Payment of personal income tax for individual entrepreneurs using the simplified tax system without employees

Does individual entrepreneur pay personal income tax using the simplified tax system? If an individual entrepreneur receives funds from those types of activities that are reflected in the Unified State Register of Individual Entrepreneurs, he does not pay this tax to the budget, since the application of the simplified tax system implies an exemption from personal income tax on income received from business activities (with the exception of income from dividends and income subject to personal income tax under rates 35 and 9%). Basis - clause 3 of Art. 346.11 Tax Code of the Russian Federation.

If an individual entrepreneur receives income not related to business activities, his income is taxed at a rate of 13% in the same way as the income of any individual. At the same time, an individual entrepreneur can reduce his income by using the right to a tax deduction.

If an individual entrepreneur on the simplified tax system does not use hired workers in his activities, then the personal income tax of the tax agent is not paid to him

Personal income tax for yourself

Should an individual entrepreneur pay personal income tax for himself under the simplified tax system? As previously mentioned, the simplified tax system exempts from payment of personal income tax on income received from the main and additional areas of business, if they were recorded during registration. However, there are exceptions under which personal income tax for individual entrepreneurs on the simplified tax system, who do not have employees, is required to be paid.

Individual entrepreneurs must pay personal income tax to the simplified tax system in 2020, despite the fact that the activity is carried out without employees, in the following cases:

- upon receipt of winnings in competitions organized by manufacturers and trade organizations to promote products, over 4,000 rubles;

- when applying for loans from financial companies. The rate is 2/3 of the refinancing rate and the interest rate under the agreement, the difference between 9% and the actual rate for loans in foreign currency;

- when deriving income from activities not specified during registration, as well as from dividends and foreign currency deposits.

The income tax of individual entrepreneurs in such cases is calculated at 13%, however, a higher rate can also be used, for example, if you win the lottery, the individual entrepreneur will have to pay 35%. In the above cases, the entrepreneur must report on the income received by submitting a declaration in form 3-NDFL.

When an individual entrepreneur’s income for the year exceeds the standard of 300 thousand rubles, it is necessary to additionally pay 1% of the difference between the actual and standard volume.

When do you need to pay personal income tax for individual entrepreneurs using the simplified tax system?

An individual entrepreneur using the simplified tax system is required to pay personal income tax if he receives:

- Prizes from participation in a promotion carried out by product manufacturers or commercial enterprises. The accrual condition is winnings over 4 thousand rubles (clause 2 of article 224 and clause 28 of article 217 of the Tax Code of the Russian Federation).

- Material benefits from interest savings. The income on which tax will be paid is calculated based on the difference of 2/3 of the refinancing rate and the amount of interest specified in the agreement. If the loan is received in foreign currency, income is calculated based on 9% per annum minus the interest specified in the agreement (clause 2 of Article 212, 224 of the Tax Code of the Russian Federation).

- Interest on deposits in rubles and foreign currency. For interest received in rubles, non-taxable income will be calculated based on the refinancing rate of the Central Bank of the Russian Federation + 5%. If interest is received in foreign currency, non-taxable income is calculated based on 9% per annum (Article 224 of the Tax Code of the Russian Federation).

- Dividends from activities in third-party organizations (Article 275 of the Tax Code of the Russian Federation).

- Income not related to business activities: gifts, lottery winnings, from the sale of one’s own property, royalties, income from which the tax agent did not withhold tax (Article 228 of the Tax Code of the Russian Federation).

When hiring employees or attracting individuals under civil contracts, the individual entrepreneur is obliged to transfer personal income tax to the budget from the employees’ earnings as a tax agent (clause 6 of article 226 of the Tax Code of the Russian Federation).

FAQ

Where to transfer personal income tax?

