When is it necessary to close a current account?

There are several reasons for closing a PC:

- Dissatisfaction with the quality of services of the selected bank. An entrepreneur may no longer be satisfied with the cost of service, which is why he will want to move to an organization with more favorable conditions. Or regular disruptions in the bank’s operation, technical problems, etc., which prevent individual entrepreneurs from carrying out their activities efficiently;

- Having a debt that has not been paid for several months;

Card and current account

- If you need to close an individual entrepreneur, closing a current account is also necessary;

- By the tribunal's decision. This is also grounds for termination of the account;

- If no movements have been made on the account for 2 years, it also ceases to exist;

- Law violation. If the entrepreneur's activities violate Article 115, this will be grounds for closure.

These are the main reasons that occur most often.

Conclusion of an agreement

When is an individual entrepreneur forced to cease its activities?

In order to close a current account after closing an individual entrepreneur, you must:

- prepare a package of documents necessary to close an account;

- fill out a special application form;

- clarify the account balance by obtaining a bank statement;

- obtain information about the presence of debt in the account and, if necessary, make full repayment;

- transfer check books to the bank, indicating unused pages;

- additionally, at the request of the bank, an extract from the unified state register of individual entrepreneurs, certified by a notary, may be required;

- reset your account balance.

You can receive cash at the cash desk of a financial institution or order a transfer of funds to a current account in another bank specified in the application.

After completing all of the above steps, you must receive a notification from the bank about the closure of the account.

In the event that the contract is closed due to a change in details, the businessman must provide information about his new details in order to avoid problems when making mutual settlements with partners.

To avoid questions about when to close a current account when closing an individual entrepreneur, it is important to understand that you need to deal with the bank and only after that initiate the liquidation procedure of the enterprise.

Useful article:

opening a current account at Sovcombank.

Is it necessary to do this upon termination of activity?

At the legislative level, the procedure is not mandatory when an individual entrepreneur ceases its activities. But practice shows that such a solution can lead to problems. The tax office will be interested in this situation. She may decide that the entrepreneur continues to engage in his activities, but illegally.

Sovcombank - open a current account for individual entrepreneurs, service tariffs

It will not be possible to use the account after the company is closed due to its purpose. It is intended only to carry out mutual settlements with counterparties. Also, PC maintenance is paid, which means you will need to regularly pay a commission. This is completely unprofitable.

Note! Some contracts contain a separate clause regarding the termination of an account if the individual entrepreneur decides to close.

Is it necessary to close the PC when closing the IP?

The Tax Code does not give a precisely defined answer to the question posed. But in any case, in the context of this problem, it is necessary to remember: the current account is used to ensure business goals, the correct functioning of the enterprise, and not to satisfy personal needs

. Accordingly, if the individual entrepreneur is closed, the payment instrument becomes irrelevant.

Important! Closing a payment instrument in a banking company is the only correct decision in the context of the issue of administrative and criminal offenses. The reason is as follows: if movements of funds are recorded in the account of a no longer functioning individual entrepreneur, this circumstance is regarded as an illegal business activity.

Any agreement concluded with a bank always indicates the reasons why cooperation may be terminated. To eliminate any problems in the future, you need to pay special attention to studying the paragraphs of the document dedicated to the closure of the RS.

If the current account is not closed, you will have to pay for its maintenance and servicing.

Those. the head of a closed business will incur losses, in fact, from scratch. Also, if you have a positive balance, cashing out money will not be so easy: the individual entrepreneur no longer exists, and the individual is not the owner.

Important! In order to avoid problems with withdrawing money, disputes with financial institutions and claims from tax authorities, the RS must be closed before the business is liquidated.

Thus, we have given a clear answer to the question posed. Now it’s worth understanding the nuances.

How to close an individual entrepreneur's account in a bank

Avangard Bank - open a current account for individual entrepreneurs, what are the tariffs

There is the following algorithm of actions:

- Preparation of the required documents for the transaction;

- If there are debts to the bank or counterparties, they must be repaid;

- Transfer of cash balances;

- Writing and submitting an application requesting termination of service;

- Receiving a notification from the bank that the agreement between the parties has been terminated;

- Drawing up a certificate confirming the termination of cooperation between the bank and the individual entrepreneur.

It is also recommended that before starting the contract termination procedure, you inform your counterparties and clients about this decision. This is not a mandatory measure, but it helps prevent unpleasant situations. After all, IP and acquiring details will soon be switched off, and it will be impossible to make transfers.

Individual entrepreneur

Closing an account upon liquidation of business activity

Closing an individual entrepreneur’s account due to the cessation of commercial activity according to the procedure is no different from the procedure for independently closing an account that occurred as a result of other circumstances.

Procedure for notification of account closure

It is necessary to understand that closing an account currently has nothing to do with liquidating the business. And now there is no need to report the closure of the account to the tax office. Starting from May 2014, according to Federal Law No. 59 dated April 2, 2014, the obligation to notify the tax service, as well as the Pension Fund of Russia and the Social Insurance Fund, is assigned to the bank itself. Law No. 52-FZ dated April 2, 2014 introduced corresponding amendments to the Tax Code of the Russian Federation.

