The normal activities of any company today are closely related to the good equipment of its existing services with communications equipment, communication systems, computers, and office equipment. But the acquisition of this property often poses a number of questions to the enterprise related to establishing their service life and the depreciation group that must be assigned to a particular object, since all of the listed assets are depreciable property. Let's figure out what should be considered when solving such problems.

Regulatory grounds

A depreciation group that determines the useful life (SPI) is assigned to each fixed asset. There are 10 of them in total, and the objects assigned to them differ in their service life. OS groups are united by the OS Classifier, which standardizes accounting information on objects, which, in turn, are grouped by types of OS. Thus, office devices are concentrated in groups, the code of which begins with the numbers 320 and 330. The depreciation group of the object is determined, focusing on the period of effective operation of the device. As a rule, the objects in question tend to undergo rapid moral and physical aging, so their SPI is small, and they are classified into the 2nd or 3rd depreciation groups.

From January 1, 2020, by Decree No. 526 dated April 28, 2018, changes were made to the OS Classifier, some depreciation groups were updated and expanded. However, the updates did not affect the categories of office equipment in question. OKOF codes previously assigned to these property groups have not undergone any changes. Let us remind you which depreciation groups include various types of office equipment.

Air conditioners shock-absorbing group in 2020

Accordingly, the useful life of a Household air conditioner is set in the range from 3 years and 1 month to 5 years. OKOF code 330.28.29 - Other general purpose machinery and equipment, not included in other groups (diesel and diesel generators with a cylinder diameter over 120 - 160 mm inclusive (diesel and drilling diesel generators); household appliances).

Air conditioner classifier of fixed assets by depreciation groups 2020

Depreciation on them will be carried out in the same manner. For new property, special tools are provided for a convenient transition to the new OKOF - transition keys between editions (direct and reverse).

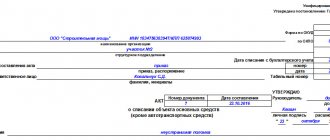

- In the first column of OKOF, find the type of property to which the OS belongs (9 digits).

- Check the code specified in the OKOF in the first column of the OS classification.

- If there is a code in the OS classification, look at which depreciation group the OS belongs to.

- depreciation group to which the fixed asset belongs. All depreciable property is combined into 10 depreciation groups depending on the useful life of the property (clause 3 of Article 258 of the Tax Code of the Russian Federation). Depreciation groups are also important in determining the amount of depreciation bonus that can be applied to a specific asset;

- the useful life must be within the limits established for each depreciation group (Letter of the Ministry of Finance of Russia dated July 6, 2020 No. 03-05-05-01/39563). Choose any period within the SPI, for example the shortest, in order to quickly write off the cost of the fixed assets as expenses (Letter of the Ministry of Finance of the Russian Federation dated July 6, 2020 No. 03-05-05-01/39563).

Method 1 - by property subclass code

The All-Russian Classifier of Fixed Assets (OKOF), which determines the depreciation group of fixed assets, remains unchanged. Since January 1, 2020, OKOF OK 013-2020 (SNS 2008), approved by Rosstandart order No. 2020-st dated December 12, 2020, has been in effect. The same classifier will be in effect in 2020.

- Write off such office equipment immediately upon commissioning in the NU and charge depreciation on it after registration in the BU. The method is not very convenient and involves the occurrence of temporary differences that are subject to additional accounting.

- Write off as expenses in NU, but not at once, but in parts (this opportunity is provided to the taxpayer by Article 254 of the Tax Code of the Russian Federation, clause 1, clause 3). At the same time, accrue depreciation for accounting purposes. Equipment that costs less than 40 thousand rubles can be written off as expenses immediately, without depreciation, both in tax and accounting.

We recommend reading: Russian Chernobyl Forum

Computer: shock absorption group

The PC is listed in the note to the 2nd depreciation group with code OKOF 330.28.23.23 “Other office machines.” This also includes printers, servers of various capacities, network equipment, information storage systems, as well as modems - all of them are listed in the note to this code, and, therefore, belong to the 2nd group, the SPI of equipment in which is a period of 2 years and 1 month to 3 years.

Laptops also belong to the PC category, which means they can be classified in group 2 and assigned the same code. Note that there is code 320.26.20.11 “Portable computers - laptops...”, which is also quite suitable for PCs. An enterprise has the right to choose which code is most suitable for designating a laptop, focusing on the parameters of the object and independently establishing the SPI.

