Who can work for the simplified tax system and do “simplified” workers pay insurance premiums?

The possibility of using the simplified taxation system (STS) is available to legal entities and individual entrepreneurs that meet certain restrictions established by Art.

346.12 Tax Code of the Russian Federation. These restrictions also include engaging in certain types of activities. At the same time, most existing types of activities can be transferred to the simplified tax system. Read about the conditions for applying the simplified tax system in 2020 here.

The presence of hired personnel in organizations and individual entrepreneurs allows them to be regarded as persons who pay remunerations and are obliged to pay insurance premiums from these remunerations (subparagraph 1, paragraph 1, article 419 of the Tax Code of the Russian Federation, article 3 of the law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ).

An individual entrepreneur may not have employees and, accordingly, will not pay remuneration to them. But he must also pay contributions (subclause 2, clause 1, article 419 of the Tax Code of the Russian Federation), although in a different order from that which applies to hired employees (Articles 421, 422, 430 of the Tax Code of the Russian Federation).

An individual entrepreneur with employees will have to pay contributions simultaneously on 2 grounds (clause 2 of Article 419 of the Tax Code of the Russian Federation):

- for myself;

- from the remuneration of these employees.

How to pay fixed fees

As a general rule, individual entrepreneurs pay insurance premiums “for themselves” no later than December 31 of the current calendar year.

Contributions calculated at the rate of 1% on income over 300,000 rubles must be paid no later than July 1 of the year following the expired billing period (clause 2 of Article 432 of the Tax Code of the Russian Federation).

You can divide the amount of contributions into four equal parts and transfer them quarterly. However, if the amount of insurance premiums paid in the current year turns out to be greater than the amount of the single tax calculated for the same year, then the part of the fixed payment not taken into account when reducing the tax is not carried over to the next year.

Therefore, it is not profitable to pay the entire amount of contributions in advance and the individual entrepreneur continues to pay insurance premiums for the past year in the new year.

Basic, additional and reduced rates of contributions under the simplified tax system

Among payers of contributions, including those using the simplified tax system, legal entities and individual entrepreneurs predominate, having employees and charging contributions at basic tariffs. These tariffs are established by art. 425 of the Tax Code of the Russian Federation and provide for deductions in the amount of:

- 22% - for compulsory pension insurance (MPI) within the current maximum base, which beyond this limit is replaced by a rate of 10%;

- 2.9% (or 1.8% for non-residents) - for compulsory social insurance (OSS) for disability and maternity within the current limit base, which cease to accrue upon reaching this limit;

- 5.1% - for compulsory health insurance (CHI), the maximum base for which is not established, and they are accrued from all contributions subject to contributions.

From 04/01/2020, reduced contributions are applied to the part of the salary exceeding the minimum wage. The rates in this case are: 10% - for compulsory health insurance, 0% - for VNIM, 5% - for compulsory medical insurance.

Find out more about the rates of insurance premiums applied under the simplified tax system from the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

If there are dangerous and harmful working conditions, additional ones are applied to the remuneration of employees working in such conditions, in addition to the basic tariffs in terms of compulsory health insurance. Their value depends on specific working conditions and can range from 2 to 14% (Articles 428, 429 of the Tax Code of the Russian Federation).

As for the reduced tariffs, for simplified tariffs for 2019-2020 they are set at the level (subclause 3, clause 2, article 427 of the Tax Code of the Russian Federation):

- 20% - for OPS;

- 0% - on OSS for disability and maternity;

- 0% - for compulsory medical insurance.

However, as of 2020, their use is limited. Now only those using the simplified tax system have the right to count on them (Article 427 of the Tax Code of the Russian Federation):

- non-profit organizations (NPOs) operating in areas such as culture, science, education, sports, healthcare, social services (subclause 7, clause 1);

- charitable organizations (subclause 8, clause 1).

For this, by the way, there are certain conditions (clauses 7, 8 of Article 427 of the Tax Code of the Russian Federation), including the conduct of exactly the activity for which these organizations were created (non-profit, charitable), and for NPOs there is also a limit on the amount of income — at least 70% must come from income from non-profit activities.

In 2020, the number of benefit recipients also included legal entities and individual entrepreneurs carrying out types of activities, the list of which was contained in subsection. 5 p. 1 art. 427 Tax Code of the Russian Federation. At the same time, the share of income from their core activities should also be at least 70% of total income, and the amount of income for the year should not exceed 79 million rubles. But since 2020, the benefits for this category of payers have ended, and since then they have been paying contributions on a general basis.

