What is an online service from the Federal Tax Service?

The Federal Tax Service invites all interested taxpayers - individuals, individual entrepreneurs, legal entities - to use the online service, which is available at https://service.nalog.ru/payment/index.html.

It allows you to generate a payment order or payment document (we will look at the differences between them in more detail later) for the payment of a tax, contribution or fee. Read about what a payment order is in our article.

Subsequently, the payment can be:

- Print and present at the bank or use as a sample for filling out a payment order in the online banking system or in a specialized payment system.

- Submit in the established format directly to the interface of the online banking system in order to make a payment using it already on the bank’s website. This function of the online service from the Federal Tax Service is available only to individuals and individual entrepreneurs and only if the taxpayer has the opportunity to indicate his TIN in the payment.

Thus, the Federal Tax Service acts as an intermediary between the taxpayer and specialized payment organizations.

Why use the online service from the tax office?

The main function of the Federal Tax Service online service - generating a ready-made payment order for a tax or contribution - is useful simply because in many cases it is not included in the range of standard functions of online banking systems. And if payment of premiums is available only through an offline bank office, then it is extremely unlikely that bank specialists will show an uncontrollable desire to prepare a payment slip for the policyholder. If only because its preparation requires quite a lot of initial data, sometimes completely unknown not only to bank employees, but also to the taxpayer himself.

In turn, the online service on the Federal Tax Service website allows, firstly, to find out a significant part of the necessary information, and secondly, to integrate it into the structure of the payment order as required by established banking standards.

Let's take a closer look at what information may be available to the payer when creating a receipt for payment of insurance premiums online (and what information he will have to provide independently).

Deadlines for paying contributions “for yourself”

The deadline for payment of fixed individual entrepreneur contributions is no later than December 31 of the current year. That is, contributions for 2020 must be paid no later than December 31, 2020.

As for additional contributions from excess income in the amount of 300,000 rubles, then according to clause 2 of Art. 432 of the Tax Code of the Russian Federation, such contributions are paid before July 1 of the year following the reporting year. That is, contributions for 2020 must be paid no later than July 1, 2020.

Next, we will consider some features of calculating and paying insurance premiums for individual entrepreneurs “for themselves” in 2020.

Generating a receipt for payment of contributions online: we receive and apply useful information

First of all, you can find out:

- Federal Tax Service Code, OKTMO.

To do this, go to the start page of the online service from the Federal Tax Service:

- select the type of taxpayer (for example, individual entrepreneur);

- indicate the type of payment (“Payment of taxes, insurance premiums”);

- select the payment affiliation (“Payment for yourself”);

- select a payment method (“Filling out all payment details of the document”);

- type of payment document (for example, “Payment document”).

Next, the service provides the ability to determine the IFTS and OKTMO codes by address. To do this you need:

- Click the checkbox on the “Detect by address” button;

- enter the legal address in a special form.

After this, the IFTS and OKTMO codes will appear automatically. For example, the address st. Tverskaya, 3, in Moscow correspond to the IFTS code 7710 and OKTMO 45382000.

- Correct KBK.

To do this, after performing the operations according to step 1, indicate:

- type and name of payment (for example, “Insurance contributions for compulsory medical insurance in a fixed amount”);

- type of payment (“Insurance premiums from January 1, 2020”, then we will study in more detail the nuances of determining the type of payment).

After this, the current BCC will automatically be displayed in the corresponding field. The remaining information for filling out the form, however, must be known to the taxpayer himself. So, after clicking the “Next” button after completing the operations in step 2, you must specify:

- status of the person (if this is an individual entrepreneur, then code 09 is indicated);

- basis for payment (for example, TP - for current payments without debt);

- tax period (for fixed contributions - annual payments);

- the year for which the contribution is paid;

- payment amount.

A little later we will look in more detail at where to get the relevant information. But for now, let’s take into account that after clicking the “Next” button, you will need to indicate the taxpayer’s full name, tax identification number, and residential address (if the policyholder is an individual entrepreneur).

After clicking “Next” the “Pay” button will appear.

By clicking on it, you can select the payment method - cash or non-cash (the second is available only if the taxpayer’s INN is indicated in the previous window).

Which method of paying insurance premiums on the tax website is preferable?

