Who is suitable for a 1 month deposit?

Short-term deposits are suitable for several categories of clients:

- Those who have a specific amount on hand and know for sure that the money will be needed in about a month. For example, investors who have sold their apartment and are looking for new housing.

- For those who have applied for a mortgage. Placing a down payment on a deposit will be an additional advantage when considering an application.

- For those who do not want to open a deposit for a long period and plan to renew the deposit every month.

Note! In the era of coronavirus, everyone is looking for additional opportunities to earn money.

It’s surprising that you can earn much more using alternative methods, up to millions of rubles a month. One of our best authors wrote an excellent article about making money on games with reviews from people.

Advantages and disadvantages

We have formulated the general advantages and disadvantages of deposits that are designed for 1 month.

| Flaw | Advantages |

| Low interest rate compared to deposits for a longer period, because it is more profitable for banks to attract deposits for a long time. | The ability to re-issue a deposit when more favorable offers appear, since the loss of interest over a few days is insignificant. You can withdraw money if you need it before the deadline established by the contract. Safety of funds - it is safer to store money in a deposit account than at home, because interest is charged on the amount. Saving money, that is, it will not be possible to spend money on unnecessary things if the funds are not at hand. |

Advice for investors

To protect your savings, follow these tips:

- Don't keep your money in one bank. The bank’s license may be revoked, in which case the funds will be returned by the Deposit Insurance Agency, but not more than 1,400,000 rubles.

- Do not keep money in one deposit. Deposits can be replenished and withdrawn early without loss of interest. Typically, interest rates are higher on deposits where deposits and withdrawals are not provided for before the end of the deposit agreement. Therefore, one deposit should be chosen with a replenishment, the other without, but with an increased rate. If you need to withdraw some money for unforeseen expenses, you can withdraw one deposit while maintaining interest on the rest.

- Keep an eye on interest rates. It is recommended to monitor interest rates and other terms of deposits in different banks and, if a more favorable offer appears, transfer money to another bank.

What to look for when choosing a deposit

For most investors, the main criterion when choosing a deposit is its profitability. However, first of all, you need to pay attention to the conditions for early withdrawal of money from the deposit.

There may be the following options:

- In case of early withdrawal, no interest is paid;

- In case of early withdrawal, the interest is paid in part;

- In case of early withdrawal, the interest is paid in full.

It is not recommended to put all your available money on a deposit, on which, if withdrawn early, all interest income is “burned out”, even if the rate on them is significantly higher. The investor may need money at any time, and in order to avoid partial loss of income, it is better to invest the money in deposits with the possibility of partial withdrawal.

Convenient deposits are those with the possibility of replenishment, to which funds can be transferred as they become available.

If a person plans to live monthly on interest on a deposit, he should choose a deposit with monthly interest payments without capitalization. Also clarify how interest will be paid: by card or only in cash at the office.

When opening large deposits, many banks provide cards as a gift with free service and various bonuses. Significant discounts are also possible on other services of financial holdings: insurance, investment.

How to choose a bank

When choosing a bank, you need to be guided not only by the profitability of the deposit, but also by the reliability of the bank.

Systemically important banks are considered the most reliable; their list is approved by the Bank of Russia. As of today, there are 11 systemic credit organizations on the list of the Central Bank. Systemic banks account for the majority of both assets and liabilities of the Russian banking system - over 60%. However, interest rates on deposits in them are not the highest.

The Central Bank constantly monitors the financial condition of banks and publishes information about this - information on the current status of a commercial bank can be found on the Central Bank website.

To avoid unexpected losses, it is not recommended to keep more than 1.4 million rubles in one bank, no matter how reliable it is. Deposits in banks are insured, so you can place money in smaller and less reliable, but at the same time more profitable banks. Interest rates in such banks are usually higher than in systemic ones, and other conditions are more favorable for depositors.

It is possible to live on income from bank deposits in the Russian Federation only if you have large sums of money. Compared to developed countries, bank deposit rates in Russia are relatively high. However, do not forget about inflation, the official rate of which is 4-5% per year. Another problem is the constant change in interest rates, which does not allow long-term income planning. Bank deposits of individuals in Russia are 100% insured (but not more than 1,400,000 rubles per bank), which is another advantage in using bank deposits.