There is one caveat that accompanies the installation of a PC. Sometimes the company purchases computer components (hard drive, monitor, keyboard, mouse) separately, reflecting the purchase on material accounts. There, these objects are taken into account if further resale is expected, but in these cases there is no talk of classifying the object by depreciation group, since they are materials/goods, but not fixed assets, and cannot function independently. Thus, it is impossible to assign a code to a monitor or system unit separately from the articulated working structure called a computer.

To put a PC into operation, it is necessary to bring it to an operational state, that is, to connect these elements into one complex, ready for operation and transfer it to the OS, assigning an inventory number, and then determine the SPI and assign the object to the 2nd depreciation group .

How do depreciation groups affect income taxes?

First of all, depreciation groups of fixed assets affect income tax. In general, the shorter the SPI, the correspondingly greater the amount of depreciation and the less tax payable.

Also, the possibility of applying a number of benefits related to the calculation of depreciation depends on the depreciation group:

- Depreciation bonus. This is the opportunity provided by law to write off part of the costs of upgrading the OS at a time. The specified premium can be no more than 10% of the initial cost of the object for groups 1-2 and 8-10 and no more than 30% for groups 3-7 (clause 9 of article 258 of the Tax Code of the Russian Federation). Read more about bonus depreciation here.

- Investment tax deduction. This benefit allows you to reduce the calculated income tax if fixed assets were purchased during the tax period. The deduction is provided only for objects belonging to groups 3-7 (Article 286.1 of the Tax Code of the Russian Federation).

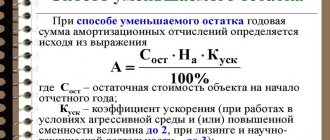

- An increasing coefficient for depreciation (up to 3) when purchasing fixed assets using leasing cannot be applied to objects belonging to groups 1-3 (clause 2 of Article 259.3 of the Tax Code of the Russian Federation).

- An increasing coefficient for depreciation (up to 2) for fixed assets produced under the terms of a special tax contract can only be applied to objects belonging to groups 1-7 (clause 1 of Article 259.3 of the Tax Code of the Russian Federation).

Shock absorption group of the phone

To designate a telephone (smartphone), the code 320.26.30.11.150 “Radio-electronic communications equipment” is provided, contained in the 3rd depreciation group, the belonging to which is determined by the SPI of this item - from 3 to 5 years. Depending on the quality and technical characteristics of the device, it can be classified under code 320.26.30.11.190 “Communication transmitting equipment” or under code 320.26.30.22 “Telephone devices for cellular/wireless networks”, also available in the 3rd group of the Classifier.

Seventh group of classification of fixed assets

- OKOF

- Shock absorption groups

- Seventh group

Property with a useful life of over 15 years up to 20 years inclusive.

Determination of depreciation group and useful life using the OKOF code:

| Code OKOF | Name | Note |

| Building | ||

| 210.00.00.00.000 | Buildings (except residential) | wooden, frame and panel, container, wood-metal, frame-cladding and panel, adobe, adobe, adobe and other similar |

| Facilities and transmission devices | ||

| 220.41.20.20.700 | Facilities for the construction industry, transport and communications | centralization control room and electrical |

| 220.41.20.20.721 | Railway transport structures | hydraulic columns; sand dispensing devices |

| 220.41.20.20.763 | Sewerage | asbestos-cement, steel sewer networks |

| 220.42.11.10.110 | Highways, except elevated roads (overpasses) | with crushed stone and gravel, soil, stabilized binding materials, coatings and rutted reinforced concrete |

| 220.42.11.10.150 | Access roads, transport and pedestrian overpasses above and below the road, bicycle paths | tram and trolleybus network without supports |

| 220.42.12.10.120 | Railway track for street trams | |

| 220.42.13.10.110 | Bridges and overpasses made of any materials for all types of land transport and for pedestrians | wooden and metal bridges on wooden supports |

| 220.42.13.10.111 | Road bridge | |

| 220.42.99.11.110 | Mining and related structures | |

| 220.42.99.11.190 | Objects specialized for the manufacturing industry, not included in other groups | open hearth furnace |

| cars and equipment | ||

| 320.26.30.11.110 | Communication facilities performing the function of switching systems | amplification, transit and other auxiliary tube and semiconductor communication equipment; railway communication equipment |

| 320.26.30.11.190 | Other communication equipment transmitting with receiving devices, not included in other groups | switching, static and other relay and electromechanical equipment; equipment for manual maintenance of central bank and MB systems; power distribution equipment, cabinets and DC power panels for communication facilities; input-cable and input-switching equipment; rectifying and converting equipment for communications |

