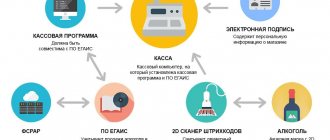

As a measure to combat counterfeit alcohol products, as well as to organize global control over all production and circulation of alcohol, a specialized application was created, the use of which became strictly mandatory for sellers. In this review, we will analyze the EGAIS system, tell you what it is, and describe how to use the application and install this software. We will also focus on the legislative aspects that regulate this innovation in our country. In addition, the law strictly defines the introduction lines, which should not be neglected so as not to lose the sales license.

General concepts

It must be said that just two years ago, counterfeit alcohol-containing products accounted for more than 30% of the total market volume. Every third bottle was actually illegal. The drink was produced in violation of established standards and could cause significant damage to health and threaten the life of the consumer. Not only did this situation harm the economy, it also massacred the country's citizens. The new application, as its main mission, involves combating such products, but also has many other tasks that are solved during operation.

Decoding and translation of the abbreviation EGAIS - a unified state automated information system. It is valid for any manufacturer and retailer in the country. If you distribute alcohol, even if it is only beer or other drinks with low alcohol content, then you are required to use it for accounting purposes. And the connection requires a cash register, which is an additional complexity.

EGAIS: decoding and purpose

EGAIS is a means of controlling alcohol circulation in our country. The module is designed to ensure transparency of all data related to the sale of alcohol. Since the use of unlicensed and questionable products is not only illegal, but also causes devastating harm to health, the program minimizes such risks. The database contains detailed information about each bottle, from composition to production date. This applies not only to domestic but also to imported goods.

Any company that sells alcoholic beverages (or any of them) is required to attach special equipment to its cash register. The installed module translates the received data into the common EGAIS database. The data transfer process is fully automated and does not depend on the human factor. The owner of the point only needs to install the program, and it will begin to carry out further actions itself. There is no need to submit any special reports or declarations.

What does sending data to the database do?

- Since the decoding of EGAIS implies a unified system, the program controls the sale of alcohol throughout Russia, regardless of the size of the territorial entity (that is, both in cities and in villages).

- Accounting is carried out not only quantitatively, but also based on other factors: the strength of drinks, their type, composition and other features are taken into account. A detailed description of each individual product is entered into the database.

- Accounting for imported products allows you to track sales of the drink in the country of origin. This way you can conduct a comprehensive analysis and get a complete picture.

- Systematization affects excise and special federal stamps and licenses.

- Control over alcohol circulation informs about the wishes of consumers, market developments, and global trends.

- Fight against counterfeit products.

It is the latter that is the main stumbling block for which the system was created. According to rough estimates, counterfeit alcohol makes up almost a third of the volume of corresponding products in the country.

Business Solutions

- shops clothing, shoes, groceries, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

Stages

The first step is production of the product and applying a special marking to the bottle. The excise tax will contain in encrypted form all the information about the quality, time of production and region of the manufacturer.

Next, the connected program, using a regular barcode, itself reads the information received. Naturally, you will have to manually run the scanner over absolutely every unit of production in order to send the data. The last stage is analysis, which is carried out in the central database. The program will only transmit all the information that will be used on the official website of EGAIS.

Functions

Thus, considering that the application collects information about each unit of alcohol produced, records the quality, conditions, number of receipts and sales, the volume of information is quite large. With its help, the application performs several functions at once:

- Keeps records of the number of goods produced and sold, recording the region, product quality, strength and price.

- Records and analyzes the quantity of products sold and received, processes price positions, the total share of imported and domestic goods, and considers the effectiveness of specific importers.

- Reveals the ratio of excise stamps and federal ones.

- Based on the data obtained, it conducts an analysis of the dynamics of overall market growth, the presence of regression or stagnation, the preferences of the consumer base, and current market trends.

- Fights counterfeit products.

