Requirements for an application to open an individual entrepreneur

To fill out an application on Form P21001 without errors, please read the basic requirements for registration:

- in a cell - one character (letter, number, etc.), capital letters, printed, font - Courier New with size 18;

- provide personal information in accordance with your passport (clauses 4.2 and 7.4);

- The TIN is filled in if you received it previously (find out the TIN in the Federal Tax Service);

- third page for citizens of other countries;

- in the application for registration of an individual entrepreneur, it is allowed to write OKVED, consisting of at least 4 characters (look at all codes in OKVED-2);

- Sheet “B” must be filled out by hand in the presence of a tax inspector; information cannot be entered in advance;

- the application in form P21001 is not stitched;

- Address names are prohibited from being abbreviated in any order.

The list shows the basic requirements. There are significantly more of them; the full list is described in the official instructions of the Federal Tax Service. To avoid having to submit an application several times, please read it carefully.

Transfer rules in form P21001

Be sure to follow the transfer rules:

- fill the line to the end, enter as many characters as will fit. On the next line, enter the data from the first cell (no hyphen is added);

- if the first word fits completely in the line, fill the next line from the second cell, since there is a space between the words;

- After the period, do not forget to put a space, that is, an empty cell.

Violation entails denial of state registration as an individual entrepreneur, so be sure to follow the rules.

Hyphenation example

Fill the line to the last cell, continue writing the word from the next line from the first cell:

The word does not fit on the line, write it from the first cell of the next line. The remaining empty cells of the previous period are considered one space:

The word ended in the last cell of the line, the next word is written from the second cell of the next line:

Options for filling out an application

As mentioned above, there are several filling options. Each of them has its own advantages and disadvantages.

- On one's own.

The easiest way is to print out the form and fill it out in black ink. There is a risk - if you accidentally made a mistake, made a blot or a typo, you will have to fill out the sheet again.

- Using a special program.

The most convenient program is PPDGR from GNIVC. It will definitely prevent you from making a mistake in filling out a particular cell, contains a loadable KLADR, and will also report an incorrect TIN (the checksum does not match).

But it is powerless against spelling errors - so be careful. Another disadvantage is that the source file is saved in the dgr format, which is not readable anywhere else, or it can be printed and saved as a multi-page tif.

There are also programs from third-party manufacturers - Comptech, Document Manager, I-Reger, etc.

In general, good products, the creators monitor their updates and actualization. But - usually they are paid.

- Online service.

There are several online services for filling out form P21001. This is also a service on the official website of the Federal Tax Service, with which you can simply fill out an application, or you can send it to the Federal Tax Service for subsequent registration. One of the inconveniences is that you need to independently search for codes in the presented OKVED code, when third-party services offer ready-made “assemblies” - for example, for a car wash, hairdresser, etc.

The most preferable option is to prepare an application in form P21001 and accompanying documents for registration of individual entrepreneurs using a free online service in 10 minutes; you will be guided throughout the entire filling out stage by prompts and at the exit you will receive a ready-made package of documents for registration.

The main advantage of this service is the free filling out of the P21001 form without errors, which eliminates the possibility of refusal to register an individual entrepreneur, as opposed to filling it out independently.

In fact, there is no strong difference in all services; at the output we receive a ready-made form P21001, in excel, pdf, or sometimes in word format.

First page of form p21001

Section 1. Full name

In the first section, indicate the full name of the individual entrepreneur. Each word is indicated on a new line in the corresponding field. Name - in clause 1.1.1

, last name -

in clause 1.1.2

, patronymic (if available) -

in clause 1.1.3

. Leave the fields in paragraph 1.2 empty; they are filled in by foreign citizens.

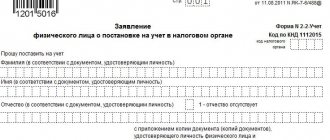

Section 2. TIN

The TIN is indicated if available, if you previously received it from the tax service. Otherwise, leave the field empty, the Federal Tax Service will assign a unique number to you and issue a document with an identification number with information about the registered individual entrepreneur.

You can find a taxpayer identification number by last name, first name and patronymic through the Federal Tax Service.

Section 3. Gender

Please indicate your gender according to the instructions on the form itself. Male - enter the number "1", female - "2".

