The transfer of administration of insurance premiums to the Federal Tax Service has raised many questions. One of the most relevant: what is the payer status for payment of insurance premiums from 2020 to indicate in field 101 of the payment order? Previously, we published material on the issues of filling out payment orders for insurance premiums in 2017. And here we will only touch on changes in filling out field 101.

It is known that the rules for filling out field 101 in a payment order are regulated by Appendix No. 5 to Order No. 107n of the Ministry of Finance of the Russian Federation. But the currently valid version of this application does not contain a status that could undoubtedly be applied to the policyholder transferring contributions to the Federal Tax Service. Let us remind you that before the transfer of administration of insurance premiums to the Federal Tax Service, it was necessary to indicate code “08” in all cases in the payment order for payment of insurance premiums.

In turn, in 2020, the Ministry of Finance of the Russian Federation published a draft order “On amendments to the order of the Ministry of Finance of the Russian Federation No. 107n.” This document states that when transferring insurance premiums by legal entities, code “01” must be indicated in field 101. Individual entrepreneurs paying insurance premiums “for themselves” must indicate payer code “09”, individual entrepreneurs paying insurance premiums for employees must indicate payer status “14”.

But this draft Order has not yet entered into force. Therefore, what the payer’s status should be in a payment order in 2020 is not entirely clear.

However, there is still no official clarification on this topic. In this regard, you can only rely on your own logical thinking, in the hope that it coincides with the thinking of the people who will administer these payments.

Meanwhile, on thematic forums on the Internet, accountants express three points of view on what status should be indicated in field 101. We bring each of them to the attention of readers.

Payment order form in 2017

Since 2020, there have been a huge number of tax and accounting changes. See “What will change in 2020: taxes, insurance premiums, benefits, reporting, accounting and online cash registers.”

However, in order to pay taxes and insurance premiums in 2020, you should, as before, use the payment order forms familiar to all accountants. The payment form, numbers and names of its fields are given in Appendix 3 to the Regulations approved by the Bank of Russia dated June 19, 2012 383-P. The form of the payment order stipulates that it must indicate the status of the payer.

Payer status is field 101 of the payment slip. A special code is written into this field, which consists of two digits. This code indicates who exactly is making what payment.

The payer status is indicated in the payment order if taxes, insurance premiums or other obligatory payments are transferred. If the payment is made in favor of the counterparty, then field 101 is not filled in.

Rules for filling out payment orders in 2017

The rules for filling out payment orders for the payment of taxes and insurance contributions were approved by Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. These rules continue to apply in 2020.

However, from 2020, instead of taxpayers and payers of insurance premiums, taxes and contributions can be paid by third parties: organizations, individual entrepreneurs or ordinary individuals (Clause 1 of Article 45 of the Tax Code of the Russian Federation). When filling out payment slips, third parties are also required to follow the rules approved by the Order of the Ministry of Finance of Russia dated November 12. 2013 No. 107n. See “Third parties now have the right to pay taxes, fees and insurance premiums for others.”

What should an individual entrepreneur indicate in a payment order?

KBK for UTII for individual entrepreneurs - what is it and where can I get it

An entrepreneur can choose the taxation system himself, for example, simplified tax system or UTII. Depending on the nature of the payment being made, certain details are indicated in the order. Further details for each individual case.

Filling out a payment form

When paying for the simplified tax system

If an entrepreneur makes payments while using the simplified taxation system (STS), he must fill out the appropriate fields in the payment order in a certain way. Each of them has its own number.

| 5 | Not filled in. |

| 24 | The purpose of the payment is specified. In this case, “Tax according to the simplified tax system for 2020.” |

| 21 | The number “5” is indicated. |

| 101 | Payer status of IP USN “09”. |

| 102 | Empty. |

| 103 | Intended for entering the checkpoint (reason code for registration). When registering an individual entrepreneur, it is not assigned. |

| 104 | The BCC (Budget Classification Code) is indicated. There are two different codes for the simplified tax system: 18210501011011000110 - for income tax; 18210501021011000110 - for income tax (“Income minus Expenses”). |

| 105 | Designed for OKTMO (All-Russian Classifier of Municipal Territories). |

| 106 | The following notations are used:

|

| 107 | The period for which payment is made is specified. For example, if for a year, then “GD.00.2019”. |

| 108 | ABOUT. |

| 109 | The date of submission of the simplified tax system declaration is entered in the case of depositing funds for the year. If an advance is made according to the simplified tax system, “0” is entered. |

| 110 | Not filled in. |

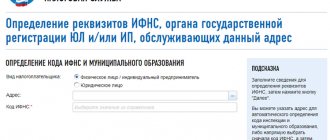

The order also indicates the details of the tax service. You can find them out either on the website of the Federal Tax Service (Federal Tax Service) or at the branch before filling out the payment form.

