The introduction of quarantine throughout the Russian Federation significantly affected the usual way of life of Russians. In a number of regions, employees of continuously operating organizations and individual entrepreneurs who have not been transferred to remote mode and are forced to attend their workplace must have a special pass or certificate from their employer. This document confirms that the citizen goes to or returns from work without violating quarantine. A certificate of place of work, as well as income, may be needed in other cases (for applying for benefits, loans, visas, etc.). If a citizen works for an individual entrepreneur or is one himself, he will need a certificate of employment from the individual entrepreneur - we will tell you how to draw it up.

What is a certificate of employment from an individual entrepreneur?

A certificate of employment from an individual entrepreneur (a sample can be found below) is a document that certifies the fact that the person indicated in it actually works for an individual entrepreneur in the declared position, and, if necessary, indicates that he receives a certain salary . This certificate is of a confirmatory nature and should not be confused with the 2-NDFL certificate. The document must contain current and reliable information.

A certificate of employment is used not only during the quarantine period. In everyday life, it may be required when a citizen applies to various institutions and organizations:

- social protection authorities;

- banking and credit organizations;

- government agencies;

- law enforcement agencies;

- embassies of foreign countries, etc.

A certificate from the place of work (a sample will be given below) is requested:

- when receiving a loan from a bank to calculate the solvency of a potential client;

- for calculating social benefits when assigning child care payments;

- to assess a citizen’s solvency when applying for a visa, etc.

Documents for registration

When starting their own business, the vast majority of entrepreneurs do not have free funds and strive to open it with less financial losses. Therefore, if your income is very modest, not stable, and the procedure for opening an individual entrepreneur is nothing more than a “tick-box” action for you, then it is not recommended to rush into making this decision. Remember that registering an individual entrepreneur is a step that imposes certain financial and administrative obligations on a person.

Important! There are cases when registration is denied. Main reasons:

- The package of documents does not contain mandatory documents;

- The completed documents contain errors, typos, signatures are missing everywhere, or invalid data is provided;

- You were declared bankrupt less than a year ago;

- Your sentence prohibiting business activity has not yet expired.

Therefore, be careful when filling out documents. And if you have weighed everything well, below are step-by-step instructions. Registration of individual entrepreneurs.

1. Documents for registration of individual entrepreneurs

- Passport of a citizen of the Russian Federation.

- Photocopy of completed passport pages. That is, the main spread also includes registration. Another question that often comes up is how to scan a passport correctly? No problems arise if you photocopy one spread (two pages) on one sheet. Most tax authorities accept this option. We can also immediately recommend submitting several copies of your passport, because they will be useful to you when interacting with other departments.

- Original and copy of TIN of an individual. If there is. If not, then this article addressed the question of how you can register a TIN + a template for filling out an application is provided. Important! If you add TIN registration to the documents for registering an entrepreneur, then the whole procedure takes 2 times longer.

- Form and pay the state fee. The fee is only 800 rubles. Important! Be sure to keep your receipt. It will be necessary to submit an application for opening an individual entrepreneur. How to correctly formulate the payment was discussed in detail in the article: Payment of the state fee for registering an individual entrepreneur.

- Application for registration of an individual as an individual entrepreneur in form P21001. It is better to have 2 copies. If you cannot submit documents to the tax office in person, then the application must be certified by a notary. The applicant's signature must be verified. Important! As of July 4, 2013, there is no need to complete an application. Fill it out, print it, sign it, put it in a transparent file and that’s it. But just in case, you can play it safe and clarify this point by calling your tax office. Very detailed information about filling out form P21001 is written here: Sample of filling out P21001. There you can download current templates to fill out.

- Completed application for application of the simplified tax system. If, when choosing a tax regime, you chose the simplified tax system, then at the moment it can be submitted together with an application for registration of an individual entrepreneur. You can find out how to fill it out and where to download it from the article: Filling out the simplified tax system correctly. The application must indicate that you are switching to the simplified tax system from the date of registration. You will need 2 copies.

You can watch in video format what documents are needed to register an individual entrepreneur.

Above is the laughter of collecting and submitting documents to the tax authority yourself. But in the age of the Internet, you can open an individual entrepreneur without leaving your home. We recommend reading : Registration of individual entrepreneurs via the Internet. Also step by step instructions.

2. Registration of an individual entrepreneur with the tax office (IFTS) After you have collected a complete package of documents, you need to take it and submit it to the tax office. How this is done correctly is described in the article: Registration with the tax office

3. Obtaining registration documents. If everything went well, then according to the law you will be able to receive the finished documents within 5 working days from the date of submission. You must be given the following documents:

- Certificate of state registration of an individual as an individual entrepreneur (OGRNIP);

- Notification of registration of an individual with the territorial body of the Pension Fund (pension fund) at the place of residence;

- Notification of registration of an individual with the tax authority;

- Extract from the Unified State Register of Individual Entrepreneurs (USRIP) - 4 pages;

- Notification of assignment of statistics codes (from Rosstat).

