Depreciation of fixed assets in accounting and tax accounting

During use, OSs lose their value due to wear and tear. Depreciation is the inclusion by fixed assets of their value over a certain period of time in finished products, works, and services.

Fixed assets in accounting and tax accounting have different criteria for classifying objects according to their value.

In addition, not all methods of calculating depreciation can be used in tax accounting. For this reason, there may be discrepancies in the amount of depreciation in accounting and when determining taxes.

For tax accounting purposes

The Tax Code of the Russian Federation establishes that fixed assets will be objects with a long service life and a price of 100,000 rubles and more.

Depreciation of fixed assets is calculated based on the original cost and the depreciation rate, which is determined based on the period of operation of the object.

Objects priced below 100,000 rubles must be shown in accounting as materials, so their price is immediately included in the cost of finished products.

The same objects that are defined as basic in tax accounting must be depreciated either linearly or nonlinearly.

The first of them involves determining the depreciation rate based on the useful life. The depreciation rate per year is calculated by dividing the unit by the useful life and multiplying by 100%. This method can be applied in tax accounting to all fixed assets.

Attention! The nonlinear method is applied only to operating systems whose application period does not exceed 20 years (group 1-7). Depreciation is determined based on the residual value of the object and the depreciation rate, which is determined for each group based on the period of use of the asset.

For accounting purposes

PBU establishes that fixed assets in accounting include objects with a price of 40,000 rubles or more. Subjects have the right to charge objects with a price less than the established criterion as expenses as materials. For objects that are priced as fixed assets, depreciation charges must be calculated.

In this case, companies and individual entrepreneurs have the right to use one of certain methods:

- Linear - by multiplying the original cost by the depreciation rate calculated based on the useful life.

- Declining balance method (non-linear) - by multiplying the residual value by the depreciation rate calculated based on the useful life.

- Proportional to the number of remaining years of use - the initial cost is multiplied by a coefficient defined as the number of years of use of the OS by the sum of the number of years of use.

- Proportional to the volume of products produced - the initial cost is multiplied by the number of products produced and divided by the planned volume of products that can be produced at the facility for the entire period of its use.

You might be interested in:

Account 19 in accounting: what is it used for, subaccounts, characteristics, postings

Obtaining a guarantee of the buyer's solvency

An example will show what postings you should make in this situation.

PRIMERAO Aktiv entered into an agreement for the supply of goods with Passiv LLC.

The cost of goods is 236,000 rubles. (including VAT - 36,000 rubles), cost - 120,000 rubles. JSC Aktiv (supplier) demanded that the buyer, LLC Passiv, provide a bank guarantee to ensure payment for the goods. Passiv LLC provided a bank guarantee. After this, Aktiv JSC shipped the goods. Aktiv’s accountant must make the following entries: DEBIT 008

– 236,000 rubles.

– reflects the amount of the received bank guarantee; DEBIT 62 CREDIT 90-1

– 236,000 rub.

– revenue from the sale of goods is reflected; DEBIT 90-2 CREDIT 41

– 120,000 rub.

– the cost of goods sold is written off; DEBIT 90-3 CREDIT 68 subaccount “VAT calculations”

– 36,000 rubles.

– VAT is charged; DEBIT 51 CREDIT 62

– 236,000 rub.

– funds were received from the buyer – Passiv LLC; LOAN 008

– 236,000 rub.

– the amount of the bank guarantee has been written off. At the end of the month, the Aktiva accountant must determine the financial result from the sale of goods: DEBIT 90-9 CREDIT 99

– 80,000 rubles. (236,000 – 120,000 – 36,000) – profit from the sale is reflected.

When is depreciation not calculated?

The accounting rules provide for cases when depreciation of fixed assets is not carried out:

- Depreciation is not calculated for land plots and environmental management facilities due to the fact that their characteristics remain the same over the years.

- Objects that have not been used for more than three months, that is, transferred for conservation

- Depreciation is not calculated on fixed assets received free of charge.

- If the object has been received by the company and requires installation and modification. That is, while it is listed as construction in progress (account 08), depreciation on it is not calculated.

- For objects that, on the basis of the rules established by accounting policies, are transferred to the inventory.

- For leased OS objects.

Features of off-balance sheet accounting

Off-balance sheet accounts are a special section of the Chart of Accounts (approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n).

Off-balance sheet accounts were separated into a separate group of accounts due to their specifics: objects on them are reflected by a simple entry, that is, only by debit or credit of the account. In off-balance sheet property accounts, the accountant takes into account assets that are temporarily held by the organization and do not belong to it.

Some company obligations and documents accounted for in a special manner are also written off to off-balance sheet accounts - read the details in the article “Rules for maintaining accounting on off-balance sheet accounts.”

