What is account 60 used for in accounting?

The current Chart of Accounts establishes that settlements with suppliers and contractors must be carried out using account 60.

Here, transactions involving the receipt of goods, works, services from counterparties, and the amount of allocated VAT are recorded, if these companies work with VAT.

The use of account 60 involves reflecting on it advances for the next receipt of goods, as well as making payments for material assets already received or services rendered, work performed.

Attention! Thus, the information reflected on account 60 allows you to find out the status of mutual settlements with each supplier, and the balance on the account reflects either the amount of debt that the company must transfer to these companies, or the cost of goods, works and services expected to be received.

The same account reflects material assets that came to the company without documents being issued for them from suppliers, that is, uninvoiced supplies.

Postings applicable for account 60

For account 60, postings are compiled in correspondence with accounts, a complete list of which is indicated in the order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

If the supplier works for OSNO, then VAT is included in the cost of goods (work, services). Often, the same counterparty can act as a supplier under one contract and as a buyer under another. In such cases, it is convenient to use offset when making calculations.

Let's give examples of some wiring.

Let's consider the standard scheme for using account 60.

Example 1

LLC "Revizor" (furniture store) on April 8, 2020 transferred an advance payment for the supply of chairs to LLC "Shinel" in the amount of 150,000 rubles. Already on 04/09/2020, goods were received in full for the amount of 200,000 rubles, including VAT of 33,333 rubles. 33 kopecks On the same day, the final payment for the delivery was made in the amount of 50,000 rubles.

Postings that were made by the accountant of Revizor LLC:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

- 04.2020: Dt 60.02 Kt 51 - 150,000 rub. — an advance has been received from the supplier.

- 04.2020:

- Dt 41 Kt 60.01 — 166,666 rub. 67 kopecks — goods are capitalized according to the invoice.

- Dr Kt 60.01 - 33,333 rub. 33 kopecks — VAT on delivery is taken into account.

- Dt 60.01 Kt 60.02 — 150,000 rub. — the advance payment is credited towards payment for the delivery.

- Dt 60.01 Kt 51 - 50,000 rub. — payment for delivery (balance) has been made.

Let us focus on transactions related to uninvoiced deliveries. Uninvoiced delivery is a supply of material assets that is not supported by documents from which one can draw a conclusion about their value. For such deliveries, the “Uninvoiced Delivery” subaccount of account 60 is used. When documents are received, the following entries are made.

Option 1

Option 2

More extensive and up-to-date material on uninvoiced supplies was prepared by ConsultantPlus experts. If you don't already have access to the system, get a free trial online.

Characteristics of account 60 “Settlements with suppliers and contractors”

Legislative norms determine that account 60 “Settlements with suppliers and contractors” is an active-passive account, which can have two balances - on the debit and credit of the account.

That is, both receivables and payables are indicated here:

- A credit balance on account 60 means that the company has unfulfilled obligations to transfer funds for previously received goods, works, and services.

- A debit balance on account 60 means that organizations that are suppliers of work, services, and material assets in relation to the company where accounting is kept have not fulfilled their obligations.

The credit of account 60 shows the receipt of material assets from supplier companies, the cost of work performed by contractors as provided for in contracts, and the cost of services provided. At the same time, the cost of goods, works, and services received under contracts may include amounts of input VAT that must be paid to suppliers.

The debit of account 60 reflects the payment under contracts within the deadlines established therein. This can be either an advance payment, which is reflected in advances paid, or payment for goods supplied. Payment can also be made using bills of exchange.

Determining the account balance depends on what the balance was at the beginning:

- If it is debit, then you need to add the debit turnover to it and subtract the credit turnover. The final balance must be reflected in debit if it is at the beginning in debit plus the debit turnover is greater than the turnover in the credit account. Otherwise, the balance must be reflected on the credit of the account.

- If the initial balance is a credit balance, then the credit turnover of the account is added to it and the debit turnover is subtracted. The same rule applies here: if the excess goes to debit, then the final balance will be debit, otherwise it is the balance on the credit of the account.

Attention! Account 60 balances are shown in different sections of the balance sheet. The debit balance must be taken into account as part of accounts receivable in the assets of the balance sheet, and the credit balance in the liabilities of the balance sheet must be included in accounts payable.

