Is it possible to open an individual entrepreneur without paying state duty and other expenses?

You can, but to do this you need to choose a method of submitting documents that does not require payment of a state fee.

According to Art. 3 of the Law “On State Registration of Legal Entities and Individual Entrepreneurs” dated 08.08.2001 No. 129-FZ, a state fee is paid for registration of individual entrepreneurs. But there is an exception to this rule.

In accordance with clause 32, part 3, art. 333.35 of the Tax Code of the Russian Federation, payment of state duty for registration of individual entrepreneurs is not required if the documents are submitted to the tax service in electronic form. In this case, you can submit documents not only through the Federal Tax Service website.

State duty is not paid if:

- Submit documents electronically through the State Services portal. A digital signature is required for registration. It costs money to buy it.

- Submit documents through a notary. There is no state fee, but the notary is entitled to a fee according to the tariff for the services provided.

- Apply with a package of documents to the MFC. In this case, there is no state duty or other expenses. The Ministry of Finance of Russia in a letter dated November 26, 2019 No. 03-12-13/91435 and the Federal Tax Service of the Russian Federation in a letter dated July 18, 2019 No. GD-4-19 / [email protected] explained that submitting documents through a multifunctional center or a notary is equivalent to submission of documents in electronic form due to the fact that electronic document flow is organized between these bodies and the Federal Tax Service.

Note! If you contact the tax service directly (in person), you must pay a fee for registering an individual entrepreneur.

Cashless payment via the Internet

Online payment of the state duty for terminating the activities of an individual entrepreneur is carried out through the tax service portal.

Procedure:

- Log in to the official portal of the tax department.

- Select the section on payment of state duty.

- Place a dot opposite the line “due to termination of activity” with the amount of 160 rubles.

- Enter your full name, residential address and Taxpayer Identification Number - the last condition is mandatory if the fee is paid by transfer.

- After checking the entered data, the payment button is pressed.

- Select the method of transferring funds - by bank transfer.

- Click on the icon of Sberbank or other financial organization.

- Generate a receipt and make a payment by clicking the appropriate confirmation.

A payer who closes an individual entrepreneur and ceases business activities will receive a message on his mobile phone containing a special code. After entering this number, the payment will be processed.

An alternative option is to choose cash payment. In this case, an electronic form of receipt is generated, which should be printed and paid at any financial institution. In this case, you will not have to fill out the form. The businessman will only have to sign in the appropriate boxes, and the remaining information will be filled in automatically.

When choosing a financial organization through which funds are transferred to pay the state fee for closing an individual entrepreneur, the entrepreneur checks the icon of the desired structure.

Amount of duty and methods of payment

In accordance with clause 6, part 1, art. 333.33 of the Tax Code of the Russian Federation, the state duty for registering an individual entrepreneur in 2020 is 800 rubles. There is no opportunity to reduce this amount, unlike, for example, the state fee for obtaining a driver’s license. You can make a payment in several ways:

- through special services on the website or application of the Federal Tax Service of the Russian Federation, on the State Services portal;

- through an ATM or terminal for making utility bills, paying fines, taxes and duties;

- in your personal account in the applications of Sberbank of Russia, VTB Bank, etc.;

- at a branch of any bank;

- through mobile applications designed for payment processing.

In some cases, for example, when paying a fee at a bank branch or through a terminal, you must have with you a receipt for payment of the state fee for registering an individual entrepreneur.

ConsultantPlus has many ready-made solutions, including reference information “Main types and amounts (rates) of state duties in the Russian Federation.” If you don't have access to the system yet, sign up for a free trial online. You can also get the current K+ price list.

When do you need to pay the state fee?

The future entrepreneur must pay the state fee before applying to the tax office for registration

. That is, a receipt for payment of the fee for opening an individual entrepreneur must already be in hand or actually paid.

If the payment was made electronically, then confirmation of payment can be carried out in one of two ways:

print a payment order from the website where the payment was made. The payment order will have a mark with the electronic digital signature of the service. Employees of the Federal Tax Service can independently view information in the State Information System about state and municipal payments. You will not have a physical document in your hands.

Payment of state duty can be carried out in the following ways:

- Service on the Federal Tax Service website;

- Portal "Government Services";

- Online Banking;

- Bank branch;

- Bank terminals;

- Post office.

Fill out the receipt for payment of the duty

The recipient of the funds is the registering authority - the Federal Tax Service of the Russian Federation. In this regard, the easiest way is to issue a receipt for payment of the state duty for registering an individual entrepreneur on the official website of the tax service in the “Payment of taxes and duties” section. To do this you need:

- Sequentially select the sections “Individuals”, “Payment of state duties”.

- In the new window, select the type of payment - “State duty for registration of an individual entrepreneur”, the name of the payment - “State duty for registering a private individual entrepreneur as an individual entrepreneur (800 rubles)”, type of payment - “Payment”. The payment amount will be set automatically. Go further.

- Fill in the details of the recipient of the duty, go further and fill in the details of the payer. Click "Pay".

