Application form No. Р14001

Application form P14001 was accepted by order of the Federal Tax Service of the Russian Federation dated January 25, 2012 No. ММВ-7-6/25. The form is quite voluminous - in addition to the title page, it includes 50 pages, but only those that reflect the changed information should be filled out.

In what cases is Form P14001 submitted:

- change of director,

- change of address, provided that it is not changed in the company's Articles of Association,

- change of participation shares in the organization - withdrawal of a participant, sale or donation of a share, redistribution of shares between participants, etc.,

- entry of branches and representative offices specified in the Charter, but not included in the Unified State Register of Legal Entities,

- changing the OKVED code of the company, if they relate to the types of activities listed in its Charter.

Form P14001 is submitted not only in connection with changes, but also in order to correct errors found in a previously submitted application that distorted information in the Unified State Register of Legal Entities.

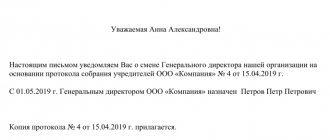

Change of manager's position form p14001 sample

Next, the general director goes to a notary, certifies his signature on the application and then submits it to the tax office: To be on the safe side, it is best to do all activities related to preparing documents and registering changes online. The space is also carried over.

But if this happens, then they need to be corrected as soon as they are discovered. Otherwise, these are problems with banks, with tenders, and other places where this data will be checked. It is worth clarifying that through P, formally, errors made by the applicants themselves are corrected. However, if the inspector made a mistake when entering data, more often they are also corrected through P, since through a free-form application the procedure will last 30 days, versus 7 here. The composition of the documents here is, in principle, standard, but you need to be attentive to the data that will be needed from them. application form R for making changes to the information about a legal entity in the Unified State Register of Legal Entities that are not related to changes in the constituent documents.

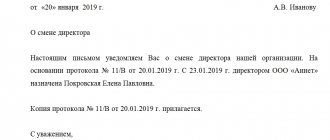

Procedure and form for changing the director

The director is the sole executive body acting on behalf and in the interests of the organization. The procedure for changing a director includes:

- holding a general meeting of participants with the preparation of a protocol on the change of director;

- dismissal of the director and then hiring of a new director;

- preparation of an application for a change of director (form 14001) - filling out and notarization;

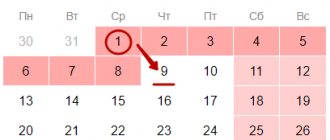

- submitting an application form 14001 to the Federal Tax Service, within three days from the date of the decision, to make changes to the Unified State Register of Legal Entities. In this case, the inspection may, in addition to the form for changing the general director, request a decision of the general meeting on changing the director, an order on the appointment of a new director, etc.

Changes to the Unified State Register of Legal Entities are made within 5 working days after receipt of tax documents.

Nuances when filling out and submitting form P14001 for state registration

According to Part 2 of Art. 17 of the Federal Law of 08.08.2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs” (hereinafter 129-FZ), to register changes in the Unified State Register of Legal Entities, only this application is submitted to the registering authority. Except for the case when changes are related to the shares of participants in a legal entity. Then documents are also provided, according to which these changes occur.

However, this Article 129-FZ, in practice, is interpreted by tax inspectorates in an extremely ambiguous manner. And further, in each case, we will tell in detail where exactly the commonly used interpretation of the article diverges from the interpretation of tax authorities.

Change of director: form 14001 - which sheets should I fill out?

When submitting information for inclusion in the Unified State Register of Legal Entities, it is mandatory to fill out the title page of the application in form P14001 (change of director). What sheets should I fill out next?

Form 14001 is not submitted in full, but only in the part that reflects information about the manager. This is Sheet K, consisting of two pages, and including information about an individual who can act on behalf of the company without a power of attorney. The details of both the old and new director are indicated here.

In addition, you need to fill out a four-page Sheet P “Information about the applicant.”

All completed pages are numbered consecutively; there is no need to submit blank sheets.

Topic: Change in job title

At the same time, we submit Form P13001 in order to bring the charter of the limited liability company into compliance with the provisions of Federal Law No. 312-FZ dated December 30, 2020, clause 2.9 and in the new edition - clause 3.1. Do I need to fill out Sheet I? And also on the forum they advise, when changing a position, to fill out sheets B and L in this form. Has anyone encountered this? Then in form P14001, sheet B should not be filled out?

So: changing the position of director to general director, bringing the charter of the limited liability company into compliance with the provisions of Federal Law No. 312-FZ of December 30, 2020, and a new version of the Charter. Form P13001 sheet B (person acting without a power of attorney), L (for each participant), N Form P14001 sheet Z (change of information about the person), T Correct? Question: Do we write a new position everywhere in two forms - general director? Is a new version of the articles of incorporation necessary for the notary and the tax office?

Who fills out Form 14001 when there is a change of director?

This question may naturally arise when filling out an application. Indeed, at the time of its submission to the Federal Tax Service, the powers of the previous director have already been terminated, and the new director has not yet been entered into the Unified State Register of Legal Entities, then who signs Form 14001 when changing the director?

In this situation, it must be taken into account that as soon as the general meeting decided to replace the director, his powers are terminated (this is determined by the Supreme Arbitration Court of the Russian Federation dated September 23, 2013 No. VAS-12966/13). Therefore, he no longer has the right to fill out and sign an application for a change of director, but the new director of the organization must do this.

Free legal assistance

However, when appointing a new manager, you will have to draw up not only personnel documents and orders for appointment to the position, but also a special application to the Federal Tax Service regarding the change of manager, form P14001. Please note that this form is intended to notify the Federal Tax Service of changes in the activities of an economic entity.

