Employer reporting

Natalya Vasilyeva

Certified Tax Advisor

Current as of December 19, 2019

Calculation of insurance premiums is submitted by all organizations and individual entrepreneurs with employees. The fact that income is paid to employees does not matter. Let's consider in what form and in what time frame you need to submit the zero RSV for 2020 to the Federal Tax Service.

Do I need to submit a zero RSV?

The calculation of insurance premiums contains information about the insurance premiums calculated and paid for employees during the reporting period. The DAM, both zero and with accruals, is surrendered in relation to:

- employees with whom employment contracts have been concluded;

- citizens working under civil law contracts;

- individuals with whom agreements have been concluded on the alienation of the exclusive right to certain results of intellectual activity, publishing license agreements, as well as license agreements on granting the right to use the results of intellectual activity;

- authors of works within the framework of an author's order agreement.

Persons required to submit the DAM include:

- organizations - regardless of the presence of employees;

- separate divisions of Russian companies (OP) - if they independently transfer salaries to their employees and pay insurance premiums from them;

- OP of foreign companies - if they operate on the territory of the Russian Federation;

- Individual entrepreneur - if there are employees;

- heads of peasant farms - regardless of the presence of employees;

- individuals without individual entrepreneur status - if they have employees.

At the same time, the fact of paying income to employees and paying insurance premiums from it does not matter for the delivery of a zero RSV. The report is always submitted when there are employees. If contributions from income have not been paid, you need to submit a zero RSV to the Federal Tax Service.

Who needs to submit insurance premium payments?

The obligation to submit calculations for insurance premiums is assigned to:

- Organizations (including foreign companies operating in Russia), as well as separate divisions of organizations;

- Entrepreneurs who make payments to individuals.

In this case, the calculation is presented regardless of the status of the insured persons to whom the above-mentioned persons pay remuneration, that is:

- Employees with whom employment contracts have been concluded;

- General Director (sole founder);

- An individual with whom a civil contract has been concluded, for example, a contract, a contract for the provision of services.

Let's consider organizations and entrepreneurs that have no employees and have suspended their activities. Tax authorities provide clarification on this issue. They proceed from the fact that upon registration an organization receives the status of an employer, so they are required to provide a report even if they do not conduct activities and do not have employees.

Important! Even if the organization has no employees and does not conduct business, they are required to submit a zero calculation for insurance premiums. This requirement does not apply to entrepreneurs. They must submit a zero calculation if they have employees who are not paid wages.

As for entrepreneurs, the situation with them is somewhat different. Entrepreneurs must submit a report only if they have employees. But in some cases, entrepreneurs still have to submit a zero report. For example, if an individual entrepreneur has an employee, but because he is on vacation at his own expense. In this case, you still need to provide a report, but it will only be zero. After all, even if the employee does not receive income, but only benefits, he still remains an insured person.

In what cases is a zero RSV surrendered?

Zero RSV for 2020 is handed over to:

- Organizations with a single founder-CEO.

At the same time, it does not matter whether an employment contract has been concluded with him and whether his salary is paid (Letter of the Ministry of Finance of Russia dated June 18, 2018 No. 03-15-05/41578).

- Organizations and individual entrepreneurs that have suspended their activities.

Employers submit a report even if no activity was carried out in 2020 and no income was paid to employees at all (Letter of the Federal Tax Service of Russia dated 04/03/2017 No. BS-4-11/6174).

- Heads of peasant farms in the absence of employees.

The heads of peasant farms submit a report not only in case of suspension of activities, but also when there are no employees at all (Letter of the Federal Tax Service of Russia dated December 25, 2017 No. GD-4-11 / [email protected] ).

Zero reports RSV and SZV-M

Often, in the absence of activity, a misconception arises that reports are not submitted. Let's figure out together when it is necessary to submit zero reports

.

A company that has employees is called the policyholder, and the employees are called the insured persons.

Since the RSV and SZV-M reports contain data on the insured persons, if there are no employees, in theory, there should be no reports either. But this is far from true.

