Today it has become very popular to carry out all financial transactions via the Internet. And this is not surprising. After all, today you don’t have to go far to make any purchases, pay utilities and transfer money. Even many banks have already begun to actively practice opening online deposits. To do this, just turn on your computer, go to the Internet, and there you can already find many sites that offer a huge variety of goods, works and services that you can purchase and receive without leaving your home, simply by clicking on the desired button.

In this article we will try to understand the nuances of opening a deposit online, its advantages and disadvantages, as well as how you can close such a deposit.

Online deposits - increase your funds without leaving home

I remember recent times when clients of credit institutions had to be persuaded and wooed for weeks in order to connect them to some kind of remote service. Now, according to research conducted by Ipsos Comcon, Internet banking is used by more than 81% of the Russian population of all age groups.

One of the most popular services performed using Internet technologies has been the opening of deposits by individuals. Banks are specially developing a line of deposits for these purposes that can only be opened online.

Such cooperation is beneficial for both service users and financial institutions:

- In this way, banks reduce their costs of opening and servicing deposit accounts, thereby increasing the profitability of the organization;

- clients have the opportunity, without leaving home, at any time, in a matter of minutes, to make a profitable investment of their savings.

Important!

Online investments of individuals in all banks are insured by the state through the DIA (Deposit Insurance Agency) in the same way as deposits opened in the usual way, in the amount of 1,400 thousand rubles. This value periodically changes upward.

Why online deposits are popular

Every year online deposits are gaining more and more popularity. After all, they have a number of undeniable advantages over the classical method of opening.

Here are just some of the main advantages of this banking product:

| № | Advantage | The essence |

| 1 | Convenience | You can open a deposit at any time from anywhere, without visiting the office |

| 2 | Save time | No need to waste time traveling to a bank branch or standing in queues |

| 3 | Increased rates | As a rule, in all banks interest rates for online deposits are higher on average by 1% |

Results

Based on all of the above, it becomes clear that opening a deposit online is a completely safe and common practice among the majority of citizens of the Russian Federation. This provides a special advantage regarding the choice of a deposit program, crediting funds from any card, as well as quick and hassle-free termination of the agreement. Such off-balance sheet investors are not something different in the deposit system. They also have the opportunity to print out the agreement with the stamp and other bank details. This paper is an official document and can also be used as evidence in court or other pre-trial proceedings.

To summarize, we can say that to gain access to opening an online deposit, just go to the bank’s website. All subsequent actions have clear instructions and are advisory in nature. Any question can be asked to a call center operator, who will help quickly resolve the problem. Thanks to the convenient remote opening of a deposit, within the framework of the current program, the depositor has the opportunity to change the parameters for crediting interest to the card or performing capitalization in relation to the body of the deposit account. Therefore, it is not necessary to visit a bank branch to manage key deposit characteristics. This also applies to termination of the contract.

Ultimately, opening a deposit online saves each client up to 2 hours of time. This reduces the burden both on the financial institution and on the actual attitude of clients towards this placement of funds. All this determines the effectiveness of cooperation, the possibility of constant control over the status of the account, as well as receiving part of it without explaining the reasons and visiting bank branches. All this radically optimizes the online service component, both through its expansion and customer feedback. A proportional increase in the share of online depositors leads to an improvement in this service, a reduction in the number of authorization processes, and also a slight, but pleasant increase in the interest rate.

How to open a deposit online - step-by-step guide

So, you are interested in the question of how to save and increase your money without leaving home, how to open a deposit simply and easily via the Internet. This means it's time to find out the details of this process.

It’s easy to open a deposit today - it only takes 10 minutes of your time

Having dealt with it in advance, you won’t have to waste time on it at the time of the actual registration. It will take you less than 10 minutes to complete the entire online algorithm.

Step 1. Register on the bank’s website

In order to open deposits and safely carry out transactions with them without visiting a branch, you must first register in Internet banking by completing the mandatory steps provided for by the conditions.

I’ll say right away that only those who are already listed as a client of the chosen financial institution can register in Internet banking (or, as it is also called, “online banking”). You must be a participant in the salary project or a plastic card holder (debit or credit). Your mobile phone must be “linked” to this card.