How the calculator works

Since 2020, the calculator for calculations is based on Article 430 of the Tax Code of the Russian Federation and in fact the calculation formula can be written as follows:

Svzn = Rfix / 12 x Nmonth, where:

- Svzn – amount of insurance premium payable;

- Rfix – a fixed amount of a specific insurance contribution (to the Pension Fund of the Russian Federation or to the Federal Compulsory Compulsory Medical Insurance Fund);

- Nmonth – the number of months for which the contribution is paid (after all, the business may not have been started from the beginning of the year or only part of the payment needs to be calculated).

Until 2020, the calculator uses the formula established by Article 14 of Federal Law No. 212-FZ to calculate insurance premiums:

Свзн = minimum wage x Рtar x Nmonth, where:

- Svzn – amount of insurance premium payable;

- Minimum wage – the minimum wage value adopted by the state for the reporting year;

- Rtar – the rate of a specific insurance premium (in the Pension Fund of the Russian Federation - 26% or in the Federal Compulsory Medical Insurance Fund - 5.1%);

- Nmonth – the number of months for which the contribution is paid.

If you need to calculate an additional contribution amount for an individual entrepreneur with more than 300 thousand annual income, then the Pension Fund should receive an additional 1% on the amount exceeding the limit.

Cash or non-cash payment

To pay in cash, you need to select the appropriate option and click “Generate payment document.” Then download it and present it to the bank's cash desk when paying. Or use it as a sample for filling out a payment document form in the Bank-Client system (but for this method of paying a fee, it is more convenient to use the classic payment order form, which we will discuss later).

For non-cash payment, you should select the desired option “Through the website of a credit organization”, then a financial institution (in which the taxpayer has an account in the Bank-Client system) or a third-party payment system convenient for the payer.

Recently, the service has implemented the function of paying via bank card directly on the Federal Tax Service website. The payment is made using the PAYMENT SERVICES.RF service.

After choosing this payment method, you must agree to the processing of personal data. Next, you will be redirected to the website https://oplatagosuslug.ru, a form for payment by bank card will appear, where you need to enter its details and make the payment.

Non-cash payment is available, as we already know, only to an individual or individual entrepreneur who has indicated his TIN in the online form on the Federal Tax Service website. If the TIN is not specified or if the taxpayer is a legal entity, you will have to pay in cash through the bank’s cash desk (or through “Bank-Client” using a payment order from the Federal Tax Service website as a sample).

To do this, you will need to fill out a payment document for the payment of insurance premiums that corresponds to the established formats. We are talking about a standard bank payment.

Pay insurance premiums for individual entrepreneurs on the tax website

It’s not that difficult to pay insurance premiums for individual entrepreneurs on the tax office’s website or print out a receipt to pay using bank details or through a bank cash desk. However, many people still have problems paying insurance premiums. In this article we will look at two points:

- payment directly on the tax website,

- receiving a receipt for self-payment at the bank in cash or from a current account.

In order to pay insurance premiums, we need to know:

- Full name of the payer

- Payer's address

- Payer's TIN

- KBC contributions

- Amount of contributions

- Tax office code

- OKTMO

So, let's begin.

The first time the application may ask you to consent to data processing, just check the box and click Continue.

Click and in the window that opens, select “Individual entrepreneurs”

Then select “Payment of taxes, insurance premiums”

Click and in the window that opens, select “Pay for yourself”

Next, if you already have a receipt, then you can enter its index and pay insurance premiums for individual entrepreneurs on the tax website. We are considering the option when we generate a receipt ourselves, so we select “Filling in all payment details of the document”

After that, select the type of payment document - check the “Payment document” box and click Next.

Entering the required details

Then fill in the details of the payee: the Federal Tax Service code where the insurance premium is paid. If you don’t remember, look at the Certificate of Registration with the tax authority, which you received when you registered your individual entrepreneur. And OKTMO - you can select this 7-digit number from the list (if you remember it) or enter your address below, and you will find out OKTMO.

So, if we want to pay insurance premiums for individual entrepreneurs on the tax office website, we need to be more careful - we need to fill out the KBK. This raises the question of where to get it. For example, when calculating on an insurance premium calculator .

You can also determine the BCC at the time of generating the receipt, select “Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of an insurance pension”, if you pay OPS or “Insurance contributions for compulsory health insurance of the working population in a fixed amount” the amount credited to the budget of the Federal Compulsory Health Insurance Fund”, if compulsory medical insurance, or those contributions that you are going to pay.

