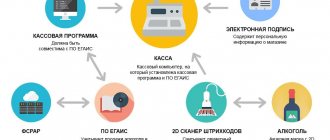

The sale of beer falls into the category of “sale of alcoholic beverages”, and therefore switches to online cash registers from July 1, 2020. When choosing a cash register, it is important to evaluate its compliance with the requirements of the Unified State Automated Information System and Federal Law-54, the ability to connect to the Internet, print paper checks, and work with payment cards. A review of seven models of online cash registers shows that there are devices for mobile and stationary trading. You can connect not only a new, but also a modernized old cash register to the Federal Tax Service.

Deadline for switching to online cash registers for beer sales

The sale of alcoholic beverages is an area that requires strict control by the state. In this regard, the introduction of online cash registers in Russia primarily covered the trade in beer and stronger alcohol.

Federal Law No. 54 “On the use of cash register equipment” notes that from March 31, 2020, organizations that are engaged in:

- retail sale of alcoholic products (including draft beer stores);

- retail sale of alcohol within public catering establishments.

Reference! According to Federal Law No. 171 “On state regulation of the production and circulation of ethyl alcohol,” alcoholic products include vodka, cognac, wine, fruit wine, liqueur wine, sparkling wine (champagne), wine drinks, beer and drinks made from beer, cider, Poiret, mead.

From April 1, only firms engaged in the beer trade that had not previously used cash registers switched to online cash registers. If the organization had already used a cash register before, then it could only exchange it for a new one or upgrade it by July 1, 2017.

Important point! There are provisions in the legislation that allow you to count on a delay in transferring beer sales to online cash registers:

- firms operating on the basis of PSN or using UTII can switch to a new cash discipline from July 1, 2020 (FZ-290);

- companies selling excisable goods in hard-to-reach areas may not use cash register equipment (FZ-171).

Amendments to Federal Law 54 oblige firms involved in the sale of beer to switch to online cash registers from July 1, 2020. This special norm has priority over the general norms given above (clause 13 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 47 of July 11, 2014). Therefore, there will be no delays in the transition to new cash registers.

Figure 2. From July 1, 2020, all retail alcohol sales points, including draft beer stores, switched to online cash registers. Source: online magazine “Modern Entrepreneur”

Which online cash registers are suitable for selling alcohol - a review of popular models

When choosing an online cash register model for companies that sell beer at retail, you should pay attention to several important details:

- compliance with the requirements of the Unified State Automated Information System and Federal Law-54 (presence in the register of online cash registers of the Federal Tax Service of Russia);

- ability to connect to the Internet wired or wireless;

- transfer of data to the Federal Tax Service through the fiscal data operator (FDO) online or within 30 days from the date of the transaction by sending information from the fiscal drive;

- generation of not only electronic, but also paper receipts (availability of a printer) for handing over to customers;

- availability of mechanisms for working with payment cards.

Important point! When selling beer, the company is not obliged to report to the Unified State Automated Information System on transactions with customers: usually it sends an invoice only upon receipt of a shipment of goods at the warehouse. Source: official website of the Federal Tax Service of Russia

If necessary, the cash register must be provided with functionality for non-stationary, on-site sales of alcoholic beverages.

In order to finally decide on the choice of an online cash register for selling beer, you should read the review of 7 cash register models.

Table 1. Overview of online cash register models for beer trade

| Name | Photo | Price | Manufacturer | Peculiarity |

| Atol Autonomous cash desk EGAIS | 26-28 thousand rubles. | Athol | For small stores (WiFi, 3G and Ethernet; transfer of information to EGAIS and OFD via cable) | |

| Barcode Mobile PTK | 30-31 thousand rubles. | NCT "Izmeritel" | For outdoor and non-stationary beer trade (connects to a smartphone via Bluetooth; works with Windows CE or Android systems) | |

| AMC 100K | 17-19 thousand rubles. | Athol | For a stationary point of sale of beer | |

| Evator Alco | 37-39 thousand rubles. | Athol | For small retail stores (touch display, ability to connect other devices) | |

| Evator Alko UTII | 33-34 thousand rubles. | Athol | For retail outlets operating on UTII (barcode scanner, data transfer to EGAIS) | |

| Stroke Light PTK | 30-32 thousand rubles. | Athol | For stationary beer trade (connection to a PC, work with basic accounting programs) | |

| F Print 22 PTK | 28-29 thousand rubles. | NCT "Izmeritel" | For stores selling any alcohol with connection to EGAIS |

The considered models of online cash registers are applicable not only to the sale of beer, but are also suitable for companies involved in the sale of any alcoholic beverages. In addition, they are suitable for any taxation system; characterized by a high level of reliability and the ability to operate autonomously for 30 days.

What kind of cash register is needed for beer sellers?

Almost any online cash register that exists today is suitable for a beer and beer beverage store. For those selling strong alcohol, a cash register compatible with the Universal Transport Module (UTM) is required. In addition, they will need a special 2D barcode scanner and possibly other equipment for EGAIS.

Important.

Beer sellers must be registered in the EGAIS system, but are not required to transmit sales data. They only register the receipt of goods. To do this, the free UTM utility must be installed on any available computer. Keeping a log of alcohol products is mandatory in electronic (special software) or paper form. To sign the fact of acceptance of invoices, you need a CEP on the token.

