How to change the CEO in an LLC step by step

General directors are elected by the founders of the company upon registration of the company for a period of 1 to 5 years, and sometimes for an indefinite period. But during the life of the company, general directors may change. In order to change the general director, it is necessary to hold a meeting of the founders, on the agenda is the issue of making a decision on changing the general director in the company. Afterwards, prepare a set of documents for the tax office, certify the application with a notary and register the change with the tax office.

Let us consider in detail the step-by-step instructions for the procedure for changing the general director at the tax office.

Sample of filling out form P14001 when changing director in 2020

How to fill out form P14001 when changing the director? The application form was approved by Order of the Federal Tax Service dated January 25, 2012 No. ММВ-7-6/ [email protected] , the document consists of 51 sheets. For different cases of changes in LLC registration information, different sheets are filled out.

The rules for filling out P14001 when changing the director are similar to the rules for filling out form P11001: only capital letters; can be filled out manually in black ink or on a computer in Courier New font 18 points high; printing on only one side of the sheet, etc. You can find out all the requirements for filling out in full in the Federal Tax Service order No. ММВ-7-6/ [email protected]

Which sheets of form P14001 should I fill out when changing directors? Total 8 pages:

- title page, where information about the organization is indicated;

- sheet K - page 1 (for the former director);

- sheet K - pages 1 and 2 (for the new director);

- sheet P – all 4 pages (information about the applicant).

Since the application is sequentially numbered, the first page will be the title page, page 1 of sheet K with the data of the former director is assigned the number 002, etc. Blank pages of form P14001 are not submitted to the tax office.

Who applies for a change of director - the old or new director? On the one hand, information about the new director has not yet been entered into the Unified State Register of Legal Entities, on the other hand, the previous director has already been deprived of his powers. About 10 years ago, there was a practice of signing an application by the old director as a person whose information was included in the state register (letter of the Federal Tax Service dated October 26, 2004 N 09-0-10/4223). Later, by decision of the Supreme Arbitration Court of the Russian Federation dated May 29, 2006 N 2817/06, this provision was declared invalid, as inconsistent with the Law “On LLC”.

Moreover, the courts have repeatedly emphasized that the powers of the former leader terminate from the moment the corresponding decision of the participants is made (for example, the decision of the Supreme Arbitration Court of the Russian Federation dated September 23, 2013 No. VAS-12966/13). Based on this, the application in form P14001 can only be signed by a new director; the previous director no longer has any relation to the LLC.

Please note: unlike form P11001, which does not need to be notarized, if the applicant personally appears at the Federal Tax Service, application P14001 must be certified. For this reason, the applicant’s personal signature on page 8 is affixed only in the presence of a notary.

An example of filling out form P14001 when changing the director can be found in our sample documents.

The first step is holding an extraordinary general meeting of participants

In order to record the change of the general director of the company, it is necessary to convene a meeting of the founders of the company, at which a decision will be made to remove the previous general director from office and appoint a new director in his place, and a protocol will be drawn up. If the founder of the company is a single person, then the decision of the sole founder to appoint a new director is formalized.

| Change of general director of LLC Cost - 9,300 rubles. (everything is included, including preparation of an application for registration of changes, protocol or decision, order for a new manager to take office, notary services, submission and receipt of documents to the tax office without your participation, as well as delivery of finished documents) Registration period: 7 days |

What is reflected in the protocol on the change of general director

The document related to the change of the head of the organization reflects the following information:

- Information about the meeting. Indicate the place where it took place, date and time;

- List all founders present at the meeting;

- Full name of the person who is the chairman of the meeting and the one who is the secretary of the meeting;

- This is why this meeting is being held. Agenda;

- Results of the voting;

- The decision that becomes final as a result of this meeting. They indicate at what point the powers of the current manager cease, who exactly takes up this position, when exactly and for what period he assumes duties.

The meeting is chaired by its chairman. The secretary documents all information. The protocol can be drawn up in any form. There is no strict form of compilation. It is important that it contains complete information related to the decision made. There is also no need to assign a number to this document. It is important that the paper must be certified by a notary.

In addition, we must not forget that the method of decision-making is also of great importance. The method of making decisions, be it a decision of a single participant or a protocol of a general meeting of participants, can be either notarial or not. Here, as they say, whatever you write in the Charter, that will be the legitimate method.

Bank

It is recommended to send a notification to the bank about a change of director immediately after the head of the company takes office, because in fact, his powers ceased to operate. And some banks stop the possibility of Internet banking, because... the electronic signature becomes invalid. According to clause 7.11 of Bank of Russia Instruction No. 153-I dated May 30, 2014, in the event of early termination (suspension) of the powers of the client’s management bodies in accordance with the legislation of the Russian Federation, the client submits a new card with signature samples.

Some banks ask for this package of documents in cases where the powers of the head of the organization have been extended (upon the conclusion of a new employment contract). In such cases, new cards with signatures are not created.

Banks usually ask for notification:

- a reference document confirming the introduction of changes to the Unified State Register of Legal Entities;

- an extract from the minutes of the meeting of the co-founders who decided to change the general director, or a certified copy of this minutes;

- order for the enterprise on the appointment and assumption of office of an appointed person.