After this, the KBK will be displayed automatically.

The type of payment in our case is “Insurance premiums”, and the period is “Payment for billing periods starting from January 1, 2017.

Next, fill in the details. Select Individual Entrepreneur, current payments, year, enter the amount.

Then enter the last name, first name, patronymic, payer’s address, click Next

Now you can view all the information you filled in and proceed with the payment process or printing a receipt.

Payment of insurance premiums for individual entrepreneurs on the website

Click Pay.

And we get to a page where we can choose a payment method. If you select “Through the credit institution’s website,” you will be taken to your bank’s online system.

By choosing “Bank card”, you pay through State Services by entering your card details.

If you want to generate a receipt in order to see all the details and be able to pay from a current account or through a cash desk at a bank, then select “Generate receipt”.

Please note that the receipt will open in .pdf format. You can print it or save it to your computer.

Take the printed receipt to the bank or scan the QR code in Sberbank Online and pay.

Don't forget to save your payment information.

Paying insurance premiums for individual entrepreneurs on the tax website, as can be seen from the article, is not difficult. A little patience and attention.

Read about when it is more profitable to pay insurance premiums in this article . If you are interested in everything about individual entrepreneur reporting, look here .

How to apply a payment order on the Federal Tax Service website

So, in order to generate a payment slip for the payment of insurance premiums using the online service in question from the Federal Tax Service, you need to:

- Having chosen the type of taxpayer, mark on the page that a payment order will be drawn up. If the taxpayer is a legal entity, such a choice will not be needed, since the alternative, a payment document, is available only to individuals and individual entrepreneurs. The fundamental difference between a payment document and a payment order is the greater versatility of the first: it can either be presented to the bank after printing, or used in the established format to pay fees online. However, a payment order is a more standardized document. It must comply with the requirements established by the Bank of Russia Regulation No. 383-P dated June 19, 2012.

- Consistently enter all the required data on the online service page. After entering all the data, the “Generate payment order” button will appear on the screen. After clicking it, the document will automatically appear on the screen. It can be printed immediately or downloaded to your computer in PDF format.

You can make a payment:

- take it to the bank and deposit funds into a current account opened in this bank through the cash register;

- use as a sample for filling out an online payment in the Bank-Client system (or in an electronic payment system that supports payment of payments to the budget).

All the necessary details will be filled in on it - and this is the convenience of the service from the Federal Tax Service.

Generating a receipt for payment of insurance premiums on the Federal Tax Service website is characterized by the fact that the service provides a significant part of the information automatically. But the taxpayer, as noted above, still needs to enter (indicate) some data independently, without prompting from the service. This information includes the type of payment.

Formation of a payment order

The transfer of mandatory payments is made directly through the Federal Tax Service “Pay taxes” service.

Thanks to this, the transaction occurs in the shortest possible time and is not subject to additional commission fees. The instructions for using the service are simple. First, you need to go from the main page of the official website of the Federal Tax Service to the section for individual entrepreneurs.

After this, a menu will open consisting of 3 items:

- payment of state duty;

- filling out a payment order;

- payment of trade tax.

Then, by pressing the button of the same name, they proceed to filling out the payment order. The subject of taxation is indicated as an “Individual Entrepreneur”. From the menu of payment forms, select “Payment document” and go to the next section.

We recommend you study! Follow the link:

Latest data on the taxation system for individual entrepreneurs

The process of processing a payment order depends on what system the organization uses.

For example, to pay online tax for an individual entrepreneur who has chosen UTII, you need to perform the following operations:

- indicate the type of payment (Unified tax on imputed income for certain types of activities);

- identify the tax to be repaid (check the box next to “Identify by address”, enter the legal address of the individual entrepreneur and select the Federal Tax Service code);

- select the basis for payment (for non-overdue fees this is TP - current period);

- specify the tax period;

- enter the transfer amount;

- enter personal information about the taxpayer (identification number, registered address at place of residence and full name).

The budget classification encoding (BCC) is automatically specified in the required field. For this purpose, the type of payment is specified. It is not recommended to drive it in manually, as this is fraught with error.

