Today it is difficult to imagine options for running a legal business without non-cash payments. To carry out such payments, individual entrepreneurs open bank accounts. In this case, there is often a need to transfer money from an individual entrepreneur’s account to an individual’s card. Most often, you need to top up the debit card of the individual entrepreneur in this way, but sometimes the transfer needs to be made to a third party. How to do all this without arousing “unhealthy interest” from the tax authorities. We will discuss this in detail.

Content

- According to the tax authorities

- From the bank's point of view

- Bottom line

First, let’s think about why this situation with payment to an individual’s bank card occurs quite often. What benefit does the entrepreneur have in this case?

Firstly, as many people think, it is convenient for clients. They have their own bank card with which they transfer money to individual entrepreneurs. But here you can still argue. This is convenient primarily for individual entrepreneurs: you don’t need to open a current account, you don’t need to pay for its maintenance either, the money “drips” directly onto the card. For the client, in fact, the degree of “convenience” of this payment method always remains the same: he pays using his card, and how the payment is made - to the individual entrepreneur’s card, to his account or to the same account through a payment aggregator - The buyer doesn't care much.

Secondly, it is cheaper for individual entrepreneurs, since servicing a personal bank card in any case will cost less than servicing a current account.

This practice of receiving payment by individual entrepreneurs is common in life precisely because they save money on services. This payment method is usually offered by many online stores and joint purchase organizers. But what could such savings turn out to be?

Transfer of funds from an individual entrepreneur's current account to the card of another individual

If you have employees or work with people under a civil contract, you can transfer payment to them from your individual entrepreneur account to their personal accounts. In this case, tax will be withheld from each payment, because for the recipient the transfer is income from you, as an individual entrepreneur.

How to transfer money from an individual entrepreneur’s current account to an employee’s card

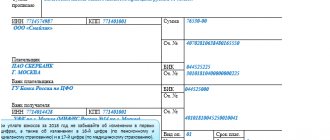

If you pay a monthly salary to a registered employee, you must indicate “Transfer of wages for such and such a month” in the payment purpose. At the same time, together with the payment slip for salary payment, send a payment slip for personal income tax and payment of insurance premiums.

Many entrepreneurs pay employees twice a month - an advance and a salary. When you transfer an advance, indicate “Payment of salary advance” in the purpose of payment.

Banks also offer a free corporate card when opening an individual entrepreneur account.

Transfer of money to an individual under a civil contract

When transferring funds from an individual entrepreneur’s current account to the card of an employee who works under a civil contract, the purpose of the payment must indicate: “Payment under agreement No. such and such, from such and such a date, for such and such work/services” .

Together with this payment order, a personal income tax payment slip is sent. Insurance premiums are paid only if this is specified in the terms of the agreement between the individual entrepreneur and the individual.

According to the tax authorities

If we consider this issue from the point of view of tax legislation, we can say the following:

- An individual entrepreneur is not required to open a current account;

- in the Tax Code of the Russian Federation there is no prohibition on the use of individual entrepreneurs for their activities on personal accounts;

- The type of account used to receive payment is not important: according to clause 2 of Art. 11 of the Tax Code of the Russian Federation, an account is a settlement (current) and other bank account opened on the basis of a bank account agreement.

- At the moment, there is no obligation for individual entrepreneurs to report the opening of an account.

What can be concluded?

In principle, there is no prohibition in tax legislation on using a personal bank card instead of a current account. But there are risks here, especially in conditions where it is no longer necessary to report the opening (use) of this or that account to the tax authorities.

What could this turn out to be?

When checking, tax authorities can count as income all amounts that were received on your bank card, and not just those that were transferred to you by clients.

Since the card is personal, you can carry out other operations with it, for example, receive a transfer from a relative or transfer money to yourself from another card. Such receipts in your understanding are not income. The tax office may well consider all this as income and charge additional tax. You will have to prove long and hard that this money is not income, and it is not a fact that you will prove it.

Even if you create a card with the intention of receiving payments from clients on it, then in practice the human factor comes into play: sooner or later you will need to transfer some amounts to pay for something, etc., because a bank card will always will be at your fingertips.

What will happen in a situation where payments from clients were received on the card, but the income was not reflected anywhere and the tax, accordingly, was not paid? If your “black transactions” are discovered, then you face more serious sanctions than a simple additional tax charge.

Can an individual entrepreneur receive money from clients to a personal bank card?

