Role and significance of 73 items

So, as was already mentioned at the very beginning, in addition to the payments indicated above, companies may also have other situations where it is necessary to take into account financial relationships with employees. Such situations should include:

- provision of preferential loans;

- compensation for material damage caused;

- payments for the use of personal property;

- reimbursement of expenses, for example, for cellular communications.

73 position in accounting is intended to summarize information about all settlements with company personnel, with the exception of wage payments and the issuance of resources for reporting.

On the debit side of position 73 of the company, the amounts issued are recorded, and on the credit side, their repayment is recorded.

Sub-accounts can be opened for the specified position, including:

- 1 – accounting of loans provided;

- 2 – compensation for material damage.

Subaccount 73.1 reflects information on loans allocated to employees, for example, for individual housing construction.

Subposition 73.2 reflects the movement of funds associated with compensation for material damage caused by one of the employees. In this situation, we can talk about the theft of financial resources or material assets, as well as the production of defective products.

Legislative basis

When making payments to employees, the enterprise's accounting department uses account 73 in certain cases listed above. All operations must be carried out in accordance with regulations:

- Loans are issued on the basis of a concluded contract in accordance with Art. 808 of the Civil Code of the Russian Federation.

- In accordance with Art. 212 of the Tax Code of the Russian Federation determines the tax base, calculates and pays the income tax of individuals within the limits of the organization’s responsibilities as a tax agent.

- The provision of financial assistance occurs upon the individual application of the employee and upon the decision of management. This type of payment does not fall into the category of production and incentive payments according to Art. 144 Labor Code of the Russian Federation. When calculating mandatory payments, the total amount of financial assistance is not included in the tax base for income tax in accordance with clause 23 of Art. 270 Tax Code of the Russian Federation.

- For remunerations in the amount of no more than 4,000 rubles, personal income tax benefits are provided. This action is regulated by clause 28 of Art. 217 Tax Code of the Russian Federation.

Accounting for allocated financial benefits

Let’s imagine that the employer paid one of the employees financial assistance due to the birth of a child. The amount of assistance amounted to 27,300.0 rubles. At the same time, the accounting service of the enterprise made the following entries:

1) Dt 91.2

Kt 73.01 – 27,300.0 rubles, financial assistance was accrued to the employee;

2) Dt 76

Kt 68.1 – RUB 3,549.0, personal income tax accrual;

3) Dt 99

Kt 68.2 – RUB 5,460.0, accounting for permanent tax liability;

4) Dt 73.01

Kt 51 – RUB 23,751.0, transfer of benefits to the employee’s card;

5) Dt 20

Kt 69 – RUB 6,650.0, insurance premiums for benefits paid.

Balance sheet – form 1: how to fill it out correctly, what errors occur

Maintaining accounting records for a business entity involves filling out certain reporting forms for certain dates. The balance sheet occupies a special place in the financial statements, to which many regulatory and other bodies assign a leading role. Therefore, it is important to know how to fill out a balance sheet and which accounts go where.

Who must submit a balance sheet?

The balance sheet is one of the financial reporting forms. The legislation establishes that all legal entities, regardless of their organizational form and the applicable taxation regime, must prepare and submit reports to tax and statistical authorities.

This obligation also applies to non-profit organizations and bar associations. Balance sheets and profit and loss statements do not have to be submitted only to entrepreneurs, as well as branches of foreign companies. But they can do this on their own initiative.

Attention! Previously, some organizations were exempt from preparing a balance sheet, but currently such provisions are no longer in effect. Business entities classified as small businesses are given the right to submit reports in a simplified form. It includes a balance sheet in Form 1 and a statement of financial results in Form 2, so enterprises must send it to regulatory authorities.

Balance due dates

According to the general rules, the balance sheet - Form 1 must be submitted as part of the reporting for the past year no later than March 31 of the following year. This deadline must be observed when submitting balance sheets and other forms to the Federal Tax Service and statistics.

In addition, under certain conditions, an audit report must be sent to Rosstat as an attachment. The deadline is set for ten days, but no later than December 31 of the following year.

Some organizations need to submit financial statements and publish them due to the type of activity they carry out, or according to other criteria defined by law. For example, tour operators must send their reports to Rostrud within three months from the date of their approval.

The legislation provides for separate deadlines for organizations that registered after September 30 of the reporting year.

Due to the fact that their calendar year may be determined differently in this case, the due date may be set by such organizations on March 31 of the second year after the current one.

For example, Rebus LLC received an extract from the Unified State Register of Legal Entities on October 25, 2017; the accounting report must be submitted for the first time on March 31, 2019.