Notification of counterparties

To notify counterparties of a change of general director, it is recommended to send a letter in free form.

A legal entity does not have a legal obligation to notify counterparties about the appointment of a new manager if this clause is not specified in the contract.

But many companies prefer to notify their customers and suppliers so that there are no documentary and information misunderstandings.

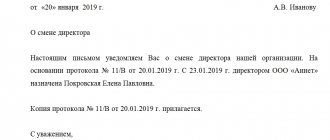

Sample notice of change of general director

Sample notice of change of general director, available upon request

To notify counterparties (clients or suppliers), attaching a copy of the minutes of the founders’ decision is not required. There is no need to make changes to already signed contracts, orders and powers of attorney.

Often the services with which you have to deal try not to recognize powers of attorney and orders issued by the previous manager. To avoid conflict situations after a change of general director, we recommend canceling old powers of attorney and issuing new ones.

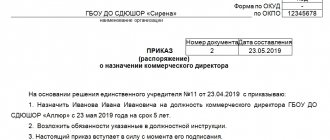

Order to change the director: document structure

The order for the dismissal of the current director is drawn up according to the unified form No. T-8. It is noteworthy that the dismissed director himself signs it, as well as puts a signature certifying the fact of familiarization with the document.

The order for the appointment of a new director is drawn up in form No. T-1. As in the case of document No. T-8, it is signed - both for the employee and for the employer - by the new director. Moreover, by that time he must have signed an employment contract with the organization. The employer will be a business company represented by its founder or the chairman of the meeting of owners.

Form P14001 when changing director

Sheet K. Information about an individual who has the right to act on behalf of a legal entity without a power of attorney

This application form must be completed twice.

The first is to terminate the powers of the old manager, the second is to appoint a new one. First, we fill out Sheet K to terminate the powers of the old manager.

- Section 1. Code “2” is entered - termination of authority.

- Section 2. Information in accordance with the information of the Unified State Register of Legal Entities.

- Section 3. Left blank.

Then to assign authority to the new manager. Chapter:

- Section 1. Enter code “1” - assignment of powers.

- Section 2. Left blank.

- Section 3. Data of the new manager is entered.

The rules for the paragraphs of the third section are as follows:

- 3.1. Full name is entered in Russian, patronymic is filled in if available.

- 3.2. If the director has a TIN, then this field must be filled in.

- 3.3. Date and place of birth of the individual. The place of birth must exactly match the information from the identity document.

- 3.4. The position of a person who has the right to act on behalf of a legal entity without a power of attorney. Here we indicate the title of the position that the previous manager had (since to change the title of the manager’s position, it is also necessary to change the charter). The phrase “CEO” is often used.

- 3.5. Code of the type of identification document and the data contained in this document: series, number, date of issue, by whom it was issued, department code.

- 3.6.1. Residence address in the Russian Federation. If there is no place of residence, the address of the place of stay in the Russian Federation is indicated. Subclauses 3.6.1.1 are required to be completed. – index, 3.6.1.2. – subject code. Subclauses 3.6.1.3.-3.6.1.9. filled in if there is information in the address. For each field you need to fill out two items. The first indicates the type of address object, the second indicates the name or number of the address object. In subparagraphs 3.6.1.3.-3.6.1.6. the type of the address object is specified using an abbreviation. In paragraphs 3.6.1.7.-3.6.1.9. the type of the address object is specified in full. When specifying address elements for cities of federal significance, paragraphs 3.6.1.3.-3.6.1.5. are not filled out.

- 3.6.2. Filled out in relation to a citizen of the Russian Federation who permanently resides outside the Russian Federation and does not have a permanent place of residence in the Russian Federation, as well as a foreign citizen or stateless person permanently residing outside the territory of the Russian Federation.

- 3.7. The telephone number by which you can contact the manager. Landline phone number is written in the format: 8 (495) 7654321. Mobile phone number for communication in the format: +7 (903) 7654321.

Federal Tax Service (FTS)

If a manager is re-elected to a position as part of the “extension of powers” procedure, the Federal Tax Service should not be notified about this, since from the point of view of the register, no changes have occurred in the organization’s management.

In all other cases, notification to the tax office of a change of director is mandatory. For failure to fulfill this obligation within the prescribed period, administrative liability is provided for in Article 19.7 of the Code of Administrative Offenses of the Russian Federation.

Algorithm and deadlines for notifying the tax inspectorate:

- Fill out an application for changes in the organization (form P14001) to enter information into the Unified State Register of Legal Entities and have it certified by a notary.

- Submit a certified application to the Federal Tax Service within 3 days after the appointment of a new manager (Clause 5, Article 5 of Federal Law No. 129-FZ of 08.08.2001 “On State Registration of Legal Entities and Individual Entrepreneurs”). The application must be submitted to the tax office at the place of registration of the legal entity.

- Receive a Unified State Register of Legal Entities entry sheet from the tax office confirming the changes.

IMPORTANT!

Other government organizations and funds (FSS, MHIF, Pension Fund) are not required to notify about the change of director. After making changes to the Unified State Register of Legal Entities, the tax inspectorate independently notifies all government agencies of the appointment of a new head of the organization.