It is unfortunate, but we live in an era of consumption. There are so many shopping centers, colorful boutiques and attractive stores around that beckon us to go in and buy something. And there’s nothing to say about electronic devices. New and useful devices are coming out at a breathtaking pace. I just want to own them.

Every trip to the store forces us to think about the money we leave here. After all, prices are constantly rising and our expenses, even planned ones, are increasing. If only we could find a tool that would help us make the necessary and planned purchases with pleasure, without worrying too much about increased prices and expenses.

Imagine that you have a magical device that allows you to simultaneously make/pay for purchases and at the same time earn money. The article will discuss what cashback is in simple words and how to use it to benefit the family budget.

The Downside of Spending

The article will discuss programs and methods that allow you to earn real money on purchases. Provided that these purchases are planned. And we will make money on cashback.

Translated from English, cash back means money back. The meaning of cashback is that the buyer gets back part of the money spent on the purchase. Thus, stimulating him to spend even more.

Cashback is a type of loyalty program to attract and retain customers in a business. These programs owe their greatest popularity to the financial sector, which widely promotes them.

Is there a difference between cashback and regular discounts? And is the game worth the candle? Let's figure it out.

What is cashback in simple words and how to use it

In standard discount programs, a discount is provided to the buyer by reducing the seller's profit. That is, by reducing the price, the seller seeks to attract more buyers, thereby increasing sales.

Unlike discounts, cashback is paid to the buyer by a third party, and not by the seller of the product. This third party is called an affiliate. Its main task is to ensure an influx of buyers into the business.

Where is the cabshack?

Currently, loyalty or cashback programs are already used not only in the financial sector, but also in retail and online stores, pharmaceuticals and many other areas.

All cashback programs are similar in that they return a certain percentage of the purchase, but there are also nuances. Let's look at the most common programs.

Financial sector

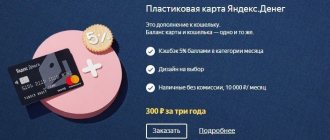

There is probably not a single bank left that does not offer its customers bank cards with a cashback program. These programs can be divided into two types. Some pay cashback in the form of real money, while others award points, bonuses or other conventional units, which, in most cases, can be converted into rubles.

Cashback programs exist for both debit and credit cards. The standard cashback amount for purchases with bank cards is 1%. But banks can pay out more. There are banks that return up to 15% cashback for certain categories of expenses.

There are separate categories for purchases in pharmacies, shops, beauty salons, restaurants and others. Purchases are divided into categories based on the MCC code of the purchase.

Each bank sets its own rules and conditions for accruing increased cashback. For example, some banks impose restrictions on the minimum amount of personal funds on a card or account. Others do not award increased cashback if there were no expenses in regular categories. Therefore, you need to carefully study the program rules.

Banks mainly use two approaches to assigning categories with increased cashback:

— permanent categories: with this approach, the categories of increased cashback do not change over time. The bank client has the opportunity to select one or more categories to receive increased cashback. It all depends on the conditions of a particular bank. However, the user can change the increased cashback category once a month. It will take effect next month.

- variable categories: with this approach, the categories of increased cashback change over time, usually every quarter. That is, at the beginning of the quarter, the bank client will need to choose which of the proposed categories he will receive increased cashback for. The selection procedure will be repeated again next quarter.

choose what is more profitable

Additionally, banks offer increased cashback, which can reach 15%, 20% and even more, when making purchases from bank partners. And these include grocery stores, and stores of household goods and electronics; service organizations, hairdressers and others did not go unnoticed.

Benefits of the programs:

- Free card servicing if certain conditions are met depends on the bank;

- Cashback is paid in real money via debit cards at most banks;

- Increased cashback yield on credit cards through the use of savings accounts and deposits. For more detailed recommendations on using credit cards, read the article (link will open in a new window);

- You can pay for purchases with a card in almost any store;

- Can be used in conjunction with other cashback programs.

