Account purpose

To account for debt obligations with a payment period of more than 12 months, account 67 is used. This account combines all possible credits, loans and other financial resources attracted from:

- in Russian rubles,

- in foreign currency,

- in securities (bills, bonds and other debt obligations).

Let us remind you that despite their identical content, credits and loans have two significant differences:

- Loans are provided exclusively by licensed credit institutions. A loan can be given by any person, both an individual and a legal entity.

- Loans are provided only on the terms of repayment with interest payment. The loan can be either interest-bearing or interest-free.

Analytical accounting

Account 67 combines a lot of information: the amount of loans by type, the amount of accrued interest, penalties for late payments. To avoid confusion, it is necessary not only to distinguish different types of long-term liabilities from each other, but also to identify each creditor separately. An enterprise, in accordance with the recommendations of the accounting policy for organizing analytical accounting for account 67, can open the following sub-accounts:

- 67/1 “Long-term loans”;

- account 67/2 “Long-term loans”;

- 67/3 “Interest on payment of loans and credits”;

- 67/4 “Fines and penalties for the payment of loans and borrowings”;

- 67/5 “Overdue loans and borrowings”;

- 67/6 “Loans for the issue of securities”;

- 67/7 “Loans and credits for employees.”

The data is reflected in summary statements, with the help of which the accuracy of analytical accounting is verified.

General account information

Account analytics 67 accounting extended, providing separate accounting:

- for credit institutions in the context of loan agreements;

- for lenders (companies or individuals) in the context of loan agreements;

- by currency of loans and borrowings;

- on interest accrued for the use of credit or borrowed funds;

- and according to other criteria convenient for the organization.

The account may have sub-accounts:

- 67.01 “Settlements on loans and borrowings in Russian rubles”;

- 67.02 “Settlements on loans and borrowings in foreign currency”;

- 67.03 “Calculations of interest for the use of loans and borrowings.”

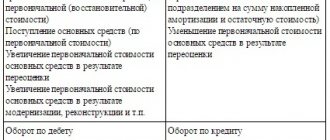

Account 67 of the accounting chart of accounts is part of the sixth, settlement section. The account is passive. The credit turnover of the account shows the amount of funds received in debt, and the debit turnover shows their return.

In general, accounting account 67 is an indicator of the financial instability of the company. The greater its share in the balance sheet liability, the more the company is exposed to commercial risks. This is the unsightly characteristic of account 67.

Now let's look at the wiring in detail.

Separate accounting

Long-term loans raised by issuing and placing bonds are accounted for separately in account 67.

Typical entries for account 67 may look like this.

| Situation | Solution |

| Bonds were placed at a price exceeding their face value | Make entries on Dt 51, etc. in correspondence with accounts:

The amount allocated to account 98 is written off evenly during the circulation period of the bonds to account 91 “Other income and expenses”. |

| Bonds are placed at a price below their face value | The difference between the placement price and the nominal value of the bonds is added evenly over the period of their circulation from Kt 67 to Dt 91 |

Interest payable on loans and borrowings received is reflected in Kt 67 in correspondence with Dt 91. Accrued interest amounts are taken into account separately.

For the amounts of repaid loans and borrowings, account 67 is debited in correspondence with the cash accounts. Credits and borrowings that are not paid on time are accounted for separately.

Analytical accounting on account 67 is maintained by:

- by type of credits and loans;

- on credit institutions and other lenders who provided them;

- for individual loans and borrowings.

A separate sub-account to account 67 records settlements with banks for discounting (discounting) bills and other debt obligations with a maturity of more than 12 months.

Accounting (discount) of bills and other debt obligations is reflected by the bill holder organization according to Kt 67 (face value of the bill) and:

- Dt 51 or 52 (actual amount of money received);

- 91 (accounting interest paid to the credit institution).

Accounting (discount) of bills and other debt obligations is closed on the basis of a notification from the credit institution about payment by reflecting the amount of the bill under Dt 67 and the credit of the corresponding accounts receivable.

When the holder of the bill returns money received from a credit institution as a result of discounting (discounting) bills or other debt obligations, due to the failure of the drawer or other payer of the bill to fulfill their payment obligations on time, an entry is made under DT 67 in correspondence with the cash accounts. At the same time, debt for settlements with buyers, customers and other debtors, secured by an overdue bill of exchange, continues to be recorded in the corresponding accounts receivable.

Also see “How to manage debtors’ debts to the enterprise.”