Is it necessary to submit a zero RSV if there is no activity?

Yes need

.

Calculation of insurance premiums must be submitted regardless of whether the company was active in the reporting period or not. A zero calculation informs tax authorities that no payments were made to employees. Otherwise, inspectors may think that the company forgot to submit a statement, which could result in the current account being blocked and a fine of 1,000 rubles.

Is a zero calculation submitted for insurance premiums when the employer did not make payments to individuals?

Yes, without fail

.

This applies to the situation:

- all employees are on leave without pay;

- Only the director is listed in the company, etc.

In this case, in subsections 1.1, 1.2 of Appendix 1 to Section 1 of the report, you must indicate the number of insured persons, and in Section 3 you must fill in information for each employee on leave without pay.

In what cases should individual entrepreneurs submit zero calculations?

IP can be divided into:

- working alone and without employer status;

- employers using hired workers.

- Individual entrepreneur - without employer status

- Individual entrepreneur - employer

An entrepreneur who has been working alone since the beginning of the year (and is not the head of a peasant farm) does not submit calculations for insurance premiums

.

If during the year the individual entrepreneur fired employees, then the DAM must be submitted until the end of the accounting year.

Individual entrepreneurs who have concluded, continue to operate, or terminated employment (civil law) contracts with individuals during the calendar year are required to submit the DAM by the end of the year.

The individual entrepreneur had 2 employees in 2020. The entrepreneur fired one employee in December 2020, and terminated employment relations with the second in January 2020.

In this case, in 2020, the individual entrepreneur is required to submit calculations for insurance premiums for the first quarter with data on the salary in January of the second employee and zero calculations with cumulative data for six months, 9 months and a year.

Starting from 01/01/2017, registration and deregistration of individual entrepreneurs as employers is not provided.

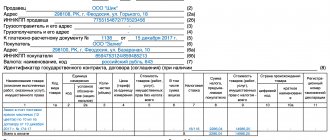

How to fill out a zero RSV?

Zero calculation for insurance premiums includes:

- Title page;

- Section 1 - summary data on the obligations of the payer of insurance premiums;

- Appendix 1 to section 1;

- Subsection 1.1. — calculation of the amounts of insurance premiums for compulsory health insurance;

- Subsection 1.2. — calculation of the amounts of insurance premiums for compulsory medical insurance;

If there are no numerical indicators for the field, then put “0”, in other cases – a dash. When printing the form on a printer, it is allowed that there are no frames around the characters and no dashes for empty fields.

Do I need to pass zero SZV-M?

Yes need

.

According to officials, the organization, in principle, cannot have zero

SZV-M because there is at least one employee in the company - and this is the director.

It should be noted that the SZV-M form is submitted for each employee with whom, in the month for which information is submitted, an employment or civil law contract was concluded/continues to be valid/terminated. It does not matter whether the salary was paid or not.

Only entrepreneurs who work alone - without employees - can not submit zero information on the SZV-M form.

Is SZV-M information submitted if the company does not have insured persons?

There is no clear answer as to whether the SZV-M form should be submitted when there are no insured persons in the organization, i.e. no employment or civil law contracts have been concluded with anyone, the Pension Fund does not provide

.

To avoid the risk of liability, we recommend one of the following options:

- Submit SZV-M information to the director

, even if an employment contract has not been concluded with him; - Submit a statement

about the absence of labor relations and financial and economic activity. After submitting the application, the company is exempt from filing SZV-M until it begins operations and concludes employment contracts.

Zero RSV form for 2020

Zero RSV for 2020 is submitted according to the form approved. By Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/ [email protected]

Zero RSV 2019 form

Starting with reporting for the 1st quarter of 2020, the zero DAM must be submitted using a new form, approved. By Order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected]

The composition of the zero RSV includes only 5 sheets:

- Title.

- Section 1.

- Subsection 1.1 of Appendix No. 1 to Section 1.

- Subsection 1.2 of Appendix No. 1 to Section 1.