Payment of taxes for individual entrepreneurs on the Federal Tax Service website is made in cash or non-cash format (the type of repayment is selected by the user). In the first case, the system-generated receipt is printed and paid at any financial institution. Cashless payments are made through government services or partner banks by debiting funds from the taxpayer’s account.

Create a receipt on the Federal Tax Service website: how to choose the type of payment

The payment form for payment of contributions provides for the following types of payment:

- Basic payment.

- Peni.

- Interest.

- Fines.

However, most insurance premiums are divided into those that are paid for periods:

- until 01/01/2017 (here we are talking about arrears);

- after 01/01/2017.

Important! Despite the fact that until 2020, the authority to collect the bulk of contributions was assigned to state funds, repayment of debts for the corresponding periods is carried out according to the BCC and the details of the Federal Tax Service.

This applies to all 4 specified payment types.

Please note that contributions for injuries are paid directly to the Social Insurance Fund. The formation of payments for them using the online service in question from the Federal Tax Service is not provided. The same applies to voluntary contributions to the Social Insurance Fund for individual entrepreneurs.

Even if you enter the correct BCC for contributions, which are administered strictly by the Social Insurance Fund, into the online form, the corresponding code will not be recognized.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Learn to decipher KBK by reading our other article.

The next type of data to be entered manually in the online form on the FSS website is the payment amount. Let's look at how it is determined.

When do you need to pay?

Insurance premiums are calculated to be paid once a year. They must be transferred by the end of the current year, that is, by December 31. Otherwise, the entrepreneur is free to choose the terms for payment: you can make one payment at any time of the year, or you can make payments in installments, again at intervals convenient for the entrepreneur. Usually, a quarterly mode of making equal shares of insurance premiums is chosen - this way the tax burden will be distributed more evenly.

If an additional contribution to the Pension Fund is provided for an individual entrepreneur (in case of income over 300,000 rubles), then it must be paid before April 1 of the next year. At the same time, the obligatory part must be paid by December 31, and until April you can “delay” with contributions calculated from the amount that exceeded the limit of 300 thousand rubles.

How to fill out a payment document on the Federal Tax Service website: calculating the amount of contributions

Using the online service on the Federal Tax Service website, contributions can be paid:

- Pension - at rates:

- 22% (from salary within the base limit);

- 10% (from salary above the base limit). The fixed amount of pension contributions for individual entrepreneurs in 2020 is 29,354 rubles. for compulsory pension insurance (OPI), and in 2020 - 32,448 rubles. From incomes above 300,000 rubles. — 1% on an amount exceeding RUB 300,000. Important! The total amount of pension contributions of individual entrepreneurs in 2020 cannot exceed 234,832 rubles, and in 2020 - 259,584 rubles. (Subclause 1, Clause 1, Article 430 of the Tax Code of the Russian Federation).

- Social (except for contributions for injuries) - at rates:

- 2.9% (within the limit);

- 0% (above limit). Individual entrepreneurs do not pay fixed contributions to compulsory social insurance (OSS).

- Medical - at a rate of 5.1% (for the entire salary amount). Fixed contributions for compulsory medical insurance (CHI) for individual entrepreneurs in 2019 - 6884 rubles, in 2020 - 8426 rubles.

May be paid in cases provided by law:

All specified contributions are at reduced rates (in accordance with Article 427 of the Tax Code of the Russian Federation) within the limit.

The following groups of preferential rates can be distinguished:

Pension contributions - at rates in addition to the basic ones:

- in workplaces with difficult and dangerous working conditions (in accordance with Article 428 of the Tax Code of the Russian Federation);

- jobs in the field of civil aviation and the coal industry (Article 429 of the Tax Code of the Russian Federation).

You can find out the deadlines for paying insurance premiums for individual entrepreneurs here.

The next type of information in the payment slip is the address of the taxable object. It may seem that when you point it out everything is obvious, but it is not.

The amount of insurance premiums for individual entrepreneurs in 2019-2020

Fixed payment calculated from the minimum wage

Regardless of whether the entrepreneur has employees or what type of taxation is applied, he is required to pay contributions to the Pension Fund and compulsory medical insurance:

| In the Pension Fund of Russia, rubles | In the Federal Compulsory Medical Insurance Fund rubles | Total, rubles | |

| For 2020 | 29 354, 00 | 6 884, 00 | 36 238, 00 |

| For 2020 | 32 448, 00 | 8 426, 00 | 40 874, 00 |

Attention! If the individual entrepreneur did not begin activities from the beginning of the financial year or ceases activities before December 31, then contributions are calculated for the corresponding period worked.

