What is direct investment

Direct investment – investing in tangible assets (production, mining, innovation). Wherein:

- independent choice of object is implied;

- monetary source – own and borrowed funds;

- obtaining a share in the authorized capital of at least 10%.

Direct investing implies the opportunity to influence the development of a company (or even an entire industry). This is the main difference - the scale of the invested finances is such that part of the corporation is bought in one fell swoop.

Who is a direct investor

It is clear that only a large enterprise, corporation, or holding company can invest such an amount. A direct investor is a legal entity, even if it is of state ownership.

Investment Example

Examples of high-profile direct investments:

- Acquisition of Mittal Steel Corporation, led by Indian tycoon Lakshmi Mittel, a steelmaking company (93.2% stake).

- Purchase of JSC Russian Chrome in Russia by Kermas Group, a British company aimed at global control of chromium (together with the Italian Luigi Stoppani Spa).

- The Ukrainian financial and industrial group Privat is trying to take ferroalloys under its wing. Controls 6 enterprises in Eastern Europe.

Development in Russia

After the collapse of the USSR in the 90s, investing in non-capital-intensive industries with a quick return on investment (trade, food from McDonald's to mini-bakeries) became popular.

During the period of active “privatization,” there were those willing to acquire promising companies cheaply. After some time, domestic tycoons began to reinvest profits in the mining industry, oil and gas production, and the production of metals and alloys.

The main foreign investors entered the Russian market from Germany, Cyprus (our guys, but registered offshore), China, USA, Taiwan.

Direct investments in shares, business, construction and other examples

Direct investments are made in the form of:

- purchase of a block of shares by a foreign investor;

- reinvestment of profits: the income received is used for business development;

- loan within the company.

Let's look at the main examples of such investments.

Investing directly in stocks can yield large returns that far exceed other investments. You can start earning income with small investments, for example, buying one share of a company. In this case, you can choose one of two ways to generate income:

- passive: bought and are waiting for dividends to be paid;

- active: promote price growth to obtain greater profits.

Among the disadvantages are unstable income in the long term, high risks due to the likelihood of bankruptcy of any enterprise, suitable for experienced investors or you will have to pay for the services of a broker.

Direct investment in construction is a more cost-effective way than, for example, purchasing a finished property. Real estate guarantees good prospects, as it has stable demand. The investor is offered a wide selection of investment objects.

Direct financial investment in a business is the most common type of investment. On the one hand, the enterprise receives the necessary funds for development, on the other, the investor participates in the development of the company and receives income for this equal to his share.

What determines the volume of investment in direct proportion?

The volume of investment depends in direct proportion on:

- changes in the share of savings;

- profitability.

In addition, the size of investments depends on the price level, production costs, and the political situation in the state.

Kinds

The classification divides investments by duration and conditions of occurrence.

According to the conditions of occurrence

An investor is often located in one country, but invests in enterprises in another. Then the export of capital occurs. Investments are considered outgoing. When the money for an object is foreign, the investment is incoming.

By validity period

In terms of validity period, investments are no different from others:

- Short-term: several months – 2 years.

- Medium term: 2–5 years.

- Long-term: over 5 years.

Geographical distribution and extent of foreign direct investment

Etc

Major foreign investments form the basis for the dominance of TNCs in the world market. In the post-war period, the largest investors were US multinationals, and investments were directed mainly to developing countries.

But the growth of foreign direct investment since the early 1970s. became slower, their direction changed. More and more investments are directed to Western European countries. Foreign direct investment since the early 1980s. from England, Germany, Canada, and the Netherlands began to be sent to the United States, which became the largest importer of capital. Since the late 1980s, a new direction of foreign direct investment has emerged - the region of Eastern and Central Europe and the economic space of the former USSR. The main importers and exporters of foreign direct investment are currently developed countries.

They account for almost 90 percent of the accumulated volume of exported investments and more than 60 percent of imported capital. The United States occupies a leading position in this area. Behind them are France, Germany, and Great Britain. In 2006, $175.4 billion of foreign direct investment was invested in the American economy. According to UNCTAD, the total volume of annual foreign direct investment in 2006 was more than $13,000 billion (for comparison, in 1995 - $315 billion ).

The demand of the RS and CEE countries for foreign capital in the last 15 years has been greater than its supply. This is explained by the fact that in the 1990s. Most developing countries have moved from a strategy of self-reliance to a strategy of economic openness. They lack domestic savings and are actively resorting to foreign capital.

Hong Kong and China remain the favorites for foreign business among DCs. In 2006, the influx of foreign direct investment into this country reached approximately $70 billion.