Section 4. Birth information

Indicate your date of birth in accordance with the data in your passport, even if for some reason the actual information differs from it. In paragraph 4.2 “Place of birth” write the city in which you were born. It must match the data from the passport.

Section 5. Citizenship

Section 5 is filled out in accordance with the instructions of the form. Indicate the number “1”, corresponding to a citizen of the Russian Federation. Leave paragraph 5.1 blank, it is intended for citizens of other states.

Detailed instructions for filling it out yourself

Filling out an application for opening an individual entrepreneur must be carried out in accordance with the requirements approved by the Federal Tax Service of the Russian Federation. This is due to the fact that the form, after it is submitted to the tax authority, will be checked not personally by an employee of the Federal Tax Service, but by machine, and deviation from the filling out algorithm will automatically lead to a refusal of registration.

You must enter information into the form in strict accordance with your passport data. Therefore, we strongly advise you to put your passport in front of you and check it, rather than filling out the application from memory.

The official instructions for filling out the P21001 form are available for download at this link. This document can confuse even an experienced lawyer, so we recommend using our step-by-step instructions with sample forms for 2020, prepared for a simple beginning entrepreneur.

Form P21001 contains 5 pages. Citizens of the Russian Federation who decide to open an individual entrepreneur fill out only 4 pages out of 5. Each page is accompanied by a detailed description and examples of filling:

- Form P21001 – page 1.

- Form P21001 – page 2.

- Form P21001 – sheet A.

- Form P21001 – sheet B.

Please note: there is no need to submit the extra (unfilled) page number 3 to the tax authority. It is intended only for registration of individual entrepreneurs by foreign citizens.

Second page of form p21001

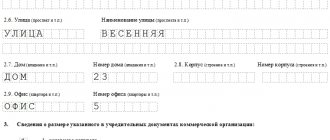

Section 6. Address of residence (stay) in the Russian Federation

Section 6 of form p21001 indicates the registration address in accordance with the data from the passport or other identification document. You cannot write the address of the actual place of residence (if it differs from the registration one) or the address of temporary registration.

It is permissible to indicate a temporary registration address in cases where there is no permanent registration address.

In clause 6.1, indicate the postal code corresponding to the registration address. To clarify the information, use the Russian Post service. In paragraph 6.2, write the code of the subject of the Russian Federation (corresponds to the region number).

Clause 6.3 is completed if the city belongs to any district. Check the information on the Wikipedia page with a list of municipal districts and urban districts of Russia.

In paragraph 6.4, write the name of the city in which you are registered (the information must correspond to the data from the passport). Clause 6.5 is not completed if the city is indicated.

In paragraphs 6.6–6.9, indicate the street, house and apartment numbers in which you are registered. Abbreviations cannot be used. If the house number has a letter, then write “10A” without a space. Housing and housing number are filled in if available. Check the data with that indicated in your passport. If there is an error, the IP registration will be rejected.

Section 7. Identity document details

In paragraph 7.1, indicate the code “21”; it corresponds to the passport of the Russian Federation. When opening an individual entrepreneur, they usually use a passport for identification. Next, fill in the series and passport number. This is done in the same way as in a passport, that is, with two spaces. Next, enter information about the date of issue of the document, who issued it, and the unit number accordingly.

Carefully check the specified data with the actual data from your passport. If there is an error in the application for registration of an individual entrepreneur, you will receive a refusal from the tax office.

Filling out an application on form P21001 - step-by-step instructions

To fill out the application, prepare:

- passport - for a citizen of the Russian Federation,

- residence permit or temporary residence permit - for a foreign citizen or stateless person,

- certificate of assignment of TIN - if available.

Let's look at the order in which each sheet should be filled out.

Sheet No. 1 - full name, birth and citizenship data, TIN, gender

Last name, first name and patronymic are indicated in full accordance with the passport. If the middle name is not included, this line is not filled in. Field 1.1 is filled in by both citizens of the Russian Federation and foreigners, field 1.2 - only by foreigners.

The TIN is indicated in accordance with the data in the certificate of registration with the Federal Tax Service. If the TIN is lost, it can be found on the Federal Tax Service website using the passport details of the individual.

If the applicant is not registered with the tax office, the Federal Tax Service will assign him a TIN when submitting an application and issue a certificate along with documents on registration as an individual entrepreneur.

In the “Gender” field, enter a numerical value: 1 - for men, 2 - for women.