- Appendix No. 2 to section 1.

- Section 3.

Starting from the reporting for the 1st quarter of 2020, the composition of the zero reporting will be noticeably reduced; it will not need to include subsections to section 1.

Nuances when filling out the form at preferential rates

Even if a small and medium-sized business is completely exempt from insurance premiums, a report in the DAM form still needs to be submitted to the tax office. The Federal Tax Service explained that the report for the 2nd quarter in this case would need to be submitted with zero indicators. If the report was previously submitted with non-zero data, you will need to submit a clarifying form.

The form for filling out the form remained the same as at the beginning of the year. In the calculation of insurance premiums, the following must be filled out:

- title page

- section 1

- appendices 1 and 2 to section 1

- section 3

Section 2 will not be considered, since it is completed only for the heads of peasant farms.

The title page and section 1 are filled out as in previous reporting periods; they are not affected by changes.

We remind you that on the corresponding lines 030-120 the total amounts of contributions from the beginning of the year are indicated, and on the lines for the corresponding months of the billing period, it is necessary to put dashes, since in fact there are no amounts.

On line 001, you must enter 1 or 2 , depending on whether payments were made to individuals for the billing months.

Section 1. Summary data on the obligations of the payer of insurance premiums

The Federal Tax Service has clarified the applications.

Filling out appendices 1 and 2 to section 1 of the RSV form

The application data must be filled out twice: at the regular rate and at 0%.

When filling out the first option on line 001, reflect the value “01” and indicate all values only in column 1; actual data for January–March 2020 will be reflected here. Information on columns 2-4 will be reflected in a separate copy.

Appendix 1. Tariff code “01”

Section 1. DAM with zero tariff

When filling out a zero copy in term 001, write “21” . Reflect here the data only for the 2nd quarter - in a generalized amount and in the context of each month. On line 060, enter zeros in all boxes.

Page numbers are numbered consecutively.

Appendix 1. Tariff code “21”

Section 1. DAM with zero tariff

Non-taxable payments are reflected depending on the month to which they relate. For example, March amounts should be reflected in copy c, and June amounts with «21».

Filling out section 3 of the RSV form

In the third section of the form, reflect the personalized information of employees in a single copy at a 0% rate . For 130, indicate the category of the employee, it could be:

- CV - if the employee is a citizen of the Russian Federation

- VPKV - the employee has the status of a temporary stayer

- VZHKV - the employee has the status of a temporary stayer, but is insured in the compulsory health insurance company

Otherwise, the filling procedure remains the same, only the place of the amounts of income and contributions must be filled in with zeros.

Section 3. Personalized information about insured persons

Small and medium-sized businesses that were not included in the list of those most affected by the coronavirus infection will also be given a discount when calculating insurance premiums for the 2nd quarter of this year. Their contributions will be calculated at a reduced rate of 15% and will be calculated on that part of the salary that exceeds the minimum wage.

How to pass zero RSV 2020

The delivery of a regular RSV is directly tied to the number of employees to whom income is paid. If there are more than 10, then the report is submitted only in electronic form; if there are fewer, submission of the DAM on paper is allowed.

The zero RSV is not tied to the number of employees, since the reason for its presentation is the lack of payments in general. This means that you can submit it:

- On paper.

You can submit the report to the Federal Tax Service in person, through a representative, or by sending a registered letter with a list of attachments.

- In electronic form.

The DAM in the form of an electronic document is sent to the Federal Tax Service via telecommunication channels through electronic document management operators. Before this, the report is signed with an electronic signature.

The employer chooses the delivery method at his own discretion.

Requirements for filling out the DAM for 2020

When filling out a zero RSV, you must adhere to certain requirements. They are listed in the Procedure for filling out the calculation, approved. By Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/ [email protected] :

- The calculation is filled out in capital block letters from left to right.

- If data is entered by hand, you can only use blue, black or purple pens. Other colors cannot be used, since the machine will not recognize the information and the report will have to be redone.