Connection deadlines

The uniform introduction period based on the law is January 1, 2016. But there are also nuances that concern sellers of products with low alcohol content. The deadline based on all possible delays (mainly due to 278-FZ) is January 1, 2020. But, given the fact that all these periods are already behind us, for current sellers, connecting to the program should coincide with the start of their activities. The receipt of products without recording them in a unified database is considered illegal.

Legislation

As for retail, the main norm regulating the entire process is 182-FZ, which actually amends the law on state regulation of alcohol-containing products. It is this federal regulation that obliges the use of a unified accounting system at all stages from receipt of delivery to sale to the target client. It is also worth paying attention to 171-FZ. This rule applies to the use of online cash registers, which not only serve to record and record the fulfillment of the terms of a public offer and confirm a retail transaction, but also keep records of the entire turnover of goods.

Connection to EGAIS

By January 1, 2020, producers and sellers of alcoholic beverages in all regions of Russia were required to connect to the new information system. Newly recognized legal entities and individual entrepreneurs are also required to register to sell alcohol through EGAIS. The official website is intuitive. It contains clear text and video instructions for connecting to the system.

Required to purchase products through the system, but exempt from recording sales:

- organizations selling beer, mead, cider, poiret and beer drinks at retail;

- restaurants, cafes and other catering organizations.

Manufacturers of champagne and other wines made from their own grapes may not register with EGAIS.

Procedure

On the official website of the service, in the left side menu there are detailed instructions for connecting to the system for different categories of activity. They are somewhat different from each other. In any case, the following equipment must be purchased before registration:

- computer (or use an existing one);

- hardware crypto key – you need to write an electronic signature certificate onto it;

- online cash register;

- 2D scanner.

Reference! A hardware key (smart card) is a compact storage medium containing a secure microprocessor and an operating system that controls the device and access to RAM and long-term memory.

It contains a program (applet) that performs all the necessary cryptographic operations inside the device and without using external resources. After purchasing the equipment, you must complete the following steps:

- go to the official EGAIS website and follow the link “Login to your personal account”;

- Click “Read the terms and conditions and check their compliance.” At this stage, the conditions for access to your personal account on the website are checked;

- follow the system requirements and, if necessary, download distribution kits of system components and install them;

- upon completion of the verification, click “Go to your personal account”;

- enter the PIN code (GOST) of the hardware key issued during its purchase;

- Click the “Show certificates” button. The electronic signature certificate will be displayed in the window that opens;

- generate an RSA key. To do this, click on the certificate and select the “Get key” section;

- load UTM (universal transport module for transferring information between service sections) into the computer;

- install an adapted and modified information system.

Reference! Before registering, importers and manufacturers of alcohol-containing products are required to send an application to the Federal Alcohol Regulation Agency, which will issue software for installation on a computer and then check the technical equipment.

How to properly connect to EGAIS and install UTM is described in detail in the video:

Hardware and software requirements

For uninterrupted operation of the service, individual entrepreneurs and legal entities involved in the purchase or sale of alcoholic beverages must have equipment that meets certain requirements.

Table 1. System requirements for organizations and individual entrepreneurs engaged in the purchase, storage and wholesale or retail sale of alcoholic products. Source: egais.ru

| Type of hardware or software | Characteristics |

| CPU | Frequency from 1.8 GHz, from 32 bits |

| Network Controller | Ethernet, RJ45 connector, 100/1000 Mbps |

| RAM | Minimum 2 GB |

| HDD | Minimum 50 GB |

| operating system | Windows or Linux |

| Required software | Java 8.0 and higher |

For manufacturers and importers, the requirements are significantly different. You can familiarize yourself with them by downloading System Requirements for Manufacturers and Importers.

Price

All EGAIS software is provided free of charge. No certification required. The equipment can be purchased from any company.

