Bookmarked: 0

What is a mixed investment fund? Description and definition of the term

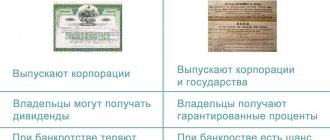

A mixed investment fund is a fund that is chosen by those who want to settle on something between bond and stock funds where investments are made.

These funds are the most suitable for people starting activities in this area.

It is possible to understand the rate of efficiency with which mixed funds operate by comparing stock market indices (MICEX, RTS), inflation rates and share price growth.

The use of mixed funds allows you to diversify your strategy. When the market falls, they can be made up entirely of bonds. During growth, it can only be stocks.

Mixed investment funds represent a compromise between average risk and average return. The policy is carried out accordingly, accepting the availability in the portfolio of both connections and shares.

How legislation regulates mixed funds

The transition from connections to shares is fully compliant with the law. The origin of this is that mixed investment funds have found use as a tool for playing a fluctuating market.

When an investment fund of a mixed nature is effectively managed, and this has led to a preliminary assumption of the dynamics of the market, which is all the chances after some time to be among the leaders, while overtaking at the same time on the weasels of stock returns. However, it should be noted that the degree of risk in the area of such funds is higher than in a regular client. In this case, the refusal of the game on fluctuations in stock prices, the comprehensive use of various tools and methods based on technical analysis is assumed.

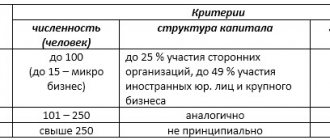

According to the Instructions on the structure and structure of assets of joint-stock investment funds and assets of mutual investment funds, adopted by the Federal Financial Migration Service on December 28, 2010, mixed investment funds can include up to 100% of shares and 100% of connections.

The rules of such a fund provide the management company (MC) with quite a lot of flexibility in choosing an investment strategy. With economic growth, there is an opportunity to invest money in stocks and make the biggest profits from their growth. When the stage of economic cycle changes, there is the next one. The stock market stops or even decreases significantly. During this time, executive directors make decisions and commit money to debt securities.

In this way, a mixed investment fund allows the investor to avoid the so-called “skew” of the portfolio in tough times – which is, protects money from serious losses. Of course, provided that the management company recognizes the change in the market situation on time and takes appropriate measures.

In practice, at the level of profitability, FSMs show worse results during market growth than equity funds - on average by 5-10%. But for him, the investor also receives a certain advantage. Thus, from January to July 2011, the stock market did not have the best times. The result of the investment was as follows: Weasel stocks fell in price by an average of 7.5%, relationship funds rose by 5%, and FSM portfolios became cheaper by only 2%. This - connections in the portfolio of executive directors, practically compensated for the fall in equity securities.

Russia mixed funds is the “Team” (British “Troika Dialog”) with assets of 1.6 billion rubles, “Alfa-Share” (British “Alpha-Share”) – 1.3 billion rubles, “Gazprombank” (British “Management”) assets of Gazprombank”) Balanced” – 1 billion rubles and others.

Advantages of mutual fund VTB

Before investing your savings in the purchase of shares, a future investor should familiarize himself with information about the most profitable areas for investment. Read reviews about the selected management company, as well as about the competence and professionalism of its employees.

VTB Mutual Fund has the following advantages:

- VTB Capital offers the most popular mutual funds today. Most of them occupy leading positions in the lists of the most popular investment instruments, which helps to obtain higher income.

- The profitability level can reach up to 32%. This percentage is a clear plus, which undoubtedly attracts citizens.

- More than 10 years of experience in this segment allows us to judge the professional knowledge of VTB’s investment experts. Demand among investors is growing from year to year.

- VTB Capital offers its investors a lower commission percentage, which is more than offset by high returns.

- Customer support is provided quickly and efficiently. It is possible to resolve the issue over the phone using a toll-free hotline. The client can contact the support service for help on the official website of VTB Capital.

- An expanded branch network and presence in almost every city of the Russian Federation is a significant advantage over competitors.

Taxation

For individuals, a thirteen percent tax is included in the payment. This makes a difference between the value for which the shares were purchased and what their settlement was for.

In 2014, for individuals who own three years or more of this term in the event of tax accumulation, a tax deduction was introduced. This measure is prescribed to increase the circulation of the fund for thinking about long-term investments.

Since mixed funds are structured, part of the assets there can be not only Russian and foreign currencies, but also other property:

- various debt instruments;

- shares and shares of investment funds having foreign registration;

- shares of funds shares, shares of joint stock funds that are engaged in investments;

- shares foreign and Russian open joint stock companies, which are fully paid.