Disadvantages of the programs:

- Credit cards mainly charge virtual units, which can be converted into rubles under certain conditions;

- Owning a credit card negatively affects your credit rating, and as a result, you may be denied a loan when you need it;

- The risk of increased costs due to late repayment of credit card debt;

- The limit on the monthly cashback amount you can receive depends on the bank.

Sellers of goods and services

Trade enterprises also do not remain aloof from implementing their own programs to attract and retain customers. More and more retailers and online stores are introducing their own cashback programs.

Unlike financial sector programs, in these cashback programs the seller credits the buyer with virtual accounting units (points, bonuses, etc., etc.) for purchases made.

These accounting units can be used to pay for subsequent purchases from the seller who accrued them. For example, one well-known sporting goods retail chain awards its customers points that can be used to pay for up to 30% of future purchases.

In most cases, these accounting units have an expiration date and can only be used to pay for part of a future purchase, and only in that store.

Benefits of the programs:

- Significant discounts on goods and services may be provided only for program participants;

- Payment by any bank cards;

- Closed sales and promotions.

Disadvantages of the programs:

- Rewards are awarded in virtual units;

- Cashback cannot be withdrawn;

- You can pay for goods or services with points only in the stores of the program organizer;

- Limited lifespan of points;

- Partial payment for purchases with points.

Online cashback services

In addition to bank cashback programs, there are also specialized cashback services that pay rewards for purchases from their partners. Sellers of goods and services pay commissions to these cashback services for each attracted buyer.

refund for online purchases

The services, in turn, share the commissions received with customers. Thus, they encourage the latter to buy goods and services through their service.

Unlike the cashback program, you can pay in various ways for purchases from bank partners in online services. These include bank cards, cash to the courier, electronic wallets, and other methods. While in order to receive rewards for purchases from bank partners, you need to pay only with a card from a specific bank.

These services became most widespread with the development of the Internet and are used mainly for online purchases. However, there are services that allow you to receive cashback for offline purchases. True, mainly for promotional items, and not for all purchases.

As mentioned earlier, these services are mainly intended for online purchases. Therefore, if you rarely make online purchases, it will take more time to accumulate enough money to withdraw money. Since many services limit the minimum amount for withdrawal, for example, 500 rubles or even more.

Benefits of the programs:

- Possibility to buy from a large number of online stores;

- Cashback with real money;

- Withdrawing rewards to a bank card;

- Discounts and promotions for service participants.

Disadvantages of the programs:

- Standard cashback 5-10% of purchase;

- There may be restrictions on the minimum amount for withdrawal;

- Mainly intended for online shopping;

- Cases of fraud are not uncommon.

Banks began to be divided?

Now a large number of banks give their cashback for purchases using their cards.

Here I’ll tell you right away - the choice is so huge that trying out every bank can drive you crazy.

But!

I will soon do a review article about debit and credit “plastics” that can return money with interest on purchases.

Wait, I’ll dig in and write an article.

So, why is this happening, have you ever wondered?

Have banks gotten so rich that they are now happy to share with their clients? I doubt .

The goal of all financial organizations is to get as much money as possible, but suddenly they suddenly became richer. Suspicious ! Don’t worry, banks have not abandoned their philosophy, but, on the contrary, have figured out how to earn even more from the cashback that is kindly provided to cardholders.

"Where is the money, Zin"

Before continuing the story about how to make the most money from cashback, you need to remember the following point. In most cashback programs, rewards are accrued even from purchases at special prices and promotions. This makes purchases even more profitable.

There are a lot of cashback programs, so how do you know which tool or combination of tools is right for you? This question is easy to answer, provided that you are managing a family or personal budget.

In the case of budgeting, you have an accurate idea of your spending categories and their amounts. For more information about managing a family budget, read the article (link will open in a new window). Now all you have to do is select a cashback program for each category.