But the scale of this process is still small. In addition, the financial crisis of 1995-1997. significantly reduced the reserves of free capital in the NIS economies. In the CIS and Eastern European countries, the main recipients of FDI are the Czech Republic, Poland, and Hungary. Their influx is facilitated by the liberalization of capital migration conditions. State policy is based on eliminating all possible restrictions on its movement, creating the most favorable investment climate in the country.

Investment climate is a set of everyday, political, economic, social, legal and other conditions (factors) that determine the degree of investment risk and profitability of capital.

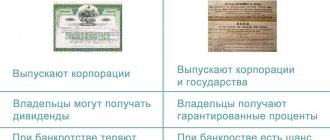

How are they different from portfolio investments?

Let's look at the difference between direct and portfolio investments in international capital flows.

| Direct investments | Portfolio investment |

| Investment in an object that produces material assets | Investing in securities |

| Provide control over the investment object | Do not give the right to real control |

| Participants: private entrepreneurial capital (with a possible share of state influence) | Participants: states and private capital |

International and state regulation of foreign direct investment

Given the increasing political importance of foreign direct investment, it is monitored both internationally and nationally.

State regulation of foreign direct investment

Nazi

Onal control is based primarily on the application in each country of the institutions and norms of traditional branches of law (civil, administrative, and so on). But due to the intensive development of the international investment process, special legislation has appeared in most countries in the form of investment codes and laws. The basis of this legislation is the investment conditions and legal guarantees in the host country for foreign investors.

State stimulation of foreign direct investment includes:

1. Providing state guarantees

Within the framework of these guarantees, the mutual interests of the foreign investor and the host country are taken into account. In most countries, legislation includes provisions that provide foreign investors (individuals and legal entities) with the national treatment of the host country, that is, there is no discrimination against foreign investors compared to local ones. This guarantee is a kind of international standard, with the help of which foreign investments are guaranteed conditions no worse than local ones.

The legislation of some countries contains provisions on protection from natural disasters, political risks, etc. For example, it is stipulated that the nationalization of private property can be carried out only in exceptional cases and with a guarantee of equivalent compensation; freedom of repatriation of capital and export of profits is guaranteed.

2. Providing administrative, customs, tax benefits in the host country

Transition and developing countries sometimes introduce special incentives for foreign investors. In particular, large benefits are provided to investors in FEZs and offshore centers, in which the procedures for registering new enterprises are greatly simplified, broad tax and other benefits are provided for foreign enterprises, currency restrictions are removed, financial reporting is simplified, the confidentiality of the identity of the company owner is protected, and so on. .

3. Control of investment disputes

4. Insurance of foreign investments.

5. Elimination of double taxation

The laws of most countries provide for direct mutual investments. For this purpose, the issue of eliminating double taxation is discussed.

Advantages and disadvantages

Among the advantages of direct investments for investors:

- market control;

- opportunity to get maximum profit;

- tax reduction;

- technological leadership;

- access to raw materials;

- reduction of transport costs;

- savings on personnel: highly qualified workers often receive inadequate pay;

- company expansion.

The disadvantages of direct investment for an investor are the risk of a change in political course, revolution - and, as a consequence, the loss of all property.

For the state:

- loss of control over certain industries;

- underpayment of taxes;

- environmental pollution.

Profitability and risks

Yield shows the net profit from invested funds. The indicator depends on the industry and the state of the investment object. It’s not bad at all when the investment pays off in 5 years (20% return).

The main risks for direct investment are politics (legislation, taxes) and force majeure.

Sources of financing, market development and direct results of investments

Sources of financing for direct investment depend on the company’s operating conditions and the dynamics of its development. It can be:

- own funds or reserves within the enterprise (if it is a legal entity);

- borrowed money;

- raising profits from the issue of securities, share contributions;

- off-budget funds;

- foreign investors.

Sources of investment are closely related to financial and credit relations that arise between other participants in this process. Another equally important source is profit from core activities. The use of foreign deposits contributes to the development of international economic relations.

The emergence of the direct investment market had the greatest impact on the development of free trade, competition and stability in the economy. Under such conditions, investments help countries receive all the benefits of global economic integration.

In addition, not only finances are invested in the company, but also the knowledge, experience, and connections of the investor, because he has a stake in the enterprise and contributes to its development. The direct results of such investments are the development of the country’s economy, increased employment, and reduction of social problems. The development of advanced industries and international trade flows are also being stimulated.