Because the asset structure of a mutual fund based on mixed investment certain conditions must comply with:

- the price of the securities must not fall lower than seventy percent of the value of the asset during the time specified for two-thirds of business days for the calendar quarter;

- the funds available in deposits of one credit institution should not exceed a quarter of the value of the asset;

- the value at which shares of foreign, joint-stock investment funds, shares of mutual funds are valued will not be higher than fifteen percent of the value of the asset.

Comparison of profitability of mutual fund VTB 24

The table below provides summary information on all mutual investment funds of VTB Capital currently operating.

| Name | Annual share return percentage | Recommended investment period |

| Treasury | 8,15% | 1 year |

| Eurobonds | — 4,08% | 1 year |

| Bonds plus | 1,06% | 1 year |

| Equity Fund | 15,09% | 1.5 years |

| Promising investments | 27,53% | 2 years |

| Global dividends | 1,78% | 1 year |

| Oil and gas sector | 4,1% | 2 years |

| Consumer sector | 19,19% | 1.5 years |

| Fund of Enterprises with State Participation | 27,31% | 1.5 years |

| Telecommunications | 1,24% | 1 year |

| Electric power industry | 44,8% | 2 years |

| Metallurgy | 13,25% | 1 year |

| VTB-BRIC | 15% | 1.5 years |

| Square of victory | 39,54% | 1.5 years |

| Balanced | 13,68% | 1 year |

| MICEX Index Fund | 8,21% | 1.5 years |

| Money Market Fund | 8,18% | 1 year |

What types are mixed funds divided into?

Mixed funds can be classic or aggressive. If the functioning of classic mutual funds is similar to that of equity mutual funds, the former are exposed to a lesser degree of risk, but are inferior in terms of profitability. The dilution of the content of the portfolio of shares of connections is the reason for this.

The main goal of these funds is to find a middle ground between risk, which should not be high at all, and profitability. Classic mixed funds satisfy, first of all, those who are satisfied with not so large profits and prefer not to expose themselves to the risk of losing shares.

Risk cannot be offset by aggressive blended mutual funds because it is not dilution applied by equity bonds. To maximize maximum results, the portfolio is under active management. During increasing periods of recession, the share of connections is typical, and here during periods of transition growth only to stocks is performed.

Even if the CEO has considerable experience and is a professional, accurately forecasting market fluctuations is a very difficult task for him. Therefore, cases when the period of recession overtakes mixed funds consisting only of shares, which causes significant distortions, are frequent. In the case of the classic choice, there is, so to speak, a safety net against connections.

However, aggressive blended mutual funds still have many fans. Along with the risk and danger of losing shares, they allow you to become rich within a fairly short period of time. These funds also rank among mutual funds that do not use a highly specialized strategy.

In Russia, funds such as “Team”, balanced by Gazprombank, have assets exceeding one billion rubles.

Tips for assembling an investment portfolio

It is important to understand one main thing - there simply cannot be universal recommendations on this issue. This is due to the uniqueness of each investor. Each person has his own financial capabilities, requirements and expectations.

For this reason, an investment policy should be created personally, for each person. However, when creating a balanced portfolio, it is worth answering 3 main questions:

- What kind of profitability do you want to receive?

- How much risk is an investor willing to take?

- What is the optimal investment period?

Based on your own decisions, you can create an investment portfolio.

For example, an investor has chosen a strategy aimed at preserving capital with minimal risks and low returns. In this case, you should focus your attention on a mutual fund with a conservative strategy and buy a share there.

If you are more interested in earning money and not just saving, then you can split your existing capital and, for example, invest 60% in a fund with a low degree of risk. The remaining 40% is divided between profitable and risky.

The VTB Capital website has a service that will help you choose the optimal portfolio. You can find it at this link. To select a package, you do not need to enter your details.

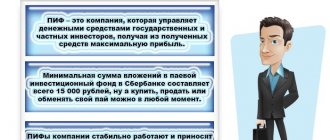

ETFs

Brokerage services are provided by PJSC Sberbank (Bank), general license of the Bank of Russia for banking operations No. 1481 dated August 11, 2015, license for the provision of brokerage services No. 045-02894-100000 dated November 27, 2000.

You can obtain detailed information about the Bank's brokerage services by calling 8-800-555-55-50, on the website www.sberbank.ru/broker or at Bank branches. This website also contains the current conditions for the provision of brokerage and other services. Changes in conditions are made by the Bank unilaterally.

