When to submit form P13001

Form P13001 is submitted by LLCs that have made changes to their Charter, for example, changed their name.

This must be reported to the Federal Tax Service to record changes in the Unified State Register of Legal Entities. Changes may not affect the Charter, then use form P14001. We have already talked about it in our article.

Order of the Federal Tax Service of Russia No. MMV-7-6/ [email protected] dated January 25, 2012 contains instructions and a template for form P13001. See Appendix No. 4 for a sample. P13001 is taken in the following cases:

- changed the company name;

- changed address;

- added new OKVED codes;

- changed the authorized capital;

- made other changes to the Charter.

There is a special case. Form P13001 is submitted when the Charter is brought into compliance with Federal Law No. 312-FZ. All companies opened before July 1, 2009 are required to re-register their Charter. This must be done at the moment when changes were made to the old Charter. That is, companies that have not changed their Charter since 2009 may have such a need and are thinking about it in 2020. Then in P13001 fill out the first page by checking the box in section 2 and prepare sheet M.

In what cases is form No. P13001 required?

According to existing legislation, an application for registration of changes must be completed if the amendments made have legal meaning for third parties. In particular, this document must be prepared when:

- changing the name of the LLC;

- change of legal address;

- changing the OKVED code, if this entails making amendments to the charter;

- change of authorized capital;

- re-registration of the enterprise after the entry into force of Federal Law No. 312-FZ and bringing the charter into compliance with it.

This list is not exhaustive, since the tax authorities also need to be notified of certain other amendments to this fundamental document.

Sample form P13001

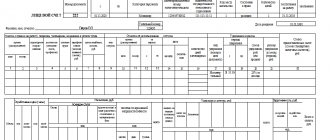

The form is quite large, includes 23 sheets. You do not need to fill out everything, but only those that relate to the changes being made. Numbering is continuous. Everyone fills out the first page and puts the number 001, and then the numbering goes 002, 003, 004 and so on.

Let's review all application sheets. You will find complete instructions for filling out in Section 5 of Appendix 20.

1. Page 1 - fill out everything. Please indicate your OGRN, INN and company name.

2. A - filled in by those who intend to change the company name. Indicate the new full and abbreviated name. Also be sure to include the page number.

3. B - for those who have changed their legal address. Codes of subjects of the Russian Federation are listed in Appendix 1. And Appendix 2 shows how to correctly fill out addresses.

4. B - needed when changing the authorized capital of an LLC.

5. G, D, E, G - fill in when information about the founder changes, when a new LLC participant is added or an old one leaves. For example, when buying and selling a share in the authorized capital, sheet D must be filled out twice. The first one is for a new participant, in section 1 the number 1 is put. The second is for an exiting participant, in section 1 the number 2 is put.

Important! Each type of founder has its own sheet. For example, for domestic founders-legal entities - sheet D, for foreign companies - sheet D, and so on.

6. Z - through it, changes are made about the mutual investment fund, which includes a share in the authorized capital.

7. And - fill in when reducing the authorized capital by paying off the company’s share.

8. K - fill in when creating, closing or changing information about a branch or representative office of an organization.

9. L - through it you can add new activities or exclude old ones.

Important! If the Charter of the LLC states that the company can conduct any type of activity not prohibited by law, then the addition of new OKVED is drawn up in form P14001.

10. M - fill in everything. Provide information about the applicant, who may be a manager, management company or authorized representative. Be sure to have Sheet M certified by a notary.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Application on form P13001: sample filling

Depending on what information in the charter is changed, different pages of the form are filled out. However, the title page must be completed in any case. First, look at a sample of filling out the new edition of the charter - form P13001 must be filled out starting from the title page.

Changing the name of a legal entity

When changing the name of a legal entity, the current name is indicated on the title page, and the new name in full and abbreviated form is indicated on sheet “A”. Also in this case, Appendix “M”, consisting of three pages, must be completed.

Change of legal address

A notice of change of legal address must be prepared if the address has been changed in the charter (postal code, region - subclauses 2.1 and 2.2 are required to be filled out. If they are not filled out, the registering authority may refuse registration. In addition, please note: for Moscow and Petersburg, subparagraphs 2.3–2.5 do not need to be filled out).

So, when changing the address, the title page and appendices “B” and “M” are submitted to the tax authorities.

Changing OKVED codes

If the organization’s charter lists any specific types of activities, and the company’s management decides to introduce new types of production or services, the tax authorities must be notified about this. In this case, a change in OKVED codes is formalized. To do this, fill out the title page, appendices “L” and “M”. Appendix L consists of two pages. The first page reflects the new OKVED codes that must be entered into the Unified State Register of Legal Entities. The second page lists the codes that need to be excluded. When changing the OKVED code, you need to indicate the old code on page 1, and the new one on page 2. If the organization is expanding its activities, then only page 1 is filled in. If it is reducing, then only the second page needs to be submitted.