Of the variety of models, online cash registers are divided into stand-alone, terminals, fiscal registrars and POS systems (more details). Each of these groups has common technical and other characteristics.

Autonomous push-button cash register

The most affordable option. It does not connect to the terminal, but interacts with the computer only for settings. Control occurs via the keyboard; it is possible to connect a barcode scanner and other equipment (depending on the model). The Atol 91F cash register is considered functional and convenient, while the Mercury-185F is less expensive but popular.

Terminal

The first cash register terminals with a smart prefix appeared in 2020. This new generation of cash registers is distinguished by the presence of a built-in sales program and the presence of a touch screen. Recommended for those who are interested in sales accounting and a large product database. Prominent representatives are Evotor and Kassatka. There is also a terminal called Sigma 10, which has a larger screen.

Fiscal registrar

The device is known to many from chain stores. It is this that prints the receipt, receiving a signal from a computer or terminal with a commodity accounting program. It is better to use such a cash register when there is a need to use 1C or another program. For small retail outlets, the Atol 30F fiscal registrar is recommended.

POS system

The most expensive type of CCP. Includes a set of equipment for quick service and convenience of the seller and cashier. You can still find it in the same mass stores. The fiscal registrar issues checks in such a system.

All of the above devices must have a fiscal drive installed.

Moreover, its validity period should not exceed 15 months (clause 6 of Article 4.1 No. 54-FZ). What you need to do to sell beer

- Purchase a JaCarta or Rutoken crypto key with a recorded qualified electronic signature (CES);

- Register in your personal account on the website egais.ru;

- Download the UTM utility for free from your personal account on your computer;

- Buy an online cash register that suits your requirements;

- Maintain a journal for recording the volume of retail sales of alcoholic and alcohol-containing products (approved by order of the RAR dated June 19, 2015 No. 164)

- It is possible to use a commodity accounting program compatible with UTM EGAIS to make it more convenient to keep a logbook of alcoholic beverages;

- Submit a sales declaration once a quarter (procedure for submitting declarations).

Attention!

When market participants connect to EGAIS to confirm the retail sale of alcohol, there is no need to maintain a journal in paper form, since it can be created in a personal account on the system’s website.

Read more

.

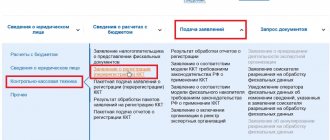

How to connect a cash register to sell beer?

Companies involved in the sale of beer can purchase a new cash register from the list above that complies with the requirements of Federal Law-54 and Unified State Automated Information System, or upgrade an already used cash register. In each case, the procedure for connecting to the Federal Tax Service will be different.

Table 2. Connecting an online cash register for selling beer

| Using the new cash register | Modernization of the old cash register |

|

|

Material on the topic: instructions for connecting an online cash register.

Buying a new cash register will allow you to avoid a lot of additional activities. In addition, not all CCPs can be modernized and provided with the ability to connect to the Internet.

Important point! The refusal of a company engaged in the beer trade to use an online cash register from July 1, 2020 involves the payment of fines in accordance with the provisions of the Code of Administrative Offenses:

- for failure to use a new cash register - 75-100% of the organization's revenue and from 10 thousand rubles. from officials;

- for non-compliance of the cash register with the requirements of Federal Law-54 - from 5 thousand rubles. from the organization and from 1.5 thousand rubles. from its officials.

Remember about the operational inventory of the bar? So I'm not talking about her.

Let's consider the situation: 10 points of sale in different parts of the city, at each point there are N taps with connected kegs of N types of beer, a mountain of full unconnected kegs. You need to quickly find out at any point in time whether the actual balance of beer at each point of sale corresponds to the book balance. In order to place an order to a supplier or to a central warehouse on a reasonable basis, I would like to know exactly how much beer is in offline kegs, without calling all 10 points of sale. Well, to the heap, so that everything fits with EGAIS when necessary.

Document settings

You, as a customer, will not be satisfied with the operational inventory of the bar for a number of reasons: the actual balance recorded by conducting an inventory in the middle of the day will not give absolutely anything if you do not immediately compare its results, and only after comparison allow you to sell beer further, simultaneously distributing these inventory. This is due to the fact that the sales report will be carried out at the end of the day and subsequent sales will also be recorded in it. The implementation act no longer has the “Current time” setting. All sales are rolled up into one document. You would also like to analyze surpluses/shortages, for example, the next day or today, but in the evening, and let them collect data for you there at the points... I inform you that tomorrow there will be no use from five inventories of one type of beer, carried out at each changing the keg during this day. You will only sow confusion in the commodity flow report. You really shouldn’t close the cash register shift every time you change a keg!?

Incomprehensible movements

If sellers steal, intentionally or in good faith, by mistake, then deviations between actual and book balances can only be identified between shifts, when inventory should be carried out in the real world.

EGAIS gives a hint on what to do.

Have you already heard about balance registers No. 1 and No. 2? While solving the problem of accounting for online beer balances in iiko, we will at the same time practice using beer cats to work with registers, as they are understood in the task “Write-off of products whose retail sales are not subject to accounting in EGAIS.”