How and where it is profitable to invest today

Every company and every industry has its own break-even point. I do not recommend:

- buy a barn if you have no knowledge about animal husbandry;

- a workshop for the production/assembly of something, etc. – if there is no specialized knowledge.

Direct investment involves direct management. But if you really want to “steer”, look at objects in a dozen sectors of the economy of the country of interest.

You don’t need to think that direct investments are only millions. For example, in Turkey one of the main industries is the tourism business. Hotels and pleasure yachts are available for investment. And if you look around, there’s a marble/sand quarry and a leather goods factory.

How to do it?

There are private equity funds. These organizations provide the opportunity to buy out a controlling stake of shares that have not yet been released to the market, that is, have not gone through the IPO procedure - public issue. PEF funds are regulated at the legislative level.

Direct investments are somewhat similar to shares in a mutual fund (mutual investment fund). Indeed, mutual funds and PEFs have common features.

The activities of both types of funds are regulated by the same laws, this applies to both international funds and Russian ones. When investing in both types of funds, investors receive shares in accordance with the amount of funds invested. Income from the acquisition of shares is subject to preferential taxes.

Mutual funds and PEFs have differences. PE funds cannot purchase shares of joint stock companies (joint stock companies) and shares of public companies, securities and invest funds in state-owned enterprises. PE gives the right to influence the economic activities of the enterprise: the votes of fund participants have different weight.

In Russia there is RDIF ( Russian Direct Investment Fund ), which was created at the direction and under the leadership of the President of Russia and the Prime Minister of the Russian Federation in 2011. This is a sovereign (state) fund created specifically to finance actively developing enterprises in various sectors of the economy. 90% of the fund's assets are investments from co-investors. The fund also attracts foreign investors, who, thanks to the fund, have invested about $30 billion in the Russian economy from its opening to 2016.

When carrying out transactions, the fund acts as a co-investor in the market together with other private equity funds (direct investment funds) and sovereign funds. Flagship companies in a particular industry invest equally with them. All partners are focused on equal sharing of risks and distribution of profits according to the level of invested funds.

Companies that are financed by the fund carry out an additional issue; the fund buys shares before they enter the market, receiving the right to participate in the management of this company.

RDIF finances only large-scale projects in the field of healthcare, nuclear energy, telecommunications and information technologies, and so on. Exit from the project for any of the participants is possible by placing the company's shares on the stock exchange or selling shares to an institutional investor. The official website of the RDIF is rdif.ru. On it you can read all the requirements for co-investors, learn about current projects and foreign partners of the RDIF.

Reliable investments on the Internet

Views: 854

What is direct investment?

Direct investments are understood as investments, the main purpose of which is direct participation in the management of the organization.

This type of investment meets the following requirements:

- The share of the entrepreneur making the investment is ten percent of the authorized capital of the enterprise.

- The entrepreneur is directly involved in managing the activities of the company and can appoint his own person as a member of the board of directors.

- The shares are not listed on stock exchanges.

Features of direct investment

As for the fundamental distinguishing characteristics of direct investments from other types of investments, this is that they are intended to participate in the administration of the company. Indirect investments, in this regard, are necessary only to generate additional income. From the point of view of the level of risks, direct investments are much more risky, since, usually, funds are invested at the stage of launching the project. But, on the other hand, they are the ones who bring big profits if the project is successful and continues to improve and develop. Sometimes an entrepreneur may turn to a specialized agency for help. Another distinctive characteristic is the long-term nature of investments. This is due to the fact that since investments are made at the start-up stage of the organization, quick profits are practically excluded. You need to understand that direct investments are aimed at the long term. However, if implemented successfully, the profit will exceed all expectations. It can also be mentioned that direct investments are much less easily realized in comparison with indirect investments.

Situations often arise in which the type of investment in question requires approval from certain financial institutions. Let's give a simple example for a clear understanding. An entrepreneur wishes to acquire a controlling stake in a banking organization. In this case, it is necessary to obtain the consent of the Central Bank of the Russian Federation.

However, even despite these difficulties, direct investment is characterized by stable growth in comparison with other types. This interesting fact can be explained by several reasons, including the requirements of scientific and technical progress, as well as competition, which acts as an impetus for the development of innovative ideas and developments.

Types of direct investment

As for the classification of this type of investment, it depends on the main characteristics inherent in them. For example, they can be carried out by individuals or specialized investment organizations. In addition, this type of investment can be made by a private equity fund.

For individuals, direct investment of funds can be realized as bank deposits or mutual funds. As for deposits, they can be made in both foreign currency and rubles. The validity period ranges from a month to several years. This factor directly depends on the characteristics of the company. As for mutual funds, all deposits are controlled by the management organization. This method is considered the most promising along with a fairly high level of risk.