That's it, the state registration process is over. You are an Individual Entrepreneur. The finishing touches remain.

4. Registration of individual entrepreneurs in the Pension Fund of the Russian Federation, Social Insurance Fund, Compulsory Medical Insurance, Rosstat, Rospotrebnadzor. On the page: Registration, you can find a detailed description of registration with each of these bodies, find out the required package of documents and download templates to fill out.

5. Making a seal The law states that individual entrepreneurs can work without a seal. But its production is not that expensive, so it is better to purchase it. What is needed and why an IP seal may be needed is described in detail in the article: Making a seal.

6. Opening a bank account Opening an account, like making a seal, is an optional procedure. But if you are engaged in commercial activities, then you can’t live without it. In the article: Opening a current account, you can get acquainted with all the nuances of this procedure.

7. Cash register. Whether an individual entrepreneur uses a cash register or not depends on his field of activity. But if you still need to transfer money through the cash register, then visit our section: cash register. Registration, work, documents. It covers every topic and issue in detail.

Answers to frequently asked questions:

— Can I register with a temporary residence permit?

Registration is carried out at the permanent residence address, i.e. the one indicated in the passport. But you can also register using temporary registration, but only if permanent registration is not indicated in your passport. You can carry out activities in any city in Russia; the place of registration does not matter.

— Can an individual entrepreneur register himself for work with an entry in the work book?

An entrepreneur is not considered an employee, so he does not make an entry in his work book. But in theory, by his personal decision, he can apply for a job. But then you will have to conclude an employment contract with yourself, make an entry in the employment record and pay deductions as for an employee. This scheme is extremely unprofitable and makes no sense.

— Is there any internship?

The internship is coming. It starts from the date indicated in the OGRNIP certificate and until the liquidation of the individual entrepreneur. And it doesn’t matter whether there is income or not.

— Is it possible to work?

Can. And you don’t have to say at work that you are an individual entrepreneur and you have a business. This does not affect taxes in any way.

— Can an individual entrepreneur have a name?

The entrepreneur is given the opportunity to choose any name for free, with the exception of registered trademarks (for example: Sbarro, Nike, etc.) The individual entrepreneur's full name must still be present in documents and seals. In addition, you can register a trademark/name, but for this you will need to pay from 30,000 rubles.

— Are there any benefits?

Unfortunately, in entrepreneurship there are no benefits either for people with disabilities or for other benefit categories.

Above is a step-by-step process for registering an individual entrepreneur yourself. If you don’t have time to do this, but need to obtain the official status of an entrepreneur, then you can seek the services of almost any law firm. In it, 95% of the problems of collecting, filling out, registering and receiving documents will be solved for you. And if they cannot resolve some issue, they will provide very detailed advice and support. But such registration of individual entrepreneurs will cost much more.

That's all, good luck to you and your business!

If you found our article useful or it helped you, please tell your friends about it on social media. networks.

Should individual entrepreneurs issue their employees with a certificate of employment?

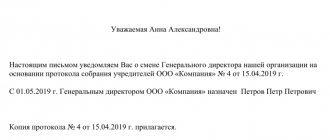

If the individual entrepreneur is an employer and hires personnel, he has the right to issue his employees all the documents they need after receiving such a request from them. Of course, if we are talking about official employment with the conclusion of an employment contract and the payment of contributions to various extra-budgetary funds. If the entrepreneur has a personnel officer on staff, you can contact him to obtain a certificate of employment from an individual entrepreneur during quarantine and under other circumstances. If such a specialist is not available, the individual entrepreneur can independently draw up this certificate.

In accordance with the provisions of Art. Labor Code of the Russian Federation, an individual entrepreneur must issue a certificate within 3 working days after receiving a corresponding written request from an employee. In accordance with the norms of current legislation, citizens of the Russian Federation have the right to obtain from their employer any information relating to their work activities.

List for foreigners

Documents for registering individual entrepreneurs on behalf of foreigners or stateless persons are not too different from the list for citizens of the Russian Federation. It is also enshrined in Article 22.1 of Federal Law No. 129. Additional papers include:

- birth certificate;

- a copy of a document confirming the right to permanent or temporary residence in Russia, indicating the current place of residence.

If the papers are presented in a foreign language, it is necessary to provide a notarized translation. Just like for citizens of the Russian Federation, foreigners can submit an application through a representative, in which case an additional power of attorney is required.

Important information! A birth certificate is not required in all cases. It can be replaced by a passport or other identity card. The main purpose of the document is to confirm the date and place of birth.

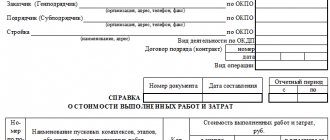

What information should be included in a certificate of employment from an individual entrepreneur?

