Can a pensioner open an individual entrepreneur and how to do it

Before starting your own business, you need to understand that this is the responsibility of the citizen himself, and accordingly, all risks lie with him. Therefore, you should initially evaluate the approximate profitability.

Persons of retirement age are also entitled to start a business. You can do this at any time. The registration process does not differ from the standard procedure. Initially, you need to collect a complete list of documentation and select the applicable taxation system.

Positive points can be highlighted:

- a pensioner can thus increase the amount of monthly income;

- there is no requirement to form authorized capital;

- use of preferential taxation;

- filing a return every quarter;

- We accept payment in cash.

The disadvantages are that:

- It will be possible to submit a report only at the place of residence of the person, which is often inconvenient;

- required to make contributions, even if no activity is carried out;

- there are no additional concessions or benefits.

It is also worth pointing out that the entrepreneur will be liable with his property.

What does an individual entrepreneur give to a pensioner?

In addition to the right to recalculate the insurance part of the paid pension, registering as an individual entrepreneur and running his own business gives the pensioner additional advantages. This is a property right in the purchase of real estate, an increase in capital, and the inclusion of all this in the inheritance.

A person with pension status can be employed in several companies at the same time, or move on to engage in intellectual activity at the official legal level. The main thing is to never forget that you still need to pay taxes, no matter how old you are.

What documents are needed for organization

A citizen will need to collect a certain package of documentation, which includes:

- application drawn up in form 21001;

- the act by which identity is verified;

- TIN;

- payment type order to confirm payment of the fee.

The application form can be obtained when contacting the fiscal service, as well as on the official portal of this body. It reflects information about the citizen, including last name and initials, TIN, date of birth and registration address. In addition, the data of the act through which the citizen’s identity is verified is entered.

The type of activity that the citizen plans to conduct is reflected. You can find this value in a special reference book. It is available for use on the web. Data in the application is entered using block letters.

Attention! According to the law, corrections cannot be made. If a person makes a mistake, the information must be reflected again.

Package of documents

In order for a certificate of registration as an individual entrepreneur to be issued, the pensioner must submit the following documents:

- Statements. For registration, form No. 21001 is established. This form requires you to provide the following information in block letters:

- FULL NAME;

- Date and place of birth;

- Citizenship;

- Information about place of residence;

- Passport registration details;

- Information about types of activities;

- Telephone for communication;

- Applicant's signature.

- Identity document, as well as a copy of its pages;

- TIN;

- Document confirming payment of the state fee.

Which tax system to choose

It is important to point out that a citizen of retirement age does not have the opportunity to use preferences in this area. This suggests that the use of individual entrepreneurs is implemented according to a standard formula.

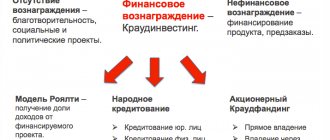

You can choose one of five systems:

- General taxation system . It is worth pointing out that this option is the most difficult. This is due to the fact that it is characterized by a large tax burden. There are no restrictions regarding an individual entrepreneur. Tax payment is carried out at the rate of 13% of the amount of profit received.

- Simplified system . Practice shows that this system is in demand. It is often chosen by new entrepreneurs. Tax payment is made in the amount of 6% of profit.

- Unified Agricultural Sciences. This system provides for a payment of 6%. From the beginning of 2020, this variety also obliges you to pay VAT. It is possible to be exempt from this tax.

- Single tax on imputed income . Then the amount not received by the entrepreneur is used, but from what is calculated by government agencies. For this reason, this variety received this name. The types of activities are strictly limited; it is unacceptable to carry out construction work or conduct wholesale trade.

- Patent. Often it has almost no differences from the imputed tax. However, it can only be used by persons registered as individual entrepreneurs.

Important! This indicates that the citizen has the right to use the system that will be beneficial to him. If one system was initially chosen, but then the person realized his mistake, another choice can be made.

About benefits

Are there benefits if an individual entrepreneur is a pensioner? Unfortunately, the legislation of the Russian Federation does not provide special conditions for opening and running a business for this category of citizens. In 2020, pensioners will be engaged in entrepreneurship on an equal basis with people of working age.