Count 60 active or passive

Account 60 is included in section VI “Calculations” of the Chart of Accounts. It is a synthetic account. Analytical accounting for it is carried out for each counterparty and for each issued invoice or agreement. Let us determine what type of account 60 is - active or passive. To answer the question, you need to understand that the accountant uses it to reflect all payments to suppliers. Therefore, a debt may arise both on the part of our organization (that is, the delivery was made but not paid) and on the part of the supplier (an advance was transferred). In accountant language, this means that the account balance can be either a debit or a credit. Thus, the count of 60 is active-passive.

What subaccounts are used?

According to the standard working plan of accounts, sub-accounts can be opened for the account:

- Advances issued - information on settlements is shown here when the company makes preliminary transfers under concluded contracts.

- Urgent—shows settlements with suppliers whose shipment of goods and materials is not yet due for payment.

- Settlements on bills issued - used if payment for goods supplied is carried out using bills of exchange.

- Calculations for uninvoiced deliveries - shows the receipt of goods from the supplier without documents issued for delivery.

- Settlements on documents for which payment is overdue - it is very important to keep records of overdue accounts payable. Within a subaccount, subaccounts can be formed with designated periods (up to 45 days, 45-90 days, over 90 days).

You might be interested in:

Income tax calculation: main types of transactions in 2020

If settlements with counterparties are carried out not only in Russian rubles, but also in foreign currency, it is advisable to open separate sub-accounts for these operations:

- Settlements with suppliers and contractors in foreign currency;

- Settlements on advances issued in foreign currency.

Each company, taking into account the specifics of its activities, can open other sub-accounts to account 60 (commercial loan, etc.)

Attention! Within these subaccounts, analytical accounting can be maintained for each supplier separately. Sub-accounts can also be opened based on contracts concluded with the supplier.

How to take into account calculations

As for the subaccounts of the 60th accounting account, the rules here do not contain strict requirements. At the same time, practice shows that you need to open at least 2 sub-accounts for it:

- to account for debt to the supplier;

- for advances issued.

When accounting for settlements on account 60 for purchased materials, accepted work or consumed services, all transactions are reflected regardless of the time of payment.

Account 60 is credited for the cost of inventory, work, and services accepted for accounting in correspondence with the accounts for accounting for these assets:

- account 15 “Procurement and acquisition of material assets”;

- or relevant cost accounts.

For services for the delivery of valuables (goods), as well as for the processing of materials on the side, entries according to Kt 60 are made in correspondence with the accounting accounts:

- industrial stocks;

- goods;

- production costs, etc.

Regardless of the assessment of inventory items in analytical accounting, account 60 in synthetic accounting is credited according to the supplier’s settlement documents.

Which accounts does it correspond with?

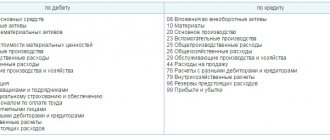

The current instructions establish that account 60 can correspond with the following accounts:

By debit:

- With account 50 — Payment in cash.

- With account 51 – Payments are made by non-cash payment.

- With account 52 — When payments are made through a foreign currency account.

- With account 55 – special invoices are used for payment.

- From accounts 60, 62, 76 - under mutual settlement agreements.

- From account 66 - when payment is made using borrowed funds.

- With account 79 - when the parent company pays for organizing the account.

- With account 91 - overdue accounts payable are written off.

- With account 99 – debt write-off in emergency circumstances

By loan:

- With account 07 - purchase of equipment that requires installation.

- With account 08 — acquisition of fixed assets.

- With account 10 - purchase of materials.

- With account 15 - when the receipt of materials is recorded using this account.

- With account 19 - when allocating incoming VAT.

- With account 20,23,25,26, 29, 44 – when works and services are purchased.

- With account 41 - upon receipt of goods that will be resold in the future.

- With account 50,51,51, 55 - upon return of overpaid amounts.

- With account 60, 76, 79 - for mutual settlements.

- With account 91 – when writing off overdue accounts receivable

- With account 94 - when a shortage of supplies from suppliers is identified.

- With account 97 - when recording expenses that are subject to distribution over a certain period (for example, rent, compulsory motor liability insurance, etc.)

How debits and credits are displayed

The account is credited for the cost of goods, inventory items, works and services accepted for accounting and corresponds with their accounts. Synthetic loan accounting is based on the supplier's documents, which does not depend on the assessment of values.