Attention! Accounting statements are usually submitted based on the total for the year. However, it is possible to present it quarterly. In this case it is called intermediate. Such documentation is very often needed when applying for loans from banks, company owners, etc.

Where is it provided?

The provisions of federal laws establish that Form 1 balance sheet and Form 2 profit and loss statement, and in certain cases other forms, must be submitted:

- Federal Tax Service - reporting must be submitted at the place of registration of the company. Therefore, branches and other separate divisions do not submit it, and only the parent company submits consolidated statements. This must be done at the place where it is registered, taking into account these departments.

- Rosstat - currently submitting reports to statistical authorities is mandatory. If this is not done, then, just as in the first case, the company and officials may be held liable.

- For the founders and other owners of the company - this is due to the fact that each annual report of the organization must be approved by its owners.

- To other bodies, if the relevant regulations define such a duty.

Currently, when concluding contracts, many large companies ask for Form 1 Balance Sheet, Form 2 Profit and Loss Statement. This should be done at the discretion of the company management.

However, at present, many specialized companies through which you can submit reports have a service that allows you to obtain all the necessary information about a partner according to his TIN or OGRN. This data is provided by the Federal Tax Service itself based on previously submitted reports.

Declaration 3-NDFL: sample filling for individual entrepreneurs on OSNO

Delivery methods

The OKUD form 0710001, which is part of the annual report, can be submitted to the Federal Tax Service and Rosstat in the following ways:

Attention! The legislation stipulates the submission of the report in electronic form if the number of employees of the organization is more than 100 people.

Balance sheet form 2020 free download

Balance sheet form 1 form 2020 free download in Word format.

Balance sheet form 1 form 2020 download free in Excel format.

Balance sheet with line codes form download in Excel format.

filling out the balance sheet in Form 1 for 2020 in PDF format.

Title part

After the name of the form, it is indicated on what date it is being generated. The actual date of submission of the report must be entered in the table, in the line “Date (day, month, year)”. Next, the full name of the subject is written down, and opposite in the table is its OKPO code.

After this, his TIN is indicated on the next line in the table. Next, you need to indicate the main type of activity - first in words, and then in a table using the OKVED2 code. Then the organizational form and form of ownership are indicated.

On the contrary, the corresponding codes are entered in the table, for example:

- The code for LLC is 65.

- for private property - 16.

On the next line you need to choose in what units the data in the balance sheet is presented - in thousands or millions. The table displays the required OKEI code. The last line contains the address of the subject's location.

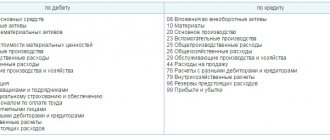

Fixed assets

Line “Intangible assets” 1110 is the balance of account 04 (except for R&D work) minus the balance of account 05.

Line “Research results” 1120 - account balance 04 for sub-accounts that reflect R&D;

Line “Intangible search requests” 1130 - account balance 08, subaccount of intangible costs for search work.

Line “Material search requests” 1140 – account balance 08, subaccount for the costs of material assets for search work.

Line “Fixed assets” 1150 - account balance 01 minus account balance 02.

Line “Income-bearing investments in MC” 1160 - the balance of account 03 minus the balance of account 02 in terms of accrued depreciation on assets related to income-generating investments.

Line “Financial investments” 1170 - account balance 58 minus account balance 59, as well as account balance 73 in terms of interest-bearing loans over 12 months.

Line “Deferred tax assets” 1180 - account balance 09, it is possible to reduce it by account balance 77.

Line “Other non-current assets” 1190 - other indicators that need to be reflected in the section, but they are not included in any line.

The line “Total for section” 1100 is the sum of lines from 1110 to 1190.

Current assets

Line “Inventories” 1210 - the sum of indicators is entered in the line:

- account balance 10 minus account balance 14, or account balances 15, 16

- Balances on production accounts: 20, 21, 23, 29, 44, 46

- Balances of goods on accounts 41 (minus the balance on account 42), 43

- account balance is 45.

Line “Value added tax” 1220 - account balance 19.

Line “Accounts receivable” 1230 - the sum of indicators is entered:

- Debit balances of accounts 62 and 76 minus the credit balance of account 63 in the subaccount “Reserves for long-term debts”;

- The debit balance of the account is 60 for advances made for the supply of products and services.

- Debit balance of account 76, subaccount “Insurance payments”;

- The debit balance of the account is 73, excluding the amounts of loans on which interest is accrued;

- Debit balance of account 58, subaccount “Granted loans for which interest is not accrued.”

- Debit account balance 75;

- Debit account balance 68, 69

- The debit balance of the account is 71.

