Closing an individual entrepreneur: what is needed for this

Sometimes a situation arises when an entrepreneur decides to close his individual entrepreneur. The reasons for this can be completely different. Maybe the business, as they say, “didn’t take off”, maybe the profit is small, but you have to transfer a fairly significant amount to the budget, or the decision was simply made not to do business anymore and to work for hire.

Regardless of the reasons, closure always follows the same pattern. In addition, the closing procedure can be carried out in two ways:

- Conduct the closing yourself. The procedure is simple; after completing the activity, you need to collect a set of documents and submit them to the tax authority. This method is not expensive, however, it will require time to prepare documents.

- Involve a specialized company in the closing procedure. For those who want to save their time or are afraid of making mistakes in documents, closing with the help of specialists in this matter is suitable. The method requires the entrepreneur to make material investments as payment for the service

In order to close an individual entrepreneur, you need to provide only two documents to the tax authority:

- Application on form P26001

- Receipt for payment of state duty in the amount of 160 rubles

The application form and receipt can be downloaded from the tax office website. Recommendations for filling out the application can also be found on the Internet. You can attach a photocopy of your passport to these documents, since some inspections require it.

Individual entrepreneur insurance premiums: what are they?

An entrepreneur can work alone or hire workers to perform work or services.

If an entrepreneur works alone, he must transfer contributions to the budget “for himself.” Contributions are made for pension and health insurance, so an entrepreneur can use free healthcare services and in the future will be able to receive a pension on an equal basis with other citizens.

There is no provision for deduction of contributions in case of disability and accidents. If an entrepreneur wants to receive sick leave benefits, he can voluntarily begin to transfer amounts to the budget. To do this, you need to contact the FSS.

If an entrepreneur uses hired labor, then in addition to fixed contributions, you will also have to transfer contributions for employees. In total, they amount to 30% of wages plus contributions from accidents to the Social Insurance Fund.

Calculation of contributions if a full calendar year has been worked

When closing an individual entrepreneur, the main point is how much time the entrepreneur worked during the year. If a full calendar year has been worked, then no difficulties arise.

Currently, the amount of contributions to the budget is regulated by law and is determined by Article 430 of the Tax Code of the Russian Federation.

The Code establishes that for 2020 the amount of contributions will be:

- For pension insurance 29354 rubles

- For medical insurance 6884 rubles

If an entrepreneur worked for a full year and closed on the last day of the year, then these are the amounts that need to be transferred to the budget.

But this is ideal; usually it doesn’t work out that way and the closure occurs within a year.

Calculation of contributions if not a full calendar year has been worked

In order to calculate the amount of contributions, you need to know the closing date of the individual entrepreneur. Closing can occur at any date during the year.

In order to calculate the amount payable, you need to find out how many full months the entrepreneur worked and add to this amount the days from the incomplete months of work. It is worth remembering that the date of termination of the individual entrepreneur’s activities is not taken into account . Let's give an example.

The entrepreneur registered on January 15, 2020, and on April 20, 2020, terminated the IP. It turns out that only 2 months were fully worked. In January 17 days were worked, in April 19 days. Thus, the contribution amounts will be as follows:

| Type of contribution | Calculation of the contribution amount |

| Pension provision | (29345/12)*2+(2446,17/31)*17+(2446,17/30)*19=7783,03 |

| Health insurance | (6884/12)*2+(573,67/31)*17+(573,67/30)*19=1825,25 |

This is how the calculation for the time spent working during the year will look like.

In addition, you must take into account the amount of income received. If they exceed the amount of 300,000 rubles, then they will have to pay 1% of the excess amount.

It should be noted here that to simplify the life of entrepreneurs, you can find many online calculators on the Internet that will allow you to accurately and quickly calculate the amount to transfer to the budget. You must enter information about the start and end dates of activities, as well as the amount of income received during the period.

Fixed contributions of individual entrepreneurs to the Pension Fund

In addition to taxes to the budget, all entrepreneurs, regardless of the presence of activity and income in the current year, are required to transfer fixed contributions to the Pension Fund. For businessmen whose income does not exceed 300,000 rubles. per year, contributions are paid in a fixed amount. To calculate them, you need to know the minimum wage at the beginning of the year.

To determine the amount of pension contributions to be paid, you need a minimum wage * rate of 26% * number of months. So, in 2020, pension contributions will be paid in the amount of 23,400 rubles. (7500*26%*12). Health insurance premiums are paid in the same way, but at a rate of 5.1%. In 2020 it is 4590 rubles.

With income over 300,000 rubles. you need to pay an additional 1% of the excess amount to the Pension Fund (this payment is not received by the Federal Compulsory Medical Insurance Fund). For example, if you earn 500,000 rubles. The individual entrepreneur must transfer 2000 rubles. ((500000-300000)*1%) in addition to the fixed payment.