Review of deposit offers for one month

In most banks, the minimum deposit period is 3 months, but there are several offers for monthly deposits. We have collected the most profitable of them and identified additional advantages of these deposit offers.

Deposit "Rastivklad" from Absolutbank

Terms of the Rastivklad deposit from Absolutbank

Part withdrawal is equal to partial withdrawal - you can withdraw funds in shares up to the minimum balance.

The minimum balance is a specific amount of money that must always be in the investor’s account. It is equal to the minimum deposit amount, that is, for the Rastivklad investment it is 10 thousand rubles.

For example, citizen Ivanov decided to open a Rastivklad deposit for 1 month. Initially, he deposited 30 thousand rubles. 15 days after opening the investment, Ivanov runs to the bank and says: “I need 25 thousand rubles.” If a citizen demands this money and does not want to terminate the contract early, then he is denied the money. Because he does not fulfill his obligations under the contract, because he wants to leave an amount less than the minimum balance: 30-25 = 5 thousand rubles. If, after all, Ivanov withdraws these funds, then the contract is terminated.

Conditions for early termination:

- if the depositor withdrew part of the money more than the minimum balance or the entire amount before the end of the agreement;

- without loss of interest.

Auto-renewal is an automatic extension of the contract. Extension conditions:

- if the client does not come for money on the day the agreement expires, then it is instantly extended for a new term;

- The deposit is automatically extended at the rate and conditions that are in effect on the day of extension.

Interest rate for 1 month “Rastivklad” from Absolutbank, in rubles

Interest rate for 1 month “Rastivklad” from Absolutbank, in dollars

Interest rate for 1 month “Rastivklad” from Absolutbank, in euros

If you open a deposit online, there will be an increase in the rate of +0.15%. All investments are insured by DIA.

Deposit "Vostochny" from Eastern Bank

Terms of the Vostochny deposit from Eastern Bank

Capitalization is the accrual of interest both on the amount previously paid by the client and on interest that has already been accrued.

Example: citizen Pechkin opened an “Eastern” deposit for 1 month and deposited 50 thousand rubles on it. The contract period has passed and at a rate of 5.55% per annum he receives +231.25 rubles, that is, he now has 50,231.25 rubles. Now, in case of prolongation of the deposit, interest capitalization will apply to this amount.

Conditions for early termination:

- if the depositor withdraws funds from the deposit early, the agreement is terminated;

- interest will be recalculated and paid at the “Demand” rate.

Interest rates for 1 month on the Vostochny deposit from Vostochny Bank when issued at a bank branch

Interest rates when registering via Internet banking for the Vostochny deposit from Eastern Bank

The bank also increases the rate by +0.1% for clients who participate in the “Interest as a Gift” program if they provide a pension certificate. This bonus is not available to those who open a deposit via online banking.

All deposits are insured by DIA.

Deposit “Profitable” from Rosselkhozbank

Terms of the “Profitable” deposit from Rosselkhozbank

A deposit in favor of a third party is a deposit that a citizen opens not for himself, but for another person.

Example: Petrov wanted to open an investment in the name of Smolin. Arriving at the bank, he makes a deposit for it. It makes no difference whether Petrov came with or without Smolin: his personal presence is not necessary to open a deposit. Despite the fact that Smolin will be the owner of the investment, Petrov will be the investor, because he contributed the money.

Conditions for early termination:

- if the client withdraws the money before the end of the period established by the contract, then it is terminated;

- interest is recalculated and paid at the “Demand” rate.

Auto-renewal conditions:

- the deposit is automatically extended if the depositor does not claim the money on the last day of the agreement;

- prolongation is valid a limited number of times: if the deposit is issued for 1 month, then it will be extended no more than 11 times;

- if on the day the agreement expires the bank no longer accepts a deposit for a specific period, then the deposit agreement with this period will not be extended.

Interest rate for 1 month of the “Profitable” deposit from Rosselkhozbank, in rubles

Interest rate for 1 month of the “Profitable” deposit from Rosselkhozbank, in dollars

For a period of 31 days there is no surcharge for opening online. In dollars:

A deposit in euros cannot be opened for 1 month, the minimum period is 540 days. Every deposit is insured.