The content of this document is provided for informational purposes only and does not constitute an advertisement of any financial instruments, products, services or an offer, obligation, recommendation, or inducement to engage in transactions on the financial market. Despite receiving information, you independently make all investment decisions and ensure that such decisions comply with your investment profile in general and in particular with your personal ideas about the expected profitability from operations with financial instruments, the period of time for which such profitability is determined, as well as the acceptable You are at risk of losses from such transactions. The Bank does not guarantee income from the operations with financial instruments specified in this section and is not responsible for the results of your investment decisions made on the basis of the information provided by the Bank. No financial instruments, products or services mentioned herein are offered or sold in any jurisdiction where such activity would be contrary to securities laws or other local laws and regulations or would subject the Bank to compliance with registration in such jurisdiction. In particular, we would like to inform you that a number of states (in particular, the United States and the European Union) have introduced a sanctions regime that prohibits residents of the relevant states from acquiring (assisting in the acquisition) of debt instruments issued by the Bank. The Bank invites you to ensure that you are eligible to invest in the financial instruments, products or services mentioned herein. Therefore, the Bank cannot be held liable in any way if you violate any prohibitions applicable to you in any jurisdiction.

Information about financial instruments and transactions with them, which may be contained on this website and in the information posted on it, is prepared and provided impersonally for a certain category or for all clients, potential clients and counterparties of the Bank not on the basis of an investment consulting agreement and not based on the investment profile of site visitors. Thus, such information represents information that is universal for all interested parties, including publicly available information about the ability to carry out transactions with financial instruments. This information may not correspond to the investment profile of a particular site visitor, may not take into account his personal preferences and expectations for the level of risk and/or return and, thus, does not constitute an individual investment recommendation to him personally. The Bank reserves the right to provide website visitors with individual investment recommendations solely on the basis of an investment consulting agreement, solely after determining the investment profile and in accordance with it. The terms of use of information when carrying out activities on the securities market can be found here.

The Bank cannot guarantee that the financial instruments, products and services described therein are suitable for persons who have read such materials. The Bank recommends that you do not rely solely on the information you have been provided with in this material, but rather make your own assessment of the relevant risks and, if necessary, engage independent experts. The Bank is not responsible for financial or other consequences that may arise as a result of your decisions regarding financial instruments, products and services presented in the information materials.

The Bank makes reasonable efforts to obtain information from sources it believes to be reliable. However, the Bank makes no representation that the information or estimates contained in this information material are true, accurate or complete. Any information provided in this document is subject to change at any time without notice. Any information and estimates contained herein do not constitute terms of any transaction, including any potential transaction.

Financial instruments and investment activities involve high risks. This document does not contain a description of such risks, information about the costs that may be required in connection with the conclusion and termination of transactions related to financial instruments, products and services, as well as in connection with the performance of obligations under the relevant agreements. The value of shares, bonds, investment shares and other financial instruments may decrease or increase. Past investment performance does not determine future returns. Before entering into any transaction in a financial instrument, you must ensure that you fully understand all the terms of the financial instrument, the terms of the transaction in such instrument, and the legal, tax, financial and other risks associated with the transaction, including your willingness to bear significant losses.

The bank and/or the state does not guarantee the profitability of investments, investment activities or financial instruments. Before making an investment, you must carefully read the conditions and/or documents that govern the procedure for its implementation. Before purchasing financial instruments, you must carefully read the terms and conditions of their circulation.

The Bank draws the attention of Investors who are individuals to the fact that funds transferred to the Bank as part of brokerage services are not subject to the Federal Law of December 23, 2003. No. 177-FZ “On insurance of deposits of individuals in banks of the Russian Federation.

The Bank hereby informs you of the possible existence of a conflict of interest when offering the financial instruments discussed in the information materials. A conflict of interest arises in the following cases: (i) the Bank is the issuer of one or more financial instruments in question (the recipient of the benefit from the distribution of financial instruments) and a member of the Bank’s group of persons (hereinafter referred to as the group member) simultaneously provides brokerage services and/or (ii) a group member represents the interests of several persons simultaneously when providing them with brokerage or other services and/or (iii) a group member has his own interest in performing transactions with a financial instrument and simultaneously provides brokerage services and/or (iv) a group member acts in the interests of third parties or interests another group member, maintains prices, demand, supply and (or) trading volume in securities and other financial instruments, including acting as a market maker. Moreover, group members may have and will continue to have contractual relationships for the provision of brokerage, custody and other professional services with persons other than investors, and (i) group members may receive information of interest to investors and participants the groups have no obligation to investors to disclose such information or use it in fulfilling their obligations; (ii) the conditions for the provision of services and the amount of remuneration of group members for the provision of such services to third parties may differ from the conditions and amount of remuneration provided for investors. When resolving emerging conflicts of interest, the Bank is guided by the interests of its clients. More detailed information about the measures taken by the Bank regarding conflicts of interest can be found in the Bank’s Conflict of Interest Management Policy, posted on the Bank’s official website: (https://www.sberbank.com/ru/compliance/ukipk)