Before the adoption of these laws, individual entrepreneurs had to report the opening and closing of their current accounts to the Federal Tax Service and all funds within seven days. Failure to notify during this time was punishable by heavy fines.

And also nowhere in modern legislation is there any indication of the need to notify your partners and counterparties about the closure of the account. Nevertheless, it is customary in business circles to send them notices of this fact. Typically, account closure notifications are sent via email in the form of derivative messages.

Current account liquidation time

Since when liquidating a business, a certificate from the bank confirming the existence of an account is not currently required to be presented to the tax authority, the time to close the account remains the prerogative of the entrepreneur himself. Still, it is best to close the account at the same time as closing the business. There are several reasons for this:

- An individual entrepreneur cannot make any transactions on the current account after he ceases his entrepreneurial activity. If the bank allows such transactions to be carried out, it will be punished, including the deprivation of its license.

- For maintaining a current account, the bank, according to the agreement, takes a certain amount, which, naturally, will increase depending on the length of the account maintenance period.

The time it takes to receive a bank notification about account closure is usually from one to seven days from the moment the individual entrepreneur submits the application. This time depends on the time it takes to verify the information provided, whether the client has a service debt and other factors.

In the absence of complications, some credit institutions issue a notification to the individual entrepreneur immediately after receiving the application, since modern banking accounting tools can provide complete information on their depositors almost instantly.

And also in many service agreements there is a clause that specifies the time required to consider an application to close an account.

A slightly different picture is observed if the initiative to close the account comes from the bank. For example, if an individual entrepreneur does not close his account within three years after liquidating his business. In this case, the bank closes the account not because of the liquidation of the individual entrepreneur’s business, which does not concern it, but because there are no funds in this account, and no transactions have been made from it for three years.

In this case, the bank sends a notice to the client about the need to close the account and after sixty days the agreement is terminated.

If no transactions have been made on the current account for three years, and there are no funds there, the account will be closed regardless of the individual entrepreneur’s wishes.

Account balances

Typically, the bank provides a statement of account balances automatically upon the client’s first request or immediately after receiving an application to close the account. At the same time, the bank checks the status of the client’s account servicing payments.

If there is a debt of this type, the bank may submit a demand for its repayment. In case of late payment, the bank has all the rights to file a claim. And then, in addition to the debt itself, the entrepreneur will have to pay legal costs and fines, which can be much higher than the amount of the original debt. Therefore, before applying for account liquidation, it is best to pay off all debts to the bank.

The bank provides information about cash balances upon the client’s request, as well as upon closing the account.

There are two main ways to withdraw money remaining in your current account:

- receiving cash at the bank's cash desk;

- receiving cash from an ATM using a plastic card.

It should be noted that when a business current account is closed, it cannot be re-registered as a personal account. Therefore, transferring the balance of funds from an individual entrepreneur’s account to a personal account and then receiving them using a personal plastic card is only possible when such a personal account is available. However, opening a personal account and the associated provision of a personal plastic card is such a simple procedure that it can be completed within a few minutes by providing just one document - a passport.

List of required documents

When figuring out how to close an individual bank account, many people wonder what documents will be required for the procedure.

6-NDFL Individual entrepreneurs without employees - do you need to submit a declaration and how to do it

A complete list of securities can be obtained via the Internet on the website of a financial institution or by contacting the bank directly. But there is a mandatory list that is required regardless of the company. It includes:

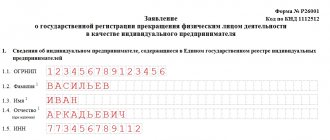

- Corresponding statement. Filled out according to the form and refers to mandatory documents;

- Receipt for payment of state duty. You can pay it online. Or print out a receipt and go to the nearest bank branch.

Note! The rest of the list can be found on the website of a particular bank.

Procedure for closing an account

Today, you can close a bank account either with the help of the services of legal companies or independently. The procedure itself is not complicated and consists of performing a certain sequence of actions:

- First of all, you need to prepare a package of documents to close a bank account, as well as pay the service debt, if any. The remaining funds can be received in cash or withdrawn to the details of another bank.

- Fill out and submit an application to close your current account.

- Receive a notification and certificate of account closure from the bank operator.

- Transfer the closure data to the tax office, as well as the Pension and other social funds.

Experts strongly do not recommend carrying out the procedure for closing an individual entrepreneur without closing the current account, because in the future problems may arise, including the seizure of the current account and the imposition of fines from the tax service.

Application for closure

When filling out an application, it is recommended to pay attention to several important nuances. The paper is drawn up in a single copy. A sample application can be obtained from the bank where the current account was opened. Employees of the financial company, having received the completed paper, mark it and send the document to the financial control department.

If there are funds left in the account, you can note this in the application and ask when closing the account to transfer them to the specified details. They can also be issued in cash through the company's cash desk. Within 7 days the funds will be transferred to the owner.

The form should include the following information:

- Information about a previously concluded agreement. All his details are entered;

- Indicate the balance of funds in the account, if any;

- Information about the account owner.

Important! The application must be certified by a bank employee. Only compliance with this condition will allow you to close the selected account.

