Bookmarked: 0

What is pure investment? Description and definition of the concept. Net investments are an increase in the capital of an enterprise, except for depreciation investments in funds.

Net investment is calculated as the difference between investment in depreciation of existing capital and gross investment.

The peculiarity is that the assessment of capital depreciation is carried out in relation to the loss of the value of the enterprise’s capital on the market due to moral or physical wear and tear of the components of the organization’s main capital over time. Therefore, the amount of net investment is difficult to measure in comparison with gross investment.

Let's take a closer look at what pure investment means.

The role of net investment in the economy

Financing production is necessary for any enterprise to ensure sustainable development.

Let's look at a simple example. The company is going to expand production. A block of shares is issued in order to then purchase equipment and construct facilities. Shares are starting to sell. In this case, the income received will be considered investment income only after the end of the auction. Private investments are funds received from the sale of shares. Sometimes investment is provided by individuals, banks, and investment companies.

Nowadays they are increasingly relying on foreign capital. In this case, private investments are investments made by foreign companies. But attracting foreign capital is not so easy. Everything here will depend on the direction of activity, the demand for products on the world market.

There is another way to obtain financing. In this case, private investment is the investment of own capital by the founders of companies. Unfortunately, it is not always possible to realize this opportunity. This is due to economic risk: it is advisable to invest money in different projects, wanting to reduce the level of risk.

The importance of investment for the country's economy

Gross private investment is taken into account when calculating company performance. Thanks to such investments, firms are able to significantly increase production capacity. Growing profits are used as the foundation for creating a stable business. Proper use of raised funds allows not only to increase the volume of material reserves, but also to reproduce spent assets.

In the case of a national scale, overall investment affects the popularity of products produced by domestic companies. The growing popularity of these goods contributes to economic development by attracting foreign investment. This means that gross investment is directly related to the development of the educational and scientific sphere.

A few nuances of investing

Let's consider several situations.

- Most economists believe that the key indicator of a company's development is net investment activity. This is quite objective. In this case, net investment is a fairly serious indicator of the success of the company’s work and development. When companies develop well, they begin to inspire confidence among investors. And there is a flow of private investment. As a result, non-current assets are also growing.

- If the investment indicator tends to zero, we can conclude that there are problems in the work: growth has stopped. In this case, there will certainly be negative consequences.

- A critical situation is a drop in net investments, their negative value. This is already followed by bankruptcy. To save the company, you will need to make accurate calculations and be sure to attract financing.

When this financing is carried out on a state scale, investment necessarily has a positive effect on the volume of national income. Investment becomes especially important due to rising inflation. Funding must cover this indicator.

What is important for investors?

It is necessary to understand that attracting investments is not so easy. Investors have a lot of choice. They take the utmost care in identifying the most promising objects for financing. They take into account the volume of net profit and be sure to monitor the flow of funds. All financial flows must be objectively reflected in the financial statements. The size of the investment is of great importance here.

Let’s draw the main conclusion: net investment is a serious objective indicator of the company’s condition, production level, and operational efficiency . It is net financing that becomes a clear indication of the pace of development of the company. When it works effectively, investors will definitely start investing their capital there.

Gross and net investment: concepts and meanings

Net investment is usually called the actual increase in the real capital of an enterprise from third-party sources. The difficulty of calculating such investments, compared with calculating gross investments, is primarily due to the depreciation of capital (loss of the market value of tangible assets under the influence of inflation and other macroeconomic and geopolitical factors).

Determination of net investment, types of investments using the financial accounting method

Net investment is the difference between depreciation and gross investment.

Let us dwell on the types of investments in accordance with the method of accounting for funds.

Investments can be classified into net and gross.

- Net investment represents the entire amount of gross investment from which depreciation deductions are subtracted.

- Gross investment is the entire volume of financing. It includes costs for the purchase of equipment, the construction of new facilities to replace outdated ones, and investments in the increase of intellectual values.

It is impossible to separate the concepts of net and gross investments, since net investments become an integral part of gross financing. At the same time, it is net investments that have a special purpose: they are needed specifically for the growth of the company’s total capital. First of all, these investments are aimed at increasing production volumes, expanding and optimizing production as a whole.