How the system works

The basis of its work lies through the integration of all points of sale into a single data archive. Upon delivery, the stage of recording information follows, upon sale, again this moment. It turns out that all manipulations with alcohol will be taken into account and processed. The seller himself does not have to do anything for this. Everything is fully automated. There is no need to keep reports, draw up documents and submit them to the competent authorities. You just need to connect the application, and then work quietly in your key.

Of course, this is very convenient. But it is worth remembering that selling products bypassing the cash register is strictly prohibited, and any check that reveals an actual discrepancy can lead not only to serious sanctions, but also to criminal liability.

How to work in EGAIS 3.0 with labeled alcohol

How to consume alcohol at retail in EGAIS 3.0

Upon receipt of products, the recipient can:

- Fully accept the products. In this case, he confirms that he has checked the entire shipment and takes into his balance all the excise stamps listed in the invoice. The products will appear on the recipient's balances in Register No. 1 and in blots ─ in Register No. 3.

- Partially accept the products. To do this, you need to draw up a statement of disagreement and indicate those electronic identifiers that were in the electronic consignment note, but were not accepted by the recipient.

- Do not accept products.

You also need to know that in electronic invoices, excise stamps are indicated for each bottle, so the number of positions in it is equal to the batch size

. And in paper consignment notes, data can be aggregated, so the number of lines in paper and electronic invoices may not match.

The technical side of acceptance using the example of Lightbox software

When a supplier uploads an invoice for product release into EGAIS, the information is transferred through UTM to the store’s inventory system.

In order to check receipt, the store needs to check the excise stamps on the bottles and the information specified in the invoice. This is easy to do through the “Scan PDF Stamps”

:

According to the explanations of Rosalkogolregulirovanie, if the total quantity of shipped products is the same in both electronic and paper invoices, then this situation does not violate the accounting procedure.

Before scanning, information about the number of units in a particular invoice will appear on the screen.

In cases where a PDF stamp is scanned again or part of the receipt remains unverified, the system will issue appropriate warnings.

After inspection, the buyer decides in what volume he accepts the products.

Is it necessary to scan every bottle received? Yes, it is better to spend time when accepting the goods and correct discrepancies at this stage.

For example, a supplier sent a batch of goods to two stores (A and B), but mixed up the bottles. And store A received alcohol, which is listed in EGAIS as store B, and vice versa. Such a discrepancy is very easy to find with proper acceptance.

If you put the receipt on the balance sheet without looking, then you will still find both extra and missing bottles. But resolving issues regarding their sale will be much more difficult: you will need to obtain a separate permit from the RAR to sell this alcohol.

EGAIS - what is it in retail, how does the program work

Let's look at what operating the software will look like and what the seller will have to do directly. We will also consider what actions should be taken if a functionality failure occurs.

Supply

First of all, you should compare the actual quantity of goods and their data on the invoice. Only then can you confirm the fact of delivery for the system using a sales document. But the key point is that any damage to the excise stamp will not allow the scanner to read the barcode correctly - careless transportation, the code has been torn off or scratched. It will no longer be possible to drive it into the database.

In this case, you can draw up a discrepancy report, in which you specifically indicate the differences between the receipts and the invoice. Or give it up. If there are no problems, then all products need to be filled into the system.

Sale

Every time any alcohol is sold, this act must be noted and synchronized with the central database. To do this, the scanner must read the excise tax code before implementation, and then wait for the information to be processed. Encrypted information in xml format will be instantly sent to the online server. And only after this, the cash register will be able to continue working and close the transaction by printing a receipt. You are wondering what the EGAIS database means - this is the main server of the Federal Service for regulating the alcohol market.

How to work with EGAIS for beer

The product accounting process is not complicated. However, it is necessary to pay attention and time to figure out how to work in EGAIS. Instructions for retailers might look something like this:

- The supplier is obliged to generate and carefully fill out invoices for the goods ordered by the buyer even before delivery.

- The company that purchases the products receives these invoices using the UTM (universal transport module). UTM is a specialized program that is installed by specialists on a personal computer. It is created to collect data in the system.