Individual entrepreneurs may also find the online service from the Pension Fund useful. It allows you to calculate the amount of fixed contributions for yourself for an incomplete period, which can be useful for individual entrepreneurs who opened their business in the middle of the year or decided to close it.

Here you must indicate the start and end date of work in the current year, as well as the income received at the end of the year (according to the declaration and in total from combining several modes). The amount received for payment to the Pension Fund will be automatically recorded in the payment receipt.

Insurance premiums for employees

With the amount of contributions for employees, everything is much simpler. Usually, by the time of closing, employees have been fired and all payments have been made to them. As for insurance premiums, they are paid last for the month in which the employees were dismissed. In this case, there is no need to specifically calculate the amount; the amount of contributions for employees depends only on their salaries.

If an entrepreneur pays two types of fixed contributions, then employees will have to pay contributions for pension and health insurance, in case of illness and accident. In total, 30% of the wage fund must be paid to the budget and a percentage to the Social Insurance Fund.

Calculation of insurance premiums in 2020 - example

To determine the total amount for ESSS in terms of pension, social and health insurance, you first need to perform a calculation for each month separately. Then, to calculate the total tax base for the period, you need to sum up the data received. The information applies to employers-legal entities that do not apply reduced rates/benefits.

Insurance premiums in 2020, rates table in FFOMS

Example of calculating insurance premiums

Initial data:

- Number of employees – 5 people.

- Reporting period – 1st quarter. 2020

- Tax regime – OSN.

- The ESSS tariff is the basic one.

- Employee income is shown by month.

| Calendar month | Taxable base – employee income | Amounts of accruals in the ESSS, in rubles. (thirty %) | ||

| OPS, at a rate of 22% | Compulsory medical insurance, at a rate of 5.1% | SS in terms of VNiM, at a rate of 2.9% | ||

| 01.17 | 75 000,00 | 16 500,00 | 3 825,00 | 2 175,00 |

| 02.17 | 90 000,00 | 19 800,00 | 4 590,00 | 2 610,00 |

| 03.17 | 105 000,00 | 23 100,00 | 5 355,00 | 3 045,00 |

| Total for the period | 270 000,00 | 59 400,00 | 13 770,00 | 7 830,00 |

Contributions are calculated and paid to the Federal Tax Service in rubles and kopecks. The payment deadline is the 15th day of the month following the reporting month (stat. 431 clause 3 of the Tax Code). Excess amounts transferred to the budget are also dealt with by the tax authorities after confirmation of the right to a refund.

Deadlines for transferring insurance premiums

There is a generally established deadline for transferring such payments to the budget. Employee contributions are paid by the 15th of the following month. That is, for example, amounts for March must be transferred before April 15.

The entrepreneur’s contributions must be transferred to the budget before the end of the calendar year, then the last day of the year is the deadline for transferring such payments. An entrepreneur can transfer these amounts throughout the year in installments. This procedure allows, for example, to reduce the amount of tax under the simplified tax system.

If an entrepreneur is obliged to pay 1% of the amount of excess income, then this must be done before July 1.

In case of completion of his activities and deregistration, the entrepreneur transfers the amount of contributions within 15 calendar days after the official termination of activities recorded in the Federal Tax Service.

How to calculate insurance premiums in 2020

The main regulatory documents are Law No. 243-FZ of July 3, 2016, Law No. 250-FZ of July 3, 2016. Regulatory provisions affected the Tax Code, Laws No. 212-FZ, 24-FZ, 255-FZ, 125-FZ Federal Law.

Many changes for policyholders regarding the payment of contributions to the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance have been introduced since the new year. The basis for determining the amount of taxes, subtypes of excluded amounts, tariff rates and benefits for certain categories of taxpayers remained the same. The new rules affected, first of all, the reclassification of contributions to tax payments, the composition of reporting, and fines. How to calculate the amount of insurance premiums is described below, but you need to keep in mind that the ESS is paid from the funds of enterprises and is not deducted from the income of employees.

Severance pay insurance premiums

How to calculate the amount of insurance premiums - regulatory changes:

- Daily allowances are exempt from taxation up to 700 rubles. for business trips within the Russian Federation, 2500 rubles. – on foreign business trips (stat. 422 Tax Code, paragraph 2).

- Taxation of income in kind is carried out on the basis of market prices (stat. 105.3 of the Tax Code), without excluding VAT (stat. 421, clause 7 of the Tax Code).

- The accrual of income to employees of separate divisions is carried out by branches independently at their location (stat. 431, clause 11 of the Tax Code). The rule applies to units formed after January 1. 2020

- Calculation of contributions to the Pension Fund for individual entrepreneurs - provides for receipt of income over 300 thousand rubles. accrual of 1% on the excess amount.