- When filling out the RSV on a computer, use Courier New font with a height of 16–18.

- Do not use any corrective or similar products. If an error is made in the calculation, it is better not to correct it, but to redo the sheet completely.

- Also, do not staple printed sheets with a stapler or paperclip if they violate the integrity of the sheet and the barcode at the top of the page. The best option is to submit the calculation for verification in a file.

- Each sheet of the report must be printed on a separate page.

- Each page must be numbered in continuous order, starting with the title page.

- In the fields where you need to indicate quantitative or total indicators, put “0”, and in all others - a dash. If the report is generated using software, then dashes can be omitted.

- The line “Last name______I.O.” On each calculation page, only individuals who are not individual entrepreneurs and do not have a tax identification number (TIN) fill out.

Reporting for the 4th quarter of 2020 and for the whole of 2020

Below is a calendar of reports that will need to be submitted for the 4th quarter and for the entire 2020.

| Reporting form | Approved | Deadline |

| Information on the average number of employees | ||

| Information on the average number of employees for 2020 | Order of the Federal Tax Service of the Russian Federation No. MM-3-25/ [email protected] dated March 29, 2007 | January 21 |

| FSS | ||

| Calculation of accrued and paid insurance premiums for compulsory social insurance against accidents at work and occupational diseases, as well as expenses for payment of insurance coverage (4-FSS) | FSS Order No. 381 dated 09/26/2016 (as amended by Order No. 275 dated 06/07/2017) | January 21 (on paper) January 25 (electronically) |

| Personal income tax | ||

| Certificate of income of an individual (form 2-NDFL) new form | Order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/ [email protected] | April 1 |

| Providing tax agents with information about the impossibility of withholding personal income tax from individuals (form 2-NDFL) | Order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/ [email protected] dated 10/30/15 (as amended on 01/17/2018) | March 1 |

| Calculation of personal income tax amounts calculated and withheld by the tax agent (6-NDFL) | Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] (as amended on January 17, 2018) | April 1 |

| Tax return for personal income tax (form 3-NDFL) | Order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/ [email protected] (as amended on October 25, 2017) | April 30 |

| Insurance contributions for pension and health insurance | ||

| SZV-M Information about the insured persons | Resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2016 No. 83p | January 15 |

| DSV-3 Register of insured persons for whom additional insurance contributions for funded pension are transferred and employer contributions are paid | Resolution of the Board of the Pension Fund of the Russian Federation 06/09/2016 No. 482p | January 21 |

| Calculation of insurance premiums | Order of the Federal Tax Service of Russia No. ММВ-7-11/ [email protected] dated 10.10.2016 | January 30 |

| Calculation of insurance premiums for peasant farms without employees | Order of the Federal Tax Service of Russia No. ММВ-7-11/ [email protected] dated 10.10.2016 | January 29 |

| Personalized reporting to the Pension Fund (forms SZV-STAZH and ODV-1) new forms | Resolution of the Board of the Pension Fund of the Russian Federation 06.12.2018 No. 507P | March 1 |

| VAT, excise taxes and alcohol | ||

| Presentation of a log of received and issued invoices in the established format in electronic form for the second quarter of 2020* | Clause 5.2. Article 174 of the Tax Code of the Russian Federation | January 21 |

| Submission of a tax return on indirect taxes when importing goods into the territory of the Russian Federation from the territory of member states of the Eurasian Economic Union | Order of the Federal Tax Service of Russia dated September 27, 2017 No. SA-7-3/ [email protected] | January 21 |

| Tax return for value added tax | Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ [email protected] dated 10/29/2014 (as amended on 12/20/2016) | The 25th of January |

| Tax return on excise taxes on ethyl alcohol, alcohol and (or) excisable alcohol-containing products | Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ [email protected] dated January 12, 2016 | The 25th of January |

| Tax return on excise taxes on motor gasoline, diesel fuel, motor oils for diesel and (or) carburetor (injection) engines, straight-run gasoline, middle distillates, benzene, paraxylene, orthoxylene, aviation kerosene, natural gas, cars and motorcycles | Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ [email protected] dated January 12, 2016 | The 25th of January |