- When the buyer receives his goods, he is obliged to count it and compare whether the quantity received corresponds to what is indicated in the documents. If everything is in order, then he needs to send a special confirmation to EGAIS.

- If this happens, the volume of alcohol indicated in the confirmation is automatically written off from the balance of goods of a particular supplier. This data is credited to the customer (for his balance).

- If what is received does not correspond to what was sent, then the store may refuse the delivered products or record a shortage in the program. The same thing happens with surplus goods.

This mechanism helps to closely monitor how much product was sent by the supplier and how much the buyer received directly at the retail point of sale.

If UTM EGAIS does not work, you need to contact support. Its specialists will help improve the situation in the shortest possible time.

Equipment

Data collection terminalsLabel PrintersMobile printersMicrokiosks (price checkers)Barcode scannersAfter sale

The final stage of the transaction in retail sales is the transfer of the receipt to the buyer. This is an agreement that confirms the fact of purchase. When using online cash registers, a QR code is displayed on the receipt. This is all the information about the current transaction, with which you can verify the authenticity. To do this, the buyer needs a special program for his smartphone. But if the data was processed in a unified alcohol accounting system, then there are two such codes. One for all goods, the second specifically for alcoholic products. Moreover, the alcohol code will be common, regardless of the number of units sold. Scanning this QR will allow the buyer to find out all the information about the quality and manufacturer.

If there is a failure

If the app suddenly stopped working, does this mean that all sales of alcohol-containing products should be stopped? Not really. This module can even work offline. Simply when access is restored, all accumulated information is immediately redirected to the server. Therefore, there will be no financial losses for the legal entity. But it’s worth remembering that you can only work in this offline mode for three days. After this time, if the problem has not yet been resolved, you will have to stop the implementation until the problem is resolved.

Why do you need the EGAIS system?

Each enterprise that is engaged in the retail sale of alcoholic beverages must necessarily connect to the EGAIS system and install a special software module at the cash desks, which will allow data to be transferred to this alcoholic beverages accounting system. Data transfer using this program is carried out automatically. Thanks to this system, the completeness and reliability of data related to the production and circulation of drinks that contain alcohol is ensured.

Using the EGAIS system, all imports of certain brands are controlled, and low-quality goods can also be identified. The EGAIS system allows you to analyze the development of this type of industry.

Why you need EGAIS and how to use it, turnover and procurement

It's time to move on from general questions to more specific ones. Since the system displays turnover and purchases, and legislative norms strictly require its installation, the question arises of how to quickly and most conveniently fulfill these requirements. And besides, what specific sanctions may follow if you do not install the application on time. Let's consider whether there are cases when this utility will not be necessary, and you can do without it without violating the law.

Business Solutions

- the shops

clothes, shoes, products, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

What do you need to connect?

In order to install this application, the point of sale must have certain parameters. Specifically, to complete the task we will need:

- Adequate network access speed. To process requests without delays, you need to focus on a value of at least 256 kbit/s.

- You will need a JaCarta crypto key. And also a digital signature for it. Simply put, CEP.

- A special application for communication with the EGAIS system. It is called UTM, which can be deciphered as a universal transport module.

- A program for accounting for goods, as well as a cash register, and is fully compatible with the application.

- Reading devices, that is, a scanner with a 2D function, as well as a fiscal recorder that can print a receipt marked in the form of a QR code.

What can we offer

For a modern legal entity, all this fuss around the mandatory registration of excise stamps, constant correction of data, and correct recording of information is a real headache. It is logical to use the help of specialists who already have ready-made integration solutions in both boxed and individual formats.

Cleverence offers:

- Boxed packages, including EGAIS 3.

- Ready-made solutions for integration with any accounting systems.

- All software is easily integrated into mobile platforms, access and processing from cellular devices.

