Drawing up an announcement for a cash contribution is necessary when enterprises or organizations deposit cash into their bank account. The document is mandatory and has a strict form, so credit institutions are very demanding about its completion and always carefully check the correctness of the information entered into it.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

In what cases is cash transferred to the bank?

According to the law, companies can make payments both through non-cash transfers and cash payments (but only when working with the public). In the second case, the company must have a cash register or use strict reporting forms of the established form.

At the same time, there is a limit on the funds that can be stored in the cash register, but the excess should be regularly deposited at the bank.

It is for such situations that the announcement form for cash contributions has been developed. It should be noted that the document is widely distributed and used by enterprises, regardless of the area in which they operate and the level of business to which they belong.

What kind of document is this?

To deposit and subsequently credit cash to a bank account

a legal entity is required to fill out a special document - an announcement for a cash contribution. The document form has a unified form, approved and enshrined in regulations. The current form (OKUD code 0402001) was approved by the Central Bank of the Russian Federation in Directive No. 3352-U dated July 30, 2014 and is valid from November 1, 2014.

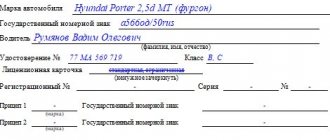

The announcement can be drawn up either by the accountant of the account owner or by a responsible employee of the bank. On behalf of the organization, only its official representative, who has the appropriate power of attorney to carry out this operation, can deposit money.

You can watch the formation and filling out of a document in the 1C program in the following video:

Action steps

At the end of each working day, the cashier or accountant of the organization is required to count the funds in the cash register. If the money turns out to be more than the established limit, then it must be handed over to the servicing bank for crediting to the current account. Just at the moment of transfer, the announcement form for a cash contribution is filled out.

The document is drawn up in the presence of a bank employee, and in some cases a bank specialist can enter the necessary information into the document himself (at the client’s request).

Money can be donated by both the head of the enterprise and a person acting on behalf of the organization (for example, a cashier or accountant), but in this case the representative must have a valid power of attorney certified by a notary.

Decoding of incoming transactions

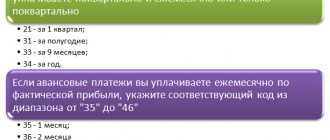

| Income item | Description | Code |

| Receipts received from the sale of goods | Using the specified code, cash receipts into the accounts of trade, catering, etc. enterprises are recorded. | 02 |

| Receipts received as a result of performing work or providing services | Code 11 records cash receipts into the accounts of transport enterprises, museums, theaters, cinemas, studios, libraries, sports, tourism and many other institutions. | 11 |

| Tax revenues, transfers from fees, various contributions, fines, customs and other payments | This code reflects the receipts of charitable, voluntary, targeted and other contributions | 12 |

| Funds received from individuals for transfer to other individuals | Applicable for transfers between individuals | 13 |

| Receipts of loans and loan repayments | Used when crediting money to debts and interest on loans and credits | 14 |

| Money received as a result of real estate transactions | Used to record payments for real estate, transfer financial resources in favor of housing cooperatives, etc. | 15 |

| Receipts to current accounts from deposits of individuals | This code reflects funds transfer operations on deposits of individuals, including in foreign currency | 16 |

| Receipts credited from structures of the Russian Communications Agency | Used to reflect transfers, amounts of unpaid pensions, etc. | 17 |

| Funds credited to individual entrepreneurs' current accounts | Used to record the receipt of financial resources into the accounts of entrepreneurs and individuals engaged in private practice | 19 |

| Receipts received as a result of transactions with government and other securities of value | Reflects transactions with government bonds and other securities of value, except bills | 20 |

| Money received as a result of performing actions with bills of exchange | The code reflects the receipts of funds from transactions with bills | 21 |

| Finances received as a result of running a gaming business | Used to record the receipt of funds to the accounts of bookmakers, casinos, slot machine parlors, etc. | 22 |

| Financial resources received as a result of the sale of currency to individuals | The code reflects receipts for payment of traveler's checks | 30 |

| Receipts credited to bank accounts of individuals | The symbol is used when money moves due to transactions in rubles and foreign currency | 31 |

| Other receipts | Return of unpaid money that was received by checks, accounting for profits from the sale of one’s property, payment for safe deposit boxes, etc. | 32 |

| Cash receipts from ATMs | Reflection of money withdrawn from ATMs and transferred to cash registers | 33 |

| Cash balance | The code reflects the balance of funds at the beginning of the reporting period | 35 |

| Receipts of money to the cash desks of banking institutions from their own divisions | Receipts from branches are reflected, including for the development of the nominal value of valuable coins | 37 |

| Receipts of cash to cash desks from other banks or branches of ROSINKAS | Receipt transactions from other banking institutions and branches of the collection association are reflected | 39 |

What happens if you don’t take “extra” cash to the bank?

If, in the event of a sudden inspection, the supervisory authorities discover that the cash limit is exceeded in the cash register, this will result in penalties for the violating company. In this case, the fine can reach up to fifty thousand rubles. The exception is those situations when the money stored in the cash register is intended to pay wages, social benefits, scholarships, insurance, and other needs of enterprise employees.