1% on excess income

Nothing has changed in the calculation of 1% - it is paid if the income exceeds the amount of 300 thousand rubles. The formula is simple: (Income – 300,000 rubles) * 1%.

Attention! It is necessary to take into account that fixed payments when combining tax regimes are summed up, after which the calculation is carried out.

So, when calculating 1%, the following must be taken into account:

- For UTII payers, it is necessary to take the amount of imputed income, and not the actual profit received.

- For the simplified tax system of 6%, the actual profit received is taken.

- Under the simplified tax system, income is reduced by the amount of expenses; currently, only income is taken as the basis for calculating 1%; expenses are not taken into account.

- For OSNO, the base will be the difference between income and expenses.

- For a Patent, it is necessary to take the calculated amount of the maximum profit, based on which payments under the patent are calculated.

Determining the address of the taxable object: nuances

The address of the taxable object determines which Federal Tax Service Inspectorate and OKTMO codes should be indicated on the payment invoice. Here the patterns are as follows:

- A taxpayer who has separate divisions in which there is a staff of hired workers (letter of the Federal Tax Service of Russia dated January 23, 2017 No. BS-4-11/[email protected]), indicate the code of the Federal Tax Service and OKTMO at the location:

- location of the legal entity;

the location of each of the separate divisions authorized to pay wages to individuals.

- Taxpayers without separate divisions indicate the IFTS and OKTMO codes only at the location of the office.

In this case, the legal entity must inform the Federal Tax Service about the vesting of the unit with powers related to the calculation and payment of wages to individuals within 1 month from the moment such powers arise.

As long as the unit has the appropriate powers, contributions must be transferred to the Federal Tax Service, which controls the territory in which the unit is located.

Whether a separate unit has a staff does not matter: the organization can pay salaries centrally without delegating authority.

The same requirements apply to the largest payers (despite the fact that they submit tax returns only at the place of registration as the largest payers).

Find out more in the article “Payment of insurance premiums by a separate division.”

Not only the taxpayer himself, but also other persons can pay the contribution using the online service on the Federal Tax Service website. Let's consider who might have such powers.

Who is responsible for paying taxes for individual entrepreneurs?

Before we talk about online payment of taxes for individual entrepreneurs, let’s figure out who is responsible for this. In this matter, it is necessary to separate the taxes of an individual from those that are related only to business. Thus, an entrepreneur pays taxes on transport and property like an ordinary citizen. Notifications for these and some other taxes of individuals are sent by the Federal Tax Service.

But taxes related to entrepreneurial activity and insurance premiums for himself and his employees are calculated by individual entrepreneurs independently. It is important not to violate the deadlines established by the tax calendar.

If an entrepreneur has an accountant or has outsourced his accounting, it is still worth checking with the person in charge whether payments to the budget have been made on time. And if there is no accountant, then this issue, even more so, must be kept under constant control.

For convenience, we provide here the deadlines for transferring payments to individual entrepreneurs in different taxation systems.

- Simplified tax system: tax at the end of the year is transferred no later than April 30, minus advance payments. Advances are paid within a year, no later than the 25th day after the end of each reporting period, if income was received in it. This is April 25, July, October respectively.

- BASIS: Personal income tax at the end of the year – no later than July 15. Advances for personal income tax are transferred at the end of each quarter, no later than the 25th day of the following month. VAT, unless exemption is obtained, is paid monthly, dividing the quarterly tax amount into three equal parts. The deadline is the 25th.

- Unified agricultural tax: the advance payment for the first half of the year must be transferred no later than July 25, and the deadline for paying the annual tax is March 31.

- UTII: tax on imputed income is paid every quarter, no later than the 25th day after its end (April 25, July, October, January, respectively).

- PSN: the tax is the cost of the patent. The deadline for payment depends on the validity period. If the period does not exceed 6 months, then you must pay before its end. For patents with a longer period, 1/3 of the part is transferred within 90 days from the date of issue, the balance - until the end of the validity period.

- Insurance premiums for yourself in a fixed amount - at any time until the end of the current year. Additional contribution for income of more than 300,000 rubles per year - no later than July 1 of the next year.