The date and place of birth are indicated in accordance with the passport data. In the “Citizenship” field, enter a numerical value: 1 - for citizens of the Russian Federation, 2 - for foreign citizens, 3 - for stateless persons.

Field 5.1 is filled out by foreigners in accordance with the All-Russian Classifier of Countries of the World (Resolution of the State Standard of Russia dated December 14, 2001 No. 529-st).

Sheet No. 2 - address and passport details

Section 6 indicates the registration address of the individual in accordance with the Russian Federation passport (registration). The address of the place of residence is needed only when there is no permanent residence permit.

Features of filling out the fields in section 6:

- 6.1 - the postal code can be found on the Russian Post website at the address;

- 6.2 - all codes of the constituent entities of the Russian Federation are in Appendix No. 1 to the Requirements for the preparation of documents submitted to the registration authority;

- 6.3—6.6 — names of address objects are filled in taking into account the abbreviations established in Appendix No. 2 to the Requirements for the preparation of documents submitted to the registration authority (for example, “district” - “district”);

- 6.7-6.9 - these items are filled in without abbreviations, for example, “house”, “apartment”.

Section 7 indicates the details of the identity document. For a passport, enter the code “21” in field 7.1. In field 7.2, first enter its series (as in the document, with a space), followed by a space - the number. The remaining information is provided in strict accordance with the passport data. When filling out field 7.4, follow the transfer rules contained in Appendix No. 20 to the Order of the Federal Tax Service of Russia dated January 25, 2012 No. MMV 7-6/ [email protected]

Sheet No. 3 - data of a foreign citizen and stateless person

Citizens of Russia do not fill out, number and submit sheet No. 3 of the main part of the application. Foreign citizens and stateless persons, when filling out this sheet, are guided by the same requirements as citizens of the Russian Federation when filling out sheet No. 2.

Sheet A - OKVED codes

Citizens of the Russian Federation number the sheet “003” and indicate the codes of those types of activities that the individual entrepreneur will conduct. One is the main one, the rest are additional. In 2020, for this purpose, they are guided by the new All-Russian Classifier OK 029-2014 (NACE Rev. 2) dated February 1, 2014. In fields 1 and 2, indicate at least four code characters.

One page contains 57 codes, taking into account the main one, but if necessary, you can include another sheet A in the application. It is no longer necessary to indicate the main OKVED code, but you must indicate the page number in ascending order.

Sheet B - contact details, signature of the applicant and certification of its authenticity

The applicant puts his full name and signature by hand and only in the presence of a tax inspector accepting documents for registration of an individual entrepreneur. Otherwise, the signature must be notarized. Section 3 indicates the details of the person who verified the signature.

The digital value selects the method of receiving documents with the Federal Tax Service's decision on registration: 1 - in person by the applicant, 2 - by the applicant or his representative by proxy, 3 - by mail.

In section 2, the telephone number is indicated without spaces or dashes, with an international telephone code. The “+” sign and brackets are entered in a separate familiar place.

E-mail is indicated when submitting an application electronically.

To submit documents to the Federal Tax Service in person, by mail or through a representative, application P21001 is printed out in one copy. Double-sided printing is prohibited; sheets do not need to be stapled or otherwise bound.

Sheet "A"

At the top of the sheet, fill in the “Page” field. For citizens of the Russian Federation, the serial number of sheet “A” is “003”. Please note that two zeros in the first two cells are required.

First, indicate the code of the main activity. It can be found in the updated OKVED-2, which came into force at the beginning of 2020. The classifier has two- and three-digit codes, but in the P21001 statement, codes consisting of at least 4 characters are allowed.

The main activity can be anything, but the Federal Tax Service imposes one limitation: the entrepreneur must receive at least 60% of the total income from this activity in the future.

There are no restrictions on the number of activities. If they do not fit on one sheet, you are allowed to take a second one and continue filling. Indicate all types of activities that you plan to engage in, even if you are not 100% sure about some of them. You will not be fined if you do not engage in any of these matters. And if you do not indicate the activity, but decide to engage in it, you will be fined.

Sheet "B"

Sheet “B” consists of three items. First, indicate the page number at the very top - “004” (if one sheet “A” is completed).

In the first section of Sheet “B”, fill in your contact phone number and email address on your computer. The rest is filled in by hand. You cannot do this before going to the tax office; data is entered into the fields in front of a tax officer.