Read more here.

In terms of contributions for injury insurance, the amount of deductions will depend on the type of activity performed and will be determined by the level of danger for the employee established for this type (Article 21 of Law No. 125-FZ of July 24, 1998).

Read more about the amount of these contributions in the article “Tariffs of contributions for compulsory social insurance against industrial accidents and occupational diseases depend on the type of economic activity .

Amount of insurance premiums in 2020

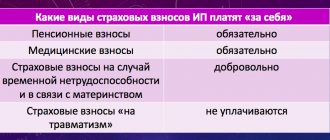

In 2020, individual entrepreneurs on the simplified tax system pay 40,874 rubles in contributions. Of this, 32,448 rubles are paid for pension insurance. 8,426 rubles are transferred for medical insurance. Individual entrepreneurs do not have to make contributions to the Social Insurance Fund, but if an entrepreneur wants to obtain the right to social benefits (sick leave, maternity leave, child care), then he needs to transfer contributions to the Social Insurance Fund voluntarily.

Additionally, the individual entrepreneur must transfer to the Pension Fund 1% of those income for the year that exceed the income of 300,000 rubles. But no more than 259,584 rubles - such a contribution will have to be paid if the annual income exceeds 25.96 million rubles. Be careful when creating bills: payment if the income limit is exceeded is processed through a separate BCC.

For individual entrepreneurs and LLCs acting as insurers, the total amount of contributions to various funds is in most cases 30% of the employee’s salary. This amount is not deducted from the salary, like personal income tax, but is paid by the employer to funds from the enterprise’s funds. 22% of the salary amount is sent to the Pension Fund, 5.1% to the Federal Compulsory Medical Insurance Fund, and 2.9% to the Social Insurance Fund for compulsory social insurance.

There are also additional FSS tariffs for insurance against work-related injuries and occupational diseases. They are established for each policyholder depending on the type of activity. It is to clarify this tariff that employers annually submit a report on the main type of activity to the Social Insurance Fund. The tariff rate ranges from 0.2% to 8.5%.

When calculating contributions, you need to keep in mind salary limits. If the amount of salary calculated on an accrual basis during the year exceeds this limit, then contributions from the excess amount are either not paid at all or are paid at a reduced rate. Here are the limits for 2020:

- Pension Fund - 1,292,000 rubles. Contributions are paid on excess amounts at a rate of 10%, and individual entrepreneurs and LLCs of preferential categories do not pay contributions.

- FSS - 912,000 rubles. There is no need to pay contributions for excess amounts.

- There is no limit for contributions to the FFOMS and for injuries; contributions must always be paid.

Until 2020, some individual entrepreneurs and LLCs on a simplified basis, falling under the benefit (for example, operating in the field of education, healthcare), had the opportunity to make contributions to the Pension Fund at a reduced rate - in the amount of 20% of the employee’s salary. There are no such benefits anymore. In 2020, only NPOs on the simplified tax system with signs of social orientation and charitable enterprises on the simplified tax system will continue to charge and pay contributions at reduced rates - they pay only 20% to the Pension Fund.

Important: check the fee rate for your type of activity in your region.

Contributions that an individual entrepreneur pays for himself

An individual entrepreneur working on the simplified tax system must pay contributions to compulsory medical insurance and compulsory health insurance (clauses 1, 6, article 430 of the Tax Code of the Russian Federation). The amount of contributions to compulsory pension insurance depends on the amount of income received by the individual entrepreneur, but not directly (subclause 1, clause 1, article 430 of the Tax Code of the Russian Federation).

So, with an income of up to 300,000 rubles. for the year, the annual amount of fixed insurance premiums (FIF) is equal to:

- in 2020 - 32,448 rubles;

- in 2020 - 29,354 rubles.

IMPORTANT! Individual entrepreneurs from the affected industries reduced contributions to compulsory pension insurance for 2020 by 12,130 rubles. See here for details.

For an amount of income exceeding 300,000 rubles, an additional 1% must be paid to compulsory pension insurance, but the total amount of payments (taking into account the fixed part) should not exceed 8 times the size of the FSV in the Pension Fund of the Russian Federation (for 2020 - 259,584 rubles and 234,832 rubles for 2020).

The individual entrepreneur's payment for compulsory health insurance (CHI) is fixed and equal to (subclause 2, clause 1, article 430 of the Tax Code of the Russian Federation):

- in 2020 - 8,426 rubles;

- in 2020 - 6,884 rubles.