Application for liquidation of RS

How to pay taxes if the current account is already closed

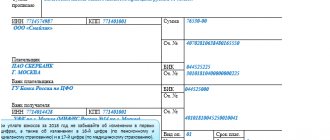

If, after closing the bank account when closing the individual entrepreneur, debts to the budget arose, then you should pay taxes like an ordinary individual. We recommend making payment in the following way:

- in cash at the cash desk of any banking organization;

- through the Russian Post cash desk;

- electronic transfer through an ATM or online banking (debit from a bank card);

- in the taxpayer’s personal account, from a credit card;

- through payment terminals.

Carefully check the details for paying taxes, fees and sanctions on them. We recommend that you independently generate a payment receipt on the official website of the Federal Tax Service if you have lost your receipt or the inspection has not sent it.

What difficulties might you encounter?

This procedure is rarely difficult. However, there are nuances that should be taken into account. You cannot close an account that has been seized. First, all restrictions and violations imposed on it are corrected, then the liquidation procedure begins. Sometimes it is enough to pay off all debts. After this, you can start closing the RS literally the next day.

Note! Therefore, before starting the process, it is worth clarifying whether there are any restrictions. To resolve problems before visiting the bank.

Some financial institutions require that the client personally come to the branch for such a transaction. This increases the safety of operations and reduces the likelihood of problems occurring. There are also companies that prefer that the client contact exactly the branch where he previously opened the account. This creates additional inconvenience for the entrepreneur. Especially if he is in another city or has left the country.

You should find out about this in advance in order to quickly solve the problem. There are special agencies that will carry out all the necessary activities on behalf of the individual entrepreneur. Then you need to draw up a power of attorney, on the basis of which legal representatives will act.

Observing important nuances allows you to avoid various problems. Before opening an account, you should carefully study the agreement. Pay special attention to the terms of its termination. Studying the main points will help you avoid difficulties with closing the PC. Be sure to check the status and details of your current account at least every few months, but it is better to do it more often. Comply with all tax requirements and resolve possible problems in a timely manner. Regularly and on time pay debts to counterparties, the Federal Tax Service, and loans.

Important! The above points are enough to quickly and easily close the required account.

Closing of RS

Can a bank close an account unilaterally?

Termination of an account can occur not only on the initiative of the owner himself, but also on the part of the bank unilaterally. The contract between the parties is terminated, which provokes the termination of the work of the RS.

The basis for which the bank will initiate termination may be economic laws. Closing does not occur from the day the contract was terminated.

Note! Termination of the account occurs from the moment when the corresponding entry was made in the Register of Open Accounts.

Among the main reasons for unilateral closure:

- Insufficient funds in the account. The most common reason. The financial minimum is not specified in legislative acts. Therefore, this clause is often included in the contract. First, the company must notify that the client does not have enough funds. A month is allocated to correct the situation. If the problem is not resolved, the bank takes action;

- No transaction for a year or more. It is important to take into account that some contracts are concluded on an individual basis, therefore, special conditions may be prescribed. And then, even if transactions have not been completed for a year, the bank will not initiate a break in cooperation. Otherwise, the company has the right to terminate the agreement due to account inactivity.

It is also worth noting that if there is a suspicion of committing economic crimes and fraud, the bank may close the RS.

Submitting an application to the bank

For what reasons is an individual entrepreneur's account closed?

The account servicing agreement is terminated at the initiative of the client, the bank or by mutual agreement.

To close an individual entrepreneur's account you need to:

- when you change banks;

- when you close a business.

The bank has the right to close an individual entrepreneur's account:

- if the service contract has expired;

- there are not enough funds in the account to pay for bank services.

This procedure may be preceded by blocking the individual entrepreneur's current account. Before closing, the client receives a letter in which the bank warns of its intention to block the account. It indicates the reasons and necessary actions on the part of the client to avoid this. You can extend the contract, pay off the debt and continue cooperation. Or don’t do this, and then the bank will terminate the relationship unilaterally.

If you owe a service fee, the bank will file a claim demanding payment. If you don't pay, the bank may sue.

Without the participation of the owner, the closure of an individual entrepreneur's account occurs when an entrepreneur is caught in illegal activities.

Resolve all issues regarding the account before submitting documents for liquidation of the individual entrepreneur, so that the tax inspectorate has no reason to suspect. After this, use the instructions that will help you close your individual entrepreneur’s current account quickly and easily.

Deadline for closing a current account

At the legislative level, the closure period is not established. The bank takes some time to consider the submitted application. On average, the period is several days.

If the decision is positive, the account will be liquidated. A specific period may be specified in the agreement that was concluded earlier, when opening the RS.

The entrepreneur learns that the account no longer exists through a special notification sent to him by the bank. The received paper must contain a date, which is considered the day the account expires.

Such a procedure may be required at any time, even before the expiration of the previously concluded contract. Therefore, it is worth studying this issue to avoid problems. The process of closing an account is usually quite simple and does not pose any difficulties. It is enough to comply with several important conditions. If the entrepreneur does not have problems with the tax authorities and debts, the PC will be quickly closed.