Please note that if the organization’s charter contains the phrase: “The company may carry out other types of activities not prohibited by law,” then you can add new OKVED codes using form P14001.

Creation of a branch

The creation of a branch or representative office must be notified using the application under consideration if any other changes are made to the charter. To do this, fill out the title page and appendices “K” and “M”. If no changes are made to the constituent documents, form P13002 is used.

Bringing the charter into compliance with Law No. 312-FZ

All companies created before 07/01/2009 must undergo re-registration of their charter. This obligation is established by Federal Law No. 312-FZ of December 30, 2008. The charters of those companies that have not re-registered will remain in force in parts that do not contradict the law until such time as there is a need to make any changes to the constituent document. Currently, almost all companies have brought their documents into compliance with Law No. 312-FZ. But those who have not yet undergone this procedure will sooner or later be faced with this need. In this case, you will need to fill out the title page, checking the second box, and Appendix “M”.

Change in the size of the authorized capital

When changing the size of the authorized capital, the title page, appendices “M”, “B” are filled out and, depending on what category the business entity belongs to, the data should be entered on the following pages:

- "G" - Russian organization;

- “D” - foreign organization;

- "E" - individual;

- “Zh”—subject of the Russian Federation or municipal entity;

- “Z” is a state authority or local government.

If the authorized capital has changed due to the redemption of the company’s share, sheet “I” is filled out.

Other changes

If any other amendments need to be made to the constituent document, the title page and Appendix “M” are submitted to the tax authorities.

Requirements for filling out P13001

You can fill out the application manually or on a computer. Requirements for filling out by hand:

- fill in block letters;

- black ink;

- we write one character in one cell - even spaces and commas.

When filling out on a computer, the requirements are as follows:

- Courier New font;

- capital letters;

- font size 18;

- we write one character in one cell - even spaces and commas.

Double-sided printing of the application is prohibited. Corrections and additions are also not allowed. Otherwise, the program will indicate that the application was filled out incorrectly.

Documents submitted along with application P13001

Since form P13001 is related to amendments to the Charter, in addition to the application to the Federal Tax Service, you need to submit:

- Charter in the new edition;

- minutes of the meeting or the founder’s decision to amend the registration information;

- a receipt for payment of the state duty of 800 rubles - you can fill it out on the official website of the Federal Tax Service.

You have 3 business days to submit your application from the date of changes. Art. speaks about this. 5 Federal Law No. 129-FZ.

What sheets should you use?

When making changes to the form, not all sheets are filled out:

- Title. If an organization changes its name, the title page is filled out, information is entered into sheets A and M. On the first page, basic information about the organization is entered: OGRN, INN and address, which is registered in the Unified State Register of Legal Entities.

- Sheet A. This page contains columns for changing the name of a legal entity. Article 1473 of the Civil Code establishes that any LLC is required to have a full name and also has the right to establish an abbreviated equivalent. If the name does not fit on one line, the hyphen is not added when writing on a new line.

- Sheet B. This page is filled out when changing the address. It is enough to indicate only the locality.

- Sheet B. The page is drawn up when the authorized capital is changed; for this, the following data is entered:

- type of funds (share, charter, etc.);

- type of updates;

- new amount;

- update day.

- Sheets G-Zh. Required when changing the legal form, be sure to include:

- page D is filled out by Russian organizations of any form;

- D is filled in by foreign enterprises (any state);

- E is filled out by individuals;

- F is issued by municipalities of the Russian Federation.

Which sheets of P13001 should I fill out?

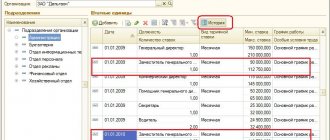

The table shows the most common situations when you need to fill out and submit form P13001 to the Federal Tax Service.

| Situation | Sheets P13001 to fill out |

| Change of company name | Page 1, B and M |

| Change of OKVED | Page 1, L and M |

| Creation of a branch or representative office | Page 1, K and M |

| Bringing the Charter into compliance with the Federal Law | Page 1 and M |

| Change of authorized capital | Page 1, B and M. Sometimes sheet I. Since a change in capital is usually associated with a change in founders, sheets D, D, E, G, Z are also filled out. |

| Other changes made to the Charter | Page 1 and M |

Maintain accounting and tax records in the cloud service Kontur.Accounting. The service will remind you when to submit the report and pay the tax. We give all newcomers free access for 14 days.