Important! Before filling out the payment form, you should definitely check the details of the tax service. There is always a possibility that they could have changed.

The OKTMO code, which is indicated in the “105” field, must also be clarified. There are several options for finding out:

- on the Federal Tax Service website (service “Find out OKTMO”);

- on the Rosstat website (by TIN or OGRN);

- directly at the Federal Tax Service office.

All payment orders for paying taxes and contributions, which are carried out by an entrepreneur using a simplified procedure, are filled out almost the same way. But there are still some differences and nuances.

Payer status: what to indicate in 2017

Payer status codes were approved by order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n (Appendix 5 to this order). According to this order, until 2020, when paying all types of insurance premiums, code 08 had to be indicated in field 101 of the payment order.

At the same time, in 2020, the Russian Ministry of Finance published a draft order “On amendments to the order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation " This document was developed, in particular, in connection with the fact that since 2020, the tax authorities have been transferred powers to administer insurance contributions for compulsory pension, social and health insurance. See "Insurance premiums from 2020: overview of changes."

The mentioned draft order of the Ministry of Finance, among other things, stipulates that when transferring insurance contributions for compulsory pension (social, medical) insurance for employees in 2020, code 01 must be shown instead of code 08. That is, payments for insurance premiums from 2020 must be issued the same as for taxes. The only difference is in the BCC and the purpose of payment.

Also, since 2020, new payer statuses have appeared, which must be used by organizations or individuals paying taxes and insurance premiums “for others”: statuses 29 and 30. Here is an updated table of payer statuses from 2020, based on the draft order of the Ministry of Finance:

Payer status when filling out a payment order in 2017.xlsx

| Field number | Field code | Field code value |

| 101 | 1 | Taxpayer (payer of fees) – legal entity |

| 2 | Tax agent | |

| 6 | Participant in foreign economic activity – legal entity | |

| 8 | An organization (individual entrepreneur) that transfers other obligatory payments to the budget | |

| 9 | Taxpayer (payer of fees) – individual entrepreneur | |

| 10 | Taxpayer (payer of fees) – notary engaged in private practice | |

| 11 | Taxpayer (payer of fees) – a lawyer who has established a law office | |

| 12 | Taxpayer (payer of fees) – head of a peasant (farm) enterprise | |

| 13 | Taxpayer (payer of fees) - another individual - bank client (account holder) | |

| 14 | Taxpayer making payments to individuals | |

| 16 | Participant in foreign economic activity – individual | |

| 17 | Participant in foreign economic activity - individual entrepreneur | |

| 18 | A payer of customs duties who is not a declarant, who is obligated by Russian legislation to pay customs duties | |

| 19 | Organizations and their branches that withheld funds from the salary (income) of a debtor - an individual to repay debts on payments to the budget on the basis of a writ of execution | |

| 21 | Responsible participant of a consolidated group of taxpayers | |

| 22 | Member of a consolidated group of taxpayers | |

| 24 | Payer – an individual who transfers other obligatory payments to the budget | |

| 26 | Founders (participants) of the debtor, owners of the property of the debtor - a unitary enterprise or third parties who have drawn up an order for the transfer of funds to repay claims against the debtor for the payment of mandatory payments included in the register of creditors' claims during the procedures applied in a bankruptcy case | |

| 27 | Credit organizations (branches of credit organizations) that have drawn up an order for the transfer of funds transferred from the budget system, not credited to the recipient and subject to return to the budget system | |

| 28 | Legal or authorized representative of the taxpayer | |

| 29 | Other organizations | |

| 30 | Other individuals |

What taxpayer statuses are used in payment orders?

Tax payments are made according to budget classification codes (BCC); in addition, a legal entity or individual (payer) must indicate a two-digit code that takes a value from 01 to 26. For example, status 09 corresponds to an individual entrepreneur paying tax. Order of the Ministry of Finance of the Russian Federation No. 107 establishes the following groups of budget classification codes for payers of taxes and fees:

- 01 - legal entity (organization). This code is indicated by all organizations paying taxes, fees, insurance premiums and other expense transactions controlled by the tax authorities. For example, contributions to the Pension Fund for company employees are made with payer status 01.

- 02 - tax agent (the organization pays tax for other persons). This code is indicated by organizations and individual entrepreneurs who pay taxes instead of employees. For example, personal income tax deductions (13% of an employee’s income) are always carried out by an organization that acts as a tax agent for its employees. When drawing up a payment order, the payer status 02 is indicated.

- 08 - legal entity or individual entrepreneur. This code is used by organizations, individual entrepreneurs, notaries and lawyers who have opened private practices, as well as heads of farms when paying contributions to insure employees against accidents at work. Contributions to the Social Insurance Fund “for injuries” range from 0.2% to 8.5%, depending on the level of risk at the enterprise. For example, the head of a construction company engaged in high-rise work pays insurance premiums in the amount of 0.9% of the employee’s salary, indicating code 08.

- 09 - individual entrepreneur. This code is used by individual entrepreneurs who pay taxes, insurance premiums and other fees on behalf of the organization.

- 10 - a notary officially conducting private practice. This code is indicated by employees of private notary offices who pay taxes, insurance premiums and other fees on behalf of the notary office.

- 11 is a lawyer officially conducting private practice. This code is indicated by lawyers who have received a lawyer's certificate and opened a law office.

- 12 - head of a registered farm. This code is used when paying taxes and contributions to extra-budgetary funds on behalf of a peasant or farm enterprise engaged in crop production, livestock breeding and similar activities.

- 13 – individual. Individuals who independently pay taxes and fees to the budget indicate code 13 in the payment order.

- 21 and 22 are a consolidated group of taxpayers. Such statuses are assigned to organizations that voluntarily unite to pay income tax on a common financial result (profit or loss). Code 21 is used for payments from a senior (responsible) group member, payer status 22 is assigned to ordinary members.

- 24 - an individual paying contributions to the Social Insurance Fund. Taxpayer status 24 is usually used by self-employed citizens who make contributions to the social insurance fund.

- 26 are founders conducting bankruptcy proceedings. Payer status 26 is used during the forced liquidation of a company under Federal Law No. 127 on insolvency (bankruptcy).

Government agencies making various payments in favor of individuals and organizations use the following codes in field 101:

- 04 - tax authorities. This code is used for payments between federal and local authorities of the Federal Tax Service (federal tax service). For example, funds from the federal budget are transferred to the budget of the village, the Federal Tax Service accountant indicates code 04 in field 101.

- 05 - FSSP (Federal Bailiff Service). This taxpayer status is used by bailiffs at the time of transferring overdue debts of individuals. For example, a citizen did not pay contributions to the Pension Fund, the pension fund lawyer turned to the magistrate to obtain a court order, then handed over the papers to the bailiff. The FSSP employee writes off part of the citizen’s salary to pay off the debt to the Pension Fund, indicating code 05.

- 07 - FCS (federal customs service). This code is used when paying customs duties withheld from individuals and organizations when transporting goods abroad.

- 23 - FSS (social insurance fund). This taxpayer status is applied when paying compensation, subsidies and material assistance from the social insurance fund.

- 25 - banks that refund VAT or excise taxes. This code is used by banking organizations that act as guarantors of transactions (refund of overcharged VAT), including foreign trade transactions (refund of overcharged excise tax).

Individuals and organizations acting as participants in foreign trade operations (import, export, customs clearance) use the following payer statuses:

- 06 - a legal entity participating in foreign trade operations. This payer status is used by organizations conducting transactions with foreign counterparties. For example, a company has entered into an agreement for the supply of goods from Brazil and pays the tax fee, indicating code 06.

- 16 - an individual participating in foreign trade operations. Code 16 is used for payments made by individuals conducting trading operations with foreign companies.

- 17 - individual entrepreneur participating in foreign trade operations. Payer status 17 is used by individual entrepreneurs transporting goods across the border or working with foreign companies.

- 18 - an organization or individual paying customs duties without filling out a declaration.

Financial and credit institutions working with funds of private clients issue payment orders with the following codes:

- 03 - Russian Post (payment on behalf of an individual). This code is used by post office employees when sending budget payments to citizens. For example, a car owner received a traffic fine and pays it through the post office. The post office employee indicates payer status 03.

- 15 - credit or postal organization transferring funds to an individual. This payer status is used in branches of commercial banks, money transfer systems and post offices when sending funds to individuals.

- 19 - an organization that calculates part of an employee’s salary according to a writ of execution. Code 19 is used by employing companies that have received a writ of execution for the forced collection of tax debts from a defaulting employee.

- 20 - a credit organization that transfers funds to the budget on behalf of a private individual. This payer status is used for automatic payments of taxes and fees through the bank application.

Payer status for individual entrepreneurs

As can be seen from the table above, individual entrepreneurs in 2020, in order to pay insurance premiums as for hired personnel, must indicate the payer status code “14”. If the individual entrepreneur pays insurance premiums “for himself,” the payer status code should be indicated – 09.

If an organization or individual entrepreneur acts as a tax agent and pays, for example, personal income tax for employees, then code 02 is indicated in the payer status in field 101 in 2020. It has not changed. This code was also used in 2020.

Insurance premiums for employees

If an entrepreneur has employees on his staff, he is obliged to pay monthly insurance premiums for them.

Contributions

The corresponding payments are made to:

- PFR (Pension Fund of Russia);

- FSS (Social Insurance Fund);

- FFOMS (Compulsory Health Insurance Fund).

Note! Also, individual entrepreneurs are obliged to pay insurance premiums not only for employees, but also for themselves.

To the Social Insurance Fund, the entrepreneur makes two types of insurance payments for employees:

- industrial accidents;

- in case of loss of ability to work (and maternity).

These payments are made only if the corresponding clause is specified in the employment contract between the individual entrepreneur and the employee.

The Pension Fund makes payments for pension insurance, and the Federal Compulsory Medical Insurance Fund makes contributions for health insurance.

The basis for calculating the amount of payments is all payments received by the employee from the manager. Payments for sick leave and vacation are also taken into account.

Payment of insurance premiums, as well as payment of taxes, is made using payment orders. You should approach filling them out very responsibly and monitor all changes.

The Federal Tax Service is responsible for accepting and administering insurance payments. In the “Recipient” field in the payment, you must indicate the short name of the federal treasury and the tax service branch at the place of registration. You can find out payment details on the Federal Tax Service website.

In field “104” you need to indicate the BCC. For each type of contribution there is a specific combination:

- KBK for insurance pension contributions - 18210202010062110160;

- KBC for payments for health insurance - 18210202101082013160;

- KBC for deductions of contributions in case of temporary disability - 39310202090071000160;

- KBK for payment of contributions in case of an accident at work - 39310202050071000160.

Important! Before filling out the payment form, be sure to check whether this combination is valid.

Field “101” indicates the payer status. For individual entrepreneurs this is “09”.

In connection with the innovations, the question may arise, what is the status of insurance premiums for individual entrepreneurs in the payment plan - “09” or “08”?

From 2020, in all payment orders, individual entrepreneurs must indicate the status “09” in the “101” field. The only exception is payments to the Social Insurance Fund, in which case the status “08” is indicated.

Sample payment order: new status

Official confirmation from the Federal Tax Service

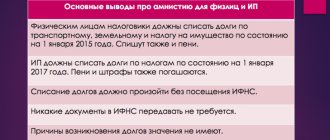

When filling out field 101 “Payer status” of the payment order for the transfer of insurance premiums, organizations must enter the value “01”, and individual entrepreneurs - “09”. This is confirmed by the letter of the Federal Tax Service dated 02/03/17 No. ZN-4-1/1931.

Tax officials learned that bank software does not allow accepting “payments” from organizations for the payment of insurance premiums with status “14.” Therefore, banks simply refuse to accept payment orders with this status and return them as erroneous. Processing banking software products may require some time from the Central Bank of the Russian Federation (more than six months). Therefore, the Federal Tax Service recommends indicating in field 101 of payment orders, in particular, for the payment of insurance premiums, the following statuses:

- “01” - for legal entities making payments to individuals;

- “09” - for individual entrepreneurs;

- “10” - for notaries engaged in private practice;

- “11” - for lawyers who have established a law office;

- “12” - for heads of peasant (farm) households;

- “13” - for individuals.

From 2020, in field 101 of the payment order when transferring insurance contributions, you must indicate code 01. In other words, payment orders for the payment of insurance contributions for compulsory pension, medical and social insurance must be filled out as for tax payments. Here is a sample payment order for 2020 for the payment of pension contributions, which indicates the new payer status.

As you can see, the payment order for the transfer of pension contributions indicates a new payer status (code 01 is indicated instead of 08). Besides:

- in the TIN and KPP field of the recipient of the funds - the TIN and KPP of the tax inspectorate administering the payment of contributions are indicated;

- in the “Recipient” field – the abbreviated name of the Federal Treasury authority is indicated and in brackets – the abbreviated name of the Federal Tax Service Inspectorate administering the payment;

- in the KBK field - the budget classification code is indicated, consisting of 20 characters (digits). In this case, the first three characters indicating the code of the chief administrator of budget revenues should take the value “182” - Federal Tax Service. See “How the main BCCs for paying insurance premiums will change from 2020.”

Also see “Payment order for the payment of taxes and insurance premiums in 2020: decoding of the fields.”

Features of filling out field 101. Examples of filling in when creating payments

The status of the document originator in the 2020 payment order is filled out based on the new requirements of the Ministry of Finance, which amended Order No. 107n.

The value is encrypted with a two-digit code from 01 to 26. In connection with the transfer of control over the funds of insurance funds, except for contributions for injuries, to the Federal Tax Service from October 2, 2020, a specialist needs to pay attention to changes in payment codes for insurance premiums administered by the tax office. The Ministry of Finance has determined that when transferring insurance premium payments with the administrator code “182” (Tax), the following values of field 101 are indicated:

- legal entities - “01”;

- IP - “09”;

- those engaged in private practice - “10”;

- lawyers - “11”;

- heads of peasant farms - “12”;

- individuals - “13”, etc.

Officials excluded code “14”, since the banking payment system requires improvement (Letter of the Federal Tax Service of Russia dated 02/03/2017 No. ZN-4-1 / [email protected] ).

Controversial point

Now let’s touch on the main controversial issue related to changes in payer status codes from January 1, 2020. So, as we have already said, the indicated changes are based on the draft order of the Ministry of Finance “On amendments to the order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n. However, according to our information, as of January 1, 2020, this project was never approved, officially published and, accordingly, did not come into force. And if so, then no changes have occurred in filling out field 101 of payment orders “Payer Status” and the following conclusions can be drawn:

- even after January 1, 2020, when paying all types of insurance premiums, code 08 must still be indicated as payer status;

- when paying insurance premiums for December 2020, as well as for months related to 2020 (January, February, March, etc.), the payer status must be indicated as 08;

- indicating code 08 when transferring insurance premiums does not entail the occurrence of arrears in contributions;

- banks do not have the right to demand that when paying insurance premiums to organizations from January 1, 2020, code 01 is indicated as the payer status.

Features of statuses 01, 08, 09 and 14 in 2020

Since the beginning of 2020, insurance premiums have been transferred to the tax service, which now regulates their calculation and payment. In this regard, many accounting workers have a question about filling out field 101.

Until the beginning of 2020, when paying insurance premiums, code 08 was entered, but now the following codes are required:

- 01 – legal entity;

- 09 – private businessmen when paying contributions for themselves;

- 14 – private businessmen when paying contributions for their employees.

Similar articles

- How is field 101 filled in a payment order?

- State duty payer status 01 or 08

- Payer status 08 or 24 for individual entrepreneurs

- Field 104 in the payment order

- Payer status 08 or 24 for individual entrepreneurs

If there is an error in the payer status

Let’s assume that changes in filling out the “Payer Status” have nevertheless occurred. If so, then at the beginning of 2020 there may be confusion: some accountants, when paying insurance premiums in the status of a payer, will, as before, indicate 08, others - 01. It is possible that tax authorities will regard one of these options as erroneous. And then there may be arrears in insurance premiums. The fact is that payments under payment orders, which indicate different payer statuses, are posted by the Federal Tax Service to different personal accounts. That is, tax authorities can accept a payment with status 08 as “other obligatory payments” and not insurance premiums. It may turn out that there will be an overpayment for “other payments”, and a debt for insurance premiums. And the tax inspectorate, as is known, can charge penalties and fines for the amount of arrears (Articles 75, 122, 123 of the Tax Code of the Russian Federation). To avoid this, you should submit an application to the inspectorate to clarify the payment (letter of the Federal Tax Service of Russia dated October 10, 2016 No. SA-4-7/19125). Please attach a copy of the payment order to your application. Such a statement will be the basis for transferring the transferred amount to insurance premiums. Here is an example of an application to clarify payer status in 2020.

If the commented draft order of the Ministry of Finance was never approved and did not enter into force as of January 1, 2020, then nothing needs to be clarified. After all, then code 08 is the correct code in the payment slip for payment of insurance premiums.

What do the Federal Tax Service say?

In 2020, in field 101 of the payment order for insurance premiums for employees for organizations and individual entrepreneurs, the Federal Tax Service advises entering code 14. Such information can be found on the official website of the Federal Tax Service. If an individual entrepreneur pays insurance premiums “for himself,” then code 09 should be shown. Such information appeared on the official website of the Federal Tax Service in January 2017. Then a joint letter was issued by the Federal Tax Service, the Pension Fund of the Russian Federation and the Social Insurance Fund with the same position. At the same time, according to our information, if organizations and entrepreneurs previously transferred insurance premiums with code 01, then the inspectorate considers such payment to be correct and there will be no arrears. Moreover, in later clarifications in the letter of the Federal Tax Service dated 02/03/17 No. ZN-4-1/1931 it is said that when paying insurance premiums, organizations need to use code 01, and entrepreneurs – 09