Dividends - what is it?

Dividends are the profits of privately owned enterprises that remain after mandatory deductions: taxes, contributions, loan payments, wages, bonuses. It consists of the income received by the company for a specific period of time. By decision of the meeting of founders, profits are distributed among the persons who invested their money in its development.

People who invest money in a company are called investors. In a Limited Liability Company, these are the founders, participants, and shareholders. In a joint stock company, there are shareholders. Cash profits (dividends) are distributed among partners, stockholders, bondholders according to the share contributed by each of them to the enterprise. — Dividends are not subject to insurance premiums, since the profit distributed among investors reflects the property, and not the labor, form of the relationship.

Frequency of dividend accrual

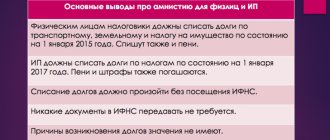

Mistake #1. Exemption from taxes for organizations applying special regimes

The application of any special taxation regime does not constitute a basis for exemption from payment of the corresponding taxes established on income from equity participation. Although the special regime itself acts as an alternative to paying three taxes, including income tax, this applies only to the main activity. An exception may be the situation when dividends are paid in kind and are essentially sales.

Mistake #2. Refund of personal income tax paid to the budget

On dividends that are required to be paid to a non-resident, the organization must calculate personal income tax at a rate of 15%. In a situation where a non-resident has changed his status of residence in our country and has completed all the documents for obtaining residency, he has the right to apply for a tax recalculation for the current year in which he received a new status at a rate of 13%. However, the tax office will recalculate and return it.

Mistake #3. Payment of income from equity participation in kind by an organization using a special tax regime (UTII)

In the case where an organization applies UTII, the transaction for the transfer of property as income from shared ownership must be taxed within the limits established for the special regime.

08.10.2018

The frequency of payment of dividends in an LLC can be as follows: once a quarter, once every six months or once a year (Clause 1, Article 28 of the Federal Law of 02/08/98 No. 14-FZ “On Limited Liability Companies”; hereinafter referred to as the LLC Law ). The organization has the right to choose any option and enshrine it in its charter or in a decision of the general meeting of participants.

Joint-stock companies can pay money to the founders based on the results of a quarter, half a year, 9 months or a year (Clause 1, Article 42 of the Federal Law of December 26, 1995 No. 208-FZ “On the Law on Joint-Stock Companies”; hereinafter referred to as the JSC Law).

08.10.2018

Are insurance premiums charged?

The Tax Code provides comprehensive information on the types of income from which mandatory contributions are made to extra-budgetary funds. To answer the question “Are dividends subject to insurance contributions or not?”, you need to study the list of types of earnings from which interest is taken in the Social Insurance Fund, the Pension Fund of the Russian Federation, the Unified Social Tax is subject to:

- salaries;

- bonuses;

- payment under the contract;

- fees.

Contributions to the Social Insurance Fund, Pension Fund and other non-budgetary organizations are levied on all types of cash payments received under an employment agreement. From this list you can see what income is not eligible for insurance premiums. For the reason that they are issued not for labor, but for monetary capital invested in the enterprise. If an employee or manager turns out to be its investor, contributions to the Social Insurance Fund and the Pension Fund of the Russian Federation are made from his salary, bonuses and other payments required by the state. Insurance premiums are not collected from the founder's dividends.

Insurance premiums from dividends in 2020

Dividends are recognized as part of the net profit of the company, which, by decision of its participants, is distributed among them in proportion to their shares in the authorized capital or in proportion to the par value of the shares they own.

For payments to disabled employees, contributions to the Social Insurance Fund are calculated at 60% of the insurance rate for the main type of activity. All policyholders are entitled to the benefit, regardless of their main type of activity (Law No. 179-FZ) Personal income tax is a direct tax and is calculated as a percentage.

Dividends in RSV

Calculation of insurance contributions - a consolidated, individual report on mandatory monetary contributions of the company, employee to the Social Insurance Fund, Pension Fund, Compulsory Medical Insurance.

Are dividends reflected in the calculation of insurance premiums in 2019? The articles of the Tax Code and the letter from the Social Insurance Fund show that the DAM must include information about deductions from those types of earnings that are subject to insurance contributions. Dividends are not reflected in the DAM, because their payments are not regulated by labor relations. Information about the amounts paid to shareholders is not reflected in the calculation of insurance premiums.

Calculation and payment of dividends in 2020, what taxes are paid on them

Concluding our consideration of the question of what taxes dividends are subject to in 2020, we present the calculation formula from Article 275 of the Tax Code of the Russian Federation. You need to know about it if dividends are paid by a company that itself has received profit from participation in another organization.

We recommend reading: Inn of an Individual Sample 2020

The tax is paid before the expiration of 30 days from the date of payment of dividends. This was done so that the tax agent has the opportunity, upon receipt of the necessary information and the need to apply other rates, to pay additional tax withheld to the recipient.

conclusions

So, are dividends subject to insurance premiums in 2019?

- Cash income received by investors, depositors, and shareholders as profit is not subject to contributions to the Unified Social Tax, because it is accrued not for work, but for investments.

- The amount of payments depends on the amount of funds invested in the company by each participant. The contribution may be expressed in value, number of shares, denomination of bonds or other securities held by these persons.

The rule is valid for deductions to the Pension Fund and other public funds.

Dividends are not subject to insurance premiums in 2020 on the basis of: clause 1 of Art. 236, paragraph 4 of Article 420 of the Tax Code of the Russian Federation, as well as Letter of the Federal Tax Service No. 015-03-11/08-13985. The only tax paid is personal income tax for individuals and income tax for legal entities.

Become an author

Become an expert

Is it necessary to reflect dividends in 4-FSS?