For periods (year and month) that turn out to be incomplete for an individual entrepreneur who began or completed activities in them, the calculation uses coefficients that take into account the share of months of activity in the total number of months in the year and a similar share of the number of days in the total number of days of the corresponding month (pp. 3, 5, Article 430 of the Tax Code of the Russian Federation).

Tax reduction method for individual entrepreneurs using a simplified tax system and without employees

For individual entrepreneurs without employees, you can use simple calculations to reduce the amount of the simplified tax system by the amount of insurance premiums. Let's look at how to do this.

A private entrepreneur has a simplified taxation system and provides services to the public. In 2020, income from the activities of individual entrepreneurs amounted to 815,025 thousand rubles. He is obliged to pay the following taxes from this amount:

- Tax of 6%: 815,025 × 6% = 48,901.5 (rubles).

- Mandatory insurance contributions: a minimum fixed contribution of 40,874 rubles is taken (this is compulsory medical insurance and compulsory health insurance together), plus an additional contribution of 1% of the amount of income is taken, which exceeds three hundred thousand rubles (5,150 rubles), a total of 46,024 rubles .

- We add all the fees and get: 48,901.5 + 46,024 = 94,925.5 (rubles). It seems that everything is clear, transparent, and it cannot even be assumed that a smaller amount will be paid to the state budget. But that's just how it seems.

Thanks to the simplified taxation system of 6% for individual entrepreneurs with no employees, it is possible to reduce the accrued tax. As a result, an individual entrepreneur will pay only 56,220 rubles to the state budget along with contributions, if everything is calculated correctly.

Despite the fact that there is a clear deadline for paying taxes until December 31, partial payment not for the year, but separately for each quarter, will help reduce the amount of taxes. The amounts of paid contributions and income for specific reporting periods are accrued on an accrual basis, in accordance with Article 346.21 of the Tax Code of the Russian Federation. The table shows approximate calculations by period (the income indicated at the very beginning is divided into three parts, and this also happens with contributions).

| Reporting period | Income (on an accrual basis) | Contributions paid |

| 1st quarter | 94 342 | 5 590 |

| 6 months | 294 342 | 17 142 |

| 9 months | 426 341 | 24 264 |

| Calendar year | 815 025 | 46 024 |

The 1% contribution can be paid until July 1, 2021. Using the table data as an example, we will understand in detail how payments are calculated and reduced at the end of the year:

- In the first quarter, 94,342 × 6% = 5,660 (rubles), from this amount the paid contributions of 5,590 are subtracted, as a result, only 70 rubles are paid.

- Then we take half a year: 294,342 × 6% = 17,660.52 (rubles), minus contributions of 17,142 and 70 rubles paid earlier, leaving 448.52 rubles to pay extra to the state budget.

- For 9 months, the calculations are similar: 426,341 × 6% = 25,580.46 (rubles). Contributions and advances are deducted: 25,580.46 – (25,264 + 70 + 448.52) = 797.94 (rubles).

- For 12 months, the total amount that must be paid by April 30: 815,025 × 6% = 48,901.5 – (46,024 + 70 + 448.52 + 797.94) = 1,561.04 (rubles).

It is easy to check the correctness of the calculations. The following payments were made:

- final advance payments: 70 + 448.52 + 797.94 = 1,316.46 (rubles);

- the tax remaining to be paid is 1,561.04 (rubles);

- annual fees - 46,024 (rubles).

It turns out that payments to the budget amounted to almost half the amount of 48,901.5 rubles, and not the 94,925.5 rubles announced at the very beginning.

If the entire amount was paid at once in one payment for the year, then it will not be possible to reduce advance payments on the simplified tax system in this way. Then, instead of 1316.46 rubles for 9 months, the amount will be greater - 36,316 rubles, and you will have to pay a tax in the amount of 12,585.5 (48,901.5 - 36,316). The reduction will occur only by the one-time contribution amount of 46,024 rubles, thus creating an overpayment in the amount of 33,438.5 rubles. The overpayment can be returned, but go through a series of procedures or be credited to future payments, subject to submitting a declaration and application of the appropriate sample to the Federal Tax Service.

Results

The use of the simplified tax system does not exempt either legal entities or individual entrepreneurs from paying insurance premiums.