The phone number must be filled in without spaces. The region code is indicated in brackets. Each bracket is written in a separate cell.

Select the method of obtaining documents confirming the creation of an individual entrepreneur. Enter the number corresponding to the method of receipt. You need to decide on this in advance, since you cannot change your choice later.

The second paragraph is filled in by the tax officer where documents are submitted. He confirms receipt of application P21001 and other documents necessary for opening an individual entrepreneur, as well as the fact of providing an identity card.

Step-by-step instructions for registration

Log in to your personal account in the Federal Tax Service “State registration of legal entities and individual entrepreneurs”. Sequentially select “Individual entrepreneurs → Register an individual as an individual entrepreneur → Fill out a new application.”

Confirm your consent to the processing of personal data and select the type of application to be submitted - form P21001.

Then select the method of submitting documents for individual entrepreneur registration. Under each option there is a “Show detailed information” button, which describes the sequence of further actions.

You can submit only the application and the entire package of documents electronically. This depends on the presence of an electronic signature. Let's look at both options in detail.

Submitting an application without digital signature

Fill out the application

Please indicate your citizenship and residence address. Drop-down lists help you fill out the fields correctly. It is enough to enter the first letters of the subject of the Russian Federation, locality or street.

On the next page, in the fields of the application, indicate gender, date and place of birth, and passport information. The Full Name and Taxpayer Identification Number fields are filled in automatically based on the data entered during registration.

You can find out your TIN on the Federal Tax Service website in the “Find out TIN” service. To do this, please indicate your full name, date of birth and passport details.

On the second page, select OKVED codes that correspond to your type of activity. To make your search easier, use the list filter.

On the third page, provide your contact information. An e-mail is required, since the Federal Tax Service will receive a decision on accepting or refusing the application. Here, select the method of receiving individual entrepreneur registration documents - issue to the applicant, his representative, or send by mail.

Wait for the entered data to be verified

The specified information is automatically verified within 5 minutes. If the verification takes longer, you can return to the service later. The completed application will be saved in your personal account in the “My Applications” section.

Pay the state fee

If you submit an application without using an electronic signature, you need to pay a state fee for registering an individual entrepreneur - 800 rubles. It can be done:

- cash - generate a receipt for payment;

- through the official website of the credit institution - select the appropriate option from those offered;

- by bank card (only with the specified TIN) - in the payment system where you will be redirected, enter your bank card details.

In the “Payment Confirmation” section, enter the payment order number, payment date and bank BIC.

Applications from the official instructions of the Federal Tax Service

Appendix No. 1. Codes of subjects of the Russian Federation

| Name of the subject of the Russian Federation | Subject code | Name of the subject of the Russian Federation | Subject code | |