“Save” deposit from Sberbank

Terms of the “Save” deposit from Sberbank

Conditions for early termination:

- if the client needs money before the expiration date of the deposit agreement, he will be able to receive it;

- income will be accrued without taking into account the monthly capitalization of interest upon early termination;

- if the terminated contract was opened for a period of up to 6 months, then the interest rate will be equal to 0.01% per annum.

Auto-renewal conditions:

- the deposit will be automatically extended on the terms and at the interest rate that apply to “Save” and “Save Online” deposits;

- The investment can be extended an unlimited number of times.

Special privileges for pensioners

Interest rate for 1 month of the “Save” deposit from Sberbank, in rubles

Interest rate for 1 month of the “Save” deposit from Sberbank, in dollars

Special privileges for pensioners:

Rates for pensioners for 1 month:

- In rubles - 3.85%.

- In dollars - 0.01%.

All deposits are insured by DIA.

Savings account as an alternative to a monthly deposit

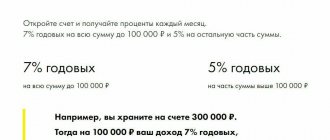

Most banks offer a product such as a savings account.

A savings account is a bank account that is needed to store money.

It is somewhat similar to a deposit, but it has undeniable advantages:

- You can withdraw the money at any time; there are no difficulties with early termination of the contract. Interest will not be lost.

- If the client needs to constantly withdraw money or, conversely, top up the account, then this is a profitable option. Because deposits with “withdrawal” and “replenishment” functions usually come with low interest rates.

- Interest is calculated monthly or daily.

- The account is opened like a piggy bank - for an indefinite period. If the client wants, he will save in it. If he doesn’t want to, he can “break” the piggy bank and put the money into another account.

Leaving money in a savings account for 1 month is often more profitable than in a deposit.

| Bank | Savings account, name | Minimum amount, in rub. | Duration, in months | Partial withdrawal | Replenishment | Rate, % per annum | Interest calculation procedure |

| Rossel-khozbank | Savings account | No restrictions | No restrictions | + | + | 5 | Daily for the balance of funds; Credited to account monthly |

| Alfa Bank | Alpha account | — | — | + | + | 5-7 | monthly |

| Prom-Svyazbank | Focus on percentage | — | — | + | + | 5-8 | monthly |

| Sberbank | Savings account | — | — | + | + | 1-1,8 | monthly |

| Tinkoff | Savings account | — | — | + | + | 5 | Daily for the balance of money; monthly capitalization |

Which bank is better to open a savings account?

Many large Russian banks offer pensioners to open a savings account with high interest rates of up to 8.5%.

The peculiarities of such a deposit are that funds can be withdrawn at any time, as well as deposited into the balance. Thanks to this, it is possible to insure yourself in case of an unforeseen situation.

Here are some current offers for 2020:

- VTB savings account up to 8.5%. Unlimited withdrawals and deposits are allowed. The profitability depends on the amount placed - from 4.00% on any deposit up to 75 thousand rubles. The best interest rates on deposits are applied when depositing more than 75 thousand rubles into an account. The rate is 8.50%.

- VTB Piggy Bank account up to 8.0%. Withdrawing and depositing money is also possible, the placement period is any. The minimum rate is 6.5% (for any amount), the maximum is 8.0% (from 75 thousand rubles).

- Promsvyazbank “Simple Rules” account – up to 6.5%. An account can be opened both in rubles and foreign currencies - US dollars, euros. You can withdraw and top up at any time.

- Promsvyazbank “Honest Rate” account – up to 7.25%, ruble deposits only. You can also top up and withdraw without restrictions.

- “Safe account” from Vostochny Bank – up to 5% with the possibility of repeated withdrawals and deposits. The maximum percentage is received by clients who placed from 30 thousand to 500 thousand rubles.

- “Alfa account” from Alfa Bank - a fixed rate of 6.0% on any amount from 10 thousand to 15 million rubles. Bonus miles are also provided (for every 200 rubles).