Some banks, upon receiving an application to open a deposit, automatically issue a debit card for the applicant, which is delivered to his home along with the deposit agreement. This is what Tinkoff Bank does, for example.

Primary entry occurs according to various scenarios, each institution has its own.

Typically, you will need to do the following:

- Click the “Login” button.

- Next, we request a new login and password.

- In the field that appears, enter your bank card number.

- Receive SMS code.

- Enter it in the line provided for this.

- Log in to your personal account (PA).

In some banks, in order to gain access to Internet banking, you must enter into a remote service agreement (RSA). Then get your password and login through an ATM or terminal. Next, use them to log into your personal account, confirming it with an SMS password.

Step 2. Select a suitable product and submit an application

It’s easy and simple to understand all the deposit diversity and at the same time save time: use information from various specialized sites.

I believe that 2 resources are excellent for these purposes: banki.ru and sravni.ru.

Having made your choice of a financial institution, proceed to registering the product through your personal account, once in which you will see several sections on the screen.

The interface of each financial institution’s account has individual features, but in general the operating principle is identical. We find and click the “Deposits and Accounts” tab, we get inside the section where the conditions of all existing deposits are described in detail. We carefully study, and then choose the one that is most suitable for you.

I advise you to pay attention not only to profitability, but also to factors such as:

- minimum contribution;

- minimum balance;

- capitalization;

- possibility of replenishment;

- partial withdrawal;

- auto renewal and its conditions;

- conditions for early termination of the contract.

Their correct selection, together with the optimal %, will allow you to get the most profitable result.

Having decided on a product, mark it with a tick and go to the application form.

It contains the following lines:

- Document number and date.

- Name of the deposit.

- Investment amount and currency.

- Account/card for debiting funds.

- % bid.

- Validity.

- Methods for calculating %.

Step 3. Read the agreement and confirm the operation with an SMS password

We fill in all the required fields, click the “Continue” button and go to the next page, where you need to check the entered information again, give your consent to place funds on the proposed conditions, and request an SMS password to confirm the operation.

Having received the password, enter it in a special field and click the “Confirm” button, thereby activating final processing. After this, a window appears with the result and the bank’s “Completed” stamp. The deposit itself is placed in a special section in your personal account.

In different commercial banks, the algorithm may have slight differences from the above.

To consolidate the material, I suggest watching a video about opening online deposits in Sberbank.

How to make money on banks

How a bank makes money is clear, but how can an ordinary person make money from banks? Banks offer various forms of investment for this. These are not only deposits in our usual understanding, but also other types of investments.

How to make money on banks in Russia:

- open a deposit, place your capital and receive interest for it;

- open a savings account. They can be freely disposed of. Rates are lower than on deposits;

- impersonal metal accounts. The client invests capital in metals and makes a profit due to the growth of their value;

- special investment programs, the bank helps manage investments and invest money in securities.

If we consider how much you can earn on interest in a bank, then the actual profit is low. Citizens who can invest large amounts of capital earn more or less decent income. If it is small, then it is more about preserving funds from inflation rather than about profitability. Well, banks spin money and get much more.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

How to calculate interest on a deposit online

To calculate %, I recommend using an online calculator directly on the credit institution’s website. Everything there is clear and extremely simple.

This is how, for example, profitability is calculated on the Sberbank website.

It is enough to enter the amount planned for investment, indicate the period in days and select the deposit currency.

Then click the “Calculate” button, and the result is in front of you:

| № | Currency | Russian ruble |

| 1 | opening date | 02.02.2018 |

| 2 | expiration date | 02.02.2019 |

| 3 | Posting period in days | 365 |

| 4 | Sum | 1000 rub. |

| 5 | Capitalization | Yes |

| 6 | Early closure | No |

| 7 | Investor-retirement | No |

| 8 | Average income for 30 days. | 4 rub. |

| 9 | % taking into account capitalization | 4,8% |

| 10 | Note | To calculate income, interest rates in effect at the time of calculation are applied. When calculating income, the length of the calendar year is always taken to be 365 days. |

If the result is not satisfactory, change the parameters and recalculate again. The number of attempts is not limited.