| Tax return on excise taxes on tobacco (tobacco products), tobacco products, electronic nicotine delivery systems and liquids for electronic nicotine delivery systems | Order of the Federal Tax Service of Russia dated February 15, 2018 No. ММВ-7-3/ [email protected] | The 25th of January |

| Submission of declarations on alcohol (with the exception of declarations on the volume of grapes) | Decree of the Government of the Russian Federation dated 08/09/2012 No. 815 (as amended on 05/13/2016) | The 25th of January |

| UTII | ||

| Tax return for UTII new form | Order of the Federal Tax Service of the Russian Federation June 26, 2018 No. ММВ-7-3/ [email protected] | January 21 April 22 |

| Unified (simplified) tax return | ||

| Unified (simplified) tax return for the first half of 2018 | Order of the Ministry of Finance of the Russian Federation No. 62n dated February 10, 2007 | January 21 |

| Single tax paid in connection with the application of the simplified tax system | ||

| Tax return for tax paid in connection with the application of the simplified taxation system | Approved by Order of the Federal Tax Service of Russia dated February 26, 2016 N ММВ-7-3/ [email protected] | April 1 (organizations) April 30 (IP) |

| Unified agricultural tax | ||

| Tax return for the unified agricultural tax | Approved by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ [email protected] dated 07/28/14 (as amended on 02/01/2016) | April 1 |

| Income tax | ||

| Tax return for income tax of organizations calculating monthly advance payments based on actual profit received | Order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/ [email protected] | 28 January |

| Tax return for income tax of organizations for which the reporting period is the first quarter, half a year and nine months | Order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/ [email protected] | March 28 |

| Tax calculation (information) on the amounts of income paid to foreign organizations and taxes withheld (when calculating monthly payments) | Order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/ [email protected] | 28 January |

| Tax calculation (information) on the amounts of income paid to foreign organizations and taxes withheld | Order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/ [email protected] | March 28 |

| Tax return for income tax of a foreign organization | Order of the Ministry of Taxes and Taxes of the Russian Federation of January 5, 2004 No. BG-3-23/1 | March 28 |

| Tax return on income received by a Russian organization from sources outside the Russian Federation | Order of the Ministry of Taxes and Taxes of the Russian Federation dated December 23, 2003 No. BG-3-23/ [email protected] | 28 January |

| Property tax | ||

| Calculation of advance payment for corporate property tax | Order of the Federal Tax Service of the Russian Federation No. ММВ-7-21/ [email protected] dated 03/31/17 | April 1 |

| Mineral extraction tax | ||

| Tax return for mineral extraction tax | Order of the Federal Tax Service No. ММВ-7-3/ [email protected] dated 05/14/2015 (as amended on 04/17/2017) | January 9 January 31 |

| Water tax | ||

| Tax return for water tax | Order of the Federal Tax Service No. ММВ-7-3/ [email protected] dated 09.11.2015 | January 21 |

| Gambling tax | ||

| Tax return for gambling business tax | Order of the Federal Tax Service of Russia dated December 28, 2011 No. ММВ-7-3/ [email protected] | January 21 |

| Transport tax | ||

| Tax return for transport tax | Order of the Federal Tax Service of Russia dated December 5, 2016 No. ММВ-7-21/ [email protected] | 1st of February |

| Land tax | ||

| Tax return for land tax | Order of the Federal Tax Service of Russia dated May 10, 2017 No. ММВ-7-21/ [email protected] | 1st of February |

| Financial statements | ||

| Financial statements | Approved by Order of the Ministry of Finance No. 66n dated 07/02/10 (as amended on 03/06/2018) | April 1 |

| Environmental payments | ||

| The calculation of payment for negative impact on the environment | Order of the Ministry of Natural Resources of Russia dated 01/09/2017 No. 3 | 10th of March |

| Calculation of the amount of environmental fee | Approved by order of Rosprirodnadzor dated August 22, 2016 No. 488 | 14th of April |

* Note. The journal is submitted by entities that are not VAT payers, or exempt under Article 145 of the Tax Code, and are not recognized as tax agents in the event that they issue and (or) receive invoices when carrying out intermediary activities.