Analytical accounting of discounted bills is carried out by:

- for credit institutions that have discounted bills of exchange or other debt obligations;

- by drawers;

- on separate bills.

Also, separately on account 67, they keep records of settlements with credit institutions, lenders and drawers within the group of companies, about the activities of which consolidated financial statements are prepared.

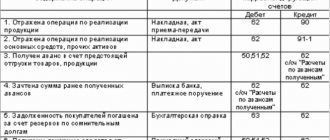

Obtaining credits and loans: transactions

| Contents of operation | Account debit | Account credit | Document | Transaction amount |

| Credit or borrowed funds received in Russian rubles | 50.01, 51.01 | 67.01 | Bank statement, receipt order | Amount according to documents, excluding VAT |

| Received a loan or loan in foreign currency | 52.01 | 67.03 | Bank statement | Amount according to documents, excluding VAT |

| Calculation of interest on a loan or loan | 91 | 67.02 | Interest repayment schedule under contracts, accounting certificate | Amount of accrued interest, excluding VAT |

| Calculation of interest on a loan or loan received for the purchase of real estate (or other large investment object) | 08 | 67.02 | Interest repayment schedule, accounting certificate | Amount of accrued interest, excluding VAT |

As with all passive accounts, the transaction amounts upon receipt of funds are recorded as credit. Examples of accounts with which account 67 can correspond are given in the table above.

Examples of transactions with transactions on account 67

Example 1. Accounting for a long-term loan received from a bank

LLC "Vesna" received a loan from the bank OJSC "Osen" for 3 years in the amount of 2,500,000 rubles. Principal and interest are calculated monthly in equal installments at a rate of 13.5% per annum.

Table of transactions for account 67 - Long-term loan:

| Dt | CT | Amount, rub. | Wiring Description | A document base |

| 51 | 67 | 2 500 000,00 | Obtaining a loan from OJSC "Osen" | Bank statement |

| 91.02 | 67 | 28 125,00 | The amount of interest on the loan for the month is reflected | Loan agreement, accounting certificate |

| 67 | 51 | 69 444,44 | Monthly principal payment | Payment order |

| 67 | 51 | 28 125,00 | Payment of interest | Payment order |

Example 2. Issue of a bond with a value higher than its par value

Let’s say an organization placed a bond on the secondary market worth 16,000 rubles, par value – 10,000 rubles. with a maturity of 24 months.

Posting table – Issue of a bond with a value greater than the par value:

| Dt | CT | Amount, rub. | Wiring Description | A document base |

| 51 | 67 | 10 000 | Reflection of the nominal value of the bond | Bank statement |

| 51 | 98 | 6 000 | Cash above par is reflected in accounting | Bank statement |

| 98 | 91.01 | 250 | Every month | Accounting certificate-calculation |

- Account 66 in accounting: entries for accounting for short-term loans and borrowings

- Postings for calculating interest on a loan

- Account 75 in accounting: entries for settlements with founders

- Account 10 Materials in accounting: postings, examples, subaccounts

Obtaining credits and loans in non-monetary form

The law allows for loans or borrowings in the form of goods or raw materials (materials). These are so-called commercial (commodity) loans. The postings for obtaining a commercial loan will be as follows.

| Contents of operation | Account debit | Account credit | Document | Transaction amount |

| Receipt of goods under a commercial loan agreement | 41.01 (10.01) | 67.01 | Consignment note, loan agreement | Amount according to the document, excluding VAT |

| Amount of VAT on goods received under a commercial loan agreement | 19 | 67.01 | Invoice for delivery note for receipt of goods under a loan agreement | VAT amount on the document |

Posting for accrual of interest under a commercial (commodity) loan agreement.

| Contents of operation | Account debit | Account credit | Document | Transaction amount |

| Interest accrued for using a commercial loan | 91 | 67.03 | Commercial loan agreement, payment schedule | Amount according to the document, excluding VAT |

Repayment of loans and loans: postings

Return (payment) of loans or borrowings is recorded in the debit of account 67. We will also present the transactions in table form.

| Contents of operation | Account debit | Account credit | Document | Transaction amount |

| Funds were transferred to repay a loan or loan in Russian rubles | 67.01 | 51.01 | Bank statement, payment order | Amount according to the document, excluding VAT |

| Funds were transferred to repay a loan or loan in foreign currency | 67.03 | 52.01 | Bank statement, payment order | Amount according to the document, excluding VAT |

| Interest paid for the use of loans or borrowings | 67.02 | 51.01, 52.01 | Bank statement, payment order | Amount according to the document, excluding VAT |

Account characteristics/description:

Subaccount 67.03 “Long-term loans” is intended to summarize information on the status of long-term (for a period of more than 12 months) loans received by an organization in the currency of the Russian Federation.