Options for registration actions using form P13001

Actually, there are a lot of options for using it. Any change affecting the charter is the application of form P13001.

Let's break it down into its components to illustrate the changes being made:

- Page 001 - Information about the legal entity contained in the Unified State Register of Legal Entities. That is, legal. the person must already be properly registered. Clause 1 indicates the assigned OGRN and TIN, as well as the full company name (see the extract from the Unified State Register of Legal Entities, and from there everything is a carbon copy). In paragraph 2, a tick is placed if you bring the charter into compliance with 312-FZ or 99-FZ, although the first case is already extremely rare, and in the second, a new version of the charter is usually simply adopted.

- Sheet A. To be completed if you decide to change the corporate name of the legal entity. Accordingly, if you change both the full and abbreviated form, fill out paragraphs 1 and 2, if you change one or the other, fill out what is changing.

- Sheet B. Required to be filled out in the following cases:

— change of location of the company, if the charter specifies only the location;

— change of the company’s address if the address is specified in the charter.

- Sheet B. Must be completed if the size of the authorized capital changes. In paragraph 1, select the option that corresponds to your company (98%, which is the authorized capital), in paragraph 2, select the action - increase or decrease, in paragraph 3 - the amount of the authorized capital, which we contribute to the Unified State Register of Legal Entities. Points 4 and 5 relate to the reduction of the authorized capital; read about them in a separate article.

- Sheet G - information about the participant - a Russian legal entity. face. Applies if the share in the authorized capital belonging to such a participant changes, since other information is changed through P14001 (from July 2010, information about participants in the charter may not be indicated). The same applies to sheets D, E and J.

- Sheet 3 - information about a mutual investment fund, the property of which includes a share in the capital of your legal entity. faces. An extremely rare use case.

- Sheet I - information about the share in the management company owned by the company. It is used when registering the exit of a participant(s) to enter into the Unified State Register of Legal Entities information about the share transferred to the company, as well as information about its distribution among the participants, if this information must be indicated in the charter.

- Sheet K, with its help, information about a representative office or branch is entered into the charter and the Unified State Register of Legal Entities, if you decide to include them in the charter (not necessary, in the Unified State Register of Legal Entities is sufficient).

- Sheet L, information about OKVED codes, if they are specified in your charter, which again is not mandatory.

- Sheet M - just like page 001, is always filled out. The applicant for this type of registration is indicated here, which, most often, is the sole executive body (director).

Change of name (LLC name)

The simplest action. Sheet 001, sheet A, sheet M are filled out. To P13001, a decision (protocol) on changing the name, a new charter in 2 copies, and a receipt for payment of the state duty are attached. The charter must contain the new name on the title page, as well as inside.

A separate issue is the execution of the decision (protocol) on changing the name. Formally, at the time of making the decision, the company’s name is old, which means we write the old name in the header. But according to the text, one of the issues on the agenda must contain a new company name, depending on which one is changing, full, abbreviated, in a foreign language, all at once.

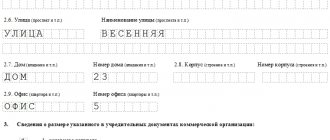

Change of legal address

Fill out page 001, sheet B, sheet M. Unfortunately, sheet B is imperfect, since from mid-2020 tax authorities require detailed filling out of all details of the address object, down to the floor, basement, room, etc. Because of this, “monstrous » options when, for example, when moving to the address Moscow, Lobnenskaya street, building 13, building 3, building 2, floor 4, room 8, office IX, the filling will look like this:

As we can see, there is a violation of the mentioned Order of the Federal Tax Service, since in paragraphs 7-9 the elements of the addressable object are indicated without abbreviations.

This is not the most difficult option, the real “creativity” begins when you need to indicate “attic”, “ground floor”, “part of the room”, etc.

By the way, everything will be entered into the Unified State Register of Legal Entities, with the indicated abbreviations.

To the set of documents for changing the address, do not forget to attach the documents on the basis of which you are using this address - a copy of the lease agreement (if sublease, then the landlord’s consent to sublease), a letter of guarantee from the owner, a copy of the Civil Registration Certificate or a copy of an extract from the Unified State Register real estate). And the address details must be listed the same as in the specified documents.

Increase the authorized capital

According to the Federal Law “On LLC”, the authorized capital can be increased at the expense of contributions from existing participants, at the expense of new participants, at the expense of the company’s property, or by combining these capabilities together.

Fill out page 001, sheet B, about the amount of the authorized capital, sheets D, D, E or F, depending on the composition of participants, sheet I, if the share owned by the company appears or changes, and sheet M, for the applicant.