For example, you have the following categories of expenses in your budget: lunch at work, groceries, utilities, fuel for cars, cellular communications, and so on. Now for each category you indicate which cashback program you will use. Below is a fragment of the cashback card selection table.

| Name of expense | Sum | Bank opening | MTS Bank | Credit Europe Bank | Bank Vostochny |

| payment for housing and communal services | 6’000,00 | 0% | 0% | 0% | 5% |

| public transport | 2’500,00 | 2% | 1% | 10% | 5% |

| automobile | 4’000,00 | 2% | 5% | 7% | 1% |

| Food | 30’000,00 | 2% | 1% | 1% | 1% |

| cellular | 1’4000,00 | 0% | 0% | 0% | 0% |

| buying clothes | 3’600,00 | 2% | 1% | 1% | 1% |

| buying medicines | 1’000,00 | 2% | 5% | 1% | 5% |

As can be seen from the table, for the category of purchasing medicines, it is proposed to use an MTS credit card, which will accrue 5% cashback for purchases in pharmacies. You can view the map in more detail (link will open in a new window). Plus, when shopping in pharmacies, we will additionally use the loyalty program of the pharmacy itself. This will allow you to save additional money on your purchases.

It's all in the details

When developing a usage strategy, you need to thoroughly work out and think through all the nuances. So, for example, using bank cards with variable categories of increased cashback is less effective. Especially when you are planning and maintaining a personal or family budget.

Moreover, using these cards is not advisable, since it will not allow you to plan your income from cashback programs for a long period, or will significantly complicate the planning process. And this can cause your cashback income to drop significantly.

For example, this quarter the bank is awarding increased cashback of 5% for purchases in supermarkets. For a month you have allocated, say, 20,000 rubles for this expense item. Thus, in a month you can receive 1,000 rubles. A very good increase in income, especially since you get it for spending money))).

In the next quarter, the bank is changing the category to purchases in flower shops, and you don’t have this article at all. There aren't even birthdays in this quarter. You are now forced to use the usual 1% cashback. That is, now you will receive 200 rubles for purchases in supermarkets. Plus, you have the task of looking for a new card with increased cashback for purchases in grocery stores in order to restore profitability.

Additionally, you will need to decide what to do with your current bank card. After all, it is not advisable to use it this quarter, and you cannot say with confidence that it will be useful for the next quarter. What if that card's annual service depends on what you spend on it? Then you will have to pay for it. That is, it will turn into a liability.

Looking for cashback

Developing a strategy for using cashback programs and their combinations is purely individual. After all, it depends on your budget and preferences.

To get the maximum benefit from using cashback programs, they need to be combined. That is, use several programs simultaneously to make one purchase.

To create a plan for making money from cashback programs, we suggest using the tools listed below. Of course, you can use other programs. Unleash your financial imagination.

drawing up a strategy

- Cashback on credit cards. The main tool for earning money. Because it allows you to use other people's money to pay for your expenses. Receive rewards for this in the form of cashback. They also allow you to increase your income by storing your own funds in bank accounts. But the use of credit cards requires high financial discipline in terms of control and timely return of funds. Otherwise, all the benefits from them will come to naught.

- Cashback on debit bank cards. A backup tool for those categories of expenses for which, for some reason, it is not possible to use credit cards.

- Online cashback services. We will use these services for online purchases. Payment will be made by debit or credit card with cashback.

- Own cashback loyalty programs for sellers of goods and services. In those stores where we most often make purchases, we will use their loyalty program. For example, grocery stores, clothing and sporting goods stores and many others. Naturally, we will pay with bank cards with cashback.

As mentioned earlier, banks offer different cashback percentages for different spending categories. Therefore, it is advisable to use several cards for different expense items of the family or personal budget. In addition to the financial benefits, it will also have a positive effect on your memory. After all, you need to remember which card is intended for which expenses.

So, when drawing up a plan to make money from cashback programs, you need to strive to maximize the income from these programs. To do this, when making a purchase, you should be guided by the following recommendations:

- If possible, place orders through an online cashback service.

- When making offline purchases, use merchant cashback programs.

- Payment for goods or services must be made by credit or debit card with cashback.