The procedure for determining the useful life of property

When determining the period of use of an OS object, a business entity must be guided by the following rules:

- First of all, it is necessary to use the approved OKOF classification. It is a table that lists all kinds of OS groups and the corresponding period of use. Typically the period is specified as an interval (for example, 10 to 15 years). A business entity has the right to choose any number of years included in this period.

- If an OS object is not assigned to any group according to the classifier, then it is necessary to establish the time of its use based on technical documentation or recommendations of the manufacturer (an indication of this is established by the Tax Code);

- If this information cannot be obtained, then you must contact the Ministry of Economic Development.

Attention! The established useful time must be secured at the disposal of the manager, or recorded in the transfer and acceptance certificate OS-1.

When determining the period of use for an OS that has already been in use, it is necessary to determine its period according to the group and subtract from it the time of operation at the previous place of work.

If the last period cannot be determined, then the company sets the time of use independently, but taking into account safety requirements. The law establishes the conditions under which it is possible to change the period of use of the OS after its commissioning.

This can be done in the following cases:

- Upon completion;

- When retrofitting;

- During reconstruction;

- During modernization.

Attention! The main conditions for extending the period are the fact that the characteristics of the OS object have changed so that it can be used longer than the previously determined period. However, the application time can only be extended to the previously accepted time of use.

Accounting structure and typical postings

As we noted earlier, accounting account 02 is used to maintain accounting records for the amounts of calculated AM in the context of each property and tangible asset.

02 which account: passive or active? Accounting account 02 is passive, since the amounts of accrued depreciation on property objects are reflected as a credit, and the write-off of the calculated AM is reflected as a debit.

Account structure:

- the credit balance at the beginning of the reporting period shows the amount of calculated depreciation at the beginning of the reporting period;

- credit turnover for the period reflects the amount of accrued AM for the selected period of time;

- debit turnover in accounting account 02 indicates the amount of written-off depreciation charges for retired objects (written off, sold, transferred to third parties);

- The credit balance at the end of the reporting period is the amount of accumulated depreciation charges at the end of the reporting period.

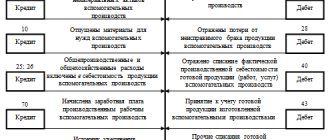

Typical wiring:

| Operation | Debit | Credit |

| Depreciation calculated: | ||

| According to OS of main production | ||

| By property used in auxiliary workshops | ||

| For OS objects operated for general economic and general production needs | ||

| Accrued depreciation on the property of a trading company (AM is included in sales expenses) | ||

| For assets leased or leased | ||

| AM was additionally accrued due to the revaluation of fixed assets | ||

Characteristics of account 02

To account for the amounts of calculated depreciation of fixed assets, account 02 “Depreciation of fixed assets” is used. It is passive, i.e., the calculated depreciation amounts on it are shown as a credit, and their write-offs are shown as a debit.

The account has the following structure:

- Initial loan balance - shows the amount of accumulated depreciation at the beginning of the billing period;

- Debit turnover - shows the amount of depreciation written off due to disposal of fixed assets, sale, etc.;

- Loan turnover - shows the amount of accrued depreciation;

- Final loan balance - shows the amount of accumulated depreciation at the end of the billing period.

The final balance is determined using the following algorithm: credit turnover is added to the initial balance and debit turnover is subtracted.

You might be interested in:

Accounting policies of organizations: why they are needed, approval deadlines, samples for 2020

For reliable and complete reflection of information, analytical accounts are opened for each asset object.

The balance of this account is not reflected directly in the balance sheet. The balance on it reduces the balance on account 01.

Attention! Account 02 is closed only when an asset is completely written off from the balance sheet - upon sale, liquidation, etc. Until this point, the balance should always be there and show the amount of wear and tear on the asset at the current time. The account is closed by writing off the balance to account 01 or 91.

Features of depreciation accounting

Accrued depreciation charges (AM) are accumulated in special account 02 in accounting. Depreciation accounting is carried out for each property of the company. It is unacceptable to make accounting entries without detailing the accounting objects.

Taking into account the peculiarities and specifics of its activities, each company has the right to open additional sub-accounts to account 02. Such detailing is carried out by the types of property assets owned by the company. For example, the company uses subaccounts: 02-01 - depreciation for buildings; account 02-02 - depreciation of machinery and equipment; 02-03 - AM on vehicles.

A complete list of subaccounts used should be determined individually for each company and fixed in the accounting policy.

Let us note that the property must be owned, because assets accepted for temporary safekeeping are not accepted on the balance sheet and are subject to accounting off the balance sheet, on the books. account 002. For assets capitalized on off-balance sheet accounts, depreciation is not accrued. However, there are exceptions. For example, objects received for rent or under leasing agreements, which, according to the terms of the agreement, must be taken into account on the balance sheet of the lessee.