Let us dwell on the exact definition of depreciation investments. When depreciation charges are subtracted from the total volume of gross investments, net financing is obtained and their exact size is calculated. At the same time, depreciation charges are an indicator of the degree of depreciation of the company's assets. They are used to replace worn-out vehicles and equipment, and to renovate production facilities in need of repair and restoration.

Profit is precisely pure investment .

Gross investment refers to the total income of a business. This is a major difference between the two types of financing. The source of capital growth is net investment, not gross.

Efficiency of application

The efficiency of using investments by a business entity is determined by their structure. Its identification is carried out by type, by sources of financing and by direction of use. The relevance and expediency of deposits is determined by profitability, the parameter of which is an important structure-forming criterion.

Private companies attract partners to various projects, participation in which involves generating income.

Their leaders are focused on industries that allow them to earn high profits through rapid capital turnover. This causes investors to avoid cooperation with companies operating in low-profit areas of the economy. Since such organizations are not attractive to investors, to ensure their functioning, managers have to rely only on their own funds.

Overinvestment can cause inflation, while underinvestment in a project makes deflation likely. The extremes of economic policy are regulated through taxation of monetary measures and through adjustments in spending.

Net Financing Value

Net investments are always additional financing, which has a positive effect on the growth of the company's capital. The key role of such financing is to be the basis for optimization, expansion of production, growth of its capacity, and increase in the volume of output. Such financing can be an investment in real estate, as well as in working and fixed capital.

Such real capital is extremely important for the creation of new equipment, the construction of new production buildings, and the expansion of space. Consequently, financing for the growth of real capital is a process of accumulation of funds.

Types of net investments

Types of net investments:

- zero: depreciation investments and gross financing turned out to be equal in volume, which led to a zero level of net investment, when they already talk about “zero growth” when the enterprise does not develop;

- positive: depreciation investments are less than gross financing, therefore there is an increase in investments and an increase in real production volume, an increase in net profit;

- negative ones arise in a critical situation, when gross investments are less than depreciation ones, as a result of which even lost capital is not reimbursed and the enterprise is on the verge of bankruptcy.

It is important to do everything to ensure a positive net investment. This is how the liquidity of the enterprise, the stability, the success of its development, and the stability of the company as a whole are confirmed.

The same criteria can be used to judge the economic situation in the country. These investments are constantly carefully analyzed, and detailed reports are provided to economists and the government. They are used to judge the level of economic development. Then certain measures are taken to ensure the growth of net investment.

Types of investments by method of accounting for funds

Based on the method of accounting for funds, the following main types of investments are distinguished:

- gross investment - the total volume of funds invested in new construction, the acquisition of means and objects of labor, the increase in inventories and intellectual values; Gross investment is characterized by the amount of money that is directed towards the acquisition of new assets.

- net investment - the entire amount of gross investment minus depreciation. According to the method of accounting, investments are classified into gross and net. Gross investments When analyzing the financial activities of an enterprise, they operate with such terms as gross and net investments.

Net investment and gross investment are two inseparable concepts, because net investment is part of gross investment.

Net investment is one of the types of investments that have their own characteristic feature - they are aimed at increasing the size of the company's capital.

The primary objective of this type of investment is mainly to expand production and increase output.

Net investment is gross investment minus depreciation. Depreciation charges are an indicator of depreciation of an enterprise's fixed assets, which include buildings, technological equipment, transport, and so on.

Profit is the net investment, and income is the gross investment. This is the difference between them. Net investments serve as a source of expanded reproduction of capital.

Types of net investments:

- positive - gross investment exceeds the amount of depreciation, this means that in each subsequent year the real volume of production will be higher than in the previous one; this also means the possibility of increasing capital, and therefore increasing profits;

- zero - gross investments are equal to the amount of depreciation charges, this situation is called “zero” growth, this situation does not lead to an increase in volumes, which means that the enterprise is simply reproducing its products and is not developing;

- negative - the amount of depreciation deductions exceeds the amount of gross investment; in this situation, even compensation for lost capital is not provided. the level of production falls, profits decrease, and the company in such a situation faces bankruptcy. With negative net investment, the effect of a falling economy occurs, that is, the economy is in a state of deep crisis.