For example, you got together with your whole family of 3 people to go to the cinema. Each ticket costs 300 rubles. In total you will pay 900 rubles. We will use the online service to order tickets. For example, MTS cashback, which offers 20% cashback for purchasing tickets. We will pay for tickets using a cashback credit card. It is advisable that the card be connected to the “Entertainment” category of increased cashback, which offers a 5% return in most banks. Thus, we will be able to get back 25% of the amount spent. The only point is that cashback from MTS can only be spent on paying for cellular communications or making purchases in MTS stores.

As a result, through the simultaneous use of different cashback programs, it is possible to increase income, in some cases, double it. You also need to keep in mind that when using credit cards, income from purchases will be higher due to storing your own funds in a savings account or bank deposit.

Additionally, online services provide the opportunity to register as a partner. In this status, in addition to receiving rewards for your own purchases, you can receive incentives for attracting new users to the service. As well as a separate bonus for purchases made by these users.

How to earn cashback

Cashback is a rather interesting way to really save on online purchases. You can earn it in two ways:

- Take advantage of special services.

- Pay using a cashback card.

Services live by receiving a percentage from each attracted client. And in order not to engage in additional advertising, they simply share part of the profit with their visitors. This is a mutually beneficial cooperation. The portal makes money, and you save on online purchases.

Bank cards with cashback also have benefits for credit institutions themselves. Firstly, they increase audience loyalty to all products, and secondly, the minimum balance on the card is used to finance additional operations of the credit institution. That is, they give someone a loan for your money.

Choosing a profitable cashback program

When choosing cashback programs, we recommend that you carefully read and understand the program rules and pay close attention to the following:

- Refund amount. It is usually indicated as a percentage. True, there are programs in which the return is calculated in accordance with the proportion. For example, 1 point is awarded for every 50 rubles of purchase. Knowing this value will help in planning your income for inclusion in your personal and family budget. For example, your expenses for visiting cinemas are 5,000 rubles per month. By paying for the purchase of tickets with a cashback card in the “Entertainment” category in the amount of 5%, you can return 250 rubles.

5’000,00*5%=250,00

- Cashback accrual period. In some cases, accrual occurs within 1-3 days after making a purchase. In others - at the end of the month. This gives you an idea of when you will be able to receive the money.

- In what units is the remuneration calculated? In some programs, payments are made in real money, which can be used immediately. In other programs, enrollment occurs in points or other virtual units. In the future, they can be converted into real money, in most cases.

program performance analysis

- Maximum cashback amount. Many cashback program organizers impose a limit on the maximum total reward amount per month. Thus, you can calculate the monthly spending limit for a specific program. For example, with a bank card with a 5% cashback in the “Entertainment” category, you can return a maximum of 1,000 rubles per month. Then for this category of expenses it is not advisable to spend more than 20,000 rubles per month.

1’000,00*100%/5%=20’000,00

- Rules for withdrawing or converting cashback. In some programs, you can withdraw money to your account or convert points into rubles only when you reach a certain amount. When maintaining a personal or family budget, you can predict in advance how long it will take to reach this minimum amount. In other words, when you will receive income from a particular cashback program.

- The lifespan of the reward received. There are cashback programs in which the accrued reward has its own lifespan, for example, 1 or 2 years. Knowing this parameter, in combination with the previous two, you can calculate not only the amount of monthly expenses for a specific program. And also the period it will take to accumulate the minimum amount for cashback withdrawal. For example, a bank awards points for spending on a card. The lifespan of these points is 1 year. The minimum amount for converting points into rubles is 4000. Let’s consider the same category “Entertainment”, as in point 1. You can accumulate 250 points per month. As a result, it will take us 16 months to accumulate the required amount for withdrawal.

4’000,00/250,00=16

Thus, with current expenses in this category, our points will expire. It turns out that a card with the “Entertainment” category under such conditions is not beneficial for us.

- Conditions for cashback payment. Some programs have restrictions that affect your ability to receive rewards. These may include, for example, a minimum order volume or spending within a month. Or the amount of own funds on the card and others.

