Every client who comes to the bank expects to choose not only a profitable, but also a convenient deposit. One of such financial products is rightfully deposits with interest capitalization and replenishment.

According to many experts, it is precisely such deposits that are currently the most profitable and in demand among clients of banking institutions. Let's figure out what causes this state of affairs.

Concept and essence

A replenishable deposit with capitalization is a banking product that has two important characteristics.

Firstly, the interest accrued on this deposit is added to the amount in the depositor’s account. The next interest accrual will occur on this updated deposit amount.

Secondly, the bank client has the opportunity to replenish the deposit. You can do this any number of times without any restrictions. Naturally, in these situations, interest will be charged on all funds in the client account.

Thus, replenished deposits allow depositors to receive the maximum possible profit from banking investment.

Existing subtlety

Depositors must understand one important aspect: banks often resort to some tricks in an attempt to mislead clients. They take advantage of the fact that many people know about the benefits of interest capitalization and themselves ask about the availability of such deposits.

In order to earn more themselves, banking institutions deliberately lower interest rates on the products in question. In this case, deposits opened on the terms of interest capitalization and possible replenishment remain profitable only on paper, but not in practice.

Let's give an example of such a situation.

Let's assume that the Omega bank offers the client two financial products. The first is a time deposit with an interest rate of 9%. The second is a deposit with monthly capitalization, which can also be replenished, with a rate of 8%.

When a potential client comes to Omega Bank and informs its employee about his desire to deposit money into his account, he is first of all offered a product with capitalization and replenishment.

However, let's check the profitability of both of these deposits. Suppose a client wants to deposit 100 thousand rubles for a year.

For a deposit with interest capitalization, after 12 months he will receive 108 thousand 300 rubles. For a term deposit of 109 thousand rubles. That is, we see that the second option is more preferable.

What does the bank count on in such a situation? Many clients, having heard from the manager that currently the most favorable conditions are available on a deposit with capitalization, will immediately agree to conclude this agreement. Some will take a bank employee’s word for it. Others will be too lazy to check the profitability of various products. Still others will be reassured by words about the presence of interest capitalization conditions in the proposed deposit.

Dear readers, remember that a replenished deposit with capitalization will be more profitable than a fixed-term deposit only in a situation of equal interest rates on them.

VTB 24 deposits with replenishment and capitalization of interest

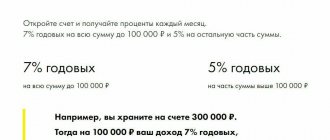

Of the proposed VTB deposits for individuals, partial replenishment is allowed on deposits: “Replenishable” and “Comfortable” and “Savings Account”. You can capitalize accrued interest on all deposits.

The most profitable VTB deposit with replenishment, capitalization and multiple withdrawals

The most convenient and profitable deposit will be a “Savings Account” with the presence of the “Savings” option on the “Multicard” card. On this deposit you can perform all operations with money, receiving interest on the average balance on the card. The interest rate, at the same time, is the highest - up to 8.5% (+0.5% / +1.0% / +1.5% per annum). At the same time, the “Multicard” includes the “Cashback” options (up to 8.5%), the “Collection” bonus program, “World Map” (the “Travel” program - accruing miles for purchases on the card, for their subsequent use in as an equivalent of money to pay for air and train tickets). All details and conditions for the savings account are on the page.

How to get the maximum benefit

If you are determined to get maximum profit from your replenished deposit with capitalization, then pay attention to 2 aspects:

- duration of the contract;

- frequency of interest calculations.

The conditions for bank capitalization are subject to two immutable laws of profitability.

The longer the term of the signed agreement, the greater the benefit the bank client will receive from it. It makes no sense to open short-term deposits on the conditions under consideration. At the same time, long-term, multi-year investments are justified.

The more often interest is accrued on the deposit amount, the greater the profit will be in the end. Ideally, a depositor should find a bank deposit with daily rather than monthly interest capitalization.

An additional condition that should also not be neglected is the possibility of partial premature withdrawal of money from the account. We never borrow exactly when we might need the funds deposited in the bank. Therefore, in case of force majeure in life, such an option will not be superfluous.