Which accounts does it correspond with?

From debit 02 accounting account to credit accounts:

- sch. 01 — Write-off of calculated depreciation for fixed assets retired for various reasons;

- sch. 02 — Transfer of depreciation of leased fixed assets to a separate account that has become property;

- sch. 79 — Write-off of depreciation on fixed assets that were transferred to another separate division or received from it;

- sch. 83 — Write-off of previously calculated depreciation for additional capital during revaluation.

To credit account 02 from debit accounts:

- sch. 02 — Transfer of accrued depreciation to another account for leased fixed assets that have become the property of the lessee;

- sch. 08, 20, 23, 25, 26, 29, 44, 90, 91, 97 - depreciation of fixed assets;

- sch. 79 — Accrual of depreciation transferred to other structural units;

- sch. 83 — Additional depreciation at the expense of additional capital when revaluing fixed assets;

- sch. 91 — Depreciation on fixed assets that are leased, if this is not the main source of income.

Specifics of use

Account 02 is intended to record materials about depreciation accumulated during the use of fixed assets. The amount that was accrued is displayed in the corresponding transactions. There are several types of objects for which depreciation is not calculated:

- elements related to the housing stock (residential buildings, dormitories, apartment property);

- external improvement;

- forestry;

- Men at work;

- plots of land;

- environmental management;

- fund of library value, museum, artistic values;

- models of layouts and other aids located in offices and scientific laboratories;

- architectural and cultural monuments.

Accounting entries for account 02

See the complete chart of accounts for 2020.

Account 02 is involved in the following standard transactions.

Depreciation calculation based on the degree of participation of fixed assets in the production process

| Debit | Credit | Operation |

| 08 | 02 | Calculated depreciation on operating systems used when upgrading other operating systems |

| 08/3 | 02 | Depreciation was calculated for fixed assets used in the construction of one’s own fixed assets facility |

| 20 | 02 | Depreciation was calculated for fixed assets used in the main production |

| 23 | 02 | Depreciation was calculated for fixed assets used in auxiliary production |

| 25 | 02 | Calculated depreciation for fixed assets for general production needs |

| 26 | 02 | Calculated depreciation for fixed assets for general business needs |

| 29 | 02 | Depreciation was calculated for fixed assets used in maintenance services |

| 44 | 02 | Depreciation was calculated for fixed assets used in servicing the sales process |

| 79 | 02 | Depreciation was calculated for fixed assets received from another division or transferred there |

| 91/2 | 02 | Calculated depreciation for fixed assets leased |

| 97 | 02 | Depreciation was calculated for fixed assets used in processes, the costs of which will be taken into account in future periods |

Write-off of accrued depreciation

| Debit | Credit | Operation |

| 02 | 01/Disposal | Write-off of depreciation on fixed assets that were disposed of, sold, liquidated, etc. |

| 02 | 03 | Write-off of depreciation on fixed assets that were intended for rental |

| 02 | 79 | Write-off of depreciation on fixed assets that was received or transferred to another division |

Subaccounts

In addition to account 08, you can open a number of additional second-order accounts. Their number varies depending on the needs of the organization. Let's list the main subaccounts:

- 8.1 - used when accounting for the costs of acquiring land;

- 8.2 - records investments in other natural objects;

- 8.3 - accumulates data on the construction of fixed assets;

- 8.4 - takes into account the costs of acquiring fixed assets;

- 8.5 - stores information about investments in intangible assets;

- 8.6 - registers funds spent on raising animals;

- 8.7 - collects information about funds allocated for the purchase of adult animals;

- 8.8 - Summarizes the costs of research and development of new production technologies.

Intangible assets

Intangible assets are assets that can bring profit to an organization, but do not have any material expression. Information about them is stored in subaccounts 8.5 and 8.8. If the technologies developed by the organization are introduced into the scope of its activities, expenses on them are recorded in the debit of account 04 - “Intangible assets”. Otherwise, debit account 91.

It is necessary to distinguish between subaccounts 8.5 and 8.8. The first one receives data only on those assets that are acquired by the organization in several stages. They usually also record the costs associated with the transaction. After settling all financial and legal issues, expenses are recorded in the debit of account 04.

Features of accounting in livestock farming

Account 08 provides for two special sub-accounts for maintaining financial reporting in the agricultural sector - 8.6 and 8.7. The costs of purchasing an adult animal consist of the cost of its purchase, delivery, examination, and other things. If it is accepted free of charge, the market value of the animal is recorded in the register. Expenses for raising animals and transferring them to the main herd are carried out at the planned cost.

An animal is put into service when it enters the main herd or place of permanent residence. Data on young animals being raised is transferred from account 11 to account 08. After this, the costs for them are transferred to account 01.