Line “Financial investments” 1240 - the sum of indicators is entered:

- account balance 58 minus account balance 59;

- account balance 55, subaccount “Deposits”;

- account balance 73, subaccount “Loan settlements”.

Line “Cash” 1250 - the sum of account balances 50, 51, 52, 55, 57 is entered.

Line “Other current assets” 1260 - indicators that should be shown in the section, but were not included in any previous line.

The line “Total for section” 1200 is the sum for lines from 1210 to 1260.

Line “Balance” 1600 - the sum of lines 1100 and 1200.

Capital and reserves

Line “Authorized capital of the organization” 1310 - account balance 80.

Line “Own shares” 1320 - account balance 81.

Line “Revaluation of non-current assets” 1340 - account balance 83 in terms of the amounts of revaluation of fixed assets and intangible assets.

Line “Additional capital” 1350 – account balance 83 without the amounts of additional valuation of fixed assets and intangible assets.

Line “Reserve capital” 1360 - the sum of account balances 82, as well as 84 in terms of special funds.

Line “Retained earnings (uncovered loss)” 1370 - account balance 84 without special funds.

Line “Total for section” 1300 - the sum for lines 1310, as well as from 1340 to 1370 minus line 1320.

long term duties

Line “Borrowed funds” 1410 - account balance 67, including the amount of loans and interest accrued on them.

Line “Deferred tax liabilities” 1420 - account balance 77, it can be reduced by account balance 09.

Line “Estimated liabilities” 1430 - account balance 96 for the subaccount of estimated liabilities for more than 12 months.

Line “Other liabilities” 1450 - credit balances of accounts 60, 62, 68, 69, 70, 76 for which liabilities with a maturity period of more than 12 months are reflected.

Line “Total for section” 1400 - the sum for lines from 1410 to 1450.

Short-term liabilities

Line “Borrowed funds” 1510 - account balance 66, including loan amounts and interest accrued on them.

Line “Accounts payable” 1520 - The amount of indicators is entered in the court:

- Balances of accounts 60 and 76, which show the debt to suppliers and contractors;

- The balance on the credit of account 70, except for the debt on payment of income on shares and shares;

- The balance on the credit of the sub-account “Settlements on deposited amounts” of account 76;

- Credit balances of accounts 68 and 69;

- Account credit balance 71;

- Balances on the subaccounts “Calculations for claims” and “Calculations for property insurance” on account 76;

- Credit balances on accounts 76 and 62 for advances received;

- Credit balance on the subaccounts “Calculations for the payment of income” of account 75 and “Calculations of income for the payment of income on shares” of account 70

Line “Deferred income” 1530 - loan balances for accounts 86 and 98.

Line “Estimated liabilities” 1540 - balance from account 96 in the subaccount of estimated liabilities for less than 12 months;

Line “Other short-term liabilities” 1550 - other short-term liabilities that cannot be included in the previous terms of Section V.

The line “Total for section” 1500 is the sum for lines from 1510 to 1550.

Line “Balance” 1700 - the amount for lines 1300, 1400 and 1500.

Common mistakes when filling out a balance

When filling out a balance sheet, novice accountants often make the following mistakes:

- Accounts receivable and payable are shown as a collapsed indicator. This is a mistake - in the balance sheet you need to show separately the debt to debtors or creditors and separately - received or paid advances. Profits and losses should be reflected using the same principle.

- The amount of the advance received should not be reflected in pure form, but together with the VAT received with this payment.

- Fixed and intangible assets are reflected at historical cost. This is not true. These values must be adjusted to the amount of accrued depreciation for each type of property.

- Interest-free loans are shown as part of financial investments. This is incorrect; they should be shown as part of accounts receivable by maturity.

- Negative indicators are written with a minus sign. According to the instructions for filling out the form, negative values must be shown in parentheses without a minus.

Source: https://buhproffi.ru/otchetnost/buhgalterskij-balans.html

Case Study

Let's imagine that one of the employees of the company 09/01/2016. provided a loan in the amount of 107,000.0 rubles. until 02/28/2017 under the following conditions:

- interest rate – 4% per annum;

- repayment of the principal debt is carried out in equal monthly installments, interest is paid in a one-time payment after repayment of the principal debt;

- funds for repayment are deducted from the employee's salary.

At the same time, the refinancing rate of the Central Bank of the Russian Federation during the entire period of validity of the agreement was 9.5%.

To reflect these transactions, the accounting department made the following entries:

1) Dt 73.01

Kt 51 – RUB 107,000.0, loan transfer to the employee’s card;

2) Dt 70

Kt 73.01 – 17,833.3 rubles, repayment of the monthly amount of the principal debt;

3) Dt 73.01

Kt 91.1 – 356.6 rubles, interest accrued monthly;

4) Dt 70

Kt 68 – 472.5 rubles, personal income tax withholding;

5) Dt 68

Kt 51 – 472.5 rubles, transfer of personal income tax to the state budget.