Money from clients to a personal bank card? Definitely yes, an individual entrepreneur can receive payment from his customers not only to his individual entrepreneur’s current account, but also to his personal bank card as an individual. But is it as good as it seems at first glance?

Thanks to the explanatory letter of the Federal Tax Service dated June 20, 2020 No. ED-3-2/ [email protected] “On the use of a bank card by an individual entrepreneur,” it became clear that “The legislation on taxes and fees does not contain a prohibition on the use by an individual entrepreneur to receive payment for services rendered with your personal bank card, followed by cashing out funds at an ATM and depositing these funds into your current account opened for business activities.”

How did the Federal Tax Service allow the individual entrepreneur not to post revenue through the individual entrepreneur's current account? And it’s very simple: thanks to the “innovation” that came into force on July 1, 2018, namely paragraph 2 of Article 86 of the Code, which states that:

“Banks are required to issue to the tax authorities certificates about the availability of accounts, deposits (deposits) in the bank and (or) about the balances of funds (precious metals) in accounts, deposits (deposits), statements of transactions on accounts, on deposits (deposits) of individual entrepreneurs and individuals who are not individual entrepreneurs, as well as certificates of electronic money balances and electronic money transfers.”

What does this mean? The only thing is that during an inspection of an individual entrepreneur, after submitting a declaration, the tax office can request from the bank a statement of the current account of both the individual entrepreneur and the individual, and compare whether all amounts are reflected in the declaration. If not, then you will have to provide evidence that the amounts received into the individual’s account were not your proceeds, but were, for example, repayment of a debt from an old friend.

If there is no evidence, then you will face a fine of 20% of the amount of unpaid tax, and, of course, you will be charged the tax itself and penalties for late payment. And if the individual entrepreneur does not have money in his current accounts, then the individual’s foreign currency accounts will come into play; deposits will be next in line, because the tax authority has the right to give the bank an order to write off taxes from deposit funds after the expiration of the deposit agreement.

However, an undoubted advantage of the innovation is that now, by receiving money from clients on a personal bank card, you can save on servicing your current account. For example, Sberbank, as a help to small businesses, sells a package of current account servicing services starting from 490 rubles. up to 8000 rub. per month depending on the volume of payments. This broad gesture from Sberbank will still cost more than servicing a personal bank card of an individual.

In general, it is possible to receive money from clients onto your own bank card, but is it worth it? Everyone decides for themselves.

More on the topic:

From the bank's point of view

Registration of a bank card is accompanied by the conclusion of an agreement between you and the bank, so it is worth considering the legality of using a personal card to receive payment from clients from the point of view of relations with the bank.

To understand the situation, let us turn to Instruction of the Central Bank of the Russian Federation No. 153-I dated May 30, 2014, in which current and current accounts are clearly separated from each other (Chapter 2 of this Instruction):

- a current account is opened for an individual for transactions that are not related to business;

- A current account is opened for an individual entrepreneur or a legal entity for business transactions.

Banking legislation denies the equivalence of current and current accounts, therefore, from the definition of the terms it follows that an individual entrepreneur cannot use a card to receive payment.

What does an entrepreneur face in case of violation?

Let's start by reading your agreement with the bank. When you open a simple personal card, many banks include a condition in the agreement that you cannot use this account for business purposes. If you receive payments from clients on your card, you will violate the terms of the agreement with the banking institution, and the bank, in turn, has every right to stop servicing the account and terminate the agreement.

Even if there is no such clause in the agreement, there may be a clause stating that by signing the agreement, you agree with the internal rules of the bank, that is, its internal regulations. These regulations may also stipulate that it is impossible to use a current account for business purposes.

Conclusion: violation of the terms of use of a bank card can lead to the bank refusing to perform certain functions of servicing the account, blocking the card and terminating the agreement. It is more profitable for any bank to open a current account for an individual entrepreneur, since its maintenance will cost more.

What else threatens mass receipt of payments from clients to a personal card?

Banks in their work are guided by Federal Law No. 115-FZ of August 7, 2001, which regulates issues of combating money laundering. So: according to this law, banks are required to monitor suspicious transactions, record information about them and transfer it to the relevant authorities for investigation. At the same time, the regular receipt of amounts on an individual’s card from a large number of other individuals is considered one of the signs of laundering proceeds from crime and raises corresponding suspicions.

What can a bank do in such a situation?

Most often, the bank blocks such a card, as well as other cards belonging to this individual, and also transmits information to law enforcement agencies and the tax service.

Conclusion: in this situation, you will find yourself in a situation where the card will be blocked, and you will have to explain yourself not to the bank, but somewhere else.