| 330.27.90.70.000 | Electrical signaling devices, electrical equipment for safety or traffic control on railways, tramways, highways, inland waterways, parking areas, port facilities or airfields | equipment, mechanisms and devices for railway automation and telemechanics |

| 330.28.21.13.119 | Other industrial or laboratory electric furnaces and chambers, not included in other groups | cement kilns and refrigerators |

| 330.28.22.14.120 | Lifting cranes | |

| 330.28.22.18 | Lifting, transporting and other loading and unloading equipment | overhead conveyors |

| 330.28.22.18.140 | Car dumpers and similar equipment for handling railway cars | Broad gauge turnouts |

| 330.28.22.18.180 | Loading and unloading equipment for rolling mills, not included in other groups | strapping machines; units and machines for surface treatment of profiles and application of protective coatings; electrolyzers and service machines; machines and mechanisms for casting and transportation |

| 330.28.22.18.270 | Equipment for loading blast furnaces | loading and unloading mechanisms for dry coke quenching |

| 330.28.91.11 | Converters, ladles, molds and casting machines; rolling mills | packaging machines |

| 330.28.91.11.150 | Rolling mills for metallurgical production | casting and rolling units and mills |

| 330.28.96.10.120 | Equipment for the production of rubber and plastic products, not included in other groups | equipment based on roller and drum machines for the production of plastic products |

| 330.30.11.33.110 | Dredgers | with a capacity of more than 400 cubic meters. m/h |

| 330.30.20.31.115 | Machines for clearing paths of snow, debris and vegetation | snow blowers, snow plows |

| 330.30.20.31.117 | Power and track welding machines and units | electrical transformers, static converters and inductors; switches, contactors and reversers of high voltage alternating current; disconnectors, short circuiters, separators, high voltage alternating current grounding switches; high voltage voltage transformers; power equipment for traction substations, sectioning posts, parallel connection points, instruments and devices for their installation and operational maintenance |

| 330.32.99.53 | Instruments, equipment and models intended for demonstration purposes | stringed and reed musical instruments |

| Means of transport | ||

| 310.30 | Other transport vehicles and equipment | ship devices and deck mechanisms; hull equipment, ship boilers, electrical equipment, ship control systems and ship machinery |

| 310.30.11 | Ships, vessels and floating structures | dry cargo self-propelled sea vessels; auxiliary vessels, self-propelled and non-self-propelled, river and lake |

| 310.30.11.21.120 | Passenger river vessels | power up to 442 kW (600 hp), except for cruise ships; river hydrofoil passenger ships; river passenger hovercraft |

| 310.30.11.21.130 | Passenger vessels of mixed navigation "river-sea" | river hydrofoil passenger ships; river passenger hovercraft |

| 310.30.11.22.110 | Sea tankers | |

| 310.30.11.24 | Dry cargo ships | universal-purpose vessels with a carrying capacity of over 701 tons |

| 310.30.11.24.116 | Combined sea cargo vessels | self-propelled; towing vessels, technical |

| 310.30.2 | Railway locomotives and rolling stock | steam turbine power trains |

| 310.30.20.11.140 | Mining electric locomotives | |

| 310.30.20.12.110 | Mainline diesel locomotives | |

| 310.30.20.12.120 | Shunting and industrial diesel locomotives | |

| 310.30.20.13.111 | Steam locomotives | except for narrow gauge steam locomotives |

| 310.30.20.13.112 | Gas turbine locomotives | |

| 310.30.20.20.110 | Passenger railway carriages, self-propelled (motor) | diesel train cars |

| 310.30.20.20.113 | Railcars | |

| 310.30.20.33.113 | Tank cars | special |

| 310.30.20.33.114 | Isothermal cars | |

| 310.30.20.33.116 | Hopper cars | |

| 310.30.20.33.129 | Other freight cars, not included in other groups | broad gauge wagons for transportation of ore and apatite |

| Perennial plantings | ||

| 520.00.10.02 | Plantings of perennial berry crops | |

| 520.00.10.03 | Perennial grapevine plantings | |

| 520.00.10.07 | Artificial plantings of botanical gardens, other research institutions and educational institutions for research purposes | |

| Fixed assets not included in other groups | ||

| 740.00.10.01 | Literary works | |

| 740.00.10.02 | Dramatic and musical-dramatic works, screenplays | |