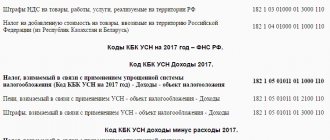

The question of where to transfer personal income tax arises, as a rule, only for beginning entrepreneurs. Personal income tax payment details remained unchanged in 2020. However, please note that if you change your legal address, then the details of the treasury to whose address the payment is made have also changed.

Please also note that when paying personal income tax, the payment purpose must indicate the payment period.

When to pay personal income tax?

Payment deadlines are determined as follows:

- for hired employees - payment is made by the employer no later than the next day after payment of income to the employee, taking into account the requirements of Article 226 of the Tax Code of the Russian Federation;

- for individual entrepreneurs and self-employed persons - payment is made in three advance payments during the year and payment before July 15 of the following year.

I have overpaid personal income tax, what should I do?

As a result of an error, a change in taxpayer status, or changes in legislation, an overpayment of personal income tax to the budget may occur. If such a situation arises, funds may be returned.

To what budget is personal income tax paid?

Personal income tax is federal. However, the majority - 70% - is transferred to the budget of the constituent entity of the Russian Federation.

Back to contents

Methods of paying personal income tax by individual entrepreneurs

Individual entrepreneurs on OSNO must necessarily pay personal income tax on the income received.

Step-by-step instructions for calculating and paying personal income tax by entrepreneurs on OSNO were developed by ConsultantPlus experts. Get a free trial access to K+ and watch the action guide.

Personal income tax must be paid in two ways:

- Advance payments, which from 2020 are calculated in a new way: from actually received (and not planned, as before) income and are transferred within the following terms:

- until April 25 - for the 1st quarter (until 04/27/2020 - taking into account the transfer from the weekend). Due to non-working days from March 30 to May 11, 2020, the deadline for paying the advance payment has been postponed;

- before July 25 - six months (until July 27, 2020);

- until October 25 - for the 3rd quarter (until October 26, 2020).

- After submitting the declaration to the Federal Tax Service, you must either pay additional tax or return the overpaid funds from the budget (offset for the future).

If the advance payment was transferred with a delay, penalties will be charged for the debt that arose for this reason (Article 75 of the Tax Code of the Russian Federation).

Tax adjustment and transfer

After calculating personal income tax and generating a declaration, you must either pay extra or return the tax from the budget (offset).

IMPORTANT! Starting from 2020, individual entrepreneurs do not submit a declaration in form 4-NDFL. Read about the presentation of 4-NDFL here.

At the end of the year, individual entrepreneurs submit a 3-NDFL declaration to their Federal Tax Service by April 30. In connection with the introduction of a non-working days regime from March 30 to April 30, 2020, the deadline for submitting 3-NDFL for 2020 was extended until 07/30/2020 (see Government Decree dated 04/02/2020 No. 409).

Read about filling out an individual entrepreneur's tax return here.

As for the individual entrepreneur who hires employees, he is an agent and must deduct tax from their salaries. The timing of tax payment depends on the type of income paid. Personal income tax from sick leave and vacation pay is transferred no later than the last day of the month in which they are paid, from wages and bonuses - no later than the day following the day of their payment (Clause 6 of Article 226 of the Tax Code of the Russian Federation).

We also draw your attention to the fact that individual entrepreneurs have the opportunity to use the right to deductions in relation to income that is subject to personal income tax at a rate of 13% (clause 3 of Article 210 of the Tax Code of the Russian Federation):

- standard (Article 218 of the Tax Code of the Russian Federation);

- social (Article 219 of the Tax Code of the Russian Federation);

- investment (Article 219.1 of the Tax Code of the Russian Federation);

- property (Article 220 of the Tax Code of the Russian Federation), except for deductions related to the sale of real estate and/or vehicles that were used in business activities (subclause 4, paragraph 2, Article 220 of the Tax Code of the Russian Federation);

- professional tax deductions (Article 221 of the Tax Code of the Russian Federation);

- in the form of losses from transactions with securities and transactions with financial instruments of futures transactions carried forward to the future (Article 220.1 of the Tax Code of the Russian Federation);

- in the form of losses from participation in an investment partnership as a result of their transfer to future periods (Article 220.2 of the Tax Code of the Russian Federation).