For a business to operate profitably, it is important that the net investment be positive. This indicates its stable microeconomic environment and liquidity.

The same assessment is given not only to individual enterprises, but can also serve as an assessment of the state’s economy in macroeconomic analysis in the system of national accounts. Gross and net investments in the country's economy are constantly analyzed and provide the government and economists with information about the possibilities for economic development and the necessary measures to increase net investment.

Sources of financing

It is customary to divide sources of net investment into external and internal.

External sources:

- profit from the issue of securities;

- investment by private investors;

- bank loans;

- financing of foreign investors.

Internal sources:

- income from the sale of property;

- depreciation financing;

- authorized capital;

- net profit.

When an enterprise operates successfully, has a stable position, demonstrates good economic performance, a balance of financing from external and internal sources is achieved. First of all, this can be associated with the presence of good profits and worthy investments. The company is performing well: achieving profit growth and increasing attractiveness for investors. Even successful companies willingly use external sources, since in this way they reduce the burden on the enterprise’s capital and reduce the risk of their own investments.

Types of Investment Decisions

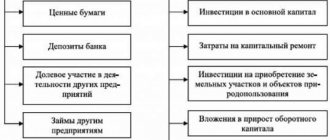

As we have already found out, gross investment minus depreciation is net investment. When making a net investment in an individual enterprise, there are several areas in which progress can be made through cash injections. These areas are classified as follows:

- Mandatory investments, without which the company will not be able to operate due to government restrictions, rules and regulations that must be met. For example, the introduction of technological and organizational solutions aimed at reducing environmental harm; improving working conditions for personnel to meet state standards.

- Investments in modernization of the enterprise and reduction of production costs. In particular, the purchase of new, more economical and productive equipment, general technical modernization; development of alternative, more progressive technological processes and techniques; structural reorganization of the enterprise in order to optimize the management of technological processes.

- Investments in the expansion of the enterprise, including the development of new products or services. This could be the construction or acquisition of new real estate, which will be needed when expanding production; or the purchase of new additional equipment that will be used along with the existing one. This also includes hiring and training additional personnel; creation of a new subsidiary in a new territory with its own production cycle.

- Investments in the acquisition of financial assets in order to improve market conditions. Expenses for the formation of a strategic partnership (alliance) with a related enterprise to create a more complete production cycle and optimize costs. Acquisition of competing companies or enterprises that have the necessary technologies or assets, as well as other decisions to manipulate fixed assets.

- Investments in the development of new markets. For example, the costs of creating new territorial branches, or the costs of winning a new audience in the old territory.

- Investments in the purchase of important intangible assets - copyrights and licenses to use other people's intellectual property.

Efficiency

To assess the level of economic development of any state, enterprise, or company, it is enough to determine the growth dynamics of net financing. They, as the most objective indicator, reflect the effectiveness of work. As soon as investment growth begins to decline, we can talk about a recession in the economy. If there is no growth, this is an indicator of crisis .

Increasing such investments makes a huge difference. It immediately provokes an increase in the well-being of the population, an increase in employment, and an increase in the level of production. Net investments are growing in individual enterprises – the country’s economy is growing as a whole. When investments increase, related industries also begin to produce more consumer goods, products, materials, and build more housing.

Structure and volume of investments

The result obtained after deducting depreciation charges from gross investments allows us to draw a conclusion about the current level and pace of development.

If the net investment is positive, it means that the enterprise’s potential is being used to the maximum and production is growing. If it is negative, it means that the company is performing worse than it could, and its performance is falling.

Net investment may turn out to be zero. In this case, we can talk about both stability and stagnation. For an unambiguous conclusion, it is necessary to analyze other indicators.

A properly formed investment structure is also important. That is, you need to clearly define for what purposes to allocate funds, because investments must be effective and profitable.

What influences the amount of funding?

Let us briefly look at factors that can significantly affect the volume of capital investments.

- First of all, economic and political instability in the country is of great importance. As a result of such an imbalance, enterprises lose profits.

- Technological progress has a significant impact on investment.

- Legislative measures and all kinds of changes are also of significant importance.

Net investment has a huge impact on the overall economic situation of a country.

Why is investing profitable?

Investors invest their finances in the company's capital. And they begin to grow together and make a profit. It is important to give an accurate forecast of the growth of the company’s liquidity so that the investment is justified. Short-term investments are the fastest to pay off, but long-term, medium-term deposits also have great prospects.

How and when will the investor make a profit?

By making contributions to expand production, the investor invests his finances in the capital of the campaign. According to the investors' agreement, the campaign management must use this money for expansion. After such a process, the firm's liquidity is predicted to increase and it will become significantly profitable.

When signing an agreement, the campaign management and the investor himself must discuss the size of payments, its procedure, and set deadlines. Short-term investments pay off in a relatively short period of time (less than a year), and very soon the investor receives his profit from the deposit. And to receive profit from medium-term and long-term deposits you have to wait a long time (from 1 year or longer).

Formula

There is also a formula for private net investment. It is necessary for an objective analysis of the economic state: the formula is used in the process of determining key indicators of gross investment in various areas of the state and economy.

This is how net investment is defined:

HIt = BIt – At.

Let's decipher the formula:

- Аt – depreciation charges in year t;

- NIT – net investment in year t;

- VIt is the entire volume of gross investment in year t.

If we specify the formula, it will become clear that in this case the volume of gross investments is just net investments. They retain value. However, the statistics include gross investment, which also includes working capital financing. Working capital and fixed capital are growing. Of course, it’s easier to calculate the amount of net investment this way.

Such financing includes investments in real estate, working capital and fixed capital.

Objects of gross investment

Types of investments

One of the elements of gross investment is fixed capital. It contains funds for the restoration of its used part in the form of moral and physical wear and tear. At its expense, work is being carried out to modernize and reconstruct technological lines, as well as to update equipment and change technology to modern methods that ensure high performance indicators.

Working capital, presented in the form of inventories of raw materials, supplies and finished products, is not included in gross investment in full. Since the calculation of the value takes into account only changes in parameters over a selected time period, with a general increase in gross investment, contributions to working capital can be expressed as a negative number.

The inclusion of intangible assets in investments can be identified as the right to ownership or ownership of real estate. Trademarks, brands, licenses, inventions, patents and software products are also constituent elements of the parameter.

Gross investments include contributions to improving human potential and ensuring a decent level of social sphere parameters. Improving the qualifications of workers, improving their living conditions, paying for the education of the children of the organization’s employees imply an increase in the profitability of production. This is due to the high qualifications of employees and their rapid restoration of physical and moral strength, due to the creation of normal living conditions.

Structure of gross investment

The indicator identifying the state of gross investment is taken into account in the system of economic criteria of an individual enterprise and is used in calculations when compiling statistical reporting. It is part of the system of parameters of national public accounts and helps to assess macroeconomic indicators.

Private domestic investment

Let us dwell on the definition of such investments. Net private domestic investment represents gross private domestic financing, but excluding the amount of investment that was spent on the purchase of new equipment and construction of structures. This refers to those cases when equipment and objects are already worn out and need to be replaced for objective reasons

It is precisely this part of financial investments that contributes to the growth of capital reserves. It is quite difficult to determine the degree of wear and tear objectively, so depreciation statistics are actively used.

Investing is an effective method of developing companies and making profits for investors . Large enterprises develop, reduce the risk of bankruptcy, and mid-level companies can reach the corporate level.

Sources of gross investment

Gross investment can be generated from the company's own assets or from other private investors. To implement such tasks, credit, borrowed or budget funds are often used.

All investment projects involve risks. In order to reduce the likelihood of losing their own money, investors seek to involve third parties in cooperation, while retaining the right to manage the project. This decision by the manager gives the company public status and makes it more controllable.

It is more difficult to attract budget funds, since the state carefully selects projects for investment according to regulated parameters. Cooperation is possible only with those companies that contribute to the development of the country’s economy and can operate in the form of a public-private partnership. The state can invest various assets, including state-owned enterprises. The objects of deposits can be land plots, real estate objects and deposits.

Investment structure

It is customary to distinguish between real and financial investments. Financial investments include the acquisition of securities issued by the state or other business entity. Real investments include investments in fixed and working capital, new construction, repairs of production assets, acquisition of real estate and land, as well as investments in intangible assets: licenses, patents, research, advanced training of employees. Thus, we smoothly approach gross investment, which is a category of real investment.

Investment assessment – classification, volume and performance indicators

There are two main goals of investing: saving money and growing it.

Each participant in the investment process must evaluate their effectiveness, calculate the main indicators and draw a conclusion about their profitability or unprofitability.

Classification

According to the object of investment, investments are:

- Real.

- Financial.

In the first case, funds are invested in real production to create tangible and intangible assets. These include: purchasing buildings, equipment, raw materials, obtaining a license, etc.

In the second case, the investment is made in financial instruments (securities, currency).

How to calculate net investment?

Net investment is part of gross investment.

Net investments can be calculated using the following formula:

GI = Gross Investment – Depreciation

Gross investment represents the amount of investment in the enterprise, and depreciation is the amount of wear and tear on fixed capital.

Calculating net investment is important. There are three cases:

- If the CI value is greater than the depreciation value, then an increase in capital should be expected.

- If CHI is less than zero, production will decrease, profits will decrease, and the company will approach bankruptcy.

- If the value of the indicator is zero, then this indicates that the company is in a static state, i.e. neither growth nor decline is expected.

How to calculate the amount of investment?

To assess the effectiveness of future investments, there is always a need to determine their volume. It is quite simple to calculate this value; you need to add up the amounts of money that are planned to be invested in the project.

This indicator consists of two types of expenses:

- one-time or initial, for example, for paperwork, purchase of equipment, purchase of a starting batch of goods;

- regular or monthly, for example, for renting premises, paying labor, paying taxes.

Regular (monthly) expenses should be summed up for the entire period of project development until the planned date of its achievement of self-sufficiency and the amount of reinvested funds should be subtracted from this indicator.

How to calculate efficiency?

To evaluate the effectiveness of investments, many formulas are used. There are separate formulas for specific securities, business projects, etc.

Values can be absolute (in monetary or time equivalent), relative (in the form of coefficients, shares and percentages).

Below we present formulas that are especially popular when evaluating investments.

Net present value

Net present value (NPV) reflects the net present value of future cash flows.

The higher the NPV, the better. If the indicator is less than zero, then the project is unprofitable; if it is equal to zero, then the project will only recoup costs, but will not make a profit.

To calculate it, you need to find the difference between future income and the volume of investment , taking into account the discount rate.

Payback period

To evaluate efficiency, the payback period is also calculated. It represents the period of time during which all income generated by an investment has covered its costs. The lower this indicator, the better.

Return on investment (ROI)

How to calculate ROI? The most appropriate metric is their return on investment (ROI) . It is a percentage that shows the return on investment.

ROI = (Revenue – Cost) / Investment Amount * 100%

Revenue represents the receipts that have been received.

Cost is the amount of expenses to create a product or provide a service.

To calculate the amount of investment you need to add up all the money that was spent on this project.

If the resulting indicator is more than 100%, then this indicates the profitability of the investment, if less, it indicates unprofitability.

When deciding to invest money, it is important to calculate these indicators, and it is also advisable to conduct a more detailed analysis. This approach will help reduce risks and find the best investment option.

Finally, we suggest you visually familiarize yourself with the video about the main indicators of return on investment.

Source: https://profin.top/investitsii/kak-rasschitat-investitsii.html

Why are these investments needed?

If there are positive (net) investments in the economy, this will indicate that gross contributions are greater than depreciation - the cost of restoration. Accordingly, in each coming year the production volume will actually be greater than in the previous year. This point is very important for any company that plans to develop and make a profit.

Net investment investments are fundamental resources that are successfully spent on the construction of new buildings and the purchase of equipment, the creation of new vehicles, etc. They can be directed along two main paths - either it will be the re-production of material goods worn out over time, or the production of additional goods needed to expand and improve production. Therefore, net investment flows are directly responsible for the development and prosperity of the enterprise, for its well-being as a whole.