- Generated packages of business processes, pre-optimized for maximum productivity.

- Russian software 100%.

Penalties for not connecting to the EGAIS system

According to the Code of Administrative Offenses (Administrative Code of the Russian Federation), all organizations and individual enterprises are required to connect to the Unified State Automated Information System, but if after a certain date they do not connect to the specified system, then penalties will be imposed on the enterprise, namely:

| The person who is fined | Amount of fine |

| Executive | From 10,000 rubles to 15,000 rubles |

| Entity | From 150,000 rubles to 200,000 rubles |

In addition to the administrative fine, organizations that have not connected to the EGIS system will not be able to confirm the goods received from the supplier. At this moment, the supplier’s balances in the EGIS system will not be written off. And therefore, suppliers will stop shipping goods to those buyers who are not connected to the EGIS system.

Who doesn't need to be connected?

If we talk about manufacturers, there are several concessions that are logical to take advantage of. It’s worth clarifying right away that the absence of legal requirements only means that you don’t have to work with the program, but if you express a desire, you can fully integrate it. Manufacturers of beer or beer drinks are exempt from registration. But only if the total production volume does not exceed three hundred deciliters annually.

Producers of various types of wine. But this rule works if the source of grapes or other raw materials for goods is one’s own plantations and lands. If the question is about retail sales, then sellers of beer and beer drinks can also refuse to work with this software, but with some restrictions. We are talking about the form of organization; only one legal entity has the right to ignore the requirements of the Federal Law - these are individual entrepreneurs.

Official website of the EGAIS system for the sale of alcohol

From all of the above, it becomes clear that for any sale of alcohol, including beer and beer drinks, entrepreneurs need to connect to EGAIS on the official website.

- Go to the portal through which all information about alcohol is transmitted to EGAIS.

- Insert the crypto key into the USB port of your PC and download the appropriate driver for it to work.

- Log in to your personal account on the EGAIS website to control the circulation of alcohol by clicking the “Login” button.

- Obtain a test certificate by selecting the appropriate button in the window that opens. Follow the instructions, download the certificate generation application and generate the required file for yourself. Write it down to a crypto key.

- In your personal account, receive a unique access key for each outlet. Find the “Generate” button in the appropriate section, click on it and enter the PIN code you received when purchasing the crypto key.

- Here, download and install the transport module on your computer or laptop (it is provided free of charge). It is installed only once, no matter how many outlets you have.

To work with EGAIS, you also need to install the appropriate cash register software or configure an existing program for accounting for goods. When selling only beer and low-alcohol drinks based on it, the free service available on the portal will be sufficient. More detailed information about connecting to a single database can be found here.

- POS system Atol Retail EGAIS Lite

64 990 ₽

64990

https://online-kassa.ru/kupit/pos-sistema-atol-ritejl-egais-lite/

OrderMore detailsDiscontinued

1 review

10 200 ₽

10200

https://online-kassa.ru/kupit/atol-utm-hub-19/

OrderMore detailsDiscontinued

2 900 ₽

2900

https://online-kassa.ru/kupit/etsp-dlya-onlajn-kass/

OrderMore detailsIn stock

Technical support service

If you have problems working with the system, declaring or keeping a log of alcohol, you can at any time contact the hotline for EGAIS users - 8 (800) 25-00-137. When applying you must indicate:

- business name and identification number;

- last name and first name of the caller, as well as contact phone number;

- describe the problem in detail.

If you provide incomplete information, the operator may not enter your request into the system.

Another article of ours: Mandatory labeling of alcoholic products in 2020

Portal sections

The main page of the site displays all the current news that relates to work in EGAIS and the sale of alcohol-containing products in the Russian Federation.

You can select the required section and get acquainted with the information presented on the portal in more detail in the menu located on the right side of the window.

- Connection to the state registry. The first section provides detailed instructions that describe the procedure for connecting all alcohol market participants to EGAIS.