Account 60 is debited for the amounts of performance obligations. This also includes advances and prepayments. Corresponds with the accounts in which these funds are recorded.

The debit and credit of account 60 reflects different transactions

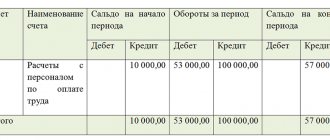

Balance sheet for account 60

Account 60 is active-passive, that is, it can simultaneously contain both debit and credit balances. In order to track their formation, it is advisable to keep records for each supplier.

Modern software products for accounting allow you to build registers to review calculations for the general account, for subaccounts, and also allow you to create a balance sheet for each individual supplier.

The balance sheet for account 60 is an accounting register. The law does not define a special form for this type of document, but it establishes a list of mandatory details:

- Company name, register name;

- Start and end date of the register, period of compilation;

- The value of monetary measurement;

- Signatures and names of responsible persons.

When creating a statement for account No. 60, you must adhere to the following rules:

- When generating debit turnover, all operations to repay the debt to the supplier, or prepayment for work or services are indicated there. It is also necessary to indicate here information about all payment documents - orders or cash settlement orders on the basis of which the payment was made. Also in this turnover it is necessary to show the operations of offset of claims, as well as the return of goods to the supplier.

- When forming credit turnover, all operations for the acquisition of inventory and materials from the supplier are indicated here - goods, works, non-current assets, etc. Also here you need to show all the primary documents on the basis of which the goods or services are posted - delivery notes, invoices, etc. etc. Also in this turnover you need to enter returns from prepayment suppliers for unfulfilled deliveries.

Account document flow

Account 60 is used to form transactions with suppliers. Basic documents for the movement of funds:

- An invoice and invoice are the basis for creating a purchase book (VAT received).

- A payment order or bank statement serves to close accounts payable to contractors.

- The certificate of completion of work is the basis for payment of the amount specified in the contract.

When goods are delivered without a document, the actual receipts are also reflected in the registers. At the time of presentation of invoices 60, the invoice is adjusted taking into account the difference between the accounting prices and the cost of the goods according to the submitted documents.

Documentation for settlements with counterparties is strictly maintained

The procedure for writing off receivables and payables on account 60

According to accounting requirements, only true facts must be reflected in accounting data and reporting. If the documents show accounts payable with an expired collection period, then this rule is violated.

You might be interested in:

Account 03 in accounting “Profitable investments in material assets”, what is taken into account, correspondence of accounts, postings

Thus, the company is obliged to write off accounts payable if the collection period established by law has passed.

In addition, a debt that can no longer be repaid is subject to removal if the counterparty has been deregistered and no longer exists as a legal entity.

The law establishes that the period during which the creditor has the right to demand its coverage is set at 3 years. In this case, it is necessary to correctly determine the beginning of this period.

When concluding a supply or service agreement, this document usually indicates the date for repayment of obligations. From the day following it, you need to start counting the statute of limitations.

However, the law provides for the deadline to be reset and counted from the beginning. This happens if the debtor acknowledges the existing debt in writing, makes partial payment, signs a reconciliation report, etc. In this situation, the limitation period must be counted first from this moment.

Attention! However, this cannot be done indefinitely. When a period of 10 years has been reached from the date of its formation, the debt must be written off unconditionally.

The debt write-off process is carried out in the following order:

- Carrying out an inventory of all payments. This procedure must be performed annually in order to compare the accounting data with the actual amounts of debt. During the inventory, it is also checked on what date the last movement on this debt occurred.

- Registration of an inventory report. There is a recommended form of the INV-17 form, but currently the company has the right to use its own forms. It is necessary to include in the act all the debts the company has, and not just the identified overdue ones. The document is drawn up in two copies, one is transferred to the accounting department, and the second remains with the commission.

- Preparation of accounting certificates. The accountant must analyze the executed act and draw up a certificate based on it. It reflects the counterparty for which there is a debt, the reason for the occurrence, the amount of the debt, as well as the day when the statute of limitations expired. Certificates of all expired debts, together with the act, are transferred to the manager for consideration and decision-making.

- Making an order. If the manager decides to write off, then he gives instructions to draw up an order to write off the debt. This document provides instructions to write off debt in accounting and tax accounting, and also appoints responsible persons. Based on the order, the accountant prepares accounting entries.