Analytical accounting is maintained for organizations that provided the loan (sub-account “Counterparties”) and concluded agreements (sub-account “Agreements”). Each organization that provided a loan is an element of the “Counterparties” directory. Each concluded agreement is an element of the “Counterparty Agreements” directory.

Description of the parent account: Description of account 67 “Settlements for long-term loans and borrowings”

“Entering initial balances: long-term loans in rubles.”

ENTRY: Debit 000 “Subsidiary account” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Entering initial balances

in the “Enterprise” menu, type of business transaction: “

Other accounting accounts”

“Acceptance for accounting of equipment requiring installation received under a loan agreement (long-term) in rubles”

ENTRY: Debit 07 “Equipment for installation” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt of goods and type of business transaction: “ Equipment”

“Acceptance for accounting of equipment requiring installation received under a long-term loan agreement in rubles.”

ENTRY: Debit 07 “Equipment for installation” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Acceptance for registration of a land plot under a long-term loan agreement in rubles.”

ENTRY: Debit 08.01 “Purchase of land” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Acceptance for accounting of a natural resource management facility under a long-term loan agreement in rubles.”

ENTRY: Debit 08.02 “Purchase of natural resources” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Acceptance for accounting of a construction project under a long-term loan agreement in rubles.”

ENTRY: Debit 08.03 “Construction of fixed assets” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Acceptance for accounting of a non-current asset (equipment) under a long-term loan agreement in rubles.”

ENTRY: Debit 08.04 “Purchase of fixed assets” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Acceptance for accounting of an intangible asset that has not been put into operation under a long-term loan agreement in rubles.”

ENTRY: Debit 08.05 “Acquisition of intangible assets” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Acceptance for accounting of raw materials and materials under a long-term loan agreement in rubles.”

ENTRY: Debit 10.01 “Raw materials and materials” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Acceptance for accounting of purchased semi-finished products, components, structures and parts under a long-term loan agreement in rubles.”

ENTRY: Debit 10.02 “Purchased semi-finished products and components, structures and parts” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Acceptance of fuel for accounting under a long-term loan agreement in rubles.”

ENTRY: Debit 10.03 “Fuel” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Acceptance for accounting of containers and packaging materials under a long-term loan agreement in rubles.”

ENTRY: Debit 10.04 “Containers and packaging materials” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Acceptance of spare parts for accounting under a long-term loan agreement in rubles.”

ENTRY: Debit 10.05 “Spare parts” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Acceptance for accounting of other materials under a long-term loan agreement in rubles.”

ENTRY: Debit 10.06 “Other materials” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Acceptance for accounting of construction materials under a long-term loan agreement in rubles.”

ENTRY: Debit 10.07 “Materials transferred for processing to third parties” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Acceptance for accounting of construction materials under a long-term loan agreement in rubles.”

ENTRY: Debit 10.08 “Building materials” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Acceptance for accounting of inventory and household supplies under a long-term loan agreement in rubles.”

ENTRY: Debit 10.09 “Inventory and household supplies” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Acceptance for accounting of goods under a long-term loan agreement in rubles.”

ENTRY: Debit 41.01 “Goods in warehouses” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Acceptance for accounting of goods at a manual point of sale under a long-term loan agreement in rubles.”

ENTRY: Debit 41.02 “Goods in retail trade (at purchase price)” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Acceptance for accounting of purchased items under a long-term loan agreement in rubles. in organizations engaged in industrial and other production activities"

ENTRY: Debit 41.04 “Purchased items” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Receipt of cash to the organization’s cash desk under a long-term loan agreement in rubles.”

ENTRY: Debit 50.01 “Cash of the organization” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt cash order

in the “Cash” menu, type of business transaction: “

Settlements for loans and borrowings”

“Receipt of cash to the operating cash desk under a long-term loan agreement in rubles.”

ENTRY: Debit 50.02 “Operating cash” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt cash order

in the “Cash” menu, type of business transaction: “

Settlements for loans and borrowings”

“Receipt of funds to the organization’s current account under a long-term loan agreement in rubles.”

ENTRY: Debit 51 “Current accounts” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt to the current account

in the “Bank” menu, type of business transaction: “

Settlements on loans and borrowings”

“Receipt of funds to a special account of the organization (letter of credit) under a long-term loan agreement in rubles.”