- Instructions. It is a selection of videos that explain in detail how to connect to the system. PDF files are also available for download on the page: print them or save them on your smartphone to always have access to answers to your questions.

- Technical means. Here are the requirements that the system places on computer equipment (processor, RAM, hard drive capacity, printer and scanner characteristics, etc.).

- Duration of connection to the system. Manufacturers, suppliers and distributors connected to the system at different times. This section specifies the deadlines for mandatory connection for each type of activity.

- Regulations. Here are all the laws, regulations and orders related to the circulation of alcohol through the Unified State Automated Information System.

- Explanations. This page contains answers to all complex questions and controversial issues in the current legislation. In addition, examples of filling out reporting documentation are shown.

- Video conferencing. Here are recordings of meetings that are directly related to the implementation, operation and changes of the government system.

- Knowledge base. This section contains all the information that businessmen may need when working in EGAIS. The information is presented in the form of an online encyclopedia.

- Monitoring. On this page you can familiarize yourself with the performance of all nodes of the current system. Data is updated every 10 minutes.

- Another portal of the federal service that regulates the market for alcohol-containing products. It provides more extensive information about the activities of the organization and contains the most complete catalog of all necessary documents. Among other things, there is also the EGAIS classifier of alcoholic products, which lists all product codes.

Responsibility for non-compliance with standards

Information on sanctions applicable in case of refusal to install EGAIS is contained in Article 14.19 of the Administrative Code. Accordingly, this is a fine of 150 to 200 thousand rubles. And also a specific punishment for the head of this enterprise in the amount of 15 thousand rubles.

It is worth understanding that the provided norm applies in the case when there has been an actual sale of a unit of goods that has not been registered on the FS server. In addition, even if all the software is installed and connected, but the product was sold without registration, exactly the same penalties are implied. That is, if for some reason the seller did not record the excise tax barcode with a scanner, this measure comes into effect. If there is no way to read the code, the product must be written off and its sale is prohibited. In addition, the same rules apply when receiving products from the supplier; you cannot keep a unit of product and sell it if the excise duty has been damaged.

Fines and sanctions for violating the procedure for registering alcoholic beverages

Let us note right away that there are no sanctions in the legislation for the failure to connect the alcohol seller to the Unified State Automated Information System. But there are - for violations in the application of the procedure for recording alcoholic beverages provided by law. Since its circulation is permitted only with the help of the Unified State Automated Information System, in fact, sanctions will be imposed precisely for its non-use.

Any release of a bottle past the Unified State Automated Information System, detected by the inspection authorities, will be accompanied by sanctions. Presented (Article 14.19 of the Code of Administrative Offenses of the Russian Federation - LINK):

- Fine:

- for an individual entrepreneur or an official of a legal entity - in the amount of up to 15,000 rubles;

- for a legal entity - up to 250,000 rubles.

- Confiscation of bottles that have not been registered in the system.

- By revocation of the liquor license (if used).

Let us note that confiscation and cancellation of a license are carried out only by a court decision - but it is highly likely to be issued.

Question and Answers

A few key points in FAQ format.

How is the EGAIS system translated, decrypted and working?

Unified state automated information system. The software synchronizes the operation of cash registers with the FS server by scanning excise taxes.

Do I need to scan the product upon receipt?

No, reception is carried out through electronic document management. But this does not mean that you can turn a blind eye to damaged stamps that cannot be counted at retail.

If the product was received before 2020?

It can be implemented without registration.

Do we need a program to sell only beer if we are an LLC?

Yes.

What is the use of this application?

There is no need to record retail sales, they are recorded automatically.

How to accept incomplete beer in EGAIS. EGAIS ACT Discrepancies.

If the goods are not accepted in full, then it is necessary to accept the invoice in EGAIS using a discrepancy report . To do this, you need to select the desired TTN and click the Create discrepancy report button.