| Republic of Adygea | 01 | Kirov region | 43 | |

| Republic of Bashkortostan | 02 | Kostroma region | 44 | |

| The Republic of Buryatia | 03 | Kurgan region | 45 | |

| Altai Republic | 04 | Kursk region | 46 | |

| The Republic of Dagestan | 05 | Leningrad region | 47 | |

| The Republic of Ingushetia | 06 | Lipetsk region | 48 | |

| Kabardino-Balkarian Republic | 07 | Magadan Region | 49 | |

| Republic of Kalmykia | 08 | Moscow region | 50 | |

| Karachay-Cherkessia Republic | 09 | Murmansk region | 51 | |

| Republic of Karelia | 10 | Nizhny Novgorod Region | 52 | |

| Komi Republic | 11 | Novgorod region | 53 | |

| Mari El Republic | 12 | Novosibirsk region | 54 | |

| The Republic of Mordovia | 13 | Omsk region | 55 | |

| The Republic of Sakha (Yakutia) | 14 | Orenburg region | 56 | |

| Northern Republic Ossetia - Alania | 15 | Oryol Region | 57 | |

| Republic of Tatarstan (Tatarstan) | 16 | Penza region | 58 | |

| Tyva Republic | 17 | Perm region | 59 | |

| Udmurt republic | 18 | Pskov region | 60 | |

| The Republic of Khakassia | 19 | Rostov region | 61 | |

| Chechen Republic | 20 | Ryazan Oblast | 62 | |

| Chuvash Republic - Chuvashia | 21 | Samara Region | 63 | |

| Altai region | 22 | Saratov region | 64 | |

| Krasnodar region | 23 | Sakhalin region | 65 | |

| Krasnoyarsk region | 24 | Sverdlovsk region | 66 | |

| Primorsky Krai | 25 | Smolensk region | 67 | |

| Stavropol region | 26 | Tambov Region | 68 | |

| Khabarovsk region | 27 | Tver region | 69 | |

| Amur region | 28 | Tomsk region | 70 | |

| Arhangelsk region | 29 | Tula region | 71 | |

| Astrakhan region | 30 | Tyumen region | 72 | |

| Belgorod region | 31 | Ulyanovsk region | 73 | |

| Bryansk region | 32 | Chelyabinsk region | 74 | |

| Vladimir region | 33 | Transbaikal region | 75 | |

| Volgograd region | 34 | Transbaikal region Aginsky Buryat District | 80 | |

| Vologda Region | 35 | Chita region | 75 | |

| Voronezh region | 36 | Yaroslavl region | 76 | |

| Ivanovo region | 37 | Moscow city | 77 | |

| Irkutsk region | 38 | city of St. Petersburg | 78 | |

| Irkutsk region (Ust- Ordynsky Buryatsky district) | 85 | Jewish Autonomous region | 79 | |

| Kaliningrad region | 39 | Nenets Autonomous Okrug | 83 | |

| Kaluga region | 40 | Khanty-Mansiysk Autonomous Okrug - Yugra | 86 | |

| Kamchatka Krai | 41 | Chukotka Autonomous district | 87 | |

| Kemerovo region | 42 | Yamalo-Nenets Autonomous district | 89 |

Appendix No. 2. Names of address objects. Area information

| Full name | abbreviated name |

| Area | district |

| Territory | ter |

| Ulus | U |

Appendix No. 2. Names of address objects. Information about the city

| Name | abbreviated name | Name | abbreviated name | |

| Parish | PIVOTALITY | Workers' village | RP | |

| City | G | Village administration | S/A | |

| Suburban village | DP | Rural district | S/O | |

| Array | ARRAY | Rural settlement | S/P | |

| Post office | BY | Village Council | S/S | |

| Settlement | PGT | Territory | TEP |

Appendix No. 2. Names of address objects. Information about the locality

| Name | abbreviated name | Name | abbreviated name | |

| Aal | AAL | Lespromkhoz | Private household plots | |

| Road | HIGHWAY | Place | M | |

| Arban | ARBAN | Microdistrict | MKR | |

| Aul | AUL | Locality | NP | |

| Parish | PIVOTALITY | Island | ISLAND | |

| Vyselki(ok) | EVICTION | Village | P | |

| City | G | Post office | BY | |

| Town | TOWN | Planning area | ETC | |

| Village | D | Village and station(s) | P/ST | |

| Suburban village | DP | Settlement | PGT | |

| Railway booth | RAILWAY_BOOK | Pogost | POGOST | |

| Railway barracks | RAILWAY_BARRACK | Pochinok | POCHINOK | |

| Railway stop, (overtaking) point | Railway_OP | Industrial Zone | INDUSTRIAL ZONE | |