When asked whether a pensioner can open an individual entrepreneur and receive benefits, the answer is unequivocal - no. Entrepreneurship has its pros and cons.

Advantages:

- No authorized capital required.

- Preferential tax regimes are provided only for individual entrepreneurs.

- A cash register is not always needed when handling cash.

- It is not necessary to open a current account and make a seal.

- Ease of preparation and submission of tax reports.

- Unlike a legal entity, closure does not require complex procedures.

A person engaged in entrepreneurial activity at an advanced age is considered a working pensioner.

He transfers payments established by law to the Pension Fund. If a pensioner opens an individual entrepreneur, this affects the size of the pension upward. Recalculation is carried out 1 year after the pension is assigned, and subsequently every 12 months, subject to the application of the individual entrepreneur. To do this, you need to submit an application to the Pension Fund.

Flaws:

- The legislation does not provide special benefits for individual entrepreneurs to pensioners, but they are endowed with rights and responsibilities on an equal basis with other citizens.

- Reporting is submitted at the place of registration, even if the entrepreneur does not live there.

- Suspension of activities or lack of profit does not exempt from payment of taxes and contributions.

- The law establishes the liability of an individual entrepreneur for all his property, and not just for what he participates in the business.

Having assessed all the pros and cons of an individual entrepreneur, your capabilities and strengths, you can decide to open or expand your business at any age.

Opening procedure in stages

There are several stages:

- The citizen chooses the type of activity in which he will engage. It will be necessary to pay attention to the fact that the person must decide for himself what he will do. Each type has specific meanings; they are referred to as OKVED. If a person wants to engage in 2 types, then they need to enter a pair of codes. The law does not prohibit the use of a larger number of directions. However, you need to choose only what the individual entrepreneur does; you can always make adjustments.

- Choosing a tax system . You should first study all the positive and negative aspects of each option. Please understand that you will not be able to make changes until the end of the annual period. The person also takes into account that fiscal payments are constantly being made.

- Payment of state duty . Its value is 800 rubles. You can obtain a form for entering information from fiscal service employees. It is also possible to print a receipt located on the official website of the Federal Tax Service. Payment is made when contacting a banking organization.

- Preparation of a documentation package. If a person does not have a TIN or it has been lost, then they need to visit the fiscal service and get a duplicate. The process takes several days. As reports are submitted, the employee issues confirmation in writing. You can use the sending option when using the postal service.

- Receiving ready documentation . This will take five days, provided that the citizen has collected the entire package of documents and has not made any mistakes. A certificate confirming registration is issued.

- Registration with the Compulsory Medical Insurance Fund and the pension authority . Documentation is transferred there by employees of the fiscal authority. The citizen is provided with notification regarding registration. The person can also do this themselves. You need to have SNILS, INN and a certificate indicating registration of individual entrepreneur with you.

- Purchase of equipment. This applies to the area related to the sale of goods. A cash register will be required. Sometimes it is permissible to carry out this process using checks and a strict reporting form. There is no need to buy a device if a person sells magazines and newspapers, does it on the street or at a kiosk, sells securities, or provides products to educational institutions.

- An account is opened in a banking organization . However, the person makes this decision independently. This suggests that the entrepreneur may not have a current account.

At the last stage, the IP seal is prepared.

Individual entrepreneur registration procedure

Registration of an individual entrepreneur by a pensioner occurs in accordance with the generally established procedure. In this case, no preferences are provided for pensioners either. With the exception of a 50% discount when paying state fees for disabled people of the first and second groups.

The citizen submits an application of the established form to the tax authority at the place of registration, to which is attached only a passport with photocopies of all its pages and a receipt for payment of the state duty. It is not necessary to provide a pension certificate to the tax service.

Registration of an individual entrepreneur takes 3 working days. Based on its results, the applicant receives an extract from the Unified State Register of Individual Entrepreneurs with a registration entry in the name of an individual entrepreneur. Based on this record, he has the right to conduct business in any region of the country.

After receiving an extract from the register, the individual entrepreneur is registered with the Pension Fund, Rosstat, Social Insurance Fund and, if necessary, the Compulsory Medical Insurance Fund. There is no need to do this yourself, since from the moment of registration with the Federal Tax Service, information about the individual entrepreneur is automatically sent to the specified institutions.

In case of refusal to register, the tax authority notifies the citizen within 3 working days in writing. The response contains detailed reasons for the refusal and an explanation of the rights to appeal.

What benefits are provided to a pensioner if he is an individual entrepreneur?

Citizens of retirement age do not have additional benefits regarding the use of the status of an individual entrepreneur. However, in foreign countries such entities are actively supported. Including, you will be able to use benefits.

In Russia, at present, the group of persons in question does not have the opportunity to enjoy preferences. This indicates that the person goes through a similar process as all entrepreneurs.

Attention! The only advantage is that a citizen does not have to pay a fee of 800 rubles for registration actions.

Thus, the process of opening an individual entrepreneur by a pensioner has a standard expression. A person collects a certain list of acts and also does not have tax breaks.

What will happen to the pension when opening an individual entrepreneur?

In Russia, the payment of pensions to working and non-working citizens has many serious differences. If a person opens his own business, he is automatically transferred to working status. Therefore, the calculation and indexing mechanism may change. These changes concern the following aspects:

- pension indexation;

- recalculation of the IPC.

Let's look at each of them in more detail.

Indexing

On January 1, 2020, the pension amount was increased by 6.6% as a result of indexation. This change affected non-working pensioners receiving insurance payments. On average, their monthly payment increased by 1,000 rubles. Since April 1, social pensions have also increased by 6.1%.

What about those citizens who continue to work after retirement? Indexation for them was frozen back in 2016. Since then, pensions have not increased specifically due to indexation of fixed payments.

Therefore, if a pensioner decides to open an individual entrepreneur, his pension will not be indexed annually. However, upon subsequent dismissal, all indices will be applied to payments, and the person will begin to receive a pension at the level of other unemployed citizens.

Recalculation of pensions

Individual pension coefficients (IPC) are formed from insurance contributions. They directly affect the size of the pension, which consists of the amount of the fixed payment and the product of the number of individual investment complexes and their cost.

If a pensioner decides to open an individual entrepreneur, he makes insurance contributions for himself. They go to the Pension Fund and are accumulated there in the payer’s personal account. Consequently, the amount of the pension paid should also increase. But what actually happens? Indeed, such a recalculation is being made. Moreover, it has some features:

- the adjustment is carried out without a statement, i.e. the pensioner himself does not need to contact the territorial branch of the Pension Fund with a request to recalculate his pension;

- recalculation is carried out for everyone once a year - on August 1;

- the size of the pension increase directly depends on the amount of insurance premiums, and it depends on the amount of wages (i.e., the more an individual entrepreneur earns, the more his pension will increase).

By the way, the number of employees includes not only individual entrepreneurs, but also some other categories of citizens, for example, notaries and lawyers in private practice.

If a pensioner, being an individual entrepreneur, has chosen NAP as the tax regime, he can pay insurance premiums, but is not obliged. If you refuse these payments, no annual recalculation will be made due to the absence of insurance contributions. Although in this case it is more logical not to open an individual entrepreneur at all, but to simply work as a self-employed person.

Mandatory taxes for individual entrepreneur pensioners

There is the following group of taxes that are paid by any entrepreneur, regardless of his age:

- Insurance tax transferred to the tax service, which is paid for oneself, as well as if the individual entrepreneur has employees hired on the basis of an employment agreement or civil contract. The amount of this payment is approximately 23,000 rubles. If the income received exceeds 300,000 rubles, the amount increases. If there are employees, 13% of their earnings are transferred;

- Contribution to the Compulsory Medical Insurance Fund. Approximately 4,000 rubles;

- VAT in the amount of 18% of the amount (paid when renting premises, purchasing goods or equipment for commercial activities).