The certificate does not have an approved form; in practice, it is compiled in a free format. To do this, it is recommended to use company letterhead. The validity period of the document depends on which institution it will be presented to. The content of the certificate is also determined by the requirements of the requesting organization, so the employee should clarify in advance what exactly should be displayed in this document.

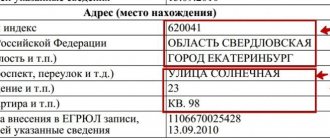

The form for a certificate of employment from an individual entrepreneur must contain the following information:

- registration data of the individual entrepreneur who issued it;

- FULL NAME. and employee position;

- if required - the amount of wages for a certain period of time (usually indicate the amount of monthly wages or the amount of earnings received for 3-6 months);

- the duration of work for this entrepreneur (date of hiring);

- the phrase “works to date”;

- you can indicate the details of the order on the basis of which the employee was added to the staff;

- date of preparation of the certificate;

- place of presentation (you can specify “At the place of demand”);

- IP signature, seal (if available).

Sample free-form income certificate for 2020:

How long is a certificate of absence of an individual entrepreneur valid?

The Tax Inspectorate did not establish validity periods for certificates for individuals indicating that they do not have individual entrepreneur status. As a rule, the person requesting this document independently sets the deadline for the freshness of the certificate. For example, when joining the police, information is required no more than 15 days ago.

Order a certificate

If you were not presented with requirements, then you can provide the document received at any time.

from 15 minutes

50 rub.

Can an entrepreneur issue a certificate of employment to himself?

The individual entrepreneur’s certificate is issued to himself in the same manner. The document indicates information about the employer (the individual entrepreneur himself) and, if necessary, the amount of income received. Certification with a seal is not required; the entrepreneur’s signature with a decryption will be sufficient. If there is a seal, its imprint should be placed next to the signature. It should be noted that an individual entrepreneur can also confirm his employment and income level by presenting a state registration document (extract from the Unified State Register of Individual Entrepreneurs) and an income statement or bank statement.

A certificate from an individual entrepreneur to himself about his place of work may have the following structure:

- Full name is written at the top of the sheet. entrepreneur, tax identification number, address, contact phone number. For example: “Individual entrepreneur Kalinina Marina Nikolaevna, INN…, OGRNIP…, address…”.

- Next, indicate the date of issue of the certificate and the number assigned to it.

Copies of which passport pages must be made to send documents for individual entrepreneur registration by mail

Double-sided printing of an application and other documents submitted to the registration authority produced by a legal entity, an individual registered or registered as an individual entrepreneur, or a peasant (farm) enterprise is not allowed .

In Moscow, delivery of documents for individual entrepreneur registration by mail is carried out by two companies that have entered into an agreement with the Federal Tax Service No. 46 - DHL and Pony Express. In this case (only for these two companies) it is NOT REQUIRED to notarize documents. This is what companies say and was confirmed by 46FTS when contacted by phone. But it was not possible to find out from the companies about the number of sheets. And I can no longer get through to the Federal Tax Service.

Copy of passport what pages for individual entrepreneur registration

If you chose a simplified taxation system, then fill out form No. 26.2-1. You can also use our service to fill out an application for the simplified tax system. Prepare 3 copies of this application.

If you filled out this application manually, then check it again for errors; if you entrusted the filling to an online service, then download the file and print it. Fasten the sheets with a paper clip so that they do not get mixed up, do not sign the document in advance, only in the presence of a Federal Tax Service employee. We recommend preparing 2 copies.

How to submit a copy of your passport for individual entrepreneur registration

All papers must be stapled. How to flash a passport for individual entrepreneur registration and other documents? Papers to be bound must be no more than one page long. The application on form 21001 has more pages, respectively, a photocopy of the passport is also more than one page.

How should a copy of the passport be submitted for registration of an individual entrepreneur? In order to open your own business, you need to register as an individual entrepreneur with the territorial tax service. This can be done by submitting the necessary documents. A copy of the passport for individual entrepreneur registration is a mandatory document and must be submitted along with the original.

Which passport pages will need to be copied for a foreign passport?

The state fee for issuing a biometric document is already 3.5 thousand rubles (for children under 14 years old - 1.5 thousand). Men aged 18 to 27 years old must present the original military ID or the above-mentioned certificate from the military registration and enlistment office. In addition, if you have an old passport, you must also bring it. Military personnel must submit permission to issue the document from their command.

We recommend reading: Cash withdrawal limit from current account

The fact of payment does not need to be confirmed with a receipt - currently the recipient himself must verify the crediting of funds to his account. However, many citizens, out of habit, still bring receipts, believing that this will be more reliable. You will also need a previous foreign passport - if, of course, you have one - and 4 photographs 35 by 45 millimeters.