- Financial costs. This is also an important parameter, as it allows you to estimate the real amount of income from the cashback program. Costs may include: annual or monthly maintenance on the card, participation fee, withdrawal commission and others, depending on the conditions of the specific program organizer. For example, let’s say that the cost of monthly servicing of a bank card with a 5% cashback in the “Entertainment” category is 99 rubles. We spend 5,000 rubles per month in this category, which gives us 250 rubles in cashback. Then the real monthly income will be only 151 rubles.

250,00-99,00=151,00

When using cashback programs, you should also be aware of transactions for which cashback is not paid. They are different for each program. Therefore, you need to carefully study the terms of the program. But there are some common transactions, in most programs, for which bonuses are not awarded.

Cashback in online services is usually not credited:

- For offline orders placed, for example, through a phone or a store’s mobile application;

- For paying for your order with gift certificates;

- For using third-party bonus programs, including stores’ own programs;

- For technical reasons, for example, an ad blocker is installed in the browser, an item is added to the cart before leaving the online service, placing a large number of orders in a short period of time, and others;

You need to study in advance the full list of restrictions that may affect the accrual of cashback under the program. To prevent technical problems, you can use a separate browser for purchases in online cashback services.

studying all the nuances

Cashback on bank cards is usually not credited:

- For receiving cash;

- For the return of the cost of the goods;

- For payment of fines, taxes and housing and communal services;

- For transactions with highly liquid assets. They are also called “quasi-cache” operations. Such as replenishing electronic wallets, purchasing securities, paying bets in gambling establishments, and so on.

It is better to study the full list of restrictions of a particular bank before applying for a card. Additionally, this will help in drawing up a more accurate algorithm for using the card in the overall strategy for making money on cashback programs.

Cashback is usually not awarded in sellers’ own programs:

- For the purchase of goods and services for which special prices have already been established;

- For the purchase of goods and services that participate in sales or promotions;

- For the use of third-party bonus programs.

Thus, cashback programs will be profitable if you follow all the rules of the program and follow your strategy.

Bank benefit from cashback

First of all, bonus programs are beneficial to the bank, because it:

- attracts new clients with its programs;

- increases the turnover of funds on cards;

- receives incentives from sellers;

- does not remove cash from circulation;

- They sell more and more new cards and options for them.

Inspired by gifts, customers try not to withdraw cash from ATMs, which are costly to operate. Money that does not leave accounts remains in circulation with the financial institution.

Bank cards with cashback

By stimulating the issuance of plastic cards, the bank can earn money by servicing them, connecting SMS notifications, and overdraft. An entire economic system is being formed that helps the development of the issuer.

TOP 5 services and cashback programs

There are many cashback services and programs. Choose any one that suits you, both with the terms of participation and the variety of partner stores represented. At the beginning of your acquaintance with these services, we recommend focusing on well-known players.

Online cashback services

| Service name | Description of the service | Minimum withdrawal amount | Service commission |

| Letyshops | More than 2400 stores available. In addition to the basic cashback amount of 3-6%, depending on the specific store, additional rewards are provided. This could be increased cashback, a discount from the seller, or user promotional codes. The service also has a loyalty program that awards up to +30% to the base cashback, depending on the level. | 500 rubles | No |

| Kopikot | More than 1300 stores available. The average cashback rate is 2 – 5%. Additionally, a super bonus can be awarded once every 3 months. Plus, some sellers periodically offer increased cashback. There are also discounts and promotional codes. | 500 rubles | No, except withdrawal to PayPal |

| Switips | More than 5900 stores available. The average cashback rate is 2-6%. Additionally, some sellers periodically offer increased cashback. Plus there are discounts. The service also has a loyalty program that pays increased cashback +66% to the base level when registering for free using a referral link. | 800 rubles | 3% +70 rubles |

| Megabonus | About 800 stores available. The average cashback rate is 2-4%. Additionally, discounts and promotional codes apply. The service also has a loyalty program that pays increased cashback up to +50% of the base level, depending on the level. | 100 rubles | No, except for card output |

| Smarty.sale | More than 600 stores available. The average cashback rate is 2-5%. Additionally, discounts and coupons apply. Plus, some sellers periodically offer increased cashback. The service also has a loyalty program that pays increased cashback up to +50% of the base level, depending on the level. | 5 rubles | No |