Note! According to the old rules, contributions to the Pension Fund, Social Insurance Fund, and Compulsory Medical Insurance are calculated. “Injuries” are determined taking into account the full amount of daily allowance; income in kind is accepted not at the contract value/prices, but at market prices.

Where should insurance premiums be transferred?

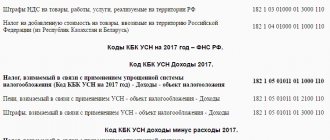

Since 2020, the legislation in the field of insurance premiums has changed dramatically. From this time on, all types of contributions, except for contributions from the National Tax Service and the Pension Fund, are transferred to the tax office, and reports on them are also submitted there. Therefore, contributions, both fixed for the entrepreneur himself and for employees, are paid to the tax authority in accordance with the BCC assigned to them.

The same 4FSS report is currently being submitted to the social insurance fund, only in a truncated form. The report now reflects information relating exclusively to accident contributions. In addition, the fund accumulates the amounts of such contributions in its accounts.

As we can see, the entrepreneur pays insurance premiums in any case, regardless of whether the individual entrepreneur has employees or not, or whether there was income during the reporting period. Even if no activity was carried out, insurance premiums will have to be paid in a fixed amount. If the entrepreneur has worked for a full year, then there are no problems with calculating the amount of contributions. In the case where the year is not fully worked, you will have to calculate the amount based on the number of full months of work and the sum of days in incomplete months. By and large, there is nothing complicated in the calculation; you just need to approach this issue carefully.

Examples of calculating social contributions in 2020 from salary (employee income)

End of advertisement

Note, an employee’s income is not the same as “salary,” but the main component of an employee’s income is salary.

Example of CO calculation

:

- from an employee’s income

of 60,000 tenge

CO

= (60,000 - 6,000_opv) * 0.035 = 1,890 tenge; - employee income 80,000 tenge CO

= (80,000 - 8,000_opv) * 0.035 = 2,520 tenge; - employee income (conditionally - salary) in 1 minimum wage (in 2020 - 42500 tenge) SO

= (42500 * 0.035 = 1487.5 = 1488 (tiyns are always rounded up). - employee income is 30,000 tenge. This often happens if the employee works part-time. CO

= 42500 * 0.035 = 1487.5 - 1488 tenge; - the employee’s income is 340,000 tenge, the salary is more than the maximum object for calculating the CO in 7 minimum wages (see above), i.e. instead of calculating CO with 340,000 tenge, you should calculate with 7 monthly wages (in 2020 it is 297,500), CO = 297,500 * 0.035 = 10412.4 = 10,413 tenge (tiyns are always rounded up).

For individual entrepreneurs “for themselves”.

Individual entrepreneurs, no matter according to the generally established procedure or a simplified procedure, are required to pay social contributions not only for the employee but also “for themselves” (in their own favor).

Calculating CO for individual entrepreneurs for yourself is not difficult. Individual entrepreneurs themselves choose from what amount to pay social contributions ranging from 3.5% * 1 minimum wage to 3.5% * 7 minimum wage and no more than the actual income (the one on which you pay income tax).

Anticipating the question, if an individual entrepreneur is a pensioner, then he does not need to pay SB, since pensioners are not participants in the social insurance system (Article 7 of the SB Law)

Also, an individual entrepreneur does not need to pay CO if there was no income in the corresponding month.

Clause 1 of Article 14 of the law “on compulsory social insurance in the Republic of Kazakhstan" (hereinafter referred to as the "law"). Social contribution rate

1. Social contributions payable by payers to the fund for participants in the compulsory social insurance system and (or) in their own favor are established in the amount of 3.5 percent of the object of calculation of social contributions, from January 1, 2025 - 5 percent of the object of calculation of social contributions .

[collapse]

Clause 2 of Art. 15 of the law. Object of calculation of social contributions

2. The object of calculation of social contributions for persons engaged in private practice, individual entrepreneurs, including peasant or farm enterprises, are:

for themselves - the amount of income received, determined by them independently for the purposes of calculating social contributions in their favor, but not more than income determined for tax purposes in accordance with the Code of the Republic of Kazakhstan “On taxes and other obligatory payments to the budget” (Tax Code);

for hired workers - expenses paid to the employee in the form of income as wages, with the exception of income from which social contributions are not paid to the fund.

[collapse]

As a rule, entrepreneurs, in order to save money, choose the minimum possible size of SB - 3.5% of 1 minimum wage

- Minimum amount of CO for individual entrepreneurs in 2020 = 3.5% of 1 minimum wage = 1488 tenge (42500 * 0.035)

- Maximum amount of CO for individual entrepreneurs in 2020 = 3.5% of 7 minimum wages = 10413 tenge (297500 * 0.035)