Free tax consultation

To prepare a receipt for an individual entrepreneur on the tax website, it is advisable to know the payment code. These are special budget classification codes that the Ministry of Finance has established for each type of taxes and contributions. The codes in force in 2020 were approved by Ministry Order No. 207n dated November 29, 2019.

The table shows the BCC for paying taxes and contributions in force in 2020.

| Payment type | KBK |

| USN Income | 182 1 0500 110 |

| USN Income minus expenses | 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

| Personal income tax on OSNO | 182 1 0100 110 |

| VAT on OSNO | 182 1 0300 110 |

| Pension insurance contributions | 182 1 0210 160 |

| Health insurance premiums | 182 1 0213 160 |

Who can pay contributions for the taxpayer

In general, the payer of contributions must transfer the required amounts to the budget himself (clause 1 of Article 45 of the Tax Code of the Russian Federation). But in principle, any third party can fulfill this obligation for him. At the same time, it does not have the right to demand the return of the contribution from the budget of the Russian Federation.

In April 2020, the Federal Tax Service published information on the procedure for paying taxes and contributions by third parties. In accordance with it, the person paying the premium for the policyholder, when filling out the payment form, indicates:

- In the fields to reflect the payer's TIN and KPP - the policyholder's TIN and KPP (or 0 if the policyholder is an individual entrepreneur).

- In the “Payer” field - information about yourself (for a legal entity - name, for an individual - full name, for an individual entrepreneur - full name with a note in brackets: individual entrepreneur).

- In the “Purpose of payment” field - your INN and KPP (indicated by the legal entity) and the name of the policyholder.

- You need to separate the TIN and KPP using 2 characters “//”. The name of the policyholder is separated in the same way.

- In field 101 - the code corresponding to the legal form of the insured.

Currently, the service allows you to make payments for a third party without any problems.

After selecting the “Payment for a third party” option, you must enter the details of the person making the payment.

Next, you will be given the choice of paying using the UIN or filling out the document details manually.

In the first case, there can be no hitches. You enter the UIN, and the service itself fills out the correct payment order and offers you to either generate a document to print and save on your computer, or make the payment immediately.

In the second case, you need to perform a number of actions:

- select the category of person whose payment obligation is fulfilled (for example, individual entrepreneur);

- enter information about the person whose payment obligation is being fulfilled (full name, tax identification number);

- enter the details of the payment recipient (tax code and municipality);

- fill in the type, name and type of payment;

- indicate the details of the payment order (ground, tax period, year, amount).

Upon completion, the service will offer to create a payment order or pay the amount immediately.

How much does an individual entrepreneur pay for himself in 2020?

Each individual entrepreneur, along with the status of individual entrepreneur, receives new responsibilities. The responsibilities of an individual entrepreneur include compliance with the law, submission of reports and, of course, payment of taxes and insurance premiums.

Let's calculate how much it costs to maintain an individual entrepreneur in 2020 and what mandatory and voluntary payments a businessman will have to make for himself.

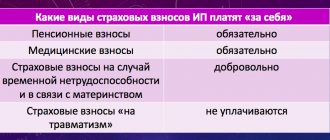

Insurance premiums (Chapter 34 of the Tax Code of the Russian Federation)

An entrepreneur is not an employee of a large corporation, where the responsibility for paying insurance premiums falls on the employer. However, he is a man who may become ill or retire. Therefore, each individual entrepreneur must pay contributions for compulsory health and pension insurance. In addition, he has the right to pay voluntary contributions to social insurance in order to go on maternity leave or receive paid sick leave.

Mandatory insurance premiums for individual entrepreneurs consist of a fixed amount and an additional contribution of 1% for income over 300 thousand rubles. Let's talk about them in more detail.

Fixed contribution amount

The fixed part of the individual entrepreneur’s insurance premiums is the amount that the entrepreneur must pay under any circumstances. Even if there is no profit and the business only generates losses, be so kind as to pay a fixed amount before December 31st.

In 2020, each individual entrepreneur must pay fixed contributions in the amount of 36,238 rubles. This amount is distributed as follows:

- for pension insurance – 29,354 rubles,

- for medical insurance – 6,884 rubles.

By the way, the fixed amount of contributions increases annually. In 2018, it was almost 12% less than in 2020. And in 2020, fixed contributions are promised to increase by another 13%.