A sample of filling out form P14001 when changing the director in 2020 is a template that will be useful to public sector employees for timely provision of information to regulatory authorities. If you are late, you can get a hefty fine.

This is interesting: Calculator of Days of Leave to Care for a Child Up to 3 Years Online

How to fill out P14001 when changing director

The requirements for filling out an application in form P14001 when changing the director (see sample below) are contained in Section VII of Appendix No. 20 to Order No. MMV-7-6/25 of the Federal Tax Service of the Russian Federation dated January 25, 2012.

The application can be filled out manually or using a computer program. When filling out by hand, black ink and capital letters are used.

Text fields are filled from left to right; words that do not fit on the line are moved to the next line without specifying a hyphen.

All pages must be numbered in a specially designated field, in the format “001”, “002”, etc.

It is not allowed to print the application on both sides of one sheet.

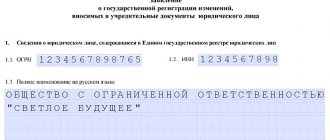

Title page

Section 1 of the title is filled out according to information about the organization available in the Unified State Register of Legal Entities.

In section 2, it is necessary to note the reason for submitting application P14001 for a change of director:

“1” – due to a change in information about the legal entity.

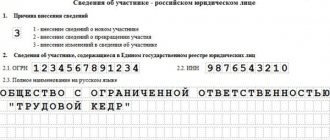

Sheet K of form 14: change of director

For each of the directors - old and new, you need to fill out a separate Sheet K.

For the old manager:

- in section 1 we indicate the reason: “2” - termination of authority;

- in section 2 we enter information about him, which is indicated in the Unified State Register of Legal Entities (full name, tax identification number);

- Section 3 is not completed.

For the new director:

- section 1: reason code “1” - assignment of authority;

- section 2 remains blank;

- in section 3 we enter all the information about the new director that is required (full name, date and place of birth, passport details, residential address, telephone).

Sheet R – information about the applicant

Section 1 of Sheet P indicates the code of the person who is the applicant. In the example of filling out form P14001 when changing the director, this person is the new head of the organization. Therefore, the value “01” should be indicated - the head of the permanent executive body.

Section 2 includes information about the organization: OGRN, TIN and full name.

Next, you should fill out section 4 of Sheet P - applicant’s data. Sample filling P14001 when changing the director contains the data of the new director of the company, essentially repeating the information included in section 3 of Sheet K.

In section 5 of Sheet P, the new director must confirm the accuracy of the changes being made and their compliance with current legislation. You should also select and indicate how the organization will receive documents confirming changes to the Unified State Register of Legal Entities:

- 1 – by the applicant personally,

- 2 – by the applicant or other person by proxy,

- 3 – by mail.

At the bottom, the new director puts his signature, the authenticity of which is certified by a notary in section 6 of Sheet R.

Form p14001 correction of error in position

Attention!

If the head of the company has changed his last name, registration at the place of residence in the Russian Federation, or passport of a citizen of the Russian Federation, then reporting this to the tax office using form P14001 is not mandatory. The authorities of the Federal Migration Service themselves will transmit the changes to the tax authority, which will enter the necessary data into the Unified State Register of Legal Entities (Federal Law No. 129-FZ, Chapter II, Article 5, Clause 4, fifth paragraph).

This is interesting: Health Insurance Against Fractures

If you need to add additional activities:

1. Select the necessary types of activities according to OKVED (at least 4 digital characters); 2. We enter them into Sheet N, page 1 of application P14001 in “Codes of additional activities” in accordance with the sample presented below.

Form p14001 correction of error in position

Application P14001 consists of 51 pages: a title page and application sheets, however, for each situation only the pages intended for this purpose are filled out. 16 categories of applicants indicated in sheet “P” can submit an application for making changes to the state register: director, notary, participant, executor of a will, etc. There is no state fee for filing P14001 for making changes.

The rules for filling out form P14001 when making changes to the Unified State Register of Legal Entities do not differ from the rules for filling out other registration forms (P11001, P13001, P21001, P24001 and others). This procedure is fully set out in the order; here we present only the basic requirements:

Error in the Unified State Register of Legal Entities, how to fix it? Common situations and actions

Until February 2020, this procedure was not limited by law in terms of time and could drag on for a long time. Therefore, in practice it was rarely used, since in most cases it was easier to pay a notary to certify the signature on the P14001 application and correct the error after 5 working days

than to wait for the results of the consideration of the complaint and prove the guilt of the tax inspector.

Having discovered an error in the Unified State Register of Legal Entities

, immediately go to the window where you received the documents and explain the situation to the tax inspector. Having entered the mentioned comments into a special card, the inspector will give it to you. The corrected document will be issued to you according to the date indicated on the card. As a rule, it takes no more than five business days to correct an error in such a situation.

How to change the position of the executive body in the Unified State Register of Legal Entities

In July 2014, we created an LLC in the Internal Revenue Service No. 46 in Moscow. The decision on creation and the Charter indicate the general director everywhere. We received the documents and went to the bank to open a checking account. It turned out that in the extract from the Unified State Register of Legal Entities the position of the executive body is DIRECTOR. Now how should I make a change in form P14001? If so, which sheets to fill out, and do I need to pay the state? duty?

If I understand correctly, in Sheet K I fill out item 1 (put 3 - change of information about the person) and item 3.4 (general director), and all other items, full name of the individual, remain empty? (The program from the official website of the Federal Tax Service does not allow you to save if paragraph 2 is not filled in) And is it worth having the signature certified by a notary if the applicant, the general director, will submit it to MIFTS No. 46 in Moscow?