Filling out section 1

In section 1, fill in:

- page 010 - OKTMO code by which insurance premiums were transferred.

The code must be specified in accordance with the Classifier, approved. By Order of Rosstandart dated June 14, 2013 No. 159-st. You can also find out OKTMO using a free service on the website of the Federal Tax Service of the Russian Federation.

- page 020 - BCC for the payment of contributions to the OPS.

When filling out the zero DAM for 2020, you must indicate BCC 18210202010061010160.

- page 040 - BCC for payment of compulsory medical insurance contributions.

When filling out the zero RSV 2020, enter the code 18210202101081013160.

- page 100 - KBK for payment of contributions to VNiM.

When completing the report for 2020, indicate KBK 18210202090071010160.

- pages 060 and 080 - put a dash.

All other lines must be filled with zeros.

Fill out subsection 1.1 of Appendix 1

In this section, fill out:

- page 001 - rate payer code.

These codes are given in Appendix No. 5 to the Filling Out Procedure.

- page 010 – number of insured persons.

From left to right, indicate the total number of insured employees for whom the report is being submitted:

- for the whole of 2020;

- separately for the 4th quarter;

- separately for each month of 4 quarters (1st month - October, 2nd month - November, 3rd month - December).

If the DAM is submitted only for a single founder-director, indicate “1” in all lines.

Enter zeros in all other lines.

Fill out Appendix 2 to Section 1

In this section you only need to fill in 2 lines:

- line 001 - payment indicator.

If the employer is located in the region participating in the FSS pilot project and the payment of benefits for VNIM is made by social insurance, indicate the value “1”. If benefits are paid at the expense of the employer, but with the offset of funds from the Social Insurance Fund, indicate code “2”.

- page 010 - number of insured persons.

We indicate the total number of employees throughout the year, in the last quarter and separately for each month of the 4th quarter. Citizens with whom civil law contracts have been concluded do not need to be taken into account.

In all other lines of the section, enter zeros.

Filling out section 3

In this section, enter data on individuals who worked under an employment and civil law contract throughout 2020.

On pages 160-180, enter the value “1” or “2” depending on whether the employee is insured or not.

Zero RSV 2019

Penalties for zero RSV 2020

| Type of violation | What threatens | Base |

| Late delivery of zero RSV | fine - 1,000 rubles. | Art. 119 Tax Code of the Russian Federation |

| Additionally, officials of the organization may be held accountable and fined in the amount of 300 to 500 rubles. | Art. 15.5 Code of Administrative Offenses of the Russian Federation | |

| Tax officials do not have the right to block a bank account for being late in submitting a zero RSV. | Letter of the Federal Tax Service of Russia dated May 10, 2017 No. AS-4-15/8659 |

Rented by whom and in what cases

Many questions asked by accounting specialists in this regard are mainly related to the existence of an impressive number of regulations that do not cover all situations. After all, there are many information sources overflowing with recommendations, additions, and clarifications. Understanding this abundance of materials is problematic. Therefore, it is worth paying attention to the most important details.

So, the first thing you need to pay attention to is the date the calculation was sent. This must be done every quarter until the 30th day of the month following the expired reporting year.

The period does not depend on the type of document execution (paper or electronic media), which is clearly and in detail stated in clause 7 of Art. 431 Tax Code of the Russian Federation.

But in the absence of a timely report, the employer will bear administrative liability in the form of a fine, as specified in Art. 119 of the Tax Code of the Russian Federation.

It is 5-30% of the amount of funds that should have been deposited (however, the minimum is 1000 rubles).

If payments to individuals are not made, how to act in this situation? In fact, there are several ordinary cases on which the course of action of the accountant, department head and general director of the enterprise depends.