Do dividends need to be reflected in 4-FSS?

You can get the correct answer to this question by analyzing the relevant legislation. This is what we will do in our article. What are dividends

Rules for reflecting income in 4-FSS

Options for including dividends in the report and their consequences

Results

What are dividends

The concept of “dividends” is found in the Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ, where it relates to the part of the net profit remaining with the legal entity, subject to distribution among shareholders. A similar concept (though without using the definition of “dividends”) is also found in the Law “On LLC” dated 02/08/1998 No. 14-FZ, which talks about the distribution of profits between participants.

Equalizes shareholders and participants in relation to dividends, paragraph 1 of Art. 43 of the Tax Code of the Russian Federation, which defines this type of payment as any income generated as a result of the distribution between shareholders (participants) of profits remaining after taxation.

Both legal entities and individuals can become shareholders (participants). At the same time, there are often situations when an individual works for a legal entity that pays dividends. And it is precisely in relation to such persons that the question usually arises: “Do dividends need to be reflected in 4-FSS?”

Rules for reflecting income in 4-FSS

4-FSS is compiled based on contributions for injuries. The form used in 2020 and the procedure for filling it out were approved by Order No. 381 of the Federal Social Insurance Fund of the Russian Federation dated September 26, 2016.

The rules for calculating contributions for injuries are regulated by the law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ, in which an indication of the types of income subject to contributions is contained in paragraph 1 of Art. 20.1. These are payments and other remunerations accrued to persons working for the policyholder under contracts:

- labor;

- GPC (if they have a condition on the payment of contributions for injuries).

In 4-FSS, all accruals made in favor of employees are reflected in line 1 of Table 1 (clause 7.1 of Appendix No. 2 to Order No. 381). However, these also include those that are not subject to contributions.

The amount of income not subject to contributions should be subtracted from the total accruals. In 4-FSS, line 2 in Table 1 is reserved for non-taxable income (clause 7.2 of Appendix No. 2 to Order No. 381). The result of the deduction (i.e., the taxable base) is reflected in line 3 of the same table (clause 7.3 of Appendix No. 2 to Order No. 381).

The types of income that make up the amount entered in line 2 are listed in Art. 20.2. There are no dividends on this list. They should not be included in the total amount of payments, since the relationships arising when they are calculated do not relate to those regulated by an employment contract or a civil process agreement.

This means that dividends do not need to be reflected in 4-FSS either in 2020 or in other periods.

Options for including dividends in the report and their consequences

By mistake, data on dividends may be included in the information shown in Table 1 of the report. Variants of this error include the inclusion of dividend amounts:

- In the total amount of income and in the amount of non-taxable payments. As a result, the taxable base will be calculated correctly.

- In the total amount of income without reflection in the amount of non-taxable payments. If, at the same time, contributions for dividends were not accrued, then the report will reveal a discrepancy between the data between tables 1 and 2. If there was an accrual, there will be no inconsistencies in the report, but the policyholder will pay to the Social Insurance Fund the amount of contributions that he could not have paid.

- The amount of non-taxable payments is not reflected in the total income. This will result in an underestimation of the assessment base shown in Table 1 and an inconsistency between Tables 1 and 2 if contributions were assessed correctly during the reporting period.

Errors in reporting, if they do not entail an understatement of the amount of accrued contributions, do not need to be corrected (clauses 1.1, 1, 2 of Article 24 of Law No. 125-FZ).

The discrepancy between the figures entered in tables 1 and 2 will not allow the FSS to accept it. Such an error will have to be corrected, even if the contributions were calculated correctly. This point may lead to failure to meet the reporting deadline.

https://www.youtube.com/watch?v=i6aDupQswBo

Errors in 4-FSS are corrected by submitting an adjustment report.

Results

Dividends are payments of a different type than those accrued in connection with the existence of relations under an employment contract or a civil partnership agreement. That is why they are not included in the total amount of income accrued to the employee.

They are also not included in the list of payments not subject to contributions. This means that they should not be shown in 4-FSS.

If it happens that the data on dividends are reflected in the report, it should not always be adjusted, but only if the amount of accrued contributions is underestimated.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Source: https://nalog-nalog.ru/strahovye_vznosy/fss/nuzhno-li-otrazhat-v-4-fss-dividendy/

Accounting for reflecting dividends

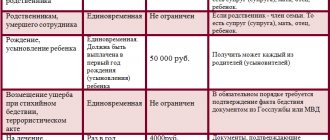

| Debit | Credit | Description |

| 84 | 70 (75) | Calculation of dividends to the founders of the organization |

| 70 (75) | 68 | Taxes are calculated depending on whether an individual works in a given organization or not. For a working employee it is personal income tax, for a non-working employee it is income tax. |

| 70 (75) | 50 (51) | Dividends paid |

| 70 (75) | 90 | Revenue from payment of dividends on products |

| 90 | 41 (43) | Reflection of the cost of products transferred as dividends |

| 90 | 68 | VAT accrual on property transferred as income from equity participation |

Initial data: Balanov O.P. owns a 10% share of Severny Wind LLC, O.P. Balanov. is an employee of this organization. owns a 20% share of Severny Wind LLC. The net profit for 2020 amounted to 4 million rubles. At the board of founders, it was decided to direct all net profit to pay dividends.

Calculation:

- Amount of payments for O.P. Balanova = 4,000,000.00 * 10% * (100% – 13%) = 348,000.00 rubles

- Amount of payments for CJSC "Cotton swab" = 4,000,000.00 * 20% * (100% - 13%) = 696,000.00 rubles

- Explanations: The income tax rate for income from equity participation in other enterprises is 13%.

08.10.2018

08.10.2018