Important! According to Part 1 of Art. 45 of the Tax Code of the Russian Federation, the taxpayer is obliged to independently fulfill the obligation to pay tax. As the Constitutional Court of the Russian Federation explained in its ruling No. 41-O dated January 22, 2004, this means that the taxpayer must pay from his own funds and on his own behalf. This rule, by analogy, is applicable to the payment of state duty, therefore, when entering the payer’s details, you must indicate your full name. future IP.

- In the new window, select “Generate a payment document”, after which an electronic receipt will be automatically downloaded. It can be printed or shown to a bank employee on the screen of a phone or other device.

What is the state duty when registering an individual entrepreneur?

The state fee for registering an individual entrepreneur is an official payment that has a fixed amount. It is determined by Federal legislation for specific categories of persons wishing to obtain the status of a business entity.

Individual entrepreneur registration

The state duty is an integral part of the registration procedure for an individual entrepreneur (Article 333.17 of the Tax Code), since the payment receipt is included in the package of documentation that is submitted to the Federal Tax Service. Previously, citizens had to look for a receipt form that had to be filled out by hand. Now the situation has changed and it can be found on any specialized service and printed with all the details.

Note! Today, those wishing to become individual entrepreneurs can pay the state fee, both in cash and by bank transfer. In the second case, they do not even have to leave their homes, since financial transactions are carried out via the Internet, in real time.

What is the amount and conditions for collecting the duty if we pay again?

In some cases, the tax service may refuse to register an entrepreneur. For example, if less than a year ago a citizen was unable to pay off his debts and was declared bankrupt (Part 4, Article 22.1 of Law No. 129-FZ). After a year, bankrupt status is no longer a basis for refusal of state registration, and the citizen can again try to obtain individual entrepreneur status. To do this, he will need to re-assemble the package of documents, and when applying directly to the Federal Tax Service, also pay a fee.

But there is an exception. According to clause 38.1 of the Administrative Regulations, approved. By order of the Ministry of Finance of the Russian Federation dated September 30, 2016 No. 169n, refusal to register, among other things, may be due to failure to submit the necessary documents to the tax authorities, their execution not in the established form, or in violation of the requirements for registration.

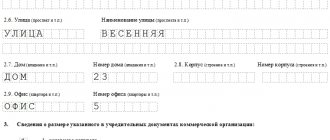

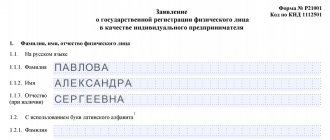

For example, in violation of clause 1.1 of the Requirements for the preparation of documents submitted to the registration authority (Appendix No. 20 to the order of the Federal Tax Service of the Russian Federation dated January 25, 2012 No. ММВ-7-6 / [email protected] ), the application is filled out with a red pen, not a black one colors or not in the form P21001 (Appendix No. 13 to the same order).

In these cases, you can submit new documents to the Federal Tax Service once without paying a state fee, provided that no more than three months have passed since the refusal of registration.

Details for paying the state fee for registering legal entities in Moscow

State registration is carried out within no more than five working days from the date of submission of documents to the registration authority. State registration of a legal entity is carried out at the location of the permanent executive body specified by the founders in the application for state registration, in the absence of such an executive body - at the location of another body or person having the right to act on behalf of the legal entity without a power of attorney.

During state registration of a legal entity, applicants may be the following individuals: a) the head of the permanent executive body of the registered legal entity or another person who has the right to act on behalf of this legal entity without a power of attorney; b) the founder or founders of a legal entity upon its creation; c) the head of a legal entity acting as the founder of a registered legal entity; d) bankruptcy trustee or head of the liquidation commission (liquidator) upon liquidation of a legal entity; e) another person acting on the basis of the authority provided for by federal law, an act of a specially authorized state body or an act of a local government body.

KBK 18210807010011000110

The amount of state duty for state registration of a legal entity is 4,000 rubles .

The amount of state duty for state registration of liquidation of a legal entity is 800 rubles .

The amount of state duty for state registration of changes made to the constituent documents of a legal entity is 800 rubles .

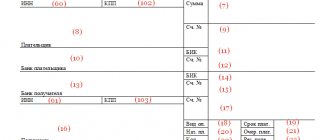

Details of MI Federal Tax Service No. 46 for Moscow: TIN 7733506810 KPP 773301001 Department of the Federal Treasury for Moscow (MIFTS of Russia No. 46 for Moscow) - Name of the bank - Branch 1 of the Moscow State Technical University of the Bank of Russia, Moscow 705 - Account number - 40101810800000010041 - Bank BIC - 044583001

Receipts for state payments. fees for legal registration persons

| Payment type | OKTMO code | Download the receipt form |

| State duty for state registration of a legal entity | 45373000 | |

| State duty for state registration of liquidation of a legal entity | 45373000 | |

| State duty for state registration of changes made to the constituent documents of a legal entity | 45373000 |

Payment orders for government payments. fees for legal registration persons

| Payment type | OKTMO code | Download the receipt form |

| State duty for state registration of a legal entity | 45373000 | |

| State duty for state registration of liquidation of a legal entity | 45373000 | |

| State duty for state registration of changes made to the constituent documents of a legal entity | 45373000 |

Assistance in registering companies and individual entrepreneurs

, changes made to the constituent documents of a legal entity