What's happened real and financial investments, What features do they have, and how do they differ from each other? These are exactly the questions that any legal entity or individual who intends to profitably invest their funds in various financial instruments should know the answers to.

And this is really important. After all, it is real and financial instruments that are the main “driving forces” for the development of Russian enterprises and the country’s economy as a whole.

Content

Real investments - what are they? Financial investments - what are they? Types of real and financial investments Main types of real and financial investments The main relationship between real and financial investments Real and financial investments - their main differences Sources of real and financial investments 1. Own funds 2. Borrowed funds 3. Raised funds Management of real investments - 6 main steps Step 1. Conduct a market analysis Step 2. Determine the form of investment Step 3. Determine the required amount of investment Step 4. Select an investment project Step 5. Assess the effectiveness of the project Step 6. Monitor the implementation of the investment project Finally

Real investments - what is it?

Real investment is the investment of funds in tangible and intangible assets that are closely related to the production and operating activities of the enterprise.

As a rule, objects of a material and tangible nature include:

- formation of fixed capital;

- research and scientific works;

- advanced training of personnel;

- innovation activity;

- creation of new product samples.

Real investments require a very large amount of initial capital. Therefore, they are not very popular, especially among individuals. After all, to make real investments you need to have a million or more rubles.

True, investing in the production and development of an enterprise pays off very quickly, and subsequently contributes to generating greater income. And directing funds directly to production significantly reduces risks.

In addition, real investments can be made not only voluntarily, but also compulsorily. That is, this is investing in those objects, without which the enterprise simply cannot function. For example, investments related to compliance with environmental regulations, safety regulations, compliance with regulations and standards, etc.

Investing in bank deposits

A minimum of knowledge is required when investing money in bank deposits. At first glance, everything is simple - I brought the money to the bank and deposited it. But even here some knowledge is required.

An important nuance when investing in bank deposits is to invest an amount of money in the bank that is no more than the insured amount covered by the Insurance Fund in the event of bank bankruptcy.

In addition, you cannot invest all your money in one bank. The money must be distributed among several banking institutions within the amount of the insured amount. As you can see, even in such a simple investment there are nuances that you should understand in order to save your money.

Therefore, when depositing money in a bank, be sure to check whether the bank is a member of the Deposit Insurance Agency - asv.org.ru.

Financial investments - what is it?

Financial investments are investments in various financial instruments.

In another way, we can say that financial investments are investments of funds with the aim of generating income over a short or long-term period of time.

Essentially, everyone, regardless of whether they have a financial education or not, is involved in financial investing. For example, paying for your education or gym. In the first case, a person in the future wants to get a good and highly paid job, and in the second - health.

As a rule, the main objects of financial investment are:

- Stock market . Entry does not require a large sum, but you do need knowledge and an understanding of the principles of how everything works. You can read how trading is carried out on the Stock market in this article .

- Credit and depository market. Here capital is spent on purchasing government bonds, corporate IOUs, etc., as well as opening deposits in banks.

- Forex market. The object of investment here is currency, which can be traded on special electronic platforms, playing with quotes and exchange rates.

The main feature of financial investments is that they are available to everyone. And even those people who have little capital and do not have special knowledge and experience can carry them out.

For many, financial investments are the only accessible and only type of investment, and for beginners - even the most profitable.

Securities

A share is its holder's share in a company. It is similar to a contribution to the authorized capital, but differs from it in that you do not need to talk to anyone: a computer and the Internet are enough to become a shareholder.

The stock brings two types of profit:

- speculative (bought low, sold high);

- dividend (received payment from the company).

To extract speculative/dividend profits, you need to buy preferred shares.

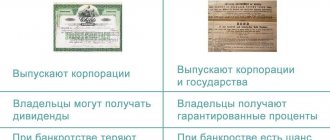

A bond is a debt security that obliges a company or government to pay interest to the holder and repay it at the nominal amount at the end of its maturity.

There are two types:

- state (OFZ);

- corporate.

Compared to stocks, bonds provide lower returns, but are guaranteed.

Types of real and financial investments

Do you know what financial and real investments are? Now let's take a closer look at what their main types exist.

The main types of real investments include :

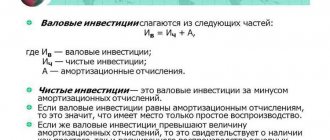

Gross are investments that were made by an enterprise over a certain period of time. In addition, all investments aimed at modernization, consolidation, increasing competitiveness, and improving productivity belong to this group.

Updates are investments aimed at the development of the company, that is, at the production of additional product categories, at the development and implementation of innovations.

Expansions are investments aimed at expanding the enterprise. That is, to capture new market territories and attract more consumers of products.

Now let's look at the main types of financial investments :

- Futures and options contracts. This type of investment requires the investor to have special knowledge and a decent amount of time. Otherwise, the investor risks losing everything at once. The entry threshold here is minimal.

- Mutual funds . The idea here is that the investor buys securities from the fund or through an intermediary. Investment management specialist in this field.

- Stocks are the easiest, but also riskiest way to make a good profit if the company prospers. In addition, this is a good opportunity for speculation (when prices rise, the owner can sell it on the stock exchange). On the other hand, you can start receiving dividends regularly from it. And, if the company turns out to be unprofitable, then you will only lose the money you spent on buying shares.

- Investments in precious metals. Precious metals constantly rise in price, even if there is a decline. In the long term, a stable increase in their prices will still be noticeable. This type of investment has minimal risks, but is a long-term financial instrument.

- Bonds are a financial instrument classified as debt obligations. The risks here are minimal and the income is not large. It also happens that in the end bonds turn out to be less profitable than regular time deposits.

Main types of real and financial investments

We have considered the types, now we can briefly characterize the main types of real and financial investments.

Real investments can be classified into 4 main types or, as they are also called, subtypes:

- Basic investments are investments aimed at expanding existing production, without changing the scope and direction of activity.

- Current investments are investments that are responsible for the reproduction process (replacement of fixed assets, major repairs, etc.).

- Strategic investments are investments aimed at expanding production and opening new divisions in other areas of the country.

- Innovative investments are investments aimed at modernization and re-equipment of production.

These types (subtypes) of investments differ from each other mainly in the level of risk. For example, core investments are much less risky than strategic ones.

When organizing the management of real investments, you should always take into account the existing risks of each type. The minimum risk is if the goal is simply to increase the efficiency of the existing enterprise. Setting up a new production facility will be a maximum risk.

In turn, financial investments can be divided into the following types:

- Speculative investment is, first of all, the purchase of securities with the purpose of reselling them in order to obtain a large income.

- Long-term investments are investments aimed at generating income in the long term. Their main goal is to take part in the management of the company.

Investing - what is it in simple words

If we talk about what investing is in simple words, we can say that it is an investment of capital with the goal of earning money. This is the main task for this activity, the features of which are risk and potential income. Moreover, there is a direct connection between these two indicators - the higher the expected income, the higher the risk indicator.

In addition, investment refers to a long-term investment, usually one year or more. This distinguishes them from speculative activities in financial markets.

In turn, the raised capital for issuers of securities has its own meaning and purpose. Additional financing allows them to expand production and enter new markets.

Summarizing all of the above, we can conclude that the whole essence of investments comes down to generating income and increasing capital.

The basic relationship between real and financial investments

The relationship between real and financial investments is very difficult to trace simply by defining these two concepts. In reality, it can only be traced in practice in the process of investment activity itself. Briefly it can be expressed as follows.

Not every investor, especially if it is an individual, has the financial ability to directly invest in the expansion or modernization of production. This is mainly available only to large companies and enterprises.

Individuals often only have the opportunity to invest their funds in financial investments: stocks, bonds, deposits, etc. Thus, financial investments take the form of real ones.

Advantages and disadvantages

| Advantages | Flaws |

| profitable investment can provide passive income | There are risks at the heart of any investment |

| provides active capital increase | In some cases, invested funds may be lost forever |

| contributes to the economic development of the industry and the state | the investor has minimal ability to reduce negatively influencing factors |

Real and financial investments - their main differences

What is the difference between real and financial investments? Here it is probably easier to ask: how are they similar to each other? But they have one similarity, and it lies in the fact that both of these types initially have a monetary form. And they take on a different form only in the process of investment activity itself. This is where their differences begin, which are that:

- Real investments are investments of own funds directly into the production process and activities of enterprises. And financial investments are investments in various economic instruments.

- Real investments do not depreciate in value. And the depreciation of the national currency can lead to a significant decrease in profits from financial investment .

- Real investments carry much less risk than financial ones .

- With real investment, the profit in the end is much greater than with financial investment .

- With real investment, a company has the opportunity to develop more efficiently, better and faster. With financial investing, this effect is not observed.

- Real investments are very low-liquidity, unlike financial ones , the objects of which can be sold at any time and left the market.

Sources of real and financial investments

Both real and financial investments require a certain amount of initial capital. Somewhere more, somewhere less. It all depends on the object in which you intend to invest your funds. In practice, there are three main sources of funds for investment.

1.Own funds

Both real and financial investments can be financed from your own pocket. In real investing, this “pocket” is the company’s free cash. And in financial terms, this is the “pocket” of the investor himself.

2. Borrowed funds

Often, when there is a lack of own funds, investors attract borrowed funds. As a rule, loans are taken out from a bank.

In case of real investment, taking out a loan justifies itself. It pays off in spades in the end. But when investing financially, it is better not to do this. Here the end will no longer justify the means.

3. Funds raised

In this case, funds are taken from the state or from third parties - shareholders, equity holders, co-owners.

Funds are usually raised by making real investments. When it comes to financial investing, this is not advisable.

Based on the foregoing, it becomes clear that all of these methods listed above are used only for real investing. When investing financially, it is advisable to use only the first method, that is, only your own funds.

Tinkoff investments for individuals

When investing in securities, it is not necessary to register with a broker; you can use the services of Tinkoff Bank through the Tinkoff Investments service for individuals. In the Tinkoff Investments personal account, the client can purchase exchange-traded shares of popular companies, as well as buy other securities such as bonds.

It should be noted that in your personal account everything is on an intuitive level and even a person who does not understand computers can buy shares.

Managing real investments - 6 basic steps

Financial investment management is similar to the method written in the article “Investment Management”. Below we will look at how to properly manage real investments.

Real investment management is a truly complex process that requires investors to have sufficient knowledge, skills and experience. And also, the obligatory presence during the entire investment process of cold and sober calculation, combined with an analytical mind and good intuition.

The investor must necessarily justify the need to invest funds, develop a consistent and step-by-step plan, and conduct constant monitoring of the project.

Step 1. Conduct a market analysis

Before any investment, it is imperative to study the market conditions and other economic parameters. For example, you should not start releasing a new product without first studying the demand for it.

Step 2. Determine the form of investment

Any investor must independently determine for himself the forms of investment.

For example, for large production facilities this means expansion and construction of new facilities. And for smaller enterprises, this means modernization and/or automation of production in order to reduce costs.

Step 3. Determine the required amount of investment

Any investment, like money, loves a thorough, thorough and accurate account. And before investing, it is imperative to make an accurate calculation of why, why and how much money needs to be invested.

Therefore, every enterprise must have a special economic department, which must make all the necessary calculations. If this is not the case, then you need to contact specialists, for example, an outsourcing company.

Step 4. Select an investment project

At this step, it will be necessary to select a specific investment project, which, first of all, depends on the goals and specifics of the enterprise.

The investment project itself is a document that must indicate the following indicators:

- purpose and timing of investment;

- the main idea of the project;

- options;

- the amount of resources required for implementation;

- calculation of performance indicators.

As a rule, project development is carried out by specialists with appropriate education. If these are not available, it will be necessary to hire third-party specialists.

Step 5. Assess the effectiveness of the project

Specialists with special education and experience should also evaluate the effectiveness of investment projects.

Here the necessary costs, amounts and timing of the planned profit must be taken into account, on the basis of which an efficiency indicator is derived. After which a detailed and step-by-step plan for the implementation of this project is drawn up.

Step 6. Monitoring the implementation of the investment project

Careful and high-quality control over the implementation of an investment project is the basis of SUCCESS. Therefore, this must be taken very seriously. Moreover, real investments, unlike financial ones, require the direct participation of the investor. And to manage such a project you need time, patience, and a strong and strong character.

In addition, in addition to negotiating and monitoring the implementation of the project on site, it will be necessary to ensure that the money is not stolen, and also manage to efficiently manage the work of the staff.