Advance payments

Such payments are made based on notifications from the tax organization. When calculating advance payments, service employees take into account the income indicated in the 4-NFDL declaration (in the case of the first year of work) or 3-NFDL (for the previous annual period).

Since 2020, a new form 3-NDFL has been in effect (order of the Federal Tax Service dated October 25, 2017 No. ММВ-7-11/ [email protected] ).

Sequence of payment of advances on personal income tax:

- January – June – you need to pay 50%;

- July – September – 25% is paid;

- October – December – the remaining 25%.

Starting from the second year of work, employees of a tax organization carry out professional tax deductions of advance payments based on the income that the individual entrepreneur received for the previous year.

We recommend you study! Follow the link:

What is Form 3 Personal Income Tax for individual entrepreneurs and what sheets must be submitted for a zero declaration

If the entrepreneur has not received a notification, there is no need to independently calculate the amount of payments and pay personal income tax. Failure to pay the advance payment does not entail the application of penalties to the businessman.

It is worth considering an example of calculating tax advances.

One year has passed since IE Kuznetsov started his business. Income for the first quarter was 150,000. Next, he fills out form No. 4, indicating the hypothetical amount of profit for one year. Let the profit for 365 days be 500,000. The conclusion follows: Federal Tax Service employees use this amount when calculating the advance payment. 500,000 x 13% = 65,000, as a result, for the first half of the year you need to pay 65,000: 2 = 32,500. At the end of the year, personal income tax goes to the budget. Advance payments must be made throughout this year. Tax officials determine the amount based on the data provided by the entrepreneur in the fourth personal income tax form.

Do individual entrepreneurs pay personal income tax while on UTII, PSN and Unified Agricultural Tax?

Payment by an entrepreneur of UTII exempts him from paying personal income tax only in relation to income received from activities subject to UTII (clause 4 of Article 346.26 of the Tax Code of the Russian Federation).

If the “imputed” person receives income from activities for which the entrepreneur is not registered as a UTII payer, then personal income tax is paid on such income.

An individual entrepreneur using the patent system does not pay personal income tax on income from those types of activities for which a patent has been obtained. If in his activities he uses those types of activities that do not fall under the PSN, he must pay personal income tax on income from these types of activities and submit a 3-NDFL declaration to the tax authorities.

Individual entrepreneurs who are agricultural producers and pay the unified agricultural tax are exempt from personal income tax in terms of income received from business activities (clause 3 of article 346.1 of the Tax Code of the Russian Federation). However, there is an exception for certain income. Thus, an individual entrepreneur on the Unified Agricultural Tax pays personal income tax on income from dividends and income subject to personal income tax at a rate of 35 and 9%.

If an individual entrepreneur on UTII, Unified National Social Economy or PSN uses the labor of employees in his activities, he has the obligation to withhold tax from their wages. It is paid at the place of registration of the individual entrepreneur. Before April 1 of the next year, it is necessary to submit information to the Federal Tax Service on income paid to employees and withheld tax in Form 2 of Personal Income Tax, and quarterly reporting in Form 6-NDFL.

Results

If an individual entrepreneur pays income to employees or attracts individuals under civil contracts, then, regardless of the taxation system applied, he performs the duties of a tax agent, which means he is obliged to withhold and pay personal income tax on income paid, submit reports in form 2-NDFL and 6 -NDFL.

Under OSNO, the income of individual entrepreneurs is subject to personal income tax, and the obligation arises to pay advance payments and submit a 3-personal income tax declaration.

When applying special regimes, individual entrepreneurs are exempt from paying personal income tax on income received from business activities. But it is important to take into account that in the application of one or another special regime there are nuances and exceptions in which the payment of personal income tax becomes mandatory.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.