Bank cards with increased cashback

The table below considers credit cards only.

| Card name | Program conditions | Cashback amount | Annual maintenance |

| Opencard from Bank Otkritie | The cashback amount depends on the selected category. The following categories are available: transport; cafes and restaurants; trips; beauty and health; for all. To receive maximum cashback, you must fulfill 2 conditions within a month: 1) Pay for services or goods through a mobile application or online bank for any amount; 3) Keep at least 100,000 rubles on all cards. | up to 11% | No |

| Card Delight from Bank Vostochny | The cashback amount depends on the selected category. The following categories are available: driving; warm; rest; online shopping; all inclusive. Cashback is awarded when making purchases over 10,000 rubles per month. | up to 15% | No |

| Yandex.Plus card from Alfa Bank | The maximum cashback is awarded for expenses on Yandex services, which change every quarter. Increased cashback is awarded for purchases in the following categories: restaurants, entertainment, sporting goods and educational services. For the rest, 1% is charged. There is no need to select categories. To compensate for a Yandex.Plus subscription, you need to spend at least 5,000 rubles per month. | to 10% | 490 rubles from 2nd year |

| Tinkoff Drive from Tinkoff Bank | Maximum cashback is awarded for all purchases at gas stations. Increased cashback for paying for any car services, including parking, toll roads, and even paying fines through Tinkoff. For other expenses, 1% is charged for every 100 rubles. There is no need to select categories. The amount of accrued cashback in upgraded categories depends on regular spending, for which 1% is added. | to 10% | 990 rubles |

| Urban Card from CreditEurope Bank | The maximum cashback is awarded for expenses in the categories of urban transport, trains, Aeroexpress, and bicycle rental. Increased cashback is awarded for purchases in the following categories: gas stations, car washes, taxis, toll roads, car sharing, tire service, parking, car and motorcycle rentals. For the rest, 1% is charged. There is no need to select categories. | to 10% | No |

The article presents a small part of services and cards with cashback. You can familiarize yourself with all the proposals yourself, applying the evaluation principles set out in the article.

Review of cashback services for earning money

Let's look at the TOP 7 cashback services that offer favorable discounts:

| Name | Withdrawing money |

| Letyshops | To phone;Webmoney;Yandex.Money;PayPal;Bank card account;Qiwi. |

| Backit (formerly ePN) | To the phone; Webmoney (dollars and rubles); Yandex.Money; Qiwi; Bank card account (rubles, dollars); ePayments (commission 1% of the amount). |

| Cash4brands | Webmoney;Yandex.Money;Qiwi;To phone;PayPal;Bank card account. |

| Kopikot | Webmoney;Yandex.Money;PayPal;Bank card account;To phone. |

| Discount.ru | To the phone; Yandex.Money; Bank card account, with a commission of 1% (but not less than 37.5 rubles); Webmoney. |

| Cashback | Bank account (commission 2.5% + 45 rubles); Webmoney (commission 0.8%); Yandex.Money (commission 1.5%); PayPal (commission 2%); Qiwi 2%; Bitcoin (no commission). |

| Getcashback | Webmoney (all currencies); PayPal; Qiwi; Bank card account. |

A list of the best offers specifically for AliExpress is presented in this article.

Seek and you will find

In conclusion, I would like to say that you can create your own strategy for using cashback programs and it is within your power. But remember that programs have many rules and restrictions that can be accidentally broken. Accordingly, this will lead to deprivation of cashback.

Plus, cashback programs motivate unnecessary spending. Therefore, be sure to maintain a personal or family budget and improve your financial literacy. Take control of your expenses and make money from it.

In the article, we looked at what cashback is in simple words and how to use it profitably. Continue to use existing programs and keep an eye out for new cashback programs. Be open to new opportunities!