The program will ask Create a discrepancy report, click YES

In the open window, we look at how many goods are listed in the TTN and there is (Qty of TTN) in the REAL column, you need to change the quantity to the real quantity, how much was accepted and click OK

Then the SEND button will appear, click on it and click Upload several times. As a result, it will be displayed at the bottom that the discrepancy act has been accepted by the Unified State Automated Information System.

Public catering

As for cafes, bars and all other HoReCa establishments, the situation here is identical to that described above.

Like individual entrepreneurs working only with beer, catering establishments are not required to record every fact of retail sale. But they must also convey all the complete information during procurement. Actually, having studied in detail what the EGAIS program is and how you need to work with it, you can understand that it is not so scary and problematic. On the one hand, this is stricter control, which is close to total. On the other hand, for enterprises that are accustomed to doing business honestly, there will be no noticeable difference. The only difficulty is in the integration, which we can help you with. Number of impressions: 4163

How to make movements in EGAIS. How to write off beer in EGAIS.

After receiving the goods in EGAIS, all beer falls automatically into Register 1 (it is also called the EGAIS Warehouse), and in order to write off beer in EGAIS, you need to move the necessary balances in EGAIS from register 1 to register 2 (Trading floor) from there the beer is written off in EGAIS .

The first thing you need to do to write off beer sales in EGAIS is to order the balances from register 1 and move them to register 2 . To do this, go to the EGAIS request section and click the Make a request .

After requesting balances, we wait for the READY status to appear , after the READY status appears, you can open and see if there are any balances in Register 1, if there are any, then you need to move the beer to further display beer sales in EGAIS.

In order to make a move to EGAIS , you need to go to the Trading Room section and click the Move .

The EGAIS program will offer to make a transfer from the balances that are listed in the EGAIS program in register 1, press YES .

In the EGAIS program you can do a partial movement of beer , in this case you need to click on the Add and add beer positions that specifically need to be moved, or move everything at once to register 2, I’ll show you how to move everything to register 2 at once. In order to make a complete move to EGAIS, in the window that opens, click the Add ALL button .

The EGAIS UTM program will ask, fill in all the balances in EGAIS, click YES

After the EGAIS program fills in all the balances, press the SEND

the Document has been sent to EGAIS will appear , click OK

After we have sent the goods movement to EGAIS , we periodically press the Upload button and check when the status of Accepted appears for the goods movement in EGAIS .

After some time, receipts for beer transfer to EGAIS , click YES

After the transfer, the status Accepted , which means the entire balance has moved to register 2 and you can show beer sales in EGAIS by writing .

In order to write off beer in EGAIS you need to go to the balances section Register 2 and click Make a request

The program will ask you to request balances on the trading floor , click YES

We are waiting for the UTM to receive the remainder of register 2 and appear in the EGAIS program . READY status appears .

When the status is ready, you can make write-offs in EGAIS.

In order to show your sales in EGAIS, you need to make write-offs in EGAIS , to do this, go to the Trading Room section and click the Write Off button.

You can write off remaining beer in EGAIS all at once ; to do this, click the Add all button, and then Send. I will show you how to write off beer in EGAIS separately for each item ; to do this, click the Add .

The EGAIS program will offer to fill in the balances from the trading floor of register 2, click Yes .

In the window that opens, the beer write-off window in the Quantity column displays the balances of EGAIS goods, which are listed in register 2. To write off the desired beer product in EGAIS, select it and enter the quantity that needs to be written off in EGAIS.

When all beer items are selected for beer write-off, click the To document button.

To send a write-off of beer sales, click the Send .

After sending the beer write-off to EGAIS, the status Document sent to EGAIS , click OK

After sending beer sales to EGAIS, periodically press the Upload .

A status will appear that a receipt for debiting from the trading floor , click Close

Based on the result, the write-off status will appear as Accepted, which means that you have written off the beer in EGAIS.

You can download the program for working in EGAIS from the link.