ENTRY: Debit 55.01 “Letters of credit” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt to the current account

in the “Bank” menu, type of business transaction: “

Settlements on loans and borrowings”

“Receipt of funds to a special account of the organization (checkbook) under a long-term loan agreement in rubles.”

ENTRY: Debit 55.02 “Checkbooks” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt to the current account

in the “Bank” menu, type of business transaction: “

Settlements on loans and borrowings”

“Receipt of funds to special bank accounts (except for letters of credit, check books, deposit accounts) under a long-term loan agreement in rubles.”

ENTRY: Debit 55.04 “Other special accounts” Credit 67.03 “Long-term loans”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt to the current account

in the “Bank” menu, type of business transaction: “

Settlements on loans and borrowings”

“Expenditure of cash from the organization’s cash desk to repay debt on previously received long-term loans in rubles.”

ENTRY: Debit 67.03 “Long-term loans” Credit 50.01 “Cash of the organization”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Cash order

in the “Cash” menu, type of business transaction: “

Settlements for loans and borrowings”

“Transfer of funds from the organization’s current account to repay debt on previously received long-term loans in rubles.”

ENTRY: Debit 67.03 “Long-term loans” Credit 51 “Current accounts”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Debiting from a current account

in the “Bank” menu, type of business transaction: “

Settlements for loans and borrowings”

“Transfer of funds from special bank accounts (except for letters of credit, check books, deposit accounts) to repay debt on previously received long-term loans in rubles.”

What does the account balance indicate?

The balance of account 67 is always a credit balance and shows the balance of the debt payable.

But there are also exceptional cases when, for unknown reasons, the transferred amount turns out to be more than the amount that the company must return. Then quickly sign a reconciliation report with the payee, write a letter to return the overpaid amount and make corrective entries.

| Contents of operation | Account debit | Account credit | Document | Transaction amount |

| Debt adjustment | 76.05 | 67.01 | Reconciliation report with the payee, accounting certificate | Overpayment amount, excluding VAT |

There comes a time when the period of time until full repayment of the loan or loan has become less than 12 months. For accounting purposes, such liabilities became short-term. It would be more correct to transfer such debts to account 66 using such an entry.

| Contents of operation | Account debit | Account credit | Document | Transaction amount |

| Transfer of the balance of a long-term dog into a short-term one | 66.01 | 67.01 | An inventory report of debt obligations, an accounting certificate, a reconciliation report with the organization that issued the loan or loan | Amount of remaining debt, excluding VAT |

But you can leave everything as it is.

Accounting information about the account

The reference document on the balances and turnover of account 67 is the account balance sheet for the period. It will show the total total amounts of receipts and payments of loans and borrowings for the period, as well as account balances.

Analytical accounting data for account 67 can be seen in the balance sheets broken down by subaccounts.

And more detailed information on all operations of the period is provided by the statement of account transactions. If information is needed on a specific organization or agreement, then a statement of transactions for the counterparty or agreement is generated.

Characteristics of account 67

This account is included in section VI of the Standard Plan, in which the accounts of the settlement group are located. They are created to characterize relationships with different debtors and creditors. In the modern economy, it is difficult for the average enterprise to manage without borrowing funds. Often this step becomes a “breakthrough” in the development of entrepreneurship.

Accounts 66 and 67 were created specifically to record transactions on loans and credits issued to the company. The procedure for organizing accounting for them is similar, but has one significant difference - the duration of the relationship between the lender and the borrower. Account 66 describes the relationship of the parties to short-term loans, i.e. those that last less than 12 months. Account 67 is intended to account for longer-term transactions occurring over 12 months or more.

It has a passive structure, since account balances at the end of the month are reflected as part of the company's sources. For a loan, there is an increase in borrowed funds (an increase in accounts payable), and for a debit, there is a decrease in debt obligations.

What an accountant needs to know about a loan agreement

Of course, the accountant must have a copy of the document - a credit agreement or loan agreement with a payment schedule for them. To correctly reflect transactions on loans and borrowings in an accounting program, you need to know:

- conditions and form of credit (loan);

- term and procedure for repayment of the principal debt;

- term and procedure for payment of interest.

If you immediately accrue all payments in the accounting program for the future, you will not have to remember them at the end of the reporting period or at the time of their payment. Just remember to adjust all future postings if the conditions for repayment of credit or borrowed funds change.