The safest and least risky way to invest directly is in precious metals. This investment object is characterized by enviable stability and constant growth in value. Of course, this method does not provide for quick profit, but it significantly reduces the risks of bankruptcy. Therefore, if you do not expect too high a profit, but want to protect your assets from various unfavorable factors, then this option will be one of the most suitable.

Also, direct investments can be made by domestic or foreign companies. In the same way, they can enter the country or, conversely, leave it.

Direct investment, depending on the duration, can be aimed at short, medium or long term. If we are talking about long-term investments, then, in this case, large volumes are possible only in a situation where the economic sphere is at a stage of stable development.

Advantages of direct investments

Since the main feature of this type of investment, as we have already said, is not just the investment of funds for the purpose of further profit, but also participation in the direct management of the organization’s affairs, the advantage can be called not only obtaining financial influence for the development of the enterprise, its modernization or expanding production, but also receiving valuable information from the entrepreneur regarding the management of the company, his experience, connections, and so on. In this case, direct investment is not a narrow concept that includes funds, but a fairly broad definition associated with a set of components that contribute to the favorable development of the economic sector. Direct investment has a positive impact not only on the activities of each individual organization, but also strengthens the economy as a whole.

Private equity fund

As we said earlier, direct investments can be made by individuals or legal entities. In addition to them, there are specialized organizations that are engaged in the accumulation of funds raised from various investors. These organizations are called private equity funds . All such companies are required to participate in the affairs of the company into which they make financial investments. Let us list the most common stages of interaction between a fund and a company.

- Selection of the most promising project for which certain financial investments are planned.

- Concluding an agreement regarding mutually beneficial cooperation.

- Taking certain measures to improve the efficiency of the enterprise and, consequently, the overall effectiveness of the contract.

- After receiving a profit, the fund leaves the management of the company.

Thanks to the activities of such funds, small and medium-sized businesses in our country have the opportunity to develop. The validity period on the part of the funds is very individual and depends, first of all, on the characteristics of the selected company. On average, we can say that it is approximately five to ten years. This only confirms the long-term profitability. Over this long period, the already unstable situation may change significantly. Therefore, in order not to go bankrupt, funds decide to distribute funds among several projects that are in no way related to each other. Thus, the risks of bankruptcy are reduced to almost zero. After all, if one area declines, the fund will be able to cover losses from profits earned in another area. This factor is related to the fact that funds do not invest more than fifteen percent of the total funds in one project. The effectiveness of such actions is assessed from the point of view of the possibility of translating the idea into the production process.

Currently, direct investment is one of the most competitive ways to invest. While the entrepreneur has direct influence on decision-making within the activities of a particular organization, the trust between him and the recipient of the investment is much higher. In addition, such funds help increase the attractiveness of the company from other investors, including foreign ones.

For a deeper understanding of the topic, consider the concept of business angels. Business angels are experts in investment activities who are both senior specialists of various organizations and private entrepreneurs. Using their invaluable experience and knowledge, experts invest money in various popular or promising projects, among which it is important to select the most profitable and promising ones. In addition to the exclusive investment of funds, in the case of the concept of a business angel, he takes an active part in the management of the organization in any matters related to strategic planning or ongoing administration. Therefore, this activity cannot be called simply investing. Much more goes into it. Business angels contribute to the growth of the company’s performance and competitiveness.

Foreign funding

We have already mentioned earlier that direct financing is possible not only from individuals or organizations operating in our country, but also from foreign companies. Most often, for the convenience of company management, enterprise branches are created. At the same time, an important feature is that the benefits of this type of investment are significant for all parties to cooperation. In addition, the economies of both countries benefit from such interaction. For the country receiving investment, it stimulates economic development, increased production efficiency, and the introduction of modern technologies. This ultimately has a beneficial effect on the social sphere, as the employment of the people and their well-being increases. A country that returns investment has the advantage of lower taxes compared to investing money in the domestic economy. Such mutually beneficial cooperation allows us to implement large and significant projects, implement innovative developments, and also contribute to the development of technology. As for our country, many investors consider it as a site with great prospects. In this regard, the issue of legal regulation of direct financing becomes especially relevant.

Legal regulation of direct investment

Control over the activities of entrepreneurs providing direct financing is based solely on legal standards. In addition, there are different methods of government investment management. These methods ensure that all rights and obligations to each party are met. As for insurance, it helps to level out possible risks.