You can deposit a fixed amount in different ways, for example, one-time - once a year, or in installments - quarterly, monthly.

Important! Experts from the “My Business” service recommend dividing insurance premiums into 4 parts and paying them quarterly. This will help reduce the tax on the simplified tax system of 6% and UTII, and on the simplified tax system of 15% and OSNO, contributions can be included in expenses, and thus reduce the tax base.

When registering or liquidating an individual entrepreneur in the current year, the amount of fixed contributions is recalculated taking into account the actual period of existence in the status of an individual entrepreneur. The online calculator from the Federal Tax Service helps calculate the amount of contributions for an incomplete year.

Example: Andrey registered as an individual entrepreneur on February 1, 2019. He does not need to pay the full amount of fixed contributions, since he does not operate from the beginning of the year. For 11 months, he pays a fixed amount - 33,218.17 rubles. This is almost 3 thousand rubles less than when paying for a full year.

Additional 1% on income over 300 thousand rubles

A fixed amount of insurance premiums is not everything. When the annual income of an individual entrepreneur exceeds the limit of 300,000 rubles, the entrepreneur must additionally pay 1% of the excess income.

These funds go towards the entrepreneur's pension insurance. They can be entered not in the reporting year, but in the next year - before July 1.

Example: Marina’s income is 600,000 rubles per year. She will first pay a fixed amount of 36,238 rubles during 2020. Then she must contribute another 1% of the amount of income above the established limit: (600,000 - 300,000) * 1% = 3,000 rubles. Total insurance premiums for the year: 36,238 + 3,000 = 39,238 rubles.

The maximum payment specifically for a pension for an individual entrepreneur is 234,832 rubles. This maximum amount of contributions will be reached with an annual income of almost 20.8 million rubles. If an individual entrepreneur earns more, then he or she does not have to pay insurance premiums above this amount.

Voluntary contributions to social insurance

In addition to the mandatory payments provided for individual entrepreneurs, there are others. For example, social security contributions. This is an optional payment, but it will allow you to receive payments on sick leave and during maternity leave.

The amount of such voluntary contributions for oneself is 2.9% of the minimum wage. As of February 20, 2020, the federal minimum wage is 11,280 rubles. To receive payments during a period of temporary disability, you need to pay 2.9% * 11,280 rubles per year to the Social Insurance Fund. * 12 months = 3,925.44 rubles.

You need to pay contributions in advance - you can only claim payments from the Social Insurance Fund next year. To receive paid sick leave in 2020, contributions had to be paid in 2018. Now you can make them to take care of yourself in 2020.

If in the foreseeable future you, as an individual entrepreneur, are going to undergo surgery or go on maternity leave, or simply get sick often, pay voluntary contributions to receive money from the Social Insurance Fund.

Example: In November 2020, Alexey voluntarily paid contributions to the Social Insurance Fund in the amount of 3,302.17 rubles (this takes into account the minimum wage for last year). In January 2020, he broke his arm, and the doctor issued a sick leave for temporary disability for three weeks. An individual entrepreneur who submits a sick leave certificate to the Social Insurance Fund along with a copy of the receipt for payment of voluntary contributions for the previous year will receive 7,641.3 rubles. If Alexey gets sick or injured again before the end of the year (we hope that this does not happen), he will again be able to apply for sick leave and receive payment.

Tax on income from business activities

The amount of tax depends on the regime. An individual entrepreneur can choose a general taxation system (OSNO), a simplified taxation system (USN), imputation (UTII), a single agricultural tax (USAT) or a patent system (PSN).

With the simplified tax system under the “Income” scheme and UTII, the tax can be reduced to zero for the entire amount of insurance premiums paid by the individual entrepreneur for himself. If there are hired employees, then the tax can only be reduced by half - by 50%.

An example for an individual entrepreneur without employees, on the simplified tax system “Income”: Maxim has an individual entrepreneur on a simplified basis, in a year he earned 1,200,000 rubles. Paid fixed insurance premiums in the amount of 36,238 rubles. Then I calculated contributions for income over 300 thousand rubles: (1,200,000 - 300,000) * 1% = 9,000 rubles. The total amount of insurance premiums was 45,238 rubles. Tax on simplified income according to the “Income” scheme: 1,200,000 * 6% = 72,000 rubles. Maxim can reduce this amount by the entire amount of already paid insurance premiums for himself without restrictions: 72,000 - 45,238 = 26,762 rubles. As a result, he will pay tax with a discount of 63%.