| Railway platform | RAILWAY_PLATF | Departure | RSD | |

| Railway post | RAILWAY_POST | Workers' village | RP | |

| Railway siding | Railway_RZD | Village | WITH | |

| Railroad station | F/F_ST | Sloboda | SL | |

| Residential area | RESIDENTIAL AREA | Garden non-profit partnership | SNT | |

| Zaimka | ZAMKA | Station | ST | |

| Barracks | BARRACKS | Stanitsa | ST-CA | |

| Quarter | KV-L | Territory | ter | |

| Cordon | CORDON | Ulus | U | |

| Resort village | KP | Khutor | X |

Appendix No. 2. Names of address objects. Street information

| Name | abbreviated name | Name | abbreviated name | |

| Aal | AAL | Village | P | |

| Alley | ALLEY | Post office | BY | |

| Aul | AUL | Planning area | ETC | |

| Boulevard | B-R | Village and station(s) | P/ST | |

| Shaft | SHAFT | A park | A PARK | |

| Entry | ENTRY | Lane | PER | |

| Vyselki(ok) | EVICTION | Moving | MOVING | |

| Town | TOWN | Square | PL | |

| Garage and construction cooperative | GSK | Platform | PLATF | |

| Village | D | Area | PL-KA | |

| Road | DOR | Stop station | STATION | |

| Railway booth | RAILWAY_BOOK | Avenue | PR-CT | |

| Railway barracks | RAILWAY_BARRACK | Directions | DIRECTIONS | |

| railway stop, (overtaking) point | Railway_OP | Prosek | PROSEK | |

| Railway platform | RAILWAY_PLATF | Country road | COUNTRYWAY | |

| Railway post | RAILWAY_POST | Duct | DUCT | |

| Railway siding | Railway_RZD | Alley | ALNEY | |

| Railroad station | Zh/D_ST | Departure | RSD | |

| Livestock point | ZhT | Rows | RANKS | |

| Check-in | CHECK IN | Village | WITH | |

| Barracks | BARRACKS | Garden | GARDEN | |

| Channel | CHANNEL | Square | SQUARE | |

| Quarter | KV-L | Sloboda | SL | |

| Kilometer | KM | Gardening certain partnership | SNT | |

| Ring | RING | Descent | DESCENT | |

| Scythe | SPIT | Station | ST | |

| Line | LINE | Structure | STR | |

| Lespromkhoz | Private household plots | Territory | TEP | |

| Place | M | Tract | TRACT | |

| Microdistrict | MKR | Dead end | TUP | |

| Bridge | BRIDGE | Street | UL | |

| Embankment | NAB | Plot | UC-K | |

| Locality | NP | Farm | FARM | |

| Island | ISLAND | Khutor | X | |

| Highway | Sh |

Appendix No. 3. Types of identity documents

| Code | Title of the document |

| 03 | Birth certificate |

| 07 | Military ID |

| 08 | Temporary certificate issued in lieu of a military ID |

| 10 | Foreign citizen's passport |

| 11 | Certificate of consideration of an application for recognition of a person a refugee on the territory of the Russian Federation essentially |

| 12 | Residence permit in the Russian Federation |

| 13 | Refugee ID |

| 15 | Temporary residence permit in the Russian Federation |

| 18 | Certificate of provision of temporary asylum in the territory Russian Federation |

| 21 | Passport of a citizen of the Russian Federation |

| 23 | Birth certificate issued by an authorized body foreign country |

| 24 | Identity card of a military personnel of the Russian Federation |

| 91 | Other documents |

An example of a completed application for opening an individual entrepreneur

To correctly fill out the application on form P21001, we recommend that you rely on samples completed by specialists. You can get P21001 for free at the beginning of the article.

Form 21001 (sample individual entrepreneur form) - DOC

Form P21001 sample - EXCEL

Each sample application for state registration of an individual as an individual entrepreneur is made through the free document preparation service “My Business”. Use it so that in 15–20 minutes you will have in your hands all the documents necessary to register as an individual entrepreneur.

Do not forget that after receiving the status of an individual entrepreneur, you need to pay contributions to the Pension Fund and social insurance for yourself. In 2020, a new deduction rate will come into force, which you should find out about in advance. A detailed description of the updated amounts is presented in the video below.

How it works?

The service for registering an individual entrepreneur online is simple and intuitive: all the necessary actions are described step by step.

So, to register an individual entrepreneur online on the website, go to the service and see the first window. Select the desired option and proceed to the next step by pressing the blue button with the corresponding inscription. Just 5 steps. Filling out the data following the instructions for registering an individual entrepreneur online takes an average of 2-3 minutes.

Step 1. Specify citizenship

Step 2. Enter the address of residence, zip code*

*You can find out your postcode, knowing only your residential address, on the Russian Post website

Step 3. To register an individual entrepreneur online on the website, enter information about the individual entrepreneur: indicate full name, gender, date of birth, enter TIN and passport details

Step 4. Select activity codes from OKVED

Click “select” main, a list of codes appears, select the one you need (for a quick search, you can enter words from the name of the code or, if known, the code numbers in the search bar):

We get:

Similarly, we select additional activity codes, in any quantity. As a result, we get a completely completed form:

Step 5. Choose a convenient way to receive a completed application:

If everything is fine and you succeeded, a small window will appear:

YOU ARE AT THE FINISH: IN 1-2 MINUTES YOU WILL HAVE A READY APPLICATION FOR OPENING AN IP IN YOUR MAIL – IN THE FORM OF AN EXCEL DOCUMENT. YOU CAN PRINT IT IMMEDIATELY: