similar work.

As a result, when organizing separate tax accounting in the accounting policy of a company, one should strive to reduce the amount of additional costs that are included in the expense part of the special tax base.

Payment terms

There are different types of bills:

- Upon presentation - paid upon presentation, which must occur within 1 year after drawing up. A specific period may be agreed upon before which the document for payment will not be presented.

- At some time from presentation. For example, after 15 days, 2 months, etc.

- At some time from compilation.

- On a certain day.

The holder of the bill must present the document for payment either on the same day as stated, or within two business days after the specified date. When transferring money, the drawer may require a receipt.

Interest accounting

The procedure for calculating interest on a bill of exchange is not regulated by accounting rules, therefore, in each company such transactions are discussed separately in its financial policy.

From an economic point of view, bonus bills are not much different from discount bills, so the amount of remuneration on them is also taken into account, as in the case of interest, discussed above.

Bonuses on a bill of exchange are calculated when accounting for bills of exchange at a discount rate based on the annual interest rate, the face value and the length of the holding period in days:

Amount of interest = nominal value * rate / 365 * length of holding period in days.

Profit on bills is charged monthly on the last day of the month by placing a debit on account 76 and a credit on account 91.

Areas of application

Why do you need a bill:

- when lending to individuals and legal entities, it is considered reliable collateral for the loan, the borrower issues it to his lender;

- to attract capital, for example, banks and enterprises do not need to go through a complex procedure for issuing shares or bonds if funds are needed for development;

- for mutual settlements between enterprises with the possibility of offsetting mutual claims;

- to pay for transactions by non-cash means;

- acts as an independent object of purchase and sale;

- To defer payment, the buyer issues a document to the seller of goods and services.

Mandatory details and exceptions to the rules

Let's look at how to properly draw up a bill of exchange. The Regulations of 1937 indicate that the details of a promissory note are:

Translated contains:

The only difference is in the point about indicating the payer. In the first case it is absent, in the second it is a mandatory element.

There are exceptions to the rules:

- The due date may not be specified, in which case the debt must be paid upon presentation.

- If the place of payment is not specified, it is considered that this must be done at the place of drawing up the document at the place of residence of the drawer.

A transferable security may carry interest if it is issued with a maturity date at sight or with payment after some time from sight.

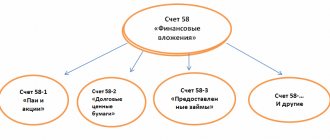

The two main types of bills are as follows: