You need to report insurance premiums in 2020 to the Federal Tax Service, and not to extra-budgetary funds. Tax authorities have developed a new calculation form that replaces the previous 4-FSS and RSV-1 calculations; it must be applied starting with reporting for the 1st quarter of 2020. The form and instructions for filling out the calculation were approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551. In addition, new BCCs are now used to pay insurance premiums.

Read more about the new form, as well as the procedure for filling it out with an example, in this article.

The procedure for submitting the calculation of insurance premiums in 2020

Organizations and individual entrepreneurs with employees must submit a new single calculation to the Federal Tax Service on a quarterly basis. The last day for submitting calculations is the 30th day of the month following the reporting period (clause 7 of Article 431 of the Tax Code of the Russian Federation). The first report on the new form must be submitted no later than May 2, 2020, due to the postponement of dates due to the May holidays.

With an average number of more than 25 people, a single calculation must be submitted only in electronic form; others can submit it on paper. Please note that now the date for submitting the calculation of premiums from 2020 is the same for all policyholders, regardless of the method of submitting the calculation.

Important: the calculation is considered not submitted if the total pension contributions for each employee do not coincide with the total amount of Pension Fund contributions. After receiving notification of this from the Federal Tax Service, the policyholder has 5 days to eliminate the error, otherwise a fine cannot be avoided.

Reporting insurance payments to the Federal Tax Service: nuances

The new powers of the Federal Tax Service, along with the administration of insurance payments, also include receiving reports on relevant payments. Initially, this competence belonged to several state funds, and therefore employer firms were required to provide several types of reporting on insurance payments.

In particular:

- in the Pension Fund of Russia - forms RSV-1 and SVZ-M;

- in the FSS - form 4-FSS.

For periods starting from 2020, taxpayers provide a new type of reporting - Unified calculation in the KND form 1151111 and send it to the Federal Tax Service.

In turn, it remains within the competence of the Pension Fund to receive reports in the SZV-M form. A new form will also need to be sent to the Pension Fund of Russia - SZV-STAZH (for the first time, based on the results of activities in 2020, it will be provided until 03/01/2018).

The FSS is responsible for reporting in a new edition - by order of the FSS dated September 26, 2016 No. 381, regarding information on contributions for injuries (since, as we noted above, the FSS will continue to collect these contributions).

You can learn more about the application of the Unified calculation of insurance premiums in the article “Unified calculation of insurance premiums from 2020 - form”.

How to fill out the Calculation of insurance premiums in 2020

The calculation consists of a title page and three sections. In turn, sections 1 and 2 include applications: in section 1 there are 10 of them, in section 2 there is only one application. All policyholders are required to submit the following parts of the Calculation:

- Title page,

- Section 1, containing summary data on insurance premiums payable to the budget,

- Subsection 1.1 of Appendix No. 1 of Section 1 – calculation of pension contributions,

- Subsection 1.2 of Appendix No. 1 of Section 1 – calculation of compulsory medical insurance contributions,

- Appendix No. 2 of Section 1 – calculation of social insurance contributions in case of temporary disability and in connection with maternity,

- Section 3 – personalized information about insured persons.

The remaining subsections and annexes are presented if there is data to fill them out.

The calculation is completed in rubles and kopecks. In unfilled cells, dashes are added. All words in the Calculation lines are written in capital letters. The detailed line-by-line procedure for filling out the Calculation was approved by order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/551.

Let's look at how to calculate insurance premiums in 2020 using the following example.

In the 1st quarter of 2020, Alpha LLC accrued insurance premiums from payments to 1 employee, who is also the manager. The organization works on the simplified tax system and applies the basic tariff of insurance premiums.

Contributory payments to Mikhailov I.P. amounted to 30,000 rubles monthly. In January-March, insurance premiums were charged for each month:

Pension Fund (22%) - 6600.00 rubles each, compulsory medical insurance (5.1%) - 1530.00 rubles each, social insurance (2.9%) - 870.00 rubles each.

The total amount of payments to Alpha LLC for the 1st quarter: 90,000 rubles.

The total amount of contributions of Alpha LLC for the 1st quarter: Pension Fund (22%) - 19,800.00 rubles, compulsory medical insurance (5.1%) - 4590.00 rubles, social insurance (2.9%) - 2610.00 rubles.

It will be more convenient to fill out the sections for calculating insurance premiums in 2020, the example of which we are considering, in the following sequence:

- First, fill in the personalized information in section 3 . This section is completed for all insured persons and includes information for the last 3 months. In our case, the information is filled in for one employee, but if there are more insured persons, then the amount of information in the Calculation must correspond to their number.

- The next step is to fill out subsection 1.1 of appendix 1 of section 1 on pension contributions: we summarize and transfer here the accounting data from section 3. Remember that all indicators of personalized information in total must coincide with the indicators of subsection 1.1. Our example is simplified and there is only one employee, so we simply transfer his indicators from section 3.

- Next, fill out subsection 1.2 of Appendix 1 of Section 1 on contributions to compulsory medical insurance. Indicators of insurance premiums for health insurance are reflected only in this section of the Calculation.

- Social insurance premiums are calculated in Appendix 2 of Section 1 . If there were social insurance expenses (sick leave, benefits) during the billing period, then this should be reflected in Appendix 3 to Section 1, which means line 070 of Appendix 2 of Section 1 should be filled in. In our example, there were no such expenses, so Appendix 3 is not fill it out.

- Having filled out the sections for each type of contribution, we fill out the summary section 1 . The amount of insurance premiums payable to the budget is indicated here. Please note that the BCC indicated on lines 020, 040, 060, 080 and 100 have not yet been approved for 2020, so in our example the codes for 2020 are indicated, in which the first 3 digits are replaced by 182, which means payment to the Federal Tax Service.

- In conclusion, we number all completed Calculation sheets and indicate their number in a special line on the Title Page. Under each section we will put the signature of the head and the date.

From January 1, 2020, insurance premiums are administered by the Federal Tax Service

Date of publication: 01/11/2017 16:10 (archive)

In accordance with Federal Law No. 243-FZ dated 07/03/2016, starting from January 1, 2020, the administration of insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, as well as compulsory medical insurance is carried out by The Federal Tax Service.

A new chapter 34 “Insurance premiums” has appeared in the Tax Code.

From January 1, 2020, the tax authorities are assigned the following functions:

- control over the correctness of calculation, completeness and timeliness of payment of insurance premiums;

- accepting insurance premium payments from payers of insurance premiums, starting with the submission of a calculation of insurance premiums for the reporting period - 1st quarter of 2020;

- collection of arrears on insurance premiums and arrears on penalties and fines, including those that arose before January 1, 2020;

- offset (refund) of overpaid (collected) amounts of insurance premiums, provision of deferment (installment plan) for insurance premiums.

The bodies of the Pension Fund of the Russian Federation and the Social Insurance Fund of the Russian Federation retain the functions of:

- accepting payments for insurance premiums for the periods 2010-2016. (that is, annual calculations for 2020, as well as updated calculations for periods before 01/01/2017, are submitted to the Pension Fund of the Russian Federation and the Social Insurance Fund of Russia);

- control measures on insurance premiums for the periods 2010-2016;

- making decisions on the return of overpaid (collected) insurance premiums for 2010-2016.

Despite the change in the administrator of insurance premiums, the procedure for calculating and paying them has remained virtually unchanged (the tariffs of insurance premiums, including reduced ones, the procedure for determining the object, the basis for calculating insurance premiums, and the deadlines for paying insurance premiums have been preserved).

Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/ [email protected] approved the form for calculating insurance premiums, the procedure for filling it out, as well as the format for submitting calculations for insurance premiums in electronic form, combining the currently valid reporting forms ( RSV-1, RV-3, RSV-2 and 4-FSS), in which the composition of indicators is optimized and significantly reduced.

Payers must submit calculations for insurance premiums quarterly, no later than the 30th day of the month following the billing (reporting) period. Payers must submit a calculation of insurance premiums to the tax authorities for the first quarter of 2020 no later than May 2, 2020.

The deadline for paying insurance premiums has not changed: the last date for payment will be the 15th day of the month of the next calendar month.

Payers whose average number of individuals in whose favor payments and other remunerations are made exceeds 25 people for the previous billing (reporting) period, as well as newly created (including during reorganization) organizations whose number of these individuals exceeds this limit, are required to submit calculations to the tax authority in electronic form using an enhanced qualified electronic signature via telecommunication channels.

For payers of insurance premiums, the Federal Tax Service has prepared a comparative table of income from insurance contributions for compulsory social insurance and the corresponding codes of subtypes of budgets for 2020, to those applied in 2020, which is posted on the website of the Federal Tax Service of Russia in the section “Taxation in the Russian Federation” - “Insurance” contributions 2017".

From 01/01/2017, the first three characters of the new budget classification code (KBK), indicating the code of the chief administrator of budget revenues of the budget system of the Russian Federation, take on the value “182” - Federal Tax Service.

The Federal Tax Service of Russia for the Ryazan region pays special attention to the fact that when paying insurance premiums for billing periods expired before January 1, 2020, and for billing periods starting from January 1, 2017, different budget classification codes are used!

Who has the right not to pay contributions to the Federal Tax Service?

In principle, the following have the right not to pay insurance premiums:

1. From 2020 to 2027 - companies that are employers of crews of ships registered in the Russian International Register. These vessels should not be used for the purpose of transporting and storing oil or petroleum products in Russian seaports.

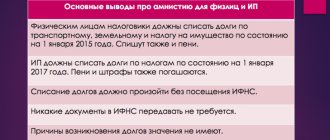

2. Individual entrepreneurs (in terms of contributions for themselves) - during the periods (clause 7 of Article 430 of the Tax Code of the Russian Federation):

- military service;

- caring for a child until he reaches the age of 1.5 years (but not more than 6 years in total);

- caring for a person with a disability of the 1st group, a child with a disability, a person aged 80 years or older;

- living with a spouse who is serving in the army under a contract, in areas where it was impossible to find a job (but no more than 5 years in total);

- living with a spouse working in diplomatic and trade missions of the Russian Federation abroad (but not more than 5 years in total).

Insurance premiums 2020: explains the Federal Tax Service

From January 1, 2020, the insurance premium administrator is changing. Previously, contributions to compulsory pension insurance and health insurance were administered by the Pension Fund of Russia, and contributions to compulsory social insurance by the Social Insurance Fund. From 2020, the main administrator will be the Federal Tax Service and its territorial tax authorities. What changes await taxpayers?

On December 2, 2020, as part of the Accounting Day, which was held, Mikhail Sergeev

, Head of the Department of Taxation of Personal Income and Administration of Insurance Contributions of the Federal Tax Service of the Russian Federation.

Cheat sheet on the article from the editors of BUKH.1S for those who do not have time

1. From 01/01/2017, the Federal Tax Service will transfer the administration of insurance premiums for compulsory insurance for temporary disability and in connection with maternity, for compulsory medical insurance.

2. The Social Insurance Fund will continue to administer contributions for compulsory social insurance against accidents.

3. Personalized accounting will remain under the jurisdiction of the Pension Fund.

4. The fiscal burden on insurance premium payers in connection with the transfer of administration to the Federal Tax Service does not increase. The basis for calculating contributions, all basic and reduced tariffs have been retained.

5. Checks on insurance premiums for the periods 2010-2016 will be carried out by state extra-budgetary funds.

6. All reporting - RSV-1, 4-FSS for the last reporting period of 2016 - is submitted to the relevant funds in the forms and formats that are currently used.

7. In the Federal Tax Service, the first calculations for insurance premiums, and this will be a single form of calculation, are submitted for reporting periods starting from the 1st quarter of 2017.

8. On 01/01/2017, all BCCs with chapter 392 (chapter for the Pension Fund and the Compulsory Medical Insurance Fund) and with chapter 393 (for the Social Insurance Fund) will be closed on January 1, 2020. At the same time, new chapters of the BCC will be opened for insurance premiums, both for old periods and for new periods, the administration of which begins from 01/01/2017.

9. The last payment for December 2020, which is due before January 15, 2020, should be made to new BCCs with chapter 182. For this purpose, codes will be opened specifically for “old” payments for the tax service.

10. Arrears on insurance premiums in 2020 must be paid using budget classification codes, which are open to the tax service with chapter 182.

11. After 01/01/2017, there is no need to try to pay off debt on insurance premiums using old BCCs. Payments will not go through.

12. Applications for the return of overpaid insurance premiums, even in 2020, if the amounts were overpaid in previous periods, must be sent to the authorities of state extra-budgetary funds.

13. The Federal Tax Service does not plan to make monthly calculations of insurance premiums.

"Happy" and "unfortunate" cases

From January 1, 2020, a new chapter 34 of the Tax Code, dedicated to insurance premiums, has been introduced, and corresponding changes have been made to part one of the Tax Code and to the law on tax authorities. Accordingly, from the new year, Federal Law No. 212-FZ dated July 24, 2009 completely loses force.

“In part of the contributions that were previously administered by the Social Insurance Fund, contributions for compulsory insurance for temporary disability and maternity are transferred to the tax authorities - this is the so-called “happy occasion.” Contributions for compulsory health insurance are also transferred to the tax authorities for administration, explained Mikhail Sergeev

. — The FSS retains the administration of contributions for compulsory social insurance against accidents—these are “accidents.” That is, we take away the happy cases, and leave the unfortunate ones.”

Watershed

In a situation related to the transfer of the administration of insurance premiums to the Federal Tax Service, taxpayers are most concerned about the transition period. Who will check the calculation and payment of contributions for past periods - the Federal Tax Service or the Social Insurance Fund? To whom should I submit reports for 2020 and to which CBKs should I transfer money?

“All control activities, desk and field audits of insurance premiums for reporting periods, starting from 2010 to 2016 inclusive, will be carried out by state extra-budgetary funds,” said Sergeev

. – Tax authorities begin to work only from January 1, 2017, that is, from reporting periods after this date. Accordingly, all reporting - RSV-1, 4-FSS for the last reporting period of 2016 is submitted to the relevant funds in the forms and formats that are already used when submitting reports to state extra-budgetary funds. At the Federal Tax Service, the first calculations for insurance premiums, and this will be a single form of calculation, are submitted for reporting periods starting from the 1st quarter of 2020.”

When making actual payments for insurance premiums, it is necessary to take into account that all BCCs with chapter 392 (chapter for the Pension Fund and Compulsory Medical Insurance Fund) and with chapter 393 (for the Social Insurance Fund) will be closed from January 1, 2020. At the same time, new chapters of the BCC will be opened for insurance premiums, both for old periods and for new periods, the administration of which begins on January 1, 2020.

“This means that the last payment for December 2020, which is due before January 15, 2020, should be made to the new BCC with chapter 182. For this purpose, codes will be opened specifically for “old” payments for the tax service,” a representative of the Federal Tax Service clarified.

Arrears on insurance premiums in 2020 must be paid using budget classification codes, which are open to the tax service with chapter 182. After January 1, 2020, there is no need to try to pay off debt on insurance premiums using the old BCC. Payments will not go through.

According to Mikhail Sergeev

, in the near future the Ministry of Finance will release the corresponding changes to the BCC, about which taxpayers will be informed in a timely manner.

Also, the head of the Department of Taxation of Personal Income and Administration of Insurance Premiums of the Federal Tax Service of the Russian Federation noted that there is no need to transfer insurance premiums in advance in 2016. The funds will transfer all information on debts and overpayments to the Federal Tax Service, and the tax department will simply “pick up” it. Pilot projects are now being introduced to test information transfer procedures.

At the same time, applications for the return of overpaid insurance premiums, even in 2020, if the amounts were overpaid in previous periods, must be sent to the authorities of state extra-budgetary funds. They will make appropriate decisions and send them to the Federal Tax Service. And the tax authorities, based on the funds’ decisions on refunds, will issue instructions to the treasury for the actual transfer of funds.

“Thereby, the legislator differentiated responsibility for the return of overpaid insurance premiums,” explained Mikhail Sergeev

. “State extra-budgetary funds are responsible for the “old” period, and the Federal Tax Service is responsible for the “new” periods.”

Personalized accounting will remain the responsibility of the Pension Fund. Taxpayers will submit information on accrued insurance premiums for compulsory pension insurance to the Federal Tax Service as part of the general calculation of insurance premiums, and the tax service will send it to the Pension Fund for posting to personal accounts of personalized records of insured persons.

And about the stability of taxation parameters

The object of taxation (Article 420 of the Tax Code of the Russian Federation) has not fundamentally changed in comparison with Federal Law No. 212-FZ. These are all payments within the framework of labor relations and civil law contracts, under copyright contracts, alienation of exclusive rights, licensing agreements and other similar agreements related to the transfer of intellectual property.

“There is no increase in the fiscal burden on insurance premium payers in connection with the transfer of administration to the Federal Tax Service. Accordingly, the basis for calculating contributions has been preserved, all basic and reduced tariffs have also been preserved,” Sergeev

.

About sick leave and Social Insurance Fund

It is expected that by 2021 the Social Insurance Fund will completely switch to “direct payments” of sick leave and benefits, and some regions have already switched to them. But until this time, the so-called “offset” scheme for paying insurance premiums for compulsory social insurance remains in place. What does this mean? All expenses incurred by the employer for the payment of compulsory social insurance benefits will be reflected in the corresponding section of the calculation of insurance premiums and will reduce the amount of contributions calculated from the base.

Control of these expenses before the transition to “direct payments” remains entirely with the Social Insurance Fund; accordingly, decisions not to accept certain expenses (payments) for offset will be sent by the Social Insurance Fund authorities to the tax authorities. The Federal Tax Service will use these decisions during desk audits and essentially “offical” them, that is, based on them, present the amount of insurance premiums for additional payment to the budget.

“Payers will have to challenge these decisions through pre-trial or judicial procedures directly with the fund. That is, it will be necessary to sue the fund - the body that made the corresponding decision, and not the tax authority,” said Mikhail Sergeev

.

Insurance premium rates

Insurance premium rates will not change due to the transfer of administration to the Federal Tax Service.

The maximum value of the base of insurance contributions for compulsory pension insurance, which is taxed at a rate of 22% (payments above this base - at a rate of 10%) in 2020 is equal to 796 thousand rubles, and starting from the reporting periods of 2020, the value of the maximum value is already 876 thousand rubles

The maximum amount of the contribution base for compulsory social insurance has also changed - from 718 thousand to 755 thousand rubles. In excess of this payment, social insurance contributions are not charged. These changes were introduced by Decree of the Government of the Russian Federation of November 29, 2016 No. 1255.

The tariff for compulsory health insurance has not changed and is 5.1%.

The remaining tariffs - 22% and 10% for pension insurance, 2.9% for social insurance - will also be extended for 2020. Now they are established in the Tax Code for the transition period of 2017-2018.

“Reduced insurance premium rates have so far been retained in the amount in which they are currently determined. The reduced tariff for IT organizations, currently set at 14%, is provided for in the Tax Code at 21% in 2018, and 28% in 2020. But the President of the Russian Federation instructed the Government of the Russian Federation to extend the reduced tariff for IT companies until 2023. It is possible that, in pursuance of the President’s instructions, the relevant amendments will be adopted in the near future,” Sergeev

».

In addition, all tariffs for participants in the Skolkovo project, tariffs for participants in free economic zones, tariffs for territories of rapid socio-economic development and for the free port of Vladivostok have been retained.

Unified calculation of insurance premiums

The first section of the calculation is summary data of the insurance premium payer. It shows aggregated data on accrued insurance contributions for social, pension and health care.

The heads of peasant (farm) households fill out section two and submit reports not quarterly, like the majority of insurance premium payers, but annually based on the results of the calendar year.

Section three is personalized information on accrued insurance contributions for compulsory pension provision for each insured person.

“The requirements for submitting calculations electronically remain the same - those payers with more than 25 employees are required to submit calculations electronically. However, this does not in any way prevent those with fewer than 25 people from submitting payments electronically,” Sergeev

. — The Tax Service always welcomes filing reports electronically. Despite the fact that we have not had queues at the tax authorities for a long time, I see no reason to come to the inspectorate once again just to submit reports on taxes or insurance contributions.”

The calculation of insurance premiums is submitted quarterly, which is, according to Mikhail Sergeev

, optimal for all participants in the process - payers, tax authorities, bodies of state extra-budgetary funds. The Federal Tax Service does not plan to increase the frequency of reporting or otherwise increase its volume.

Reporting deadlines

Currently, reporting on contributions consists of several forms that are submitted at different times. Since 2020, the four forms have been combined into a single calculation form. All indicators related to the calculation of insurance premiums will be included there. The deadline for submitting this calculation is the 30th day of the month following the reporting or billing period.

“The payment form has already been approved, registered with the Ministry of Justice and published. The form has already been given to software developers,” explained Sergeev

. “We therefore expect that the appropriate software update will be released on time and reporting in 2020 will be at the click of a button.”

Also, the head of the Department of Taxation of Personal Income and Administration of Insurance Contributions of the Federal Tax Service of the Russian Federation warned about new criteria according to which a single calculation of insurance premiums will be considered unsubmitted. The list of such criteria was supplemented by Federal Law dated November 30, 2016 No. 401-FZ.

One of the criteria concerns control of the amount of insurance premiums in a single calculation. A representative of the Federal Tax Service explained: “Section 1 of the calculation indicates the total amount of insurance contributions for compulsory pension insurance. But you know that contributions are calculated based on payments made to each individual and the limits are determined for each individual, and not for the company as a whole. Therefore, values within partition 1 are not multiplied. Section 1 is the summation of data from section 3. Control of this sum will be implemented in the software package for receiving information.”

“A calculation containing an error will be considered not submitted,” added the head of the Federal Tax Service.

The second criterion by which a single calculation will be considered not submitted will be the unreliability of personal data identifying the insured persons. “In this case, the reliability of the full name, SNILS and TIN is implied,” clarified Mikhail Sergeev

.

TIN will not be required in the format. At the same time, Sergeev

still urged to indicate it if such information is available, in order to avoid incorrect identification of the person. At the same time, Mikhail Sergeev clarified that in 2020 the department plans to launch a new online service to simultaneously verify the accuracy of three information - full name, SNILS and TIN.