If the activity is not carried out

If there is simply no financial and economic activity, it is necessary to provide a zero document on the DAM, which is detailed and clearly stated in the letter dated 04/03/2017 No. BS-4-11/6174.

This approach will help tax authorities make sure that the established framework has not been violated.

If employees went on leave without pay

In this situation, mandatory completion and provision of the DAM is required. The number of insured persons within the reporting period is to be indicated in lines 010 in subsections 1.1, 1.2. Filling out is also done in section 3, which requires the reflection of personal data for all insured individuals.

For each document participant, a specific set of data is indicated:

- FULL NAME;

- TIN;

- SNILS;

- date of birth;

- male or female gender;

- Country of Citizenship;

- ID card details.

The sign of the person’s insurance and the code value of its category also appear here.

Only the director is listed on the staff

The list of insured citizens is shown in detail in paragraph 1 of Art. 7 Federal Law No. 167 of December 15, 2001. These are Russian citizens, foreigners and those who do not have citizenship at all.

They are united by one condition: they reside permanently or temporarily in the country and carry out their labor duties on the basis of an agreement.

The sole participant of the Company has the right to assume the options of a sole director. In this situation, drawing up an agreement is not a mandatory point.

According to the norms of the current labor legislation, the interaction that has arisen between the company and its director is carried out outside the framework of labor relations. However, ignoring the deadlines for providing the DAM will force the general director to pay a fine of 1,000 rubles.

Moreover, the fact that there is no labor or civil law agreement does not play any role.

The procedure for paying contributions by the employer

The Tax Code of the Russian Federation, in particular its articles 425-429, acts as the legislative basis in this situation.

Tariffs were established precisely in these documents, as well as in Federal Law No. 179 of December 22, 2005. The validity of these rates was extended to 2019 on the basis of the legislative act “On Labor Tariffs” Federal Law No. 419 of December 19, 2016.

Tariffs are applied based on the size of the base, the type of activity and the category to which the payer belongs.

Along with this, social contributions are subject to reduction exactly by the amounts for which the payer managed to incur expenses (payment of sick leave, benefits). Calculations are made every month, and actual payment is made no later than the 15th day of the next monthly period.

Peculiarities of payment by a person who is not an employer

The procedure in which SV is calculated and entered is reflected within the framework of Art. 430 Tax Code of the Russian Federation. Payers who are not employers are obliged to provide transfers for two types of contributions (pension and health insurance). Pension payments include a fixed and variable component.

As for compulsory medical insurance, only a fixed share is included in them. The variable part is subject to transfer with an annual income of 300,000 rubles. The fixed amount can be received in installments throughout the year in accordance with any schedule convenient for the payer.

Let's sum it up

- A zero RSV for 2020 will need to be submitted if no income was paid to employees during the year, but employment and civil law contracts with them continued to be valid.

- It is also necessary to submit a zero RSV to the heads of peasant farms that do not have employees and organizations with a single founder-general director, even if an employment contract has not been concluded with him and his salary is not paid.

- The zero RSV for 2020 must be sent to the Federal Tax Service by January 30, 2020.

- In the zero RSV you need to fill out the title page, section 1, subsections 1.1 and 1.2 of Appendix No. 1 to Section 1, Appendix No. 2 to Section 1 and Section 3.

- As of reporting for the 1st quarter of 2020, the zero DAM is submitted using a new form and consists of only 3 mandatory sheets: title sheet, section 1 and 3. There is no need to fill out any more appendices to section 1.

If you find an error, please select a piece of text and press Ctrl+Enter.

Results

Filling out a zero calculation for insurance premiums is mandatory even if there are no indicators. To fill out the cover sheet for calculating insurance premiums in 2020 with zero reporting, standard data about the company is sufficient. Place zeros in the cells of sections 1 and 3, intended for summary and quantitative indicators, and cross out the remaining empty spaces.

It is better to fill in the fields for the BCC, otherwise difficulties may arise with the generation of an electronic insurance report.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.