If there is no such calculator on the financial institution’s portal, then use third-party services. For example, on the website banki.ru.

Is it possible to use cans for children?

The procedure can be performed on children starting from the age of three. It will help a lot with colds and coughs. Knowing how to place cups on the back of an adult, you can carry out the procedure on a child. But the baby needs fewer cans, and the duration of exposure is reduced to 6 minutes.

Also, the ability to place jars depends on the individual qualities of the children. If the sick baby is impressionable, then fire and hot glass jars are likely to cause panic.

Where to open a deposit online - review of the TOP 3 banks

Almost all major Russian banks offer online deposit opening. To save your time, I analyzed the available offers on the Russian banking market and selected 3 credit institutions with very attractive conditions in this category of banking products.

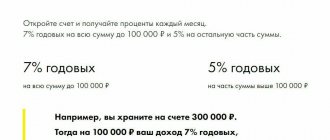

Tinkoff Bank

A well-known private Russian credit organization that operates exclusively remotely.

Its credit cards and business services are especially popular among Russians. I recommend taking a closer look at Tinkoff deposits with very attractive conditions.

Here are just a few of these conditions:

- rate up to 7.76%;

- wide time range (from 3 to 24 months);

- capitalization (at the client’s request);

- bonuses.

Touch Bank

One of the retail banks of the international company OTP Group. It has no branches. All services are provided remotely, through online banking and a mobile application.

The latest technologies, high security of funds and information, round-the-clock service seven days a week and holidays, instant cashback, fast loan processing (decision in 5 minutes, only with a passport, rate from 12%) - these are just a few of the advantages that a client receiving services in Touch Bank.

Interesting conditions are offered for deposits:

- Placement period - 30 days. with the possibility of extension.

- High% - from 6 to 8 percent.

- Daily accrual of %, which can be spent immediately.

- Opening and maintenance 0 rubles.

Rosselkhozbank

A credit organization, a joint-stock company, 100% of the shares of which belong to the state. The institution was created in 2000 to support domestic agricultural producers.

Now RSHB is a universal credit and financial organization that provides a full range of services to all client categories:

| № | Clients | Services offered |

| 1 | Private individuals | Lending, card products, deposits, brokerage services, precious metals and coins |

| 2 | Small and micro business | Cash settlement services (CSS), lending, deposits, affiliate programs, insurance, online services, government support |

| 3 | Medium and large business | Cash settlement services, lending, deposits, affiliate programs, documentary transactions, bank guarantees, salary projects, remote banking services, currency transactions and currency control, safe deposit boxes, trade acquiring |

| 4 | Investors | Providing information on securities issues, shareholders, significant events, reporting, etc. |

| 5 | Credit organizations | Cash settlement, documentary and trade financing, cash transactions |

Urgent online standard and its automatic extension

A convenient online time bank deposit is the undisputed winner in the “Best Savings Deposit” category. In terms of the main parameters, the key ones are the replenishment, which is carried out at the depositor’s own request, as well as the monthly payment of interest on the card, which can be replaced by capitalization to the principal amount of the deposit.

As for early closure, it remains possible in any case when choosing a deposit for a period of 1 and 2 months. Provided that an online deposit is issued for 3 to 12 months, possible early closure is determined by the client at the stage of concluding the contract. Once approved, such a decision cannot be changed. The fixed-term standard in national currency for a period of 3 to 12 months has the function of a premium when extending.

As a rule, the amount of the premium is 0.5% of the current interest rate, which is in effect at the bank at the time of registration of the extension. It is important to note that when opening a fixed-term standard from 3 to 12 months, the right of early closure may be accompanied by a reduction in the interest rate in the following amount:

- 2.5% in national currency;

- 0.75% per annum in dollars;

- 0 25% per annum in euros.

How to avoid becoming deceived by a depositor - tips for opening a deposit via the Internet

Many Russians who invest their savings in bank deposits in the classic way (by drawing up an agreement in the office) would like to take advantage of the opportunity to open a deposit online, but are afraid of being deceived.