But here, too, a certain order must be followed: the storage period for such “cash” should not exceed three days. Moreover, if the company operates in the Far North or in hard-to-reach areas, the period increases to 5 days (including the day of payment).

Legality of cash transactions

The trend towards withdrawing cash from circulation and subordinating all monetary transactions to banking structures is growing stronger every year. However, the law does not yet prohibit organizations and enterprises from conducting cash transactions, although it limits these operations on the grounds of working with the public.

To ensure continuous control over the circulation of funds, the state obliges enterprises and organizations that work with the population and, for this reason, accept and transfer cash:

- have a cash register or use strict reporting forms;

- observe the limit on money stored in the cash register;

- donate excess over the limit to the bank. It is for this operation that an announcement for cash contributions is provided.

It is worth noting that tax and other regulatory authorities are very fond of checking cash registers for storing excess funds in them, with the subsequent imposition of fines for exceeding the limit.

Money cannot be considered as surplus, even if the amount exceeds the established limit, if the money is intended to pay wages, social benefits, scholarships, etc. provided that the storage period for “cash” at the cash desk will not exceed three days or 5 days for hard-to-reach places and regions of the Far North.

Rules for drawing up an advertisement for a cash contribution

The document has a standard unified form that is mandatory for use. In addition to the announcement itself, the form includes an order and a receipt - they are filled out in the same way. The document contains:

- information about the company to whose account the cash is transferred,

- Bank's name,

- current account number,

- amount (it must exactly match the one deposited into the account)

- and the source of its receipt,

- date of enrollment (i.e. the day on which the action actually occurs).

It should be noted that the source of financial resources can be written either in words or noted in the form of a code. For example, 15 – sale of real estate; 11 – enterprise revenue from the provision of other services; 02 – trade revenue from the sale of consumer goods through any sales channels.

If you have any difficulties in this part, you should consult a banking specialist for a complete list of codes (15 main values in total).

Sample and form

I would like to immediately note that the filling out procedure is not particularly complicated and should be understandable even to a person who is encountering this issue for the first time. So, the following nuances

:

- Write the form number and indicate the date the document was completed.

- Enter information about the name of the company.

- In the debit line you should enter information about the sender's account number, and in the credit line - the name of the company to whose current account the funds are received. It should be noted that information about debit and credit may not be filled in, since in some cases a bank specialist can independently enter this information.

- After this, you should fill out information about the identification code.

- The next stage is entering information about the bank.

- Next, the amount is written down in the amount of cash that is deposited into the current account.

- The document must be signed by the bank teller and the person who deposits the funds - the head of the enterprise or a trusted employee. If cash is deposited by a trusted person, he must have a power of attorney from a notary.

Rules for placing an advertisement for a cash contribution

The announcement can be filled out either by hand or on a computer (but using only the approved form - the bank will not accept another), in addition, the company details can be entered using a stamp or seal.

You cannot make mistakes in the document form, so when filling it out you need to be as focused and collected as possible. If a blot or inaccuracy does occur, you should not correct them - such an advertisement will in any case be considered damaged, so it is better to immediately fill out a new form.

The form is drawn up in a single copy and after accepting cash, a specialist from a banking organization (cashier) signs and stamps it.

The completed announcement form remains with the bank employee, the receipt with his signature is handed over to the company representative who deposited the cash, and the receipt order is sent to the accounting department of the credit institution and is subsequently attached to the bank statement.

Sample of filling out an announcement for a cash contribution

The form of the document is not very complicated and is quite understandable even to an inexperienced person.

- At the beginning, the form number is written and the date of completion is indicated, which must correspond to the date of depositing cash into the account.

- After this, enter the name of the company that deposits the cash.

- Next comes the “Debit” line: the account number of the sender of the funds is entered here, and the name of the company to whose account they are received is entered in the “Recipient” line.

The “Credit” column indicates the recipient’s current account number. It should be noted that it is not necessary to fill in the lines “Debit” and “Credit”, since the specialist of the credit institution himself can enter the necessary information into them when receiving “cash”. - Then fill in the information about the Taxpayer Identification Number (TIN), KPP - the numbers corresponding to the constituent papers of the company are entered here. The line called “Account No.” refers to the recipient’s current account number.

- Then information is written about the depositing bank and the receiving bank: their names and BIC (bank identification code).

- After this, the amount of funds deposited is entered (in the required cells in words and numbers), and the source of receipt is also indicated: in words or in the form of an appropriate code. The “Symbol” cell indicates the code of the source of money receipt and the corresponding amount of receipt.

- The document must be signed by the cashier of the credit institution, as well as by the person who deposits the money (this can be the head of the enterprise or a representative acting on his behalf).

How to fill

- The ad itself.

- First, the serial number of the advertisement is placed;

- Then they set the date for depositing cash;

- In the “from whom” field write the name of the organization and the initials of the direct depositor of the money;

- After this, write the account number to which the money will be credited;

- The name of the bank that accepts cash must be indicated;

- The amount of money deposited must be indicated in both numbers and words;

- In the “source of contribution” field the contents of the transaction are indicated.

- Receipt – filled out in the same way as the advertisement itself.

- The order is filled out in the same way.