How much does translation cost?

There is another type of cost that hits business entities when transferring money from a legal entity to an individual or from an individual entrepreneur to an individual - this is a commission. Even if this burden is small, but along with the tax payment, the total amount of costs will be significant. The amount of the commission will depend on the bank where the account was opened, and it rarely exceeds 2%. Let's give examples.

- VTB24 Bank will charge at least 1.5% for the transfer, and the minimum commission amount is not established.

- Sberbank will charge the client 1.1% of the transfer amount, but not less than 115 rubles per transaction.

- Rosselkhozbank estimates this operation at 1% of the transferred amount, but not less than 100 rubles per transfer.

- Alfa-Bank takes 0.5%, but not less than 100 rubles.

Please note that banks set monthly limits for these types of transfers. You cannot transfer huge sums from an individual entrepreneur’s account to a card, and the number of transactions is limited, so be careful when choosing the bank in which you will open an account.

So, a transfer from an individual entrepreneur’s account to an individual’s plastic card is technically easy to do; you just need to remember some of the features of this operation so as not to incur additional costs. We tried to highlight these features as clearly as possible. Good luck!

Bottom line

In order not to risk your existing relationship with the bank, or the possible blocking of all your cards, or additional taxes from the tax office, as well as communication with law enforcement agencies, an individual entrepreneur must open a current account. At the moment, banks are ready to offer their clients a variety of options for opening and servicing a current account with the ability to use additional services. Bank tariffs for servicing a current account differ, so everyone can choose the appropriate option for themselves. HERE you can choose the appropriate option and even with free service.

To accept online payment on the website of an online store, it is recommended to enter into an agreement with a payment aggregator: customers will be able to pay for purchases with cards, and you will legally receive money through the aggregator to your current account. To do this, read the more detailed article “How to accept payments on your website legally.”

How can an individual entrepreneur transfer funds to his card?

A businessman acting individually must somehow receive the money he earns. Transferring money from a current account to a personal card is one of the ways to achieve this task.

Tax legislation, as well as a banking agreement with an individual entrepreneur for account servicing, do not contain restrictive rules for such an operation. However, in order to avoid disputes with tax authorities, the payment order should indicate the correct purpose of the transfer.

The options are:

- for personal needs;

- transfer of own funds.

Sometimes the money that goes to your bank card is also designated by individual entrepreneurs as income from business.

However, such a definition is not very accurate and the tax office (at the request of the bank) may ask what is meant by this phrase. We recommend you study! Follow the link:

Can an individual entrepreneur use a personal bank card for payments?

The wording that should be avoided is the designation of money transferred from the account as salary. When the amounts are named as such, the entrepreneur is obliged to withhold personal income tax from them and charge insurance premiums. But an individual entrepreneur does not have a salary - he has income, on which a single tax is charged, which also replaces income tax. As a result, a conflict arises, allowing the tax inspectorate to assess additional tax.

If the operation is being carried out for the first time and there are doubts about your own competence, you should consult with bank employees who will suggest the safest wording.

Banks do not charge fees for this type of transaction, but they have the right to limit the amount of money withdrawn to the card. Usually they set a certain monthly limit, depending on the entrepreneur’s turnover and the volume of loans taken from a credit institution. Especially great difficulties arise if the card is from another bank or it is a credit card.

How to transfer money from a card to a current account

When, after receiving payment from clients, there are not enough funds in the current account and the operation needs to be carried out, an individual entrepreneur has the right to top up the account.

There are two ways to add:

We recommend you study! Follow the link:

Opening or closing a bank account for an individual entrepreneur

- depositing cash into the bank's cash desk;

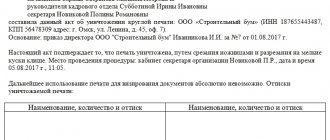

- transfer of the missing amount from the card.

When depositing through the cash register, the purpose of the deposit is indicated - replenishment of the account.

The entrepreneur fills out a minimum of documents and deposits money; the rest of the actions are up to the employees of the institution. The second way - transferring from a card is much more complicated, since it requires entering full bank details. This procedure is carried out either through ATMs (or terminals), from a mobile phone if online banking is connected, or from a desktop computer on which the client-bank program is installed.

The user needs to take special care when entering numeric values. An error in even one digit may result in incorrect enrollment.

The program installed in the ATM will correct the user in the text of the bank's name, its correspondent account and BIC, but the correctly entered recipient's current account is the responsibility of the entrepreneur.