Calculation for individual entrepreneurs with employees, using the simplified tax system “Income”: If Maxim has at least one employee, then the tax amount can be reduced not by 100%, but only by 50%. But not only payments for yourself are taken into account, but also contributions for the employee.

Insurance premiums for yourself will be the same: 45,238 rubles per year. And with an employee’s salary of 30,000 rubles, Maxim, as an employer, will pay contributions at 30,000 * 30% = 9,000 rubles per month. This is 108,000 rubles per year.

The total contributions for yourself and the employee are 153,238 rubles per year, which is already more than the calculated tax of 72 thousand. As a result, it will be possible to reduce it only by half - to 36,000 rubles. In total, individual entrepreneurs will have to pay contributions and taxes of 153,238 + 36,000 = 189,238 rubles. He will save 50% of the tax amount.

A reduction in the amount of tax on the amount of insurance premiums paid will also work in the case of imputation and the unified agricultural tax. The amount of UTII or Unified Agricultural Tax can be reduced by 100% minus contributions for oneself and in the absence of employees, and by 50% if an individual entrepreneur pays contributions for employees.

But an individual entrepreneur under the patent taxation system cannot at all reduce the amount of tax on the amount of insurance premiums - neither on contributions for himself, nor on contributions for employees. You will have to pay both the entire amount of insurance premiums and the PSN tax.

Entrepreneurs who use the general taxation system and the simplified “Income minus expenses” scheme can reduce not the tax itself, but the tax base by the amount of insurance premiums for themselves and for their employees.

Example: So, if Maxim chooses a different tax regime for himself - the simplified tax system “Income minus expenses”, he must pay tax at a rate of 15% of this difference.

His income is 1.2 million rubles. The expenses we know are the amount of insurance premiums for oneself, so it can be deducted from income. Of course, a businessman has other expenses, but they are very individual and difficult to take into account.

But we can find out exactly what a reduction in the tax base by the amount of insurance premiums gives. This will save 15% * 45,238 = 6,785.7 rubles.

When an entrepreneur uses the general regime (OSNO), personal income tax is calculated at a rate of 13% of revenue, taking into account professional deductions. In this case, the tax base for personal income tax can be reduced by the amount of insurance premiums paid. The savings will be 13% * 45,238 = 5,880.94 rubles.

Thus, under almost all tax regimes, it is possible to reduce the amount of tax payable through insurance premiums.

The deduction will not work if insurance premiums were paid during periods other than those in which the income was received:

- If you pay contributions in advance in January - for the whole year, then you can only count them towards the amount of income for the first quarter - January, February, March. It will not be possible to reduce the tax on income that was received later - from April to December;

- similarly, it works the other way around, if the contributions were paid in a lump sum at the end of the year - they will help reduce tax only for the last three months - October, November, December, and not from the beginning of the year.

With proper planning of insurance premiums for an individual entrepreneur, you can save tens of thousands of rubles on tax payments. Use this to optimize your costs.

How to automate payment of contributions?

In order not to calculate everything yourself, there are special services. Working with them is simple and convenient, because taxes and contributions are calculated automatically using step-by-step algorithms. One of these services: online accounting “My Business”. A personal tax calendar will remind you that it’s time to pay contributions to reduce income tax, and also generate documents with up-to-date details so that money is not lost by mistake.

Share:

Comments 0 Nothing found.

Fresh materials:

30.09.2020

0

142

The procedure for writing off accounts receivable in accounting and tax accounting

It happens that it is not possible to get money from debtors. Then the “receivable” can be written off, but only if a number of conditions are met. We talk about the features of writing off overdue receivables in tax and accounting.

Read >

29.09.2020

0

184

The impact of coronavirus “vacations” on the calculation of average wages

In 2020, due to the coronavirus pandemic, a new concept appeared in the legislation - non-working days with pay. Let's figure out how to take them into account when calculating average earnings.

Read >

29.09.2020

0

190

Saving on taxes with a student agreement

Organizations that train employees at their own expense can enter into an apprenticeship agreement with them.

This will protect against the fact that the employee has graduated and quit, and will also help partially save on insurance premiums. We talk about the features of a student agreement with an employee. Read >