It is for those who are tormented by such doubts, who are looking for pitfalls in such remote services, that my advice will be useful.

Vigilance is the first rule of a competent investor

Tip 1. Request a statement confirming the amount deposited

In banking practice, there are cases when money received from clients was not officially reflected in the bank’s balance sheet. This scam deprived decent investors not only of income, but also cast doubt on the return of the investments themselves.

Of course, such behavior of a credit institution is the exception rather than the rule. However, to reduce the risk, I recommend asking your bank for an official statement with signatures and stamps on the deposit transaction.

This document must indicate:

- deposit opening date;

- investment amount;

- bank details;

- information about the agreement and the investor.

Tip 2. Check information about restrictions and prohibitions on the website of the Central Bank of the Russian Federation

Place your money only in accounts in a reliable bank. Before making a transaction, check the reliability of the chosen financial institution.

This can be done on the Bank of Russia website. Here you can find all the information about the presence/absence of restrictions or prohibitions on the conduct of activities of a particular bank. The absence of an organization in the register of institutions with a suspended license is a positive signal for formalizing cooperation.

Tip 3. Do not place all funds in one bank

You've probably heard the expression: "You can't put all your eggs in one basket." In other words, if you don’t want to lose everything at once, place your valuables in different places. This is especially true when it comes to personal savings.

If you want to maximize the safety of your bank deposits in times of economic instability, I advise you to open them in different financial institutions in amounts of no more than 1,400,000 rubles.

It is for this amount of investment that the DIA is insured. The depositor can count on its return, for example, if the bank’s license is revoked. Moreover, this is the maximum amount for all accounts of one individual depositor in one credit institution, which he can claim under force majeure circumstances.

Please note that this amount also includes accrued interest.

Example

Victor opened a Maximum Interest deposit in Tatfondbank (TFB) in the amount of 1,380 thousand rubles. for a period of 2 years at 9% per annum with monthly interest capitalization. At the time of revocation of the license of this financial institution, the money had been lying in the account for 1.5 years and, together with interest, 1,578,085.51 rubles had accumulated there.

As a result, the DIA did not pay Victor the full amount, but only 1,400 thousand rubles, provided for by the law on insurance of investments of individuals. If the investor had thought about this in advance, he could have placed a slightly smaller amount in the TFB (for example, 1,100 thousand rubles) and eventually received all the accrued interest along with the money originally deposited.

Victor could place the rest of his available funds under similar conditions in another banking institution.

How banks make a profit on loans

The second important component of income is issuing loans. Both for the population and business representatives. Moreover, business is even more interesting to creditors, since it involves much more significant amounts, and transactions are often secured by collateral of liquid property. But interest rates on loans for individuals are higher, so their mass issuance also brings high income.

Some banks even specialize almost exclusively in working with individuals in terms of attracting deposits and issuing loans on simplified terms. This strategy brings good revenue, which was verified by the same Tinkoff bank, and Alfa-Bank is quite active in terms of working with the population and issuing loans to them.

As a result, commercial banks make profit due to:

- interest rate. The greater the risks of the loan, the easier it is for the borrower to obtain, the higher the rate. Standard cash loans with certificates are issued at an average interest rate of 18% per annum. Banks take money for issuance from their depositors (who cost him 5-6%) or from the Central Bank of the Russian Federation at a key rate, currently 6.25%. The bank's income is equal to the difference between the borrowing and issuing percentages;

- additional services accompanying loan processing. Of course, we are talking primarily about insurance. Insurance companies pay a lot of money to their partner banks in this area, since in fact no more than 1% of the insured end up applying for the due payments.

And if we are talking about a credit card, then these sources of bank income bring even greater profits. People spend money not only on paying the interest rate, but also pay for maintenance every year or monthly; many use paid SMS notifications. Plus, profits come from stores that accept card payments. This is a fairly profitable tool for bankers, so they often literally push it onto people who receive cash loans. They frame it as a free extra service or bonus.