Account 94 in accounting entries - shortages and losses

Operations for accounting for losses and shortages are specific and atypical for many enterprises. Accounting account 94 is used to reflect the amounts of identified shortfalls. In the article we will look at the features of accounting for shortages and damage to valuables, and also consider typical entries and examples for account 94.

Features of accounting for losses and shortages

The fact of a shortage of goods, materials and other valuables that are the property of the organization can be identified based on the results of the inventory, as well as when checking the quantitative availability of goods and materials received from the supplier. Losses of valuables established after an inventory can be identified in connection with:

- natural loss of inventory;

- abuse of officials of the organization;

- force majeure situations (natural disasters, accidents, etc.).

Shortage of valuables from the supplier may be due to incorrect execution of documents, as well as violations that were committed during the release and acceptance of goods.

To reflect generalized information about the amounts of losses and shortages identified upon acceptance of goods from the supplier or after an inventory, account 94 is used.

Write-off of inventory items (at actual cost), fixed assets (at residual cost) and partially damaged assets (at the amount of actual losses) is carried out according to Dt 94.

Dt 94 also reflects the cost of inventory items not received from suppliers.

The basis for recording transactions on account 94 is the inventory sheet. If a shortage of purchased goods is identified, its amount is reflected in accounting according to primary documents (invoices/receipt invoices, acts of acceptance and transfer of goods).

Typical transactions for account 94

The most common transactions on account 94 are entries to reflect the shortage of goods, materials and fixed assets identified based on the results of the inventory.

| Dt | CT | Description | Document |

| 94 | 01 | A shortage of a fixed asset item was identified (the residual value of fixed assets was written off) | Inventory sheet |

| 94 | 11 | Write-off of the cost of animals at livestock enterprises (if a shortage is identified, as well as dead and forced slaughter) | Inventory sheet |

| 94 | 07 | Equipment shortage identified | Inventory sheet |

| 94 | 08 | A shortage of investments in non-current assets has been identified | Inventory sheet |

| 94 | 10 | A shortage of materials has been identified | Inventory sheet |

| 94 | 41 | Reflection of the actual cost of goods for which shortages or damage have been identified | Inventory sheet |

The amounts of shortages identified in production are reflected in the following entries:

| Dt | CT | Description | Document |

| 94 | 20 | A shortage of work-in-progress products (main production) has been identified. | Inventory sheet |

| 94 | 23 | A shortage of work in progress products (auxiliary production) has been identified. | Inventory sheet |

| 94 | 29 | A shortage of work in progress products (service production) has been identified. | Inventory sheet |

| 20 (23, 29) | 94 | The amount of the identified shortage is attributed to the expenses of the main (auxiliary, servicing) production | Write-off act |

Depending on the fact of identifying the person responsible for the shortage, the cost of losses can be covered or written off as expenses:

| Dt | CT | Description | Document |

| 73 | 94 | The amount of the shortfall is attributed to the guilty party | Inventory sheet, Commission report |

| 91 | 94 | The amount of the shortfall is charged to other expenses (in the absence of the culprit) | Inventory sheet, Commission report |

| 99 | 94 | The fact of the shortage is recognized as an extraordinary expense | Inventory sheet, Commission report |

An example of accounting for transactions on account 94

An inventory was carried out at Mechanic LLC, as a result of which a shortage of goods and materials was revealed (working clothing in the amount of 3 units). Based on the fact of the investigation, the culprit was identified - the mechanic of the production workshop S.R. Petrenko. The cost of workwear (4,275 rubles) was withheld from Petrenko’s salary.

Reflection of the shortage and its compensation were reflected in the accounting of Mechanic LLC:

| Dt | CT | Description | Sum | Document |

| 10.11 | 10.10 | Special clothing was issued to workshop foreman Petrenko | 4275 rub. | Transfer and Acceptance Certificate |

| 20 | 10.11 | The issued protective clothing is reflected in expenses | 4275 rub. | Transfer and Acceptance Certificate |

| 94 | 98 | A shortage was identified (3 sets of workwear * 1425 RUR) | 4275 rub. | Inventory sheet |

| 73 | 94 | The debt of Petrenko S.R. was taken into account. according to identified shortage | 4275 rub. | Commission act |

| 70 | 73 | An amount was withheld from Petrenko’s salary to cover losses from the identified shortage | 4275 rub. | Payroll |

| 98 | 91.1 | The amount of repaid damage is reflected in non-operating income | 4275 rub. | Inventory sheet, Commission report |