Contributions for both must be paid from payments in favor of employees. At the same time, the individual entrepreneur has the obligation to pay contributions for himself, regardless of whether he has employees. The procedure for determining the amount of contributions accrued for employees and individual entrepreneurs is different. For contributions to employees, three types of tariffs can be applied: basic, additional, reduced. The ability to use the latter has been limited since 2019. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Reducing individual entrepreneur taxes by the amount of insurance premiums

Based on the provisions of the Tax Code of the Russian Federation, entrepreneurs are given the right to reduce their tax payment obligations at the expense of the amount of insurance premiums paid for themselves and for employees. The procedure for accounting for contributions when calculating tax depends on the tax system that the individual entrepreneur uses.

USN Income 6%

Entrepreneurs using the simplified taxation system according to the “6% Income” scheme calculate the tax as the product of the income received at the end of the reporting period (excluding expenses) by the tax rate of 6%:

TaxUSN Income 6% = YearIncome * 6%,

where YearIncome is the amount of income based on the results of the reporting period (calendar year).

Payment of tax under the simplified tax system Income 6% is made by transferring advance payments by the entrepreneur in the following order:

- for the 1st quarter – until April 25;

- for the 2nd quarter – until July 25;

- for the 3rd quarter – until October 25.

The final tax payment must be made by individual entrepreneurs by April 30 of the year following the reporting year (for 2020 - by April 30, 2019).

Individual entrepreneurs have the right to offset the amount of insurance premiums paid for themselves and for employees in the following order:

- Insurance premiums paid by individual entrepreneurs for themselves are fully taken into account when calculating tax.

- The amount of contributions accrued for employees is taken into account when calculating taxes in the amount of no more than 50% of the tax amount.

- Contributions can be taken into account when calculating advance tax payments, provided that at the time of transfer of the advance payment, contributions have been paid in the prescribed amount.

When calculating the advance tax under the simplified tax system Income 6%, taking into account paid insurance premiums, the formula will be as follows:

Advance TaxUSN Income 6% = Quarterly Income * 6% – StrVznIP for yourself – StrVznza employees,

where AdvanceTaxUSN Income 6% is the amount of advance tax due for payment by the 25th day following the reporting quarter; Income quarter – income received by the individual entrepreneur based on the results of the reporting quarter; StrVznIP for yourself - the amount of insurance premiums paid by an individual entrepreneur for himself in the reporting quarter; Employee insurance premium – the amount of insurance premiums paid by individual entrepreneurs for employees in the reporting quarter.

Let's look at an example. IP Sidorov works independently, uses the simplified taxation system Income 6%.

03/15/2020 Sidorov paid insurance premiums for 1 quarter. 2020:

- according to OPS - 6,636.25 rubles. (RUB 26,545 / 12 months * 3 months);

- according to compulsory medical insurance – 1,480 rubles. (RUB 5,840 / 12 months * 3 months);

Sidorov's income based on the results of the 1st quarter. 2020 (excluding expenses) amounted to 165,005 rubles.

Let's calculate the amount of advance tax for 1 sq. 2020, which Sidorov must pay by 04/25/18:

165.005 rub. * 6% – 6,636.25 rub. – 1,480 rub. = 1,784.05 rub.

It is advisable for an entrepreneur to pay insurance premiums in such a way that the amount of payment for contributions does not exceed the amount of tax liabilities based on the results of the reporting quarter. In this case, the credit for the contributions will be proportionately distributed among the advance tax payments during the year.

UTII

“Imputed” entrepreneurs pay a tax calculated on the basis of the profitability indicator approved in the region in relation to a specific type of activity, as well as a variable physical indicator, the value of which is determined depending on the characteristics of the individual entrepreneur’s activity (for example, for the trade and catering sector - the number of square meters trading floor). The formula for calculating UTDV is as follows:

UTII = Profitability * FizP * Coefficient-1 * Coefficient-2 * St,

where Profitability is a profitability indicator established for a specific type of activity in the region; PhysP – physical indicator; Coefficient-1 and Coefficient-2 are deflators K1 and K2, respectively (fixed annually at the legislative level; St – tax rate established in relation to the type of activity of an individual entrepreneur (15% or 7.5%).

Payment of UTII is made by entrepreneurs quarterly until the 25th day of the month following the reporting month.

Entrepreneurs who are “imputed” have the right to reduce the amount of UTII by the amount of insurance premiums paid, similar to the procedure applied for “simplified” entrepreneurs, namely:

- the amount of insurance premiums paid by individual entrepreneurs for themselves during the reporting quarter reduces the amount of UTII payable for the quarter;

- The entrepreneur has the right to take into account contributions paid for employees in an amount not exceeding ½ of the UTII amount for the quarter.