Selecting a project for financing

Direct investment differs from other types of financing in that, in addition to its main goal of making a profit, the entrepreneur is directly involved in the affairs of the company, thereby influencing its development and improvement. That is, he himself influences the possible profit. Therefore, since the duration of this type of investment is quite long, it is important to approach the selection of investment objects especially responsibly. Such a long period can be marked by big changes, so it is important that the project can withstand them. When making the final decision and funding, it is important to be confident that the organization will show sustainable growth. Therefore, in the process of selecting projects, the investor pays special attention to the following parameters:

- Business plan. The largest number of direct investments is characterized by the investment of funds not in start-ups, but in an already developing business, which, in order to expand production or increase its volumes, requires additional financial injections. In order for an investor to give preference to one or another project, a detailed justification for the need for investment is required.

- Availability of an experienced manager. This factor is practically one of the most significant, since by investing money, he does not receive the company completely under his individual management, but becomes the owner of only a share of the project. Therefore, it is important to be confident in the administration’s ability to achieve all its goals.

- General situation and development of the organization. If the company is in stable growth, then finding investors is much easier. Since rarely will anyone agree to take a risk and finance a company that is in a state of stagnation or decline and is close to bankruptcy.

- General condition of the sphere. This parameter is also very important, because it is necessary to take into account the saturation of the area with similar projects, as well as the level of competition.

Conclusion

An organization that requires direct investment must understand and accept all the advantages and nuances that this type of financing brings. As a key advantage, we can consider that the company receives the necessary amount of funds, which will help solve existing problems and reach a fundamentally different level of development. In addition, it is important to consider that the company receives not only money, but also the experience, connections and reputation of the investor who has entrusted his assets to this particular company.

At the same time, it is important to understand that when attracting investments from outside, you will have to come to terms with some difficulties, including changes in the administration of the organization.

(Visited 23 times, 1 visits today)

Please rate the article and leave your opinion in the comments

[Total: 0 Average: 0]

This might be interesting:

Investments in scientific development

Investing in shares

Tinkoff investments review and reviews | Bonus 1000 rubles for new investors!

Horizontal diversification

Why is it necessary to create an investment portfolio?

Crowdinvesting (Equity crowdfunding)

Investments in bankruptcy auctions

How to make money on stocks

Algorithm of actions when forming an investment portfolio

Sequence of steps when creating an investment portfolio:

- Determining investment goals, including choosing the direction of work. A person chooses investments with low returns or investments with increased profitability and the risk of losing money.

- Choosing an activity strategy (passive or active investments); at this stage, the extent of the investor’s participation in transactions is determined. If a person does not have experience investing funds, then it is recommended to choose a passive algorithm with the invitation of a hired consultant.

- Analysis of the structure and intricacies of the stock market, allowing you to understand the algorithm for the emergence of profits or losses. It is also necessary to analyze work methods for passive investments, which will subsequently allow you to refuse the services of intermediaries.

- Analysis of profitability of activities, allowing to evaluate the effectiveness of the investment portfolio. During the study process, it is possible to replace some of the tools, which makes it possible to increase the profitability of the work.

- Checking the feasibility of the tools used makes it possible to identify low-income areas and exclude them from the list of objects responsible for generating profit.

Portfolio investments and investment objects

Depending on what the investor's funds are used to generate income, types of portfolio investments based on equity investments in:

- Money market. Here you can choose several interesting currency pairs for the difference in price, which you can earn income. This type of investment is often short-term;

- Government securities. These are bonds of different issues that have low yield and are long-term in nature;

- Private securities or financial investment portfolio. The funds are invested in shares of various issuers, and assume a short-term nature with high income. If you invest in blue chips (the largest and most famous companies), you can get a stable income. Investing in shares, especially those issued by new companies, involves risks and uncertainty of returns. If one of these companies succeeds in the market, its shares will rise greatly in value in a short period of time.

How to attract?

The effectiveness of active investment activity in the real sector of the economy is clear to everyone. However, another question arises. What can stimulate the attraction of direct investment ?

Creating a favorable investment environment and acceptable conditions for the development of production in the country could affect the situation in a positive direction.

It is necessary to ensure the reliability of investments for domestic and foreign investors and the protection of their rights. The state should take a key role in creating a favorable environment. What measures can contribute to all this?

- ensuring political stability

- the presence of balanced legislation and a fair tax regime

- Innovation potential

- company performance results must be completely transparent and understandable to investors

- provision of minerals and natural resources

- sufficient level of purchasing power among the population

- modern economic institutions

- acceptable level of personnel qualifications.